Overview

In brief

What is it?

Our opinion

In detail

Card machines

POS integration

Fees and contract

Remote payments

Support and reviews

MobileTransaction has tested several of Takepayments’ card machines and the service for an honest review of the product. Opinions are the editor’s own.

What is Takepayments?

Takepayments is a UK-based independent sales organisation (ISO) offering card machines, online payments and card processing contracts for small businesses. It is one of the fastest-growing card payment companies in the UK, with many merchants under its belt.

The company has been around for over 25 years, previously trading as Payzone. In 2019, it transitioned into Takepayments for card payment solutions, leaving the brand Payzone to focus on payment hubs for utility bills and services.

Our opinion

Takepayments is generally a good deal for small businesses with an average transaction size well above £10 (the higher, the better) and sales volume of at least £2,000 monthly. The transaction rates will not be lower than SumUp’s or Square’s if individual sales are typically low (£5 or less).

The fees are competitive for a merchant service provider (see the best competing card machines), but Takepayments could do a better job of communicating them on the website. The sales reps will be more communicative than the ongoing support staff, as we can see from customer reviews.

The touchscreen card machine from PAX is very good quality and easy to use with both simple or advanced POS features, making it versatile for any setup.

“The Takepaymentsplus app worked well on the PAX A920Pro I tested – I’d highly recommend it. I did have some hiccups trying to find my way around settings, but the features are broad enough to accommodate most types of businesses.”

– Emily Sorensen, Senior Editor, MobileTransaction

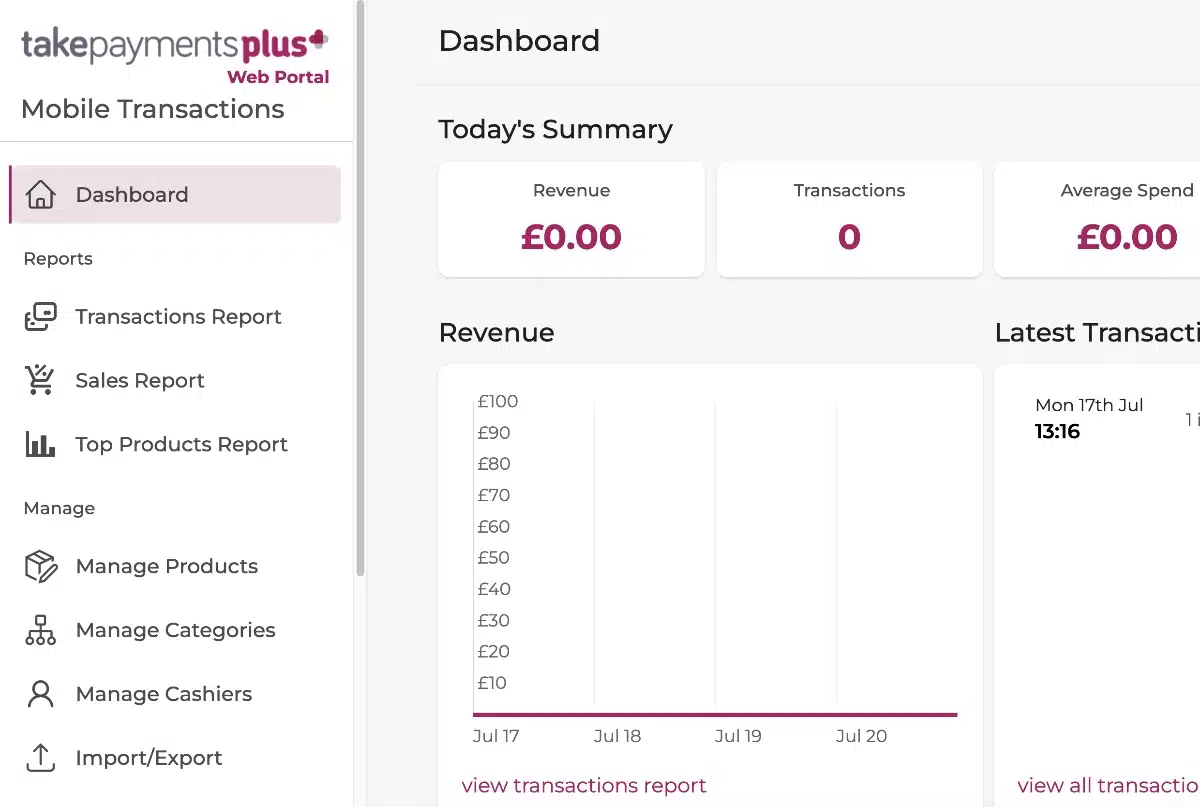

Takepayments’ other terminals, from Ingenico, do not have an online dashboard for tracking sales remotely or exporting transactions to bookkeeping software. That’s partly why Takepaymentsplus (with its upgraded PAX A920Pro terminal) is more popular – it comes with both on-screen reporting and a browser-based interface for admin features, reports and analytics.

The tPOS system for hospitality has improved over the last year, but some businesses will be put off by its 18-month lock-in. Your existing POS system could integrate with the card machines, but Takepayments prefers to promote its own tPOS system.

The most similar card machine alternatives are Dojo and Teya, both with 12-month contracts, but they do not have as much to offer as Takepayments.

| Criteria | Verdict |

|---|---|

| Product Payments: Good / Excellent Hardware: Good / Excellent Software: Good / Excellent |

Good / Excellent |

| Cost and fees | Good |

| Value-added services | Good |

| Contract | Passable / Good |

| Sign-up and transparency | Good / Excellent |

| Customer service | Good |

| FINAL RATING | [4.2/5] |

Card machines

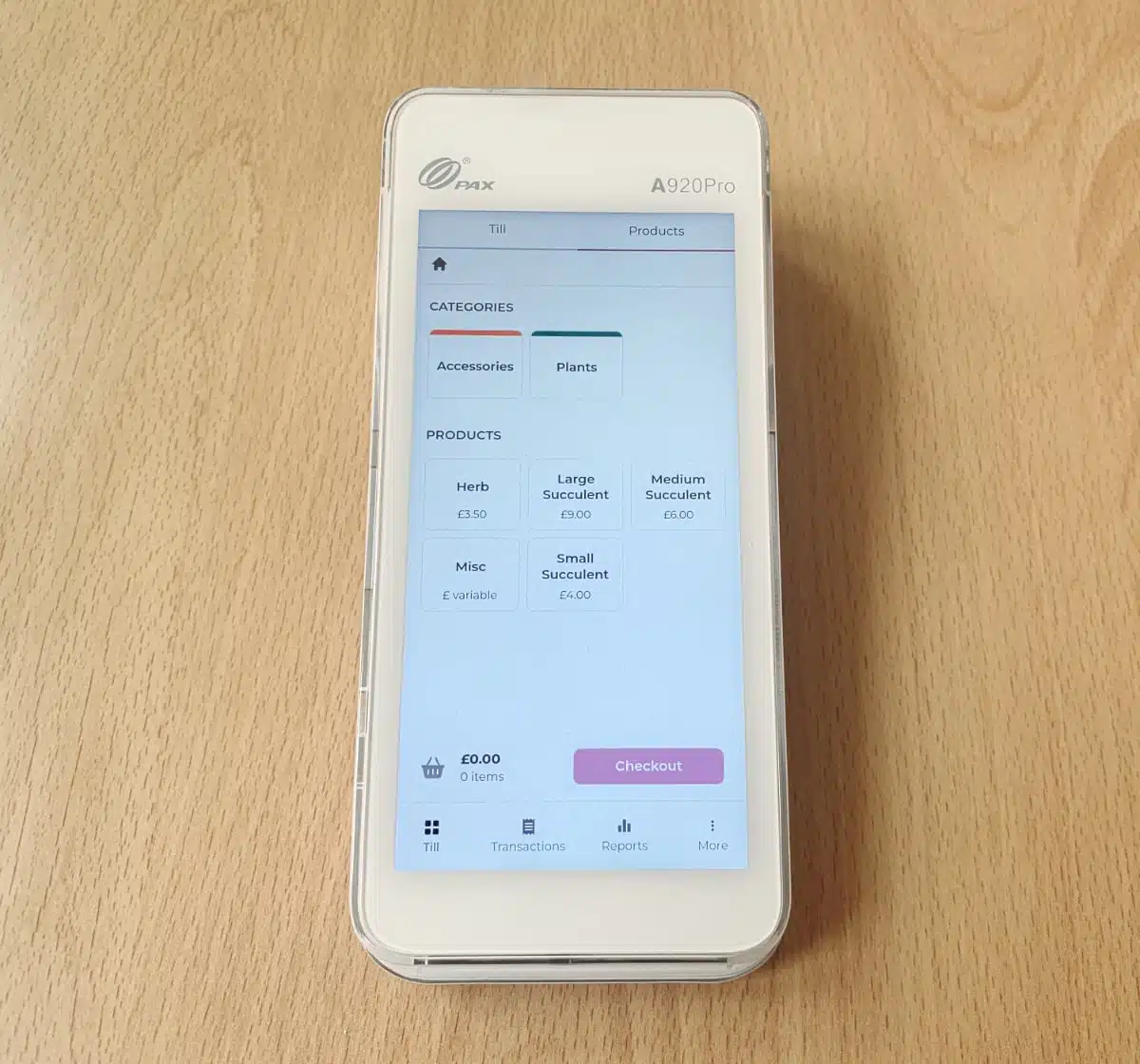

Takepayments’ main product is both a wireless card payment machine and checkout in one portable device: the PAX A920Pro card machine. This is a newer and better version of the original PAX A920 still offered by other payment companies.

A920Pro accepts cards via WiFi, Bluetooth or 4G, has a 10-hour battery life and comes with a countertop dock for when it’s not carried around. It has a receipt printer built in, which can print VAT rates and itemised receipts.

The majority of new users opt for this terminal with the Takepaymentsplus app installed.

Photo: Emily Sorensen (ES), MobileTransaction

PAX A920Pro comes with a mix of PAX’s and Takepayments’ own software.

That being said, there are two subscriptions to choose from:

The Easy Deal – has only basic transaction software for accepting card payments on the go (SIM included) without additional software like inventory tracking or cash acceptance. It’s ideal for merchants who can’t commit to more than a monthly plan, but it does have a hefty setup fee.

Takepaymentsplus – takes features to the next level with an integrated product library, tipping, cash acceptance, sales and inventory reports and itemised receipts. The monthly cost includes a SIM card, card machine rental and software, and there is no setup fee – but it does have an 18-month contract.

Our experience of Takepaymentsplus

We tested Takepaymentsplus and found it very easy to use, with a standard interface for a touchscreen card terminal.

The till features aren’t extensive, so there is not too much clutter in the app menu to be confused about. Still, it has very useful tools like a product library that can be edited on the go, service charges and split bills.

“I didn’t have any real problems with Takepaymentsplus – the software was uncomplicated (in a good way) and worked smoothly. It was only during setup that I needed help.”

– Emily Sorensen, Senior Editor, MobileTransaction

The only real issue for us was getting started, since we did not immediately receive a merchant login. If you’re locked out of the app like we were in the beginning, there is not anything you can use the terminal for, but Takepayments is fast to resolve this once you’re on the phone with them.

Photo: ES, MobileTransaction

Takepaymentsplus has simple, self-sufficient point of sale (POS) software built in.

The card machine has no physical keypad, just a 5.5″ IPS touchscreen that’s easy to clean. For increased accessibility for the visually impaired, the package includes a tactile sticker to guide users to the right keys when entering their PIN.

Although the Takepayments app is easy to navigate, finding general settings on the screen is not entirely intuitive. The problem is when you leave the Takepayments app and are presented with different menu layouts with miscellaneous app icons, and then it’s not clear how to switch between it all.

We wanted to increase the screen brightness so it was more visible in strong sunlight (it can look dark when not on maximum brightness), but couldn’t find this setting without help. It took a Google search to find a guide explaining how to do this.

By and large, however, the terminal is user-friendly and clearly good quality with potential to add more features down the line.

Photo: ES, MobileTransaction

Takepaymentsplus’ terminal prints paper receipts from the top side.

Takepayments also has some Ingenico card machines for a fixed till point (Countertop), carrying around on premises (Portable) or using independently on the go (Mobile). Most of them have faded in popularity and are only preferred in some circumstances, except for the high-performing Axium DX8000, another smart POS terminal as advanced as the PAX model.

But the only sales reports you get with the Ingenico terminals are a monthly statement from your acquirer. There is no online dashboard to log into to manage card machines, view transactions, payouts and account settings. This could be an issue if you need to integrate with accounting software or export your sales to a file. It is therefore better to choose the PAX terminal, which has both online and built-in reports on the terminal.

Photo: ES, MobileTransaction

Takepaymentsplus includes access to an online Web Portal where you can create sales reports.

All the card machines accept contactless, chip and PIN and swipe card payments including the mobile wallets Apple Pay, Google Pay and Samsung Pay. Visa, Mastercard and Maestro are accepted as standard, while American Express can be added with an additional agreement.

Point of sale (POS) integrations

What POS integrations are available? Takepayments has its own till system called tPOS. This includes EPOS software, a register tablet and portable PAX A920Pro for card payments.

You cannot download the POS software on a commercial tablet or your phone. Instead, you get a specialised tablet register manufactured by PAX (either the E700 or E800 model) with a built-in receipt printer.

tPOS is Takepyaments’ own POS system.

There’s a package with features for retail (£45-£55 + VAT monthly) or hospitality (£55-£65 + VAT monthly). Both come with a £250 + VAT setup fee. Takepayments have added more features to the hospitality software over the past year, like table plans and a kitchen display system, so seems to prioritise that over the retail system.

The setup can be expanded with a cash drawer, kitchen printer, barcode scanner and other compatible hardware.

The company used to offer the PAX A920 terminal with Epos Now till software (‘eposmove’), but this is no longer the case.

No other external POS systems can currently be integrated with Takepayments, which could be an issue for businesses with specific till preferences.

Takepayments fees and contract

Takepayments offers standard, 18-month contracts with their card machines. The Easy Deal has a high setup fee (£150 + VAT), whereas the other packages have no setup fee. In general, the company takes pride in stating all fees upfront to avoid surprises later on.

Takepayments will set you up with two contracts:

The exact costs are tailored around the individual business and not listed on the website. Instead, Takepayments encourages you to request a quote through their online form and get a visit from a local sales consultant.

We can, however, state the following example of fees:

| Takepayments | Pricing |

|---|---|

| Contract length | 1 (Easy Deal) or 18 months Early exit fee applies |

| Setup fee | £150 (Easy Deal) or £0 (other card machines) |

| Card machine rental | Easy Deal: From £7.50 + VAT/mo per terminal Takepaymentsplus: £25 + VAT/mo per terminal |

| Transaction rates | Personalised, e.g. 0.3%-2.5% (depends on card/business) + flat fee |

| Monthly minimum charge | £10+/mo |

| Chargebacks | £9 each |

| Payouts | Next-day w/EVO: Free Elavon: 30p each |

| Refunds | 30p each |

| PCI-DSS compliance | Takepayments fee: £49/yr (optional) Acquirer fee : £2.5/mo (mandatory) with Elavon / free with EVO |

Whereas other acquirers charge monthly and annual fees for card processing, the merchant accounts from EVO or Elavon have no monthly or yearly account fees. You are only paying fees for card machine transactions, chargebacks, refunds and PCI-DSS compliance. There’s no charge for the paper statements.

Transaction charges

Transaction fees are mainly based on the transaction value and sales volume.

If your average transaction value is low, like £5, your quoted fees would be higher than someone accepting high transaction values like £100. This means cafés and convenience stores, for example, probably won’t find that Takepayments is the right fit. Car dealerships, beauticians, restaurants and independent retail shops would, on the other hand, get competitive fees.

Transaction fees are composed of a variable rate associated with the card type and brand, plus a fixed authorisation fee. Takepayments splits the range of fees into four groups:

- Domestic debit cards

- Domestic credit cards

- Business debit cards

- Business credit cards

Domestic cards have the lowest rate – as low as 0.28% – while a business/corporate card typically costs 1.8%-2% but can go as high as 2.5% plus the fixed authorisation charge.

You can also expect a monthly minimum service charge, which is an agreed amount (say, £20) required in transaction charges every month. If you accept few card machine payments during a month so the total transaction charges are, say, £10, your transaction charges will still amount to £20 in that case.

American Express acceptance requires a separate agreement – it is not automatically accepted until this is set up through your acquirer.

If your average transaction value is low, like £5, your fees would be higher than someone accepting high transaction values like £100. So cafés and convenience stores, for example, probably won’t be the right fit.

Contract

There’s no cancellation fee if you cancel at least 30 days (Easy Deal) or 60 days (annual plans) before the end of the contract. An early exit fee is equivalent to buying out the remaining contract.

Apart from the monthly rolling Easy Deal contract, all Takepayments card machine contracts require 18 months’ commitment.

Other fees

There’s a monthly fee for card machine rental, the cost of which depends on the card machine model. Takepaymentsplus plus comes with a monthly £25 + VAT fee as standard, which includes on-screen point of sale software and reporting in the browser-based merchant dashboard.

A stationary Ingenico card machine costs between £10-£15 + VAT per month in rental. Portable or mobile models have a higher monthly cost, except for the PAX A920Pro terminal in the The Easy Deal that costs £7.50 monthly.

A complimentary SIM card is included with any mobile terminal if needed, though the free data won’t be unlimited.

PCI-DSS compliance requires a compulsory monthly fee of £2.5 if you opt for the acquirer Elavon. If you opt for EVO, there is no PCI fee. There is an ongoing non-compliance fee if you don’t complete the required paperwork within a certain time frame. If you want help managing PCI-DSS compliance, Takepayments can do this for you for an annual fee of £49.

Chargebacks have a fixed fee of £9 each, while refunds cost 30p to process.

Transactions are settled in your bank account according to your agreed schedule with the acquirer. With EVO, you get free next-day settlement, whereas a merchant account with Elavon charges 30p per settlement.

Online payments have separate charges, requiring an annual fee upfront or monthly subscription charge for months in arrears. The first 350 transactions per month are included in the price, whereafter you pay 10p per transaction online.

Remote and online payments

Apart from credit card machines, Takepayments has a good range of online payment methods to subscribe to, usually on an annual contract. These include:

Payment gateway: Customisable online checkout page integrated on your website, but hosted by Takepayments. You can get help setting up the online gateway, so hiring a developer isn’t needed. Compatible with 50+ online shopping carts.

Pay by link: Payment links through either email invoices (invoice creation included), customised email with “pay now” button, or by copying and pasting a link into an email. Links go to a payment page in a web browser.

Photo: ES, MobileTransaction

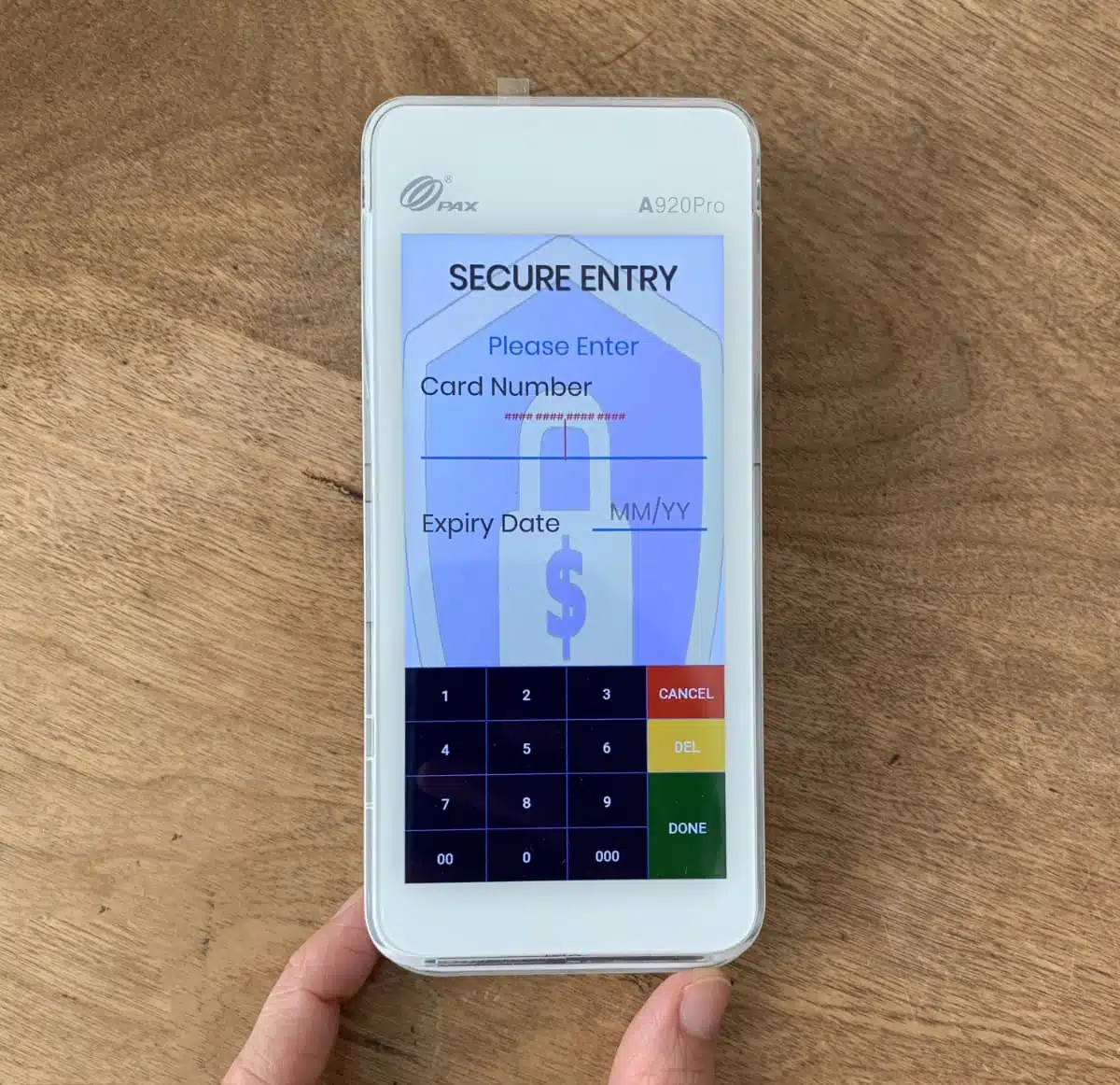

You can accept keyed card entry (over-the-phone) payments on the PAX terminal.

Virtual terminal: Secure web page where you can enter card details to process a transaction for the cardholder. Used for over-the-phone payments.

Merchant can accept keyed-entry cards on the PAX A920Pro terminal or from the Merchant Management System (MMS) in any web browser. MMS also helps you keep track of payments, add users and manage the online payment (not card machine) account in one place.

It is even possible to set up recurring payments or run preauthorisations to verify if someone can pay.

There are also the two following apps by Takepayments. They are not publicly available through Google Play or App Store. Instead, Takepayments gives you a URL to access for the below features.

- beepaidGO: Lets you send payment requests by email or text message and manage those transactions through the app.

- Order and beepaid: Includes a personalised web page with your food and drink menu and QR code to print for contactless ordering on your premises. When customers scan it, they can order and pay.

Customer service and reviews

Takepayments takes pride in their onboarding support so you can get up and running quickly. This includes a dedicated account manager and welcome team for each merchant to turn to when needed, and a welcome journey via email.

Takepayments support can be telephoned or contacted via a live chat or email every day of the week, but with varying opening hours: 8am-7pm on weekdays, 9am-5pm on Saturdays and Bank Holidays, and 9am-1pm on Sundays.

There is a YouTube channel and online support section for frequently asked questions, but we couldn’t find answers to several unique questions since the search function rarely shows results even for keywords that you know are covered.

Before sign-up, a local consultant can come and visit your premises to get to know your business. This is part of the promise that you get a unique package, but some merchants may find it intrusive.

As for Takepayments reviews, they are mostly positive, but there have been many complaints in the past years. Common themes in the negative reviews include:

Some of these issues can be avoided by getting a copy of the contract to read in your own time before signing up. A 2-month cancellation period is unfortunately common, but Takepayments does highlight it during sign-up.

The sales consultants can reportedly be pushy, in some cases requesting the merchant’s ID before it’s even agreed they want to sign up. We recommend never passing on more details than you’re comfortable with.

That being said, the average Takepayments merchant ends up staying with the company for several years – which we can only take as a good sign.