- Pros: Well-designed card machines. Can be used in many different environments.

- Cons: Not the cheapest. Long-term contract required. Some poor customer reviews.

- Choose if: You want a good card machine from a well-known brand for the longer term.

What is Verifone?

Verifone is an American card machine manufacturer famous for its payment solutions globally. The company provides their card terminals to a number of merchant service providers in the UK, but also offers products directly with a card processing contract.

Apart from card terminals, Verifone offers accompanying software, payment gateways for online stores, omnichannel solutions (i.e. integrated in-person and online payments) and other payment setups for a large variety of business sectors.

We recognise it’s an impressive all-round payment solution for retailers, service industries and hospitality – any sector, really – as long as the costs match your expectations. Let’s delve into the card machines models first, then pricing and our view of the service as a whole.

Verifone card machines

Verifone’s terminal models have advanced over the years. Because of the (we think) high quality of the hardware, you may still see old Verifone card machines in shops – or even on websites of slow-moving merchant service providers.

But currently, only the following card machines are sold in the UK now. All of the below models accept chip, swipe and contactless cards and mobile wallets.

Verifone T650c (all-in-one countertop)

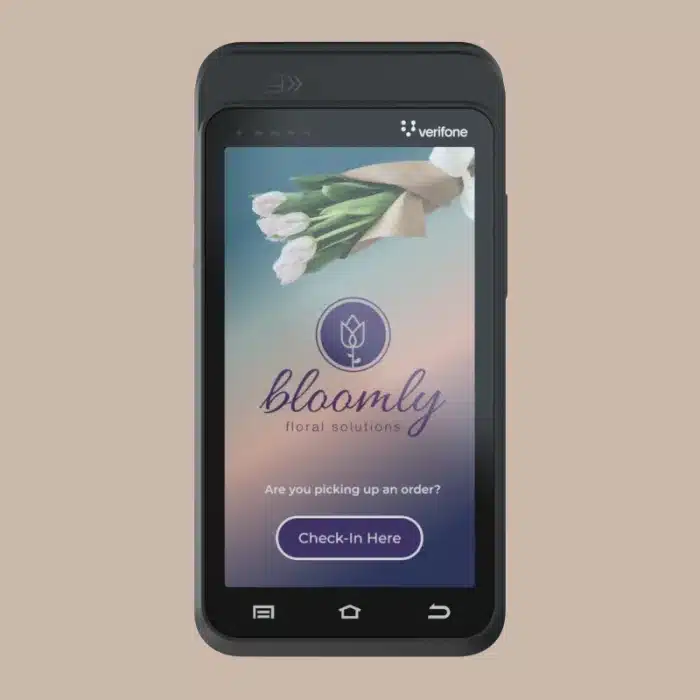

Verifone T650c is a new Android-based model that retailers can customise with software.

Verifone V200c (all-in-one countertop)

The V200c isn’t touchscreen, but benefits from push-buttons that some people find easier to use. Photo: Verifone

Verifone P400 (PIN pad for customers)

P400 is built on the V/OS (Linux-based) system. Photo: Verifone

Verifone P630 (PIN pad for customers)

Verifone P630 connects with your main countertop card machine.

Verifone T650p (portable)

T650p is one of the newer portable models that’s a pleasure to use. Photo: Verifone

Verifone V240m (portable)

Linux-based V240m is ideal on the go or around premises. Photo: Verifone

Verifone T650m (mobile)

Verifone T650m is a small powerhouse of a mobile card reader that does most things.

Verifone e285 (mobile)

The e285 reader can work independently or with a mobile app. Photo: Verifone

Transactions processed through the terminals can be analysed and sorted into sales reports through Verifone’s own transaction reporting solution. This may not be the best at the moment, judging by a user that criticised the online dashboard for being too basic.

But if you have more than a few card machines, the Verifone Central Device Management system allows you to oversee and control all sales channels remotely from an internet browser. For instance, you can push rich media to all your terminals at the same time with the push of a button.

No matter your business size, there is a software package for your card payments, but they may cost extra.

Verifone also offers ticketing and vending machines (like the ones in train stations), unattended card readers and terminals for self-service checkouts.

Some of Verifone’s old models which you might still see in shops or other countries include Verifone VX 520 (countertop), VX 820 Duet (countertop), VX 680 (portable), Carbon Mobile 5 (mobile) and e355 (mobile). These have been phased out gradually and Verifone is no longer selling on them in the UK.

Where to get the terminals

It’s actually got more difficult to get a Verifone card machine in the UK, since many payment providers only rent out Ingenico or PAX models.

When this article was first published four years ago, I identified 12 merchant service providers offering Verifone models. Now, I could only find the following that sells or rents them out:

- Adyen

- Retail Merchant Services

- Verifone

XLN and Glorydale Merchant Services might still offer them as well, but they are not among the best card machine providers. There may be others in the UK, but many payment companies aren’t exactly transparent about products until you ask. If you are interested in a particular provider, you can always ask if they have any Verifone models.

Verifone fees

Costs are dependent on where you get the Verifone terminal from, the card machine model and your type and size of business.

To give an example, we contacted Verifone directly for quotes on a mobile and portable card machine. With them, you don’t buy the card machines outright. Instead, the chosen terminals are rented on a contract lasting 12, 24 or 36 months. Pricing and credit card processing fees depend on whether you are a limited company or sole trader.

We were quoted the below for a small limited company:

| Verifone’s own pricing | |

|---|---|

| Contract length | 12, 24 or 36 months |

| Setup fee | None |

| Monthly fee for mobile card machine | £9.99 |

| Early termination fee | Equivalent of the remaining monthly fees of contract |

| Visa Debit, V Pay, Mastercard Debit, Maestro | 0.4% per transaction |

| Visa Credit, Visa Electron, Mastercard Credit | 0.9% per transaction |

| Commercial & corporate cards | Additional 1.3% per transaction |

| Non-EEA cards | Additional 1.6% per transaction |

| Verifone’s own pricing |

|

|---|---|

| Contract length | 12, 24 or 36 months |

| Setup fee | None |

| Monthly fee for mobile card machine | £9.99 |

| Early termination fee | Equivalent of the remaining monthly fees of contract |

| Visa Debit, V Pay, Mastercard Debit, Maestro | 0.4% per transaction |

| Visa Credit, Visa Electron, Mastercard Credit | 0.9% per transaction |

| Commercial & corporate cards | Additional 1.3% per transaction |

| Non-EEA cards | Additional 1.6% per transaction |

Verifone told us they manage the card processing, i.e. your merchant account. This means the above card transaction fees are decided by Verifone, so you do not need to deal with a different card processor unless you also want to accept American Express. To accept Amex, you need to get a separate merchant account from American Express.

There is no setup fee with Verifone. According to the sales rep, you only pay the monthly fee and transaction fees, nothing else. If you decide to end the contract prematurely, you have to pay an early termination fee equivalent to the remaining costs of the contract. When ending the contract after the full term, you only need to give 90 days’ notice to cancel the contract any time – this does not incur a termination fee.

Other merchant service providers will have different rates, fees and packages. It’s always a good idea to request quotes from multiple providers to get an idea of which is the best deal for your particular business. Some will have minimum monthly turnover requirements, meaning a fee applies if sales are not reaching a certain threshold. Some will have setup fees, service costs and other charges, but perhaps also more included in their packages.

If you can buy the card machine upfront, the price would be in the multiple hundreds of pounds, and then you would still need to connect it with a card processing contract and pay for ongoing services.

Verifone reviews and support

In the last few years, we’ve noticed Verifone has improved their customer service in the UK. Users are mostly satisfied with the card machines and prompt support when they get in touch with Verifone directly.

A few negative recent Verifone reviews talk about:

- Customer service agents letting the merchant down

- Reports being too basic in the online dashboard

- Some glitches in the card machines

Still, I’m cautious highlighting these experiences, as the norm seems to be that merchants are reliably happy about the product. We’ve also seen enough signs that the company takes issues seriously in most cases.

But the availability and quality of customer support depend on where you rent the card machine from. Verifone offers technical support every day of the week including Bank Holidays (8am-8pm Monday-Saturday and Bank Holidays, 10am-5pm Sundays). Other merchant service providers have different support options.

We recommend looking at reviews of the merchant service providers dealing with the rental contract before settling for a provider.

Our verdict: is it right for you?

There’s a Verifone terminal for almost any type of face-to-face business, and in our experience, they are good builds with advanced technology.

That’s why I’d recommend it to anyone looking for a modern card machine that customers would immediately trust to use. It is, however, one of several trusted card machine brands on the market today.

When it comes to price, it’s not really possible to get a Verifone card terminal without contractual commitment. Payment companies prefer long-term rental, usually with hidden fees that could be problematic for a micro-business on a budget.

“I think Verifone matches the quality of popular Ingenico and PAX terminals, but Verifone is generally less affordable to small businesses. British payment providers prefer to offer deals with the other two brands.”

– Emily Sorensen, Senior Editor, MobileTransaction

But with a steady flow of sales, a small business can get low card rates on domestic credit and debit cards. Medium and larger businesses would likely benefit the most, since they can afford the advanced customisations available for both the hardware and software.