- Highs: Free software. No limit on invoices sent. Simple transaction fee. Decent features. Complimentary payment tools.

- Lows: Can’t integrate with popular accounting software. Non-negotiable transaction rate. Many features require desktop access.

- Best for: Multichannel merchants who don’t want to pay a monthly fee for a decent invoicing system.

How it works

SumUp Invoices is a complete digital invoicing system for small businesses, entrepreneurs and sole traders in the UK.

Apart from one-off or recurring email invoices, you can generate quotes, credit notes and delivery notes. Most of these features are managed in a browser dashboard, while SumUp App only gives you the core invoice functions.

Accepted cards

While it is possible for recipients to make a manual bank transfer or pay by cash (if you instruct this clearly), every SumUp email invoice contains a prominent payment link encouraging them to pay online. Through this, SumUp processes the transaction at a fixed rate – the only cost for the service.

The payment system is built into the platform, so you can’t use another card processing system. The software is, however, flexible in other ways, as we shall see below.

Pricing

SumUp’s pricing is extremely simple: there’s no fixed, ongoing fee, only a pay-as-you-go 2.5% rate per online payment. You can send unlimited invoices, as you don’t pay for them or the software features.

There’s no contractual commitment, so you can stop using the service any time without cancellation. If customers decide to pay outside the SumUp payment system – for example, by bank transfer or cash – no transaction charge will apply.

| SumUp invoice charges | |

|---|---|

| Monthly fee | None |

| Fee per invoice | None |

| Online transactions via SumUp | 2.5% |

| Bank transfers or cash payments | Free |

| Refunds | Before payout: Free After payout: Transaction fee is retained |

| Chargebacks | £10 each |

| SumUp invoice charges |

|

|---|---|

| Monthly fee | None |

| Fee per invoice | None |

| Online transactions via SumUp | 2.5% |

| Bank transfers or cash payments | Free |

| Refunds | Before payout: Free After payout: Transaction fee is retained |

| Chargebacks | £10 each |

Online payments via SumUp’s invoice link normally take 2-3 working days to settle in your bank account, or just one day if settling in the complimentary online SumUp Business Account. If the customer uses Amex or an international card, it can take an extra 2-3 working days to clear.

Refunds can be processed free if the transaction has not yet settled in your bank account. Otherwise, the original transaction fee will be retained by SumUp.

If a customer disputes a transaction with their bank, a chargeback fee of £10 may be applied.

Features

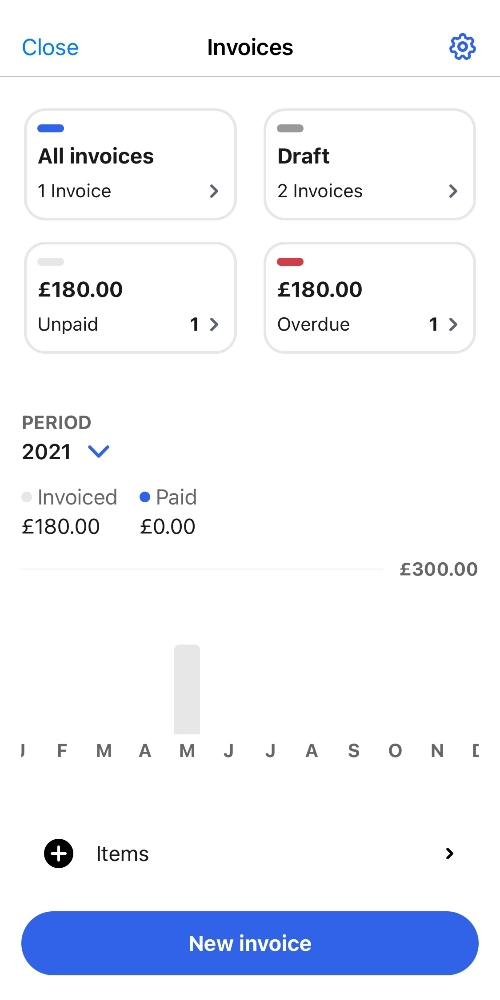

Most of the Invoices features are found in SumUp Dashboard that is accessed in a web browser. You can nevertheless send a new invoice and monitor existing ones in SumUp App on your iOS or Android device.

The app and software are regularly updated, with new features seemingly added every month. So what are the main functions now?

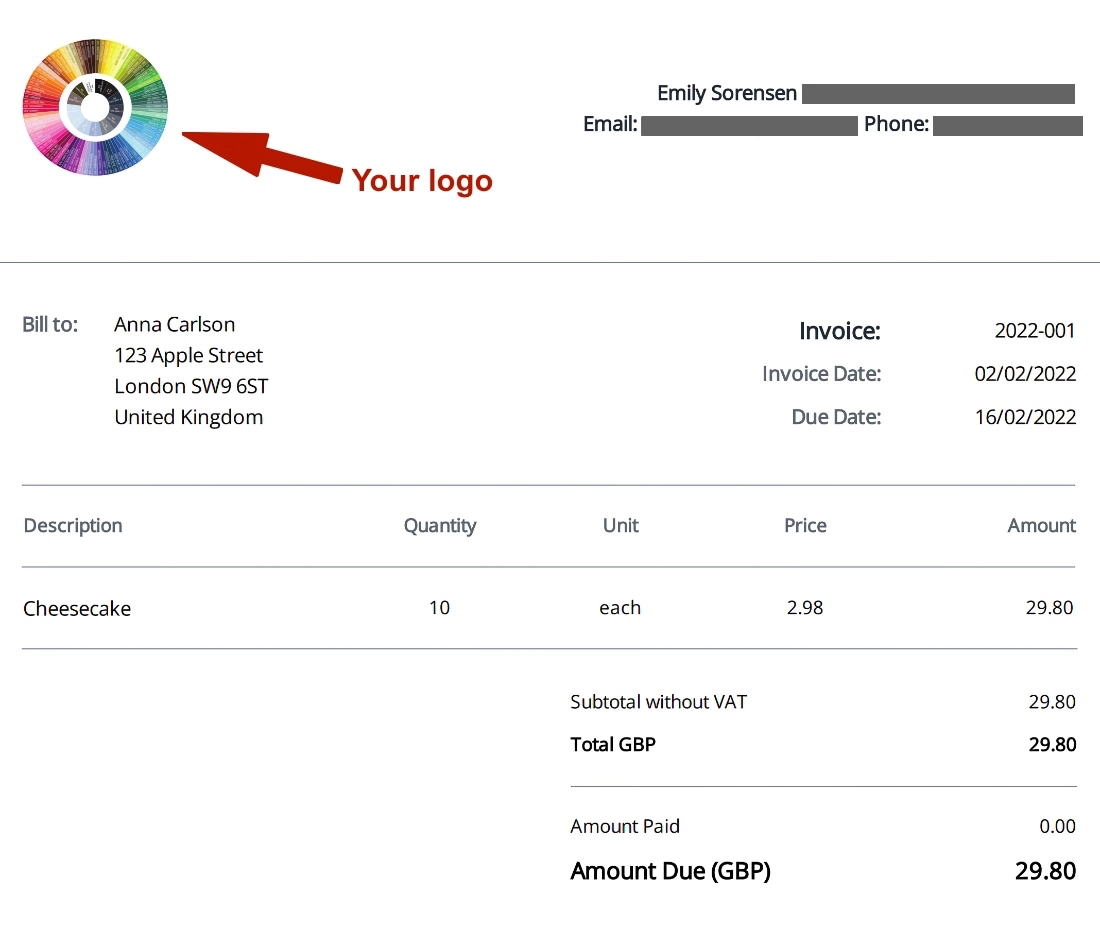

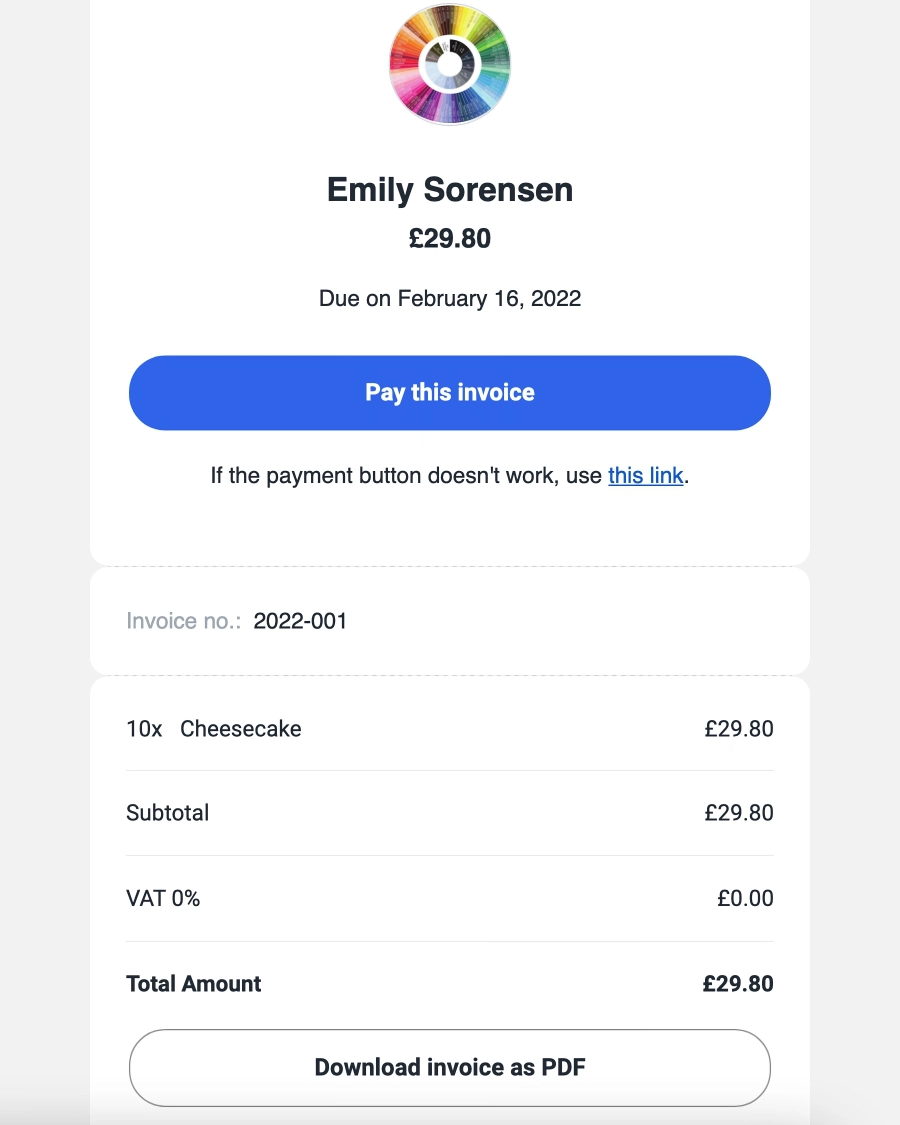

Customisations: You don’t get any choice when it comes to layout and design, except for uploading your company logo to be displayed in the top left corner of all invoices. Your business name, address, email address and phone number are also displayed. Apart from that, terms and conditions of up to 5000 characters should be added. It is otherwise a very neutral design that looks professional, but not unique.

When you create an invoice in the Dashboard (not app), you can also set the language to the recipient’s to provide a better service for non-English speakers. To be legally binding, an invoice date and payment due date are added too.

Image: Mobile Transaction

Layout and look of a SumUp invoice. Your logo is displayed in the upper left corner.

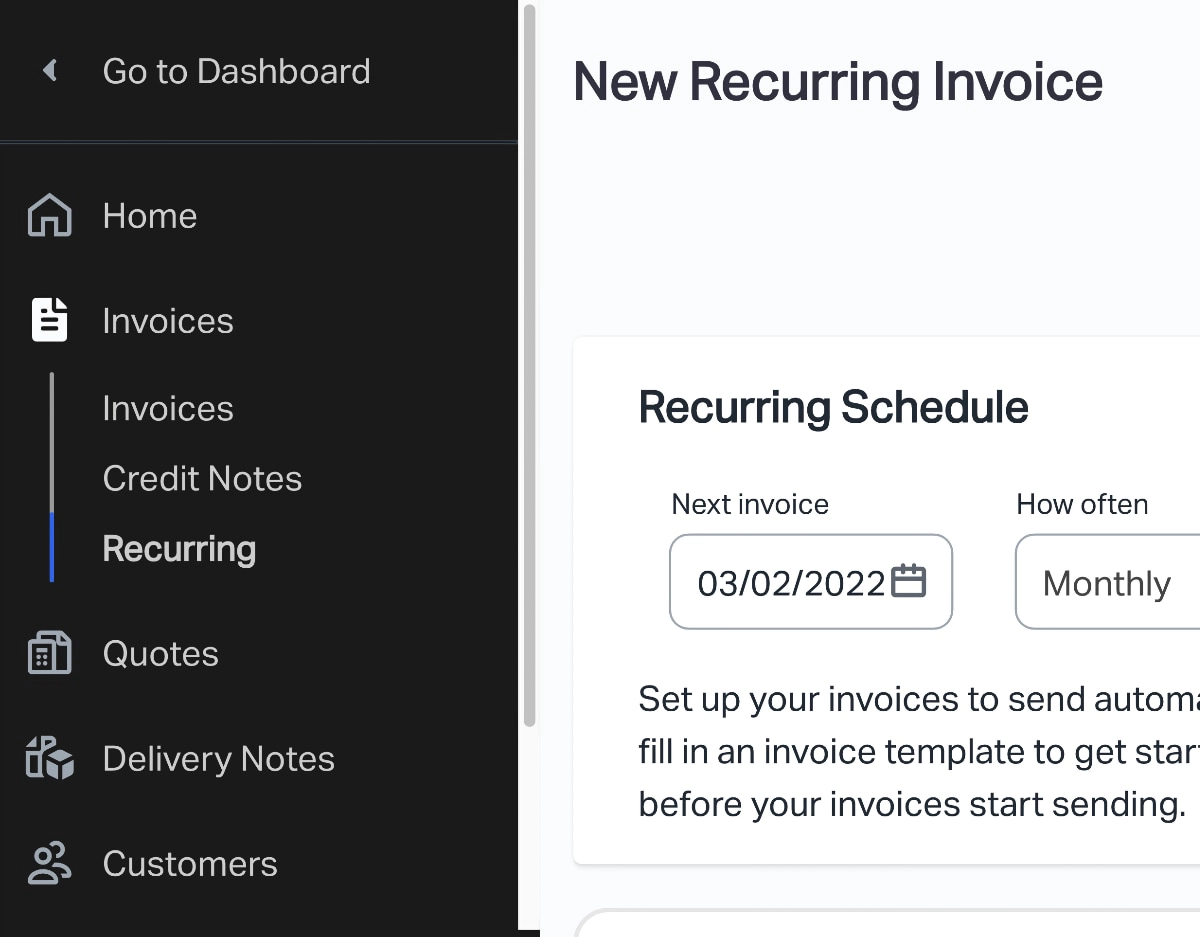

Recurring invoices: For long-term clients, it may be useful to automate invoices to save time manually creating one every month. This can be done from the Dashboard.

You can set the date of the first invoice, how often it needs to be sent, when the schedule should stop, and whether you want SumUp to auto-create a draft that you manually complete and send off or send it out automatically.

Image: Mobile Transaction

All features, seen in the side menu, are available in the browser-based SumUp Dashboard.

Credit notes: Here’s something other free solutions do not include: you can issue credit notes in case you need to refund a payment, or cancel or amend an issued invoice in another way. This is done in the Dashboard, not mobile app.

SumUp gives you the choice of linking a credit note with an existing invoice in the system, or creating an independent one.

Quotes: If your client wants to see the scope and price of a service before they accept it, you can easily send a quotation from the Dashboard. This is similar to a legally binding invoice, but it also allows you to add a discount. If the client accepts the quote, you can turn it into a normal invoice in a few clicks.

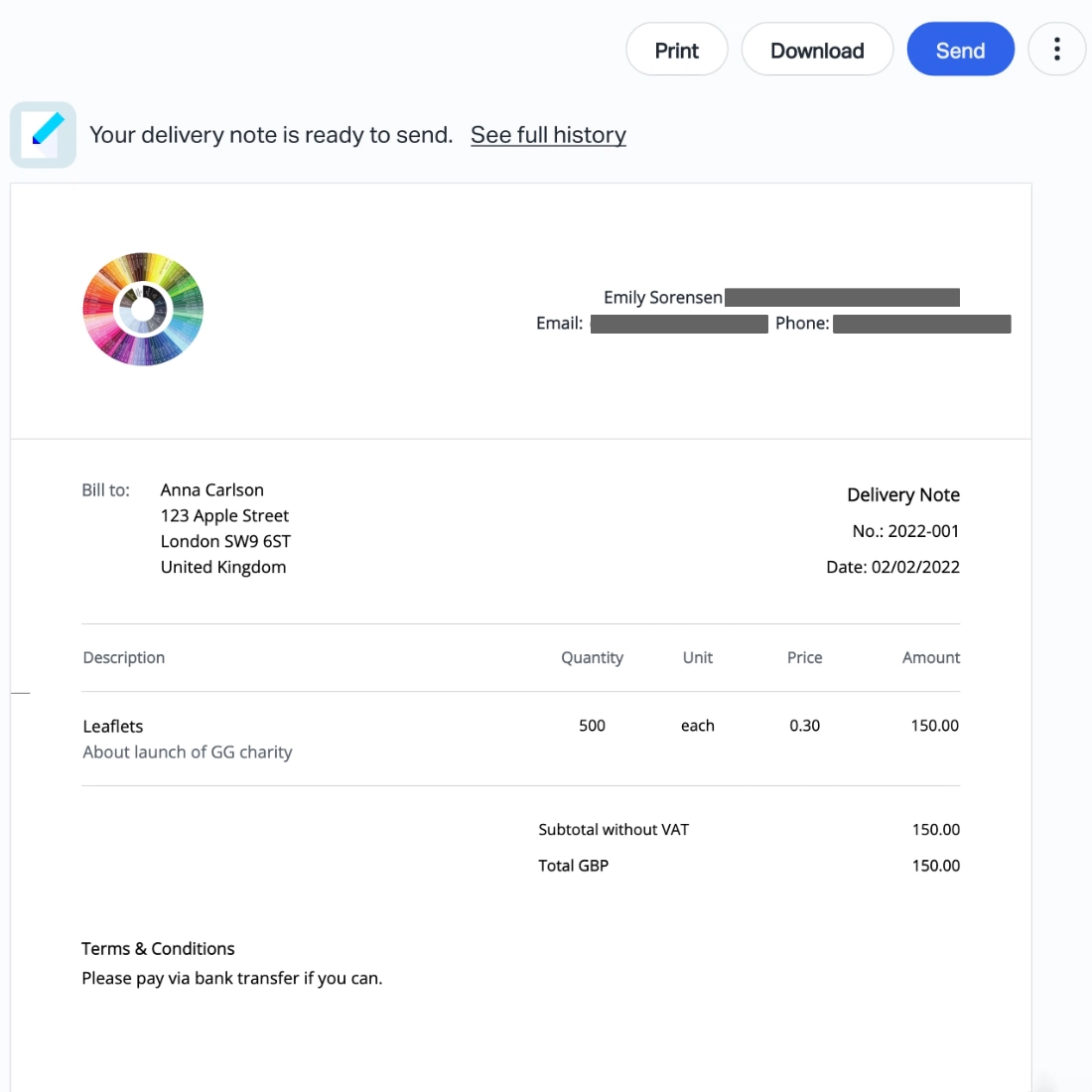

Delivery notes: If you ship physical products, a delivery note can be generated to help the customer check they have received all of their order. Delivery notes are generated in the Dashboard. They look a lot like an invoice, except there’s no payment link or due date – just the details of the order and products received.

Image: Mobile Transaction

Example of a SumUp delivery note.

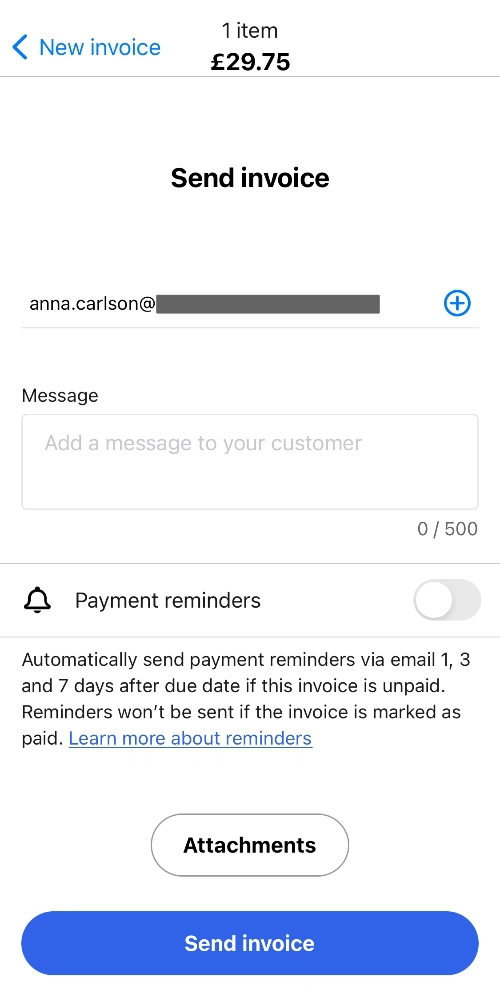

Payment reminders: You can select that SumUp automatically sends out payment reminders via email 1, 3 and 7 days after the due date if it remains unpaid.

These reminders are not sent if the client pays via SumUp’s payment link or you manually mark the invoice as paid. If you expect a bank transfer or other means of payment, it is your responsibility to check the client has paid and then log into SumUp to confirm this.

Contracts: There’s no contract creation function, but you can upload an additional document from your computer or phone every time you bill a client.

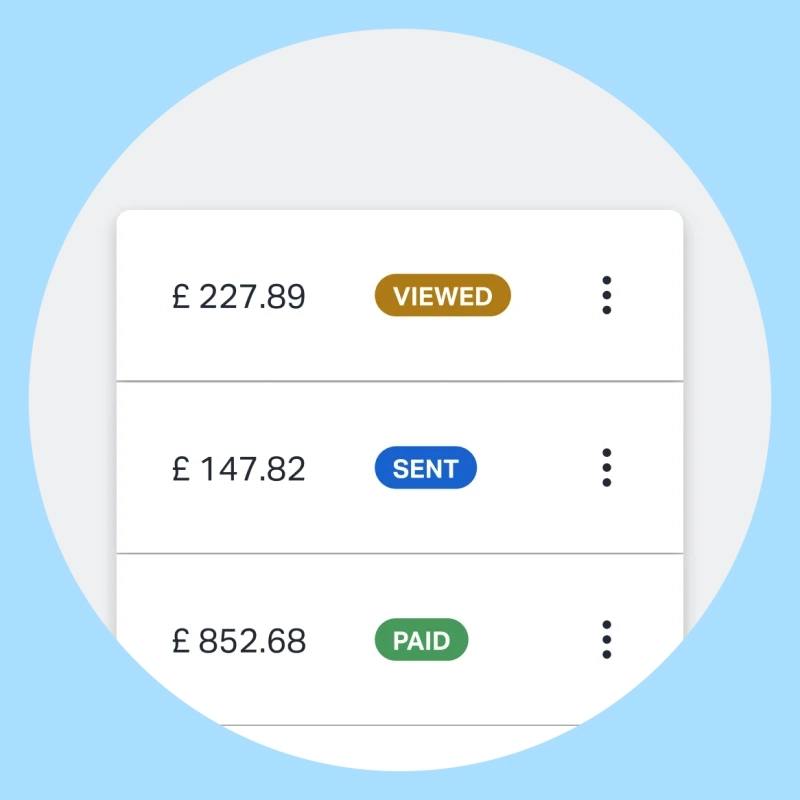

Tracking: SumUp records the status of each document you’ve generated. For example, you can see when an invoice has been viewed by a customer, sent or paid.

The app and Dashboard shows a simple graph of paid vs unpaid invoices for an easy overview.

Monitor the status of bills.

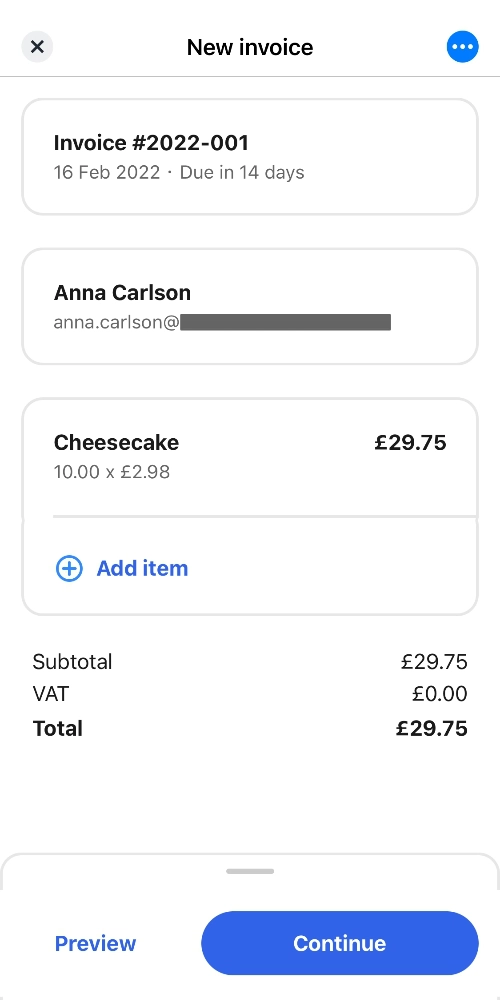

Customer directory: Instead of repeating the same client details on different invoices, you can just save the address and contact details in the customer directory. When creating a new document, pick the person in a drop-down menu, and the relevant client information will populate the recipient fields.

This also allows you to click on each customer for their complete history of invoices, quotes and credit notes. If you need to provide this information, you can generate an account statement of this information to send to the client.

Photo: Mobile Transaction

Invoice section in app.

Photo: Mobile Transaction

Sending an invoice is simple.

Photo: Mobile Transaction

Last screen before send-off.

Products: Another directory that saves you time is the items library. If you already use SumUp’s product library for in-person payments, the same products are included on this list. However, you can add new items that apply to just invoices.

These can easily be selected from a drop-down on new invoices so you don’t need to manually add an item description, tax information etc. each time.

Payment options: The main payment method for your clients is a payment link that goes to an online checkout page by SumUp. This is displayed at the top of the email received by the client when you issue an invoice, which makes it easy and quick to pay with their credit or debit card details.

Photo: Mobile Transaction

A blue SumUp payment link is displayed at the top of the client’s email when you send an invoice.

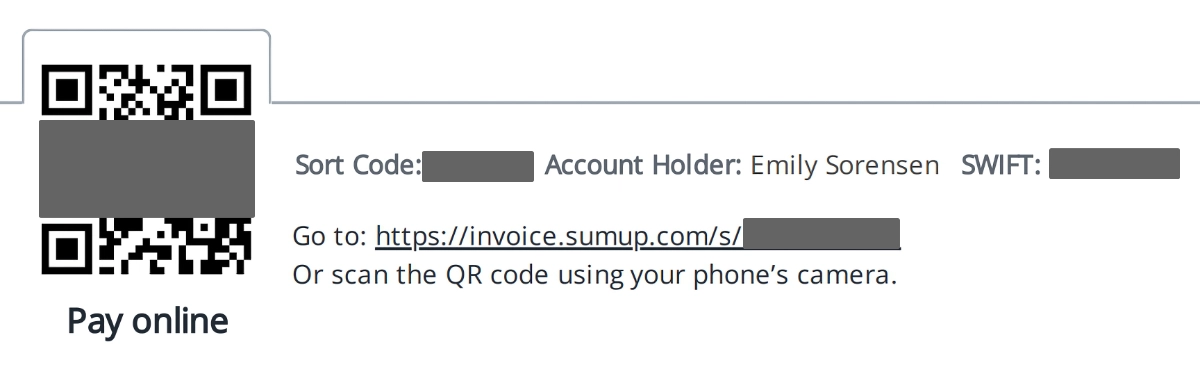

At the bottom of the PDF invoice is also a QR code and hyperlink to the online payment page. You can also display your bank account details that clients can enter in their banking app for a manual bank transfer. This way, you can avoid a SumUp transaction fee, but it may not be what clients prefer since it takes more effort to do a bank transfer than pay via a link.

Photo: Mobile Transaction

Payment options displayed in the footer of a SumUp invoice.

It’s up to you to leave clear instructions for the client, preferably communicate in advance that you prefer a bank transfer or other payment method if that’s the case. Once the client receives the SumUp invoice, it will be tempting for them to just pay via the invoice link.

Accounting: A potential downside is its lack of integrations with external software like Xero or QuickBooks. But SumUp does have its own accounting system, which you can check out through the Dashboard. Alternatively, you can export data to an XLS or CSV file to upload in your chosen accounting system.

Customer service and reviews

SumUp support is available to contact by email, chat or phone between 8am-7pm on weekdays and 8am-5pm on Saturdays and Sundays. This is more support hours than Square that only has a helpline on weekdays.

There is also a comprehensive resource section on the SumUp website that explains everything you need to know about invoicing, including a dictionary of legal terms and when to use different types of documents. This is a great support when you’re still not confident about your businesses processes.

In terms of reviews and user experience, SumUp generally fares well among freelancers and small-business owners. The system is really easy to use, the app is reliable and updated regularly to avoid bugs, and the lack of complicated fees appeals to many.

That said, some merchants have experienced issues with specific transactions, which could be due to things like security protocols that SumUp has to abide by. If you run into a complicated issue, it may also take a while before it gets resolved through SumUp, especially if you contact them by email or chat instead of calling.

How to get started

To get started, you first need an account with SumUp. Through one of the sign-up buttons on the website, you just submit some basic information about your business, identity and bank account (to receive payouts).

It takes about 5-10 minutes to complete the whole sign-up form. You may be encouraged to purchase a SumUp card reader, but you don’t have to buy one if you don’t need it.

SumUp will then check that your business details match the public records – private individuals are not accepted. It can take a few days for your bank account to be verified, but you can start creating and sending invoices straight away unless there’s an immediate issue with the account.

If you receive transactions before your bank account is accepted, the money can just settle in your online Business Account.

Considering other options?

View best invoicing software for UK businesses

Our verdict

For a free invoicing system with payments built in, SumUp offers a surprisingly complete solution that covers more or less everything required from a legally compliant business that bills clients.

For many sole traders and small businesses, invoicing software seems like an unnecessary cost compared to manually creating one. SumUp at least removes the need for a paid subscription. It is free to sign up, and the only cost is a rate applied to online payments.

Although you can’t stylise layout or colours, it has genuinely useful functions like credit notes and quotations. Before these were added in the past few years, Square had the most advanced free invoicing software (with its own app, no less), but theirs is mostly geared towards services, not physical products requiring, say, a delivery note.

SumUp Invoices hasn’t got its own app, but you can still send and manage invoices – not quotes or other special documents – from SumUp App. Most features require Dashboard access in an internet browser.

Other potential downsides include the lack of accounting integrations (if not using SumUp Accounting) and the prominent display of a SumUp payment link in email invoices.

Even if you instruct clients to pay via other means, you can’t disable the SumUp link so clients may still opt for this, resulting in a transaction fee for you. That’s the trade-off for this otherwise excellent free invoicing software.