Businesses in Ireland have a choice of point of sale (POS) systems, but many are not straightforward, affordable or specific to the hospitality sector. For a restaurant, café or coffee shop, this can be a challenge.

Some of the best-known POS solutions worldwide are not available in Ireland, but thankfully several are. We have included five internationally-popular ones and one Ireland-only option on our list.

Most providers charge a monthly subscription and some have a minimum contract length. Others work on a “pay as you go” basis. Which is most suitable depends on your budget and business needs.

Let’s compare the best POS systems for restaurants, cafés, bars and pubs we can recommend specifically for Ireland:

A good POS system is relatively quick to set up, integrates with a range of software and hardware, and includes all the hospitality features you and your customers need. This could be table plans, split bills, kitchen monitor display, integrated payments and handheld terminals for tableside orders.

Here’s an overview of the type of hardware they work with and what businesses they would suit, in our opinion:

| POS | Hardware | Suited for | With payments? |

|---|---|---|---|

| Square for Restaurants | iPad, Square devices | Small to medium food-and-drink venues | Yes |

| Epos Now | iPad, Android, Epos Now devices | Any type of hospitality, small and large | Yes |

| Revolut POS | iPad | Cafés and similar small food and drink | Yes |

| SumUp Point of Sale | iPad | Bars, pubs, cafés and small venues | Yes |

| Postree | Windows devices | Small to medium food businesses | No |

| Loyverse | iPad, Android | Newly started, small food businesses | No |

Best for: From small cafés to multi-location restaurants

Pricing: From €0/mo

Compatibility: iOS, Android, Square terminals and kits

Pros: No commitment, many payment tools included, range of hardware, offline mode

Cons: Can only use Square card machines

Square offers a range of tools for business. Its main POS app has been popular with coffee shops and cafés in several countries for more than a decade. In addition, Square offers a specialised system, Square for Restaurants, for fast-paced cafés and restaurants with more complex needs.

The software is available on iOS and Android devices and works out-of-the box with Square’s card terminals. As well as ordering and payment capabilities, you get many additional online payment tools integrated with the front-facing POS system.

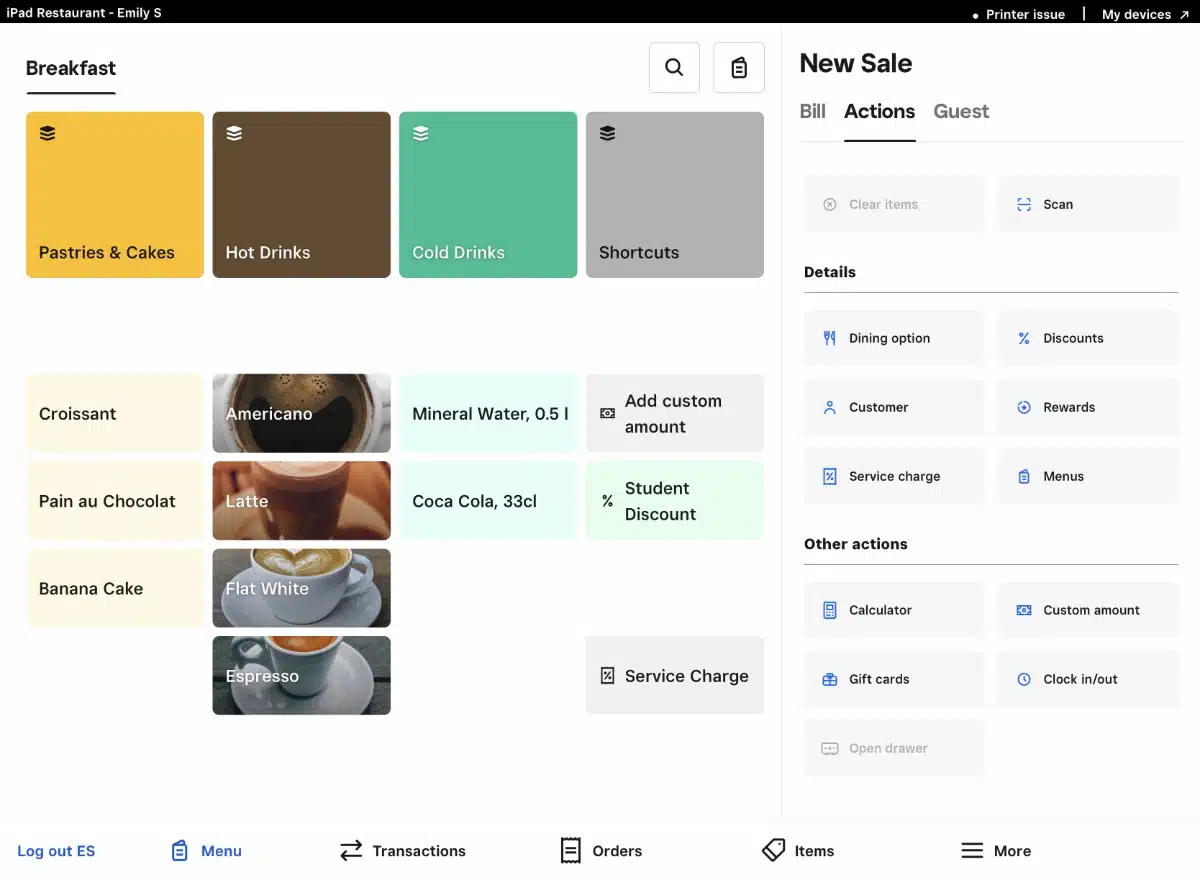

Photo: MobileTransaction

Although built for restaurants, Square for Restaurants can suit many cafés.

To sign up, you complete a simple online form and connect your bank account. Then you have several options. The Point of Sale app is suitable for hospitality businesses with simple inventory and customer ordering requirements, such as coffee shops. The Square for Restaurants Free plan has more hospitality features, and the Restaurants Plus plan has the full range of features.

The free Restaurants software is simple, but sufficient for a small restaurant where tills need to coordinate kitchen orders and table service.

You can use unlimited POS devices in as many locations as you like with the Free plan, and only pay Square’s card processing fees. This plan lacks some important features, though, like close-of-day reports, seat and course management, advanced employee management and a kitchen display system for both dine-in and online orders. These are all included on the Plus subscription for €69 + VAT per month.

When we tested this system, it took a bit of time to get a handle of it. The features surprised us, though: it is now among the top systems for hospitality in Ireland, with potential for massive time and cost savings.

The system connects with a click-and-collect ordering page and optional QR codes to print for table-side ordering (all included free). Square for Restaurants also integrates with many popular services like Deliverect for online food orders, the Opentable booking system, and Xero and FreshBooks accounting software.

Hardware-wise, there are a few options. Square Register is popular — an all-in-one touchscreen register with an attached card reader-and-display for the customer, costing €599 + VAT.

If you want to use an existing iPad as the checkout system, you could start with the card reader (€19 + VAT) or Square Stand (€119 + VAT) with a built-in card reader. The standalone Square Terminal with its own touchscreen display is also suited for table orders. An offline mode ensures you can accept cards in most circumstances.

| Costs | |

|---|---|

| Square Point of Sale app | Free |

| Square for Restaurants subscription | Free: €0/mo Plus: €69 + VAT/mo |

| Card transaction fee (chip, tap) | 1.75% + VAT (lower fees for high volume) |

While Square Terminal syncs with the system for tableside orders and payments, it has not got access to all the restaurant features available on iPad.

All chip and contactless card transactions cost 1.75% + VAT, including corporate and premium cards like American Express. If you make more than €100k per year, you qualify for reduced rates.

Transactions settle in your bank account within two working days (usually the next working day).

You get 24/7 customer phone support on the Restaurants Plus subscription, and 9am–5pm weekday phone support on all free plans. Live chat support is available on the website and in-app.

Payment integration: Square

Can you try before committing? Yes, a free trial is available

Best for: All types of hospitality, especially retail-hospitality combos, needing an adaptable solution with room to grow

Pricing: From €90 + VAT/mo including hardware

Compatibility: iPad, Android tablets, Epos Now touchscreen registers

Pros: Good-value hardware packages, very customisable, integrated payments

Cons: Costs can rack up, contract lock-in, service complaints

Founded in the UK over a decade ago, Epos Now offers POS systems to businesses of all kinds. The company sells hardware packages including touchscreen monitors, receipt printers, cash drawers and more, along with its hospitality POS software and kitchen display system.

Users fundamentally pick between two subscription tiers: Basic and Plus. In both, you can add unlimited products, users and customers, and till software, cloud reporting and security updates are included. Certain inventory features and integrations with other software may cost extra.

Contrary to what it may sound like, the Basic package costs a hefty €114 + VAT per month, but it allows you to use your payment provider of choice. The monthly Plus plan includes an integrated Epos Now card machine with a transaction fee of 1.7%.

With both packages, you get a touchscreen register, cash drawer, receipt printer, back office software, one accidental damage repair per year, training, implementation and support. Additional accessories and solutions like kitchen display systems are also available.

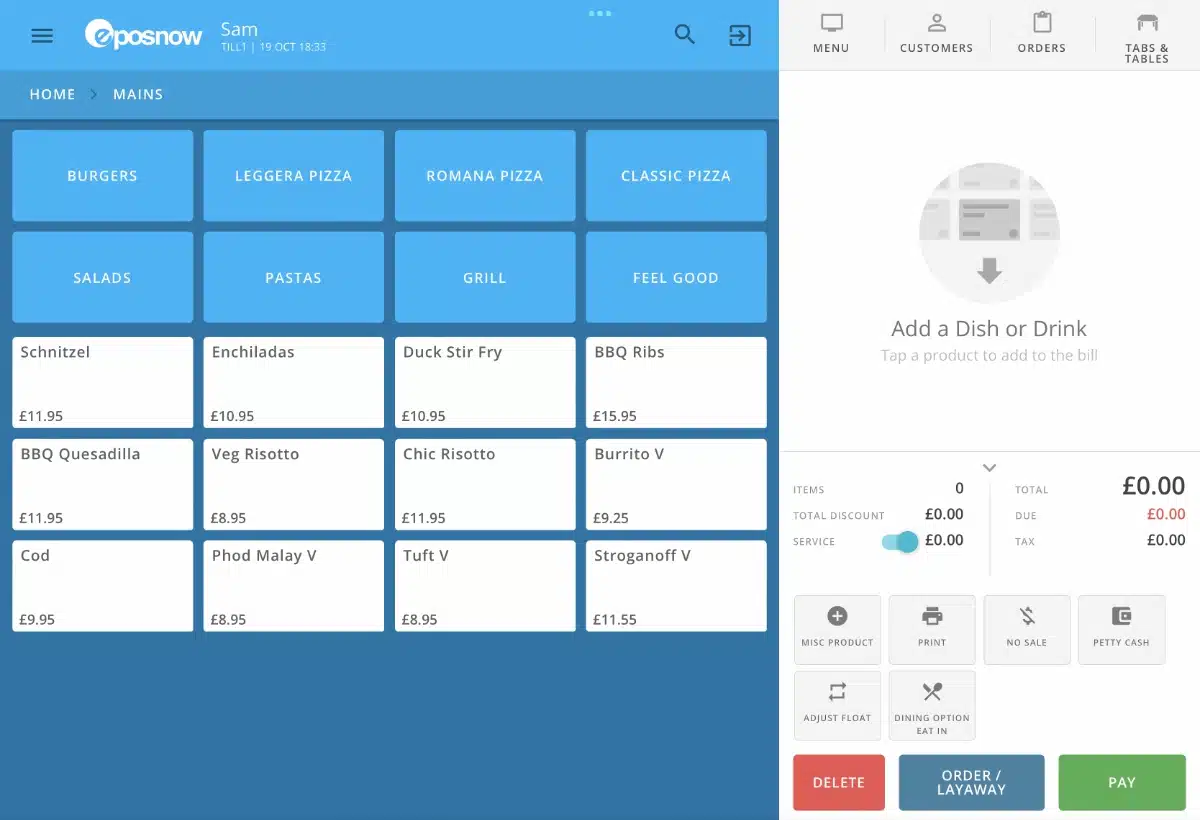

Image: MobileTransaction

The food and drink menu in Epos Now can be organised neatly into Mains, Hot Drinks etc.

Epos Now offers 24/7 customer support on the Plus plan, whereas Basic only includes chat support on weekdays between 9am–6pm and Saturdays between 9am–5pm. The additional charge for 24/7 customer support (i.e. you have to be on Plus) could be a deal-breaker for cash-strapped merchants, considering most other POS systems include phone support at any price level.

To get a custom offer from Epos Now, you need to request a call with the onboarding team.

| Epos Now costs | |

|---|---|

| Contract lock-in | 12-24 months |

| Basic (without payments) | €114 + VAT/mo |

| Plus incl. Epos Now card machine | €90 + VAT/mo |

| Epos Now Payments transaction fee | 1.7% per transaction |

In user reviews and our own tests, we’ve noticed some features being limited, technical issues getting started and usability challenges. Nevertheless, Epos Now offers a good range of essential functions for restaurants and the option to integrate with popular apps for accounting, marketing and customer loyalty.

The Epos Now software is highly customisable, particularly for hospitality businesses that also have a retail element, such as hotels, breweries and any café or restaurant selling foodstuffs from the shelves.

Payment integrations: Epos Now Payments, popular payment processors possible

Can you try before committing? No, but live demos are possible

Best for: Revolut Business account holders

Pricing: Free with account (from €10/mo)

Compatibility: iPad only

Pros: Easy to use, no monthly fee for POS system, low domestic card rate

Cons: No Android compatibility, few POS features, only works with Revolut’s card reader

Since Revolut’s card reader was launched, there was a brief time when it only worked with the Revolut Business app. It now also works with a dedicated POS system we’ve tested, Revolut Point of Sale.

The POS app is accessible through the business account, and it only works with Revolut’s payment system and card reader. For some, that’s a limitation, but it’s also one of the biggest advantages of the product if you bank with Revolut.

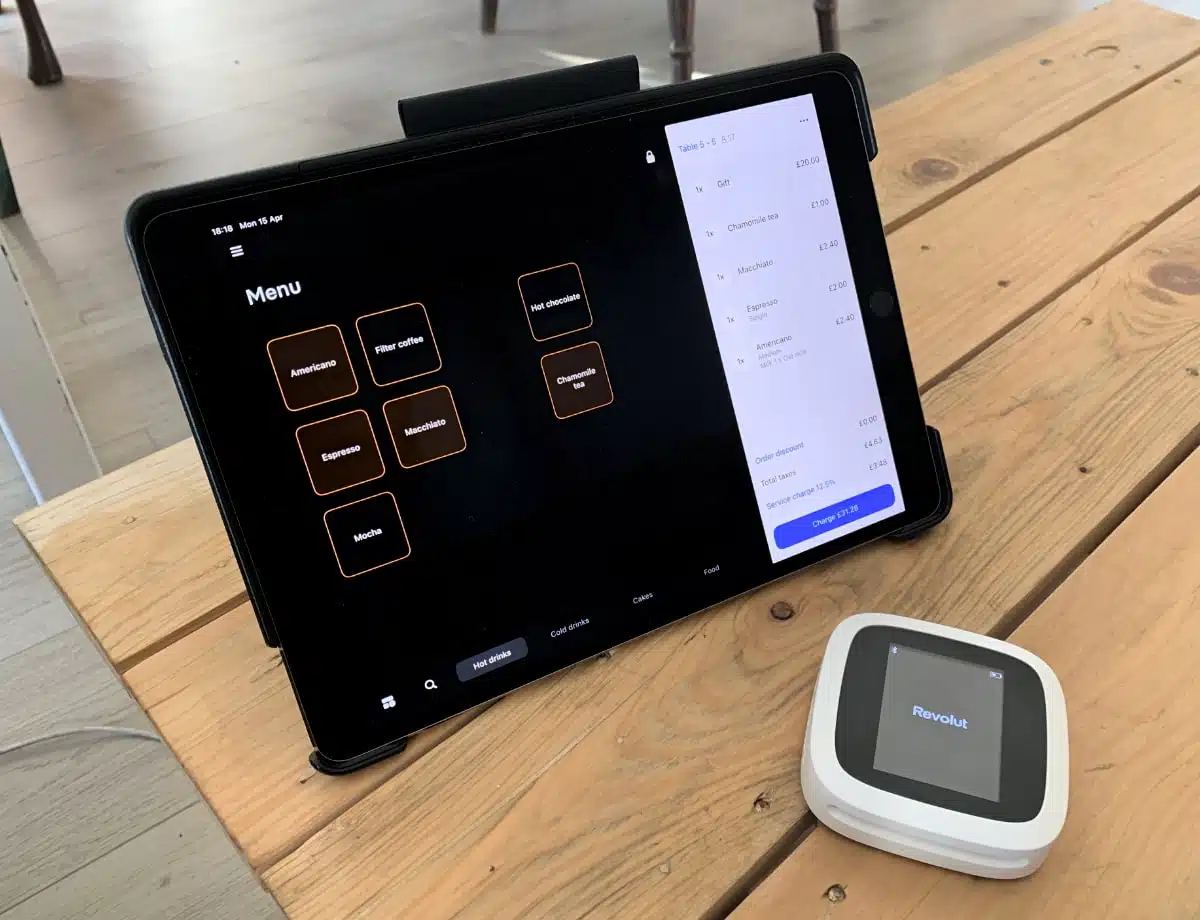

Photo: MobileTransaction

Revolut POS only accepts chip and contactless cards with a Revolut Reader.

When we first tried the POS software, we thought it was a little basic. The interface looked extremely plain, but it turned out the app can be customised with a range of features relevant to cafés. This includes table and floor plans, different VAT rates, service charges, tipping and food menus with variations, modifiers and categories.

Once your food and drink menu is set up, and the card reader is connected, it’s a very smooth-running checkout. Contactless and chip card payments reach your Revolut Business account within 24 hours, where you can choose to transfer or spend it with the debit card.

| Revolut costs | |

|---|---|

| Business account subscription | €10-€90 + VAT/mo |

| Revolut POS software | Free through the account |

| Revolut Reader purchase | €49 + VAT |

| Card transactions | Domestic consumer cards: 0.8% + €0.02 All other cards: 2.6% + €0.02 |

Although the POS system itself is free, you still need to pay a monthly fee for any of the Revolut Business accounts. Then it’s essential to apply for a Merchant Account, which enables you to accept cards online and in person, and order the card reader.

Domestic card payments have a very low rate (0.8%), but there is a fixed fee added (€0.02). If you accept man international or commercial cards, the rate is considerably higher (2.6%). The only other payment method method accepted is cash, in which case we recommend getting a cash drawer.

Overall, Revolut POS would suit a small food and drink business with one point of sale and few staff. If you’re just looking for a cheap solution and love the many account features in Revolut, you should check it out.

Payment integrations: Revolut Reader only

Can you try before committing? You need a Revolut Business Account (€10-€90 monthly) before you can try Revolut POS on iPad for free

Best for: Good features for a low overall cost

Pricing: From €55 + VAT/mo

Compatibility: iPad only

Pros: Tableside and online ordering features, choice of add-ons, offline mode

Cons: No Android compatibility, extra cost for advanced features, 12-month lock-in

SumUp Point of Sale for iPad is ideal for small hospitality businesses due to its flexibility and food and drink features.

While SumUp has a “Lite” Point of Sale for a one-off upfront cost of €299, this is basically just a hardware bundle with a very basic POS app. Those looking for a hospitality system should instead opt for the Pro (€55 + VAT monthly) plan with many more features.

You can use any iPad and SumUp card reader and add cash drawers and printers to suit your business. The Pro plan features multiple-order processing, guided onboarding, menu editing, table and floor management, and reservation and delivery features. Reporting features are much more extensive than with the Lite plan.

Photo: SumUp

The SumUp POS system is advanced enough for restaurants, yet still not complicated to use.

A customer display and other add-ons for e.g. stock and promotions are available, and the software integrates with accounting and food delivery apps. The software has an offline mode, so taking orders without internet connectivity is no problem. In addition, support is available 7 days a week.

For more advanced stock management such as purchase ordering and stock audit reports, you can subscribe to the Advanced Stock add-on for €20 + VAT per month. There’s also a Kitchen Display Screen add-on for €10 + VAT monthly per display. Both are essential for bigger food venues and multi-site businesses.

| SumUp costs | |

|---|---|

| Point of Sale Pro plan | €55 + VAT/mo |

| Add-on features | Advanced Stock: €20 + VAT/mo Kitchen Display Screen: €10 + VAT/mo per terminal |

| SumUp card transactions | 1.69% per transaction |

We like the friendly look of the till hardware, and the checkout screen has a nice, adaptable interface. For wet and rough environments, though, the Epos Now hardware is more robust.

SumUp Point of Sale can in theory work with several payment providers, but the out-of-the box integration is with SumUp card machines, either the Solo Lite or Solo terminal. The card processing rate is fairly attractive at 1.69%, even for premium cards like American Express, Discover, Diners Club and UnionPay. Lower rates are possible with a subscription or agreement with SumUp (with a high sales volume).

Payment integrations: SumUp card readers

Can you try before committing? You can book a demo through SumUp’s website

Best for: Hospitality businesses that value an Ireland-only service

Pricing: Custom plans

Compatibility: Windows devices

Pros: Strong local support team, flexible options, offline option

Cons: Reports of buggy software and slow fixes, opaque pricing, no iOS or Android compatibility

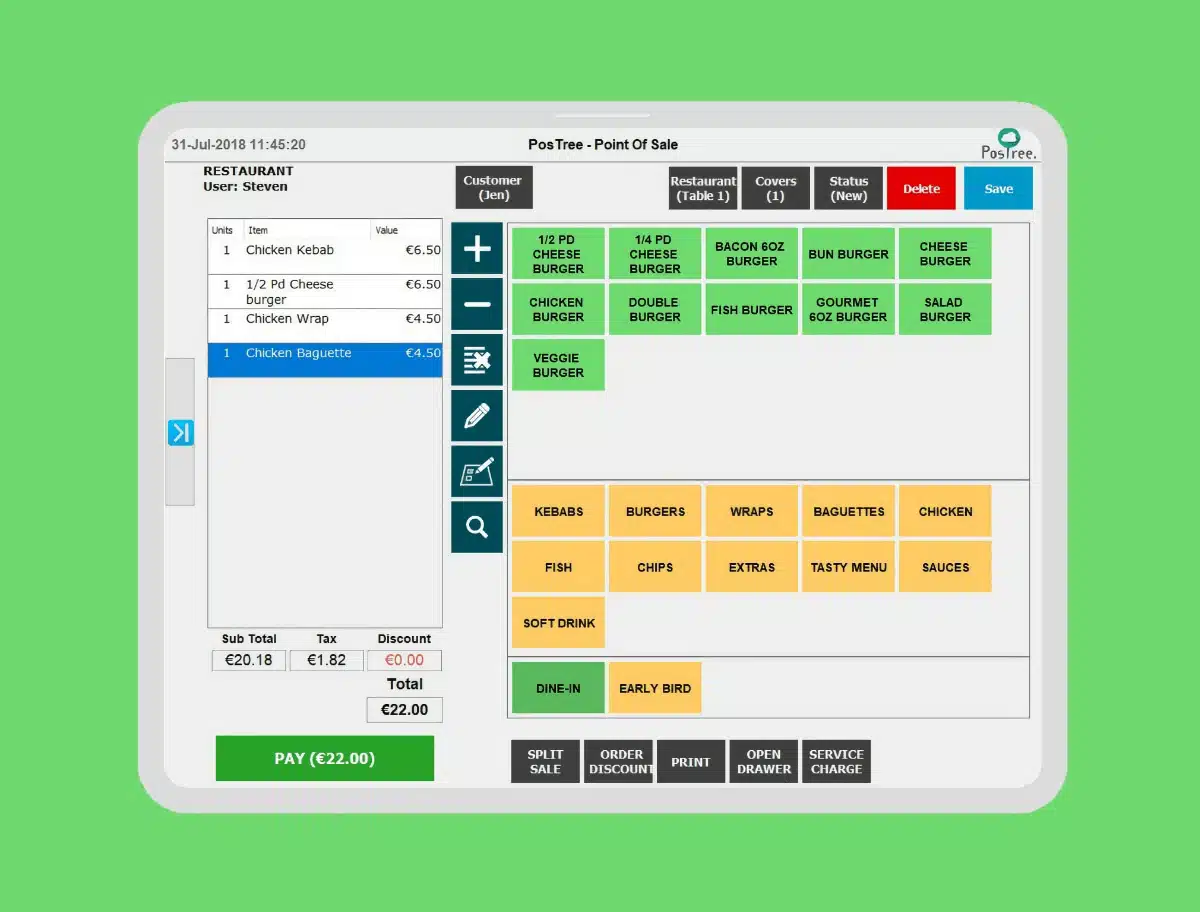

Postree is an Irish, cloud-based POS provider specialising in hospitality. The company provides tailored POS hardware and software packages with many of the features you would expect: employee, inventory and order management, in-depth reporting, online ordering and payment integration.

The fact that Postree also offers a web design service for your online menus and ordering is probably indicative of this being a service for those who would like a bit more hand-holding and support. Other optional services like CCTV integration are available for a monthly fee.

Postree only works on Windows devices, whether tablets or computers.

Postree’s minimum contract length is 12 months, so it is a bit of a commitment. Pricing is based on your tailored set of services and features agreed to during onboarding. The company offers its hardware and software on a for-lease basis, with costs determined after a call to assess your needs. It is also possible to purchase equipment through Postree upon request.

When signing up, you’ll have the option to enrol on one of two support plans. The Software Support plan includes access to the support team 7 days a week between 9am–10pm, remote support, email support, remote team training, software updates and on-demand encrypted data backups. The Hardware and Software Support plan adds replacements or repair of faulty hardware.

| Postree costs | |

|---|---|

| Subscription | Custom quote |

Although Postree is not a big market player, swift and personal customer service is what you should expect. That being said, the user base of the company appears to be small, and buggy software with slow fix times have been reported as issues, so you should definitely request a trial or demo before committing to a package.

Payment integrations: Major payment processors

Can you try before committing? Yes, a 14-day free trial is available

Best for: Businesses looking for a cheap, simple POS solution

Pricing: Free with optional add-ons

Compatibility: Android, iOS

Pros: Low cost, adaptable, works offline

Cons: Live support requires subscription, limited card reader options, costs can add up

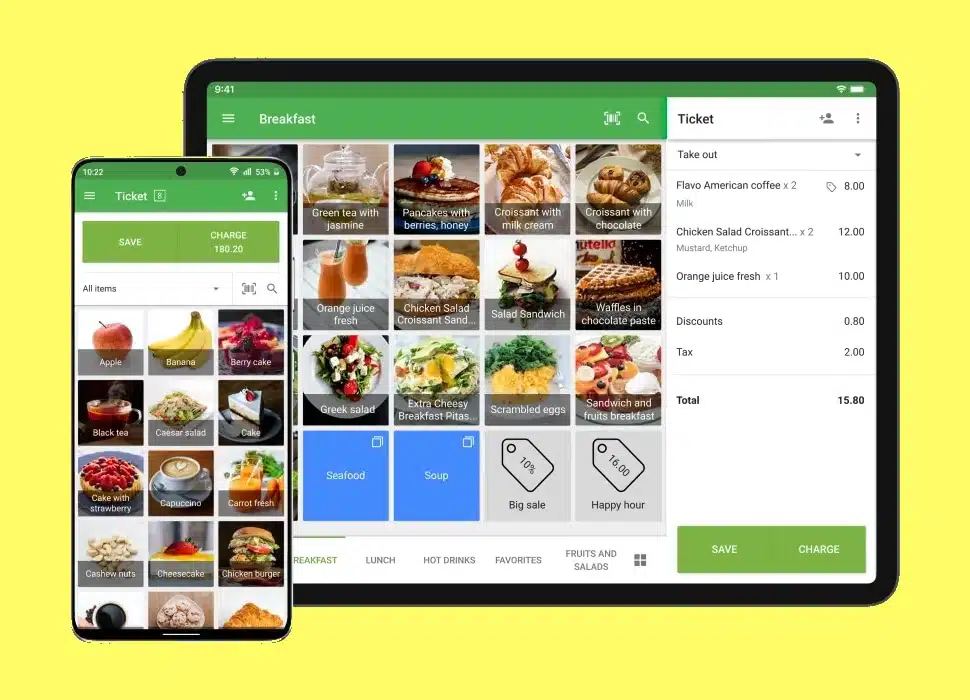

Loyverse – short for Loyalty Universe – is run by a Cyprus-founded company now based in London. The product is a mobile POS application available on iPhone, iPad and Android devices.

Based on a “freemium” model, Loyverse’s Point of Sale app is free to use, with no monthly cost or contractual commitment. However, there are paid add-ons for employee management, inventory features and integrations. These are charged monthly or annually upfront, but note that any costs cannot be refunded.

Loyverse point of sale menu for a café.

If you require lots of app integrations, costs could really add up. We therefore give a word of caution for restaurants and more complex cafés. Loyverse is fairly popular among smaller businesses like food trucks and places without table service.

The paid add-ons start with a free 14-trial that does not require your card details. If you choose to continue with a paid subscription, you are free to cancel it any time from your web dashboard.

The POS system is basic, but extremely adaptable so it can be used for both retail and hospitality. The browser-based Dashboard/Back Office has detailed reports and general features for managing POS operations. There is also a free kitchen display app for communicating with the kitchen and a free customer display app.

Any hardware is purchased outside of Loyverse, and your payment provider charges for card processing. The software works with different hardware like receipt printers and cash drawers, a list of which is available on the website. In Ireland, the only card readers that integrate are from SumUp.

| Loyverse costs | |

|---|---|

| Loyverse POS and Dashboard | Free |

| Loyverse Kitchen Display | Free |

| Integrations with accounting, payments etc | From €9 + VAT/mo |

| Employee management | €5 + VAT/mo per employee |

| Advanced inventory | €25 + VAT/mo per store |

| Unlimited sales history | Cost applies per store |

Live support is only available for subscribers to one of Loyverse’s paid add-ons. If you’re just using the free software without a paid subscription, you just have an online help section with step-by-step guides and a peer support forum where you can post questions publicly.

There is an email address that anyone can contact for help, but you’re likely going to get a slow response to that. Only on a paid plan do you have a prompt live chat.

Payment integration: SumUp card reader

Can you try before committing? Yes, a 14-day free trial is available

Verdict

Coffee shops and restaurants in Ireland have several POS options, but ultimately, the right choice depends on your business needs.

In our tests, we’ve found Square to be a reliable, intuitive and adaptable solution that works for most hospitality businesses. The low costs, complimentary payment tools and commitment-free setup make Square our top choice overall.

Businesses looking for more flexibility in hardware and payment processing options might prefer a more tailored solution from Epos Now or Postree. The latter only works with Windows devices, though, whereas Epos Now offers POS for hardwearing touchscreen registers, Android tablets and iPad alike.

The potentially free Loyverse is interesting if your business is just starting out and you’re still figuring out which features are important to you. SumUp Point of Sale Pro would be a gentle step up from that, with modern-looking hardware bundles and hospitality integrations that are better long-term.

Revolut POS is a new promising alternative for small food and drink venues on a budget. It doesn’t pack in the same amount of features as Epos Now or Square, but it’s an ideal integrated solution that runs smoothly with Revolut’s wide-ranging services.

Another popular alternative in Ireland is Clover with its hospitality package. Their hardware looks sleek, but the company tends to require long contracts, many fees and expensive add-ons.

| Food & drink POS | Best for | Site |

|---|---|---|

| Cafés and quick-service venues reliant on different sales channels | ||

| Custom hardware-and-software packages with many add-ons | ||

| Small cafés that want funds quickly and use Revolut for banking | ||

| Budget point of sales with click-and-collect options | ||

| Tailored Windows tills and web design service | ||

| Temporary setups requiring some flexibility |

| Food & drink POS |

Best for | Site |

|---|---|---|

| Cafés and quick-service venues reliant on different sales channels | ||

| Custom hardware-and-software packages with many add-ons | ||

| Small cafés that want funds quickly and uses Revolut frequently | ||

| Budget point of sales with click-and-collect options | ||

| Tailored Windows tills and web design service | ||

| Temporary setups requiring some flexibility |