How it works

Tide Invoicing is one of Tide Business Account’s core features. It allows all account holders (some of them bank account holders) to send and manage email or PDF invoices through the Tide Business app or browser dashboard. Invoice recipients can pay through a payment link, Direct Debit or alternative means.

Tide only accepts Visa and Mastercard debit and credit cards, as well as Google Pay and Apple Pay, through its payment links. These payments take 2-3 working days to settle in your Tide Business Account, or longer for certain less common cards.

There are different eligibility requirements for Tide Payment Links than for the business account, but most users are accepted quickly. This gives you a “merchant account” (provided by Adyen) that deals with the payment processing side. Direct Debit acceptance requires connecting with GoCardless.

Although basic invoice capabilities are free, an additional invoicing module adds a few more features that could make a big difference to when you get paid.

Pricing

To use Tide Invoicing, you must first have a Tide Business Account, of which there are tiered subscription plans. They all include the core invoicing features and options to add payment links and Direct Debit payments (none of which cost extra per month).

The four available account plans are:

- Free (£0/month): All account features, limited customer support, 20p per in/out transfer

- Plus (£9.99 + VAT/month): All account features, priority and phone support, 1 free expense card, 20 free transfers monthly

- Pro (£18.99 + VAT/month): All account features, priority and phone support, unlimited free transfers, 2 free expense cards

- Cashback (£49.99 + VAT/month): All account features, dedicated account managers, 0.5% cashback on card usage, 3 free expense cards

None of the plans come with contractual commitment, so you are free to unsubscribe and stop using the service any time.

| Tide Invoicing fees | |

|---|---|

| Monthly fees | Business account: £0-£49.99 + VAT/mo Invoice Assistant add-on: £10 +VAT/mo |

| Transaction fees | Visa/Mastercard: 1.5% for UK consumer cards, 2.5% for all other cards GoCardless: 1% + 20p for UK/Eurozone payments, 2% + 20p for international payments |

| Refunds | Original transaction fee is retained by Tide |

| Chargebacks | £10 per chargeback |

| Contract | Cancellable any time |

If you want the following features, you need to subscribe to Invoice Assistant for £10 + VAT per month:

- Automatic payment reminders via email for unpaid invoices

- Receive notifications when invoices are paid and auto-link payments to invoices

- Two free Direct Debits per month through GoCardless

No other features are added. The automatic email reminders for chasing up payments make a difference to how soon recipients pay – 4 days sooner on average, according to Tide.

Payments processed through Tide Payment Links cost the business 1.5% when a domestic consumer card is used and 2.5% when all other Mastercard and Visa cards are used.

The only other costs are for chargebacks (£10 per instance) and when customer refunds are processed (the 1.5% or 2.5% transaction fee is retained by Tide/Adyen). Note that refunds are not easily processed – it requires contacting Tide to state which payment has to be refunded, and then the support team will action this.

Direct Debit transactions can be set up on a recurring basis, and fees are paid to GoCardless according to the payment plan you have with them. The Standard GoCardless plan charges 1% + £0.20 per UK bank debit and 2% + £0.20 per international (cross-border) bank debit. An extra 0.3% fee applies to domestic bank debit payments above £2,000.

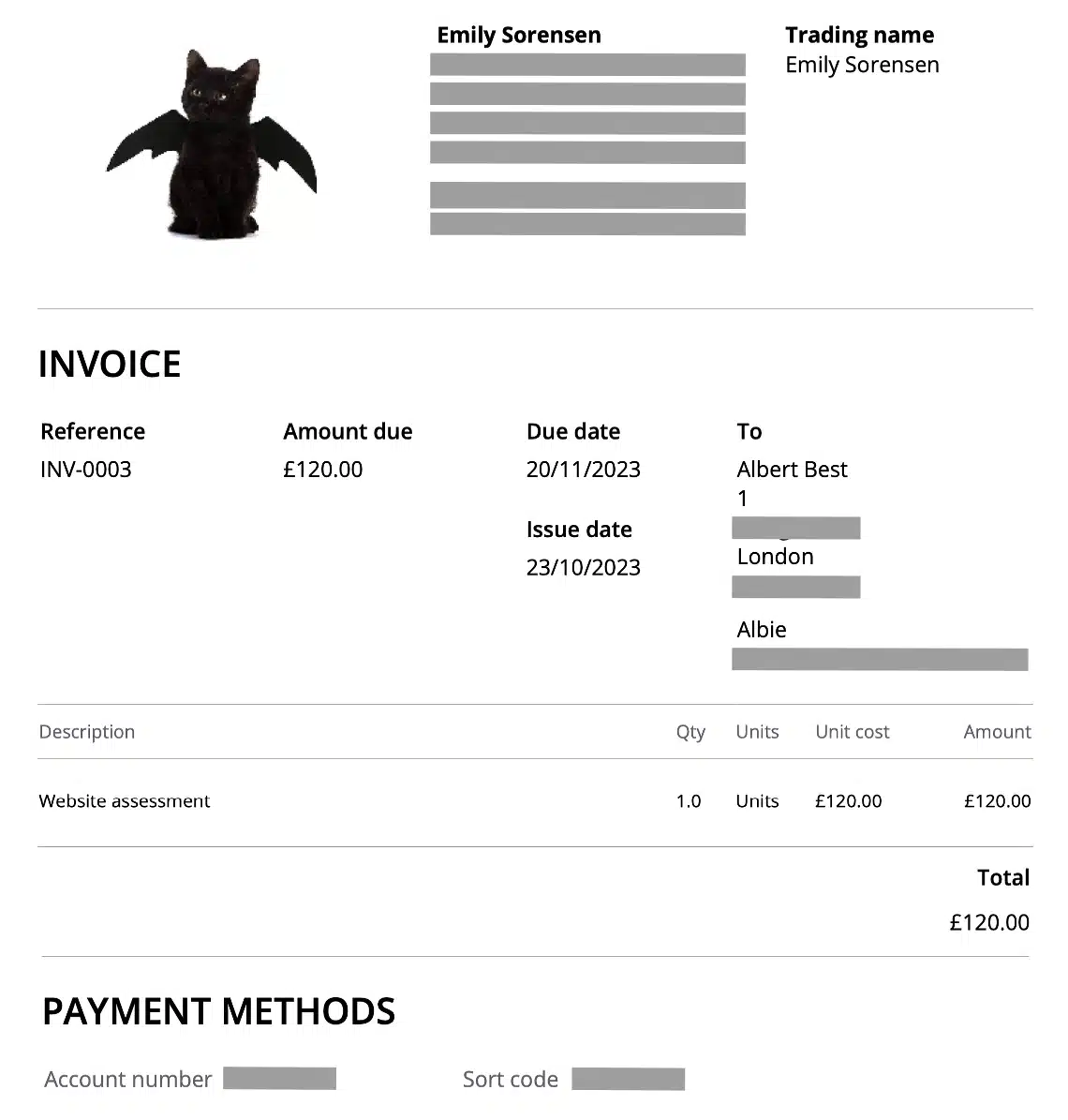

Image: Mobile Transaction

A PDF invoice we created and sent through Tide.

Invoicing features

Invoices are created and sent from the Tide Business Banking App (on an iPhone or Android device) or by logging into your Tide Business Account in an internet browser. Both interfaces have a dedicated invoicing section for invoices and billing. Note that the banking app has extremely small fonts in some places, which some users will struggle to read, in which case the desktop account is better for invoicing.

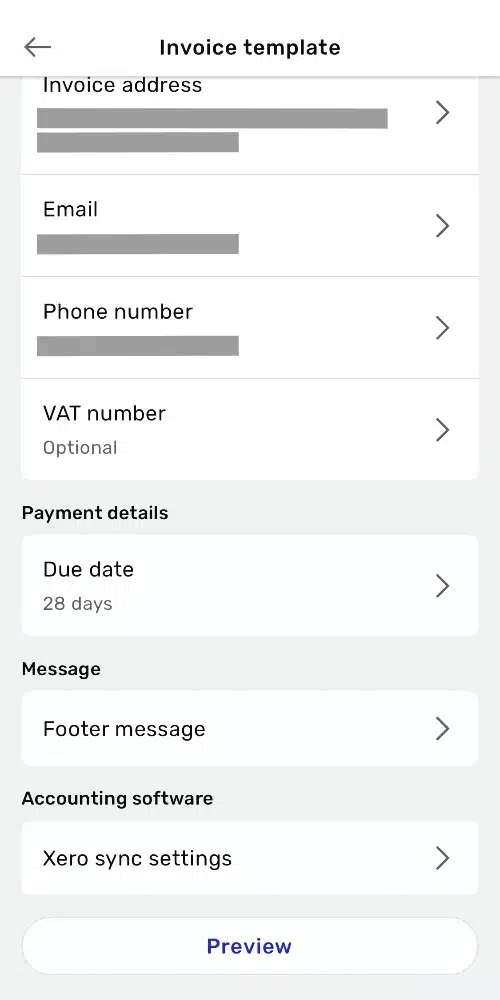

To get started, you should edit the invoice template to show your correct business details, payment due date, footer message and logo (if applicable). It’s also in the template section that you connect with your accounting software (e.g. Xero, FreeAgent, QuickBooks) to sync transactions with your bookkeeping system.

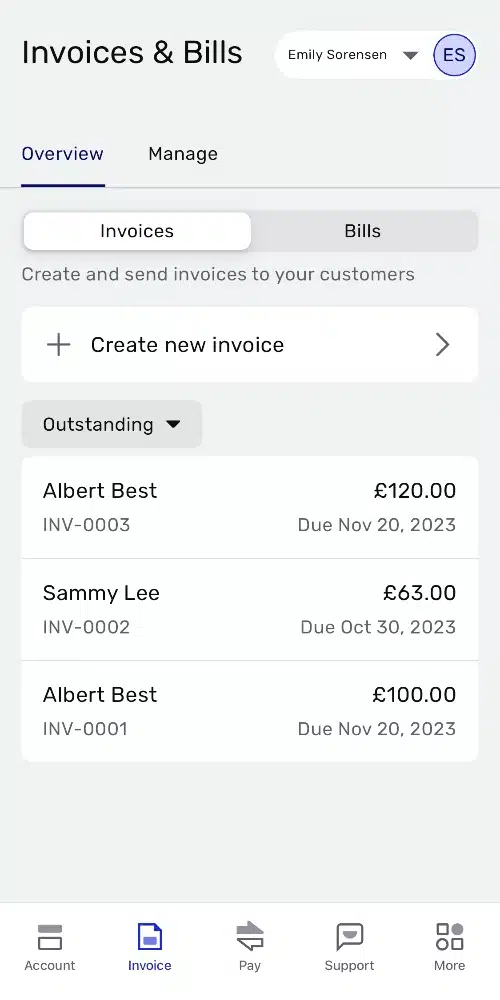

Image: Mobile Transaction

Invoice overview in the app.

Image: Mobile Transaction

Invoice template options.

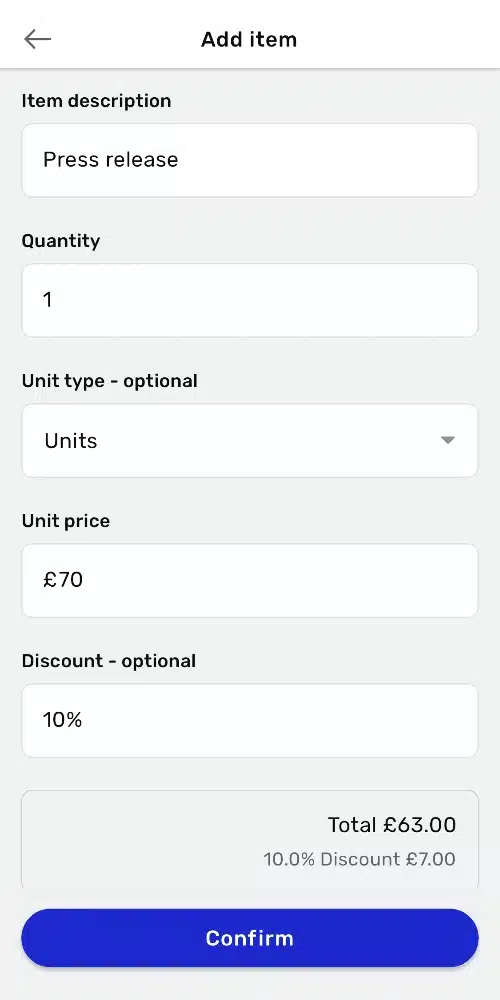

Image: Mobile Transaction

Adding an item to an invoice.

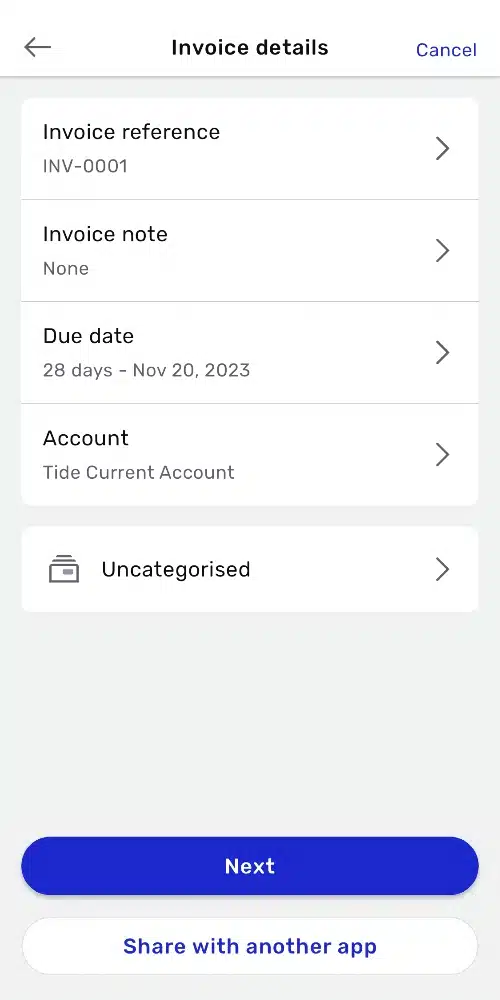

Sending an invoice is straightforward: you complete the invoice creation steps adding essential details like who it’s for, items purchased and pricing. Once you’ve added a customer profile, they appear on the Customers list for easy addition to future invoices. Optional extra information includes VAT, a custom note, discounts and the invoice category (e.g. Income).

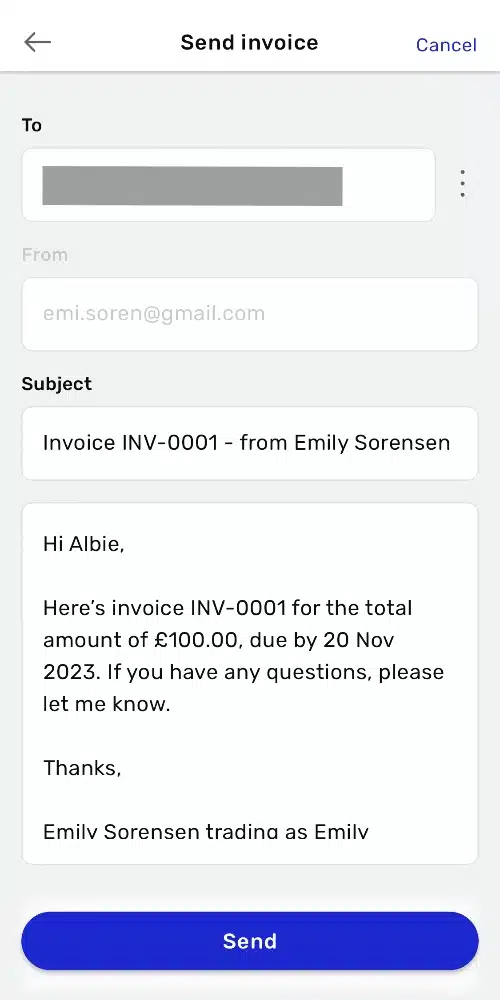

The invoice can be emailed with a short message or shared as a PDF file via WhatsApp, Messenger, Gmail or another phone app.

Image: Mobile Transaction

Details for the invoice.

Image: Mobile Transaction

Edits for the invoice email.

Image: Mobile Transaction

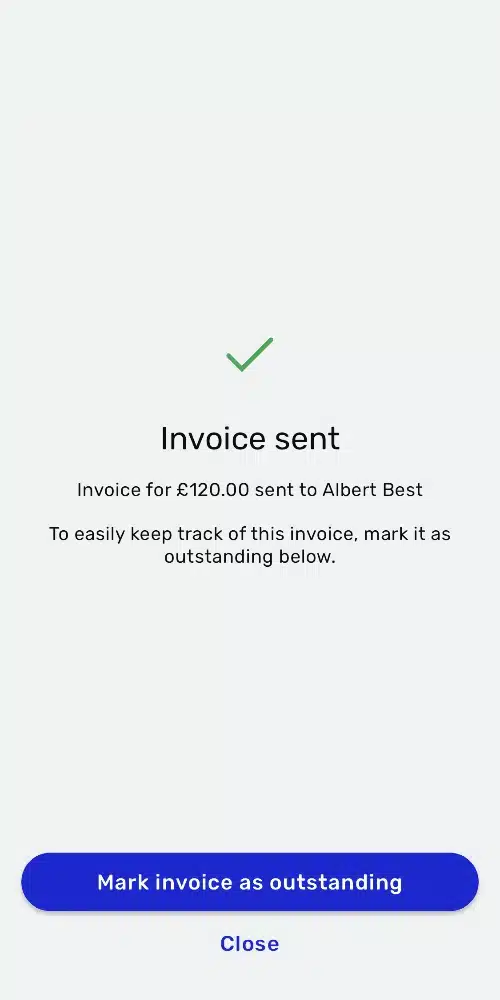

“Invoice sent” confirmation.

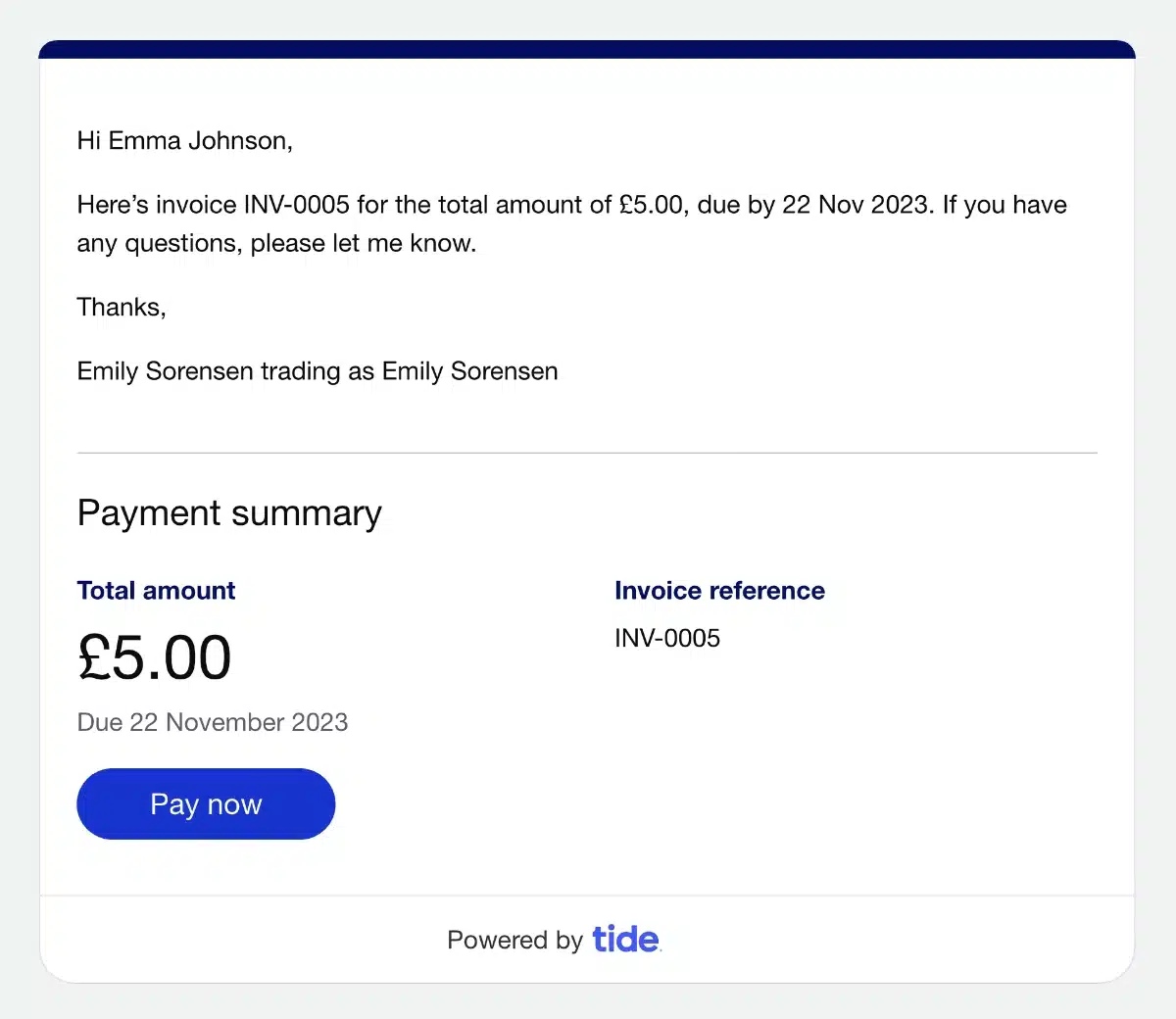

Unless you share the digital invoice as a PDF file through another app, the recipients receive an email with a message you created. This contains a link to an online checkout page opening in the customer’s mobile or desktop browser.

Image: Mobile Transaction

Invoice recipients receive an email with a custom message like this one.

Here, they can pay the invoice amount with their credit or debit card or mobile wallet.

If you’re accepting Direct Debits, the invoice has to be sent from the desktop account, where you schedule the payment via Direct Debit instead of other means.

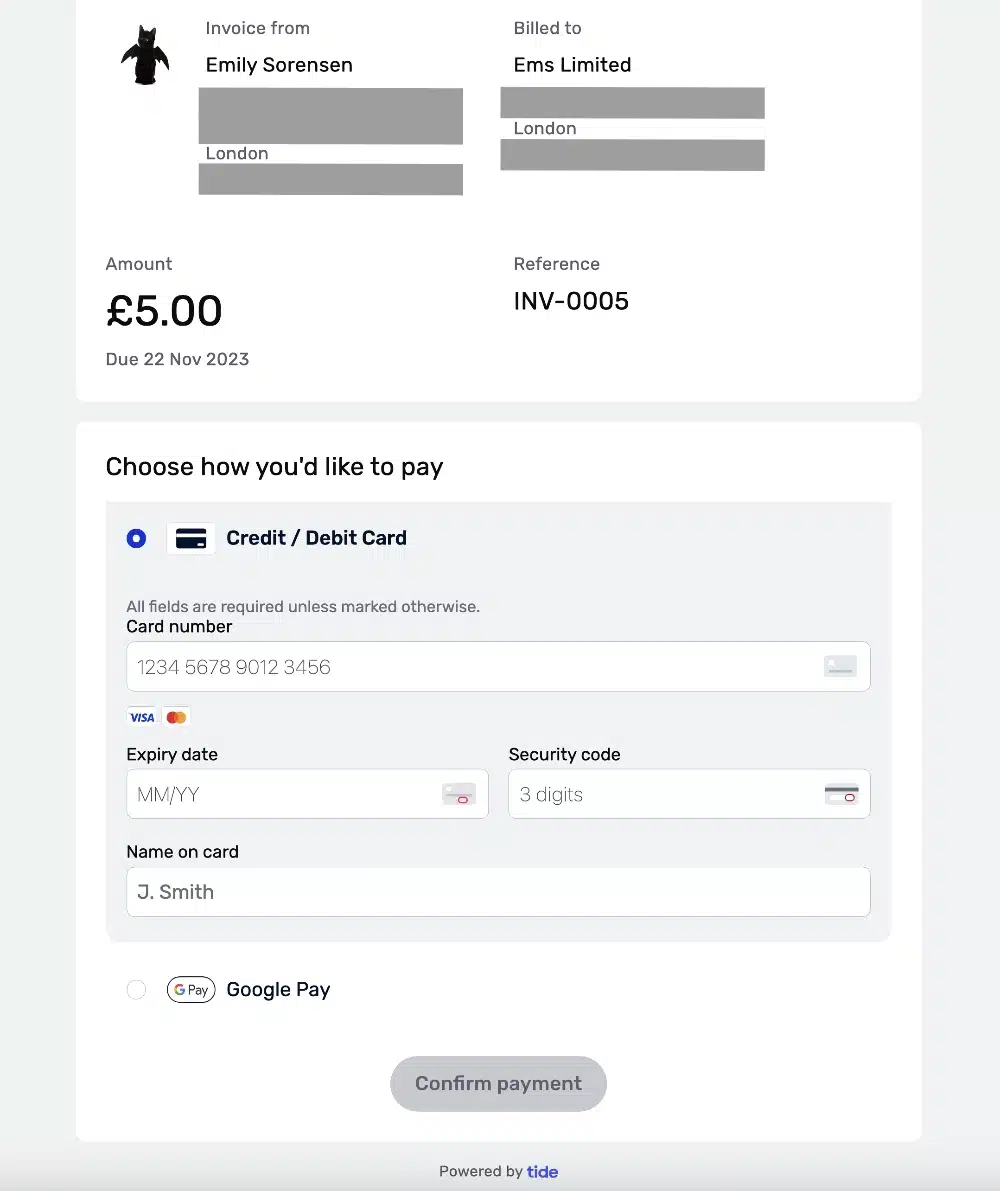

Image: Mobile Transaction

Your customers can pay online through a payment link going to this web page.

How does a business know when the customer has paid? Without the Invoice Assistant add-on, merchants won’t know automatically. Instead, they’ll receive the payment in the Tide account after 2-3 working days, after which the merchant can manually mark the relevant invoice as paid.

With Invoice Assistant, the business receives a notification when an invoice payment is received. What’s more, the relevant invoice is automatically marked as paid in your account.

The add-on subscription also sends automatic payment reminders if an invoice is outstanding, which typically results in customers paying up earlier.

Compared with alternatives

We’ve tested quite a few invoice apps in the UK, so can confidently say that Tide Invoicing is neither cutting edge nor lacking. It is an average email invoicing solution that’s best for sole traders and businesses who use Tide as their preferred business account.

The most similar alternatives are Revolut, Monzo and SumUp that all provide free business accounts with invoicing features.

Revolut’s has more invoice features than Tide, including free payment reminders, multiple currencies and next-day payouts. All of Monzo’s invoicing features require a £5 monthly subscription, which gives you fewer features than Tide Invoicing, but then you receive online payments in your Monzo bank account (good if you prefer this).

SumUp Invoices is a more comprehensive invoicing solution than Revolut’s and Monzo’s, as it includes useful extras like quotes, delivery notes and a product library. For an additional subscription of £7 + VAT monthly, you can also create invoices in different languages and choose the style of the invoice templates (incl. fonts, colours, etc.). SumUp merchants can receive transactions the next day in their SumUp Business Account or later in any chosen bank account.

Square Invoices is another free, user-friendly solution with a dedicated invoicing app and optional subscription for more advanced features. The invoices accept payments online for a fixed transaction fee of 2.5% for any type of card. Payers can also use Clearpay, but not bank transfers unless they do it manually to your non-Square bank account.

Customer service and reviews

The amount of customer support you get depends on your chosen account subscription. The free business account plan only includes free messaging support via the app or browser dashboard. We tested this while using the invoicing feature, and our query on the support chat took hours (overnight, in fact) to get any response.

Paid account plans (Plus and Pro) include phone support, a 24/7 legal helpline and “priority in-app support”, which essentially means you should get timely instead of slow responses on the support chat. On the Cashback plan, you also get a dedicated team of account managers.

Reviews of Tide are mostly positive, but Trustpilot still receives daily complaints from users with issues like slow and unhelpful customer service and inaccessible accounts.

When we tested Tide again after months of no use, we also experienced that the invoicing feature didn’t work, which turned out to be because Tide needed to reverify the account. So the problem of inaccessibility could in some cases be because of security checks needed after months of inactivity. In our case, this was resolved in a matter of hours, but some users have said it takes longer.

Our verdict

Tide Invoicing is overall a great solution if you want an easy way to send and manage invoices through a banking app. The features are not unique compared with other popular invoice apps in the UK, but it allows sole traders and companies who like using Tide as their business account to manage invoices in the same app.

| Tide Invoicing criteria | Rating | Conclusion |

|---|---|---|

| Product | 3.8 | Good |

| Costs and fees | 3.9 | Good |

| Transparency and sign-up | 3.7 | Passable/Good |

| Value-added services | 3.7 | Passable/Good |

| Service and reviews | 2.8 | Passable |

| Contract | 4 | Good |

| OVERALL SCORE | 3.7 | Passable/Good |

| Tide Invoicing criteria |

Rating | Conclusion |

|---|---|---|

| Product | 3.8 | Good |

| Costs and fees | 3.9 | Good |

| Transparency and sign-up | 3.7 | Passable/Good |

| Value-added services | 3.7 | Passable/Good |

| Service and reviews | 2.8 | Passable |

| Contract | 4 | Good |

| OVERALL SCORE | 3.7 | Passable/Good |

Useful features that not all invoicing apps have include accounting integrations, Direct Debit billing and the fact that some Tide users are given a full-fledged bank account (like Monzo’s) rather than an online account (like Revolut’s).

The biggest shortcoming is probably the slow and sometimes insufficient customer service on the free account plan. You can wait days for a resolution to a problem or even an answer from a person. You’ll need to upgrade to a paid Business Account plan for more responsive support.

Processing a refund for a customer also requires contacting support, which is unusual for an online payment system that typically allows users to initiate one themselves. And while most other invoicing apps include free auto-reminders for unpaid invoices, Tide users have to pay £10 + VAT for this valuable feature.