- Pros: No monthly fees or contract lock-in. Fixed rate for all cards including Amex. Online payments. Business account.

- Cons: POS features limited. No evening support. No accounting integration.

- Best for: Merchants who need need a very easy, low-cost solution for taking card payments.

MobileTransaction has tested SumUp’s card machines for years, so our opinions are based on experience.

Contents

In summary

What is it?

Verdict

In detail

Card readers

Fees

App and reports

Hardware and printers

Customer service

Who is it for?

Getting started

What is SumUp?

Many Irish entrepreneurs are looking for alternatives to a lock-in card machine contract – and the commitment-free SumUp fits the bill exactly.

SumUp Solo Lite is one of the few app-based card readers in Ireland working via Bluetooth in conjunction with a smartphone or tablet app. The mobile device needs to be connected to the internet via WiFi, 3G or 4G and then you can take card payments anywhere through the terminal. Then there’s the standalone SumUp Solo that works on its own, with or without a receipt printer.

Image: MobileTransaction

SumUp Solo and Printer box contents that we unpacked.

These come with a free online business account, Mastercard and next-day funds transfers, even on weekends. If preferred, transactions can be deposited in your bank account of choice within 2–3 working days instead.

The card can be added to your Apple Pay wallet and used in shops accepting Mastercard, whether online or in store.

Image: MobileTransaction

SumUp Card is a prepaid debit card for next-day payouts.

Online payment options can also be accepted via payment links, invoicing and a basic online store page.

There are no fixed monthly fees or minimum transaction volume required. Instead, SumUp is a pay-as-you-go service costing only a simple transaction fee for successful sales and the one-off cost of the card reader, which is yours to keep indefinitely.

Cards accepted

SumUp accepts a wide range of debit and credit cards from the brands above. Popular contactless mobile wallets are also accepted.

Our opinion: still one of the best

In Ireland, SumUp is no doubt one of the leading options for mobile card payments. But with Square, Revolut and Worldpay having entered the Irish market, SumUp does have more competition now.

Small-business merchants will find SumUp’s simple fee structure and app just what they need for accepting cards in the most user-friendly way possible. The card machines are good piece of engineering that look good and fit in a pocket.

“I love how pretty SumUp’s card readers are, but I did find a few shortcomings with Solo. On its own, the battery life wasn’t great when I tested it, but the printer attachment can top it up on the go if power is low.”

– Emily Sorensen, Senior Editor, MobileTransaction

The complimentary business account with next-day payouts is important for many merchants in need of a fast cashflow. We’ve spoken to some businesses saying how slow payouts are a deal-breaker. If you went with Square, fast payouts cost extra.

Overall, SumUp is a very low-risk, easy payment solution for anyone who just wants to take payments without hassle.

Card readers: choice of 3

SumUp sells a few types of card readers:

- SumUp Solo Lite: The cheapest card reader, but it requires a Bluetooth connection with SumUp App to operate.

- SumUp Solo: Independent touchscreen card machine with basic software to accept card payments.

- SumUp Solo and Printer: SumUp Solo card reader in a receipt printer-and-charging dock.

The cloud-based processing power of SumUp App is what allows the Solo Lite card reader to accept payments.

Photo: SumUp

SumUp Solo Lite (pictured) replaces the old SumUp Air.

The payment process itself is simple: firstly, enter the transaction amount in the SumUp App or add products from the product menu. The customer inserts their card into the reader and confirms the payment with their PIN on the card reader keypad or taps a contactless card or phone on the Solo Lite display.

When the payment has gone through, you can send an email or text receipt to the customer.

SumUp Solo Lite has a very long battery life: over 1000 transactions from a full charge. That’s twice as long as its predecessor SumUp Air that only lasted 500 transactions.

Image: MobileTransaction

SumUp Solo and Printer next to SumUp Solo in a basic countertop stand.

Alternatively, you can opt for the standalone SumUp Solo or SumUp Solo and Printer terminal. These come with a built-in SIM card with unlimited data for payment processing anywhere (though they also work with WiFi). None of them require a connected mobile device to function – in fact, they are meant to be independent card readers that don’t work with a point of sale app.

Solo is a touchscreen terminal with built-in features like smart tipping, language settings and screen brightness settings. It looks fancy and can be purchased with a simple countertop stand or receipt printer that doubles as a charger.

SumUp Solo and Printer consists of a SumUp Solo card reader attached to a printing-and-charging cradle. The whole thing is portable, but heavier than the handheld Solo reader.

These standalone card machines are ideal for merchants requiring an additional, portable card terminal to function independently from a point of sale system. They also work well for on-the-go payments that do not require a phone to operate the card reader.

SumUp Solo vs Solo Lite:

| SumUp Solo Lite | SumUp Solo | |

|---|---|---|

|

|

|

| Price | €34 + VAT | €79 + VAT |

| Works without smartphone/tablet | ||

| Connectivity | Uses connected mobile device’s network or WiFi | 3G, 4G, WiFi |

| Battery life | 1000+ transactions | 100 transactions |

| POS integrations | SumUp App, SumUp POS | None |

| Receipt printing | Compatible printers available | SumUp Solo Printer only |

| SumUp Solo Lite |

SumUp Solo |

|

|---|---|---|

|

|

|

| Price | €34 + VAT | €79 + VAT |

| Works without smartphone/tablet | ||

| Connectivity | Uses connected mobile device’s network or WiFi | 3G, 4G, WiFi |

| Battery life | 1000+ transactions | 100 transactions |

| POS integrations | SumUp App, SumUp POS | None |

| Receipt printing | Compatible printers available | SumUp Solo Printer only |

Fees: predictable, simle

SumUp’s rate is currently 1.69% per transaction and the card terminals cost €34–€139 + VAT through this link (with free delivery). The terminal has a 30-day-money-back guarantee from the day of purchase.

There are no monthly fees, no contractual commitment and no setup fee.

| SumUp charges | |

|---|---|

| Card reader price | Solo Lite: €34 + VAT Solo: €79 + VAT Solo and Printer: €139 + VAT |

| Shipping | Free |

| Account creation | Free |

| Monthly cost | Free |

| Card reader transactions | 1.69% |

| Cancellation fee | None – no contract |

| Refunds | Free within 2-3 days, 1.69% after |

| Chargebacks | €10 each |

| Invoices, Online Store, Payment Links | 1.69% per transaction |

| Virtual Terminal | 2.95% + €0.25 per transaction |

| SumUp charges |

|

|---|---|

| Card reader price | Solo Lite: €34 + VAT Solo: €79 + VAT Solo and Printer: €139 + VAT |

| Shipping | Free |

| Account creation | Free |

| Monthly cost | Free |

| Card reader transactions | 1.69% |

| Cancellation fee | None – no contract |

| Refunds | Free within 2-3 days, 1.69% after |

| Chargebacks | €10 each |

| Invoices, Online Store, Payment Links | 1.69% per transaction |

| Virtual Terminal | 2.95% + €0.25 per transaction |

While some merchant service providers charge for processing refunds, SumUp does not – as long as you process the refund before the transaction has settled in your account. After this, the SumUp retains the original transaction fee. Chargebacks incur a fee of €10.

It is also possible to accept remote payments through Invoices, Online Store, Payment Links (incl. QR codes) and SumUp Virtual Terminal. The virtual terminal is subject to approval by SumUp. Transactions through the virtual terminal cost 2.95% + €0.25 each and all other remote payments are 1.69% per transaction.

There is no monthly cost for the business account, no fees for using the card, and you get three free monthly ATM withdrawals (further withdrawals cost 2% each).

SumUp’s transaction fee appears to be the best fixed rate currently available in the Irish mobile card payment market. Both Square and Elavon MobileMerchant advertise a 1.75% rate, and Elavon charges more for JCB, UnionPay, Diners Club and Amex. High-volume merchants might find better deals with a traditional card machine.

App features and reporting

Whether you use the app-based SumUp Solo Lite reader or now, merchants can al access the handy SumUp App. It has essential features for accepting and managing payments – and a bit more.

For example, you can add products to a product library for an easier checkout experience as you can click on these to add to the shopping cart. Alternatively, enter the sales total directly in the app when you take the payment.

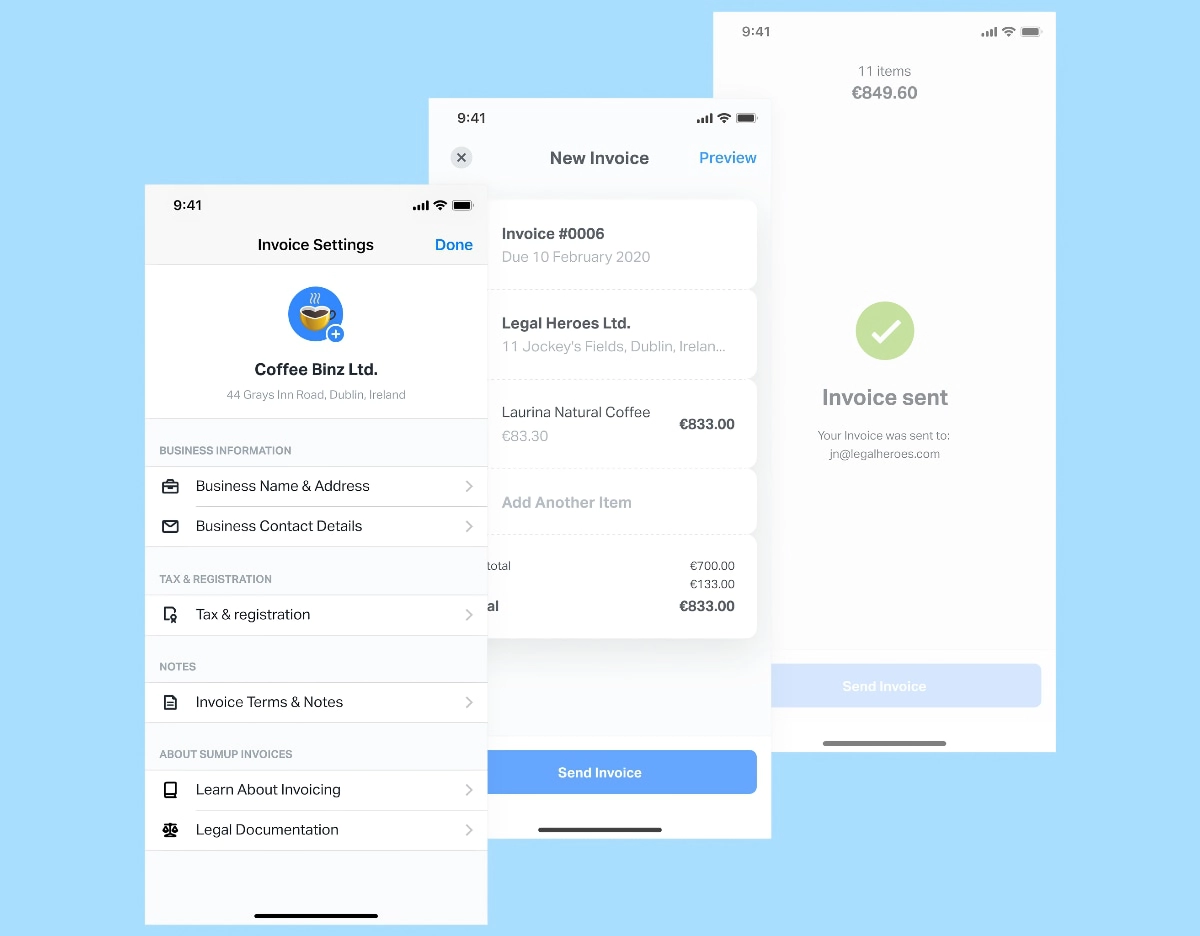

If you were granted access to Payment Links, the payment methods will (apart from cash and card) show payment link, SMS link and QR code as payment options – plus SumUp Gift Cards if you have sold any for redemption. Email invoices can be sent and managed from the app by all SumUp users.

SumUp Invoices are useful for many professionals.

Tipping can be switched on in the app, where the customer can choose the tip amount from a few suggested percentage options.

You can create multiple staff accounts in the app, defining whether they are allowed to process refunds and view all transactions in the app. If you need to have more than one person accepting card payments at a time, it is possible to link more than one card reader to the main SumUp account.

SumUp’s online dashboard provides an overview of important sales statistics. You can also access more sales data and export an entire sales history – or history of a particular day, week or month – to a CSV/Excel file.

Payout reports are automatically emailed to you for every settlement in your bank account (if this setting is switched on), listing the associated transactions.

When ready to expand your checkout features, it is possible to upgrade the software to a more feature-rich SumUp POS system built around your requirements.

Photo: MobileTransaction

SumUp Solo and Printer card terminal.

It’s also possible to connect the SumUp App to printers using AirPrint (iOS) and Google Cloud Print (Android).

Of course, if you need receipt printing and not the SumUp App, you can buy the SumUp Solo and Printer set.

What about customer service?

To contact customer support, messaging chat is encouraged, but you can phone them between 8am and 7pm on weekdays and 8am-5pm on weekends, or email any time. The support team is unavailable in the evening past opening hours. The helpline is generally responsive, but non-urgent email queries can take a few days for a response.

The online Support Centre answers the majority of user questions. Apart from that, the product is designed to be so simple to use that very little input is needed from the customer service team.

Who is SumUp suitable for?

SumUp is a great option for merchants and small businesses needing a single mobile card reader, as opposed to multiple readers and staff accounts. This could be market stalls, small shops, cafés, taxi drivers, fundraisers, tradespeople and other professionals.

For lower-volume traders and businesses, the flat rate is competitive. If monthly card sales exceed €5000, it may be worth getting a quote from a traditional terminal provider to compare. Just bear in mind the additional monthly fees, contractual lock-in and minimum transaction volumes that other providers often require.

SumUp is for registered businesses and sole traders only, meaning only bank accounts in your business, sole trader or organisation’s name are accepted.

If you’re travelling to trade shows, for example, SumUp offers the flexibility of using it abroad – as long as you’ve alerted customer service, and only if you’re going to one of the other countries SumUp operates in.

How to get started

You register for a SumUp account online through a short online form, then order the card reader which will be delivered by post within a week’s time.

As with other payment providers, SumUp performs an automatic identification, bank account and business check upon registration to be sure your details are legitimate and your business is not classed as high-risk. As a self-employed person, your bank account can be in your own name. If registering a business name, the bank account should be in your business’ name.

If you have the card reader, download the free SumUp app on your iOS or Android device and pair it with the terminal via Bluetooth (needs to be enabled on your mobile device). That’s it – when all of these things are connected, you are ready to take card payments.