Numerous iZettle reviews have mentioned the long list of positive benefits of the iZettle chip & PIN system for accepting credit and debit card payments, which is rapidly transforming the business landscape.

However, one subject that continually causes confusion and is the source of some negative iZettle review comments and feedback on various forums is the issue of iZettle transaction limits and the apparent confusion this causes among customers.

Why is there confusion about iZettle transaction limits?

The reasons for the confusion stems from three separate factors:

Firstly, the transaction limit depends on what type of account you have, i.e. whether it is a business account or a personal account; the second issue is how you enter the data from the card; and the third factor is which card reader you are using, namely whether you are using a chip and PIN reader or a chip and signature reader.

The transaction limits are in place for security reasons to help prevent fraud by ensuring that limitless amounts of money are not transacted using iZettle.

Two different systems: the chip & PIN is 2nd generation

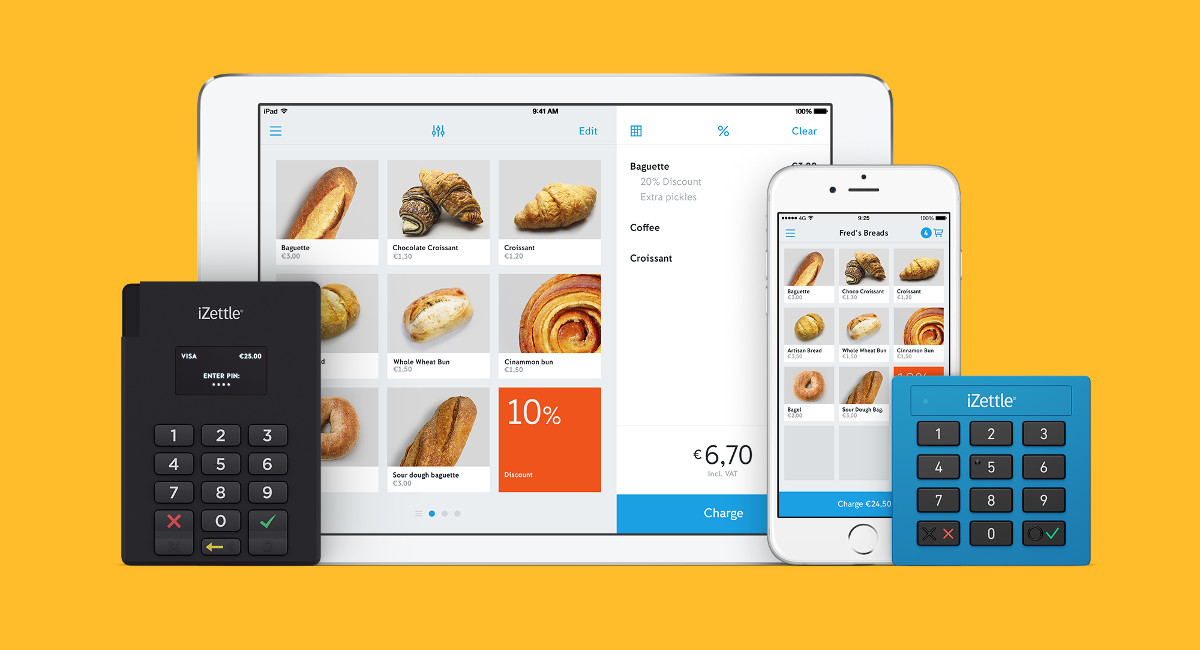

The reason for the two different readers lies in the fact that the iZettle chip & signature reader was the system that was initially launched. The system uses a card reader that is connected to the smartphone or tablet using the device’s audio jack and the transaction is confirmed by the customer’s signature.

However, initially there were some problems accepting Visa payments with the chip & signature reader, which were a result of the policy decision taken by Visa not because of any problem with the device. These issues were overcome when iZettle brought out the chip & PIN reader and iZettle is now part of the Visa Ready Program

Our more detailed review and comparison is based mainly on the iZettle chip & PIN reader, which is a better system for merchants because of the higher transaction limits and simpler method of accepting cards.

iZettle transaction limits: Chip & PIN reader

For the chip & PIN reader, the maximum limit for a business account is £200,000 per day with a £5,000 transaction limit per card and transaction.

For private accounts the limit is £3,000 per day with a per card/transaction limit of £1,500. This is fairly straightforward and the system accepts a large number of cards and these limits are the same for all accepted cards using the chip & PIN reader (see our comparison table in the link above).

iZettle transaction limits: Chip & signature reader

The transaction limits are more confusing for the chip & signature reader because there are different limits for MasterCard and Visa payments. For MasterCard payments the limits are the same as for the chip & PIN reader with the exception that the limit per card and transaction for a business account is £2,500 (compared with £5,000 for the chip & PIN).

There are much lower limits for Visa payments, however. For business accounts the daily transaction limit for the Chip & signature reader is £1,000 and for a private account £500. Both business and private accounts have a per card and transaction limit of £150.

Magnetic stripe entry: £100 limit for both systems

Both the chip & PIN and the chip & signature solutions have a limit of £100 per day and per transaction if the card’s magnetic stripe is used. However, this does not apply to Visa payments using the chip & signature reader, which has a per transaction limit of £150 as stated above.

Manual entry

There is also a £100 limit for manual entry of card details if a reader is not used at all. In this instance, the merchant needs to tap ‘Manual Card Payment’ after tapping Charge on the device and then the customer’s card number, expiry date and CVC code need to be entered before the customer is asked to sign on the screen.

Merchants should also be aware that in accordance with iZettle’s terms and conditions, iZettle cannot be used when the customer is not present – i.e. for ‘remote transactions’ such as sales over the phone.

Multiple devices – limit per account, not device

It is possible to have multiple iZettle devices linked to your account. In this instance the transaction limits are still tied to the type of account you have and not to the device.

One obvious point worth reminding merchants in addition to the above information on transaction limits is that customers will have their own individual credit card limits.