- Highs: No monthly fee, no contract. Accept payments both from SumUp App and a browser. Very straightforward to use.

- Lows: Only basic information can be entered for transactions. Activation requires approval. Transaction fee not the lowest.

- Use if: You’re a SumUp merchant who wants easy access to over-the-phone payments.

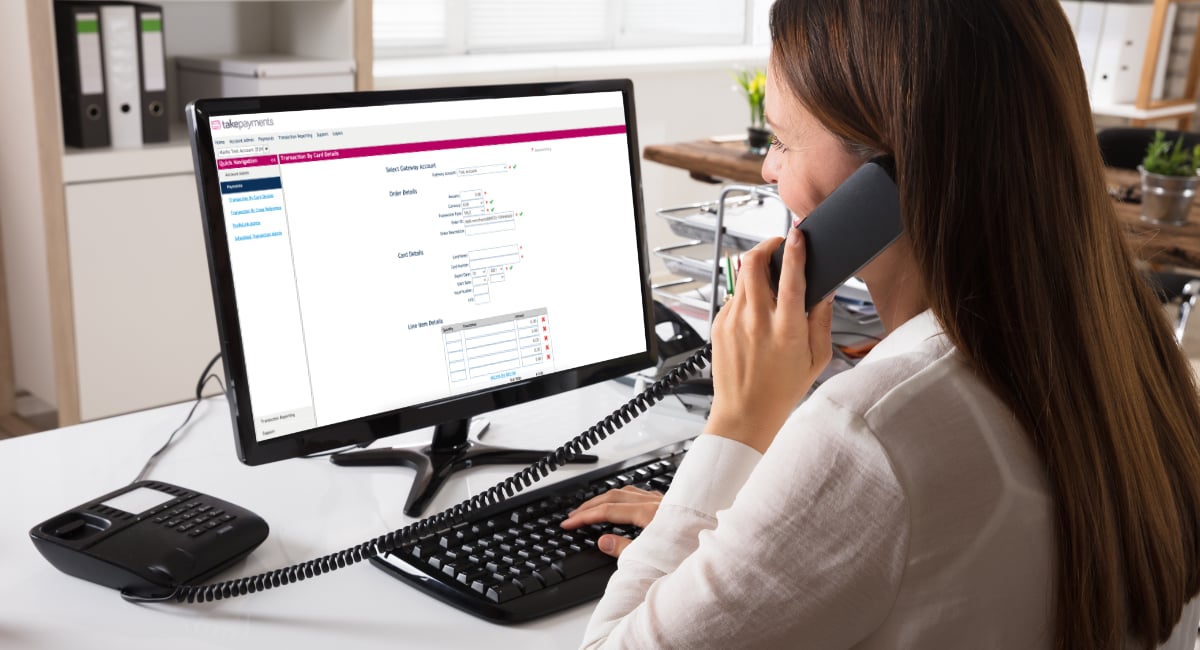

Companies typically use virtual terminals when they’re closing sales or taking deposits while on the phone with the customer or if they are receiving mail orders where card details are included on the form.

SumUp offers their own virtual terminal that can be accessed in a web browser or in the SumUp App. It accepts a broad range of cards including Mastercard, Maestro, Visa, American Express, JCB, Diners Club and Discover. This is more than most virtual terminal providers in the UK.

Accepted cards

Since the online terminal page has few fields to complete, it only takes a few steps to finish a transaction. There are, however, certain security steps you are encouraged to familiarise yourself with before taking remote payments routinely.

Get customers to complete their own payments for a lower transaction fee:

Send SumUp Payment Links to customers

| SumUp Virtual Terminal | Charges |

|---|---|

| Setup | Free |

| Contractual commitment | None |

| Monthly fee | None |

| Transactions | 2.95% + 25p per transaction |

| Refunds | Free within 1-3 days, 2.95% + 25p after |

| Chargebacks | £10 each |

| SumUp Virtual Terminal |

Charges |

|---|---|

| Setup | Free |

| Contractual commitment | None |

| Monthly fee | None |

| Transactions | 2.95% + 25p per transaction |

| Refunds | Free within 1-3 days, 2.95% + 25p after |

| Chargebacks | £10 each |

Transactions are automatically paid into your bank account within 1-3 working days. Refunding a payment can be done for free while the transaction is still processing to your bank account. Once it has landed in your bank account, it costs the original transaction fee to process that as a refund.

Should a customer dispute a transaction, it will cost a £10 admin fee for the chargeback.

There is no monthly minimum sales volume requirement, so you are free to use the service as little or much as needed without additional charges.

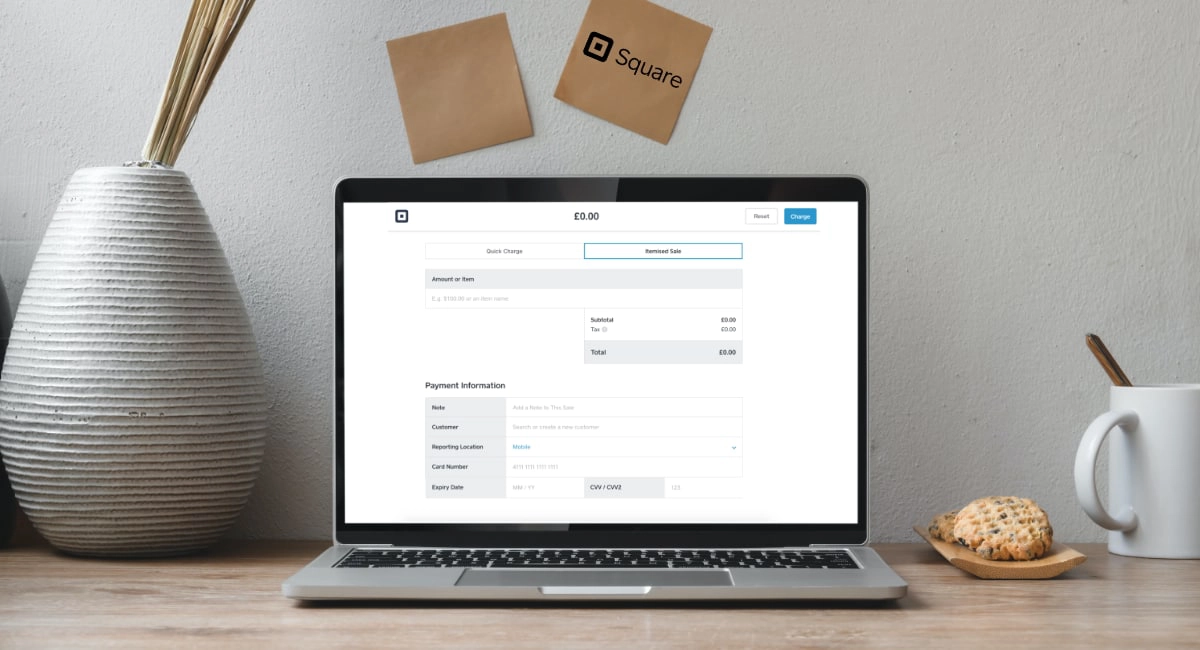

Overall, SumUp fees are pretty competitive if you just focus on the lack of ongoing fees, but the transaction rate is higher than the similarly subscription-free Square Virtual Terminal‘s fixed 2.5%. Also, the flat 25p per SumUp transaction makes it relatively expensive for very low amounts, whereas a fixed percentage only would be cheaper.

Setting up

To get started with the Virtual Terminal, you first sign up with SumUp on the website. The sign-up pages only require basic information about your identity, business and bank account. After submitting everything, your account should be verified soon after.

Since SumUp is primarily for face-to-face merchants, you will be encouraged to order a card reader. Alternatively, go straight to contacting customer support to request access to the Virtual Terminal. You will be sent an application form specifically for the Virtual Terminal, which needs to be filled in and returned to SumUp Support.

It may take a few days before SumUp approves the application and adds the virtual terminal to your account, provided you fulfil their requirements for access.

To qualify for the virtual terminal, you must be able to demonstrate “strong proof of your business’ online presence” including links to your website and social media. In addition, one of these documents should be submitted:

- Business registration number

- Annual business tax returns

- Employer Identification Number/copy of Employer Identification Number letter

- Registration documentation issued by official authorities

It is quite normal having to submit such proof, particularly as the virtual terminal is for cardholder-not-present transactions that require more security checks than face-to-face payments.

Payment process

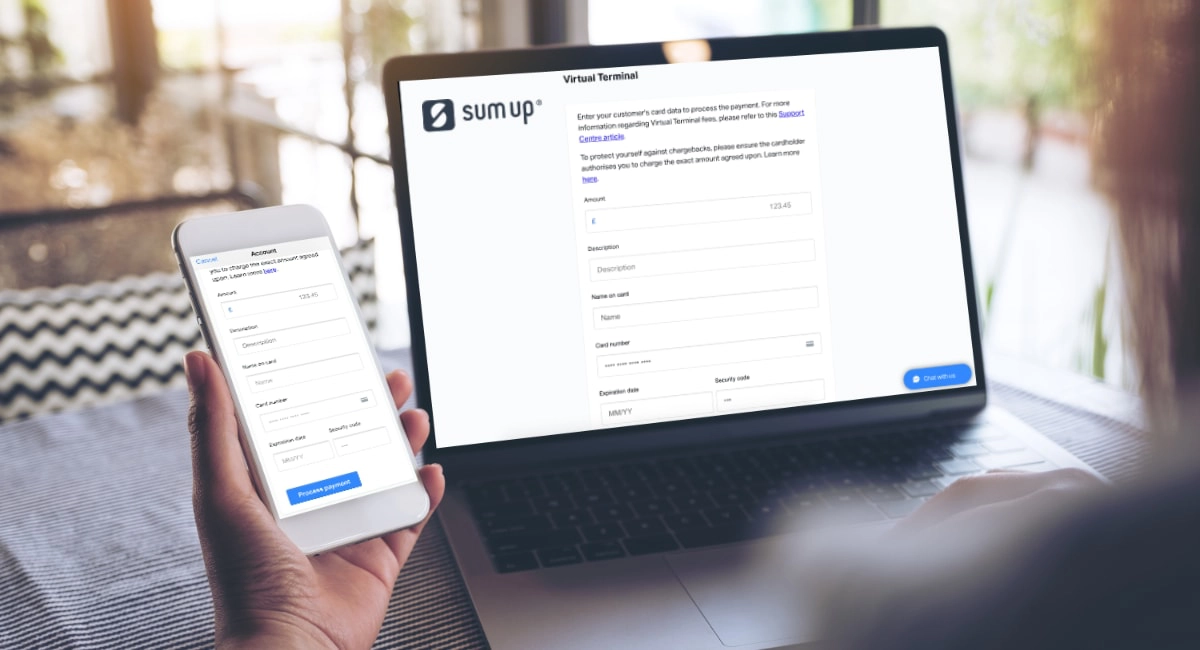

There are two ways to use SumUp Virtual Terminal: through a web browser and through the SumUp App. Other payment platforms typically only have an in-browser version, not an in-app virtual terminal, so SumUp is ahead of the game on that aspect.

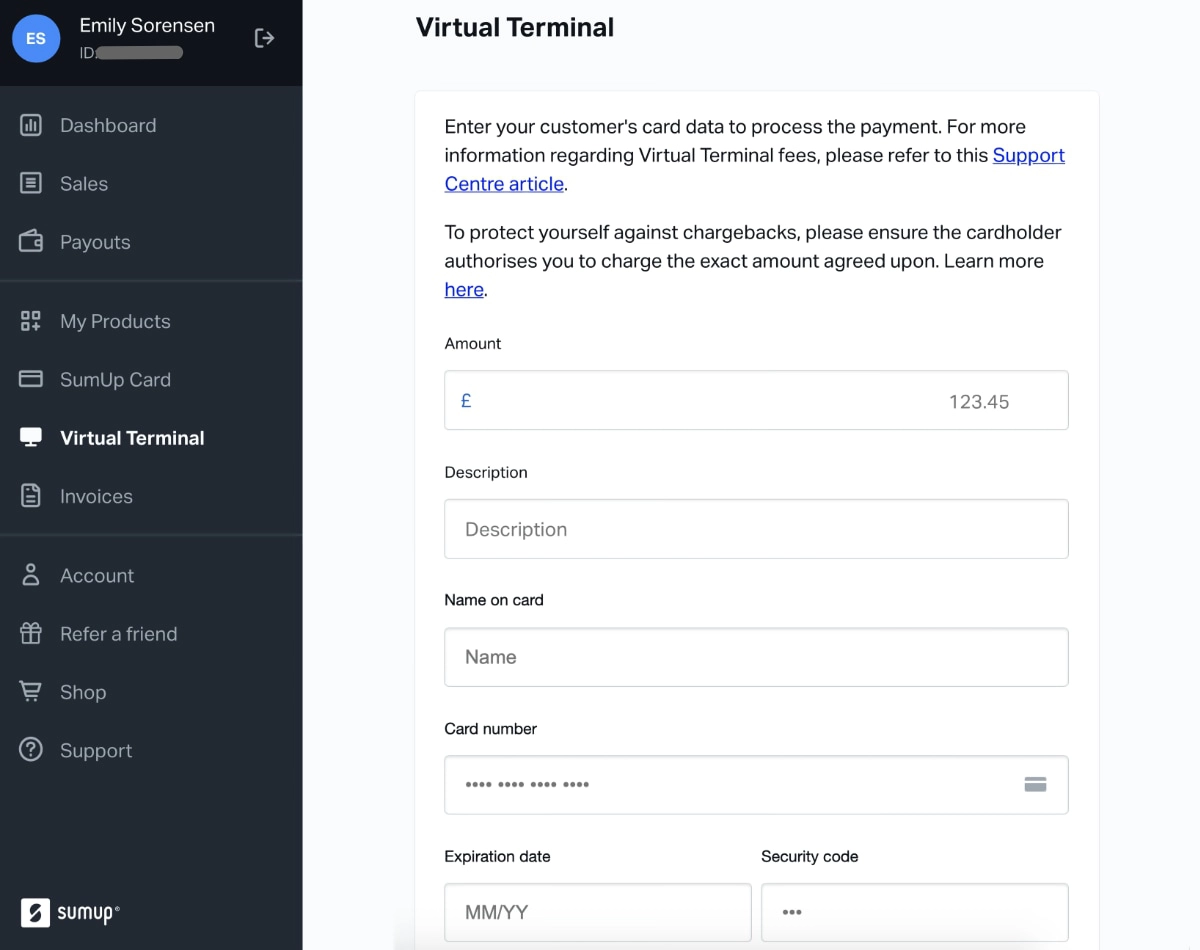

On a computer, you just need to log into the web dashboard through the SumUp website. The Virtual Terminal is in the left-hand menu – clicking this will open the Virtual Terminal page where card payments are taken.

Image: Mobile Transaction

The SumUp Virtual Terminal is accessible in any web browser when logged into the dashboard.

The only fields to complete are:

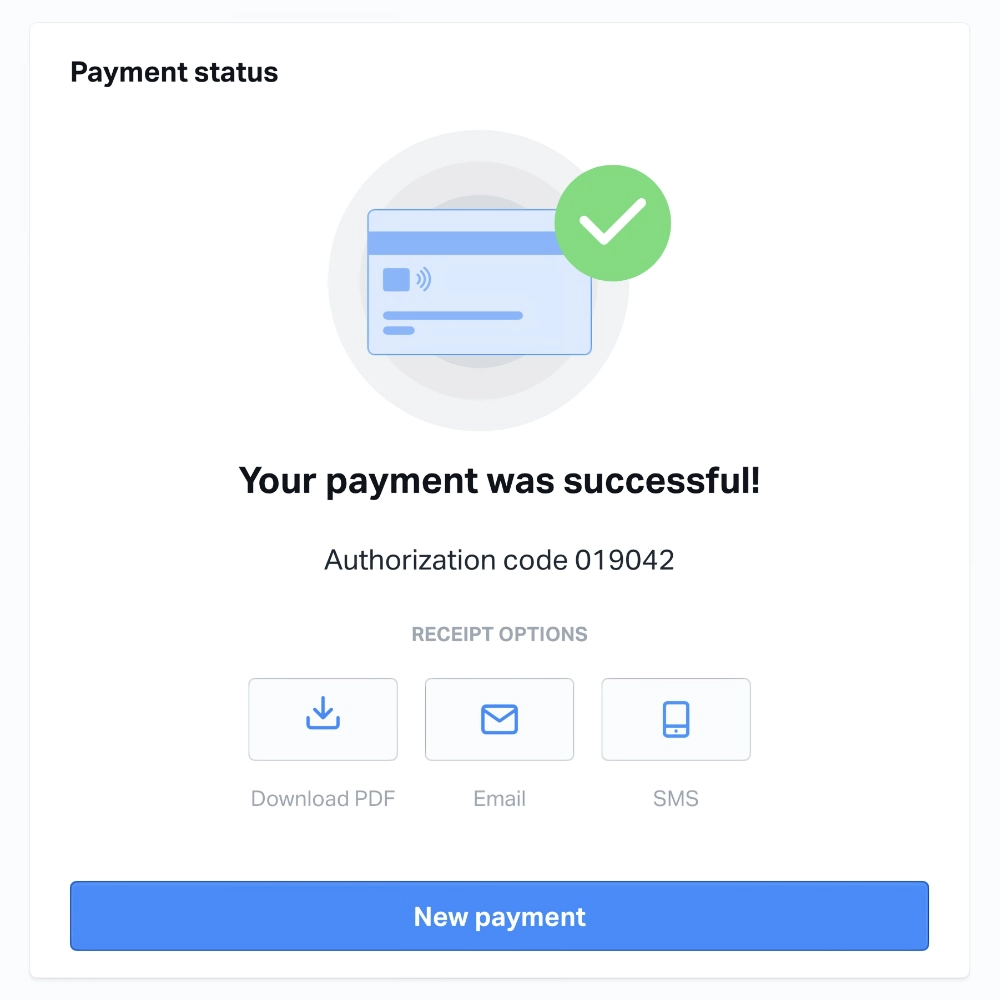

After completing all these fields, click “Process payment”. When the transaction is successful, you have the option to send a receipt via email, text message or download it as a PDF file for printing or filing.

Image: Mobile Transaction

Receipt options after a successful transaction.

On a mobile phone, you go into the SumUp App and tap the ‘More’ menu, then ‘Virtual Terminal’. Precisely the same Virtual Terminal is then displayed within the app (it doesn’t open a mobile browser), where you can enter the same fields as described above. Following the transaction, the same receipt options are displayed.

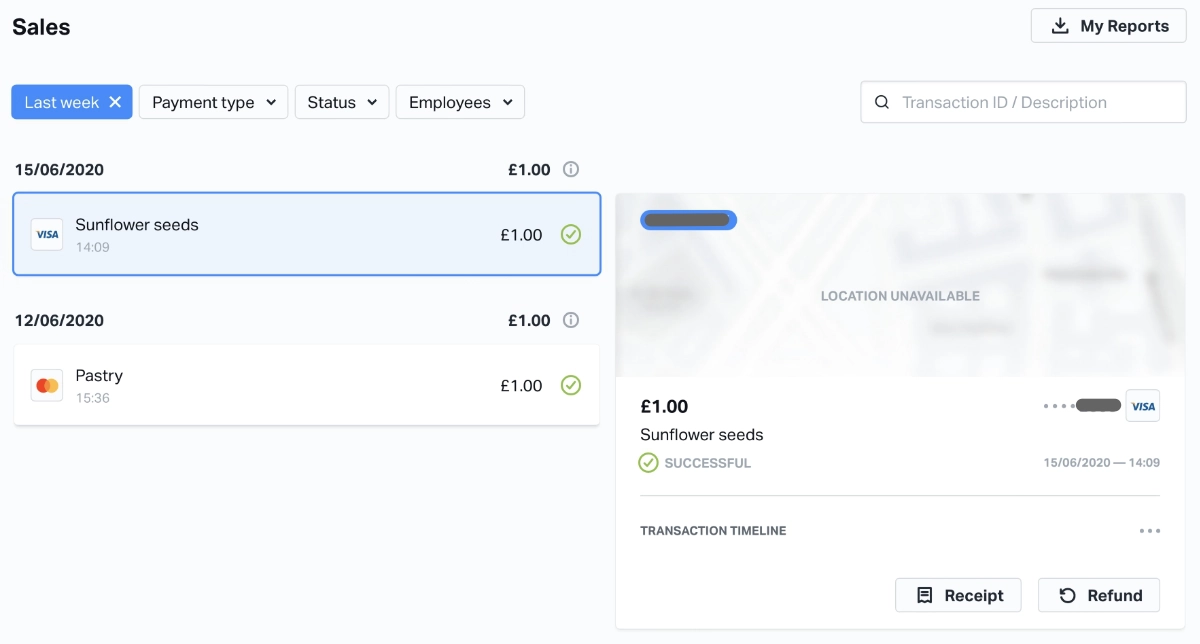

Sales can be found in SumUp App’s and Dashboard’s sales reports, where transactions can be sorted according to time, payment method, employee and status of the transaction. It is also here you can refund individual transactions and export sales reports for bookkeeping.

Image: Mobile Transaction

Find sales in your SumUp account or the app.

Security

With remote payments, you are responsible for handling the customer’s sensitive card data, plus a card machine cannot verify the presence of a card when the customer is not present. These two points mean there is slightly greater risk involved in virtual terminal payments.

Unlike most other virtual terminals, SumUp merchants do not need to set up and pay for PCI compliance, which is a set of industry-approved security protocols for cardholder-not-present payments. Instead, SumUp asks users to consider a few things when using the Virtual Terminal:

- Is the cardholder the owner of the card?

- Is the customer satisfied with the goods/services provided?

If in any doubt, it is encouraged to ask the customer to sign a ‘cardholder declaration form’ and send you a copy of the front of their debit or credit card. This will help if the customer or bank later disputes the transaction, as the documents count as proof of the customer’s credentials. It is also perfectly fine to refuse the payment if you’re unsure of whether the customer’s details are legitimate.

Limitations

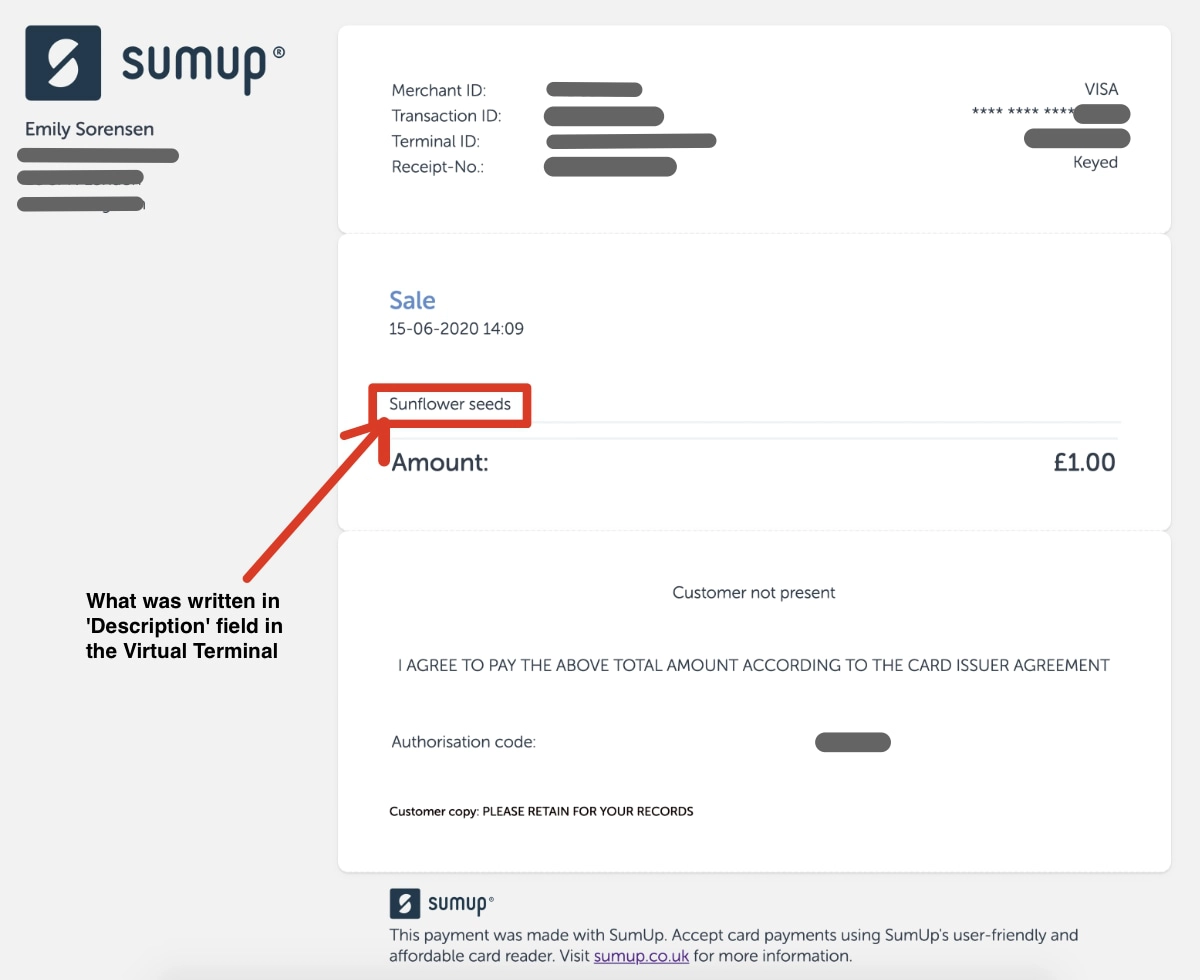

The strength of SumUp’s virtual terminal is its simplicity, but that is also a deal-breaker for many businesses. Because you are only allowed to enter core payment details and a single, manually written description for each transaction, the payments will not be linked to the rest of your product library in your SumUp account (if using that).

Every transaction is unique, and it is your responsibility to write an accurate description for each transaction to minimise issues identifying what was paid for and who the customer is.

If you have a big inventory, SumUp wouldn’t be the best system anyway, as you cannot add stock levels to items or use an order management system. If you need to ship items, you cannot add the postal address or dispatch information on the Virtual Terminal page either, so be prepared to write this down manually or digitally in a separate document/filing system.

Image: Mobile Transaction

Online customer receipt for a payment via the virtual terminal.

Customer service and reviews

SumUp can be contacted via chat-message, email or telephone Monday to Friday between 8pm and 7pm and Saturdays and Sundays between 8am and 5pm. There is also an online Support Centre with user guides covering most questions.

In the UK, SumUp generally gets very positive reviews for their service. We have tested the service several times ourselves, and the products, app and ease of use are really good for merchants who just want to get paid simply. It can, however, take some days to get an email response to non-urgent issues, but it seems the responsiveness has improved in the last half a year.

What is it best for?

Given the simple layout and lack of complicated features, SumUp Virtual Terminal is perfect for quick transactions that cannot be done in person.

Perhaps you need to secure a deposit over the phone, complete a remote payment for someone who doesn’t have internet access, or finalise a transaction later after a failure to connect a card reader to the internet. SumUp Virtual Terminal works effectively in these scenarios (we’ve tested it), so it’s a great back-up for SumUp merchants who do not want to ever miss a sale.

On the other hand, the virtual terminal is really basic. You can’t connect it to order management features, add customer details like a postal address, or integrate with SumUp’s product library used at the point of sale. Instead, businesses should be prepared to record these details themselves. If a transaction covers multiple products, for example, it is up to you to list these on a separate note associated with the transaction.

Certain areas of business are prohibited from using the virtual terminal, including charities, sales of alcohol, illegal goods and financial services.

Need a basic online store? SumUp Online Store Starter sets you up fast

Verdict

Although SumUp Virtual Terminal is quite basic, the fact it is accessible from an app makes it attractive for mobile merchants (it is common for virtual terminals only to exist in a web browser). The absence of monthly fees makes it an excellent backup solution for card-not-present transactions the payer cannot complete themselves.

The lack of bells and whistles can pose issues for more complicated businesses, though. The virtual terminal is not suitable for advanced orders, unless you are prepared to set up a manual system to identify which payments connect with which order details.

Bottom line: SumUp Virtual Terminal is a great supplementary payment method for situations where the customer isn’t able to pay on their own phones.