Need to take payments over the phone, but unsure which virtual terminal is best for your small business? In Ireland, there are only a few reliable options for MOTO (Mail Order and Telephone Order) payments we can vouch for.

Bear in mind that entering card details manually is pricier than using card machines because of the higher fraud risk involved in keyed entry.

Nevertheless, costs vary widely among online payment terminals. Some charge a monthly fee, require PCI-DSS documentation and have transaction fees, while others only charge a transaction fee without a contract or subscription.

So which is the right one to choose? Every virtual credit card terminal comes with key benefits, which we’ll dig into.

What is a virtual terminal?

| Virtual terminal |

Costs | Best for | Website |

|---|---|---|---|

| Square | €0/mo Transaction fee: 2.5% + VAT |

Many free payment features | |

| myPOS | €0/mo Transaction fees: 1.8%-3.4% + €0.20 |

Instant funds in business account | |

| Opayo | €32/mo Transaction fees: 350 free transactions/mo + custom fees |

Choice of flexible or fixed fees | |

| SumUp | €0/mo Transaction fee: 2.95% + 25¢ |

Access in app and browser | |

| Dojo | From €20/mo Transaction fees: Custom rates |

Keyed entry on card machine |

How we rate virtual terminals

We have tested most of the virtual terminals for an honest comparison. The most important criteria for a high rating is how easy and efficient it is to take a payment with the virtual terminal.

We also look at the features on the virtual terminal page itself, like options to add information about the cardholder (to minimise the risk of chargebacks), preauthorisation, bill itemisation and adding items from a product or customer library. Do you have to use it on a computer or is it accessible on a smartphone too?

Apart from the product itself, we base our ratings on the following, in order of priority:

Pros:

Cons:

If you’re looking for no commitment, quick registration and no monthly fees, our top recommendation – based on our own tests and experience – is Square. The only thing you pay is a fixed transaction fee per Virtual Terminal payment, and then you get a polished product that’s very easy to use.

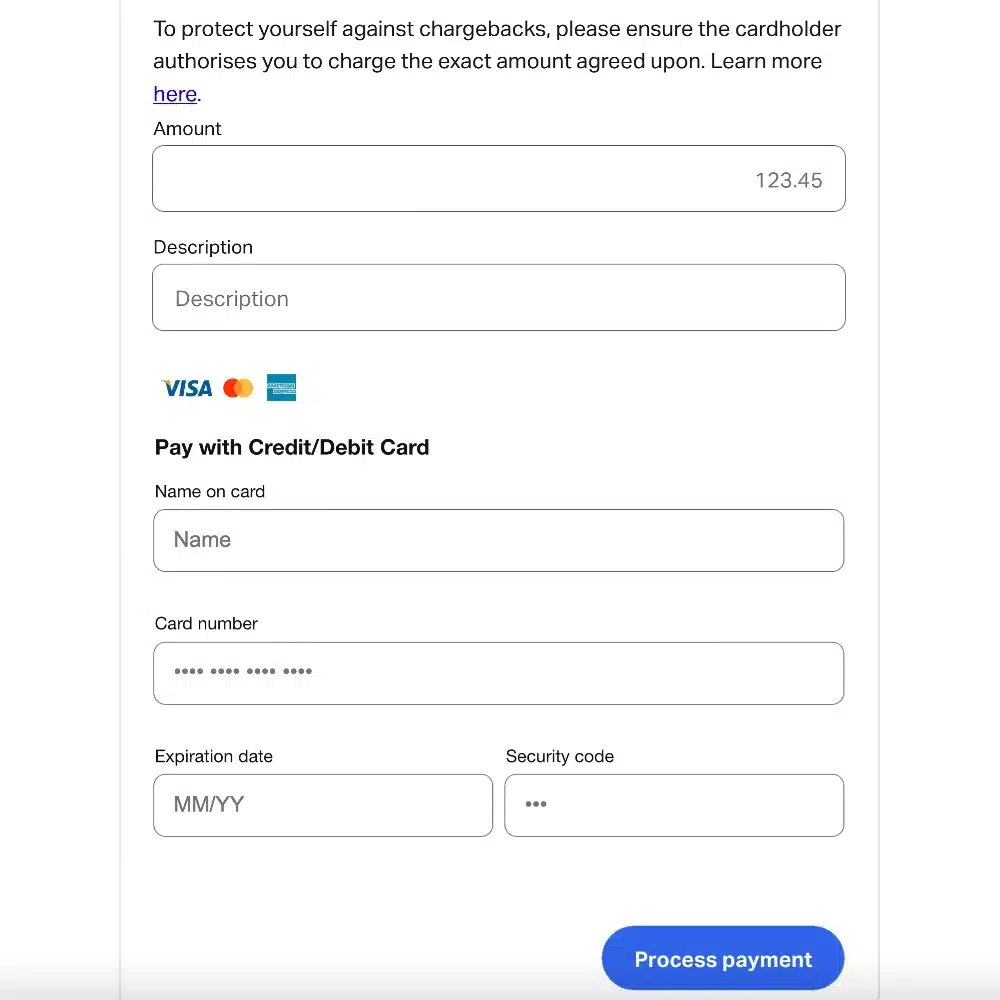

Image: Square

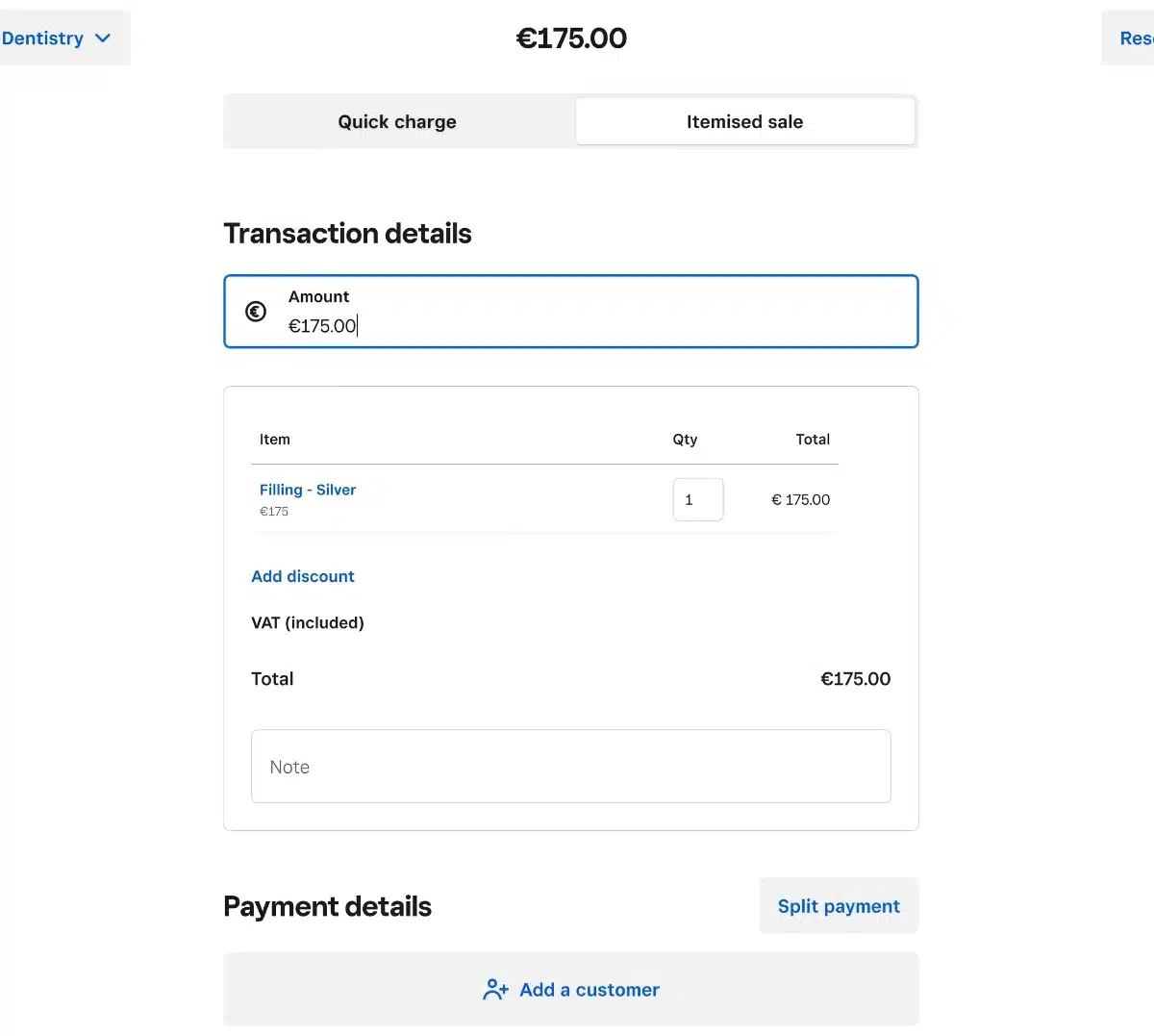

Square Virtual Terminal has a Quick Charge and Itemised transaction option.

You can go months without using the terminal, and it will still be available for free in your Square account.

Square Virtual Terminal accepts Visa, V Pay, Mastercard, Maestro and American Express.

Every time we tried the virtual payment terminal page, it was super-easy to fill in and process each sale. Only the card details, amount to pay and a short note for your sales reports (not for personal details) are submitted for a ‘quick charge’. Itemising the bill let you choose products from your library or new custom items, taxes, discounts and variants.

Pricing

Monthly cost: Free

Transaction fee: 2.5% + VAT (all cards)

PCI-DSS compliance: No cost

What’s more, you can save cardholder details in the system for a recurring payment, if a subscription or ongoing service has been authorised. Cash, gift cards and other tenders can be recorded and transactions split into different payment methods.

Merchants with no computer can key in card payments in the free Square Point of Sale app on iOS and Android devices.

“We tried Square’s browser-based virtual terminal on iPhone, which was possible, but the responsiveness of the page was frustrating on a small screen.”

– Emily Sorensen, Senior Editor, MobileTransaction

Square has really lowered the threshold for getting started with payments, whether it’s for the point of sale, invoicing, ecommerce or in this case a virtual terminal. There is no requirement to submit PCI-DSS documentation, but you should follow general security recommendations in line with the regulations.

Best for: Small, new or seasonal businesses needing an easy, commitment-free option for remote payments.

Pros:

Cons:

myPOS is a payments platform with a wide package: an online business account, debit card, POS terminals, online payments and a virtual terminal. There’s no monthly fee or contract, though you do need to close the account if you stop using it to avoid inactivity fees.

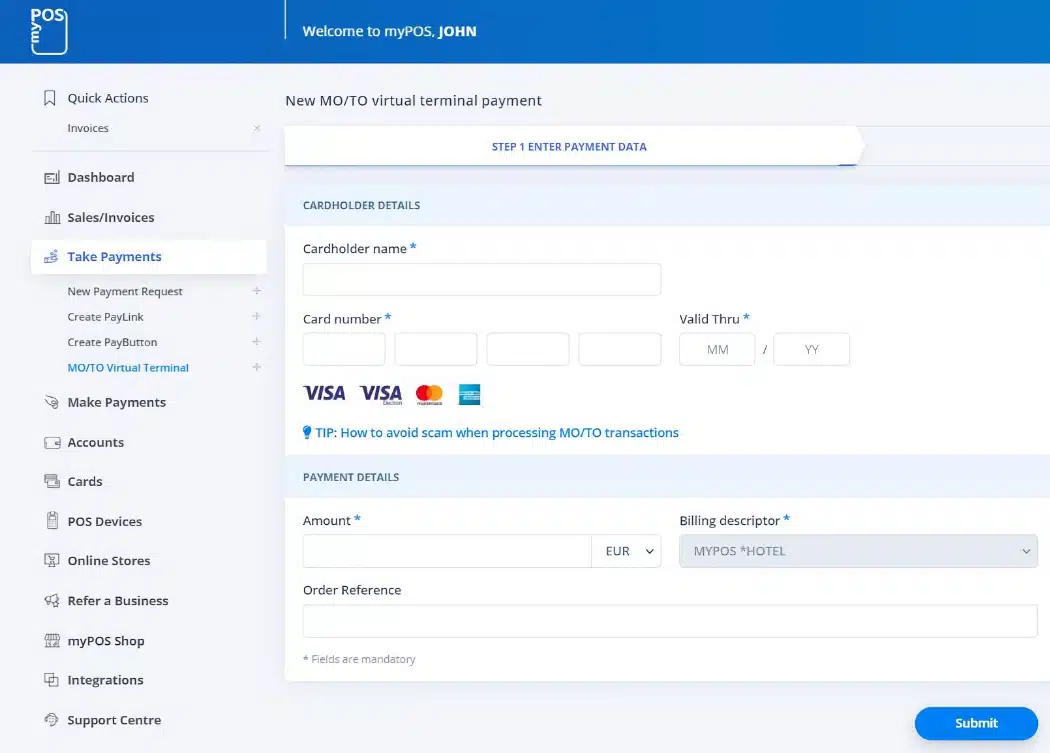

myPOS Virtual Terminal in a browser, as shown to us by a myPOS rep.

You can process MOTO terminal payments from either the myPOS app or merchant account in a browser. This makes it more flexible than Square that requires signing into its browser dashboard.

myPOS Virtual Terminal is pretty straightforward, with not too much required information to fill in.

Funds reach your online myPOS account immediately, so it can be spent straight away with the complimentary business Mastercard or transferred to any account globally (at varying costs).

The solution suits businesses with a team of staff, since multiple cards and user logins can be created.

Pricing

Monthly cost: Free

Transaction fees: 1.8% + € 0.20 for EEA consumer cards, 3% + €0.20 for Amex, 3.4% + € 0.20 for all other cards

PCI-DSS compliance: Free

Its multi-currency features also lends itself to cross-border payments, but it’s not cheap to accept or send money internationally.

In fact, transaction fees are pretty high for international (incl. UK), premium and commercial cards at 3.4% + € 0.20, while domestic and EEA personal cards cost 1.80% + €0.20 per telephone payment. Amex has its own fee at 3% + €0.20.

Onboarding for myPOS is lengthier than Square’s, as you’ll need to submit various documents and complete a video call to sign up (takes a few days in total). Once you have an account, the virtual terminal requires a separate sign-up through the online merchant account.

Best for: Small businesses who want instant access to funds and a cross-border account.

Pros:

Cons:

Elavon has been around for over 30 years, providing card machines and payment processing solutions to merchants globally. In Ireland, the virtual terminal is offered under the sub-brand Opayo, which is the company’s online payment platform.

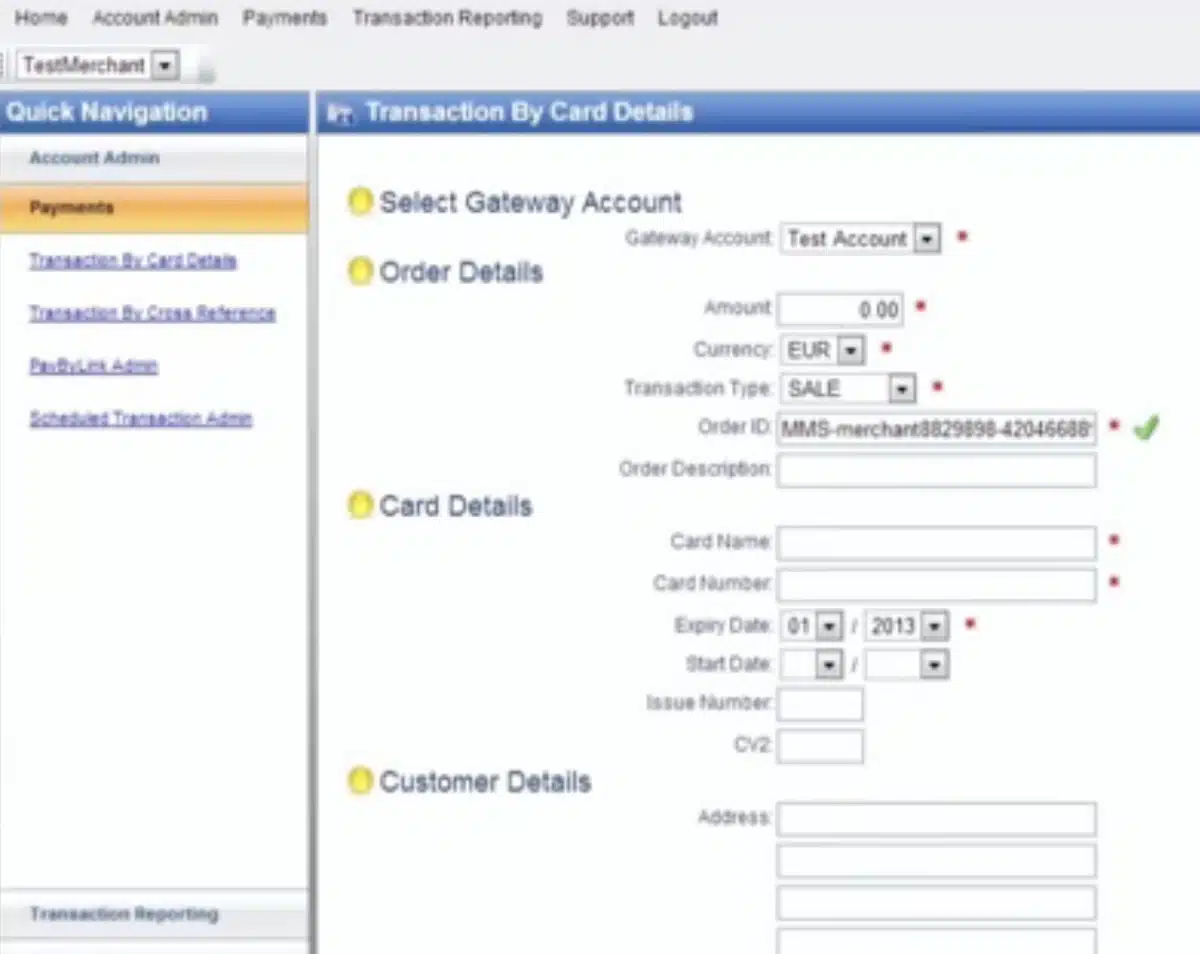

Image: Opayo/Elavon

Opayo Virtual Terminal is accessed in a computer browser.

Unlike Square and myPOS, Elavon doesn’t list their transaction fees upfront, just the monthly fixed fee: €32 for all plans. The “Flexible” plan includes fraud screening tools, whereas the “Fixed” plan doesn’t seem to.

350 free transactions are included on both plans, which you can assume are just for domestic card payments (foreign, premium or commercial cards are usually more expensive).

The Fixed plan advertises a low starting rate (1.25%) per transaction outside the 350 monthly free bundle. Otherwise, both Fixed and Flexible plans tailor rates according to your card turnover.

Only Mastercard, Maestro and Visa cards are accepted by Opayo Virtual Terminal.

Pricing

Plans:

Flexible plan: €32/month, fraud screening tools included

Fixed pricing: €32/month + €49 joining fee, from 1.25% per transaction

Transaction fees: 350 free transactions included per month, then tailored fees

The virtual terminal is accessed in your merchant portal on a computer. We don’t recommend using it in your mobile browser, since it’s not built for small screens.

Transactions can have many details like a home address, delivery address and the cardholder’s contact information. Currencies other than euro can also be processed. Funds are processed in your bank account the next business day.

A great thing about the package is its payment links and options to integrate with an ecommerce website. This makes it particularly attractive for those expecting to transact more broadly online through a card processor with flexible rates.

Best for: Existing Elavon users expecting to sell more broadly online and remotely.

Pros:

Cons:

SumUp is mostly known for its card readers. They don’t advertise its Virtual Terminal in Ireland, but if you have a SumUp account, you can – like we did – message customer support to get it activated.

Then you have to complete an application and submit documents and proof of an online presence. If all goes well, the virtual terminal will be activated both in the online dashboard and mobile SumUp App.

Image: MobileTransaction

SumUp Virtual Terminal has a simple layout, in line with all of SumUp’s no-fuss products.

The virtual terminal costs nothing in monthly fees, but transactions cost 2.95% + 25¢ regardless of card type or sales volume. Although this is pricier than other virtual terminals, the lack of a monthly cost could still mean it is one of the most economical solutions for occasional phone payments.

SumUp merchants taking card payments through a card reader benefit from keeping both face-to-face and phone payment transactions viewable in the same account, or exported to Excel for accounting.

The virtual terminal accepts Visa, Mastercard, Maestro, American Express, Diners Club, Discover and JCB, which is the largest selection of accepted cards (on this shortlist) included automatically.

Pricing

Monthly cost: Free

Transaction fee: 2.95% + 25¢ (any card)

PCI compliance: Free

There is no contract with SumUp. Once activated, you can accept payments through the virtual terminal when required, but a period of non-usage may deactivate it eventually, requiring you to contact SumUp again.

“The main advantage of SumUp Virtual Terminal is the fact we could use it in both an app and web browser. Most virtual terminals require a computer, but SumUp’s app makes it ideal for mobile merchants.”

– Emily Sorensen, Senior Editor, MobileTransaction

The only additional information you can enter on the virtual terminal page is a short description. No customer address or other information than essential card details can be added, so it is by far the most basic option on this shortlist. It does mean that it’s quick and easy to use, as we found when testing it.

Best for: SumUp users requiring a simple solution for occasional over-the-phone payments.

Pros:

Cons:

Dojo is a well-known merchant service provider in the UK and has expanded to Ireland. It doesn’t actually have a browser-based virtual terminal yet in Ireland, but merchants can key in payments on the Dojo Go card machine.

The parent company Paymentsense has a traditional, browser-based virtual terminal, which can be added through Dojo.

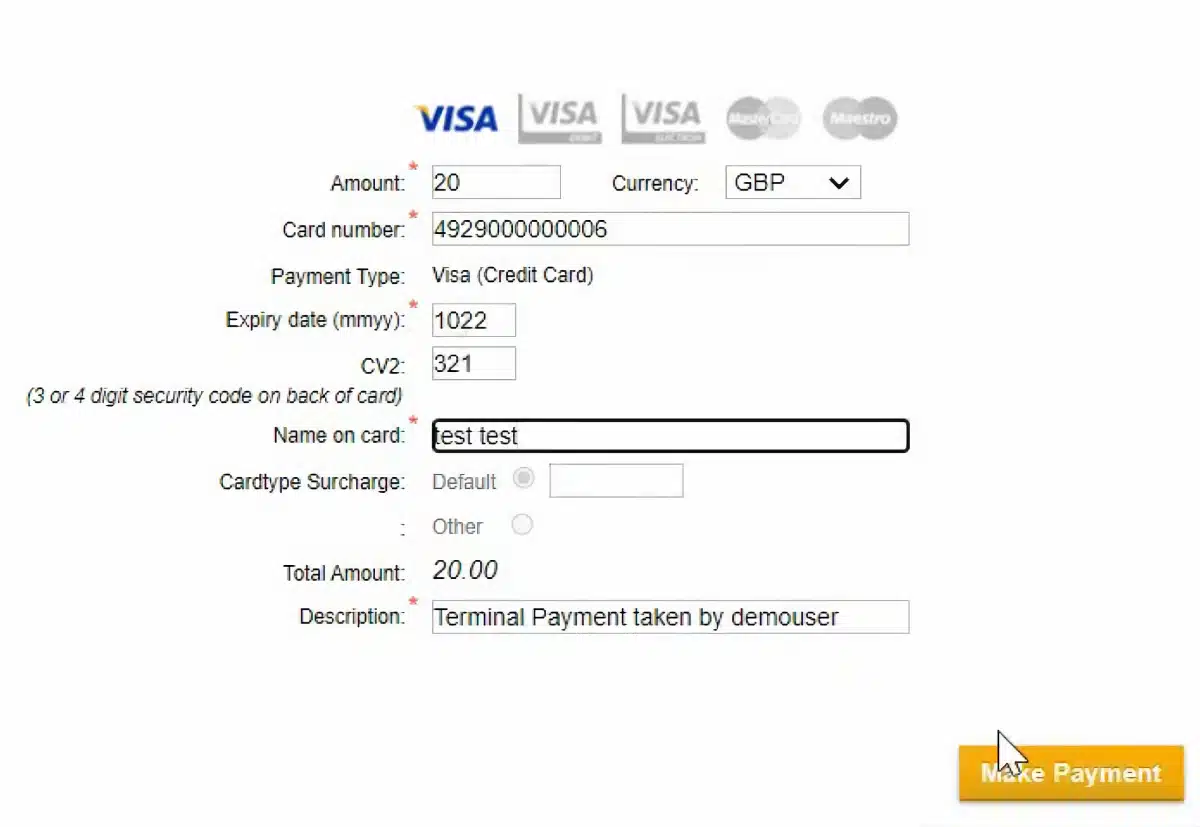

Image: Paymentsense

Paymentsense’s virtual terminal isn’t anything fancy.

Paymentsense says you can use its MOTO terminal on a computer, tablet or mobile phone, but we haven’t seen evidence of an app with the feature. We’ve only seen the browser-based merchant portal designed for computers, not small screens like a smartphone.

Nevertheless, Paymentsense has a virtual terminal with a monthly fee dependent on the card turnover:

- €16.62/month with less than €50k annual payments

- €20.78/month with annual transactions up to €250k

- €24.95/month with annual transactions up to €1.2m

Transaction fees are added on top.

Pricing

Monthly fee: Card machine from €20/mo + optional browser virtual terminal from €16.62/mo

Transaction fees: Rates depend on cards and turnover

PCI compliance: Costs may apply

Keyed entry of remote payments on Dojo’s card machine is very basic, not with complex details like itemised bills. But we expect Dojo to add its own virtual terminal for the web in Ireland at some point, like it has in the UK, so the Paymentsense alternative gets phased out.

Dojo’s keyed transaction fees (on a 6-month contract) are 1.9% + €0.05 for consumer Mastercard and Visa cards and 2.49% + €0.05 for business cards, if the annual card turnover is less than €150k. Custom rates apply for higher turnovers.

Contracts are either monthly or annual for Paymentsense’s virtual terminal. We recommend asking for a full pricing list as there may be extra costs to PCI-DSS compliance, chargebacks and other account activities.

Best for: Dojo card terminal users who need a simple way to accept deposits and over-the-phone transactions.

Summary

If you only accept remote payments occasionally, you should go for an option without fixed monthly costs, like Square, myPOS or SumUp.

Square has the best overall features and value-added, free tools for a lower rate than alternatives, whereas myPOS works in an app with instant access to funds in a business account.

But there could be a few reasons for choosing SumUp: convenience for card reader users and the simple virtual terminal in its app.

In contrast, Opayo and Dojo require fixed, monthly fees with somewhat tailored rates. Opayo suffers from poor mobile responsiveness, so is geared towards laptop users. Dojo’s virtual terminal is keyed entry on a card machine, or a browser-based virtual terminal through Paymentsense.

If none of these appeal, you could try asking Worldpay about their virtual terminal.

Virtual terminals compared:

| Virtual terminal | Best for | Website |

|---|---|---|

|

Quickest startup, no commitment, simple rate – least hassle for a small business. | |

|

Business account with multiple currencies and online payment tools. | |

|

Complete online payment platform with transactions included in fixed fee. | |

|

Convenience for SumUp users taking occasional phone payments. | |

|

Card machine users taking occasional payments over the phone. |