The editors at MobileTransaction have tested, researched and used Zettle’s products in real life for a decade to give an honest appraisal of the service. Our ratings are decided in relation to competing payment services in the UK, and opinions are the editors’ own.

What is Zettle by PayPal?

Zettle is most famous for its card reader that works in tandem with a clever mobile app, making it possible to take payments anywhere. You just need a tablet or smartphone with a WiFi or 3G/4G connection to use the Zettle Go app whilst connected with the card reader through Bluetooth.

The company was previously called iZettle with an ‘i’, but has been rebranded to Zettle by PayPal – or Zettle, for short.

“We’ve seen a gradual rebrand of Zettle to match PayPal’s branding even further, now with a blue Zettle logo and PayPal fonts in the Zettle Go app. Users are also forced to agree to PayPal’s terms and conditions now. This is not to everyone’s liking.”

– Emily Sorensen, Senior Editor, MobileTransaction

The system operates a pay-as-you-go model, which has been the main driver of the company’s popularity in the UK. You simply purchase the card reader, then use it however frequently or sporadically you need to. There’s only a fixed transaction rate for card payments accepted – no monthly fee.

Cards accepted

In addition to the app, merchants get payment links, gift cards, reporting and very basic sales analytics. The card reader accepts contactless and chip and PIN payments.

Zettle used to accept one of the broadest ranges of credit and debit cards among card readers in the UK, but SumUp now shares this privilege by accepting the same number of cards.

A newer touchscreen card machine, Zettle Terminal, was launched in October 2021. As a freestanding terminal, it comes with the Zettle Go software built in and a SIM card for mobile connectivity.

Our opinion

All things considered, Zettle is good for any small business looking for a robust, uncomplicated and highly affordable point of sale that does precisely what you need it to do. But we recommend that you’re aware of the constant changes to PayPal’s terms that you’re forced to agree to.

We know Zettle’s free app features have long been a draw for mobile merchants. The integrated barcode scanner, saved carts and payment links elevate what could have been just a basic POS app to a complete payment system for your business. Currently, only Square’s breadth of free POS features really compete.

In addition, the company accepts a wide range of cards at a transparent, low rate where it’s usually the norm for card processors to charge high fees on foreign or premium cards like American Express.

But we’ve also seen features being taken away from the Zettle app: email invoices and QR codes are now unavailable and require the PayPal Business app. Zettle is therefore not great for online payment options, particularly with the lack of keyed-entry card payments.

“Over the years, I haven’t personally had major system problems requiring support, but I know of people who often have issues connecting the app with the card reader – in which case the tap-to-phone feature is a handy backup.”

– Emily Sorensen, Senior Editor, MobileTransaction

The biggest downside to Zettle is probably the customer support which is not always available, and doesn’t always solve issues or respond. Most users don’t need support, though, as the system is easy to figure out and just (generally) works.

Pros

Cons

| Criteria | Verdict |

|---|---|

| Product Payments: Good / Excellent Hardware: Good / Excellent Software: Good |

Good / Excellent |

| Cost and fees | Passable / Good |

| Value-added services | Passable / Good |

| Contract | Good / Excellent |

| Sign-up and transparency | Good / Excellent |

| Customer service | Passable |

| FINAL RATING | [3.8/5] |

Compare pros and cons:

Is SumUp or Zettle the best option?

Costs and fees

As well as being transparent with no hidden costs, Zettle fees are on the low side compared with similar payment solutions.

The transaction fee is a fixed 1.75% for all chip and contactless transactions regardless of card type, brand, country of issue and sales volume, e.g. foreign and premium cards cost the same to process as domestic Visa Debit cards.

Payment links cost 2.5% per transaction.

| Charges | |

|---|---|

| Zettle Reader 2 | First one: £29 + VAT Additional ones: £59 + VAT |

| Zettle Dock 2 | £39 + VAT |

| Zettle Terminal | Without barcode scanner: £149 + VAT With barcode scanner: £199 + VAT With printer dock: £199 With scanner and printer dock: £249 |

| Shipping | Free |

| Monthly fee | None (no contract lock-in) |

| Chip, tap payments | 1.75% per transaction |

| Payment links | 2.5% per transaction |

| Payouts in bank account | Free |

| Refunds | Free |

| Chargebacks | Up to £250 chargebacks/month covered free |

The first mobile card reader is decent value at £59 excl. VAT, and then it costs £59 + VAT per additional reader – a big step up, which some users have complained about.

Zettle Terminal is more expensive at £149–£249 + VAT, including a SIM card with unlimited mobile data.

There are no monthly fees, rental charges, monthly minimums or other fixed costs that traditional payment providers normally charge. Since there’s no contractual commitment, early termination fees do not apply either.

Refunds are free to process, but you must have the full refund amount in your Zettle account balance (where money is held before bank account settlement is complete). It’s not possible to top this up from your bank account, but you can set a minimum balance to stay in the Zettle account at any given time or choose to settle in a PayPal Business account where you have more control over balances.

Merchants get chargeback protection for up to £250 per month if you follow best practice for taking card payments. So if, for example, a customer signs for a payment, you should compare the signature with the one on the card and ask for a valid ID.

There are transaction limits, but these are unlikely to affect most business accounts where the daily limit is £200,000. The lowest transaction amount possible is £1.

Payouts and access to funds

Transactions are cleared in your bank account within 1-2 working days, minus the transaction fee. The exact settlement time depends on your bank’s processing schedule. There’s no option to receive funds faster directly in the bank account.

You can, however, receive payouts in your PayPal account within minutes. This allows you to spend the money faster, particularly if you also have the PayPal Business Debit Mastercard.

With a Starling Bank business account (if setting funds there), you can get a detailed payout breakdown thanks to their partnership with PayPal.

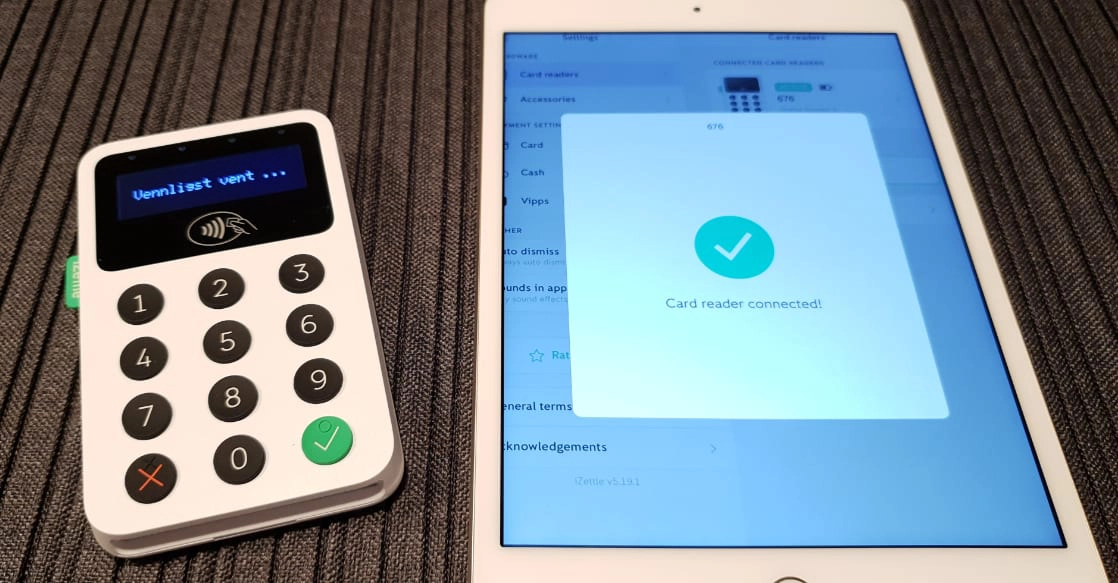

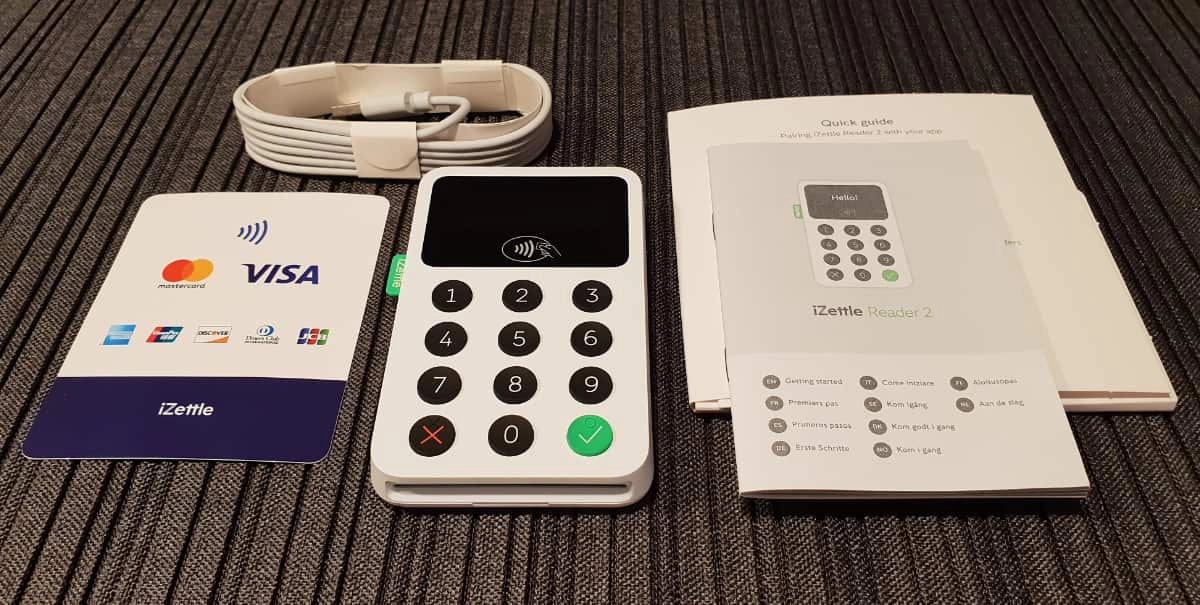

Photo: MobileTransaction

The card reader connects with a tablet or mobile phone via Bluetooth pairing.

You take a payment by entering an amount or tapping a product in the Zettle Go app and tapping “charge”. Transaction details are sent wirelessly to the card reader through Bluetooth. The customer inserts their card in the card reader and enters their PIN, or taps it with a contactless card or mobile wallet.

Zettle Reader 2

Zettle Reader 2 (initially iZettle Reader 2) was launched in November 2018. With the main distinguishable difference being the green button instead of a blue one, we consider it a minor upgrade from the first generation.

Zettle Reader 2 (initially iZettle Reader 2) was launched in November 2018. With the main distinguishable difference being the green button instead of a blue one, we consider it a minor upgrade from the first generation.

While the previous reader is still portrayed in some pictures, this review has been updated to reflect changes with Reader 2.

The latest card reader model, Zettle Reader 2, looks very similar to the old one but has some important improvements.

It is slightly prettier (in our opinion), more energy-efficient and with a coating that makes it more resistant to dirt. Beneath it, you have two rubber “sausages” to keep it firmly on a countertop. We sense it’s possible to just throw it on the ground without inflicting damage (of course we do not recommend trying this – we’ve seen examples of broken displays!).

We love the minimalist design and the fact it comes in white or black, giving you the freedom to pick one that blends in with your environment.

Photo: Emmanuel Charpentier (EC), MobileTransaction

It’s pretty straightforward to insert a chip card at the bottom.

Internet connection: To process a payment, the app connects to its servers using your mobile device’s WiFi, 3G or 4G connection. In the past, we’ve seen reports from users that they’ve had no problems using slower connections such as EDGE, so it appears the system is robust enough to work even on weak connections.

Mobile devices: In addition to the card reader and payment app, you’ll need a compatible iPhone, iPad or Android smartphone or tablet with Bluetooth switched on.

“In our experience, the Bluetooth connection with the card reader doesn’t always work and sometimes fails when it’s needed most. This has caused us lost sales and impatient customers – the last things you want when people are waiting in a queue.”

– Emily Sorensen, Senior Editor, MobileTransaction

We’ve noticed that new features tend to be released in the iOS app for Apple devices first. For example, it took some time before the Android app began supporting contactless payments, but features seem to find their way to both apps eventually.

Battery: The card reader is charged with a micro USB cable. It will automatically go into sleep mode when not in use, and the battery therefore lasts longer than older models that received complaints about short battery life. Battery life is on average 8 hours with a transaction every 5 minutes, or 250+ transactions from one charge.

Businesses selling from a fixed location would want to use the card reader with a Zettle Dock – a small stand with an inbuilt charger. Placed in the dock, the card reader is automatically charged. The Dock for Zettle Reader 2 is more stable than the old one which we found a bit flimsy.

Photo: EC, MobileTransaction

The power button at the top is hard to press by accident.

Accessories: Unlike chunky, traditional chip and PIN machines, Zettle Reader doesn’t have an inbuilt printer, so you have to buy that separately if you want to offer paper receipts. Fortunately, it’s compatible with a range of Star Micronics and Epson receipt printers, both stationary and mobile. The compatible printers connect either wirelessly or by cable.

Specific barcode scanners and cash drawers are also compatible, making it suitable for a busy, counter-based till point. Stationary iPad setups will also benefit from the Zettle tablet stand, which – apart from protecting the iPad – gives a professional feel to your customer-facing environment.

Taking payments with Zettle Reader: what you should know

Before accepting the first payment, Zettle Reader has to be paired with a Bluetooth-enabled mobile device. This is done by following simple instructions in the app. You may have to repeat the Bluetooth pairing several times over a day if you’re not using the payment app actively (like we had to do). Sometimes, this doesn’t work at all, which is what happened to us. You can avoid this completely by using Zettle Terminal that has the software built in.

Those who need to accept multiple payments of the same amount quickly, for example street musicians or charity fundraisers, can request access to a Repeat Payments feature in the iPhone (not Android) app.

Repeat Payments allows you to bypass that annoying step of entering an amount and payment method every time someone wants to tap a card. Instead, a fixed amount is automatically charged via contactless or chip-and-PIN, customer after customer without your input, whilst you play your song or do your work.

Zettle Terminal: standalone card machine

The latest card machine model called Zettle Terminal (from £149 + VAT) works without a phone or tablet, because it has a built-in SIM card (unlimited data is included free) and touchscreen so you can use the Zettle app directly on the device.

Although advertised as having the same features as the card reader app, we noticed several features that are missing on Terminal during our tests. This includes the search field for finding an old receipt, gift card overview and certain detailed settings.

The new Terminal accepts chip and contactless cards, but the PIN pad is shown on the screen in place of a push-button keypad. You can purchase the card machine on its own or with a dock that prints receipts and charges the terminal when placed in it.

Photo: Emily Sorensen (ES), MobileTransaction

Zettle Terminal feels like a smartphone.

My favourite part is this: the handheld card machine works directly through WiFi, or 3G and 4G when there’s no wireless internet connection. If you – like me – have had Bluetooth connectivity issues with Zettle Reader, the biggest advantage of Terminal is the fact you don’t need to link it with a phone. It simply works, as long as the mobile network or WiFi is there.

Its 5″ touchscreen interface and small size give it a smartphone feel, making it perfect for table-service, queue-busting and market stalls.

The battery lasts around 12 hours with average usage, 4-6 hours if used intensely or less with the display brightness on max. For an energy-hungry touchscreen device, this is not bad.

POS app features

The free point of sale (POS) app, Zettle Go, has enough features to work as a self-sufficient till system. Most – not all – of the below features of the mobile app are also included in the Zettle Terminal software.

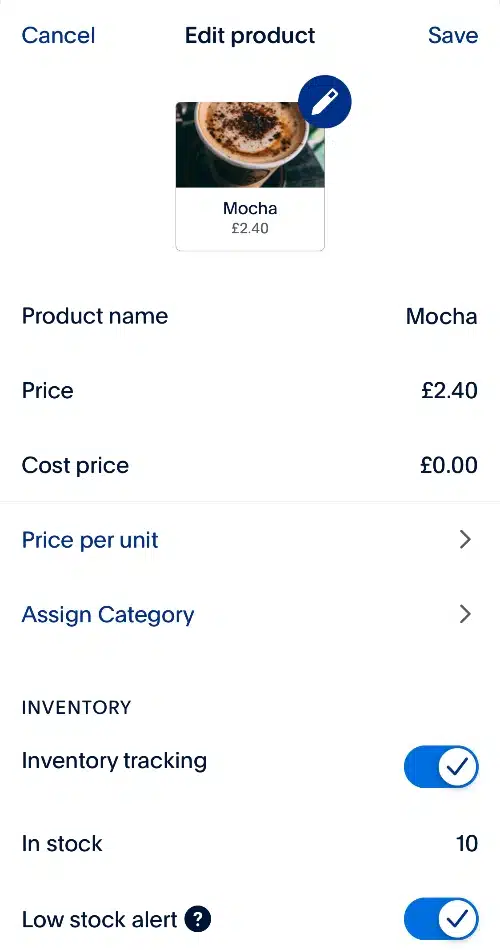

Image: MobileTransaction

You can track inventory and get alerts when stock levels are low.

Product library and inventory: Inventory items can be added with names, prices, descriptions, stock counts, barcodes and images. Tapping a product in the app adds it to the checkout bill. The app’s inventory section and low stock alerts help you monitor stock levels.

VAT and discounts: VAT can be added to receipts at the rates of 20%, 12.5%, 5% and 0%, and customised discounts can be applied to individual products or the transaction total as a percentage or amount in pounds.

Accepting cash: Cash sales can be registered in the app to make the system more useful for accounting. If you’re selling at a fixed till point, you can connect a cash drawer with a standard 24V or RJ11 plug, but it needs to connect to a receipt printer to open.

Refunds: Refunds can be processed for the full transaction amount or individual items on a receipt, but not for tips.

Tipping: The tipping option will please food and drink businesses. You only need to enable this in your settings, then customers will be asked directly on the card reader display if they want to add a tip.

Receipts: After each transaction, there’s an option to send an e-receipt via text or email. Printed receipts require a compatible receipt printer.

Saved carts: We noticed Zettle has added an option to save a bill, attached to a description or table number (despite there being no table plan in the app) – useful for busy venues. When the customer is ready to pay, you can then open the transaction and complete the payment.

Image: EC, MobileTransaction

If you’re going to scan barcodes, it’s easiest to get Zettle Terminal with a barcode scanner built in.

Barcode scanning: Use your phone camera as a barcode scanner, eliminating the need for a separate scanner. We tried this on iPhone, and it works smoothly. There is currently no option to use the scanner for internal audits, so this is purely for scanning items at checkout (barcodes should be registered in the product library beforehand).

Tap to Pay on iPhone/Android: If the card reader stops working, you can get customers to tap on your mobile device with their contactless card or mobile wallet to accept a payment. Essentially, your smartphone is turned into a card reader with the help of its built-in NFC (contactless technology). Our own use of this has proven quite handy when all we had was a phone.

In the backend Zettle account in a browser, you have some extra features not available in the app. For example, the Customers section shows email addresses so you can invite customers to join your mailing list, and you can add staff members with different logins to separate their sales in the analytics section.

Payment links: the only online payment option

Zettle has a pay-by-link option: the ability to send a unique link via text or apps (e.g. Facebook Messenger, email, WhatsApp), which the customer can click to pay through from their end.

Payment links are different from email invoices because they only register in your system once they are paid. There’s no payment due date and the customer is not obliged to pay.

The only information the seller needs to enter before requesting a payment is the name and contact details of the customer.

Payment links have proven to be a flexible tool for cafés and restaurants to get paid for takeaway orders, but retailers and online sellers can use them too to get customers to pay a deposit or for picking up an item later.

Email invoices and PayPal QR codes used to be available in the Zettle Go app, but PayPal has removed these for new sign-ups. You’ll have to use those features via the PayPal Business app, which is part of the company’s move to win more merchants over to PayPal.

POS integrations and ecommerce

Many small businesses will find the free POS features sufficient, but Zettle Go is not the only POS system that can be used with the card reader.

More advanced POS systems for both retailers and hospitality are available through integrations. You can, for example, use the reader with Loyverse, Lightspeed Retail and Tabology. These have monthly costs.

Ecommerce integrations are available including BigCommerce, PrestaShop, Shopify, Shopware, ePages and WooCommerce. This allows your inventory and products to automatically sync between the in-store and online shops.

Photo: ES, MobileTransaction

Zettle is popular among small beauty salons and hairdressers, here pictured at Beaut Box, London.

All transactions are recorded, and full sales reports are always available, including cash sales if you’ve accepted these from the app.

Free analytics are included to help keep track of inventory and identify repeat customers, as well as helping to spot business trends, such as revenue growth and top-selling products. Compared with Square’s comprehensive free analytics, however, Zettle’s are quite basic.

All reports can be exported to Excel and CSV files. Those who require advanced features can integrate with the cloud-based accounting and invoicing systems Xero, ANNA or QuickBooks Online.

Integrate with Xero

Zettle data can be fed into Xero automatically. Offering all the standard features of a cloud accounting system, such as a live view of your bank balance, Xero also includes payroll functions.

Read more: Xero integration with Zettle

Who is it best for?

The Zettle platform is suitable for most trades and sectors. It’s used by a range of merchants from plumbers to barbers, retailers, street vendors, hairdressers, beauty parlours, taxi drivers to coffee shops and pubs.

The mobility of the payment terminals means it excels at trade fairs, markets, pop-ups and car boot sales. Many sole traders use the reader, but since the app allows for unlimited users with restricted permissions, it is equally suitable for businesses with employees.

It is, however, a fairly basic till system that is not sufficient for advanced inventory management or full-service restaurants.

The free Go app doesn’t yet offer table layouts or split tenders usually required by restaurants, but features suit many smaller food-and-beverage outlets such as cafés. The card reader is actually thriving in this sector, in part because you can integrate with more comprehensive restaurant EPOS.

Out of the free till apps on the market, Square has the most features and would therefore be the best alternative for the till. There is also SumUp that is much faster at launching new features like online payments, a business account and ecommerce, but its POS features are more basic than Zettle’s.

Both SumUp and Square have been adding more features over the last years than Zettle, who appears more cautious about launching new products and features.

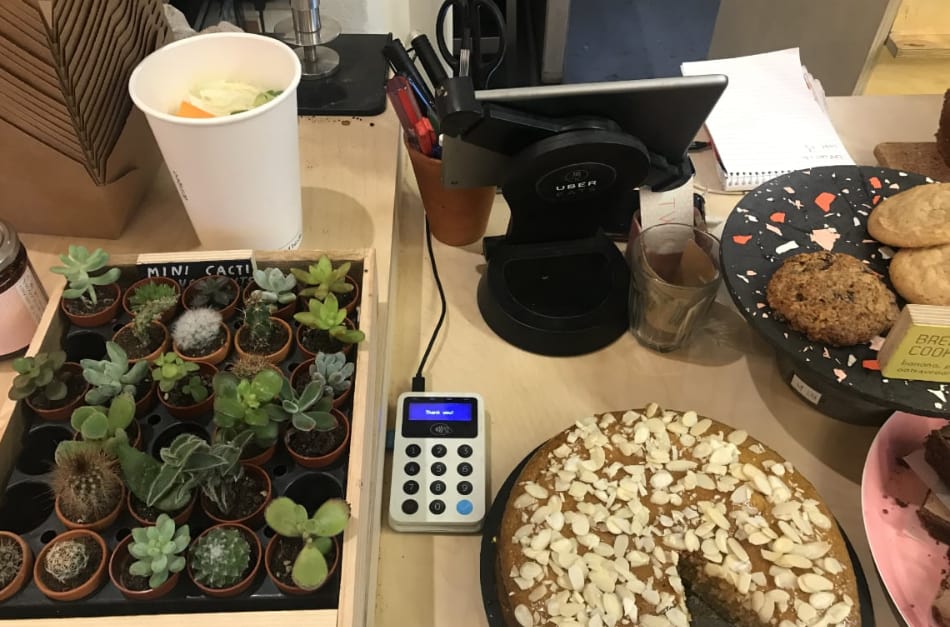

Photo: ES, MobileTransaction

Zettle is a frequent sight in independent, British cafés – here pictured at Twigs Hackney, London.

That being said, Zettle Reader has long been the preferred card reader given its ergonomic design and easy-to-use app. Merchants may simply prefer this over competing card readers.

Payment links are the only way to sell without the card reader or customer being present, so businesses who need to take orders over the phone have to look for alternatives.

Like any other payment company, Zettle prohibits certain services and products from being sold through them. We recommend checking whether your business falls under any of these areas.

Customer support and Zettle reviews

Zettle’s customer service team is available to contact between 9am and 5pm on weekdays. You can phone or email them but will only get a response during those opening hours. It may take several days to receive a reply for non-urgent queries via email, so we recommend calling them during office hours for a faster response.

There is also a decent online help section answering most questions that users have.

The company on average ranks highly in customer reviews. Reviews in the App Store average 4.6 stars out of 5 (based on 10k+ ratings) and 3.2 stars out of 5 in Google Play (based on 42k+ ratings). On TrustPilot, Zettle’s average rating is just 2.9 out of 5.

Recent complaints highlight a lack of responses from customer support, account holds, missing features on Zettle Terminal and ‘dark mode’ being removed in a recent update without warning.

Several users complain about not being able to refund customers when there are not enough funds in their account balance, or they have to pair the reader with the app several times a day, implying the Bluetooth connection is not consistent.

Signing up is easy

In contrast to the strenuous application processes required by traditional payment processors, you just go to Zettle’s website to submit basic details to get started.

A “unique risk assessment” involving a credit check is initiated to verify your identity, business and bank account. Only bank accounts in your company’s or company director’s name will be accepted. Charities, sole traders and partnership businesses may need to submit additional documentation.

When we tested registering as a sole trader, the automatic checks went smoothly without the need to submit more information.

We should emphasise: you can only have only one account per business or sole trader, so if you’ve already registered your name or company with Zettle, it won’t be possible to create a new account under that name.

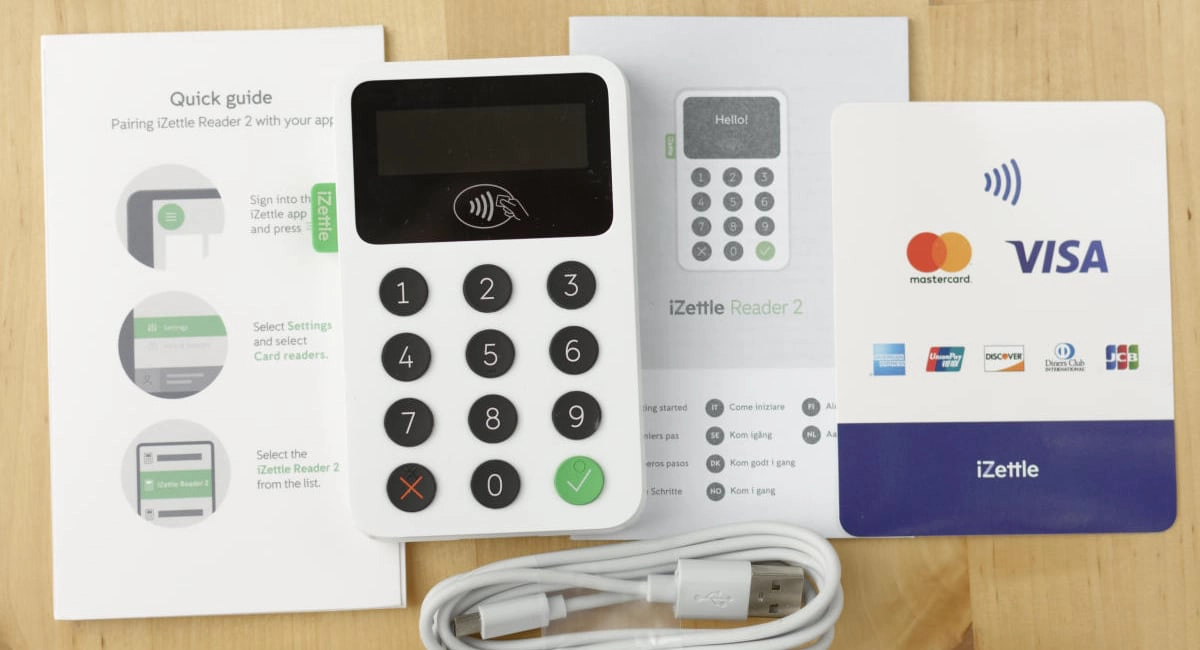

Photo: MobileTransaction

Box contents of a Zettle Reader 2 delivery.

After the sign-up, you can order a card reader. It usually takes 1-3 working days to receive this by post. We got it two days after placing the order. DHL sent us a text message the day before, saying when it would arrive and that a signature will be required. The package was neatly wrapped up in a padded envelope, and the card reader was ready to use immediately.