Accepted cards

Merchants already using the Square Point of Sale app (with or without Square Reader) can also send invoices from that app for the same transaction fee, but without the full umbrella of features detailed below. It is also possible to invoice from any internet browser logged in to Square Dashboard, where you get a similar range of features as the app.

The recipient can pay with Visa, Mastercard, American Express, V Pay, Visa Electron and Maestro, and even Apple Pay or Google Pay. The customer does not pay transaction fees – it is only you who pay the same flat rate for all transactions.

More recently, Clearpay (a Buy Now, Pay Later option) has been added so you can offer this to customers who need some financing to afford your bill.

When an amount is paid, the money is deposited in your bank account the following working day, provided it was paid by 4pm. You can manually schedule what time deposits are “sent” to your account, or decide to have them settled sooner via Instant Transfers (incurs extra cost).

All Square payments are shown in your main Square reports, so multichannel businesses do not need to collate transactions for accounting if they are only selling through Square.

Fees and costs

A huge benefit of Square is the transparency around prices. You don’t commit to ongoing usage – there’s just a 2.5% transaction fee for all card payments received online through invoices. If Clearpay is used, the transaction fee is 6% + 30p.

Payments manually registered in cash, by cheque or via bank transfer are free, since these do not involve any processing on Square’s part. If the customer pays the invoice in person via Square Reader, the transaction fee is 1.75%.

There’s no charge for sending an invoice or using the features, so if no payments are processed, it is absolutely free.

A paid Invoices Plus plan gives you more time-saving features for a monthly fee of £20 (cancellable any time). The free plan is sufficient for my small businesses, though.

| Square Invoices | Cost |

|---|---|

| Transaction fee – online card payments | 2.5% (any card) |

| Transaction fee – Clearpay payments | 6% +30p |

| Transaction fee – card reader payments | 1.75% (any card) |

| Transaction fee – cash, cheque, BACS, gift cards | Free |

| Instant Transfers (optional) | 1% on top of card fee |

| Monthly fee | Free: None Plus: £20/mo |

| Refunds | Transaction fee is retained by Square |

| Chargebacks | Free (conditions apply) |

| Square Invoices |

Cost |

|---|---|

| Transaction fee – online card payments | 2.5% (any card) |

| Transaction fee – Clearpay payments | 6% + 30p |

| Transaction fee – card reader payments | 1.75% (any card) |

| Transaction fee – cash, cheque, BACS, gift cards | Free |

| Instant Transfers (optional) | 1% on top of card fee |

| Monthly fee | Free: None Plus: £20/mo |

| Refunds | Transaction fee is retained by Square |

| Chargebacks | Free (conditions apply) |

If you need the money deposited straight away in your account, you can switch on the Instant Transfers feature (subject to Square’s approval), which adds an extra 1% to the transaction fee. Then payouts will reach your bank account within 20 minutes instead of the next day.

Chargebacks are free if you follow good practice for payments, e.g. can provide proof of the service or products provided to the customer disputing the payment. Square has a dedicated legal team to deal with such disputes, which is also free of charge.

Refunds used to be free to process through Square, but the company has changed their policy so it now keeps whatever transaction fee was charged for the transaction refunded.

Invoicing features

For a free app, we are quite impressed by the invoicing options. The following are just a snapshot of them.

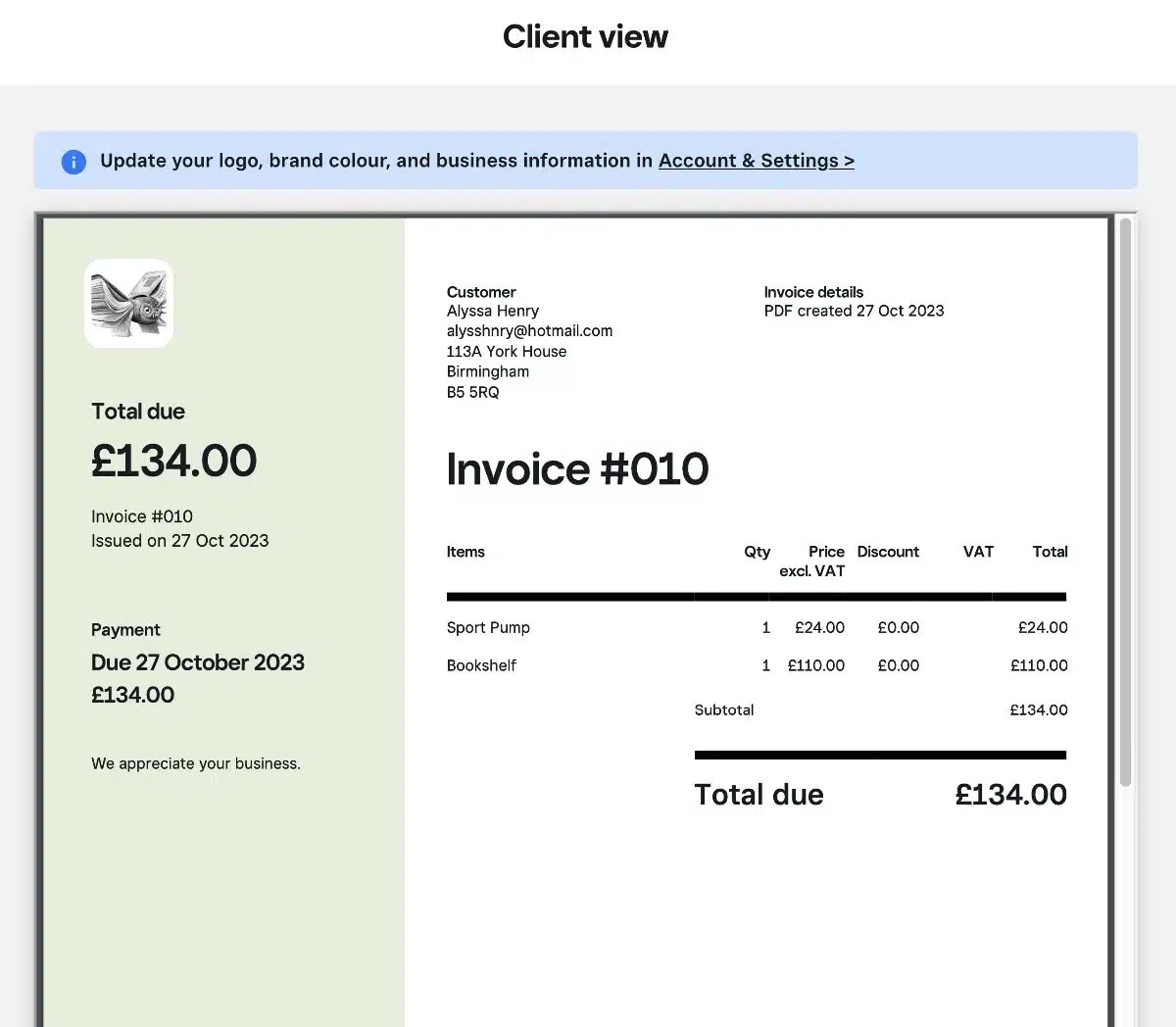

Design options: Choose banner colour and company logo to be displayed at the top of all invoices. Small tweaks, yes, but it helps you look respectable as a brand. On the Plus plan, you also get to choose a custom invoice layout, add customisable fields and make other specific edits.

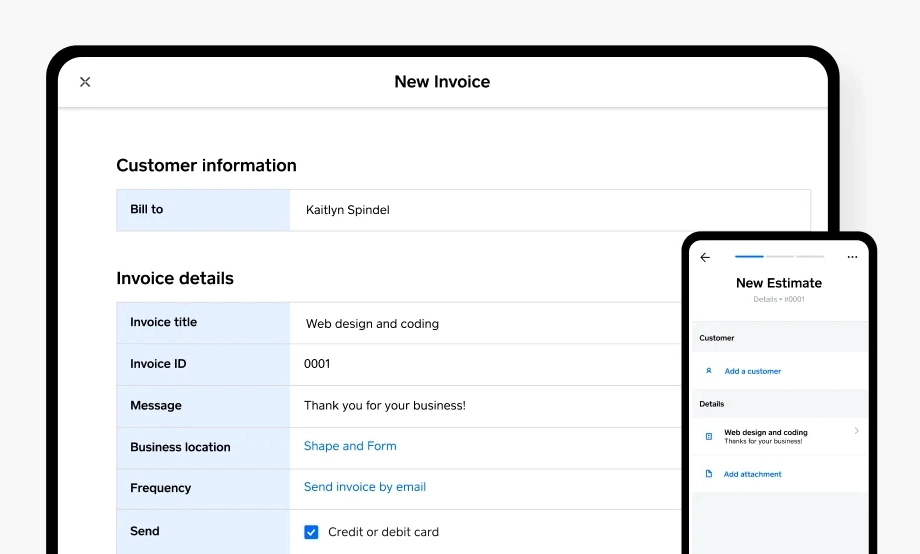

Image: Mobile Transaction

You can pick a template, logo, colours and more for the invoice.

Recurring invoices: Rather than sending invoices manually every month, week or day, you can automate the process by setting up recurring invoices. You set up how often the invoice should be sent as well as the due date.

Payment reminders: Manually send payment reminders in the app, or decide in advance when exactly reminders should be sent to the customer. For instance, add reminders for a week or 3 days before, on the due date or any time after the due date if there has still been no payment.

Tipping: Allow clients to add a tip by switching on tipping for the particular invoice.

Requesting delivery address: If you need to ship items to customers, you can make it a requirement to enter a delivery address through the electronic invoice. This little detail could save you time chasing up the recipient in order to send a parcel.

Estimates: If your customer needs to agree on a quote, you can send an estimated amount for the recipient to accept. On the Plus plan, accepted estimates automatically convert into a normal invoice so the customer can pay immediately. On Free, you will need to send an invoice manually after the recipient accepts the estimate.

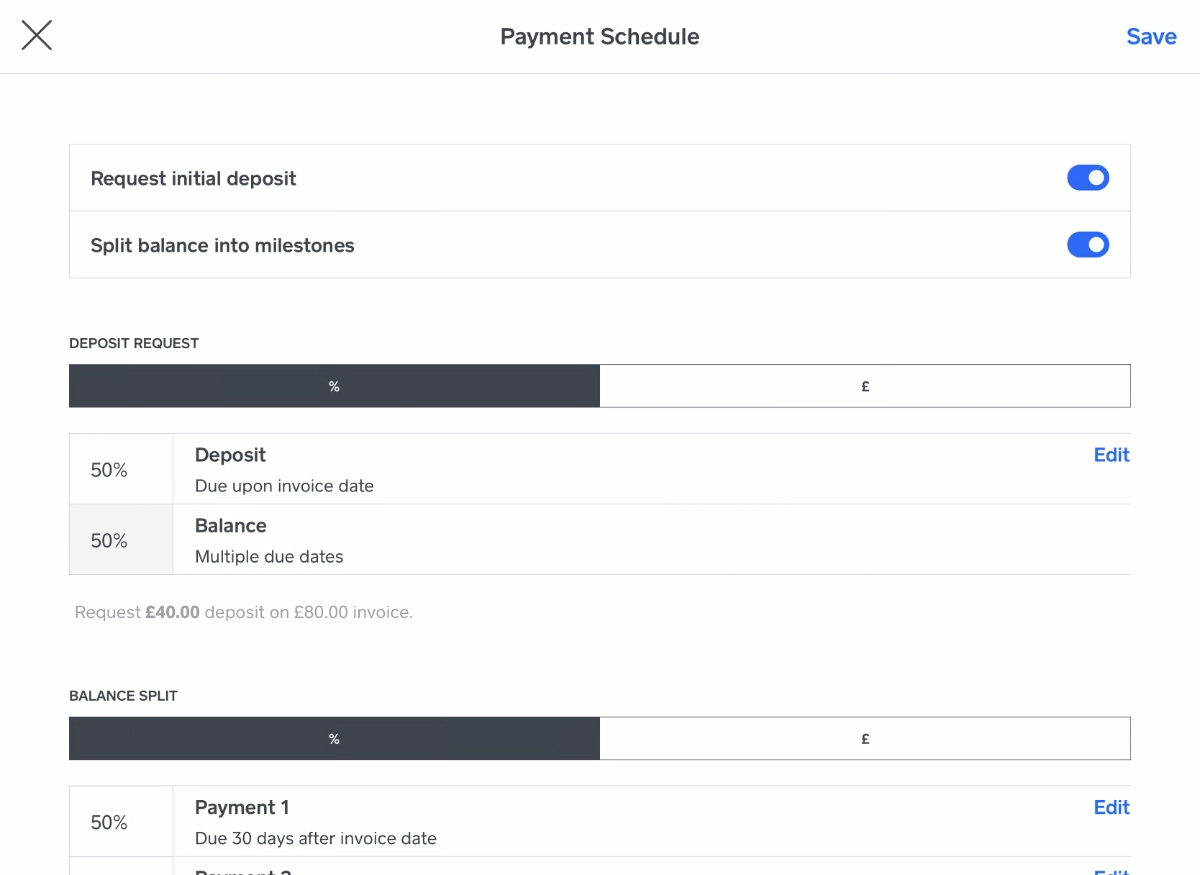

Deposits: Partial payments are possible though the invoice if you request a deposit. You decide what amount should be paid as a deposit for the goods or service, and the customer will be required to pay this and then the remaining amount at a later time.

Image: Mobile Transaction

On the Plus plan, you can schedule when the client has to pay parts of the invoice bill.

Customer directory: Rather than entering customer information over and over again, you can save client details in the Square account. This way, you only need to add a person from a list to the invoice.

The customer can voluntarily opt to have their card details saved on the system, if you prefer processing payments for them without having the customer submitting details every time.

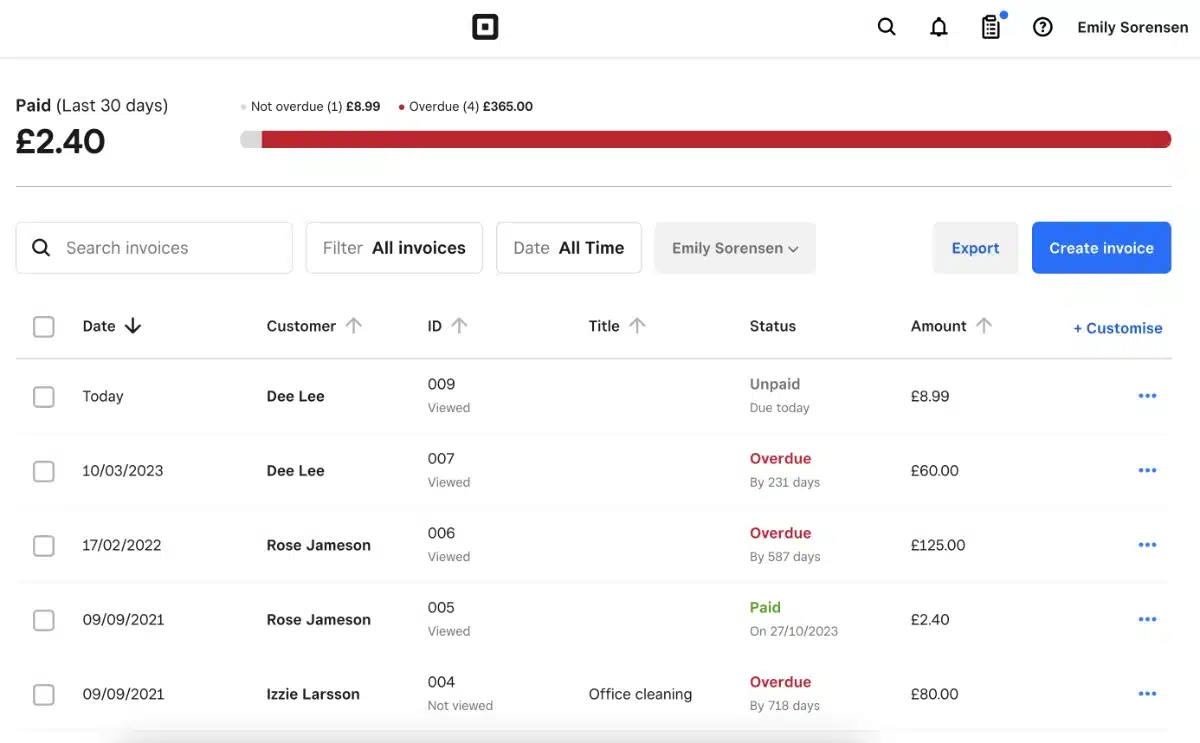

Photo: Mobile Transaction

Overview of paid and outstanding invoices in Square Dashboard.

Tracking: The app shows an overview of outstanding, paid, cancelled and past-due invoices so you can track payments wherever you are. If you cancel an invoice, an optional notification can be sent to the client. Individual invoices and estimates even show whether they have been viewed by the customer (so they can’t get away with saying they didn’t see it!).

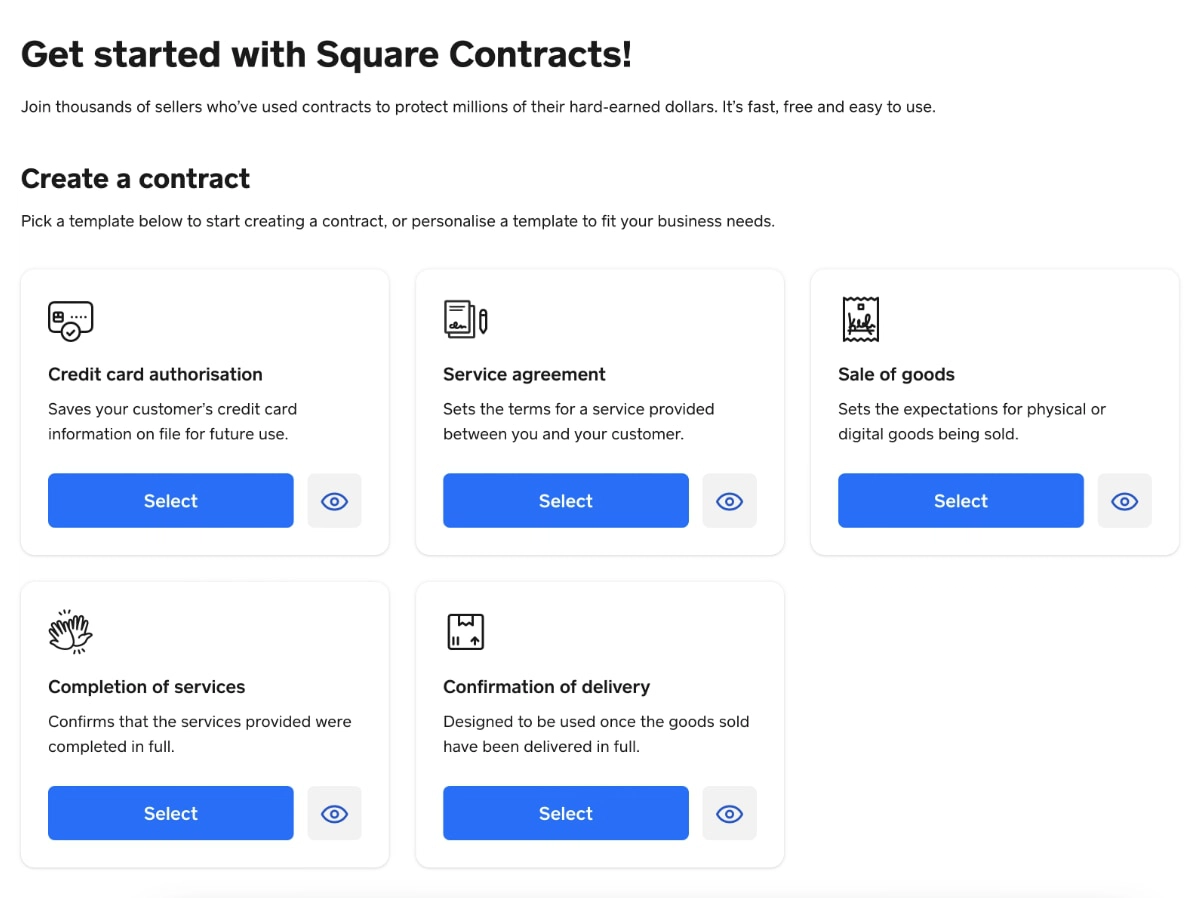

Contracts: A new feature is Square Contracts, which enables you to pick a contract template to edit and include as a document with any estimate or invoice. Custom invoices can be saved for reuse later. You can also collect a digital signature through any contract, which is often a paid feature in other software – but with Square, this is free.

Photo: Mobile Transaction

Square Contracts makes it easy to create and send a contract for clients to sign.

Payment options: All Square invoices prominently display a payment link through which the customer can pay online with debit or credit card (2.5%) or Square eGift Card (also 2.5%). Merchants benefit from this, since it usually yields a faster payment from recipients, because many prefer to pay with a card or mobile wallet these days.

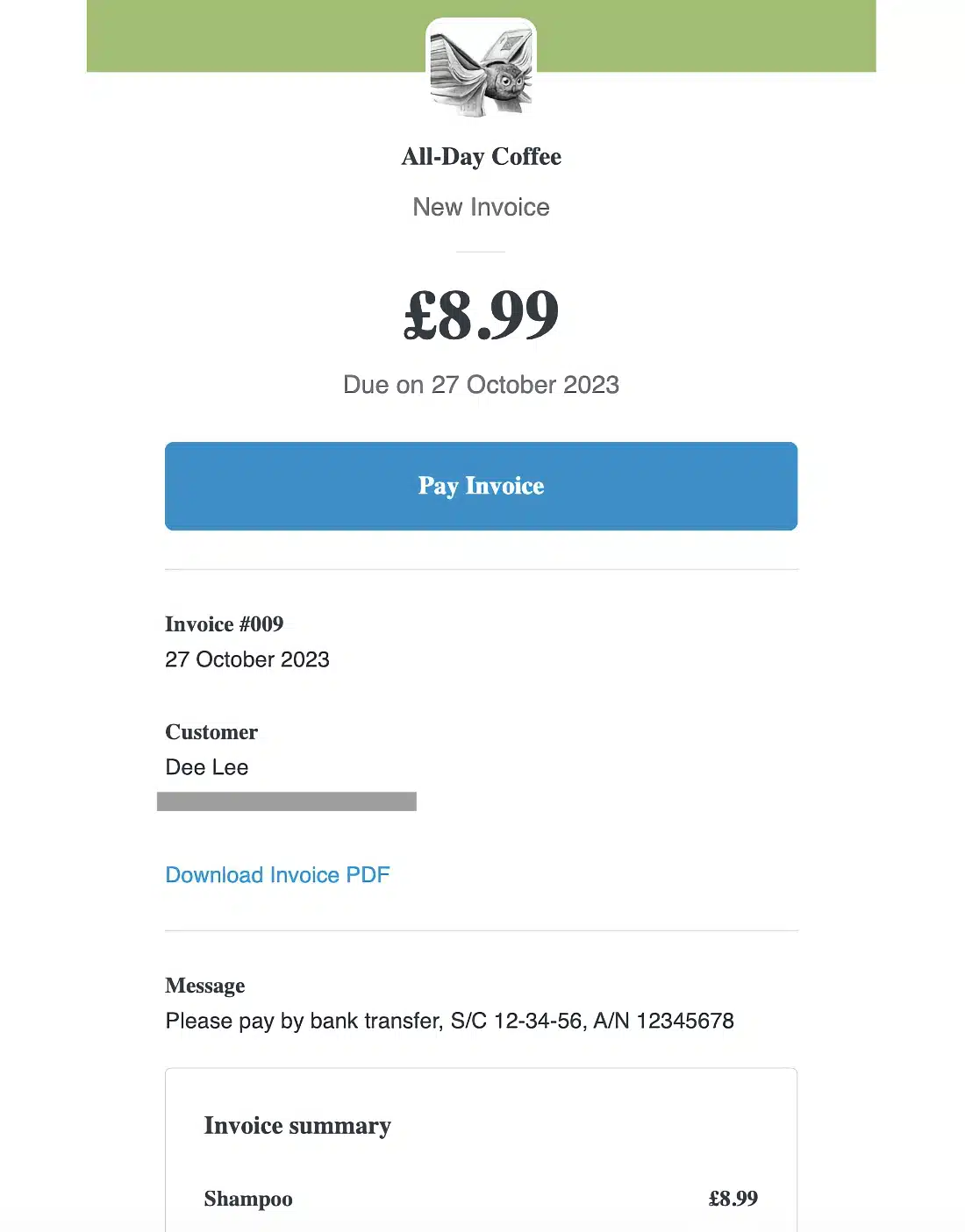

Image: Mobile Transaction

This is what customers receive in an email when you send an e-invoice from Square.

You can, however, include a note in a custom field (one available on Free, multiple fields possible on Plus) to say that you prefer a bank transfer or other method (which would be free), alongside instructions for what to do. But with a Square payment link present on all invoices, the payer may still choose a card transaction since it’s easier and quicker to do.

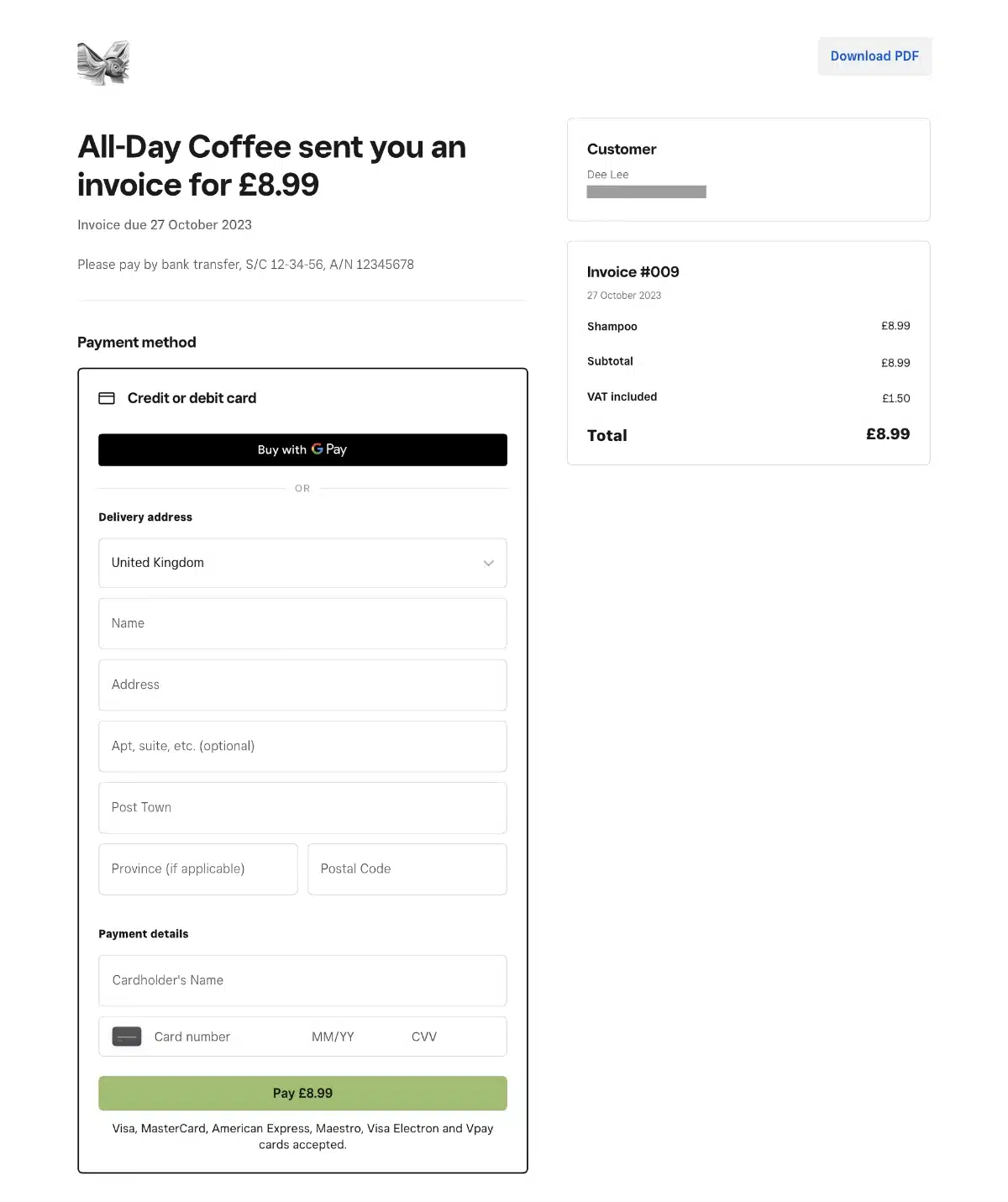

Photo: Mobile Transaction

Example of the page that customers see when they follow a link to pay online with a card.

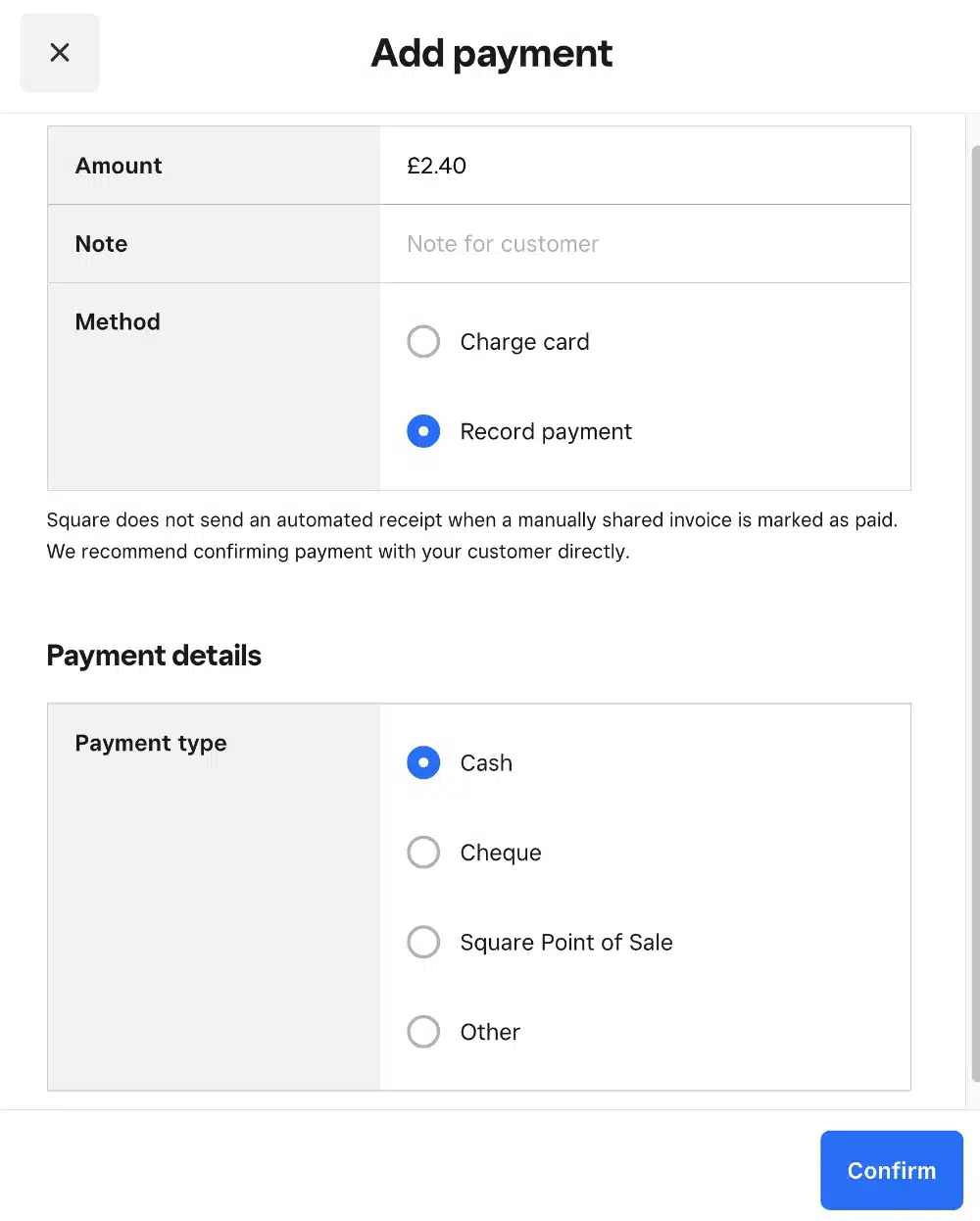

If you’ve received money in cash, by cheque or BACS, you need to register the payment through the app yourself.

If a merchant is given the customer’s card details over the phone, these can be entered in Square Virtual Terminal to process a transaction that the cardholder has asked you to action. If you have Square Reader, the app can connect with it via Bluetooth for direct payment via chip and PIN or contactless.

Photo: Mobile Transaction

Square allows you to manually add payments for invoices, if the customer pays by e.g. bank transfer.

Most invoicing features are included for free in all Square accounts, but specific time-saving functions require the monthly Plus subscription. The differences between the Free and Plus plans are mainly:

| Square Invoices feature | Free | Plus |

|---|---|---|

| Unlimited invoices, estimates & contracts | ||

| Unlimited users & customers | ||

| Invoices by email, text & link sharing | ||

| Schedule recurring invoices | ||

| Charge cards on file | ||

| Collect deposits | ||

| Schedule auto-payment reminders | ||

| Real-time invoice tracking | ||

| Milestone payment schedules | ||

| Save & reuse custom invoice templates | ||

| Add custom fields to invoices | ||

| Multi-package estimate options | ||

| Auto-convert accepted estimates to invoices | ||

| Organise files into project workspaces |

| Square Invoices feature |

Free | Plus |

|---|---|---|

| Unlimited invoices, estimates & contracts | ||

| Unlimited users & customers | ||

| Invoices by email, text & link sharing | ||

| Schedule recurring invoices | ||

| Charge cards on file | ||

| Collect deposits | ||

| Schedule auto-payment reminders | ||

| Real-time invoice tracking | ||

| Milestone payment schedules | ||

| Save & reuse custom invoice templates | ||

| Add custom fields to invoices | ||

| Multi-package estimate options | ||

| Auto-convert accepted estimates to invoices | ||

| Organise files into project workspaces |

Square offers a lot of additional tools in general, plus the ability to integrate with partner platforms such as WooCommerce and Xero. Invoicing is just one facet of Square’s entire offering for small-business merchants.

Who is Square Invoices suitable for?

Square is recommended to most small businesses, entrepreneurs and sole traders within many kinds professions. It is the go-to option for those on a budget who require a fast, adaptable and easy way to get paid for their work.

Since Square is widely known for its compact card readers, it is ideal for the many users already seeing clients in store or out-and-about doing jobs on location.

Professionals with international clients expecting to pay in another currency than British Pounds may feel restricted by the inability to charge in anything other than Pound Sterling.

Certain business types are prohibited, but only those considered “high risk”. This includes trades like direct marketing, property investment services and dues for membership clubs.

More on features: Square Point of Sale review – free, but worthwhile?

Customer service and user feedback

Customer support is available to phone or message between 5am and 9pm from Monday to Friday. There is no weekend support. This is usually okay for Square users who generally find it very easy to navigate the system.

On the negative end, some customers have complained about sudden account holds for no apparent reason. This could be due to Square detecting payments that go against their terms, so it is a little hard to determine the extent of Square’s fault around this.

Image: Square

Invoices can be accessed in the app and Square account in-browser.

How to get started

Getting started with Square Invoices is straightforward. On the website, you have to fill in an online form with personal, business and bank account information. After submitting the required information, it takes up to four working days for Square to verify your bank account.

Once the bank account is connected (i.e. approved), invoice payments will settle there automatically. It is, however, possible to accept invoice payments immediately after registering with Square, but payments will then be held in the Square account until your bank account is linked up.

Our verdict

Square Invoices is ideal for anyone in the UK who needs an easy, fast and free way to create, manage and send invoices online. Out of all the invoice apps, it simply has the most features for free alongside an integrated payment system that lets you get paid quickly. You don’t enter into a long contract, and the free plan is a big advantage for those living sparingly on a month-to-month budget.

Square is also one of the few affordable payment platforms offering immediate payouts – if you qualify for it, that is.

| Square Invoices criteria | Rating | Conclusion |

|---|---|---|

| Product | 4.3 | Good/Excellent |

| Costs and fees | 4 | Good |

| Transparency and sign-up | 4.8 | Excellent |

| Value-added services | 4.4 | Good/Excellent |

| Service and reviews | 3.8 | Good |

| Contract | 5 | Excellent |

| OVERALL SCORE | 4.3 | Good/Excellent |

| Square Invoices criteria |

Rating | Conclusion |

|---|---|---|

| Product | 4.3 | Good/Excellent |

| Costs and fees | 4 | Good |

| Transparency and sign-up | 4.8 | Excellent |

| Value-added services | 4.4 | Good/Excellent |

| Service and reviews | 3.8 | Good |

| Contract | 5 | Excellent |

| OVERALL SCORE | 4.3 | Good/Excellent |

If you send lots of invoices for various projects, you could really benefit from an upgrade to the Plus subscription. This gives you more freedom to customise your invoicing tools and track payments according to projects and milestones.

Businesses that require very specific, advanced functions may want to look at alternative invoicing software.