Any business accepting credit and debit card payments can risk getting a chargeback, but what is it? How does the chargeback process work?

Chargeback definition:

A chargeback is an in-store or online card transaction that the cardholder disputes and reverses through their debit or credit card issuer.

This is different from a refund, which the merchant voluntarily processes through their card machine or POS system.

Cardholders can dispute transactions for a number of reasons, such as fraud suspicion or not receiving the product they paid for. The mechanism was originally introduced to protect consumers from credit card fraud.

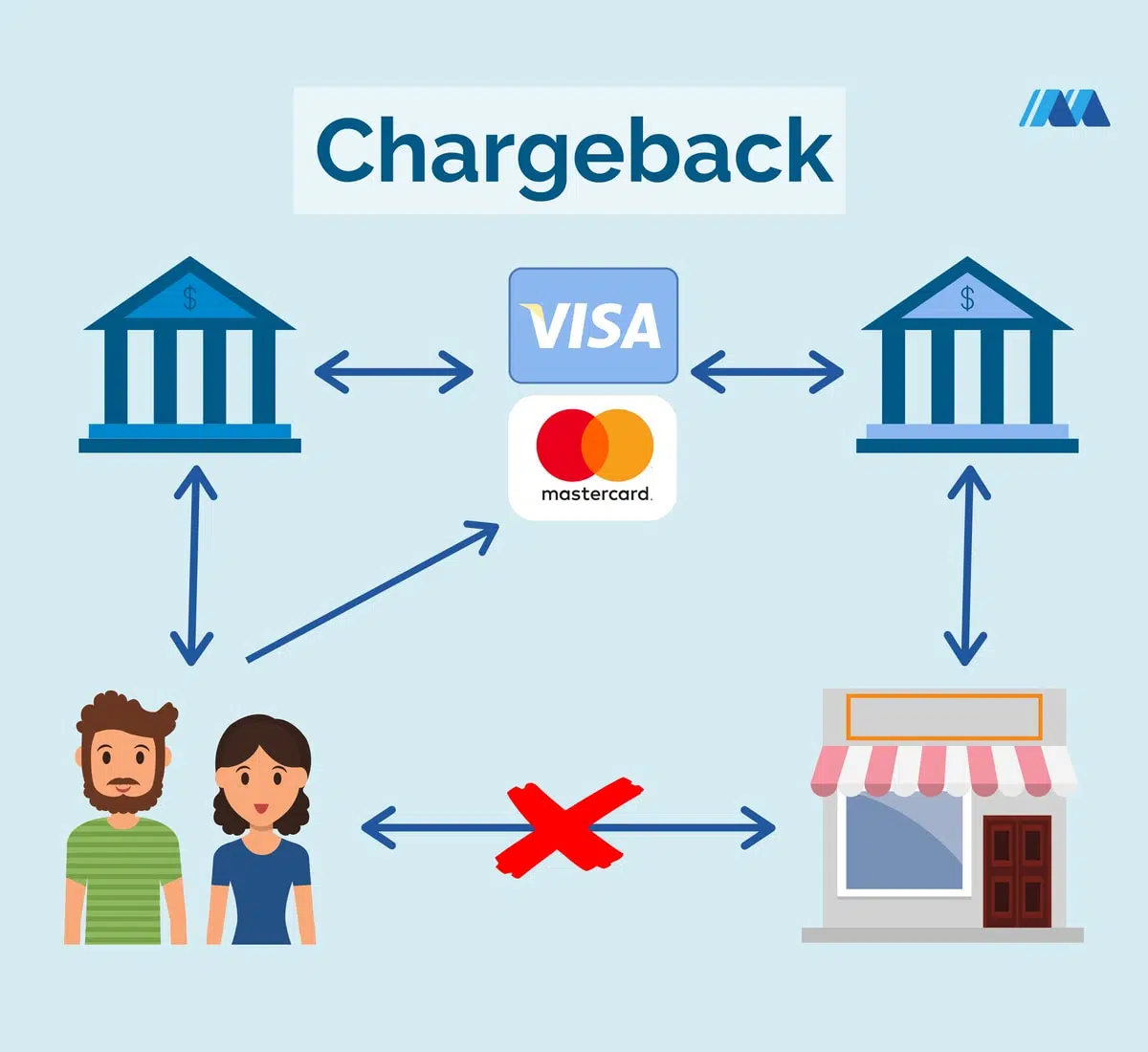

With a chargeback, customers raise the dispute directly with their bank or card issuer instead of the business that received the payment. In rare cases, a bank – instead of the cardholder – might initiate a chargeback to rectify a processing error.

When a chargeback is accepted and initiated by the card issuer, the merchant’s card processor returns this money to the customer’s bank while the dispute is under investigation. This typically results in a hefty chargeback fee for the merchant.

How it works

When raising a dispute to their bank or card issuer, the customer has to identify the specific transaction, state a valid reason for the chargeback and provide some evidence to back up this claim. The card provider needs to submit this to the merchant’s bank to make the chargeback claim.

Valid chargeback reasons include:

- Fraudulent transactions

- Payments made without the cardholder’s knowledge or approval

- The business didn’t provide the service or product paid for

- Transaction errors not rectified by the merchant

- Technical bank errors that wrongly enabled the transaction

Following that, the card provider and merchant’s bank refund the transaction (also called a reversal) by charging back the transaction value from the retailer’s account. The merchant’s acquirer will in turn charge the business a fixed chargeback fee to cover the cost of processing this.

Chargebacks are requested by the customer through their bank and mediated by the card network.

The business then gets a fixed period of time when they can dispute the chargeback to the customer’s bank if they think it was unfair.

For example, if the merchant has proof of delivery despite the claim the product wasn’t received, this could be submitted along with other documents to show the business fulfilled their obligations. The bank may or may not accept these, but if it does, the merchant may eventually receive the chargeback fee and transaction back.

This whole process can take weeks, months or even years depending on the complexity of the case and cooperativeness of parties. Often, the merchant and issuing bank will go back and forth with requests and documents. In the end, the card scheme might need to conclude the case if no resolution could be reached.

Consumers are generally encouraged to raise payment issues directly with the business first and only request a chargeback when those efforts have failed.

Businesses can actively prevent chargebacks by e.g. making sure transactions clearly show their business name on bank statements or encouraging customers to call if there’s any issue.

It is in the interest of the business to avoid any chargeback, as it usually incurs a significant fee for the merchant on top of the enforced refund. If too many chargebacks incur, the business may also get penalty fees and the lost income from these charges add up.