Starling Bank is a fully-fledged, UK-based bank without physical bank branches. Instead, you manage your account almost entirely through a mobile app.

Starling offers current accounts for private individuals (personal accounts) and current accounts for sole traders and limited companies (business accounts). We focus on the business accounts which we’ve tested for this review.

Two types of business current accounts in GBP currency are available:

Business account: Bank account for limited companies and other registered business entities.

Sole trader account: Bank account for sole traders, self-employed and freelancers without a registered company.

Each comes with a:

Starling used to offer secondary accounts in euros or USD, but as of 2024, new customers cannot sign up for accounts in other currencies than GBP.

In contrast with high street banks, the sign-up is done entirely through the mobile app.

There are pros and cons of Starling Bank influencing how good of a fit this bank account is for your needs. Let us go through the requirements, costs, features and services on offer.

Is Starling Bank safe? Yes, up to £85,000 of your money is protected by the Financial Services Compensation Scheme (FSCS) in each account. Starling Bank’s security is top-notch, using a combination of biometric identification measures, fraud prevention tools, a human support team and more to keep your money safe. It has all the proper licences in place so that it is legitimately a real, regulated bank – just managed remotely.

Who can open a Starling Business account?

To open a Starling business account, certain requirements apply. You need to be a resident of the United Kingdom and have a UK phone number for registration, though Starling may allow non-UK numbers from certain countries.

Limited companies and other types of businesses or partnerships have to be registered at Companies House in the UK. Only a ‘Person of Significant Control’ can open an account for a registered company, and that person should be a UK resident. Sole traders must also live in the UK and be registered as self-employed.

Only the account owner or Persons of Significant Control may use the account, so you can’t just give the business debit card to staff members. That’s a big disadvantage for teams used to expense cards like Monzo’s or Revolut’s.

Costs and fees

While competing neobanking platforms offer tiered price plans (from free to “premium” plans), Starling’s costs are piecemeal according to what services are used.

The Business accounts for sole traders and limited companies have no monthly fees. You can subscribe to an additional feature package called Business Toolkit for £7 per month, but this is mainly useful for sole traders.

There is no setup charge, and you receive the debit card free of charge after you’ve had the account approved. Starling does not currently pay interest on any business current account, only on their personal current accounts (there is no Starling savings account).

| Business account (company or sole trader) | Charges |

|---|---|

| Account creation | Free |

| Monthly fee | Free |

| Business Toolkit add-on | £7*/mo |

| Interest rate | None |

| Debit card | Free |

| Faster Payments bank transfers, Direct Debits, Standing Orders (UK only) | Free |

| ATM withdrawals (UK & abroad) | Free |

| Cash deposits | 0.7% (min. £3 charge) |

| Cheque deposits | Free |

*Includes VAT.

| Business account (business or sole trader) |

Charges |

|---|---|

| Account creation | Free |

| Monthly fee | Free |

| Business Toolkit add-on | £7*/mo |

| Interest rate | None |

| Debit card | Free |

| Faster Payments bank transfers, Direct Debits, Standing Orders (UK only) | Free |

| ATM withdrawals (UK & abroad) | Free |

| Cash deposits | 0.7% (min. £3 charge) |

| Cheque deposits | Free |

*Includes VAT.

It is free to withdraw cash from a cash point in the UK and abroad, though you are not exempt from charges that individual ATMs may add. Cheques are free to deposit through the app or Freepost (by letter), but cash deposits at the Post Office cost 0.7% of the cash amount, where a minimum of £3 is required.

Then there are costs for overdrafts or business loans for companies and partnerships, with interest rates that depend on your situation and qualifying factors.

If there are annual fees or other charges for the business loan or overdraft, these will be communicated to you when the loan application has been reviewed. Starling claims there are no hidden fees, but it is always good practice to read the small print.

Transfers and use abroad

What about international payments, foreign currency and use abroad? This gets a bit complicated, depending on your needs.

The Business and Sole trader accounts can only contain British pounds. Bank transfers to another UK-based GBP account are free to do. That said, the business debit card can be used for payments in any currency without added fees.

There are no options for accounts in other currencies. Businesses dealing with multiple currencies are generally better off with Revolut Business or Airwallex.

“Starling Bank still advertises EUR and USD currency accounts to compete with Revolut, but insists to us that these are no longer available. It seems to me that Starling still wants to look good to businesses with international customers, but if you always deal in foreign currency, you’ve got to choose a bank that really prioritises multi-currency accounts.”

– Emily Sorensen, Senior Editor, MobileTransaction

If a client sends a EUR payment to your GBP account, a 2% charge will be added by Starling Bank on top of the real exchange rate to convert that currency into GBP. It is not possible for your clients to send any other currency (including USD) to your GBP account – instead, it will be rejected and sent back to the payer.

| Sending/receiving money | Charges |

|---|---|

| Business debit card transactions in foreign currency | No Starling fee applied, but local fees may apply |

| Inbound payment in same currency as account | Free |

| Inbound EUR transfer to GBP account | 2% on top of real exchange rate |

| International outbound transfers – currency conversion fee | 0.4% on top of real exchange rate |

| SWIFT outbound transfer – delivery fee | £5.50 |

| International outbound transfer via local partner – delivery fee | From 30p |

| Sending/ receiving money |

Charges |

|---|---|

| Business debit card transactions in foreign currency | No Starling fee applied, but local fees may apply |

| Euro account, monthly fee | £2 |

| USD account, monthly fee | £5 |

| Inbound payment in same currency as account | Free |

| Inbound EUR transfer to GBP account | 2% on top of real exchange rate |

| Transfers between EUR, USD & GBP accounts | 0.4% on top of real exchange rate |

| International outbound transfers – currency conversion fee | 0.4% on top of real exchange rate |

| SWIFT outbound transfer – delivery fee | £5.50 |

| International outbound transfer via local partner – delivery fee | From 30p |

Starling does not apply a fee when you use the debit card in another currency, but the merchant may use their own exchange rate with additional fees if you choose to pay in the local currency.

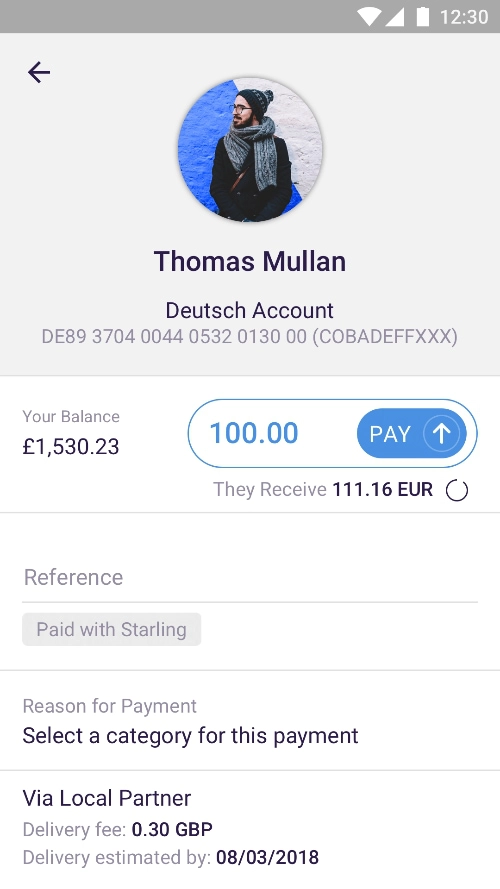

Image: Starling Bank

Transfer directly from the app.

It is currently possible to send money to any of 34 countries and 17 currencies. One major economy, China, is missing from this list, but Starling is gradually expanding the options. You can choose to set the amount that the payee has to receive, or an amount that the transfer fees are deducted from.

The app has different transfer options with fees disclosed upfront depending on the speed and method of transfer. Starling adds a currency conversion fee of 0.4% to the exchange rate. With the local delivery option, it costs a flat delivery fee of 30p and currency conversion fee of 0.4% of the transfer amount.

That said, Starling Bank cannot control if there are any additional charges added somewhere between yours and the receiver’s account because of the reliance on external third party providers or inter-banks to process the transfer.

Which is better for international transfers: PayPal or Wise?

Starling Business Debit Mastercard

The debit card is managed in the app or desktop account, and I’ve got to say: the card controls are superb compared to the high street banking apps.

There’s a dedicated section for card settings and card information. Here, you can add the card to your Apple Pay, Fitbit, Garmin Pay, Google Pay, Samsung Pay wallet, cancel and replace the card, get a PIN reminder, and view limits for transactions, ATM withdrawals and mobile wallet payments.

If you lose your card but are not sure whether it’s stolen, lost or misplaced, you can simply lock it via a toggle in the app and unlock it if you found it down your sofa. In many other banks, you can only cancel a card, then wait some days to receive a new one by post.

The app also comes with options to lock specific types of transactions like card machine or online payments, ATM withdrawals, mobile wallet payments, swipe card and even gambling payments.

“I’ve used Starling Bank’s card controls, and I think they’re superior to any other card security settings I’ve seen in other banking apps. I just love how specific the settings are.”

– Emily Sorensen, Senior Editor, MobileTransaction

If you turn on location-based fraud protection, the app uses the location of card transactions to determine whether the card has been stolen, thereby preventing fraudulent transactions.

Cash and cheques

Does your business deal with cash? No problem. You can deposit cash in any Post Office as long as you have the Business Mastercard. Just hand the banknotes to the cashier, insert the card in the terminal, confirm the amount deposited and it will appear in your Starling Bank account immediately.

This costs 0.7% (minimum £3) per deposit. You can maximum deposit £5,000 per day, with a maximum of £250 in coins.

ATM cash withdrawals are free up to 6 times a day, but the daily total withdrawal maximum is £300. If you take out cash from a Post Office, it costs 50p.

Cheques can be deposited in the app without having to go to a Post Office. In the ‘Add money’ section of the app, you take a photo of the cheque, then await clearance in your account which normally takes two working days. The maximum cheque amount permitted through the mobile cheque imaging feature is £1,000, but you can post higher-amount cheques with Freepost to Starling Bank.

Business loans and overdrafts

Starling Bank does not offer credit cards like Zempler Bank, but has announced its intention to do so in the near future.

But Starling certainly doesn’t lack lending options. A business overdraft between £1,000-£50,000 is available to limited companies and limited liability partnerships, but not sole traders. A setup and annual fee of 1.75% of the overdraft limit applies.

The overdraft interest rate is based on different factors like information from several credit reference agencies.

It is also possible to change the overdraft limit directly in the app through a handy overdraft slider, which is way more flexible than traditional banks allow.

Thought about a cash advance? 10 best cash advances in the UK

What about loans? Again, only a limited company or limited liability partnership can apply for a business loan – not sole traders, charities, trusts and partnerships.

The business loans (when available) are usually between £5,000 and £250,000 for a term of 1-6 years, with a one-off loan arrangement fee of 4%. The loan applications are reviewed by real people, not automatically through an algorithm, and the interest rates are set for your circumstances and background.

Starling Bank app

Since your account is managed through the app (or a more limited Desktop for Business in a browser), it’s quite important the app has all the functions you need. From our testing, we were not disappointed. We also like how the app has evolved up to our recent test in October 2024, since we first tested it in 2021.

“As someone who used to work in app development, I feel that Starling Bank has really invested in developing a good app experience. I feel reassured when I use the Starling Bank app – it just works smoothly, makes sense and looks professional. But it does lack payment acceptance options other than bank transfers.”

– Emily Sorensen, Senior Editor, MobileTransaction

The mobile app can be used on Android devices, iPhone and iPad, not on a computer. The user experience is polished with enough features to explore even with a new account that hasn’t properly got started yet. Customer support is always available directly from the app.

These are the main app sections:

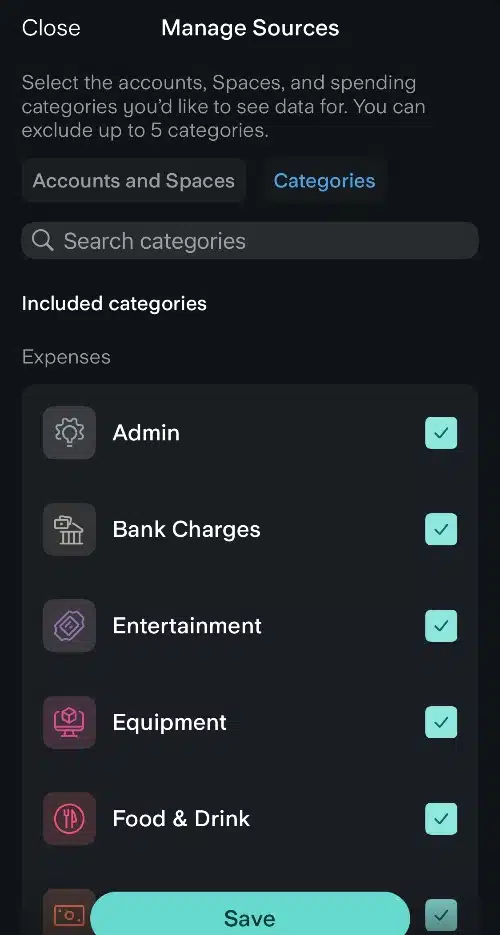

Image: MobileTransaction

Expense categories.

The Spaces feature is genuinely useful for working towards goals. Basically, you can allocate money for individual things you want to save money for, e.g. a new laptop or a business trip, or the loans you have with Starling.

A setting lets you automatically save money from the main balance by rounding up each transaction to the nearest pound (or more), sending the surplus pennies to an allocated goal.

The money placed within a goal is not part of the visible balance of your account or debit card, but it is still in your bank account. This way, you do not dive into money reserved for a goal when using the debit card, and it becomes easy to see what money you’re allowed to spend by not having the saved money in the main app balance.

At any time, you can transfer money from Spaces back to your main balance.

It’s easy to switch between Starling accounts in the corner of the app. If someone else nearby uses the Starling app, you can wirelessly connect with that person to get paid by them. Or just check your bank account details in the app to share them.

You can move everything from a previous bank to Starling through the Current Account Switch Service directly from the app, if you want to make a complete switch to Starling Bank after testing the service. Other admin tasks can be done in the app, such as changing account details, applying for an overdraft, adding a new account, managing subscriptions and more.

What I do miss in the app is a range of payment acceptance methods, like payment links, Tap to Pay on iPhone and invoicing (only available in a browser via an add-on) which Revolut and Tide are great at. So this is not the solution if you want to use it to accept card payments.

The online banking platform in a web browser has fewer features than the mobile app. It’s clear that Starling is developing this, though, as they have acknowledged that some admin tasks are just easier to do on a desktop computer.

Business Toolkit, accounting and integrations

What about the Business Toolkit? This is an add-on for £7 monthly that is particularly useful for freelancers, the self-employed and small businesses without an accountant. It has advanced accounting, invoicing and bookkeeping features available through the online account (not mobile app), including:

Alternatively, there are over a dozen financial software integrations to connect with through the so-called ‘Marketplace’. These are external platforms or apps that Starling Bank has partnered with for a seamless integration with your business account.

For accounting features, you can choose between a FreeAgent, QuickBooks and Xero integration. If you don’t want an additional accounting subscription, it’s possible to export bank account statements to a PDF or CSV file through the app or online banking account in a web browser. Expenses can automatically be grouped into categories in the app to simplify reporting, and you can track payments with push notifications from the app.

Image: Starling Bank

Push notifications can be a nuisance, but helps monitor transactions in your account.

It also integrates with apps for security, insurance, receipts, loyalty, lending, mortgages, taxes, legal matters and project management.

Customer service and Starling Bank reviews

Starling Bank provides round-the-clock UK-based support even on weekends. You can call the support team, email or chat with support through the app, and there’s a help section online answering the common questions people have about each product.

I tested the in-app support chat after there was a mistake in my name on the debit card I received, and although the queue time was over 20 minutes, once I got through, the help was to-the-point and the issue got resolved right away. Asking questions on the web chat yielded a faster response, but the extent of delays will depend on the time of day.

Like any other financial institutions, there are customer reviews indicating the service is not perfect for everyone, but not (we think) to an alarming extent.

Starling Bank won the ‘Best Business Banking’ award in 2023, plus it is rated highly for customer satisfaction.

Like any other financial institutions, there are customer reviews indicating the service is not perfect for everyone, but not (we think) to an alarming extent.

The negative reviews are about different issues that look like they have individual causes, rather than a pattern of serious issues indicating systemic faults with the bank.

There are several cases of businesses opening a new account and being unhappy with having to provide various documents to verify their company. We noticed some cases of frozen accounts or payments in response to suspicious transactions. Banks commonly apply security protocols to keep their accounts safe, so this is not unusual to see in banking reviews.

Looking at TrustPilot, we see that Starling gets back to individual complaints promptly with thoughtful responses, showing they are taking their service seriously.

Signing up

The Starling Business account sign-up is very streamlined and for most people, it is quick (for me, only about 10 minutes). The only downside is that you can’t go back a step, so whatever you submit on one screen cannot be edited again during the application steps.

You need a picture ID which has to be a passport, UK driving licence (full or provisional), EU/EEA ID card or UK Residence Card. Some applicants may also need to provide additional documentation such as invoices, payslips, accountant’s letters or bank statements to prove the nature of their business. During the sign-up, you will be asked to do a short video recording on your phone of yourself saying a sentence in order to verify your identity.

The sign-up requires sole traders to create a personal Starling account before adding a sole trader account through the app after approval. Limited companies and partnerships can create a business account without a personal Starling account attached.

Signing up triggers a soft credit check, which won’t affect your credit score or be visible to other financial service companies.

Approval takes less than a day in most cases, after which you can use the account immediately. The debit card takes a few working days to arrive after that. Sole traders receive two separate cards, one for the personal account and the other for the business account. My cards arrived only two days after sign-up.

Our verdict

Our overall experience of Starling Bank was positive from the start. The app is user-friendly – clearly developed to be best-in-class. The debit card settings are also more sophisticated than any we’ve seen elsewhere, but it lacks expense cards and team access for budget delegation (Monzo, Tide and Revolut are better for that).

The queue for the chat support could have been faster, but always got us through to a real person who answered our questions or fixed the issue. I can’t emphasise how rare that is among the digital business accounts I’ve tested. We like how their values of transparency and fairness shine through in their communications.

Starling is clearly a real bank with options for loans, but there are still things that can be added. For example, not being able to send money to China could be an issue, and sole traders are not able to get a loan or overdraft. The lack of credit card could also prevent some from making a complete switch to Starling Bank.

Starling Bank is great for general banking and money management, but isn’t ideal for cross-border transfers or payment acceptance.

On the other hand, Starling is gradually adding new features and services, so it might be more like the big high street banks eventually. The ease and speed of opening an account certainly make it worthwhile to try it as an additional account to e.g. manage money for “goals” or expenses.

All that being said, you should only choose Starling Bank if you’re happy banking through an app. It’s possible to do some things in a browser, but most features rely on the app. This could be bad news for those with an old (or no) phone, but entirely natural for others.