Revolut Business is gaining traction in Ireland, mostly from being so big in the private account market. Although not as recognisable among consumers, Square has been around for years and cemented its status as a payment solution for small businesses.

They are fundamentally different, but with similar features that sole traders and companies rely on. Revolut is primarily a business account for money management, whereas Square is primarily a payment and point of sale (POS) company. Yet they overlap in some ways.

| Revolut | Square | |

|---|---|---|

| Account type | Online multi-currency business account | Merchant account for payment acceptance |

| Pricing | €0-€90/month From 0.8% + 2¢/transaction |

No monthly fee From 1.75% + VAT/transaction |

| Website | ||

| POS hardware | Card readers | Card readers, POS registers, self-ordering kiosk |

| POS systems | 1 POS app, limited POS in Revolut app | 4 POS apps |

| Online payments | Payment links, invoicing, ecommerce integration | Payment links, invoicing, virtual terminal, online store, ecommerce integration, QR codes, recurring payments |

| Payouts | 1-7 days to Revolut account | 1-2 business days to bank account |

This comparison looks at Square and Revolut in key areas: accounts, pricing, apps, payment products and service. Our insights are based on personal experience and our wider knowledge of the banking and payments competitors in Ireland.

Different accounts, different sign-ups

Revolut wants to replace traditional bank accounts by offering an all-in-one app with built-in payment features.

Businesses can sign up for one of these accounts:

- Pro for sole traders (free): personal account with added business tools for freelancers

- Business for companies (paid): full business account features for teams and complex payments

Pro is easy to sign up for via the Revolut app, whereas Business requires more documents and more ongoing account verifications. You also need to apply for a Merchant Account in the app to take card payments.

Square offers one merchant account for accepting card payments into any bank account in your business’ name. It’s very easy to sign up on the website – usually, you can start taking payments within a day, and then you’re less likely to experience additional account verification requests than with Revolut.

Although Square doesn’t have a current account like Revolut, it has a full range of payment features so sellers can take card payments in person, online and remotely. It also has a good selection of POS terminals and POS software.

Photo: Mobile Transaction

Revolut business accounts come with a Debit Mastercard.

Fees: big differences in rates

While none of the platforms require commitment or complicated fees, they differ on the monthly cost and transaction charges.

For a start, Square charges nothing for the merchant account – all users sign up and use the account features free. It’s only transactions that cost.

Revolut charges monthly fees for all its Business Accounts (for companies), but not its Pro account (for freelancers). There’s also a slight difference in transaction fees between Pro and Business.

Revolut and Square pricing:

| Revolut | Square | |

|---|---|---|

| Account fee | Revolut Pro: Free Revolut Business: From €10/mo |

Free |

| Card reader price | Reader: €49 + VAT Terminal: €189 + VAT |

Reader: €19 + VAT Terminal: €169 + VAT |

| Card reader transactions | Pro account: 1.5% for all cards Business account: 0.8% + €0.02 for domestic consumer cards 2.6% + €0.02 for all other cards |

All cards: 1.75% + VAT |

| Tap to Pay transactions | Pro account: 1.7% for all cards Business account: 0.8% + €0.10 for domestic consumer cards 2.6% + €0.10 for all other cards |

All cards: 1.75% + VAT |

| Online transactions | All accounts: 1% + €0.20 for domestic consumer cards 2.8% + €0.20 for all other cards |

EEA cards: 1.4% + €0.25 + VAT UK and non-EEA cards: 2.9% + €0.25 + VAT |

| Refunds | Transaction fee is retained | Transaction fee is retained |

| Chargebacks | €15 | Free |

Square charges less for the card machines: €19 for Square Reader versus €49 for Revolut Reader, and €169 for Square Terminal versus €189 for Revolut Terminal (all excluding VAT).

“Revolut Business’ cheapest plan is currently going up in price from £25 to £35 monthly in the UK, and we would not be surprised if the same happened in Ireland. It’s clearly for companies of a certain size – but a Revolut Pro account is still a very good deal for freelancers.”

– Emily Sorensen, Senior Editor, Mobile Transaction

It’s more or less the other way around for transactions. Square’s fixed 1.75% + VAT for all chip and contactless transactions is markedly higher than Revolut’s domestic rate on Business, though Square adds no fixed fee. Commercial and international cards cost much more with Revolut Business, though.

Revolut Pro’s 1.5% (card reader transactions) and 1.7% (Tap to Pay transactions) for all cards are also lower than Square’s fixed 1.75% + VAT. This can make a difference for high transaction values – freelancers can save with Revolut.

Square’s percentage rates and fixed added fee are in all cases higher for online transactions than Revolut’s.

Card readers and hardware: Square excels

Square has been around for much longer in the point of sale (POS) area and sells a couple of user-friendly card machines and POS hardware. They all work smoothly together and come with free POS software that can be upgraded to hospitality, retail or booking POS systems.

The card reader that started Square’s success is Square Reader, which works with an app on your phone or tablet. We love how small it is (6.6 cm x 6.6 cm x 1 cm), but some users might not like that PIN entry has to happen on your mobile device.

Photo: Mobile Transaction

Square Reader would look cute anywhere.

Photo: Mobile Transaction

Although portable, Square Terminal is for fixed locations.

Standalone Square Terminal is the only other handheld card terminal, but it only works with secured WiFi or Ethernet, not 4G. This means it’s only really for fixed locations like a shop, pop-up market or café where you might use it for table service.

Revolut similarly sells a card reader that works with the Revolut app and a standalone card terminal. The card reader has a rudimentary touchscreen display, but it displays a PIN pad when required, in contrast with Square Reader where the virtual PIN pad is in the mobile app.

Photo: Mobile Transaction

Revolut Terminal is arguably better than Square Terminal, as it comes with a SIM card for mobile connectivity, as well as WiFi. But the software on this standalone terminal is basic for payments only, whereas Square Terminal has a POS app that syncs with your wider POS system on your premises.

Square sells some gorgeous, uniquely-designed checkout terminals too:

- Square Stand: iPad stand with card readers built in

- Square Register: all-in-one tablet register with a detachable card reader

- Square Kiosk: self-ordering kiosk for iPad

Tap to Pay on a phone is available through both, but only Square has it for Android as well as iPhone.

Apps and POS systems: not equal

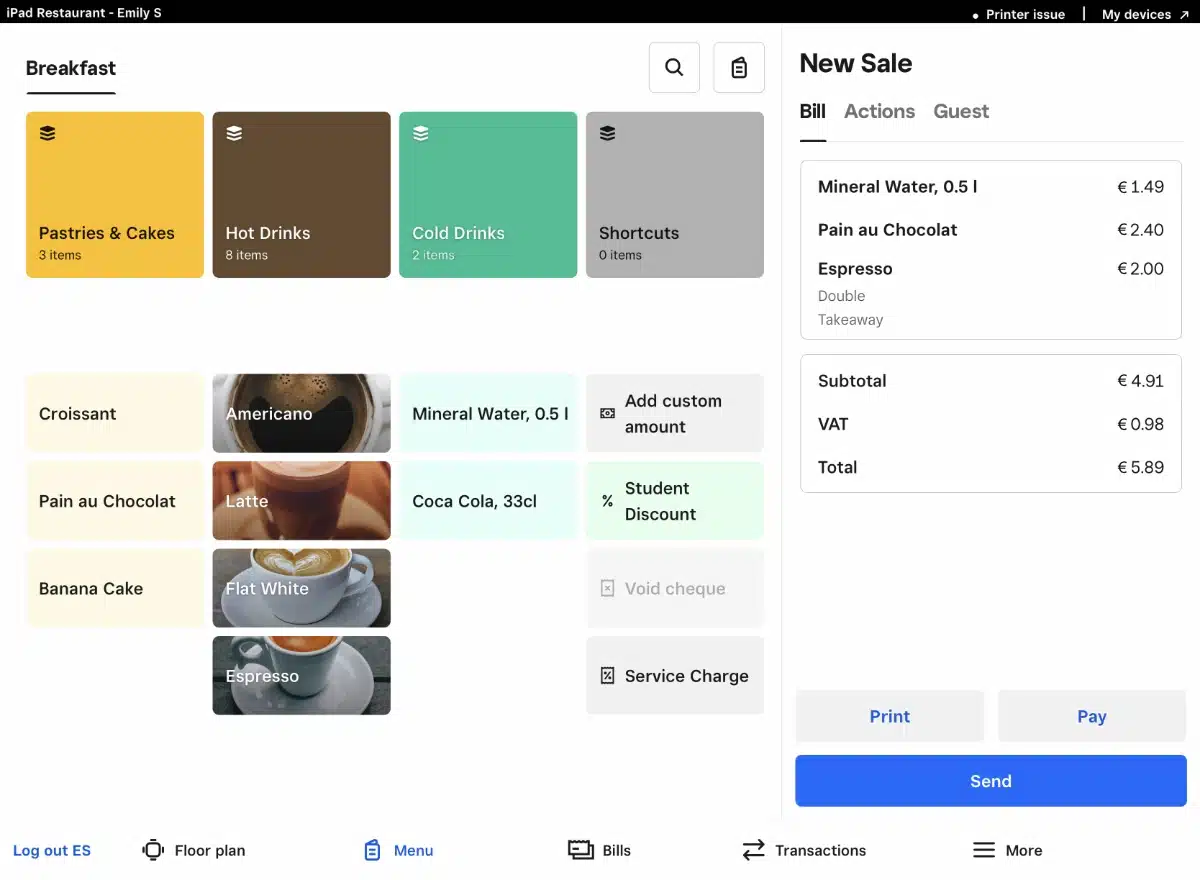

Square has developed apps for over a decade and excels in user-friendly point of sale (POS) apps. Revolut entered the POS space by acquiring Nobly and turning it into its own stripped-down POS system, but it’s still in its early days of development.

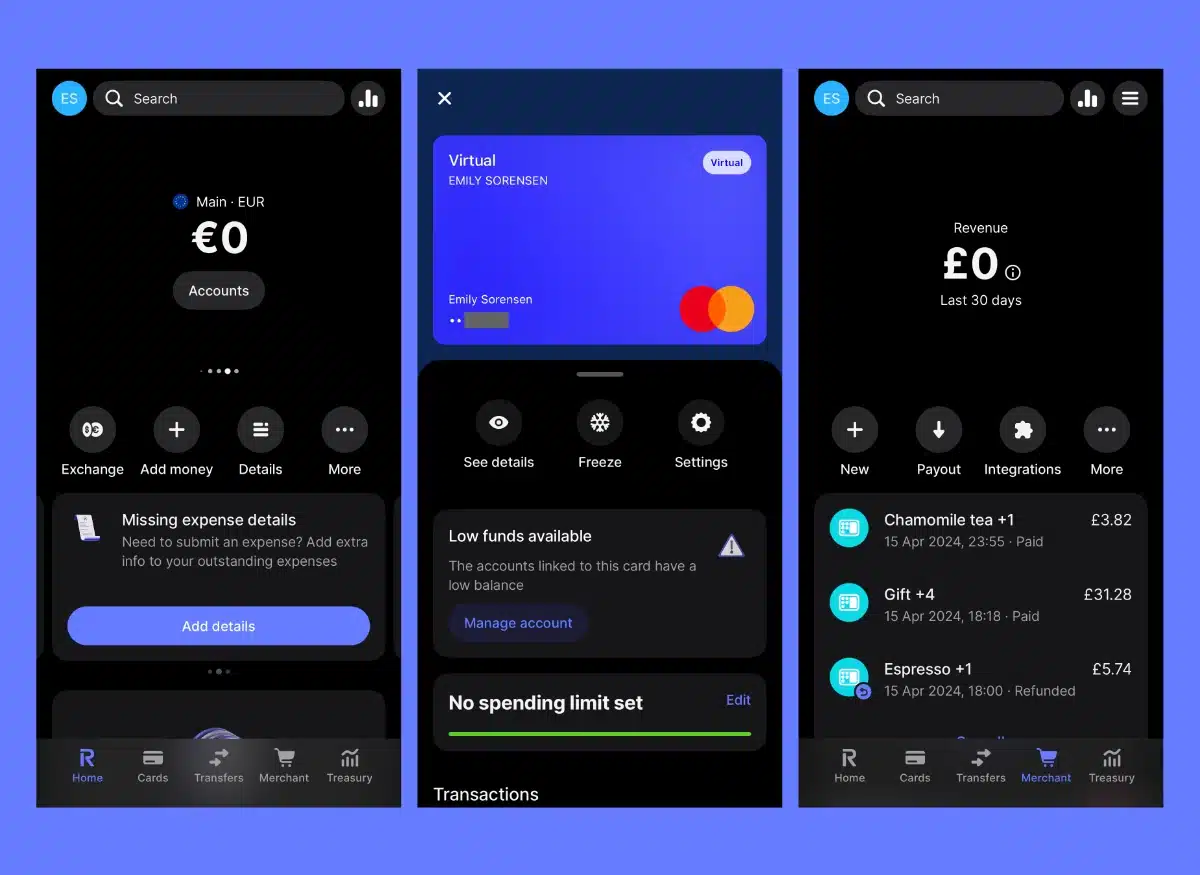

Instead, most of Revolut’s features are in their banking app designed for phones. The Revolut POS app for iPad is what used to be Nobly. We found it efficient for small cafés, not so much retail, when trying it out.

“Both Revolut and Square improve and update their apps frequently, but I find Square has a more accessible interface. The buttons are bigger and wording more logical. Revolut Business app’s interface isn’t always intuitive – it takes me several extra steps and seconds longer to find the same features I can quickly access in Square apps.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Revolut also has a separate app for Personal and Pro and one for Business accounts. It means freelancers with the Pro account have a different experience from the “full” business account app for companies. Since sole traders usually don’t need team management and complex banking anyway, it simplifies things a bit.

Image: Mobile Transaction

Revolut Business app, which is different from the regular Revolut app that freelancers use.

Square has a free POS app for phones and tablets with a versatile checkout interface, inventory features, payment links, sales data, etc. You can use it with Square readers or independently, since customers can tap to pay via contactless directly on your phone (Tap to Pay).

Additionally, Square has apps for invoicing and team management and separate POS apps for retail, restaurants and booking systems. These work equally well on smartphones and tablets, and they are regularly updated and optimised for usability.

Image: Mobile Transaction

Square for Restaurants is one of Square’s specialised POS systems.

What’s more, Square offers plenty of integrations for more complex needs, so merchants need not feel limited. Revolut doesn’t integrate with external POS or inventory software (yet, at least).

Online payments: different advantages

Accepting payments online is no problem for Revolut and Square. They both include:

- Payment links

- Ecommerce integration

- Email invoicing

Revolut has some interesting options for these, like choosing the currency and accepting “easy” bank transfers, not just cards – both unmatched by Square.

Still, Square offers more ways to accept payments remotely, like:

- A dedicated invoice app and advanced invoicing tools (for a monthly cost)

- Integrated online store builder

- Highly customisable payment links and pay buttons

Square also accepts over-the-phone payments through a virtual terminal, where you can set up recurring payments.

Which is best really depends on how you plan to charge customers remotely. Revolut could win if you’re charging clients abroad, while Square is the only option for keyed telephone payments (for example, to secure a sale over the phone).

Transfers, debit card and access to finds

Fast access to card transaction funds is priority for both companies, but Revolut has the edge with its 24-hour payouts (including weekends) into its Business Account. Square settles funds from card transactions within 1-2 business days in your chosen bank account.

Revolut also provides a debit card for spending funds straight after settlement.

Payout times are longer for some Revolut Pro accounts: 7 days to begin with. It’s only after Revolut unlocks the 24-hour payouts, after some payment history, that sole traders enjoy faster transfers too.

In several other countries, Square offers instant bank account access to funds for an additional fee and a card for spending it straight away. We expect these things to come to Ireland eventually, but can’t know this for sure.

Multiple currencies: only with Revolut

Many entrepreneurs choose Revolut for its multi-currency accounts, because it helps avoid currency exchange fees for international payments. Its payment tools allow you to accept 25+ currencies into the corresponding currency account – that’s pretty cool.

What’s more, Revolut Business has some very advanced foreign exchange (FX) features. If you’re really into getting the best currency exchange deals, Business subscribers can automate when they exchange one currency to another, based on market fluctuations. We haven’t seen this in another business account in Ireland.

Square has taken no interest in foreign currencies in any of its markets, instead focusing on domestic, small businesses serving locals. It only accepts euros in a nominated euro bank account in Ireland. Then again, Square doesn’t charge extra for accepting international cards, which Revolut does.

Expense and team management: different angles

Square and Revolut have very different angles to team management. This is only really relevant for companies with staff, not solopreneurs.

If you’re looking for expense management, only Revolut Business addresses that. Not only does it allow companies to issue expense cards to staff members, it also has complex approval, spending and permissions settings for them. I was quite surprised by the extent of this – it’s certainly scalable for larger companies.

“Square has the software to manage shop team schedules smartly, while Revolut manages how any staff spend company budgets. They’re totally different features.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Unlike Square, Revolut has nothing in the way of shift scheduling for shop teams, though. Square has advanced permission controls (extra cost), timesheets and labour cost analyses, but no expense management or expense cards since it’s not a business account. There’s even a Square Team app for managing staff.

Accounting: no shortage of integrations

You can’t go wrong with either Revolut and Square when it comes to bookkeeping. Both have at least 9 integrations with the likes of Xero, QuickBooks and more niche accounting software.

The platforms let you export sales and transactions data too, so merchants can manually upload numbers to their chosen system.

But when it comes to analysing sales within the platforms, Square has much more. It digs into transactions, payment methods, customers, profit and product trends, staff performance and other custom insights. This makes sense because all this data are recorded through the POS systems.

Revolut only digs into transactions and basic sales patterns by dates in the app. There’s no way to analyse cash payments, for example, since it only shows transfers and card transactions in the app.

Service and reviews: difference in quality and availability

Both Revolut and Square have had their fair share of complaints about service. This is unfortunately common for banks and payment companies, but some are better than others.

It’s definitely good that Revolut’s support is available 24/7 through a chat in the app, but you get the same quality support across all plans, and there’s no phone number or email for in-depth queries. It’s only on Business Enterprise (expensive plan) that you get a dedicated account manager.

“I’ve needed to contact Revolut many times over the in-app chat to solve verification issues, mostly. To be honest, their chat responses were repetitive and frustrating at times. I was mostly passed over to other departments, taking several days, sometimes weeks, for a resolution. I’ve personally never needed to contact Square, because everything has just worked for me.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Apart from messaging support, Square also offers telephone and email support to all users, but only on business days within working hours. The Square for Restaurants subscription includes 24/7 phone support, though.

Although Square has limited support hours, users are generally pleased with the product and manage with the in-depth user guides online. Revolut has a similarly big resource section, but users tend to need help more often for account holds, verification requests and fraudulent transactions.

What are the alternatives? Compare card machines in Ireland

Who should go for Square and Revolut?

The choice between Square and Revolut depends entirely on what you’re looking for.

Revolut could be the answer if you:

- Prefer to use the same account for banking and payments

- Handle multiple currencies and want to save on exchange fees

- Need to manage expense budgets for a team

- Want the lowest rates for domestic card acceptance

- Need an handheld card machine that works with mobile networks

- Want the fastest settlement and a business debit card

Square could be the right choice if you:

- Want to accept more payment methods, both remotely and in person

- Need the best point of sale system and the option to add integrations to it

- Prioritise user-friendly software that’s reliable

- Prefer a solution that can manage store teams

- Need more complex invoicing software

- Want to manage an online and brick-and-mortar shop in the same account