MobileTransaction has tested the Revolut Business account, its service and many features such as payment acceptance.

The account is made for limited and unlimited companies, partnerships and sole traders, not charities or associations.

Let us go through the account features and fees to determine whether professionals and companies in the UK should consider Revolut as their main business account.

Account features

Firstly, what kind of account is Revolut Business? Is it a bank account?

Since Revolut was granted a UK banking licence in July 2024, it is technically a bank, but the business accounts are still electronic money (e-money) accounts until further notice. This is what is called a ‘mobilisation stage’ that allows Revolut to prepare to fully operate as a bank soon. We expect business accounts to turn into bank accounts once this stage is complete.

We should also note that Revolut used to have a Freelancer and Company types of accounts, the latter for users with several employees. Now, there’s only one type of business account that accepts both freelancers and companies, with different pricing tiers available depending on the features you want.

Some main account features are:

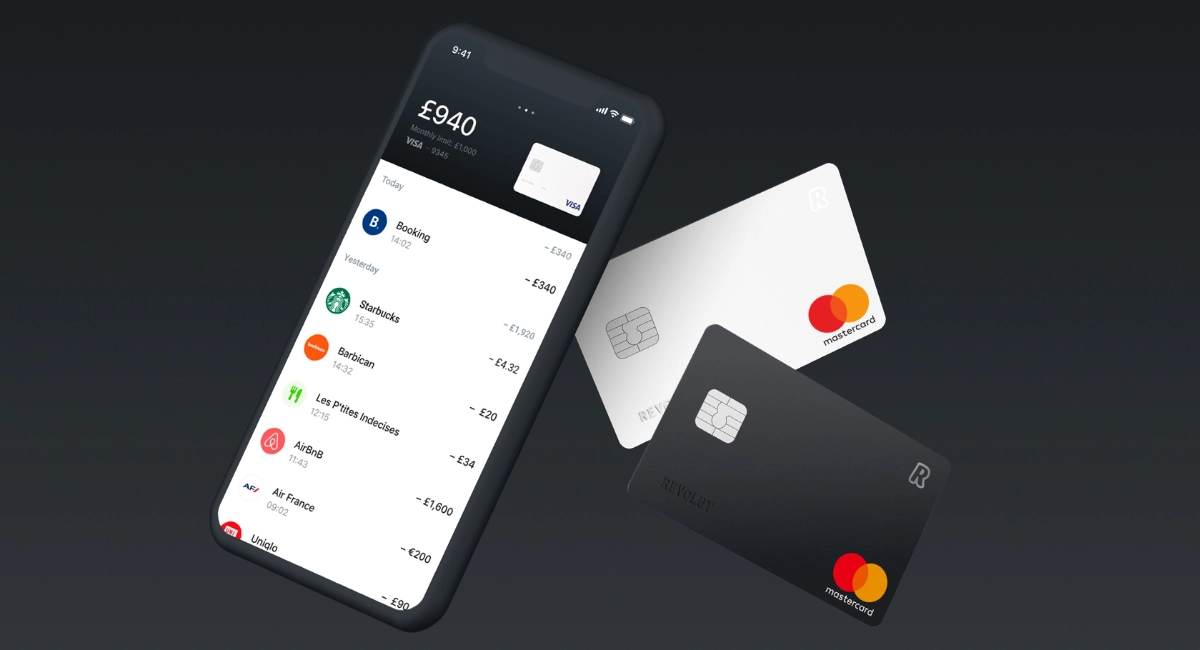

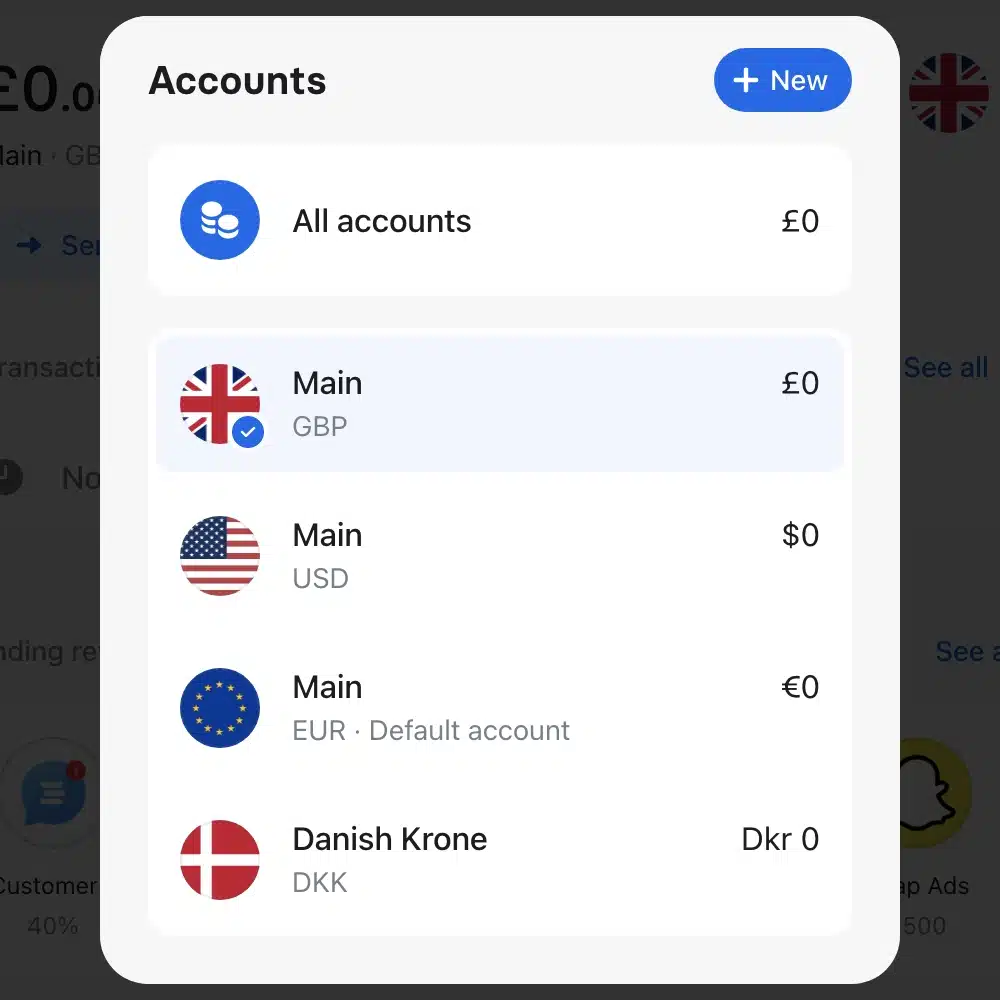

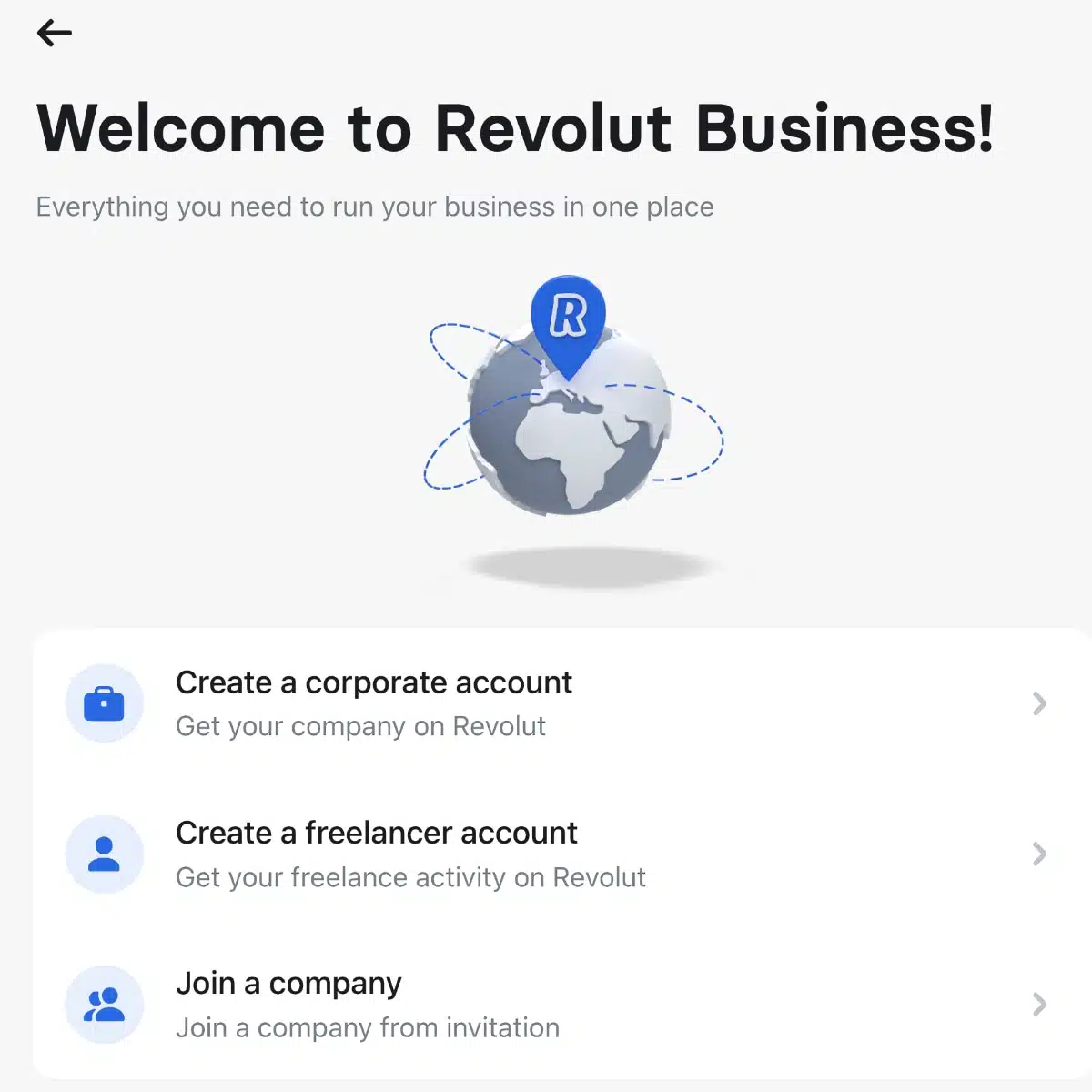

Multi-currency accounts: Revolut’s business accounts allow you to receive and send money in 25+ different currencies. Money transfers in the Eurozone and UK (via Faster Payments) don’t cost much or are included on the paid plan, while global transfers incur a transfer fee plus potential hidden fees by intermediary banks.

Image: MobileTransaction

Business users can create sub-accounts in several different currencies.

Payment cards: A Revolut Business account includes the option to order several debit cards. These allow you to withdraw money at ATMs and pay in most shops in the UK and abroad via chip and PIN or contactless. Paid plans include at least one metal Mastercard or Visa card, which is more for show than any functional benefits.

You can also create virtual bank cards in your choice of currencies for secure online transactions. The main account manager can set up custom restrictions for every card, or block it with just a click.

Revolut still does not offer loans or overdrafts in the UK, only in other countries such as Ireland, Australia, France, the United States and Germany.

Image: MobileTransaction

Our older Revolut Business prepaid debit card looks cool and slightly glittery.

Mobile app: You can manage the account entirely through the Revolut Business app for phones and tablets, although the web account has a slightly more detailed interface. The app is fairly straightforward, but can be buggy and is not always intuitive when you’re trying new features for the first time.

“One thing I found tedious is how soon the auto-logout happens in the web application especially. And every time I log in, the account requires verification via the mobile app or text message, which would be an issue away from my phone.”

– Emily Sorensen, Senior Editor, MobileTransaction

Revolut Connect: Users can link their Business account to different apps for accounting (Xero, QuickBooks, FreeAgent), ecommerce (Shopify, WooCommerce), task automation (Zapier) or communication (Slack).

Open API: Advanced users can use Revolut’s application programming interface (API) to integrate with other software and applications. This allows you to automate your own workflows such as cross-border payments and payouts to clients and staff.

Perks: The paid Revolut plans give you discounts and benefits from partners like Google Ads, Slack and Deliveroo for Business.

Image: MobileTransaction

The app allows anytime banking.

We tested both free and paid accounts in the UK and France. Compared with the free (‘Basic’) plan, we noticed paid plans have handy extras like expense management where you can capture payments on the move, bulk payments and the ability to give an accountant limited access.

We think the free plan is suitable for those with few transactions monthly, while paid plans are better value for companies and sole traders with multiple incoming and outgoing transactions a month in different currencies.

All account holders can have to 200 virtual cards, and 1-2 metal debit cards are included on paid plans (it’s not possible to get one without an account subscription). The plastic card I received in the UK looks pretty with its minimalist, white and glittery surface.

The paid business plans have identical features, but with the varying limitations shown in the following table.

| Basic | Grow | Scale | |

|---|---|---|---|

| Users allowed |

Unlimited | Unlimited | Unlimited |

| Cards included |

Up to 3 plastic cards /user 200 virtual cards /user No metal card |

Up to 3 plastic cards /user 200 virtual cards /user 1 metal card |

Up to 3 plastic cards /user 200 virtual cards /user 2 metal cards |

| Free UK transfers |

5 | 100 | 1000 |

| Free international transfers* |

0 | 5 | 25 |

| Free currency conversion |

£1,000 | £10k | £50k |

*A hidden transfer fee may be applied before reaching the Revolut account.

See our interview: Revolut enters business payments – where is it headed?

| Revolut Business fees | ||

|---|---|---|

| Monthly cost | Basic: £0 Grow: £19 Scale: £79 Enterprise: Custom |

|

| UK transfers beyond free quota |

20p per transfer | |

| International transfers beyond free quota* | £5 per transfer | |

| Transfers to or from another Revolut account | Free | |

| Currency conversion fee beyond free quota |

From 0.6% markup on FX rate | |

| Cash withdrawal rate | 2% | |

| Online payment acceptance | Consumer UK cards, bank transfers, Revolut Pay: 1% + 20p Other cards: 2.8% + 20p |

|

*A hidden transfer fee may apply before reaching the Revolut account.

Revolut for Business accounts differ from many competitors by the absence of conversion fees – up to a limit – on the paid plans. In case of withdrawing or transferring in a currency other than pounds sterling, only the interbank exchange rate (FX) applies. Revolut does not take any additional commission on the currency conversion within the limits determined by the chosen plan. Beyond the limits of your chosen plan, a conversion fee of 0.6% applies to each transaction involving currency conversion.

There are no limits to the number or size of transfers you can receive, but if you receive more than £250k per day, Revolut may contact you to perform some security checks.

When you just open the account, you get the option to credit the Revolut account with a credit card in your name. After this initial transfer, credit card deposits will no longer be an option – only Faster Payments (UK), SEPA and SWIFT deposits will.

To top up your account using PayPal, you must register the RIB of your Revolut account and make a SEPA transfer. It takes about two days for such a payout to process.

Different Revolut accounts can also send each other money instantly free of charge, whether from a Personal Revolut account or Business Revolut account.

Alternatively, you can fund the account by having a customer make a first SEPA or SWIFT transfer.

Online payment options

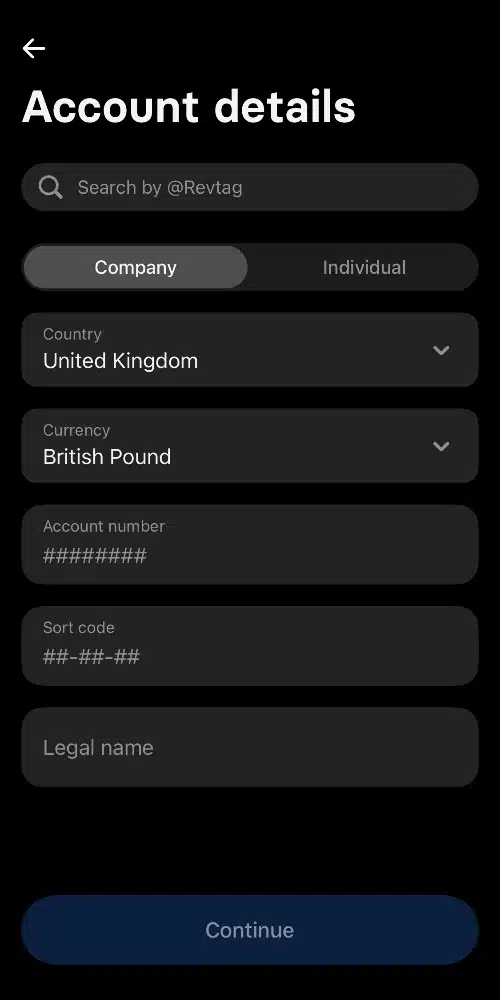

No matter which Revolut Business plan you’re on, you can set up online card acceptance for free through some additional application steps in your account. The features include:

Online payment gateway: Add a Revolut online checkout through an easy plugin in your Magento, PrestaShop or WooCommerce online store. Alternatively, web developers can build their own checkout flow with the Revolut Merchant API and integrate it on other platforms.

Revolut online checkout page.

Payment requests: If you don’t have a website, you can create a payment link or QR code from the Revolut app to request a payment from a customer. Links can be sent via email or text, whereas QR codes are displayed on your phone for the customer to scan with their phone in person. While creating the link, you can choose the currency, amount and description.

Online transactions are paid directly into your Revolut account the following working day. You can accept 25+ different currencies, settling either in the same currency as the payment or in a select currency at the interbank rate to save on foreign exchange fees.

Online transactions cost only 1% + 20p for consumer cards issued in the UK, “easy bank transfers” (quick to submit for payers) or Revolut Pay. All other card transactions cost 2.8% + 20p.

It is possible to accept cards in person with either the new Revolut Tap to Pay on iPhone feature or the chip and contactless card reader that connects with the Business app. These also require an approved Merchant Account.

Recently, a Revolut POS system for iPad was also launched. This is mainly geared towards coffee shops, not retailers, but it works perfectly with the card reader.

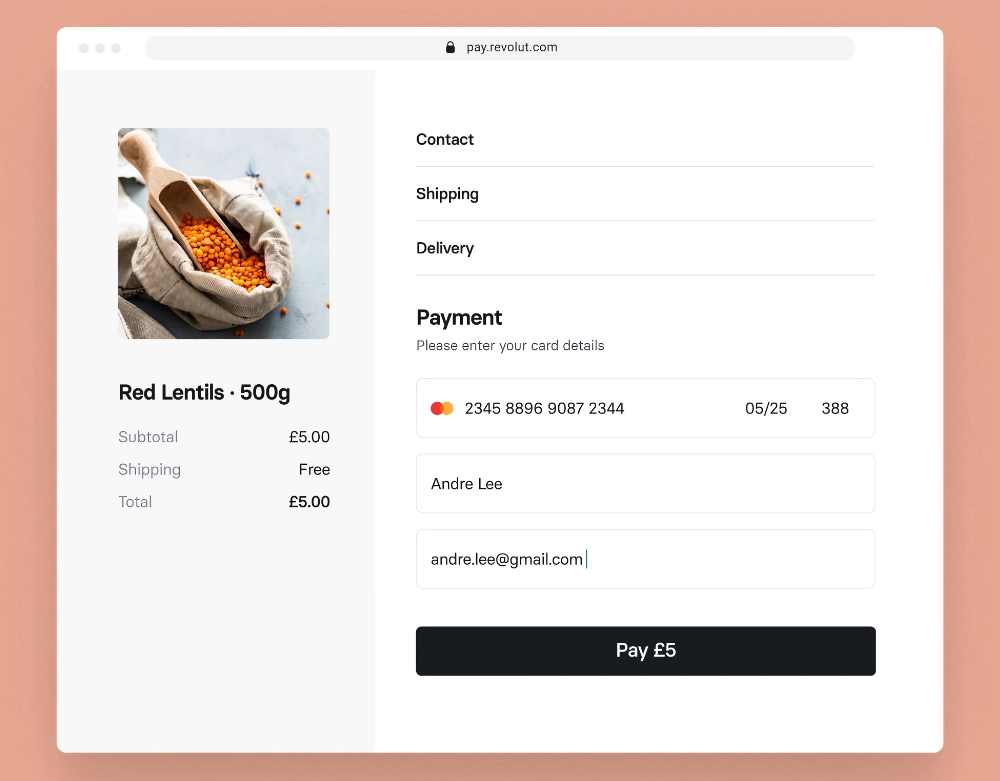

Getting started

Signing up is done entirely online. It takes 10-15 minutes to fill in the sign-up pages and complete the verification steps for Revolut Business (longer if you can’t find your proof of ID). First, you provide an email address to receive a confirmation code for signing up.

Then come the verification steps, including giving general information about your business.

Simply submit the required information about your business and take a picture of your identity document (passport, driver’s licence or other photo ID), then finalise the application. You receive an email saying it may take up to a week to approve the application, but we actually got approved the day after.

Signing up requires email and identify verification, but it is a simple procedure with step-by-step guidance.

Once opened, you’re encouraged to transfer money to the new account so subscription fees can be deducted from it (if applicable). It wasn’t possible for us to transfer less than £10 into the new account by debit card.

To order a prepaid Mastercard, pick between free shipping taking up to nine working days, or £19.99 express delivery taking up to two working days – in which case you need £19.99 in the new account.

Every time you log into your Revolut account, a number code is sent to your email address, ensuring only the approved user can access it. Clicking on that code logs you into the account which opens up in a new tab.

Revolut Business is without contractual commitment, but two weeks’ notice is required to properly close the account.

Our experience of Revolut for Business

We performed our own tests of Revolut by opening two separate freelancer accounts, one in the UK and another in France.

In both cases, opening the account took less than 24 hours, which is a significant improvement if we are to believe the complaints in user reviews of this neobank.

We tested the account’s funding by debit card (UK), credit card (French) and PayPal. The transactions by credit and debit card were received immediately, but PayPal’s took less than 24 hours, similar to an incoming SEPA credit transfer.

The prepaid Mastercard was supposed to arrive after two weeks, but we were pleasantly surprised to receive it after three days. In the meantime, we had already been able to make online purchases using the virtual card on the same day the account was opened.

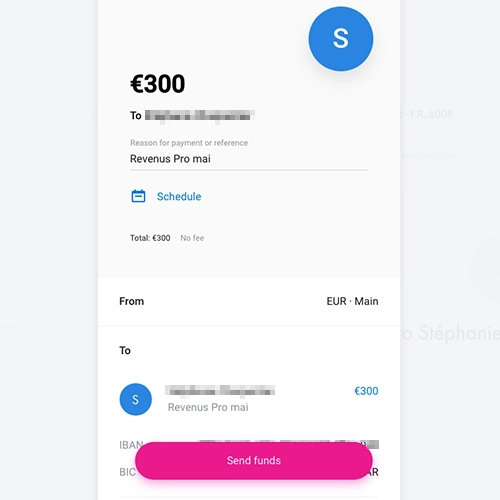

Image: SG, MobileTransaction

Example of a free international transfer.

We were also curious whether the lack of transfer fees – one of Revolut’s big selling points – was real.

Indeed, there were no transaction fees for a SEPA transfer received in the Eurozone. This may of course vary depending on the issuing bank, but from our tests in France, that promise was kept.

But when we performed an incoming SWIFT transfer from outside Europe to a UK Revolut account, both from GBP to GBP currency and euro to GBP currency, exactly £15 was deducted before reaching the Revolut account.

We know this fee was deducted in the UK, but Revolut did not include it in the total – they only included the £3 Transfer Fee they advertise online. So in total, we were charged £18 for each international SWIFT transfer to GBP.

We contacted Revolut to ask about this, and they replied: “sometimes there are fees, which are applied by the intermediary banks”. They refused to refund the £15 as it was not applied by them, despite us pointing out that Revolut does not mention the existence of such an extra fee on their website.

You should be careful when communicating bank details to your debtors so you don’t leave out the BIC code when necessary, for transactions outside SEPA.

Another drawback: Revolut for Business is in principle a multi-currency account. When activated, it first offers three accounts: in GBP, EURO and USD. To benefit from the promised multi-currency account, you must go through an additional verification step and make the request via the chat. After our request in France, our multi-currency account was activated that day.

It’s regrettable that this procedure is not clearly explained at the time of account creation and in the FAQs. We had to browse the Revolut user forum to discover this step-by-step activation.

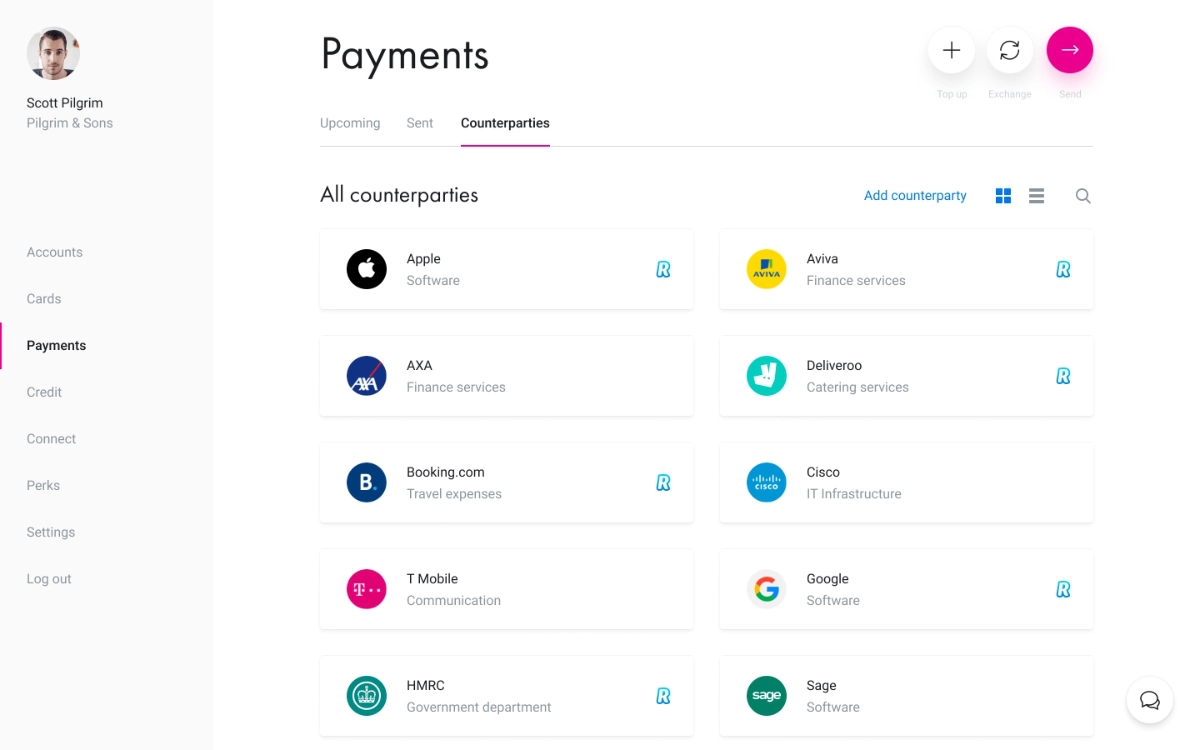

Save all your payees in the ‘counterparties’ section.

The lack of clarity in customer communication is also not great. While generally reactive during the day, customer service is only available via chat. And during our many attempts to resolve issues around the card reader and account verification, we often got a response just only said they are still working on it, rather than an actual resolution.

It may be necessary to use the dedicated forum to solve your problems on the free plans, but any of the paid plans include 24/7 support when you need to reach a member of the Revolut team to fix something more urgently.

Our verdict

This business account is particularly valuable for small businesses with employees abroad or that regularly carry out transactions within SEPA, whether that be payments, direct debits, outgoing or incoming transfers.

It is not the cheapest business account for international SWIFT transfers to the UK, as we found out with the hidden fee that wasn’t even shown in the Revolut account. You have to compare the amount sent by the payer with the amount received in Revolut to discover all the fees. Revolut is not transparent about this on their website.

| Revolut Business criteria | Rating | Conclusion |

|---|---|---|

| Product | 4.1 | Good |

| Costs and fees | 4 | Good |

| Transparency and sign-up | 4.4 | Good/Excellent |

| Value-added services | 4.8 | Excellent |

| Service and reviews | 3.7 | Passable/Good |

| Contract | 4.2 | Good |

| OVERALL SCORE | 4.2 | Good |

Revolut has recently made many changes to their offering, including payment requests and online payments. This could attract more freelancers and businesses looking for a cheaper solution for online payments than PayPal, or indeed anyone selling remotely.

Sole traders will indeed find the account interesting, especially as it is very simple to switch from the free to paid plans when it looks like you will receive more transfers than included on the free plan.

The no-fuss interface and speedy transactions are clear draws for freelancers.

The business account is really ideal for entrepreneurs and sole traders who depend on UK transfers – the no-fuss interface and speedy transactions are clear draws. Just keep an eye on the fees applied to international transfers.

The absence of an authorised overdraft is limiting and requires regular verification of the balance, which can be prohibitive for a company using several bank cards. Some companies will also not like that you cannot apply for credit from Revolut.

Those negatives should eventually be resolved as Revolut plans to have an overdraft and credit option for the Business accounts. Revolut is constantly evolving, regularly promising new features that are sometimes slow to arrive.