ANNA Money and Starling Bank provide business accounts with a friendly service.

The current accounts have considerable differences, though. Starling offers bank accounts while ANNA’s accounts use electronic money.

Both come with a full-fledged debit card, round-the-clock support and bookkeeping tools.

So which is better for UK freelancers and companies? Let’s compare the features, costs and service.

|

|

|

|---|---|---|

| Link | ||

| Service |

Online current account with Debit Mastercard | Bank account with Debit Mastercard |

| Monthly fee for business account | £0-£19.90 | Free |

| Eligibility | UK-registered/-based sole traders & companies | UK-registered/-based companies & sole traders |

| Sign-up | Entirely through app | Entirely through app |

| Account no. & sort code | ||

| IBAN & SWIFT | ||

| UK payments available |

Bank transfers, Direct Debits, standing orders | Bank transfers, Direct Debits, standing orders |

| International transfers | Yes, through workaround | |

| Euro & US accounts | ||

| Business loans | ||

| Business overdrafts | ||

| Team access | Yes, on high account tiers | Only with co-directors |

|

|

|---|---|

| Service | |

| Online current account with Debit Mastercard | Bank account with Debit Mastercard |

| Monthly fee for business account | |

| £0-£19.90 | Free |

| Eligibility | |

| UK-registered/-based sole traders & companies | UK-registered/-based companies & sole traders |

| Sign-up | |

| Entirely through app | Entirely through app |

| Account no. & sort code | |

| IBAN & SWIFT | |

| UK payments available | |

| Bank transfers, Direct Debits, standing orders | Bank transfers, Direct Debits, standing orders |

| International transfers | |

| Yes, through workaround | |

| EUR & USD accounts | |

| Business loans | |

| Business overdrafts | |

| Team access | |

| Yes, on high account tiers | Only with co-directors |

|

|

Account features of ANNA and Starling Bank

ANNA (Absolutely No Nonsense Admin) is not a bank – it’s a tech company providing e-money accounts for sole UK-registered sole traders, limited companies and partnerships. They come with an account number and sort code, but no IBAN for international transfers. ANNA is regulated by the Financial Conduct Authority (FCA) in the UK, but funds are not protected by the FSCS.

In comparison, Starling is a real bank providing bank accounts for private individuals, sole traders (self-employed and side-hustlers), companies and partnerships registered in the UK. They come with a bank account number, sort code and IBAN for international payments. Up to £85,000 of your funds in the account is protected by the FSCS.

While the main (free) Starling account only contains GBP, there’s an optional US dollar account and Euro account for a monthly fee. You can also add a Business Toolkit subscription that includes bookkeeping and invoicing features particularly useful for professionals doing their own accounting.

Here are other ways the current accounts differ.

Banking apps – The platforms have a dedicated app for managing the account through your smartphone. Only with Starling can you access the account in a web browser too.

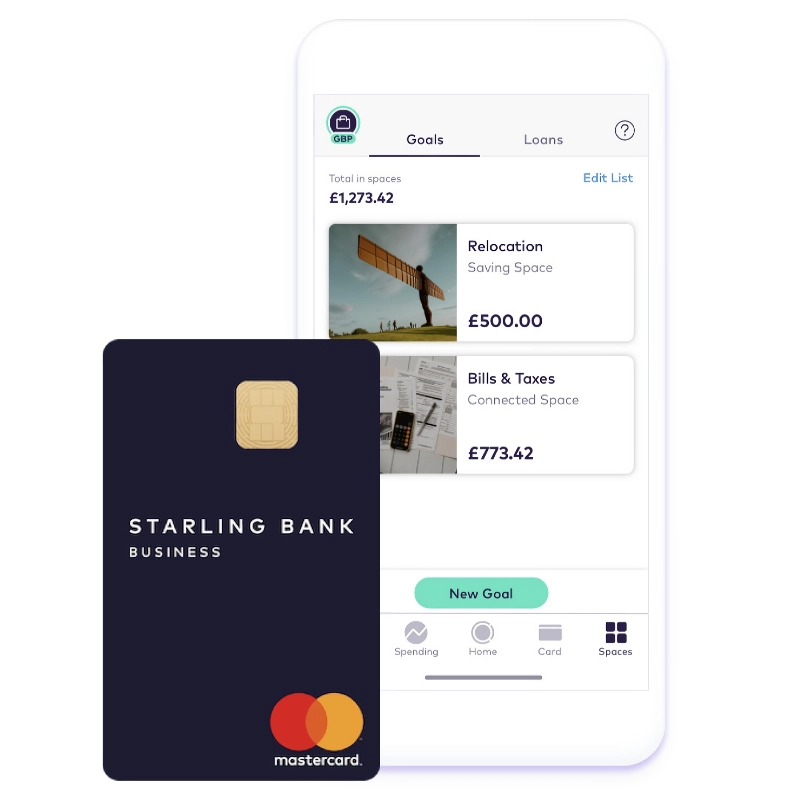

Image: Starling Bank

Starling bank accounts can be accessed in a mobile app or web browser.

Payment cards – Both ANNA and Starling accounts come with a Business Debit Mastercard, which is better than most online accounts that usually come with a more limited prepaid debit card.

ANNA’s card stands out with its embossed card details and audible “miaow” when it’s tapped for a contactless payment (a cool or awkward gimmick, depending on how you look at it). The Starling Bank card is not embossed, but it’s portrait-format with card details printed on the back for greater privacy when using it publicly.

ANNA’s debit card miaows when tapped on card machines.

International payments – Starling accounts include an IBAN and SWIFT/BIC just like other bank accounts, so you can receive and send international transfers directly from the app. The optional USD and EUR accounts are additional bank accounts associated with your main business account – useful if you frequently send and receive money in those currencies.

The ANNA account only sends and receives UK payments – it does not come with an IBAN and SWIFT code. However, cross-border transfers are available through workarounds.

If you ask the support chat in the app to send money abroad, ANNA will send the money for you. Signing up with their partner Payoneer allows you to receive money from abroad in the Payoneer account, then transfer it to ANNA.

Loans and overdrafts – Starling offers loans and overdrafts for businesses, but not a credit card. At the moment, they only take applications for the government-backed coronavirus support schemes. When these no longer take priority, you will be able to apply for a regular business loan or overdraft, like you can with a high street bank. There are no loan, credit or overdraft options with ANNA Money.

Different pricing systems

It’s free to sign up with ANNA and Starling, but they have different pricing systems.

ANNA’s account is free until you cross a maximum limit of one of the following:

- Monthly income (free below £500)

- Account balance (free below £5,000)

- Number of account users (one is free)

- Number of debit cards (two are free)

- Number of in/out UK transfers (two/month are free)

- ATM withdrawals (up to £100/month free)

There are four tiers with different limits of the above. The three paid tiers (the first is free) are priced between £4.90 and £19.90 monthly. Most freelancers and small companies will be on the £4.90 and £9.90 monthly tiers. This pricing system means you do not have any pay-as-you-go fees to worry about – just the monthly cost determined by your usage of the above.

The Sole Trader or Business accounts at Starling have no monthly costs, but then you pay charges for foreign transfers, loans, overdrafts and cash deposits. There is also an add-on feature package, Business Toolkit, costing £7 per month. The US dollar account costs £5 a month and the Euro account costs £2 a month.

| Costs |  |

|

|---|---|---|

| Account creation | Free | Free |

| Monthly fee | £0-£19.90 | ‘Business’ or ‘Sole trader’ account: Free EUR account: £2 USD account: £5 Toolkit add-on: £7 |

| Debit card | Included in monthly fee | Free |

| UK payments | Included in monthly fee | Free |

| Cash withdrawals | Included in monthly fee | Free in UK & abroad |

| Cash deposits | n/a | 0.3% (min. £3) |

| Cheque deposits | n/a | Free via app |

| Card payments in other currency | Free | Free |

| Outbound international transfers | Free | 0.4% + £5.50 delivery fee + 30p (w/local partner) |

| Inbound international transfers | Up to 2% charge to Payoneer + £1.50 transfer fee to ANNA account | Euros to GBP account: 2% Other currencies to GBP account: Free Same currency as GBP, EUR or USD account: Free Between EUR, USD & GBP accounts: 0.4% |

| Registration |

|

|

|---|---|

| Account creation | |

| Free | Free |

| Monthly fee | |

| £0-£19.90 | ‘Business’ or ‘Sole trader’ account: Free EUR account: £2 USD account: £5 Toolkit add-on: £7 |

| Debit card | |

| Included in monthly fee | Free |

| UK payments | |

| Included in monthly fee | Free |

| Cash withdrawals | |

| Included in monthly fee | Free in UK & abroad |

| Cash deposits | |

| n/a | 0.3% (min. £3) |

| Cheque deposits | |

| n/a | Free via app |

| Card payments in other currency | |

| Free | Free |

| Outbound international transfers | |

| Free | 0.4% + £5.50 delivery fee + 30p (w/local partner) |

| Inbound international transfers | |

| Up to 2% charge to Payoneer + £1.50 transfer fee to ANNA account | Euros to GBP account: 2% Other currencies to GBP account: Free Same currency as GBP, EUR or USD account: Free Between EUR, USD & GBP accounts: 0.4% |

| Registration | |

Starling charges 0.3% (minimum of £3) per cash deposit at a Post Office, and depositing cheques can be done in the app for free (it takes two working days to process a cheque electronically). You cannot deposit cheques or cash into the ANNA account, only transfer money to the account via Faster Payments or BACS from any other UK account.

ANNA Money can send payments to accounts in another country for free, as long as you provide an invoice with payment details for the transfer. They then do it through their own banking system and take the money from your ANNA account. You cannot do this yourself from the app menu.

The only way to receive transfers from abroad with ANNA is to sign up to the Payoneer service that gives you a different account for receiving cross-border payments. It costs 2% above the exchange rate to receive payments in the Payoneer account, and a £1.50 charge is deducted when transferring this money to the ANNA account.

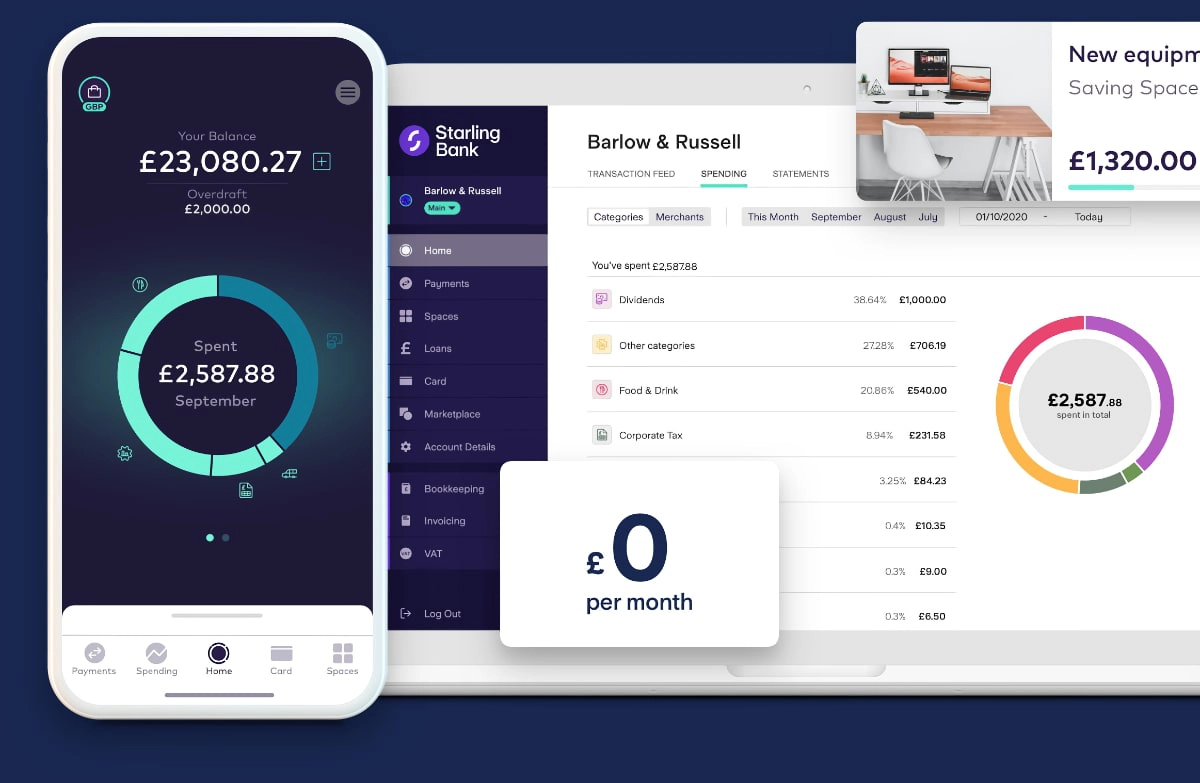

Starling, on the other hand, can send payments to any of 38 countries and 20 different currencies from the app, and you can receive transfers from abroad. It’s free to receive payments in the same currency as your account, but it does then cost 0.4% on top of the real exchange rate to transfer between the GBP, Euro and US dollar accounts.

Image: Mobile Transaction

Send payments abroad from the Starling Bank app.

It costs 0.4% above the exchange rate to send a payment to another country or currency, plus a SWIFT cost of £5.50 and delivery fee from 30p if using a local partner.

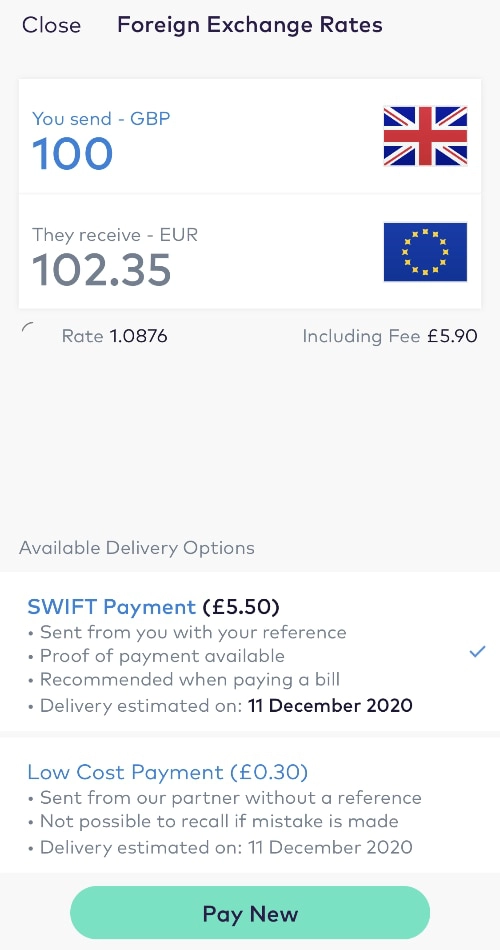

The ANNA Money app’s default screen is a messaging chat with automated responses for straightforward queries and a person stepping in for more complicated requests. It is basically a 24/7 virtual assistant chat where you tell ANNA to do certain things like finding a transaction or sending an invoice, whereas Starling lets you do these things yourself in the relevant sections.

The ANNA app does also let you do certain things yourself such as creating an invoice or changing tax settings, but you can do more through the chat.

Image: Mobile Transaction

An ANNA assistant is on hand in the chat 24/7 for any tasks or questions.

With Starling, you can log into the account in a web browser too, which is handy for when you have to sort out taxes on a computer. You can only use ANNA through the mobile app.

Let’s take a look at the main business features available through the accounts.

| Feature |  |

|

|---|---|---|

| Payment notifications | ||

| Scheduled payments | ||

| Account statements | ||

| Card controls | ||

| Receipt capture | ||

| Open Banking | ||

| Saving pots | ||

| Transaction categories | ||

| Invoicing | w/Toolkit (desktop) | |

| Expense, VAT & tax management | w/Toolkit (desktop) | |

| Accounting integrations | Xero | FreeAgent, QuickBooks, Xero |

| Mobile wallet compatibility | Apple Pay, Google Pay | Apple Pay, Garmin Pay, Google Pay |

|

|

|---|---|

| Payment notifications | |

| Scheduled payments | |

| Account statements | |

| Card controls | |

| Receipt capture | |

| Open Banking | |

| Saving pots | |

| Transaction categories | |

| Invoicing | |

| w/Toolkit (desktop) | |

| Expense, VAT & tax management | |

| w/Toolkit (desktop) | |

| Accounting integrations | |

| Xero | FreeAgent, QuickBooks, Xero |

| Mobile wallet compatibility | |

| Apple Pay, Google Pay | Apple Pay, Garmin Pay, Google Pay |

Some of the differences are crucial to some users:

Invoices – ANNA has good, free invoicing features in the app for all users. For example, ANNA can send polite reminders to clients who still haven’t paid up, and you can edit invoice templates in the app. With Starling Bank, you need the Business Toolkit add-on for good invoicing tools accessible in the desktop account.

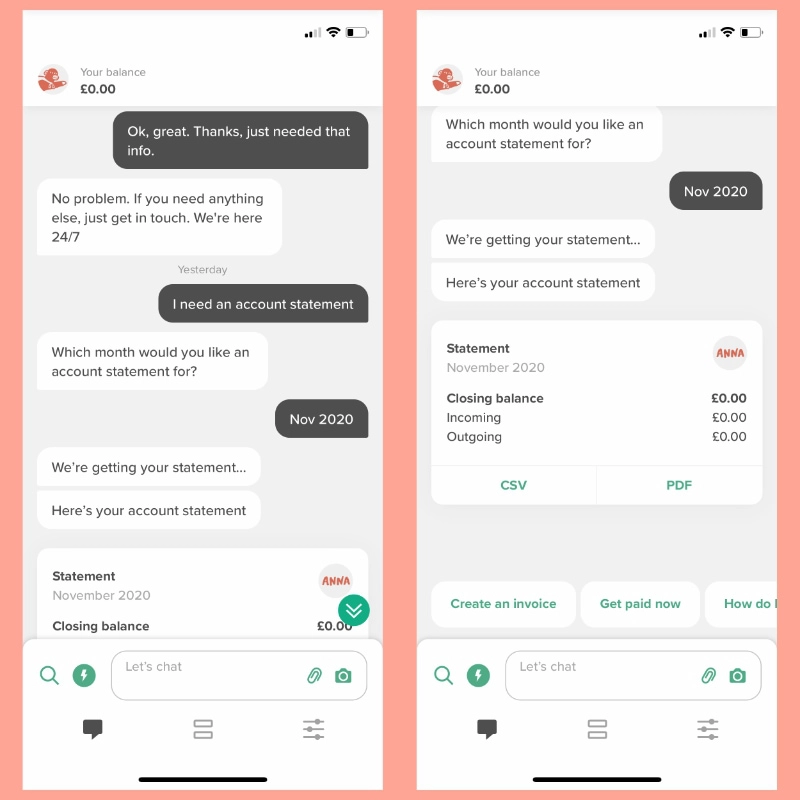

Saving pots – You cannot put money into different savings pots with ANNA – there’s just one total account balance. Starling has ‘saving spaces’ where you can transfer money from the main account balance into individual sub-accounts, so you can reserve money for goals like tax bills, a new laptop etc. You can automatically save money into pots from the surplus of transactions rounded up.

Card controls – While you can set a spending limit, temporarily freeze the debit card and order a replacement card from the ANNA app, Starling’s card controls are a lot more advanced. For example, you can lock gambling payments, online purchases, ATM withdrawals and more, or unblock the PIN from the app (often, you have to do this from a cash point).

Image: Starling Bank

With Starling, you can reserve money for goals into tucked-away ‘spaces’.

Bookkeeping: All ANNA users can get tax reminders, fetch transactions reports and view estimates of VAT, expenses and taxable income from the app. You can also give your accountant special access to your ANNA payments through a web browser.

Starling has a nice, visually presented spending overview and transaction lists in the app. You need Business Toolkit for bookkeeping tools, but then you get good features like connecting to HMRC for VAT submissions (via Making Tax Digital), bills management, automated expenses, email integration and tax calculations for sole traders.

Integrations: ANNA only lets you integrate with Xero for accounting, and the Apple Pay and Google Pay mobile wallets. Starling Bank also integrates with Garmin Pay, FreeAgent and QuickBooks, plus a selection of other software platforms from an app marketplace.

Both have excellent support

Here’s where Starling and ANNA are most similar: the quality of customer service.

All account users can access round-the-clock support from the app, with fast response times from a real person. ANNA goes a step further with the promise of a subscription fee refund for the month if no one gets back to you within 10 minutes.

Starling has won the Best British Bank awards for 2018, 2019 and 2020 and is the recommended current account provider by Which? (November 2020). ANNA Money and Starling Bank both have high customer ratings on Trustpilot.

Alternatives: 6 best business accounts for small businesses

Verdict: Starling for features, ANNA for assistance

Businesses registered at Companies House would in most cases prefer a Starling Bank Business account. It simply has more accounting features, money management tools (e.g. savings pots), loans, overdrafts and the lure of being a full-fledged bank account protected by the FSCS.

ANNA accounts are better suited for sole traders who’d feel comforted by the friendly chat that does most things for you. If you want to save money, ANNA’s free invoice tools are perfectly sufficient, whereas you have to pay £7 monthly for invoicing with Starling.

While it’s free to send money to other countries through ANNA, the lack of options to do this directly from the app is not ideal. Also, the extra process (and cost) of a Payoneer account to receive payments from abroad is not practical. Starling Bank’s ability to do both from the app is very attractive along with the optional euro and US dollar accounts.

Desktop users will prefer Starling because the bank has this option, while those preferring to message a person to complete tasks would prefer ANNA Money for its virtual assistant chat.