What’s the best online payment solution for small businesses?

The answer depends on your type of business, sales volume and which payment methods you actually need. This comparison of online payment platforms will help you choose a solution that’s right for your sales channels and budget.

Our list includes complete and simple options that get you started easily at no monthly cost – even if you’re new to the field. Some of the platforms require more technical know-how, but are then more customisable and scalable for growing businesses.

Best online payment solutions in the UK:

| Solution | Best for | Fees |

|---|---|---|

| 1. Square |

Breadth of user-friendly, free online payment tools accessible in app or browser | UK cards: 1.4% + 25p Other cards: 2.5% + 25p Invoice payments: 2.5% |

| 2. Airwallex |

Superior international business account with fast, reliable payment system | UK cards: 1.3% + 20p EEA, Amex cards: 2.4% + 20p Intl. cards: 3.15% + 20p |

| 3. Worldpay |

Trusted payment processing with your own merchant account and custom fees | Custom card rates £9.95 + VAT/mo |

| 4. PayPal |

Popular with payers because of Buyer Protection, familiarity and convenience | Standard rate: 2.9% + 30p Cross-border fee: +1.29%-1.99% Currency conversion: +3% |

| 5. Stripe |

Advanced, scalable payment flows managed by your own developer | UK cards: 1.5%-1.9% + 20p EEA cards: 2.5% + 20p Intl. cards: 3.25% + 20p Currency conversion: +2% |

| 6. SumUp |

Simplicity and accessibility of payment features with fixed rate and no monthly fee | Pay-as-you-go: 2.5% (any card) £19/mo: 0.99%-1.99% |

| 7. Revolut |

Low transaction costs and multi-currency accounts for international payments | UK consumer cards: 1% + 20p Other cards: 2.8% + 20p |

| 8. Adyen |

High-volume businesses needing a custom solution for global customers | Variable card rates No monthly fee |

| 9. 2Checkout |

International payments and advanced subscription features | One-off payments: 3.5% + 25p Subscriptions: 4.5% + 35p |

Basics of online payments

To sell online, you need an account with an online payment system that offers the payment methods you need. These methods could be:

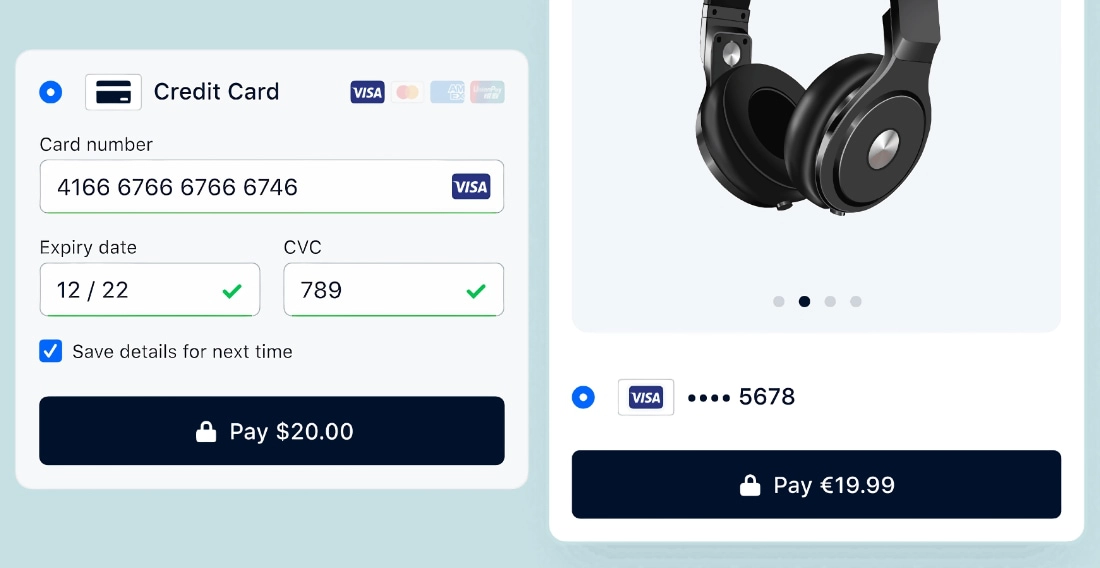

Online payments are processed through an online payment gateway, which is basically the checkout page where the customer submits their card information.

Whether you use payment links, e-invoices or an ecommerce site, it’s the gateway that’s core to online card processing.

What it takes to accept payments online

Thankfully, it’s not so complicated to start selling online with one of the out-of-the-box solutions on this list.

Such user-friendly solutions already have a payment gateway integrated so you just create the online store in a website builder or start sharing payment links or email invoices. We refer to these as all-in-one platforms, because their software includes everything needed to sell online easily.

Other online platforms on this list offer a standalone payment gateway to connect with ecommerce software through APIs (Application Programming Interface). This requires technical know-how, but it’s ideal for a larger business that needs a more personalised setup with custom fees.

Either way, you’ll need to sign up on the website of your chosen platform and submit business details and (usually) bank account information to receive payouts.

| Gateway integration |

Payment links |

Recurring payments |

Invoice software |

Pay buttons |

Online store builder |

|

|---|---|---|---|---|---|---|

| Square | Yes | Yes | Yes | Yes | Yes | Yes |

| PayPal | Yes | Yes | Yes | Yes | Yes | x |

| Stripe | Yes | Yes | Yes | Yes | Yes | x |

| SumUp | Yes | Yes | x | Yes | x | Yes |

| Adyen | Yes | Yes | Yes | x | Yes | x |

| 2Checkout | Yes | x | Yes | Yes | Yes | x |

| Airwallex | Yes | Yes | Yes | x | x | x |

| Worldpay | Yes | Yes | Yes | x | x | x |

| Revolut | Yes | Yes | x | Yes | x | x |

If you don’t want to hire a developer or pay for a custom ecommerce setup, it is best to choose a provider that has out-of-the-box tools with payment processing already integrated.

The most extensive out-of-the-box solution is Square, while SumUp includes easy payment tools intended for merchants using card readers too. We think Revolut has some good payment links, but a developer is required in some cases for the online gateway.

Bigger businesses are better off with a provider that can lower transaction rates for a high sales volume, like Worldpay and Adyen. Small or seasonal businesses can benefit from a lack of monthly fee, reasonable fixed rates and no commitment offered by Square and SumUp.

Adyen, 2Checkout, Airwallex and Stripe are geared towards multiple currencies and complex solutions, but you may need technical expertise to use these systems. The one that stands out is Airwallex which caters to small businesses too with its payment links, easy plugins and more localised currency accounts.

| Accepted currencies | Stored currencies | Local account currencies | |

|---|---|---|---|

| Airwallex | 27 | 27 | 12 |

| Revolut | 25 | 25 | x |

| PayPal | 24 | 24 | x |

| Stripe | 134 | x | x |

| Worldpay | 126 | x | x |

| 2Checkout | 99 | x | x |

| Adyen | 34 | x | x |

| Square | x | x | x |

| SumUp | x | x | x |

PayPal comes with an online business account and lots of accessible online sales tools, but can be very expensive. Revolut Business has lower domestic card fees, but fewer tools, for online payments.

It’s also worth checking out GoCardless for easy bank payments, particularly if you’re a charity requiring one-off and repeat donations, since it uses Direct Debit.

If you’re just looking for an online store solution, an all-in-one website builder might be best. Popular Shopify has its own payment system, with options to add Amazon Pay or other payments. Ecommerce platforms can usually connect with a range of payment gateways including some of the above.

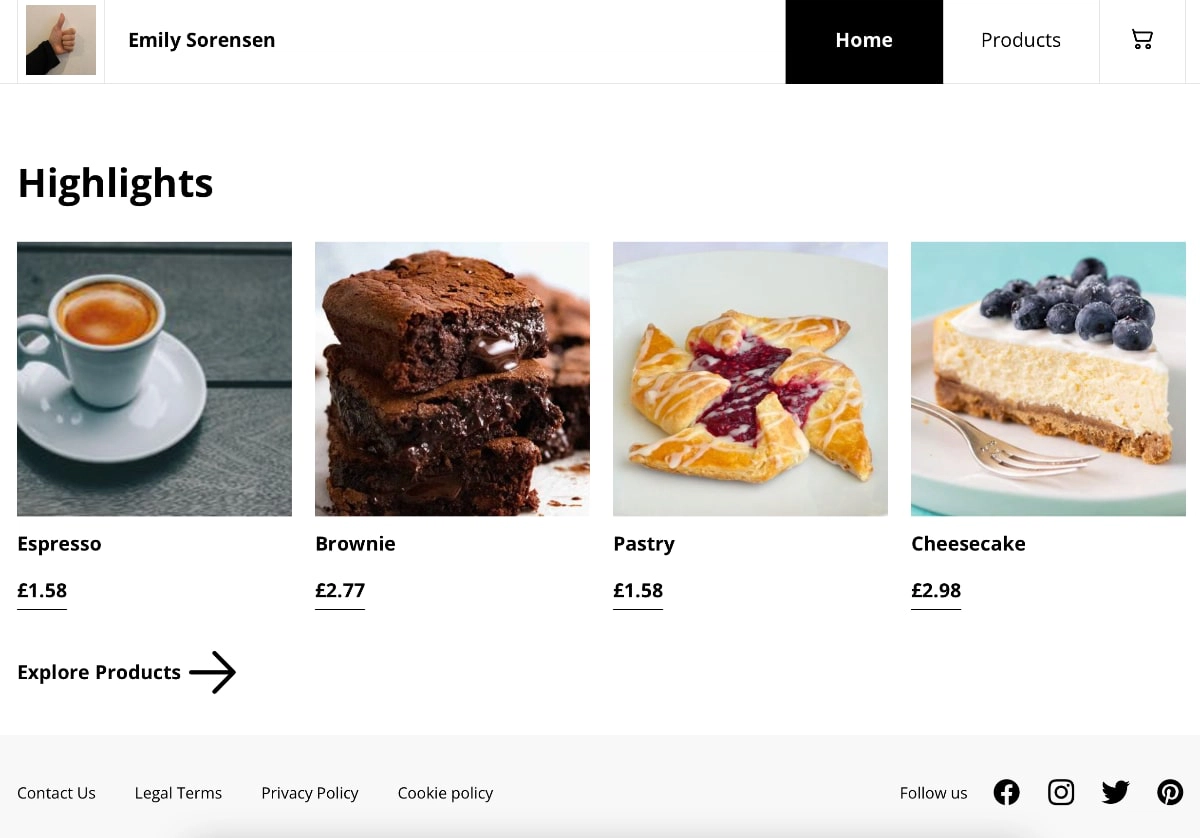

Square – easiest, most complete out-of-the-box solution

No other payments platform in the UK has a wider range of free online payment tools than Square. There’s no contractual commitment, no monthly fees (unless you upgrade to a paid plan), only pay-as-you-go transaction fees.

Square handles payment processing so there’s no need to install anything to accept payments in your bank account. You just need to create an account via the quick online sign-up form and start using the tools available in the Square account.

|

|

|---|---|

| Payment system | Already integrated with Square selling tools. APIs available to connect Square Payments with external ecommerce software. |

| Selling tools |

|

| Payouts | In bank account within 1-2 working days. Immediately with Instant Transfers (1% extra fee). |

| Fees | Online store, links: UK cards: 1.4% + 25p, Non-UK cards: 2.5% + 25p Virtual terminal, invoices: 2.5% No contract, no monthly fees (except for online store or Invoice Plus plans) |

| Link |

|

|

|---|---|

| Payment system | Already integrated with Square selling tools. APIs available to connect Square Payments with external ecommerce software. |

| Selling tools |

|

| Payouts | In bank account within 1-2 working days. Immediately with Instant Transfers (1% extra fee). |

| Fees | Online store, links: UK cards: 1.4% + 25p, Non-UK cards: 2.5% + 25p Virtual terminal, invoices: 2.5% No contract, no monthly fees (except for online store or Invoice Plus plans) |

| Link |

Domestic debit or credit card transactions have an attractive, fixed rate of 1.4% + 25p per online transaction. Non-UK cards incur a 2.5% + 25p fee per transaction. With an annual turnover of at least £250k, you can negotiate lower fees.

“No other payment company in the UK offers as many online payment features as Square. I personally love the interface and ease of use of it, but the transaction fees can be much if most customers use foreign cards.”

– Emily Sorensen, Senior Editor, MobileTransaction

We are impressed with how many features you actually get without a monthly fee.

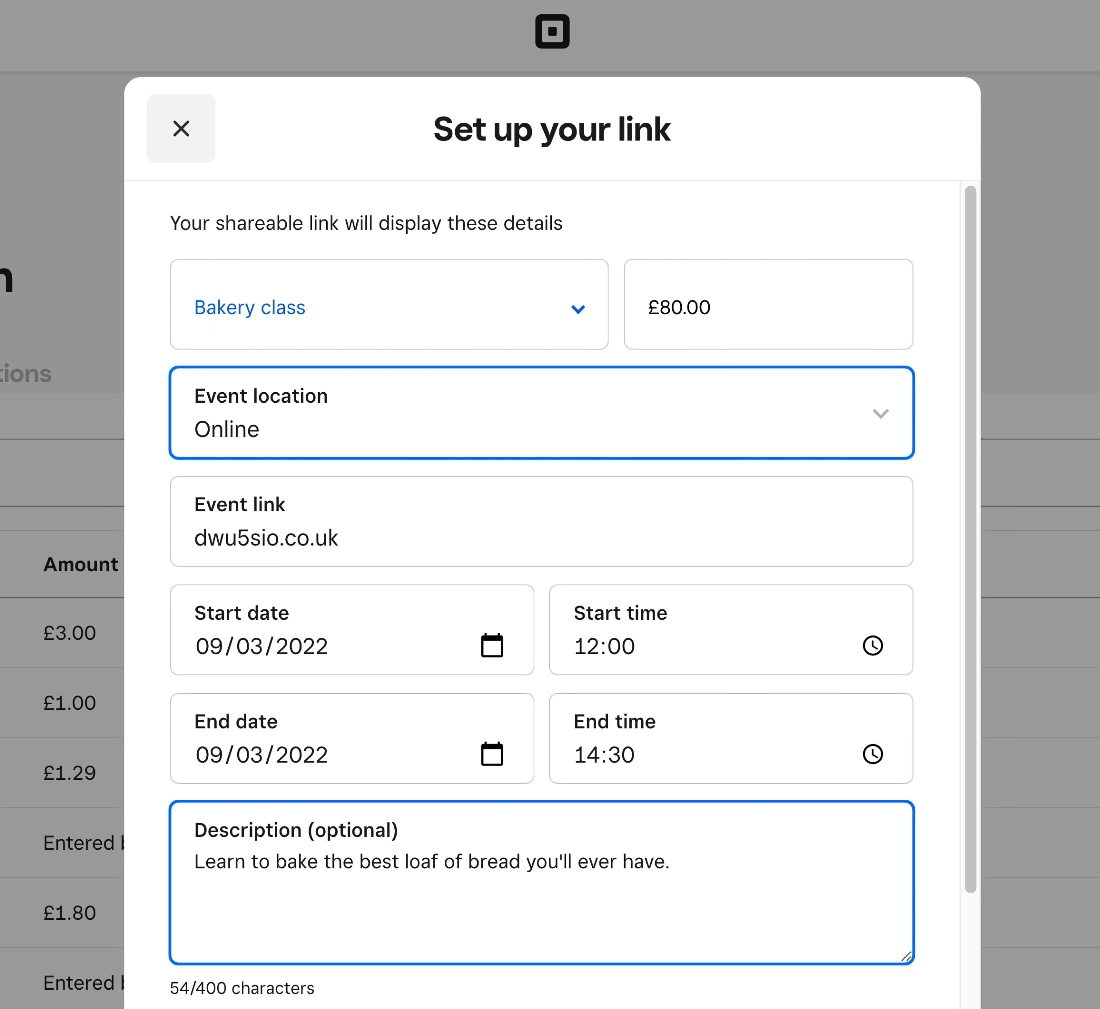

For example, the virtual terminal for telephone payments is more advanced than those of other providers charging for theirs. Online Checkout can be used for sending payment links, printing QR codes for socially distanced orders and adding pay buttons on an existing website. Square Invoices has its own app for managing all client invoices for bills or estimates. You can even create subscriptions for clients for ongoing services or digital content.

Credit: MobileTransaction

You can set up an online store for free, but a professional-looking website requires a paid online store plan with more features. An online ordering page for collection or delivery can be set up for free. Online gift cards can also be issued and accepted.

Alternatively, you can integrate Square with many different kinds of partner apps for e.g. accounting and online takeaway platforms. APIs are available if you want to add Square Payments to a different ecommerce solution.

Pros

Cons

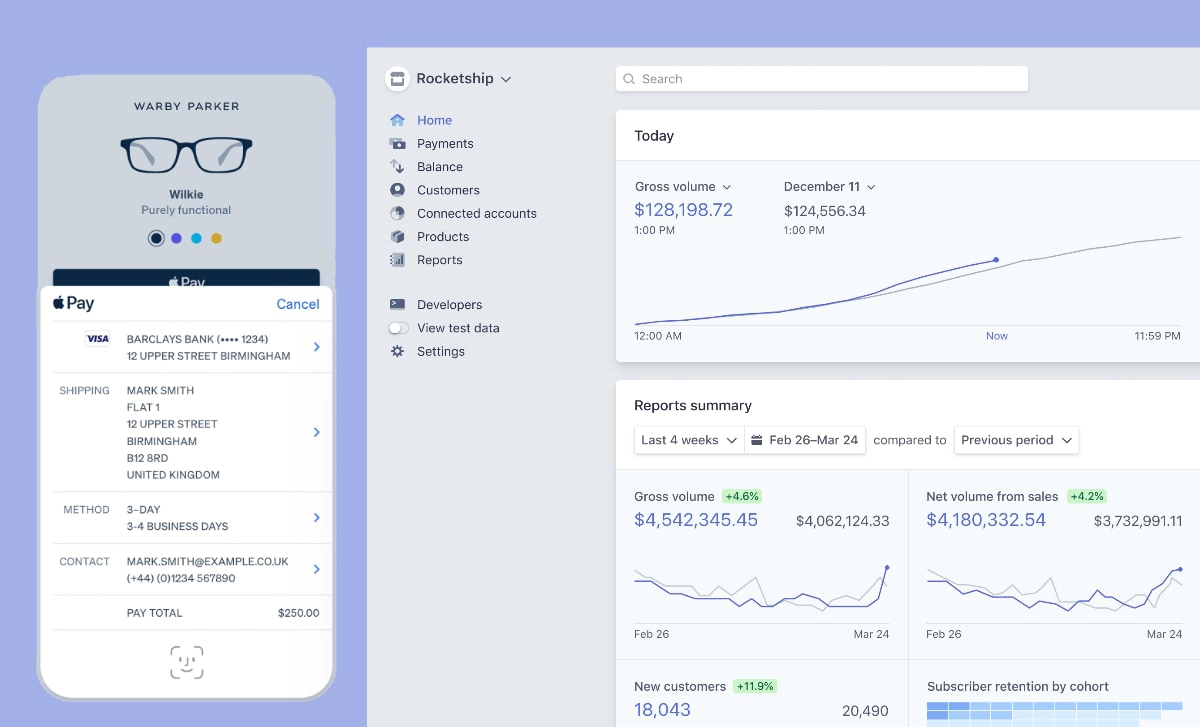

Airwallex – superior for cross-border payments

Airwallex is a very efficient multi-currency account, used and approved by the MobileTransaction team for several years. It can be used to spend money globally with a Visa Business card, make international transfers at a low cost or open local current accounts – similar to Wise.

Account holders can send payment requests by link and add Airwallex’s payment gateway to an ecommerce site. Although invoicing software isn’t part of the service, you can still add an Airwallex payment link to digital invoices in e.g. Xero so clients can pay online and you can track payments.

|

|

|---|---|

| Payment system | Online payments are already connected with the business account. Plugins and APIs are available to connect Airwallex’s payment system with ecommerce software. |

| Selling tools |

|

| Payouts to Airwallex account | 0-5 working days (depends on type of payment) |

| Fees | UK Visa and Mastercard cards: 1.3% + 20p EEA and Amex cards: 2.4% + 20p International cards: 3.15% + 20p Other payment methods: 20p + payment method fee No contract, no monthly fees |

| Link |

|

|

|---|---|

| Payment system | Online payments are already connected with the business account. Plugins and APIs are available to connect Airwallex’s payment system with ecommerce software. |

| Selling tools |

|

| Payouts to Airwallex account | 0-5 working days (depends on type of payment) |

| Fees | UK Visa and Mastercard cards: 1.3% + 20p EEA and Amex cards: 2.4% + 20p International cards: 3.15% + 20p Other payment methods: 20p + payment method fee No contract, no monthly fees |

| Link |

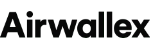

A big advantage of Airwallex is its long list of local payment methods (160+) it lets you accept online. Your account shows the card schemes (Visa, Amex, etc.) and local methods (Klarna, Skrill, bank transfers, etc.) that can be activated straight away or after 1+ days in your account. You can always request a specific local payment method by contacting Airwallex.

“Airwallex has saved MobileTransaction a lot of money and sweat waiting for money (transfers are usually immediate). It’s a reliable, very flexible platform for businesses working in different countries.”

– Emily Sorensen, Senior Editor, MobileTransaction

Payout times differ between payment methods and are based on the accounts’ reserve requirements. Unfortunately, this is kept under wraps until you sign up for an account.

Credit: MobileTransaction

Another strong point is Airwallex’s developer platform rivalling Stripe. With the right coding skills, it’s possible to integrate an online checkout in your online store and customise the payment flow. The system is quite advanced, with built-in fraud prevention tools and features that improve success rates of transactions – similar to Stripe, but with a business account attached.

Those less tech-savvy can use an Airwallex plugin in Shopify, WooCommerce or Adobe Commerce (Magento).

We think Airwallex is great for merchants who deal with several currencies and would like to save money selling internationally. Whatever the payment method, funds go into the online Airwallex account in the relevant currency account. Like Revolut, you can sell in and set up different currency accounts so US dollar transactions go directly into your USD account that pays your US suppliers – saving you a currency conversion fee and giving you full control over fees.

Pros

Cons

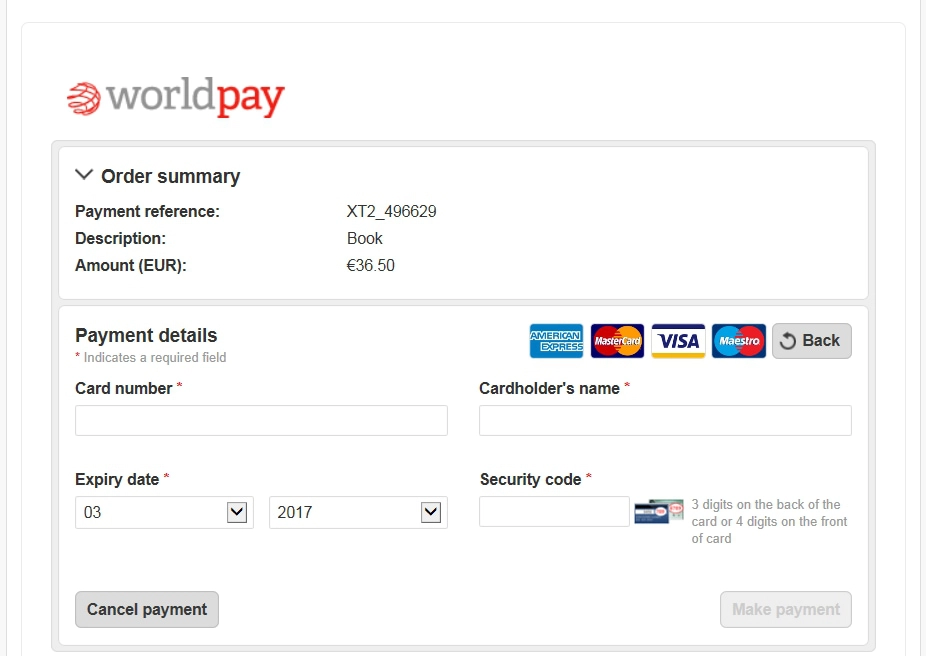

Worldpay – solid processor for established merchants

Worldpay has been a trusted online payments provider for decades. In fact, it processes around 40% of all card payments in the UK, making it the leading payment processor in this country.

Signing up requires talking to a Worldpay representative who will give a quote based on your sales volume, type of business and online system required. This is great for those preferring personalised rates but difficult for those uneasy about negotiating transaction fees and a contract for a new business that hasn’t taken off yet.

|

|

|---|---|

| Payment system | Online payment gateway that can be connected with many ecommerce platforms. Certain tools are available from Worldpay without the need to install software. |

| Selling tools |

|

| Payouts | In bank account within 1-3 working days. |

| Fees | Virtual terminal, pay-by-link: £9.95 + VAT/mo + custom rates Other ecommerce: Custom pricing 30-day rolling contract or longer commitment |

| Link |

|

|

|---|---|

| Payment system | Online payment gateway that can be connected with many ecommerce platforms. Certain tools are available from Worldpay without the need to install software. |

| Selling tools |

|

| Payouts | In bank account within 1-3 working days. |

| Fees | Virtual terminal, pay-by-link: £9.95 + VAT/mo + custom rates Other ecommerce: Custom pricing 30-day rolling contract or longer commitment |

| Link |

You can get long-term contracts or rolling, 30-day contracts that can be cancelled any month. Businesses get their own merchant account, which makes payment processing more reliable than, say, Square’s or PayPal’s.

Transaction fees are competitive with a consistent online card turnover of at least £2,000 per month. Foreign and premium cards like American Express have the highest rates (e.g. 2.75%), whereas domestic cards typically have the lowest rates (e.g. 0.95%). Some plans include PCI-DSS compliance (payment security standard), whereas others require you to set up PCI compliance at a cost.

Worldpay Virtual Terminal can be used for remote payments where the merchant enters card details while talking to the customer on the phone. Worldpay Pay by Link is for embedding unique payment links into an email or digital invoice so the customer can pay on a secure web page. Both can only be used in a web browser, not mobile app.

The online payment gateway can either be a ‘Hosted Pay’ page taking your customers to a standard checkout page outside your website, or an ‘Integrated’ payment page on your website.

The latter makes you responsible for your own PCI compliance, but then you have full control over the checkout experience. You can, for example, enable the option for customers to save card details (card on file), set up recurring payments and accept different currencies. There are many ways to customise online payments with Worldpay, but it may be a little complicated to do.

Pros

Cons

PayPal – accessible tools with online account

As an early innovator in online payments, PayPal is well-known among businesses and consumers alike. The familiarity of the brand and Buyer Protection mean that customers are likely going to feel safe paying through PayPal – but it is far from the cheapest payment system for most businesses.

It is easy and free to sign up online for a PayPal Business account, which you’ll need for any of the payment tools. It is an e-money account based online, so not a bank account or traditional merchant account such as Worldpay’s.

Money received through PayPal will go straight into your online account. If you need to have the money in a bank account, you have to manually withdraw it to the bank account connected in the PayPal account. This can take a few working days or hours, depending on your bank.

|

|

|---|---|

| Payment system | Already integrated with payment tools. Codes available to integrate pay buttons or online gateway on your website. |

| Selling tools |

|

| Payouts | Immediate in online account. Manual transfers to bank account take 0-2 working days. |

| Fees | Standard transactions: 2.9% + 30p Non-UK cards: 1.29% (EEA) or 1.99% (other) cross-border fee, 3% currency conversion fee No contract, no monthly fees (except for Virtual Terminal & advanced checkout plan) |

| Link |

|

|

|---|---|

| Payment system | Already integrated with payment tools. Codes available to integrate pay buttons or online gateway on your website. |

| Selling tools |

|

| Payouts | Immediate in online account. Manual transfers to bank account take 0-2 working days. |

| Fees | Standard transactions: 2.9% + 30p Non-UK cards: 1.29% (EEA) or 1.99% (other) cross-border fee, 3% currency conversion fee No contract, no monthly fees (except for Virtual Terminal & advanced checkout plan) |

| Link |

Email invoices, QR codes, payment links, buy buttons and a standard integrated checkout on your website (PayPal Checkout) have no monthly fees. The payment tools with a monthly fee of £20 include the virtual terminal and advanced checkout solution called Web Payments Pro. There’s no contractual commitment for any of these features, so they can be cancelled any time.

The standard transaction fee for invoicing, payment links, pay buttons and online checkout is 2.9% + 30p. An additional cross-border fee of 1.29%-1.99% applies to non-UK cards, as does a currency conversion fee of 3% where applicable. Merchants can apply for blended fees that adjust to the type of card being used, and those with an online turnover above £50k monthly can also get better fees. Other general fees apply, such as £14 per chargeback.

Although non-UK card payments are expensive, a main advantage of PayPal is its ability to accept many currencies. Moreover, adding PayPal as an optional payment method to your online checkout can secure more transactions because payers trust it and already have a PayPal account that’s convenient for them to use.

Many sellers, however, have had issues with account holds and poor customer support. We don’t recommend PayPal for their fees or taking the seller’s defence in customer disputes where Buyer Protection takes priority, but it is undoubtedly an asset to offer PayPal to customers who prefer it.

Pros

Cons

Stripe – developer-friendly tools for online payments

Stripe is a big, international payments platform that’s popular among startups and high-growth businesses, small and large. Unless you’re connecting an all-in-one website builder with a Stripe checkout (which is easy in many cases), the platform is mainly geared towards internet businesses needing a custom payment solution.

A Stripe account is easily created online without setup fees or a contract. If you’re doing this as a step to connect e.g. Squarespace with Stripe, you don’t need coding skills to start receiving payments. Most other features require development expertise, as Stripe provides extensive API documentation to help you create a tailored payment system for your online business.

|

|

|---|---|

| Payment system | Integrates easily with many ecommerce platforms. APIs available to create custom payment flows for your business model. |

| Selling tools |

|

| Payouts | In bank account within 7 working days. |

| Fees | UK standard cards: 1.5% + 20p UK premium cards: 1.9% + 20p EEA cards: 2.5% + 20p International cards: 3.25% + 20p Currency conversion: 2% No contract, no monthly fees |

| Link |

|

|

|---|---|

| Payment system | Integrates easily with many ecommerce platforms. APIs available to create custom payment flows for your business model. |

| Selling tools |

|

| Payouts | In bank account within 7 working days. |

| Fees | UK standard cards: 1.5% + 20p UK premium cards: 1.9% + 20p EEA cards: 2.5% + 20p International cards: 3.25% + 20p Currency conversion: 2% No contract, no monthly fees |

| Link |

Types of payment solutions created in Stripe include subscriptions, custom checkout flows for websites and apps, payment links, graphical ‘buy’ buttons and invoices. A virtual terminal is available in the Stripe account for occasional over-the-phone payments.

The customisation options make Stripe ideal for marketplace platforms, membership-based businesses and SaaS products, but cross-border retailers also benefit from the many currencies accepted.

With ‘Integrated’ Stripe, you’re charged 1.5% + 20p for transactions paid with consumer cards issued in the UK, 1.9% + 20p for commercial UK cards and from 2.5% + 20p for non-UK cards. An additional 2% currency conversion fee is added to payments in a non-GBP currency. Recurring payments only incur a 0.7% fee per transaction. ‘Customized’ Stripe users with a large sales volume and/or unique business models have other fees.

Stripe’s payment system is a scalable solution with good sales reports, fraud prevention tools and step-by-step guides for shaping your online payment system. Just beware it is not an easy thing to set up – unless you’re a developer.

Pros

Cons

SumUp – simple and convenient features from app

SumUp has added lots of new online payment features in the past years. This is a payments provider primarily for face-to-face merchants (see SumUp’s inexpensive card readers), but merchants with a card reader can accept transactions online as much as they like.

The online sign-up form is very quick to fill in, after which it takes a few days for SumUp to verify and connect your bank account. Payouts automatically go into this bank account within 1-3 working days, or transactions can settle in an online SumUp Business Account (with Mastercard) the next day, even on weekends.

|

|

|---|---|

| Payment system | Already integrated with SumUp selling tools. APIs available to connect SumUp with external ecommerce software. |

| Selling tools |

|

| Payouts | In bank account within 1-3 working days. Day after in SumUp Business Account. |

| Fees | Online store, links, invoices: 2.5% Virtual terminal: 2.95% + 25p No contract, no monthly fees |

| Link |

|

|

|---|---|

| Payment system | Already integrated with SumUp selling tools. APIs available to connect SumUp with external ecommerce software. |

| Selling tools |

|

| Payouts | In bank account within 1-3 working days. Day after in SumUp Business Account. |

| Fees | Online store, links, invoices: 2.5% Virtual terminal: 2.95% + 25p No contract, no monthly fees |

| Link |

The pay-as-you-go fee of 2.5% applies to transactions via links, QR code, e-gift cards, invoices and ecommerce. It costs 2.95% + 25p for all virtual terminal and keyed transactions. If you can cough up a monthly charge of £19, online transactions with a domestic consumer card are only 0.99% whereas all other cards would cost 1.99% – no commitment required.

The online payment features can all be accessed in the SumUp App from an iPhone, iPad or Android device. This includes the Online Store, an extremely basic ecommerce store that can be created in minutes from your app. You can then link to it on social media or elsewhere online and accept orders for delivery or collection.

Credit: MobileTransaction

Through the point of sale (POS) checkout in the app, you can send payment links for specific transactions through SMS or messaging, or generate QR codes for customers to scan with their phone camera. You can send email invoices, or key in payments through the simple Virtual Terminal in the app or web browser. A gift card page can be shared online so people can buy digital gift cards to spend in your store.

A great thing about SumUp is how extremely easy it is to use the features, but also the easy access to online tools through an app. The competitive fixed rates make this attractive to casual or micro-merchants, but there’s no straightforward way to connect SumUp’s online payments to a professional ecommerce website. For this, you need a developer on hand.

Pros

Cons

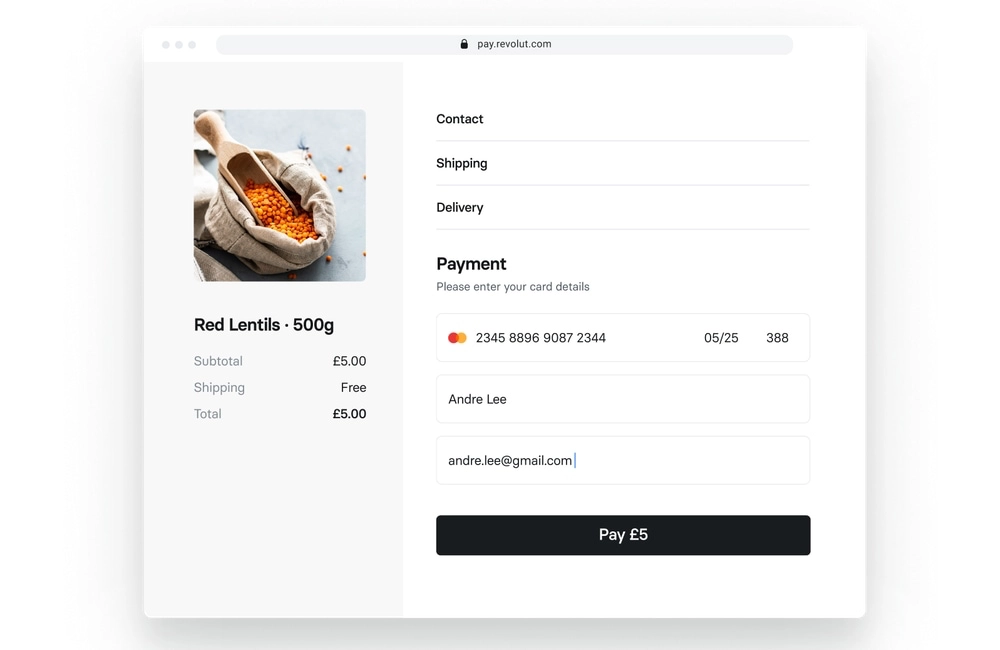

Revolut – low rate for UK consumer cards

Revolut Business accounts have the option to accept payments online: this is called Revolut Online Payments and includes payment links, QR code payments, invoicing and an online gateway.

With a range of free and paid business accounts for either companies or freelancers, the first step is to sign up for one of these plans, which includes a Prepaid Mastercard. You can then apply for online payments through the account. It may take a couple of working days to process this application.

|

|

|---|---|

| Payment system | Payment links ready to use. Online gateway plugin compatible with WooCommerce, Magento and PrestaShop; APIs available for other website platforms. |

| Selling tools |

|

| Payouts | In Revolut account within 1 working day. |

| Fees | UK consumer cards: 1% + 20p All other cards: 2.8% + 20p No contract, monthly fee from £0 |

| Link |

|

|

|---|---|

| Payment system | Payment links ready to use. Online gateway plugin compatible with WooCommerce, Magento and PrestaShop; APIs available for other website platforms. |

| Selling tools |

|

| Payouts | In Revolut account within 1 working day. |

| Fees | UK consumer cards: 1% + 20p All other cards: 2.8% + 20p No contract, monthly fee from £0 |

| Link |

On all the business plans, you only pay 1% + 20p for consumer debit or credit card transactions if the card was issued in the UK. All other Mastercard and Visa cards incur a 2.8% + 20p fee (no other card brands are accepted).

You can send payment links directly from the Revolut app via text message, email or social app, whereafter the customer just needs to click on the link, enter card details and finalise the transaction. QR codes are generated on the screen for touch-free scanning, if the customer prefers this for the payment. The e-invoices allow you to create invoices with various, easy payment methods to suit the client.

A Revolut checkout can be deployed in your existing online store through a quick installation of a plugin. The plugin is so far only available for WooCommerce, PrestaShop, Magento, OpenCart and BigCommerce.

If you’re using another website platform and have the technical skill, you can implement the Revolut payment gateway there through APIs. Web developers can also customise the checkout experience thanks to these APIs.

Revolut’s multi-currency accounts are great for those receiving payments across borders. You can accept 14 different currencies via links and invoices, or more (25+) through the online gateway. Payments can go directly to the matching currency account to avoid conversion fees.

Pros

Cons

Adyen – excellent features for high-volume businesses

Adyen is a global online payments system used by many popular companies like Spotify, Booking.com and Etsy. It is geared towards high-volume businesses making at least £1.5-£2 million yearly who’d consider it their one and only payment system (including till sales, if that’s required). You can pretty much take any kind of payments online with Adyen, in any currency.

To be frank, you need to make at least £20k per month in online sales to make this worth the cost, because Adyen requires a minimum monthly transaction fees payment of €100/US$120. While there’s no setup fee, you have to pay Adyen a minimum of €500 as a deposit to sign up, which is returned when you close the account.

|

|

|---|---|

| Payment system | Card processing integrated with payment tools requiring coding and/or customisations. |

| Selling tools |

|

| Payouts | Batch payouts every day, twice a week, weekly, every 2 weeks, monthly or yearly. |

| Fees | Transactions: Variable fees depending on payment method (min. €100/mo required) Account deposit required: €500 No contract, no monthly fees |

| Link |

|

|

|---|---|

| Payment system | Card processing integrated with payment tools requiring coding and/or customisations. |

| Selling tools |

|

| Payouts | Batch payouts every day, twice a week, weekly, every 2 weeks, monthly or yearly. |

| Fees | Transactions: Variable fees depending on payment method (min. €100/mo required) Account deposit required: €500 No contract, no monthly fees |

| Link |

Transaction fees are typically between 0.2%-3% depending on the card being used (domestic debit cards are cheapest while premium cards from abroad cost more). There’s also a 10p gateway fee per transaction. Apart from a full choice of debit and credit cards, you can accept many alternative payment methods such as PayPal, Klarna and Amazon Pay.

With Adyen, you cannot easily set up payments without some degree of technical know-how. After signing up, you go through integration steps and customisation options. For example, an Adyen online checkout has to be installed manually on your website. The payment flow, layout, language, taxes, receipts and more are tailored by you, whether that’s for an online store checkout or the many different uses you can have for Adyen’s payment links. A payout schedule can be set via APIs, which obviously requires coding.

You can accept recurring payments like subscriptions, and gift cards if integrated with an external gift card provider. Although pay buttons can be added to messages, websites, social media and invoices, Adyen doesn’t have a way to manage email invoices or accept virtual terminal payments.

Overall, Adyen is excellent for custom solutions where you want a lot of influence in the style and payment flow of online transactions. It’s best managed with a developer on hand, but that also makes it highly scalable.

Pros

Cons

2Checkout – for global businesses and complex solutions

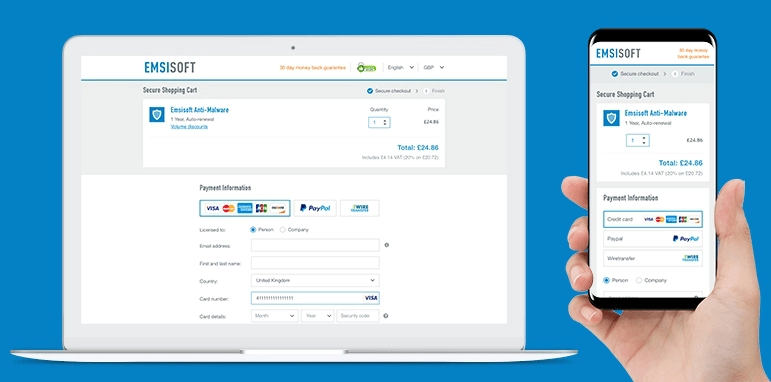

2Checkout (acquired by Verifone) was one of the first to offer online payments internationally. It works in 180+ countries, which opens up business to anywhere across the globe. The platform accepts many payment methods in over 120 different currencies and has the option to accept payouts in different currencies (normally, you can only settle transactions in your local currency).

Creating a 2Checkout account is done easily online with no setup fee. There are three main plans with no monthly fees: 2SELL with a 3.5% + £0.25 transaction fee, 2SUBSCRIBE with a 4.5% + £0.35 transaction fee, and 2MONETIZE with custom fees for card payments.

|

|

|---|---|

| Payment system | Needs to be connected with ecommerce software via integration steps or APIs. |

| Selling tools |

|

| Payouts | Weekly, every-2-weeks or monthly payouts in bank account. |

| Fees | Transactions: From 3.5% + £0.25 depending on plan Currency conversion: 2%-3% No contract, no monthly fees |

| Link |

|

|

|---|---|

| Payment system | Needs to be connected with ecommerce software via integration steps or APIs. |

| Selling tools |

|

| Payouts | Weekly, every-2-weeks or monthly payouts in bank account. |

| Fees | Transactions: From 3.5% + £0.25 depending on plan Currency conversion: 2%-3% No contract, no monthly fees |

| Link |

In order to receive payouts, you need to have at least £50 in your 2Checkout account on the two former plans or £100 on the 2MONETIZE plan. This “deposit” can make it a bit confusing to check how much you’ve been charged in transaction fees.

2Checkout takes a modular approach to features. This means you can add bundles of features related to subscriptions (recurring billing), global payments, tax and financial services, digital commerce and more. You can integrate the online gateway with over 120 ecommerce platforms for a custom checkout flow and access more tools on the two higher plans.

The subscription payment system is especially advanced, so 2Checkout is particularly useful for software-as-a-service (SaaS) businesses or other membership payment models.

2Checkout’s system is built for high-growth and large online businesses, but fees are pretty steep for card transactions. You’ll need to really benefit from the global sales tools and optimisations that the platform excels in to justify the charges.