What does Yavin offer?

In Ireland, Yavin’s offering is still a little basic, but nonetheless complete for merchants who take card payments in person.

For a monthly fee and upfront cost, you get a package containing:

- A mobile, touchscreen smart POS terminal with payment software built in

- Acceptance of Visa, Mastercard, Amex and contactless mobile wallets

- Browser-based back-office (MyYavin) with reports and business settings

- Customer service

Accepted cards

After completing the sign-up, you should get the card machine delivered at your Irish address in about 10 working days, i.e. 2 weeks. It’s easy to get started with it once you have it – just switch it on and follow the on-screen prompts. It’s ready for the first card payment immediately.

Funds are processed within 2 working days to your chosen bank account by the payment company Paymatico. You can use any Irish bank account with an IBAN, as opposed to myPOS and AIBMS that require their own accounts.

Yavin Terminal features

Since the card machine is the central product, it matters how good it is. The one and only card machine model Yavin offers in Ireland is the Nexgo N86 smart POS terminal, referred to as Yavin Terminal.

It’s a high-quality, wireless and mobile touchscreen terminal that can be used at a point of sale, portably around premises or on the go.

The battery lasts 7-8 hours from a full charge, so it is highly capable for mobile merchants like taxi drivers, tradespeople and market stalls.

The Yavin card machine works independently via WiFi or a mobile network.

It includes a SIM card for GPRS/3G/4G connectivity anywhere in Ireland, but also works with WiFi, Bluetooth or a USB-C cable.

Yavin Terminal is sturdy, dust-proof and shock-proof when dropped from 1.5 metres. It prints receipts (requiring paper rolls), unless you opt to send a digital receipt via email or text message.

The Yavin card machine has a built-in receipt printer, but can send digital receipts too.

The core feature is to accept chip cards and contactless cards or mobile wallets. When a PIN code is required, a virtual PIN pad appears on the touchscreen so the customer can enter it.

It’s up to the merchant to activate these optional features:

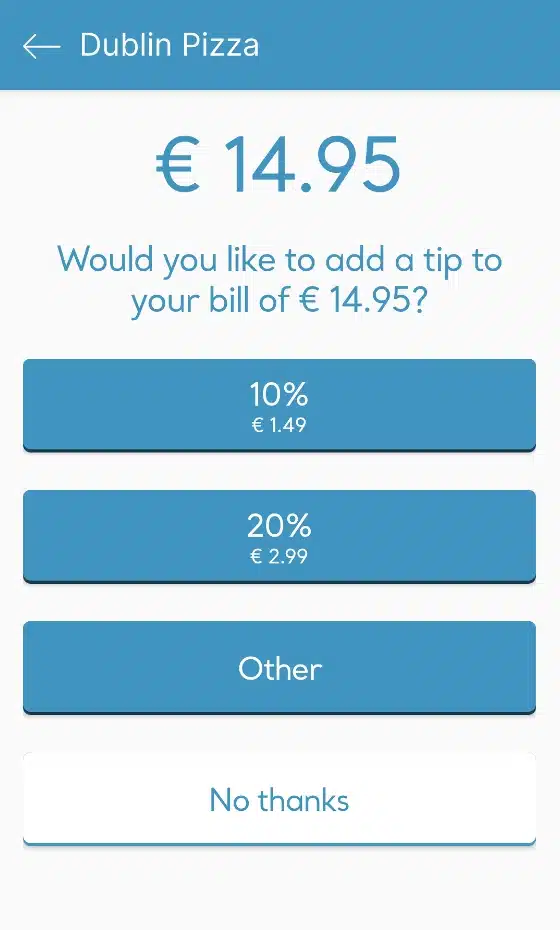

- Tipping – prompts customers to add a fixed, custom or no tip

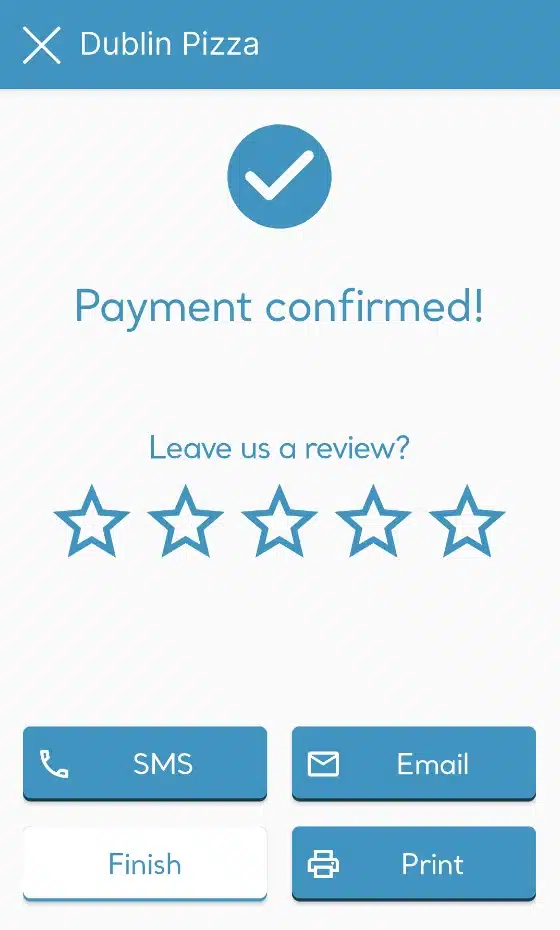

- Reviews – prompts customers to submit a Google or Tripadvisor review directly on the terminal

More apps can be added via the app store on the terminal. Some of these currently include features for remote payments (conditions apply), taking deposits/preauthorisations and ‘Buy Now, Pay Later’ payments. Yavin is working on adding more payment types, such as cryptocurrencies, PayPal, WeChat Pay and Alipay.

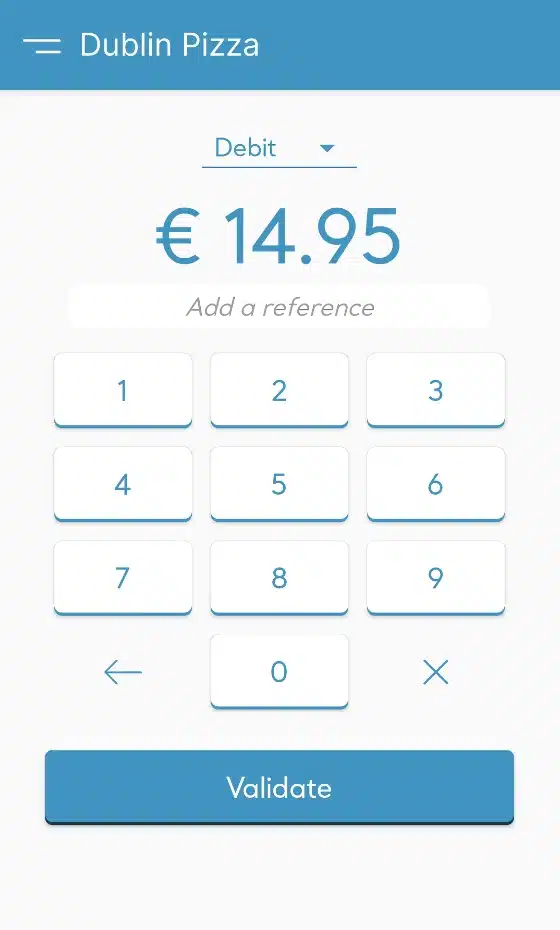

Main transaction screen.

Tipping is optional.

Payment confirmation.

Merchants taking payments in rural areas will wonder about connectivity. Many card machines require a live internet connection to accept cards electronically, but Yavin Terminal has an offline mode that lets you process card transactions without a connection. Just beware that the transaction only truly completes in the backend when the card machine is back online, which has to be within a certain time frame.

Fees and pricing

Yavin offers one pricing plan for everyone.

First of all, you buy the terminal for €199 upfront (€99.50 through our link) which includes VAT and a year’s warranty. A €10 shipping fee is added to all deliveries.

To use the card machine, you have to pay a monthly fee of €29 incl. VAT, which gives you access to the online dashboard and card acceptance service. Contrary to the banks, there is no long-term commitment. The service can be paused, resumed or cancelled any time to avoid the monthly fee when the terminal is not in use.

| Yavin fees | |

|---|---|

| Contractual commitment | Monthly |

| Terminal purchase price | €199 (or €99.50 with code) |

| Shipping | €10 |

| Monthly fee | €29 |

| Transaction fees | Interchange fee* + 0.5% + €0.05 |

| Refunds | Free |

| Payouts in bank account | Free |

| Chargebacks | Free |

*Fees set by card scheme (Visa, Mastercard, etc.) and card issuer.

Then you pay transaction fees for each contactless and chip and PIN transaction. Yavin has opted for an interchange plus plus (interchange++) fee structure with Yavin’s own small margin added on top. It looks like this:

Interchange fee + 0.5% + €0.05

The interchange fee is what card schemes and the card issuing bank truly charge per transaction, and this varies according to the type of card accepted. Domestic consumer debit cards have the lowest fees (perhaps 0.9% in total including Yavin’s fees). Higher interchange fees usually apply to foreign-issued, premium, business and credit cards, so a Visa or Mastercard payment from a tourist could cost over 2%.

American Express, however, has its own fees that are different (and usually higher) from the interchange++ system. Their core rates sometimes exceed 2%, so with Yavin’s fees added on top, this could amount to around 3% in some cases.

Compared to other card machines, Yavin’s variable fee structure can be quite low for those who accept mostly domestic cards. No other merchant service providers offer interchange++ pricing to small businesses in Ireland, making Yavin unique. It is usually an option you have to qualify for with a high enough sales volume.

There are no fees for refunds, chargebacks or payouts to your bank account.

Online dashboard, reports and integrations

While some traditional banks and acquirers still don’t offer much in the way of reports, Yavin gives business owners access to an online back office account.

The back office (or MyYavin) is the web interface where you go to find sales reports, transactions and Yavin account details. It also gives you an overview of your Yavin Terminals, customers and app integrations.

Yavin gives access to an online back office (pictured) where sales can be monitored.

The back office links to application programming interface (API) codes that enable you to integrate the system with your choice of POS system, digital bank, accounting software and much more. This may require help from the support team or a developer, as it can get complicated otherwise.

These codes make Yavin an open platform that can be synced with other business software relevant to your sector.

Service and Yavin reviews

Paid subscribers can contact Yavin for live support on weekdays between 8am and 7pm. We would’ve liked to see a support line every day at least, since e.g. hospitality tends to accept payments during evenings and weekends too.

Because Yavin is so new, there are not yet enough user reviews to indicate the quality of customer service. The company has onboarded over 1,000 businesses in France, and is currently building its customer base in Ireland since February 2022, but it remains to be seen whether there are any shortcomings to the service.

Our verdict

Yavin Terminal is a modern, welcome alternative in Ireland where banks like AIBMS still rule with their long contracts and less flexible solutions. The terminal is a solid, premium model that works in all contexts, even offline.

The commitment-free package with fair, variable rates differs from other small-business card readers (like Square and SumUp) that only offer fixed fees exceeding Yavin’s for domestic Mastercard and Visa cards. You just have to stomach the 2-week delivery time of the terminal.

A potential issue is the monthly cost of €29 that always comes on top of transaction rates, so you really need a sales volume high enough to justify this. That said, the monthly charge can be paused any time while not selling.

| Yavin criteria | Rating | Conclusion |

|---|---|---|

| Product | 4.5 | Good/Excellent |

| Costs and fees | 3.8 | Good |

| Transparency and sign-up | 3.7 | Passable/Good |

| Value-added services | 3.7 | Passable/Good |

| Service and reviews | 3.7 | Passable/Good |

| Contract | 4.2 | Good |

| OVERALL SCORE | 3.9 | Good |

The solution provides the flexibility to use any Irish bank account for payouts, POS integrations and (to a limited extent) custom terminal features. What we would like to see is more customer support, which should be more extensive when a monthly fee is required.

We think the package suits a wide variety of businesses from small to big, new to established. Whether you’re a retailer, restaurant, bar, hairdresser, hotel or professional, this is an interesting card machine that’s likely to expand its offering fast.