How can businesses set up and accept recurring payments from customers?

Recurring payment solutions save time and money, as payers are debited automatically without the business or customer having to do anything.

Depending on the chosen solution, payments can be made via:

- Account-to-account payments (using bank account details)

- Credit or debit cards (using the long card number)

There are other criteria to take into account when choosing a solution:

- Transaction costs and whether or not a subscription is required

- Recurring payment types available, e.g. Direct Debit, debit card subscription

- Integrations and compatibility with invoices, accounting, ecommerce, etc.

To help you choose, let’s compare the best subscription payment services in the UK:

| Provider | Payment type |

Sign-up channels |

Fees |

|---|---|---|---|

| 1. GoCardless | Bank debit |

|

|

| 2. Square | Card |

|

|

| 3. Stripe | Card, bank debit |

|

|

| 4. PayPal | Card |

|

|

| 5. Chargebee | Card, bank debit |

|

|

| 6. Tide | Bank debit |

|

|

The best approach is to find a solution that supports your setup for recurring payments. Consider how your customers sign up and pay: via a link, button, email invoice, ecommerce store or another channel?

The above are multi-purpose payment processors or e-money platforms that also handle subscription payments.

Many others specialise in billing management, for example Checkout.com, Rcur, Mollie and Zuora. We chose not to include them in this comparison since they are either too complex for individual entrepreneurs or don’t focus on the UK market.

Related: What is a recurring payment?

1. GoCardless – Direct Debit specialist

GoCardless is perhaps the best-known British company specialising in account-to-account payments. The platform simplifies Direct Debit mandates by removing administrative constraints and setup hurdles compared with other solutions.

While you can manually send payment links to customers, GoCardless stands out for its easy integration with many apps and software for invoicing, accounting, subscription management, etc. This allows you to easily add recurring payments to your favourite platform.

| Solution | GoCardless |

|---|---|

| Logo |  |

| Recurring payment types |

|

| Channels |

|

| External integrations |

|

| Payouts | 5-6 working days to your bank account |

| Link |

GoCardless handles Direct Debits in the UK and SEPA transfers in the Eurozone, but also bank debits from outside Europe, thanks to a partnership with Wise who also takes care of currency exchange for an advantageous rate.

Bank-to-bank payments do not use card networks like Visa and Mastercard, so merchants avoid card transactions fees and instead pay lower bank fees. On the other hand, it does take about a week to receive payments in your bank account.

| UK Direct Debits | Standard features: 1% + £0.20 Advanced features: 1.25% + £0.20 Pro features: 1.4% + £0.20 +0.3% for amounts over £2,000 Max. fee: £4-£5.60 (depending on plan) |

| International bank debits | Standard features: 2% + £0.20 Advanced features: 2.25% + £0.20 Pro features: 2.4% + £0.20 |

| Monthly subscription | Your business name on bank statements: £50/mo Custom checkout and payer notifications: £150/mo |

*All fees exclude VAT, which GoCardless will add.

The paid Plus subscription allows you to have your company name on credit card statements instead of GoCardless, and to add your logo and colour. The Pro subscription allows further customisations to the payment page and emails.

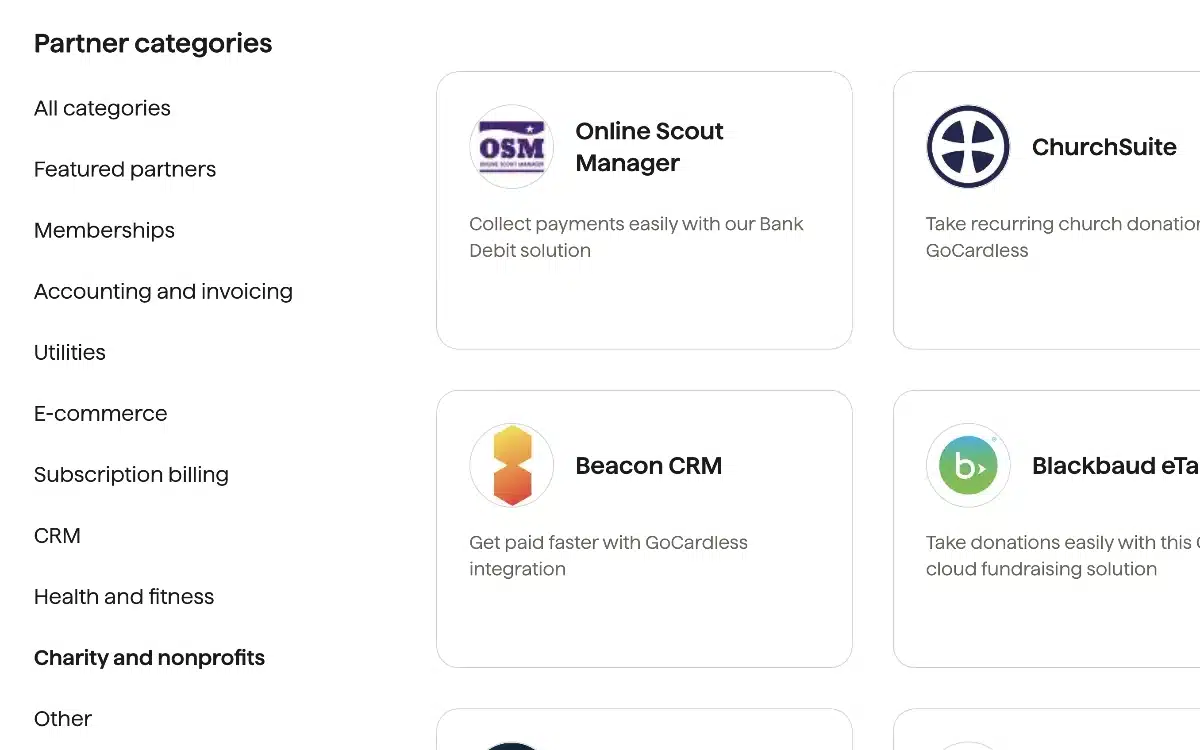

Image: MobileTransaction

Example of the 350+ apps compatible with GoCardless.

Over 350 apps and software partners integrate with GoCardless in the UK, from general business tools to specialised platforms for e.g. gyms and charities.

Bottom line: Thanks to its many integrations (that do not require programming knowledge), GoCardless makes bank debits accessible at a fair price point for small businesses.

Pros

Cons

2. Square – simple invoices with card billing

Square is an all-round payments solution, offering merchants both in-person and remote payment methods. You can choose to use card machines, a virtual terminal (over-the-phone transactions), point of sale software, payment links, an online store or email invoicing software.

The Square Invoices module allows you to create recurring payments. On the invoice, customers can click to a web page where they enter card details to set up recurring payments from the debit or credit card. Direct Debit is not possible with this system.

There is also a standalone Subscriptions section in the Square web portal, where you can create plans and send links to customers for subscribing online.

As the payment is made by card, there is no geographical limitation. All Visa, Mastercard and American Express cards are accepted at the same rate via invoices: 2.5%. Payment links have separate fees for domestic cards (1.4% + 25p) and non-UK cards (2.5% + 25p).

| Card transactions | Invoices: 2.5% Payment links: 1.4% + 25p–2.5% + 25p |

| Monthly subscription | Invoices Free: £0 Invoices Plus: £20 |

Square’s invoicing software comes as a free or paid plan – recurring payments are available with both. The paid version also offers automatic conversion of quotes into invoices, creation of templates, personalised invoices, etc. If you don’t want to send invoices, the payment links have no monthly fee.

The platform integrates with many external apps, though not as flexibly as GoCardless. You can, however, expand the Square subscriptions with more complex subscription features from the likes of Billforward and Churn Buster.

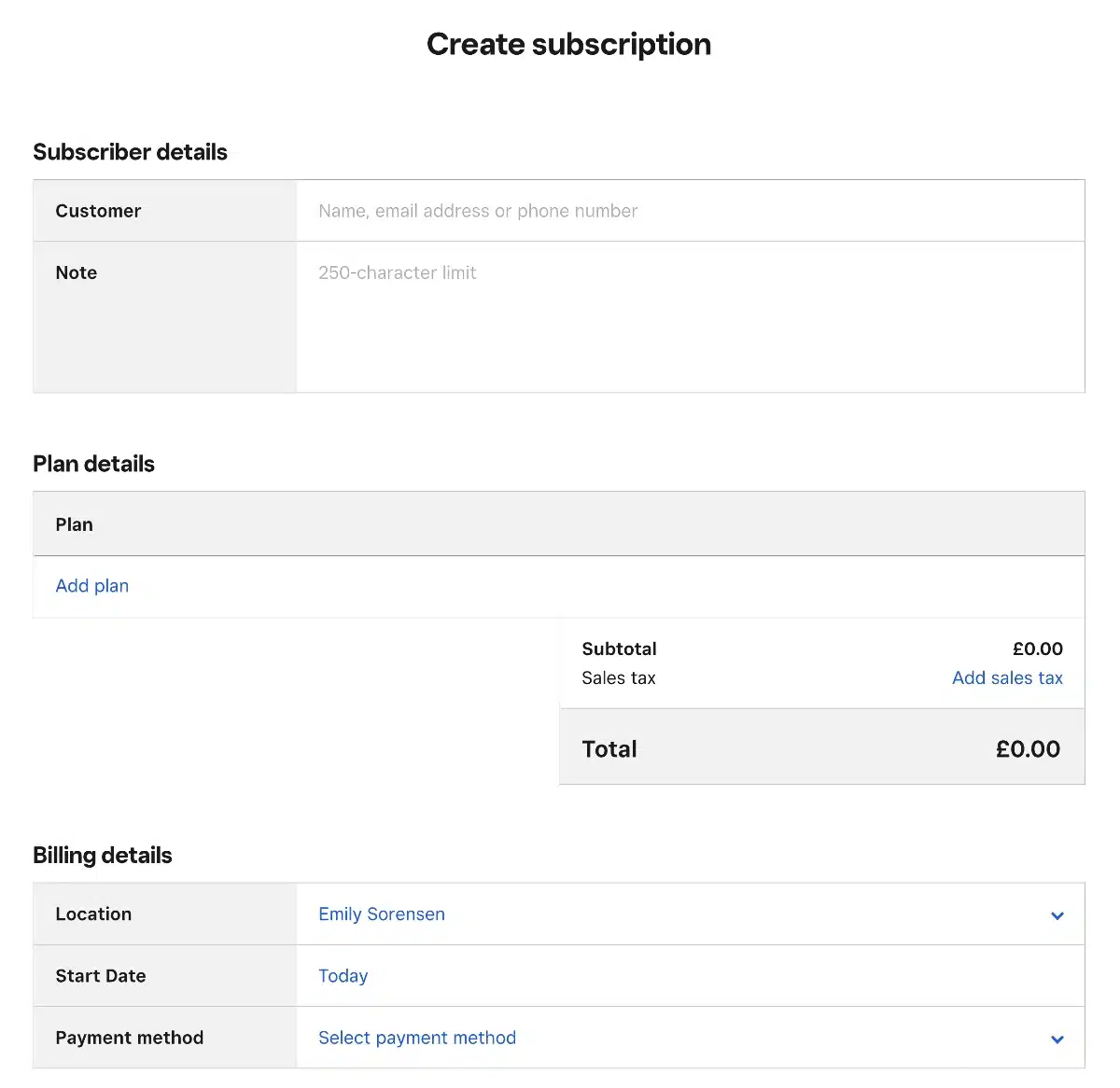

Image: MobileTransaction

After defining your subscription plans, you can add customers to these subscriptions.

Bottom line: Recurring payments are very easy to set up with Square. Transaction fees are higher, but the payment tools are free.

Pros

Cons

3. Stripe – pretty versatile

Stripe is a popular payment gateway for global card acceptance in online stores, even if it’s not the cheapest. The platform’s many features usually require more experienced users such as web developers.

That said, Stripe offers payment requests via links, invoices and recurring payments without coding. It also integrates easily with online stores.

Stripe is known for its ability to accept a large number of payment methods. This includes Bacs Direct Debit, domestic and international debit and credit cards, SEPA and other international payments.

| Solution | Stripe |

|---|---|

| Logo |  |

| Recurring payment types |

|

| Channels |

|

| External integrations |

|

| Payouts | About a week to your bank account |

| Link |

Stripe includes several modules such as Payments (payment acceptance), Invoicing (via email), Billing (recurring payments) and Payment Links. You can create a recurring payment from a link, invoice or compatible online store.

The recurring payment management tool has a 0.7% commission fee per transaction on the “Pay as you go” plan, plus the cost of online payments. It includes useful features like smart reminders and bank reconciliation.

| Visa, Mastercard, Amex | UK standard cards: 1.5% + 20p UK premium cards: 1.9% + 20p EEA cards: 2.5% + 20p International cards: 3.25% + 20p + 2% currency exchange |

| Recurring payments | Bacs Direct Debit: 1% (Min. 20p, £4 cap) 0.7% additional billing fee (Pay as you go) |

| Monthly subscription | None |

Bacs Direct Debits are much cheaper than card transactions, costing just 1% per bank debit. This is especially noticeable with service providers like Stripe, which offer both payment options.

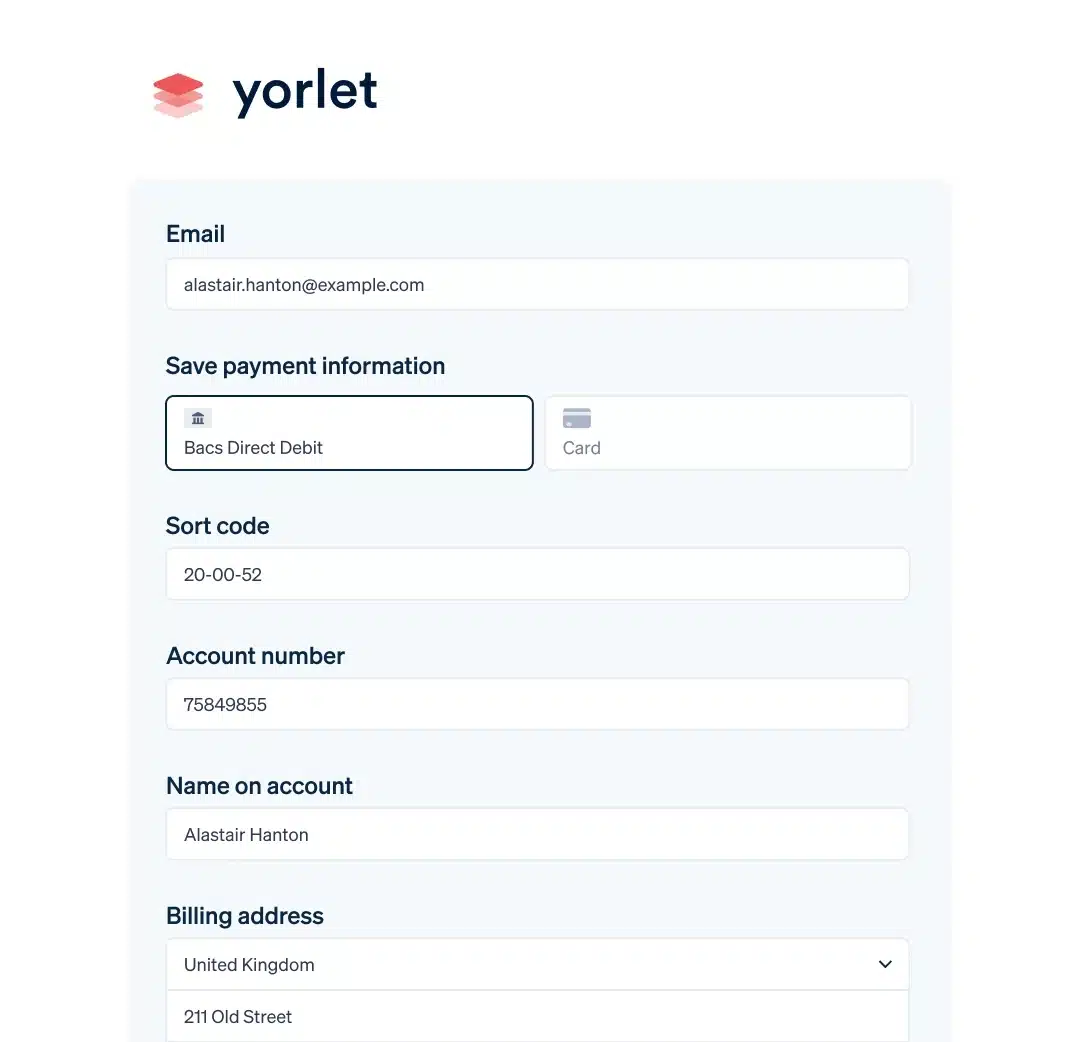

Image: Stripe

Stripe lets you customise your online payment page.

Bottom line: Stripe is a good solution if you sell subscriptions to people in different countries and want to offer several payment options.

Pros

Cons

4. PayPal – subscriptions via website button

PayPal is a popular platform for both one-time and recurring card payments.

Although the PayPal Business account connects with the merchant’s bank account, any payments are received directly in the online account. That said, your customers are able to use their bank account for recurring payments.

For non-programmers, you have to go to the subscriptions section of the PayPal dashboard. This takes you through a series of screens resulting in the generation of JavaScript code to copy and paste on your website to make a payment button appear.

The personalisation of subscriptions is very advanced. There’s a choice between four types of pricing: fixed or decreasing, depending on volume, frequency, and the level of pricing chosen.

The customer can pay with their PayPal account or enter a credit/debit card number.

If you want to add PayPal subscriptions to your ecommerce site, but don’t know how to implement the code, you can use Lyra’s PayZen solution.

| Transactions | Domestic: 2.9% + 30p Additional fee for EEA cards: 1.29% Additional fee for other global cards: 1.99% Currency conversion fee: 3% |

| Monthly subscription | £20/mo |

One of the attractions of PayPal is to accept payments in myriads of currencies. Just beware: cross-border payments incur an added transaction fee of 1.29% or 1.99% depending on the card’s country of issue + 3% for currency conversion.

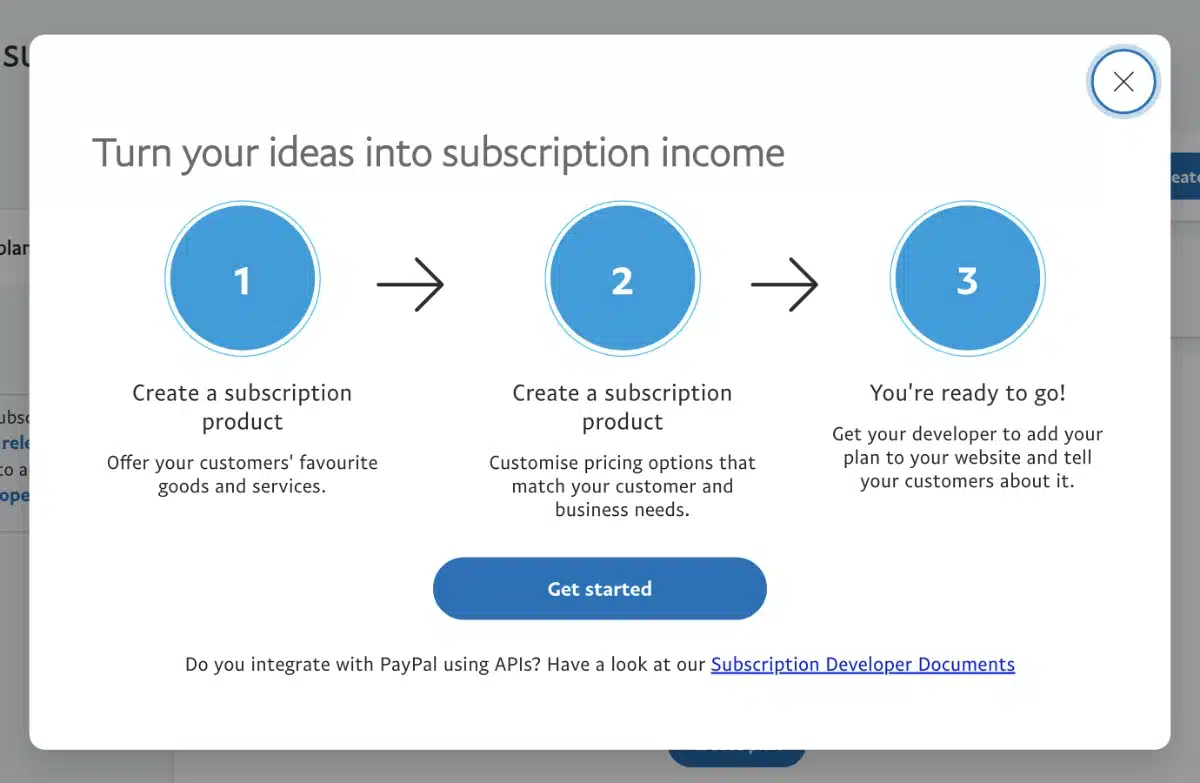

Image: MobileTransaction

PayPal’s instructions for creating a subscription in the business dashboard.

Bottom line: PayPal is an effective solution for adding recurring payments to any site – but it’s expensive.

Pros

Cons

5. Chargebee – specialised billing management software

Recurring billing software Chargebee is quite established in the UK and used by big companies like Pret A Manger, Typeform and Toyota. It allows you to tailor subscriptions, optimise your own invoicing system and create payment flows specific to your website.

Small businesses can sign up for the pay-as-you-go Starter plan, which has no monthly fee. The first £200,000 of cumulative billing raised through invoicing has no fees, but you pay 0.75% for the billed amounts on top of payment processing fees.

| Solution | Chargebee |

|---|---|

| Logo |  |

| Recurring payment types |

|

| Channels |

|

| External integrations |

|

| Payouts | Depends on chosen payment gateway |

| Link |

A big draw is the custom lifecycle management system helping you to onboard new customers, manage changes to subscriptions and streamline cancellations. Chargebee also offers an automated invoicing system specifically for recurring payments, as opposed to one-off bills.

Linking the account with a payment system like Stripe (or its many other integrations) allows you to add more tools. For example, sending a payment link might be easier through Stripe than Chargebee.

| Transactions | Fees depend on chosen payment processor/method |

| Monthly subscription | Starter: £0 (£200k billing free, then 0.75% per transaction) Performance: £499 + VAT/mo (£80k billing/mo free, then 0.75% per transaction) |

Although features are extensive, Chargebee is not easy to use. It has many analytics tools and software integrations (which may need tech skills), but these are not necessarily useful for a very small business.

Since Chargebee does not directly process payments, it’s completely up to your chosen payment provider which methods are accepted. With GoCardless, for example, Direct Debits are possible, whereas Worldpay accepts cards.

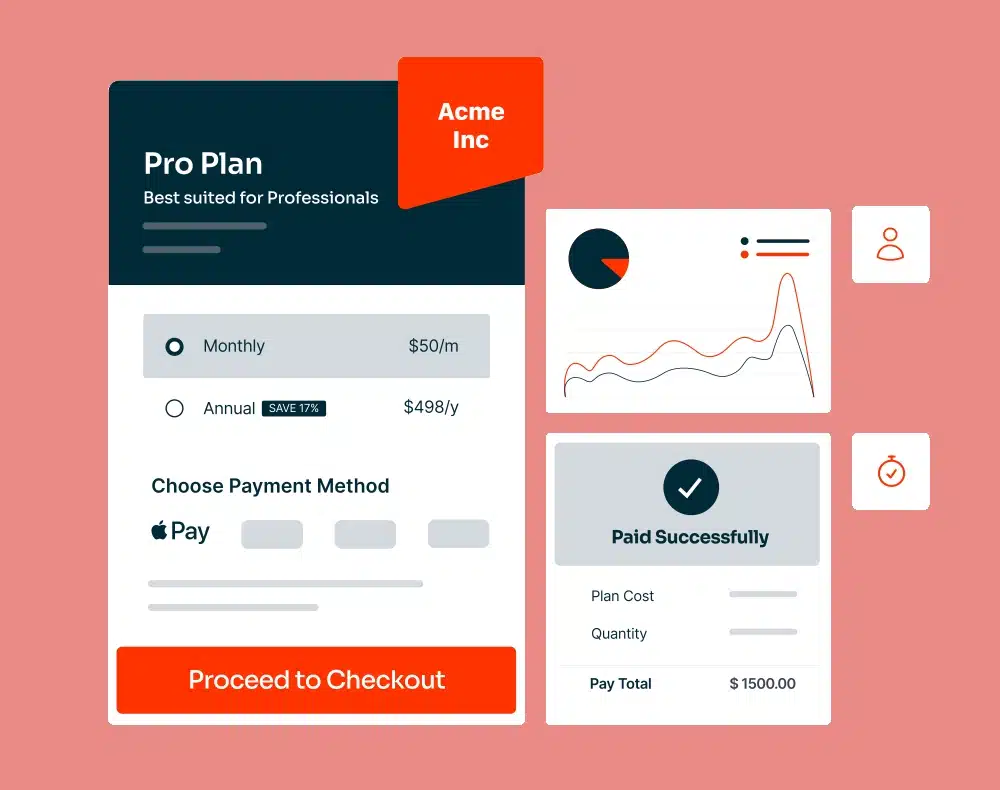

Chargebee lets you customise the checkout process and subscription flow.

Bottom line: Chargebee is a specialised recurrent billing platform with lots of customisations, but it may not be the simplest for a small business.

Pros

Cons

6. Tide – business account with Direct Debit invoicing

Tide Business account holders have invoicing features in the free banking app or browser dashboard. You just need to sign up for a Tide business bank account online and select one of the free or paid plans.

With the £10 + VAT/month Invoice Assistant add-on, you can accept Direct Debits through invoices. This requires a GoCardless account connected with Tide, as GoCardless processes the bank debits, not Tide.

Since Tide is primarily a business account, the billing customisations in the app are rather simple. But you can manage Direct Debits, including payment amounts and dates, directly in your GoCardless account.

| Direct Debits via GoCardless | 1% + 20p (£4 cap) 0.1% added to amounts over £2,000 |

| Monthly subscription | Business account plans: £0-£49.99 + VAT Invoice Assistant: £10 + VAT |

Bottom line: Tide is one of the easiest ways to accept Direct Debits in your business account, but it does require a monthly fee.

Pros

Cons

Our take: solutions likely to evolve quickly

Several viable solutions can help small-business entrepreneurs set up recurring payments via:

- Payment links and pay buttons

- Electronic invoices

- Online shops

The offering is not easy to understand, though. We can loosely define two types of companies in the billing sector:

- Payment gateways processing payments, embedded in different software like invoicing apps and ecommerce sites.

- Subscription or invoice management systems used by merchants and connected with a payment gateway.

In reality, it’s more complicated.

Gateway providers often offer interfaces that can be used directly by humans, for example GoCardless and Stripe with their payment links, or Stripe and PayPal with their invoices. This does not prevent them from connecting with solutions of the second type, like Tide’s or Chargebee’s automated invoicing systems.

We’ve seen rapid developments in billing systems in the UK, with bank debits rising in popularity among small businesses. Recurring card payments are also easier to set up now (think Square or even Squarespace) than 10 years ago, but cost more.

Undoubtedly, we’ll add more solutions to this comparison as they become accessible and affordable.