- Pros: Choice of card machines. Same-day settlement available. Online payment methods.

- Cons: Pushy sales reps. Lack of pricing transparency. Contract lock-in with exit fees. Poor reviews and support. Standard payouts slow. Limited POS integrations.

- Choose if: You’re a small business wanting an Elavon merchant account, but couldn’t get one directly from Elavon.

Overview

In brief

What is it?

Our opinion

In detail

Card machines

Fees and contract

Remote payments

Service and reviews

What is Retail Merchant Services?

Retail Merchant Services (RMS) is an independent sales organisation based in the UK. The company offers merchant accounts from Elavon and Global Payments (in fewer cases) and card machines for small- and medium-sized businesses.

The card processing contract is handled by Elavon, whereas RMS acts as the middleman employing sales reps to set you up with a card payment package. There is also a range of online payment solutions and phone payments to sign up for.

Despite the name, Retail Merchant Services also serves hospitality businesses, not just retailers. The company was acquired by Teya in 2022 in an effort to expand its reach in the UK and Ireland.

Our opinion: nothing special

Even inferior card machine providers usually have some competitive advantage – but we struggle to find a compelling reason for anyone to go for Retail Merchant Services.

Let’s start with the positives: RMS has a good range of great card machines, reliable merchant accounts, same-day settlement and decent online payments. But you can get the same card machines, stable merchant accounts and better online payments elsewhere.

What’s more, same-day payouts are costly, and standard payouts take up to a week.

| RMS criteria | Rating | Conclusion |

|---|---|---|

| Product | 4 | Good |

| Costs and fees | 3.2 | Passable |

| Transparency and sign-up | 2.3 | Bad/Passable |

| Value-added services | 3.5 | Passable/Good |

| Service and reviews | 3 | Passable |

| Contract | 2.3 | Bad/Passable |

| OVERALL SCORE | 3.2 | Passable |

Moreover, RMS only offers full integration with Epos Now and partial integrations with other POS systems. So RMS may not work for you if you want another POS system.

Where RMS truly stands out are the Elavon merchant accounts for low-volume businesses. Elavon caters directly to medium and large businesses and may reject a small business trying to apply for their card machine contracts.

In contrast, RMS is eager to sell you an Elavon contract with fees appropriate to a smaller sales volume – except, there’s no actual proof that RMS fees are better than any other card machine providers.

RMS sales reps are notoriously pushy and dishonest about fees and contract, so merchants should not sign up before seeing the full contract and fees from all parties involved.

Card machines: unchanged for the last 4+ years

Compared with other payment service providers, RMS has a wide range of card machines, but they haven’t updated their selection for years. This means most of them are traditional, push-button models rather than touchscreen smart POS terminals like PAX.

An RMS card machine is either an Ingenico or Verifone model, both specialists in manufacturing the high-quality, traditional card terminals you’ve seen in most shops. They’re grouped into these types:

Mobile: Wireless and works with a mobile network or WiFi anywhere. Includes built-in SIM card, so it’s suitable for on-the-go merchants.

Portable: Wireless and works with WiFi within 100m of base unit. Suitable for table-service, queue-busting and event spaces.

A popular RMS card machine for tills is Ingenico iCT250.

Countertop: Requires power cable and broadband or telephone line (most reliable connection). Suitable for a stationary till setup.

Smart: Wireless and works with WiFi, GPRS or Bluetooth anywhere. Has a colour touchscreen with access to downloadable app features. Suitable for portable use on premises or on the go.

“We haven’t had issues with the card machines offered by RMS. Some people like the physical push-buttons, as it’s better for accessibility. But it would’ve been nice to see more modern payment terminals.”

– Emily Sorensen, Senior Editor, Mobile Transaction

The latest addition to RMS’s selection of card machines is Verifone V240m, the featured ‘Smart’ terminal. It’s the most reliable for a mobile connection, detects issues before they become a problem, and you can download apps on its colourful touchscreen to add features related to customer loyalty and payment methods.

RMS’s only smart terminal is a Verifone V240m model.

If you want to use a card machine with a point of sale (POS) system, RMS partners with – and therefore recommends – Epos Now. If you already have a preferred POS system, you may be able to go for a “semi-integrated solution”. To know more, you’ll have to contact the sales team.

Retail Merchant Service fees and contract

Retail Merchant Services is notorious for hiding fees upfront, so the following are indications based on what the company told us and what users have reported.

We were offered a choice between two card machine contracts:

- Pay as you go: No contractual commitment. Card machine is purchased upfront (we were told £299.95 for a mobile model). Pay-as-you-go transaction charges. Misc. other fees apply, possibly a merchant account contract with lock-in.

- 18-month contract: With lock-in, auto-renewal and early cancellation fee. Monthly cost for terminal rental (we were quoted £9.95/month for a mobile model). Transaction fees and other misc. charges apply.

To know all the fees, you’ll need to ask RMS directly for a quote based on your monthly sales volume, type of business and product requirements.

These are some of the main fees applicable to RMS contracts:

| Retail Merchant Services | Pricing |

|---|---|

| Contract length | 0-18 months |

| Monthly terminal rental cost | £9.95+/month |

| Monthly minimum charge | £30+/month |

| Merchant account | Various fees apply |

| Transaction rates | Dependant on business, card type and turnover |

| Early termination fee | Equivalent to buying out remaining contract |

18-month contracts are offered as standard (it used to be up to 48 months!), but we’ve seen pay-as-you-go contracts too. In any case, they need to be cancelled within a specific timeframe to avoid auto-renewal. Hefty cancellation fees apply for exiting a longer contract early.

We’ve seen very different transaction fees quoted, none of which explain exactly which cards they apply to. We were quoted 0.4% for “debit cards” and 0.95% for “credit cards”, but such low fees typically only apply to domestic Mastercard and Visa cards, whereas premium, business and foreign-issued cards have higher fees. Other quoted charges range between 2.65%-3.75% + 19p depending on the type of card being used.

An Elavon merchant agreement should include American Express acceptance. If you go for a Global Payments merchant account, you’ll need to set up Amex acceptance directly with Amex at an additional cost.

“While some of the quoted transaction fees appear low, RMS reportedly always adds fees on top – and in the end, RMS is actually pricier than the competition.”

– Emily Sorensen, Senior Editor, Mobile Transaction

A monthly minimum service charge typically applies for months you make less than an agreed amount in card payments. Some users have said there are separate monthly minimum service charges from RMS and Elavon. RMS may only mention its own, so do ask the sales rep about this outright.

You can expect monthly and annual fees for the merchant account, PCI-DSS compliance costs, terminal replacement or setup fees, chargeback fees, admin fee, paper statement fee, currency exchange, and more. Separate charges also apply to online payments and EPOS integration.

Standard settlement takes up to 7 days to process to your bank account, but same- or next-day settlement is available for an additional fee (£3+ per same-day payout).

The variety of costs makes it important to ask for full disclosure of all fees from all parties involved, including RMS, the merchant account provider (most likely Elavon, maybe American Express), and the card machine provider (Verifone or Ingenico). All these parties have separate costs which RMS does not want to disclose upfront unless pressured to do so.

You should ask for a description of transaction charges, cards they refer to and the full contract to read in your own time before signing up.

Remote and online payments: okay range

While some payment service providers are slow at adapting to merchant demands, RMS has done a decent job of keeping up with the trend to buy online.

Not only does the company offer payment links, telephone payments and an online payment gateway, there’s also an online ordering page for food and drink businesses. These features are part of an all-in-one Online Payments platform designed to manage all sales channels from one account.

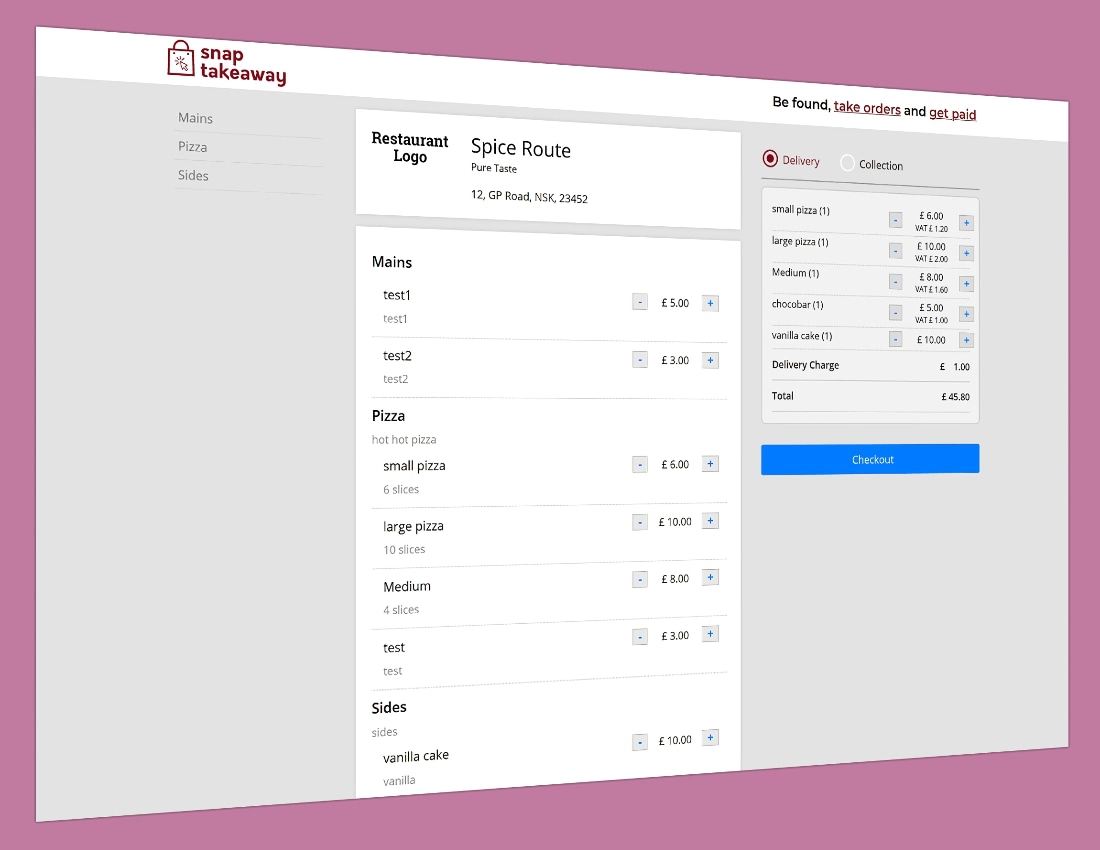

A basic online ordering page can be created through RMS.

Available tools include:

Pay by link: Unique payment links for one-off or recurring payments. Ideal for email invoices and remote payments over text message, WhatsApp or email.

Online payment gateway: Online checkout connected to your online store. Compatible with 20+ checkout plugins on various ecommerce platforms. Choice of fully hosted checkouts with a fixed design or a custom integration with full control over design and checkout flow.

Virtual terminal: Web page where merchants can enter card details to process mail order and telephone order (MOTO) payments.

Online ordering page: Web page with menu of products to order for click-and-collect, delivery, takeaway or touch-free table-side ordering (via QR code).

The online payment system can accept 140+ currencies and mobile wallets like Alipay, Apple Pay, Google Pay, WePay and Masterpass by Mastercard. The option for recurring payments is ideal for subscriptions, donations and membership fees.

With ‘Next Day Settlement’ switched on, transactions through the online payment gateway reach your bank account the following working day.

Most complaints relate to hidden fees, underhanded sales tactics, inadequate customer support and how slow it is to fix a terminal problem.

On TrustPilot and Google, there are many positive reviews, but the amount of negative reviews are more than competing companies, and complaints talk about the same kind of issues. RMS sales reps are also pushed hard to get new customers at all costs, according to ex-employees. For these reasons, we are wary about recommending this company as a trusted service.

We recommend pushing for a copy of all costs and terms upfront on the phone before agreeing to anything – if they’re not giving it to you, then that’s a red flag.

When I contacted the company about costs and available contracts, as soon as I asked for all of the fees and terms via email (I was initially given a few suspiciously low costs), they stopped responding. We recommend pushing for a copy of all costs and terms upfront on the phone before agreeing to anything – if they’re not giving it to you, then that’s a red flag.