- Highs: Low transaction fee for some cards. Free online transactions on paid plans. Accept different currencies. Next-day payouts.

- Lows: Checkout plugin only for few ecommerce platforms. Only Visa and Mastercard accepted.

- Choose if: You have a Revolut Business account, sell across borders and want low rates on transactions online.

How it works

Online payments is a new addition to Revolut Business accounts, but it is somewhat separate from the current account features. Why? Because you need to apply separately for a Revolut Merchant Account – a PCI-compliant acquiring solution for online card acceptance – through your business account.

Accepted cards

Accepted currencies

GBP, EUR, USD, CAD, CHF, JPY, AUD, HKD, SEK, DKK, NOK, NZD, PLN, ZAR

Only after approval can you start to send payment requests, accept QR code payments and implement an online checkout hosted by Revolut.

Whereas you can view incoming transactions, send payment links and generate QR codes for in-person payments from the Revolut app, the online checkout has to be set up through a plugin on select ecommerce platforms or customised if you’ve got the technical skills for that.

Transactions are settled in your Revolut Business account the following day – faster than Stripe and many other online gateways.

You can accept 14 different currencies, but the only accepted card brands are Mastercard and Visa (prepaid, debit, credit and all other kinds), not any other cards.

Revolut alternatives?

See 8 best online payment systems in UK

Revolut fees

There are no monthly fees for the online payments per se, but you do need to be on one of the Revolut Business plans to quality for – and activate – the features.

There are different plans, including a free tier, for freelancers and companies. Each plan is a monthly subscription that can be cancelled or changed any time to a different plan. The free tiers do not include any free transactions, but all the paid plans include a monthly quota of free online transactions with a UK- or EEA-issued consumer credit or debit card.

| Revolut Business plan | Monthly cost | Free online transactions | Free currency conversion |

|---|---|---|---|

| Company plans | |||

| Free | Free | None | None |

| Grow | £25 | £2,000 | £10k |

| Scale | £100 | £9,000 | £50k |

| Enterprise | Custom | £100,000 | Custom |

| Freelancer plans | |||

| Free | Free | None | None |

| Grow | £7 | £500 | £5k/mo |

| Ultimate | £25 | £2,000 | £10k/mo |

| Revolut Business plan |

Cost/ month |

Free online transactions |

Free currency conversion |

|---|---|---|---|

| Company plans | |||

| Free | Free | None | None |

| Grow | £25 | £2,000 | £10k |

| Scale | £100 | £9,000 | £50k |

| Enterprise | Custom | £100,000 | Custom |

| Freelancer plans | |||

| Free | Free | None | None |

| Grow | £7 | £500 | £5k/mo |

| Ultimate | £25 | £2,000 | £10k/mo |

Any transactions with an EEA/UK card beyond the above limits incur a 1.3% transaction fee. All other types of debit and credit card payments are not included in the free quota and they cost 2.8% per transaction.

Transactions in GBP currency go into your pound sterling account, whereas you can choose to receive other currencies directly into the corresponding currency sub-accounts. This way, you can avoid conversion fees, whereas there’s a 0.4% currency conversion fee beyond a monthly free quota (see table above) for any conversions into another currency.

| Revolut Merchant Account | Cost |

|---|---|

| Account creation | Free |

| UK/EEA consumer card transactions (beyond free quota) | 1.3% |

| All other transactions (Visa & Mastercard only) | 2.8% |

| Refunds | Free |

| Chargebacks | £15 |

| Revolut Merchant Account |

Cost |

|---|---|

| Account creation | Free |

| UK/EEA consumer card transactions (beyond free quota) | 1.3% |

| All other transactions (Visa & Mastercard only) | 2.8% |

| Refunds | Free |

| Chargebacks | £15 |

If a customer disputes a transaction, you will be charged a chargeback fee dependent on the currency of the original transaction. In GBP, this chargeback fee is £15.

Refunds are free to process online. There’s no exit fee for cancelling the Merchant Account, nor are there other costs involved.

Online payment gateway

The Revolut online payment gateway is a simple checkout page that can be installed on any compatible website.

There’s a plugin for the Revolut checkout on Magento, PrestaShop and WooCommerce, so these are the only ecommerce solutions where Revolut can easily be installed. According to Revolut’s website, you don’t need technical experience to install the plugins on those platforms.

If you want a custom checkout flow, or simply wish to install it on another ecommerce platform, you can do this with the Application Programming Interfaces (APIs) provided by Revolut. This does require development skills, as you’ll be creating a unique checkout widget.

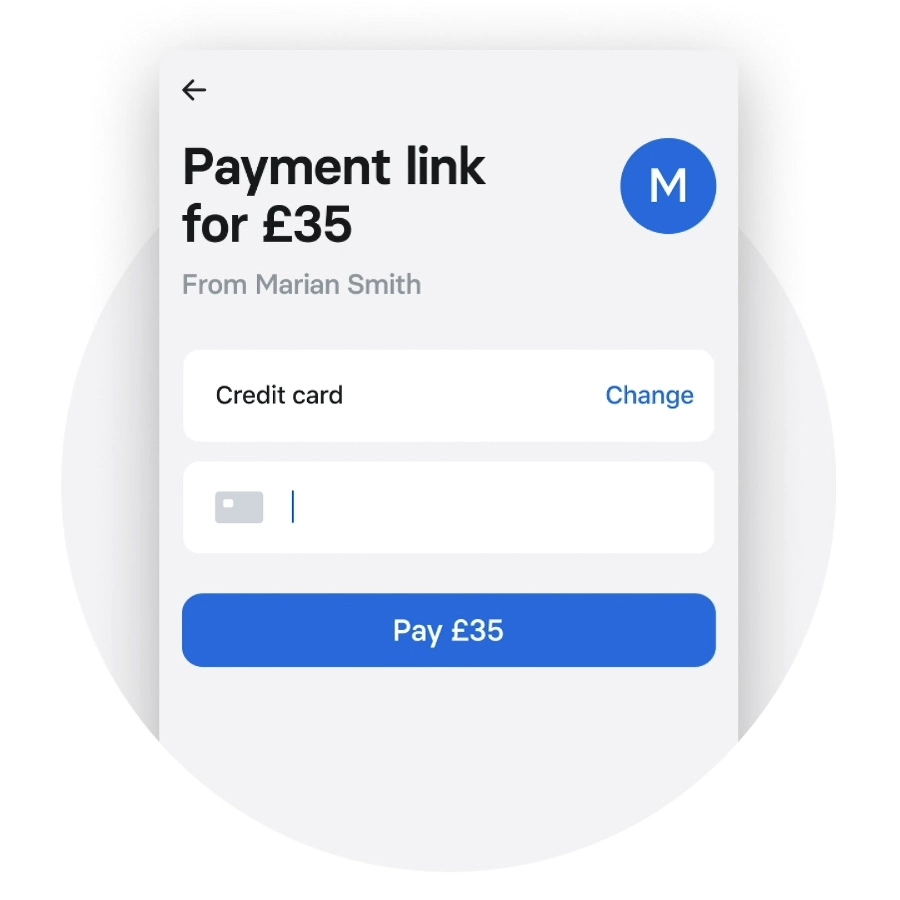

Credit: Revolut

Revolut Business payment link.

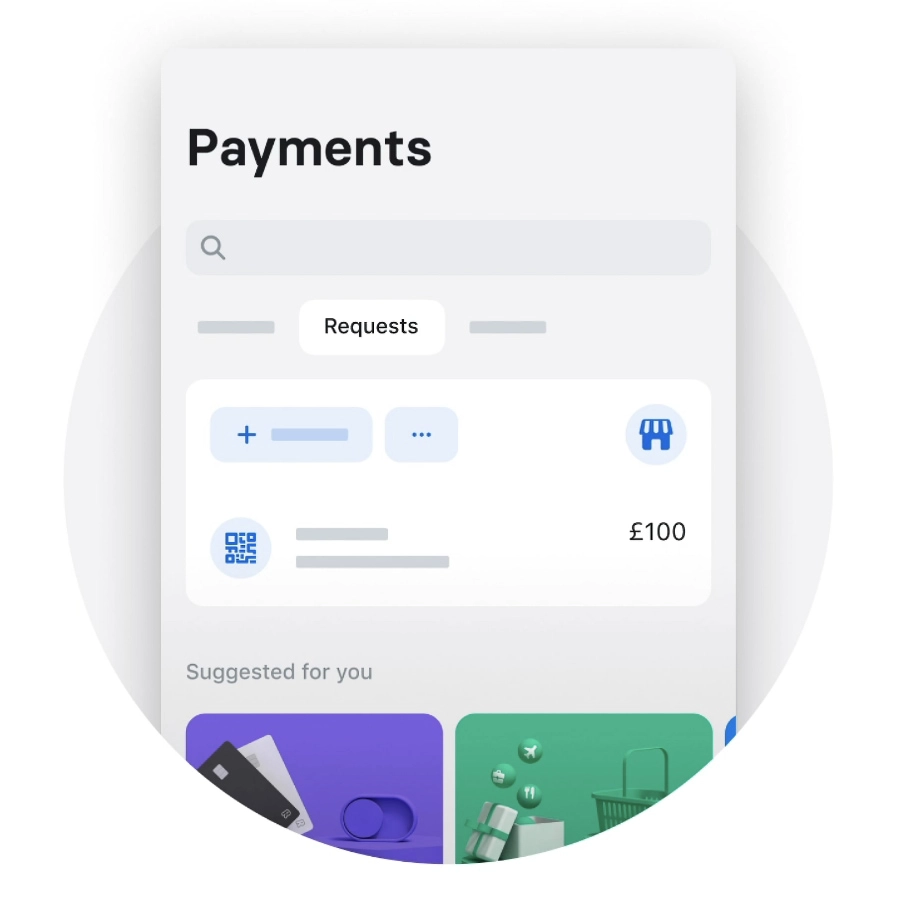

Credit: Revolut

View pending online payments in the app.

Payment links and QR codes

If you don’t have a website, or you need to request a payment from someone specifically, you can use the payment request feature. This is a Revolut-hosted checkout web page generated for the customer who needs to pay a specified amount.

There are two ways to use it. In the Revolut app, you choose to send either a payment link or generate a QR code. After choosing, you select the transaction currency, amount and description.

If you chose a payment link, you can then send it via text or email. If you picked QR code, this will be generated and displayed on your mobile screen to show your customer who can scan it with their phone camera in person.

Clicking the payment link or scanning the QR code opens up a web page with the Revolut checkout, enabling the customer to enter their card details to complete the transaction.

Revolut also offers email invoices now, through which clients can pay online by card.

Getting started

To use Revolut online payments, you’ll first need a Revolut Business account (Company and Freelancer plans are both acceptable). The online sign-up for that typically takes 10-15 minutes to complete through the website, after which you need to submit proof of ID, then await approval by Revolut.

In our case, it took a day for the account to be approved and ready for use. You’ll need to transfer some money into the account balance for the subscription fees.

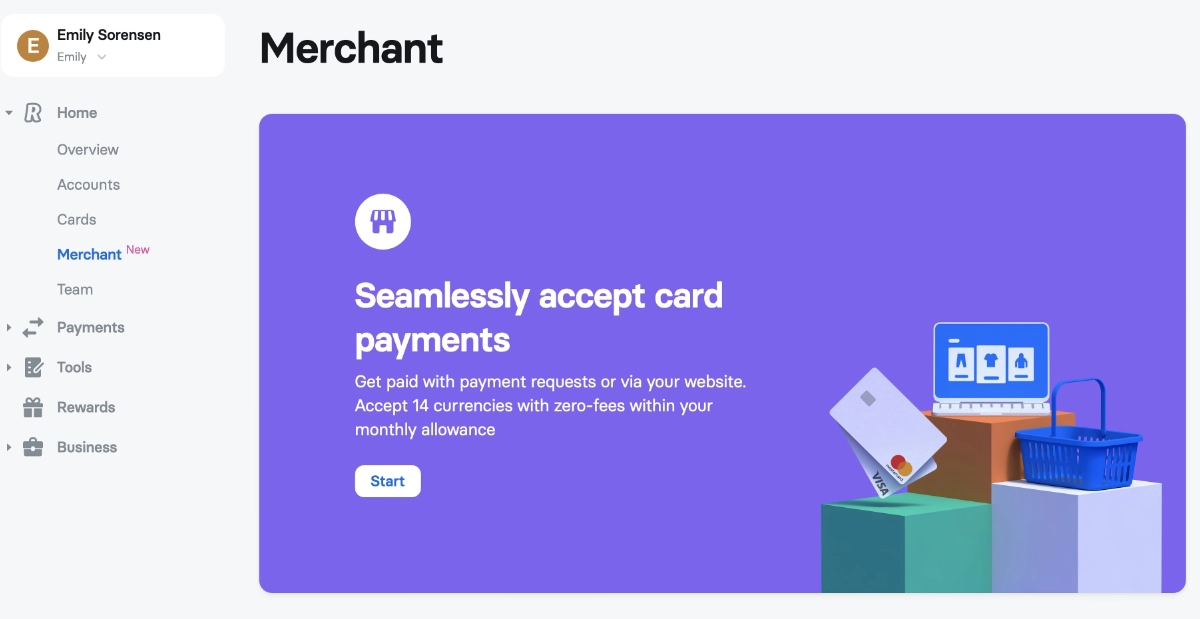

Then you can apply for a Merchant Account through your web account. This requires submitting information about your business, online presence and expected turnover. Some merchants may be required to submit documentation.

Only after Revolut has approved this application – usually within two working days – can you access online payments though the web dashboard and Revolut app.

Credit: Mobile Transaction

Apply for a Merchant Account for online payments through the web dashboard.

Customer support and reviews

All Revolut users can access chat support through their online account in a web browser or the Revolut app. Only those subscribed to a paid plan can get round-the-clock support. Revolut calls this “priority” but customer reviews suggest there’s nothing special about the quality of support on paid plans. You cannot phone Revolut, which is not to everyone’s liking.

Some businesses have had issues using the Mastercard as it is not a full-fledged debit card – the prepaid nature of the card means not everyone accepts it.

There are also issues around international transfers not getting through while Revolut requires documents to confirm the legitimacy of the transaction. This is sometimes a lengthy process that is deeply frustrating for the account holder.

Our verdict

Are Revolut’s online payment methods worth relying on when its primary product is the business account? It depends on what you need.

It certainly is convenient to keep online payments connected to Revolut if this is your main business account, especially when you’re making use of the different currency accounts to avoid conversion fees.

Freelancers and small businesses that only need simple payment links, QR codes for touch-free transactions and an online checkout are likely to find Revolut cheap and convenient for those needs.

The monthly allowance of free transactions on paid plans is a great add-on to the business account, but the allowances are not high. It’s probably not worth subscribing to a paid plan if you’re not actually making use of Revolut’s other account features that the subscription cost is primarily for.

As for ecommerce, those who don’t use WooCommerce, Magento or PrestaShop for their online store will not be able to integrate the Revolut checkout on their online store platform of choice unless they have a developer to do it for them.

Compared to Stripe and most other payment gateways, Revolut has a speedy payout time (next-day), low currency conversion fee and low transaction fees.

But while Revolut only accepts Visa and Mastercard, Stripe accepts more payment methods, more currencies and has better anti-fraud measures. PayPal – which also has an e-account for business, and a full-fledged debit card unlike Revolut – similarly accepts more currencies and offers many more payment tools, but for a higher cost.