- Highs: Simple fees. No contract. Works independently anywhere with 3G or WiFi.

- Lows: No out-of-the-box integration with POS systems. Bit chunky with receipt printer.

- Buy if: You want a no-friction mobile device for taking cards, without monthly fees or lock-in.

Note: SumUp 3G is now only sold together with the printer attachment. A new standalone card terminal, SumUp Solo, has replaced the printerless SumUp 3G.

Lowdown

SumUp’s 3G card machine is for those who want a simple way to get started accepting cards without any extra features or equipment. With this device, you enter the transaction value directly on the terminal, put in the chip card or tap the contactless card, and it will process the payment over the mobile network or WiFi.

The card reader accepts Visa, V Pay, Mastercard, Maestro, American Express, Diners Club, Discover and UnionPay as well as Apple Pay and Google Pay.

It’s a pay-as-you-go system – you purchase the card reader, then pay only one fixed transaction fee for all transactions through the machine. There’s no contract or other fees to commit to, making this an economical solution for price-sensitive businesses, sporadic sales or startups that can’t predict where they’ll be beyond the next few months, or just those who need a mobile device to take cards where the customer is.

If you need receipt printing, you can purchase SumUp 3G as a bundle with a receipt printer attachment.

Emmanuel Charpentier, Mobile Transaction

We have tested SumUp 3G, which is as small as you get a terminal with built-in SIM card.

Fees and settlement

The two things you pay for are: the €129 + VAT one-off cost of the card reader-and-printer bundle and transaction fee for all the payments processed through it. There’s no extra fees for foreign cards. Delivery of the card reader is free, and there’s no monthly fee or minimum sales volume required. SumUp has a 30-day money-back guarantee for the card machine in case you change your mind, and one year’s warranty.

| SumUp costs | |

|---|---|

| SumUp 3G and Printer bundle | €129 + VAT |

| Shipping | Free |

| Monthly fee | None |

| Contractual commitment | None |

| Card transaction fee | 1.69% |

| Payouts | Free |

| Refunds | Free within 1-3 days, 1.69% after |

| Chargebacks | €10 each |

| SumUp costs |

|

|---|---|

| SumUp 3G and Printer bundle | €129 + VAT |

| Shipping | Free |

| Monthly fee | None |

| Contractual commitment | None |

| Card transaction fee | 1.69% |

| Payouts | Free |

| Refunds | Free within 1-3 days, 1.69% after |

| Chargebacks | €10 each |

Payments automatically reach your bank account 2-3 business days after the transaction, minus the transaction fee. Alternatively a free SumUp Card is provided, which is attached to an online SumUp account where you can receive payouts the next day, even on weekends.

Image: SumUp

SumUp Card gives next-day access to funds.

Refunds are free if done straight after the transaction took place, i.e. before settlement has completed. However, if payments have already been paid out to your bank account, SumUp charges the original transaction fee for the refund. Chargebacks incur a €10 admin fee.

SumUp can also activate a virtual terminal for phone payments, costing 2.95% + €0.25 per transaction. This is not an automatic feature – SumUp will look at your sales history and account as a whole and only add the virtual terminal if you pass their internal checks.

All users can accept online payments via payment links, QR codes, email invoices, e-gift cards and a basic online store page without special approval. These remote payments all cost the same as card reader transactions: 1.69% per payment.

Of the pay-as-you-go solutions, SumUp is known for having the lowest transaction fee. Their other terminal, SumUp Air, also accepts cards for the same transaction cost.

Emmanuel Charpentier, Mobile Transaction

SumUp 3G’s chip card slot is at the bottom.

Card machine specs

The terminal is very lightweight, small and easy to carry around compared to a traditional one, but sturdy enough to be reliable.

You navigate it through the keypad buttons and view the menu and information on the screen above the keypad. For some functions, you can use the display as a touchscreen.

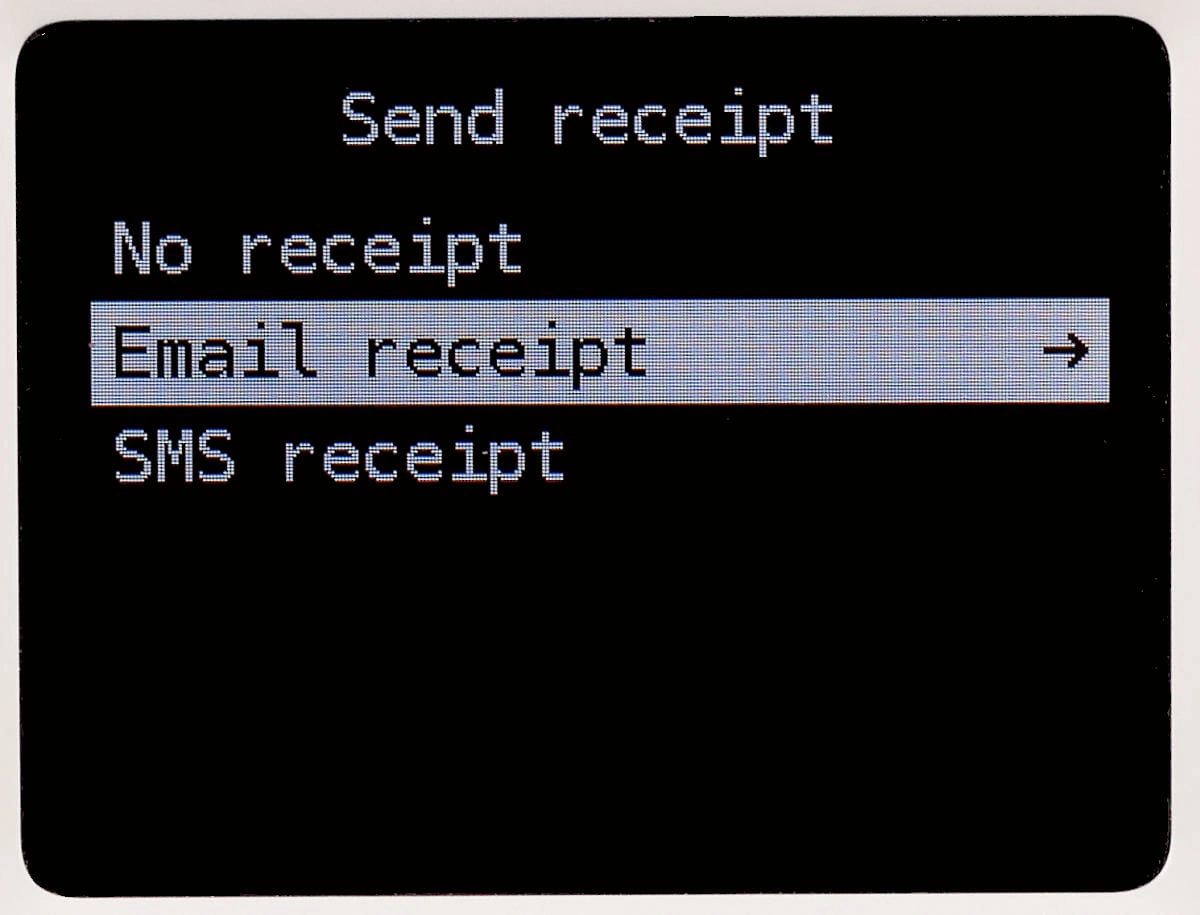

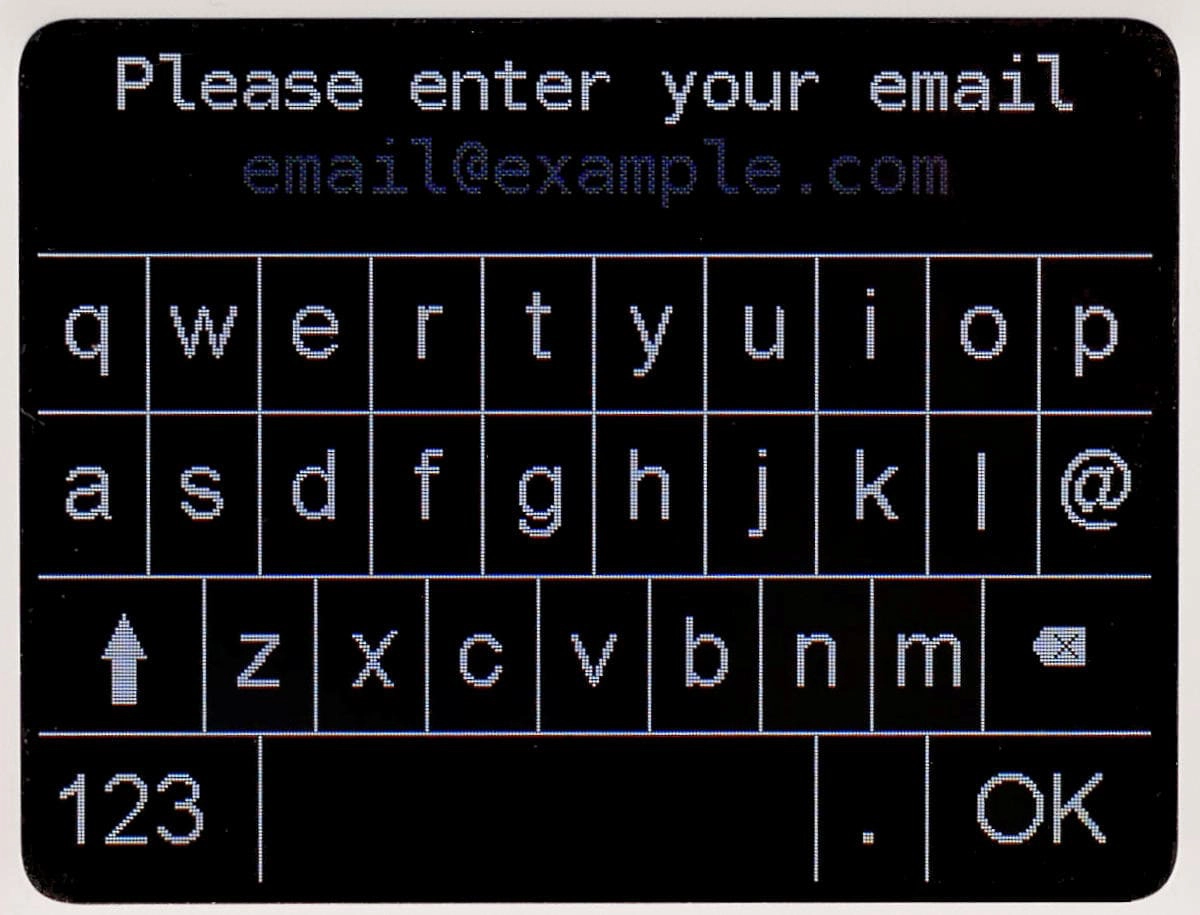

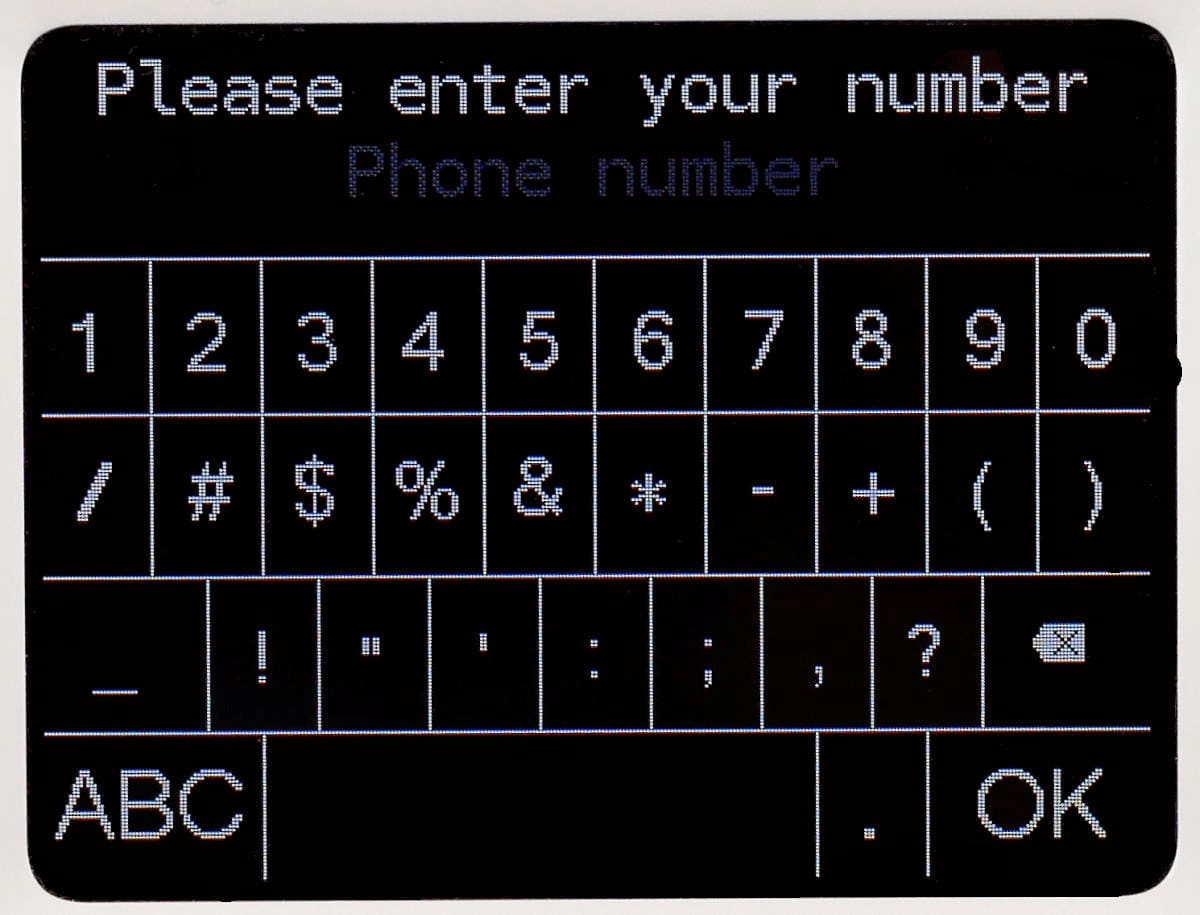

SumUp 3G displays for sending a digital receipt.

For instance, the screen gives you an option to send a text or email receipt after each transaction. This, of course, requires asking the customer for a phone number or email address, or you can ask them to enter it themselves on the touchscreen.

The card reader itself does not have a receipt printer built in like conventional PDQ machines, but you can buy it with a SumUp 3G Printer.

It is limited what other more-than-basic functions are hardcoded on the device, but food businesses will like that you can add a tip on the machine before payments.

The card machine automatically uses a local 3G network via the preinstalled SIM card to process card transactions. SumUp provides unlimited data on this card, so no topping up is required. You just need to keep the machine charged in advance of using it and be somewhere with a stable network connection. That said, it doesn’t take much to have a stable connection, since it automatically switches between networks to get the best service. The device also works with WiFi so you can switch between mobile networks and wireless internet for the best connection.

| Tech specs | |

|---|---|

| Dimensions | 133 x 71 x 19 mm |

| Connectivity | GPRS, EDGE, 3G, WiFi |

| Data | Unlimited with preinstalled SIM card |

| Included accessories | USB type C cable for charging |

| Battery life | 50+ transactions from full charge |

| Card technology | EMV (chip), NFC (contactless) |

| Receipts | Email, text/SMS, printed (with SumUp printer) |

| Tech specs | |

|---|---|

| Dimensions | 133 x 71 x 19 mm |

| Connectivity | GPRS, EDGE, 3G, WiFi |

| Data | Unlimited with preinstalled SIM card |

| Included accessories | USB type C cable for charging |

| Battery life | 50+ transactions from full charge |

| Card technology | EMV (chip), NFC (contactless) |

| Receipts | Email, text/SMS, printed (with SumUp printer) |

Businesses with employees can use several SumUp 3G devices under the same SumUp business account. For this to work smoothly, it’s recommended you set up sub-user accounts in the SumUp dashboard, so individuals can log in with their email address and password and take payments simultaneously with the other card readers. All of these sub-accounts will process payments through the main SumUp account, allowing you a real-time overview of staff transactions in your web dashboard.

SumUp 3G and Printer

If printed paper receipts are essential for your business, you can buy the SumUp 3G card reader and printer as a bundle. This comes in two parts: the card reader and a charging cradle with built-in receipt printer.

When the card reader is slotted into the cradle, it can give you the option to print an itemised receipt after each transaction.

Emmanuel Charpentier, Mobile Transaction

SumUp 3G and Printer bundle enables receipt printing.

SumUp 3G is not compatible with any other receipt printers, so it must be bought as a set with the printer to have this option.

The terminal with the printer is a bit chunky to hold in your hand, but it is portable and suitable for use anywhere with connectivity. It would, however, be more suited for resting on a counter space where the cradle can charge the reader in between transactions.

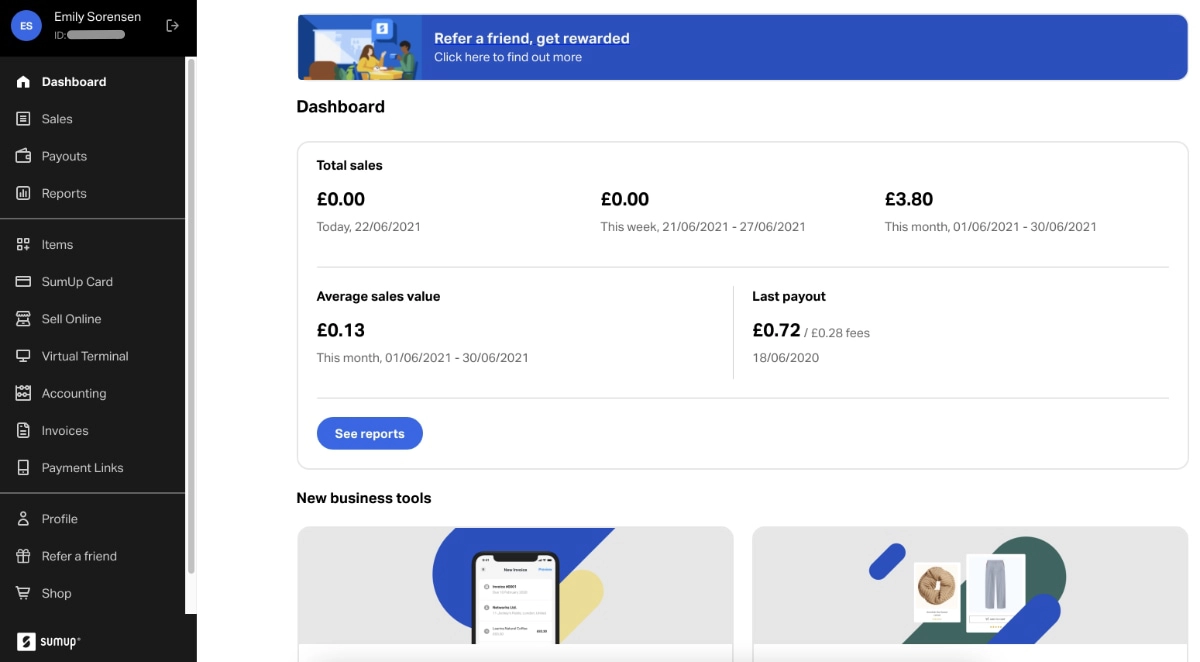

Reporting

As a SumUp customer, you can log in to an online dashboard accessible in any internet browser. Here, you can see details such as payment history, sales categorised into card types, where the payments were made, and payout history. If you’ve created multiple user accounts, you can filter payments to focus on individual employees.

SumUp sends payout PDF reports via email, and you can export transaction data to a CSV or XLS file from SumUp Dashboard. Furthermore, your transaction history is available on the card machine display.

Mobile Transaction

SumUp Dashboard has the full overview of sales and operations.

Who is SumUp 3G best for?

SumUp 3G is perfect for merchants on the go, market stalls or rural areas where connectivity is basic (it works with EDGE, GPRS, 3G and WiFi – not 4G). The fact that tipping is available – and it fits comfortably in your pocket – makes SumUp 3G interesting for cafés and restaurants taking orders at the table.

The device can be the most convenient choice for businesses that don’t need card machines to be synced automatically with a central POS system, and just want to get something at a reasonable price, low card fees and without contractual obligations.

The terminal cannot register individual products, but works with payment amounts (other terminals on the market, like SumUp Air, can integrate with product libraries). This could be a deal-breaker for retail businesses, but you could also just use it in parallel to a main till system as a supplementary card reader.

Photo: SumUp

SumUp 3G is a convenient choice for small cafés and restaurants where table service is required.

The simplified pricing structure makes it ideal for seasonal sales, since there’s no contract, monthly fees or minimal sales volume required.

Travelling businesses could benefit from the option to use it in countries where SumUp’s service is available (almost all European countries).

SumUp does not accept businesses taking payments for products or services provided over a week after the transaction. Other restricted businesses include non-profit organisations, door-to-door sales, business seminars, adult entertainment, airlines, pyramid sales, and a range of other businesses, some which are dubious or high-risk in nature.

Customer service

SumUp’s customer support is over the telephone, chat and email on weekdays from 8 AM to 7 PM and weekends from 8 AM to 5 PM. There’s an online Support Centre where the most common questions have been answered. We recommend checking answers there first, since SumUp can occasionally take days to respond over email. If you need an immediate answer or prefer talking, it’s best just to call or chat-message them during opening hours.

SumUp 3G is an economical solution for price-sensitive businesses, sporadic sales or startups wanting to take card payments without the hassle of complicated contracts.

SumUp is a streamlined service that, because their products are so simple, usually only require minimal contact with customer support. That said, if you’re having problems with the card machine out of hours, you won’t get help until the next day during opening hours.

If something happens to the card machine after the first year, you may have to buy a new one, but SumUp claims they usually offer free replacements even after the 1-year warranty is up. However, the machines should last a while provided you treat it well.

SumUp is generally rated highly online, with many saying how valuable the service has been for them. Some users have had connectivity issues, for a number of possible reasons, but SumUp puts in the effort to resolve any issues flagged to them.

Setup process

Registering for a SumUp account is completely online-based. It takes about 5-10 minutes to fill in the sign-up pages and order the card machine. Delivery is free and takes up to a week.

When you sign up, SumUp will perform some basic identity and business checks to ensure your details are legitimate and that your bank account is used by your company. If your business is within the restricted businesses category – such as multi-level marketing or door sales – SumUp will likely reject your account. However, most merchants will have a smooth sign-up with quick acceptance of their account.

Verdict

There’s no simpler card reader service than SumUp in Ireland, whether you go for the mobile app-dependent SumUp Air or standalone card machine SumUp 3G. The latter comes with a SIM card and mobile data, the one-off price is affordable, and all you’re paying for onwards is a fixed rate for transactions accepted (barring potential reasonable fees for chargebacks and refunds).

If you just need to take cards anywhere and with minimal fuss, we reckon SumUp 3G is the best choice in Ireland.