Tide is a financial technology company providing online current accounts to small businesses and sole traders in the UK. Their mission is to “help business owners spend less time on money admin”.

Tide is not a bank, but offers a business bank account provided by ClearBank with a prepaid Mastercard.

All Tide current accounts come with a UK account number and sort code. An IBAN and SWIFT code are also included for receiving transfers in GBP only.

You can use the account to:

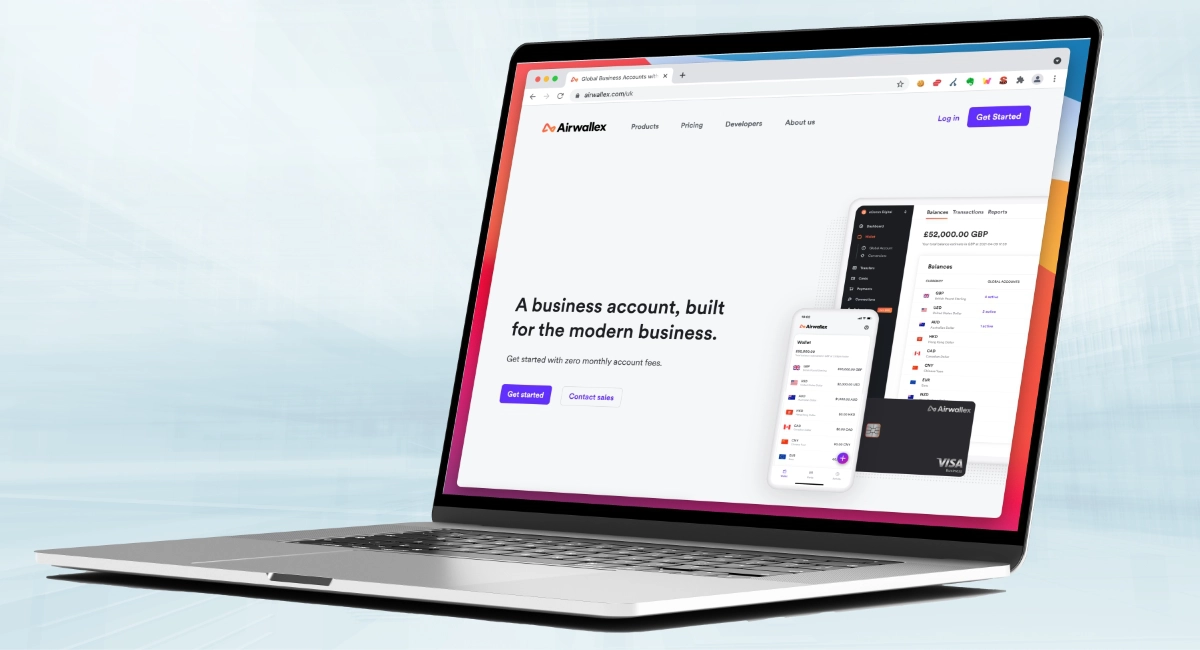

As a digital fintech platform, Tide’s strengths lie in their financial tools to manage money through the Tide app and accept payments.

For example, you can send invoices through the app, get paid via links or card readers and store photos of expense receipts for bookkeeping.

Eligibility: can accept company owners based abroad

To open a Tide business account, you need to be a UK-registered business or sole trader.

Companies should be registered at Companies House, and only the director of that business can apply.

Tide is actually the only business account in the UK that accepts limited companies with only foreign non-resident directors and shareholders, making it very attractive for that segment. Most others, like Barclays, do not want to take the risk without a local director. They just have to have a company address in the UK, a UK phone number and be able to use the UK App Store or Google Play to download the Tide app.

Sole traders and freelancers should be registered with HMRC as self-employed and live in the UK.

All applicants need to be at least 18 years old, have a UK phone number and use a device registered with the UK App Store or Google Play.

Not all types of business are permitted with Tide, such as charities, those providing money services, gambling, sales of precious stones and metals, cryptocurrency trading, charities, the adult industry, bidding fee auctions and sales of unlicensed pharmaceuticals.

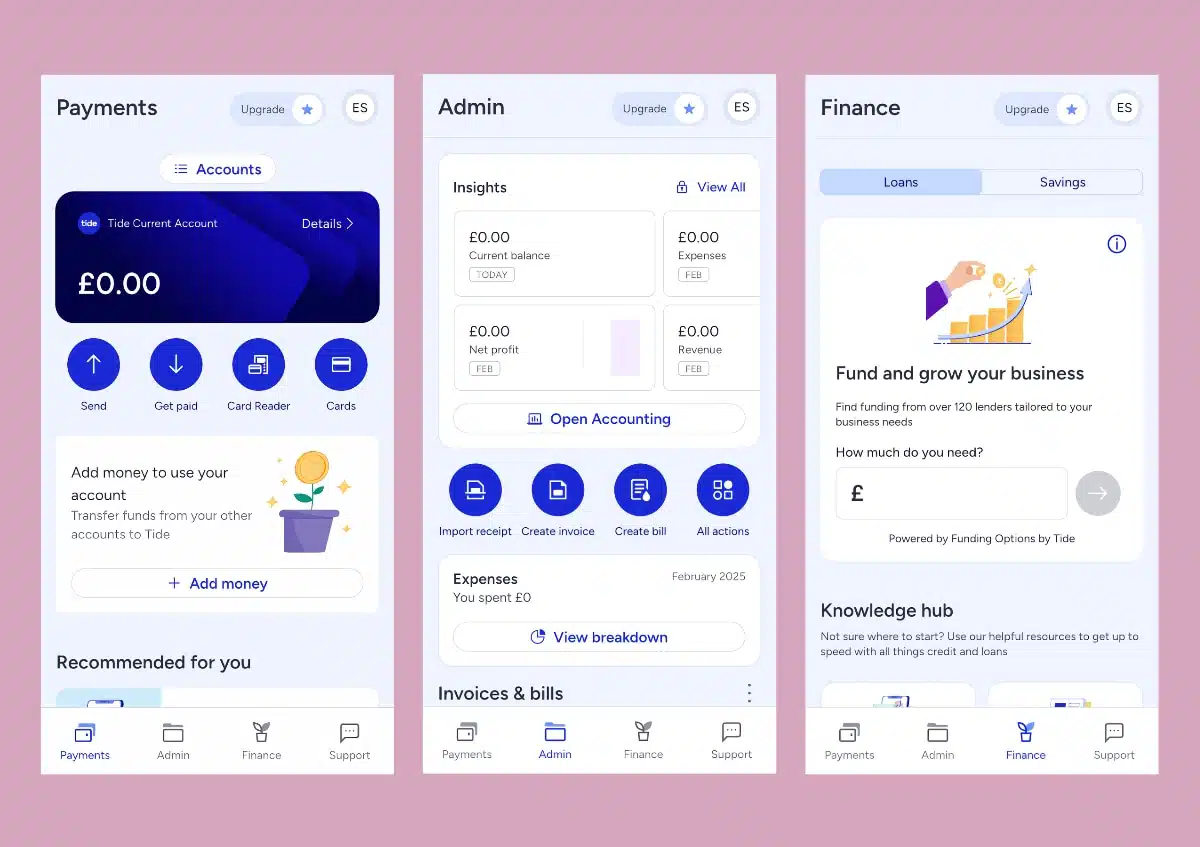

Image: Mobile Transaction

The Tide app makes it easy to manage payments, bookkeeping and money.

Pricing

It’s free to open a Tide account and use the basic account features, plus you receive a prepaid Mastercard when your application is approved.

Tide offers a Free account plan, but businesses can upgrade to these paid plans for better fees, features and support:

- Smart – £12.49 + VAT monthly

- Pro – £18.99 + VAT monthly

- Cashback – £49.99 + VAT monthly

These all include a main current account with read access for team members/an accountant and a range of tools like scheduled payments.

On the Free plan, all inbound and outbound transfers cost 20p each, which includes Direct Debits, Faster Payments bank transfers, BACs and CHAPS. This only includes UK transfers as there is no option to transfer money internationally.

| Tide Free plan | Tide Smart plan |

|---|---|

| £0/mo | £12.49 + VAT/mo |

| Team read access, scheduled payments, accounting integration | |

| In/out transfers (Faster Payments, CHAPS, BACs, Direct Debits) 20p each | 25 free in/out transfers (Faster Payments, CHAPS, BACs, Direct Debits) a month, then 20p each |

| No extra account | 1 additional account |

| No team access | 1 team member with enhanced access |

| No enhanced rewards | Enhanced rewards/discounts |

| Basic in-app support | Priority in-app support |

| No phone support | 24/7 phone support |

| No legal helpline | 24/7 legal helpline |

| No trademark support | Support with trademark filing and disputes |

Compared to the Free plan, Smart gives you “enhanced rewards” (discounts at participating companies) as opposed to Free’s basic rewards, 25 free UK transfers monthly, a free expense card and additional account, a team member with enhanced access, no fee on foreign currency card transactions, priority in-app support, 24/7 phone and legal support, and help with trademark queries.

The Pro plan adds another free expense card and user with enhanced account access, as well as unlimited UK transfers.

The Cashback subscription includes one more free expense card (so a total of 3), dedicated member support and 0.5% cashback on Tide card transactions.

Smart gives you one extra sub-account to help ring-fence money for a specific department, purpose or budget such as taxes or expenses. Pro has 2 additional accounts, and Cashback has 3.

Outside the free card allowances, expense cards cost £5 + VAT per month each.

ATM withdrawals cost £1 each regardless of where in the world you’re taking out cash with the Tide Business Mastercard. It costs 0.5% of the deposit (min. £2.50) to deposit cash at a Post Office or 3% of the total to deposit cash at a PayPoint.

| Tide account features |

Charges |

|---|---|

| Tide card payments in the UK | Free |

| Tide card payments abroad | 1.75% fee |

| ATM withdrawals (UK & abroad) | £1 each |

| Cash deposits | 0.5% of deposit (min. £2.50) at Post Office, 3% at PayPoint |

| Replacement cards | Free |

| Transfers between Tide accounts | Free |

| Card payment acceptance | Online payments: 1.5%-3.7% per transaction Card reader: 1.5% per transaction Tap to Pay on phone: 1.65% per transaction |

It’s free to transfer money between Tide accounts, and it’s free to use the Business Mastercard in shops and online in the UK. A 1.75% charge applies on card transactions abroad.

Accounts, security and card options

Unlike Starling and Monzo, Tide is not a bank. Yet it is authorised to issue bank accounts provided by ClearBank.

Some users have a Tide e-money account provided by PrePay Solutions (PPS), an electronic money (e-money) institution. We’re not sure why some users have an e-money account and others a bank account, but most get a bank account at sign-up.

I personally got a bank account by ClearBank with a prepaid Mastercard issued by PrePay Solutions – that’s what new sign-ups can expect too.

Either way, a Tide account should be safe. PrePay Solutions holds an amount equivalent to the money in your Tide current account in a safeguarding account, which gives protection if PPS becomes insolvent. And as a bank, ClearPay abides by even stricter security measures.

Still, some customers report issues with slow response times from Tide after an unexpected account closure, in effect holding the money until they get around to releasing it to the user.

Image: Mobile Transaction

The Tide card we received.

Image: Mobile Transaction

Tide card is a Prepaid Commercial card.

This can cause a lot of pain for businesses relying on that money urgently. Most users will not experience frozen accounts, though.

Tide uses Faster Payments to process standard one-time transfers, standing orders and scheduled payments, like most current accounts.

What’s t

Each account comes with a Prepaid Commercial Mastercard, which is a limited type of debit card. This has caused some issues for business customers who have tried – and failed – to link it with PayPal, Google Adwords, or get it accepted for government-backed lending schemes.

A full-fledged Debit Mastercard from a bank would not have these issues.

“If you’re really keen to get a bank account with an unrestricted debit card issued by the same place, go for a full-fledged bank. Tide is an intermediary between a bank, card issuer and other third parties behind some of its features.”

– Emily Sorensen, Senior Editor, Mobile Transaction

You can, according to Tide, link the account to Zettle, Stripe and GoCardless. The company also claims to work with PayPal, but not every Tide user has been able to do that.

In addition, you can order expense cards for team members. There is currently no credit card or Debit Mastercard available for Tide customers, though.

If your primary motivation is to have somewhere to manage business ingoings and expenses, a Tide account could work just fine.

It’s possible to add 1-3 extra (depending on the paid plan) current accounts with a different account number and sort code. These can help distinguish different budgets e.g. for marketing and buyer teams or to save for your tax bill.

International transfers and use abroad

The Tide account can only deal with GBP currency, but has a SWIFT or IBAN code for receiving money from abroad, which is converted into GBP.

The only outbound international transfers you can make are in EUR to SEPA countries (36 countries across Europe), but only after accepting some additional terms. It’s not possible to send other currencies to other countries via SWIFT, so this isn’t suitable for companies paying contractors in other parts of the world.

The Tide Business Mastercard, on the other hand, can be used anywhere in the world where Mastercard is accepted. When using the card abroad, Tide recommends processing the transaction in the local currency for the best exchange rate.

Cash and cheques

Not all e-money accounts enable cash deposits, but Tide does. This can be done at any Post Office for £2.50 or 0.5% (whichever is highest) per deposit or a PayPoint for 3% of the deposited amount. Just hand your Tide card with the cash to the person at the till who will then count and register the deposit.

Post Office deposits usually reach your account within a few minutes, while it takes about 10 minutes at a PayPoint.

The maximum that can be deposited in one go is £25,000 at a Post Office, whereas PayPoints have a daily maximum of £500. Other currencies than GBP are not accepted.

You can withdraw cash from any ATM accepting Mastercard.

A few years ago, it was’t possible to deposit cheques into any Tide account, but sole traders can now do that digitally through the app. Unfortunately, the function isn’t available for companies yet.

Alternatives to a loan: 10 best cash advances in the UK

Business loans

Tide offers no credit card or overdraft, but several financing options:

- Funding Options by Tide: Credit marketplace connecting you with 120+ lenders

- Start Up Loan: Government-backed loan for businesses, available through Tide

- Invoice finance: Use invoices as security and receive a percentage of unpaid invoices straight away

Even though Tide is not a bank, these options exceed those by most other digital banks. It’s clear Tide has put in the effort to offer value to small businesses by helping with their finances.

Tide app: greatly improved with more features

The Tide app has changed rather a lot in the last 3-4 years. We used to think it was a bit too basic, but it has more to offer now.

Some of the features of the mobile app – available on iPhone, iPad and Android – include:

Payments: Send and manage transfers to other accounts or set up recurring payments via Direct Debit or a standing order. The app also has plenty of ways to accept cards (more on that below).

Card controls: Order, view and manage cards, including cancelling, freezing and replacing the cards. Expense cards can have spending limits set in the app.

Billing: Send and manage invoices, or upload invoices to pay for record-keeping. You can add and manage repeat customers to save time.

Transactions: View transactions grouped into categories and an expenses breakdown, and add a transaction manually for the record.

Receipt import: Snap a picture of your expense receipts and attach it to a transaction, so you can get rid of the paper receipt.

Accounting: For deeper insights, VAT returns, a separate tax account and advanced invoicing, you can sign up for Tide Accounting for £22.99 monthly.

Otherwise, Tide connects with Xero – other accounting integrations require a slightly more complicated setup.

Apart from this, you can manage account limits, view statements, edit profile details, manage login and security information and get customer support through the app.

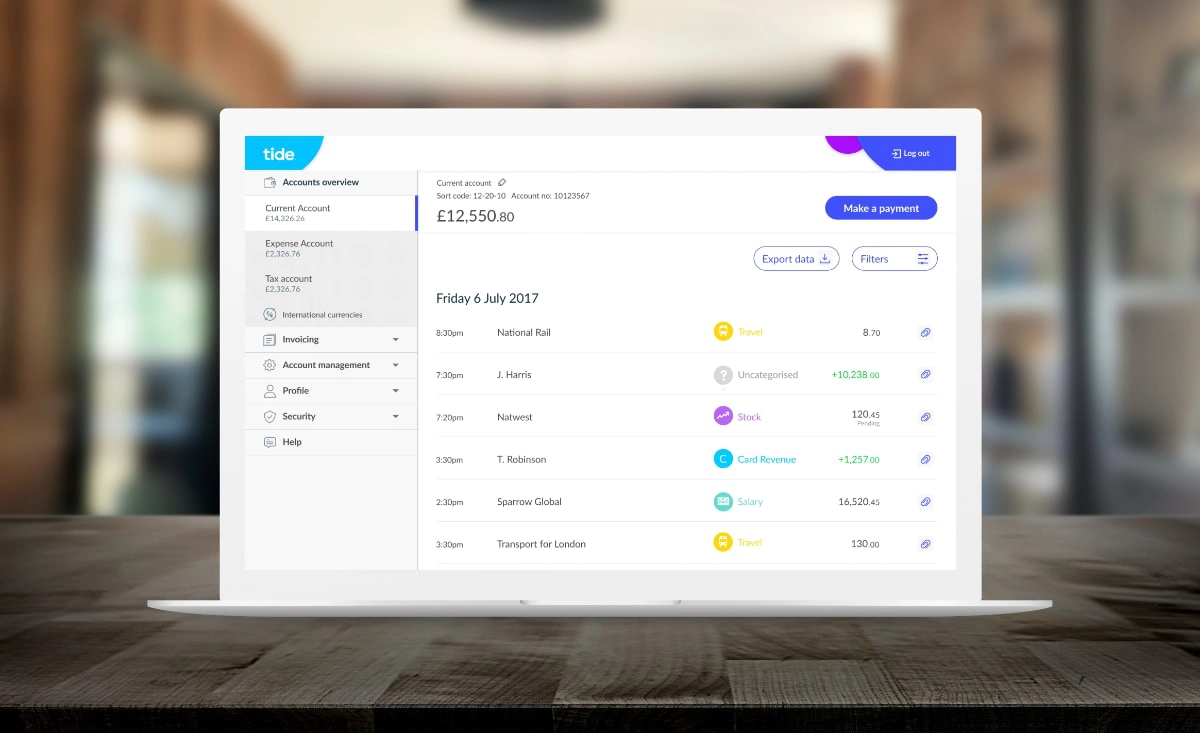

Users can log in to their Tide account in a web browser with the help of a phone.

Logging into the account in a web browser requires having your phone handy to scan a code displayed on the computer. Needless to say, this could pose issues if the phone is out of reach.

That said, team members and accountants can get read access to the web account.

Accepting card payments

One of the biggest improvements we’ve noticed with Tide is the many ways account holders can accept card payments. This includes:

- Invoicing – all features require an Admin Extra/Invoice Assistant subscription for £22.99 monthly

- Payment links – send links so customers can pay online in their browser

- Card readers – buy a card machine to accept chip and PIN and contactless payments in person

- Tap to Pay on a phone – turn your phone into a card reader to accept contactless cards and mobile wallets

- Online payment page – add products and services to a web page and share its link to sell on social media

This is great news for sole traders and startups who need to charge clients remotely, take payments in person or sell online.

Customer service and Tide reviews

Tide offers in-app chat and email support 24/7 every day of the year. There is also a community forum where users can ask questions and receive answers from other users or Tide personnel. If you upgrade to the Smart plan, you get “priority” in-app support, 24/7 legal support, phone support and help with trademark disputes and filing.

However, customer service is not up to scratch according to many Tide reviews. The most common complaint is a lack of response or inadequate service once the customer does hear back from support. Some are complaining of issues using the account with external services due to Tide’s lack of bank status.

Others are experiencing account closures where the balance is held for an undetermined amount of time, accompanied by no (or very slow) responses.

The most common complaint is a lack of response or inadequate service once the customer does hear back from Tide

Repeated, inadequate handling of chargebacks have also been mentioned which goes against the FCA’s requirements, and issues getting accounts accepted.

All that being said, I had a smooth experience setting up my account. Unlike Revolut Business, Tide hasn’t repeatedly asked me for supporting documents after a break of not using the account for months.

On TrustPilot, Tide answers most customer reviews promptly – a positive sign, at least externally.

Signing up

Signing up with a Tide account is easy for most registered businesses and sole traders. As long as you are not on a list of high-risk business areas, you can have your account accepted in a matter of minutes, after which a Tide card is dispatched. It took only a couple of minutes for our sole trader account to be accepted. 81% of users have their accounts opened within 48 hours.

Just download the Tide app and go through the sign-up questions there, or start on a laptop and continue on mobile (you can’t sign up entirely on a laptop). At some point, you’ll need to take a picture of a valid photo ID and your face for identification. In some cases, Tide may ask for extra documentation about your business, in which case the sign-up will take longer.

Tide doesn’t perform credit checks, but electronic checks are run by third-party providers to verify your details. These will not affect your credit score but will appear on your credit report.

Our verdict: enough for some, not everyone

Tide is one of several banking services lowering the threshold for entrepreneurs to open a business account easily and cheaply. It’s certainly attractive for its openness to limited companies with directors based outside the UK.

We think the main value of Tide is its breadth of features for managing business income and budgets through an app. But I wouldn’t want to stay on the free plan, given its fees for payments and feature limitations.

There are still some shortcomings. For one, you cannot make foreign transfers for outside Europe, so anyone paying contractors internationally would struggle.

Secondly, we think the accounting and invoicing add-on could be a tad expensive for users already on a monthly account subscription.

“I’d like to see the accounting and invoicing add-on included in on a paid account plan, rather than adding further strain to a sole trader’s monthly expenses.”

– Emily Sorensen, Senior Editor, Mobile Transaction

It’s also worrying to see users experiencing problems with the prepaid Mastercard that could’ve been avoided by choosing another platform with a proper debit card. Customer support is not the best either (on the free plan especially), but some users are really happy with it.

And the good things? Expense management for staff, loan options, a savings account, invoicing, ways to accept card payments, SEPA transfers and cash deposits (not a given for online accounts).

Still, if Tide’s features cover everything you need, this could well be a good solution. Just be aware of its limitations and compare with alternatives if Tide lacks clarity on the services you need.