- Highs: Very easy to use. No monthly fee, just a transaction rate. Can send links from app. Accepts many card brands. Can print QR codes.

- Lows: Basic sales reports only. Some poor customer service reviews. Overview of sent links very basic.

- Choose if: You need a simple way to accept remote payments, as well as a cheap card reader for face-to-face sales.

| Charges | |

|---|---|

| Monthly fee | None |

| Contractual commitment | None |

| Payment links & QR codes | 2.5% per transaction |

| Payouts | Free |

| Refunds | Free within 1-3 days, 2.5% after |

| Chargebacks | £10 each |

| Charges | |

|---|---|

| Monthly fee | None |

| Contractual commitment | None |

| Payment links & QR codes | 2.5% per transaction |

| Payouts | Free |

| Refunds | Free within 1-3 days, 2.5% after |

| Chargebacks | £10 each |

Payouts are automatically cleared in your bank account within 1-3 working days for free. Full and partial refunds are free to process as long as there is enough balance in the SumUp account (i.e. money currently being processed to your bank account). If there isn’t, the refund will cost you the original transaction fee – that is, the 2.5% payment link fee.

Should a customer dispute a transaction, an chargeback fee of £10 will be charged.

Signing up

To use the service, you first need to complete a short, online sign-up form available on the website to create a SumUp account. Basic information about your identity and business need to be submitted, and your bank account connected so you can receive payouts.

It may take a few days for SumUp to verify your bank account, but you can start accepting mobile payments before that, in which case transactions will pend in the SumUp account until they can settle in your bank account.

SumUp’s primary service is in-person payments, so you will be encouraged to buy a card reader. Other payment features are available from the start including invoicing, card reader payments (if you purchased a SumUp card reader), a simple online store page and electronic gift cards.

Not all businesses qualify for SumUp’s remote payment options. Restricted businesses include sellers of alcohol, tobacco, e-cigarettes, pharmaceutical products, illegal goods, certain financial services and others.

Payment links

Payment links are sent directly from the mobile SumUp App available in the App Store on iPhone and iPad or Google Play on Android smartphones and tablets.

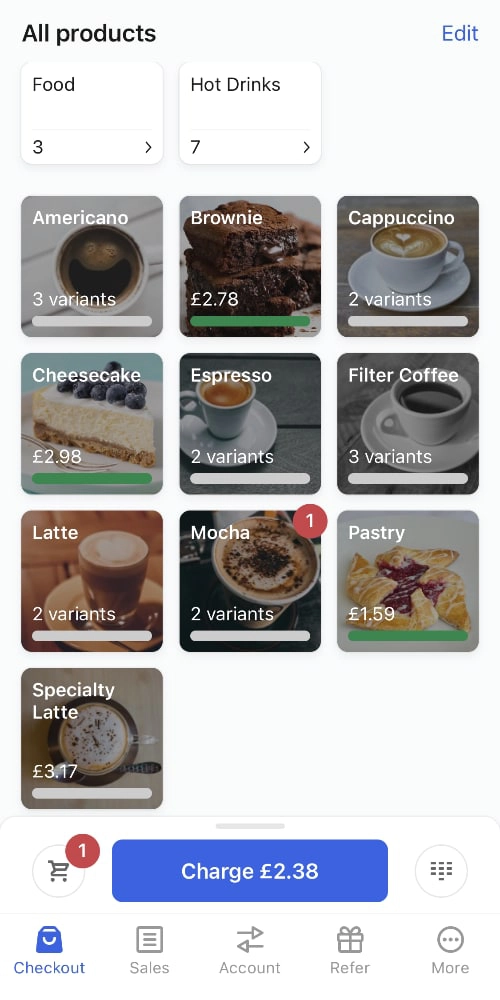

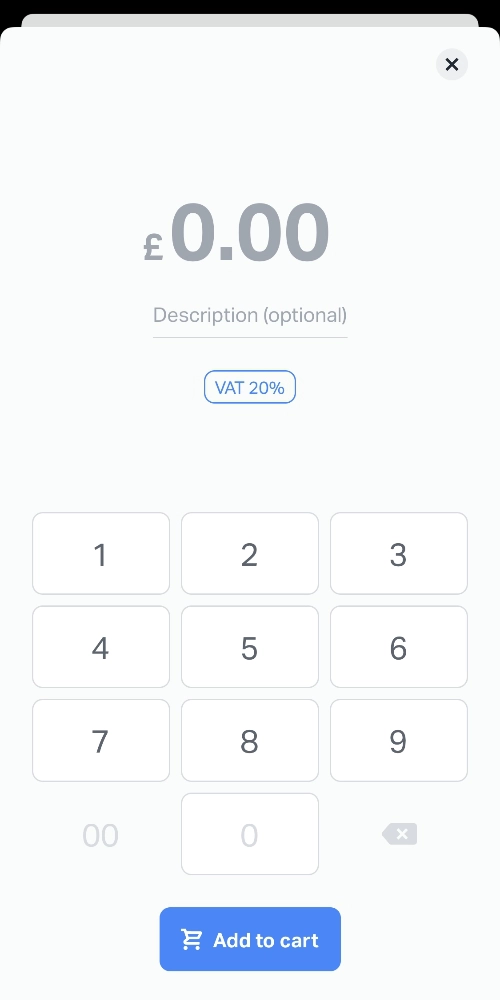

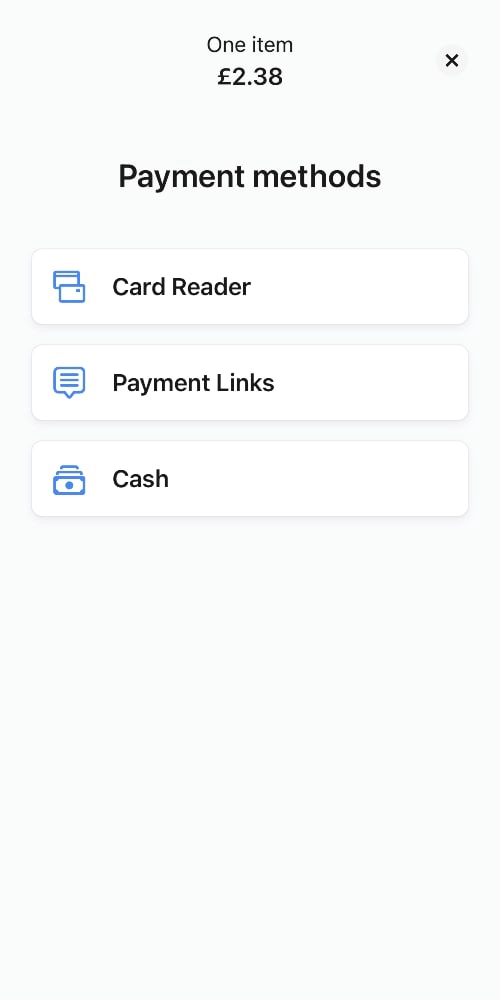

If you’re selling the same things again and again, we recommend adding items to the product library. This way, you can just tap to add products to the bill so receipts become itemised. Otherwise, you can add custom amounts with a written description. When the bill is ready, tap “Charge”, then “Payment Links”.

SumUp App product menu.

Add custom amount in app.

Payment methods in app.

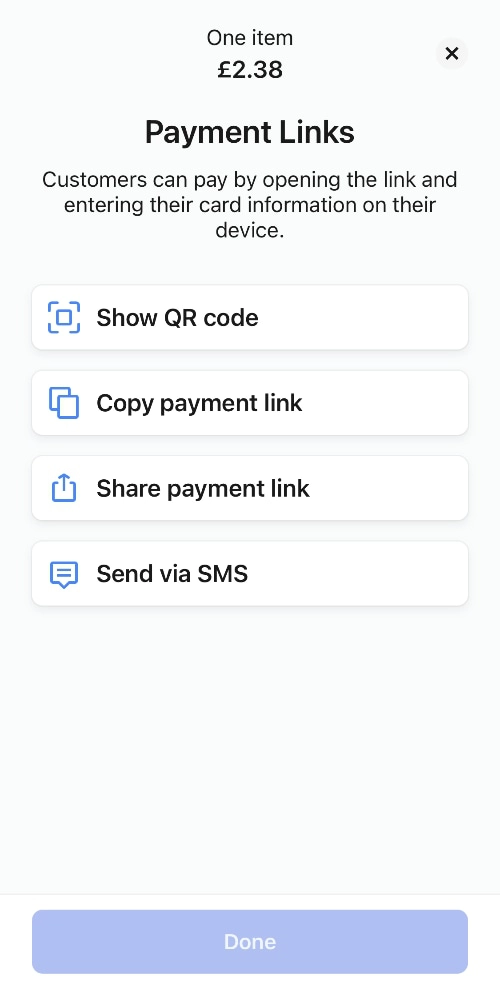

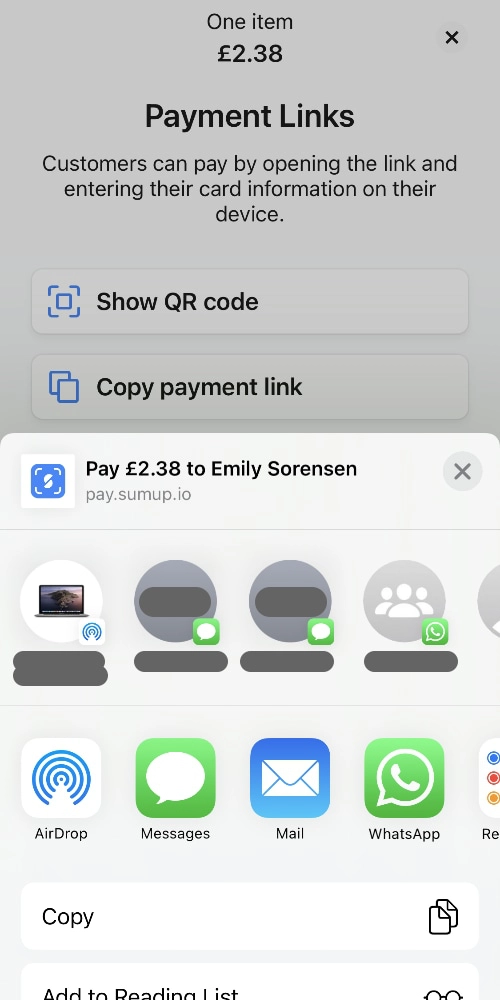

In the Payment Links menu, you can choose between sending a link via SMS or app on your phone.

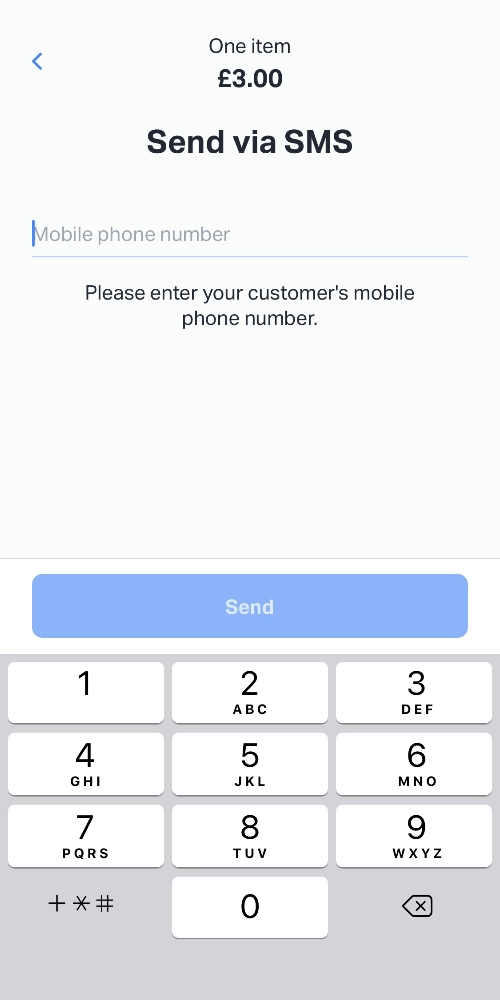

Choosing the ‘Send via SMS’ option prompts you to enter a mobile number, which can be a UK number or foreign mobile number (if you text a non-UK number, you should include the country code starting with “+”). This will send a text message saying:

You have received a payment request from [your business name] [amount] GBP. Please use the following link to complete the payment [link]

We tested sending an SMS this way to a non-UK number, but in our case, the text message never arrived. Instead of texting a foreign number, it may be better to email a payment link through the ‘Share payment link’ option.

It’s also possible to send the payment link as a text message through the ‘Share payment link’ option that opens up your apps through which the link can be sent. In this case, you pick the app for text messages, and then you can write the message that includes the link. This could be more reliable for a foreign number.

Mobile payment methods.

When clicking ‘Share payment link’.

After tapping ‘Send via SMS’.

Choosing ‘Share payment link’ enables you to pick any suitable messaging app installed on your phone, then customise the message after you’ve chosen an appropriate app. This could be an app for emailing, WhatsApp, Messenger or similar. You can also share the link via AirDrop (iOS devices only) or copy the link to paste it anywhere else on your phone.

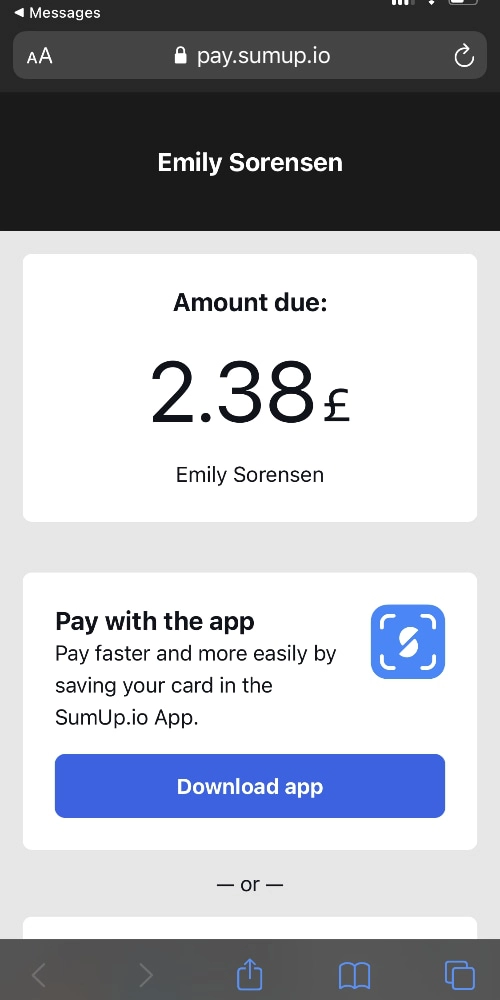

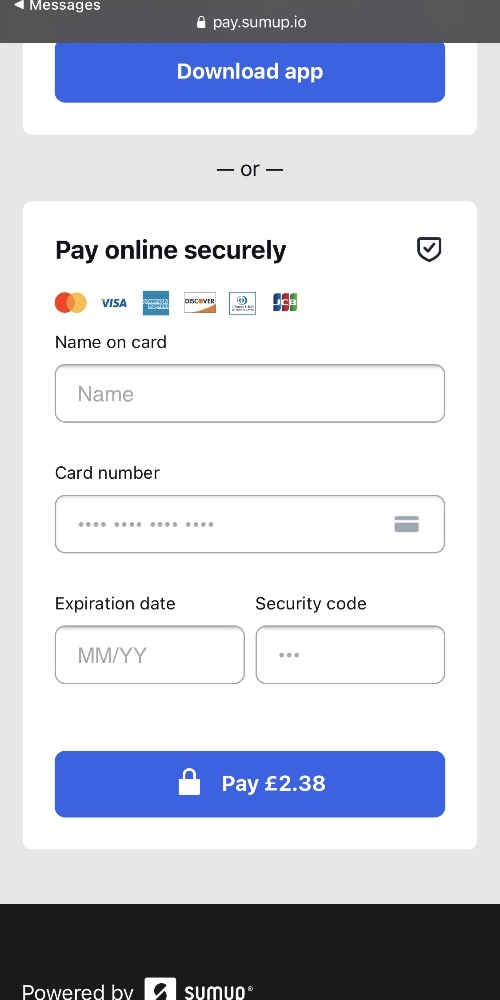

No matter how customers receive the link, they will be able to click it which will open up a secure SumUp checkout page in their mobile web browser. The checkout page uses the high security standard 3D Secure managed by Visa and Mastercard. Customers can pay with a Mastercard, Visa, American Express, Diners Club, JCB or Discover card – an impressive range compared with other payment link providers.

If the customer has the SumUp.io app installed on their phone, the payment page will open in this app where they can pay faster if their card details are saved.

QR code payments

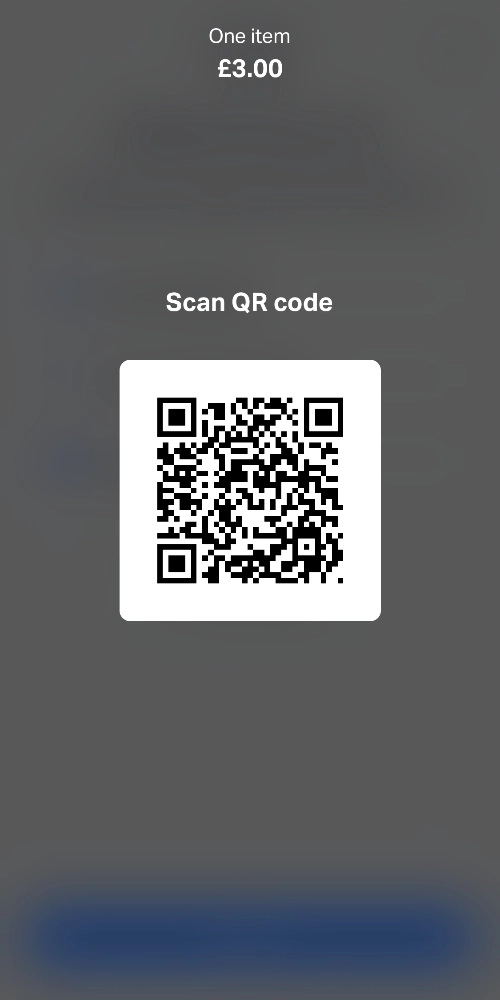

If you pick the ‘Show QR code’ option in the app, a QR code generated for that transaction will display on your phone. The customer can then open their camera app, point the camera at the QR code, and then the payment page will open up in their mobile web browser. This is the same pay-by-link checkout as the one generated from a payment link.

SumUp QR code.

Pay-by-link page.

Card details required.

Again, if the customer has the SumUp.io app installed on their phone, the QR code will open a payment page within that app for a faster way to pay. If the customer hasn’t got the app installed, they will see a prompt at the top of the payment page to encourage downloading the app – but this is by no means necessary since you can just enter the card details to finalise the payment.

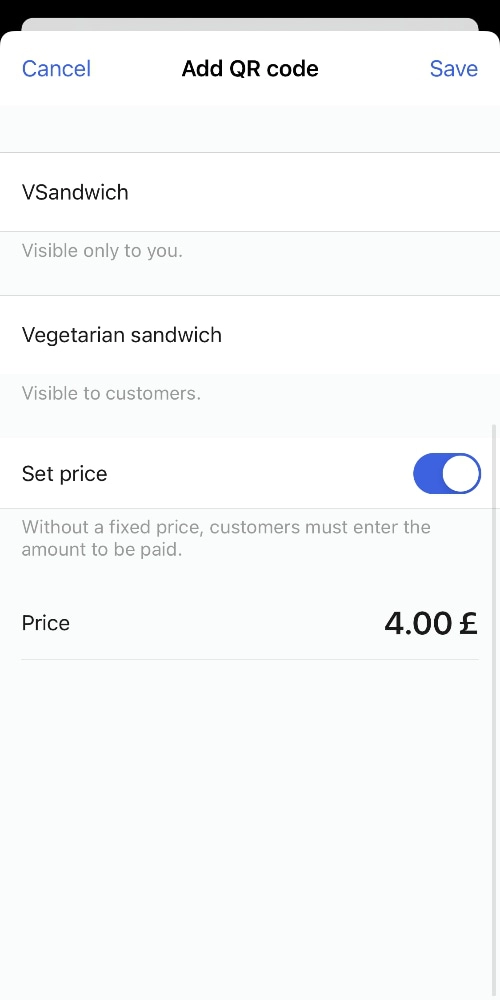

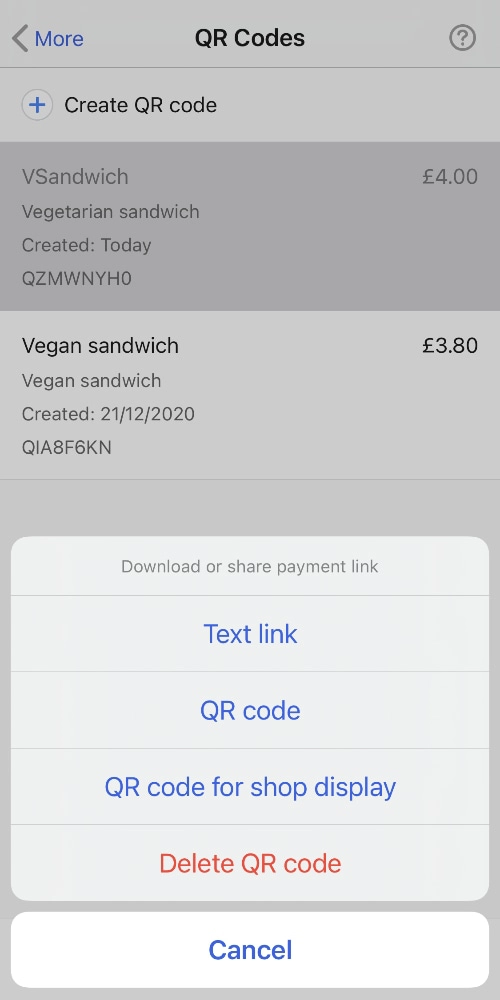

You can also go to the QR Codes section in SumUp App to create codes for individual products you sell repeatedly. This can be an easier way to share QR codes instead of having to create new transactions through the POS checkout.

Adding a new QR code.

QR code management.

A QR code to print.

A bonus is the ability to print QR codes saved in this section. For example, you can print a QR code for a particular sandwich to print and display in your café so customers can pay it at a distance from your staff.

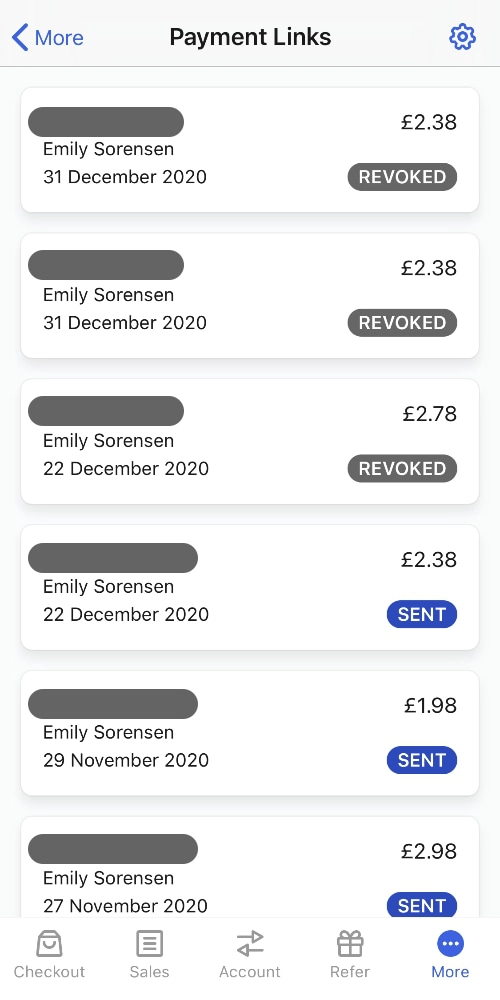

Only a basic overview of sent payment links

Every sent payment link will show on a simple overview page in the SumUp App so you can see which ones have been paid, not paid or revoked. The only actions you can take from this section is to revoke sent links or resend individual links. You cannot view what items are billed for within the links, making it difficult to identify specific transactions (it only shows a letters-and-numbers code, business name and date).

Overview of payment links.

Once the customer pays at their end, the status will change from ‘Sent’ to ‘Paid’.

Transactions are only registered in the SumUp Dashboard (backend account accessed in a web browser) when the transaction has been completed from the customer’s end. This could be a problem for merchants wanting to chase up outstanding payments on a computer.

In the Dashboard, you can filter successful and failed transactions, refunds and chargebacks. It is also possible to filter payments accepted by different employees, provided you’ve created different user accounts with unique logins for each staff member.

Transactions, revenue, payout and sales reports can be exported to a PDF, XLS or CSV file, but there is no direct integration between the SumUp account and accounting software.

What are SumUp Payment Links best for?

SumUp mobile payments are great for home delivery services, taking orders remotely – whether over the phone or online – and to offer clients a way to secure a booking remotely. For online orders, it doesn’t matter where your customer is in the world, as you can send the links to any country.

It can also be a replacement for when a customer you’re serving in person cannot pay through your card reader. If, for example, someone hasn’t got their debit or credit card and does not want to share their contact details, they can scan a QR code on your phone and finalise the payment themselves on their phone. Otherwise, you can ask the customer for an email address, mobile number or app profile to send the link for paying later.

You could argue that SumUp payment links are better for businesses with trustworthy customers, perhaps mostly regulars, because there’s an element of trust required as it is up to the customer to finalise the payment in their own time. This is typical for pay-by-links, so you have to keep an eye out for customers not paying their bills.

The QR code feature is particularly handy for buskers and street performers, as it enables you to accept card donations from people who don’t carry cash.

Easier to track: Invoice apps to consider in the UK

Customer support

SumUp’s customer support is every day of the week, but the phone support is slightly more limited.

Mondays to Fridays between 8am-7pm and Saturdays between 8am-5pm, you can call or message SumUp support. The Sunday support – open between 8am and 5pm – is only available by messaging chat.

The chat support is accessible on the website whether you’re logged in or not. We tested it and SumUp responded within minutes, giving us the answers we needed. Alternatively, you can email support any time, but a reply can only be expected during business hours.

Online customer reviews are a mixed bag, with recent reviews complaining of a poor service when contacting support. Many users are also happy with the user experience, low cost and convenience.

Our verdict

For years, SumUp has primarily focused on low-cost card readers without a contract, a simple transaction rate and basic merchant tools for managing a face-to-face business. However, the recent year has seen a broad expansion of remote payment options offered by SumUp.

To give customers a way to pay on their phone for orders placed remotely – or in-person – is a flexible way for merchants to start accepting payments without a card reader. All you need is a phone, internet reception and contact details of the payer, or the customer can scan a QR code without giving contact info.

The costs of using SumUp Payment Links are low, sharing the same simple transaction rate as Zettle Payment Links. But the general simplicity in usability results in a few shortcomings like the inability to track unpaid links in a web browser and the lack of options to expand on reporting tools.

That being said, SumUp’s mobile payments are excellent value given their usefulness, ease of use and lack of ongoing costs.