- Highs: No ongoing fees, just a transaction rate. Simple setup. Can send links from mobile app. QR code payments possible.

- Lows: Can’t customise checkout page. Can only refund payments and access link overview in app.

- Choose if: You want to start taking remote payments quickly without paying a premium for it.

| Charges | |

|---|---|

| Payment Link transactions | 2.5% |

| PayPal QR code transactions | 1.75% |

| Contractual lock-in | None |

| Monthly fee | None |

| Payouts | Free |

| Refunds | Free |

| Chargebacks | Up to £250 chargebacks/month covered for free |

| Charges | |

|---|---|

| Payment Link transactions | 2.5% |

| PayPal QR code transactions | 1.75% |

| Contractual lock-in | None |

| Monthly fee | None |

| Payouts | Free |

| Refunds | Free |

| Chargebacks | Up to £250 chargebacks/month covered for free |

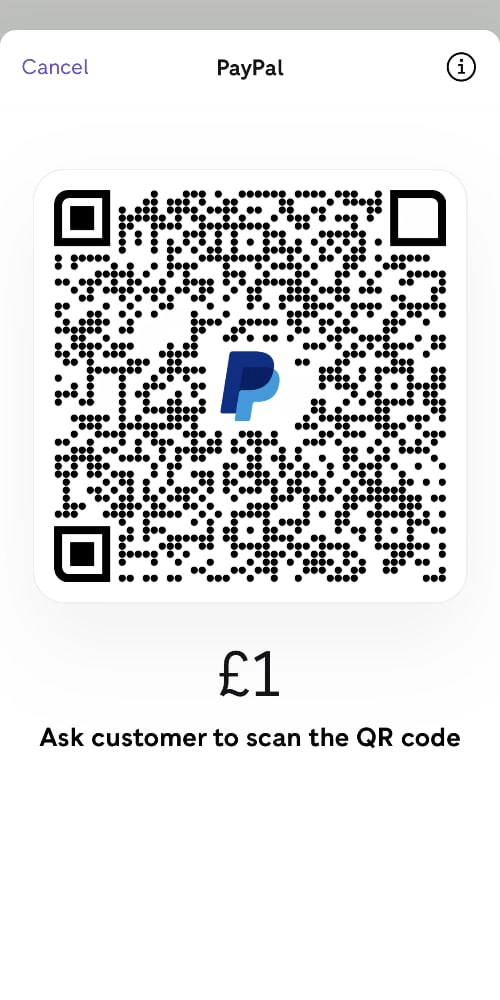

The Zettle Go app also lets you generate a QR code for transactions, only payable through the customer’s PayPal app. These QR code payments cost 1.75%.

There’s no contractual commitment or monthly minimum turnover required, no monthly fees or charges for setup or payouts, so it is a true pay-as-you-go solution with just the transaction charge. Up to £250 worth of chargebacks per month are also covered without an admin charge.

All transactions automatically settle in your bank account within 1-2 working days. The lowest transaction amount Zettle allows is £1.

Refunds are free, though these can only be processed while enough money is underway to your bank account (i.e. it is best to do it within a day of the transaction). If there is not enough money currently transferring to the bank account, you won’t be able to make the refund until next time Zettle is processing money for you.

Alternatively, you can set a “minimum account balance” ensuring a chosen amount of money is always available for refunds, but then this money is held by Zettle until you choose to transfer this balance to the bank account.

Sign-up process

To start taking payments with Zettle by PayPal, you need to create an account through a short online form on their website.

Basic personal, business and bank account information should be filled in. After submitting, it takes a few working days for your bank account to be approved and connected with the payment system. Only registered businesses, sole traders and self-employed can use the payment system, not private individuals.

You can send links and accept payments even while waiting for the bank account to be connected.

How it works

To send a Payment Link with Zettle, first download the Zettle Go app from the App Store (on iPhone and iPad) or Google Play (Android phones and tablets). Log into the app with your email address (username) and password created during sign-up. ‘Send links’ has to be enabled in app settings for this to work.

There are two ways to create the bill for the payment link:

- Enter a total transaction amount along with a description of the purchase, which could be the products sold or payment reference.

- Add items from the product library to the bill – this will itemise the receipt.

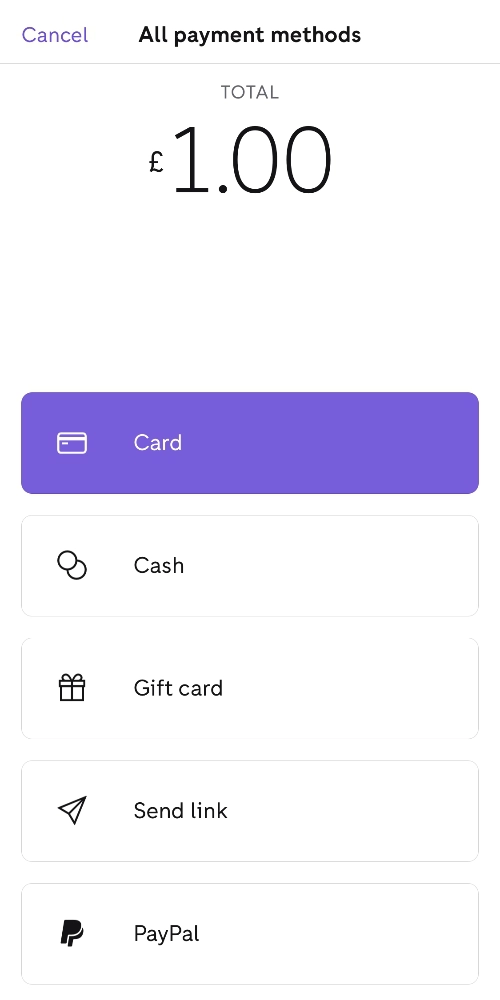

When the payment total or itemised bill is ready, tap ‘Charge’ and choose ‘Send link’ as payment method.

Payment methods: pick ‘Send link’.

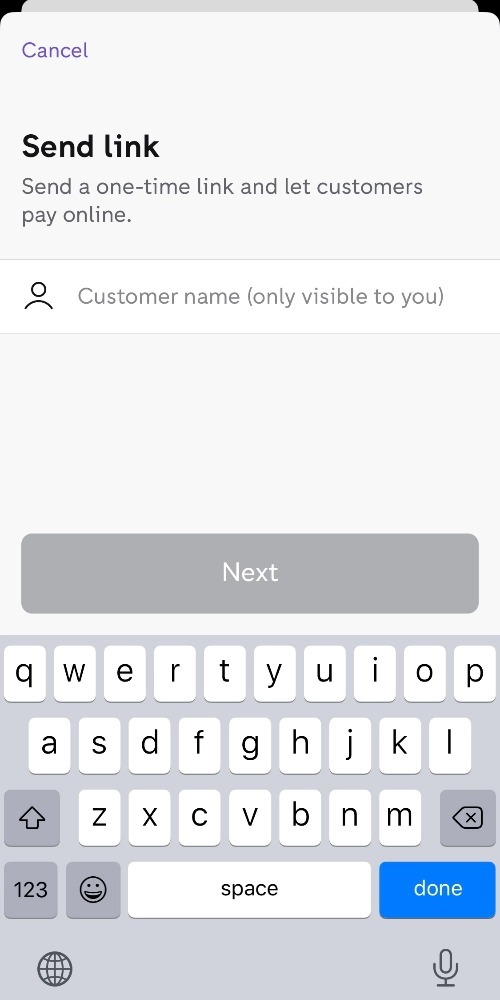

Enter recipient name or reference.

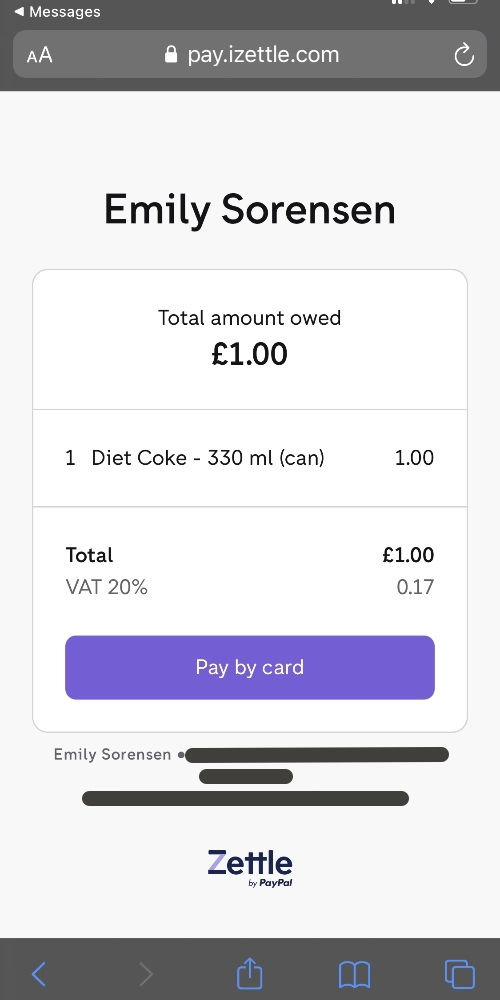

Send as SMS or share through an app.

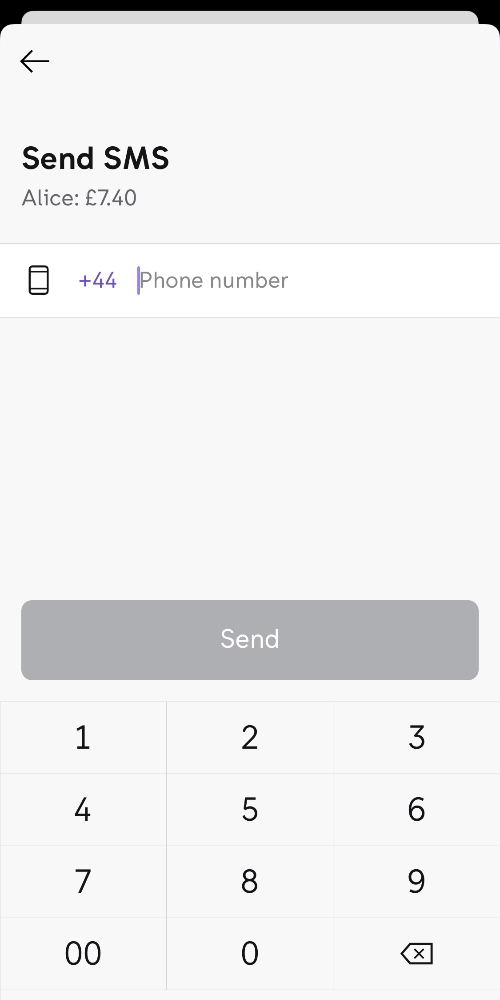

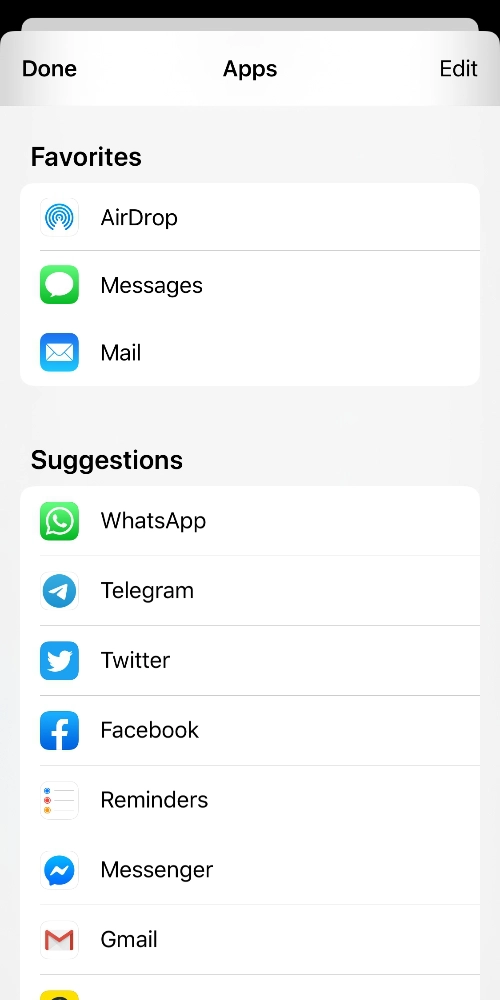

You can then choose between sending the link as a text message to any mobile number in the UK, or share it via one of your social apps on your phone. If you choose the latter, you have quite a lot of freedom to customise the message once the link is pasted into the app, plus you’re able to send it anyone in the world. Choosing to send by SMS limits you to UK-based recipients.

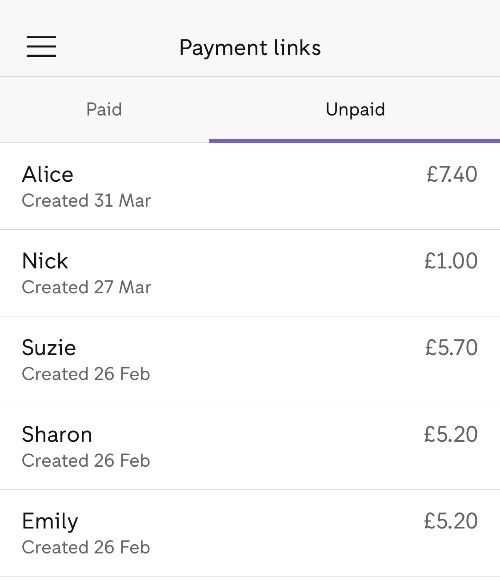

In any case, the link generated will be unique to this transaction and can only be paid for once. If you want to cancel the link before a payment is processed, you can delete it in the Go app under the ‘unpaid’ links overview.

If you are planning on sending lots of payment links with personalised content through email, messaging apps or social media, you will need to add this content from scratch every time a link is sent. This could be fast if it’s a simple copy-and-paste job, but potentially fiddly if you want more than just plain text.

On the other hand, sending links through an app or email allows you to write a message for specific individuals, which can be particularly valuable for over-the-phone payments where you need to include a personal instruction.

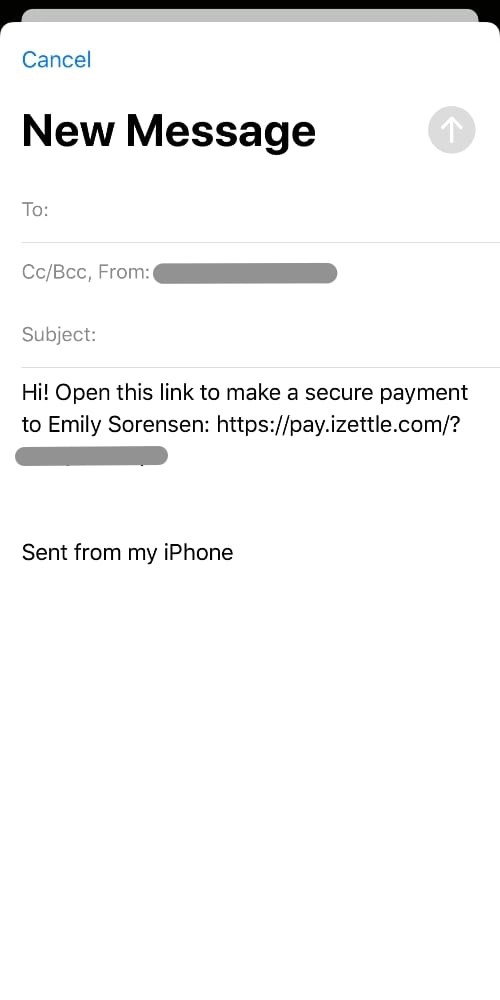

Send it as a text link to any UK mobile number.

Or share it via a social app on your phone.

If email is chosen, you can edit the content.

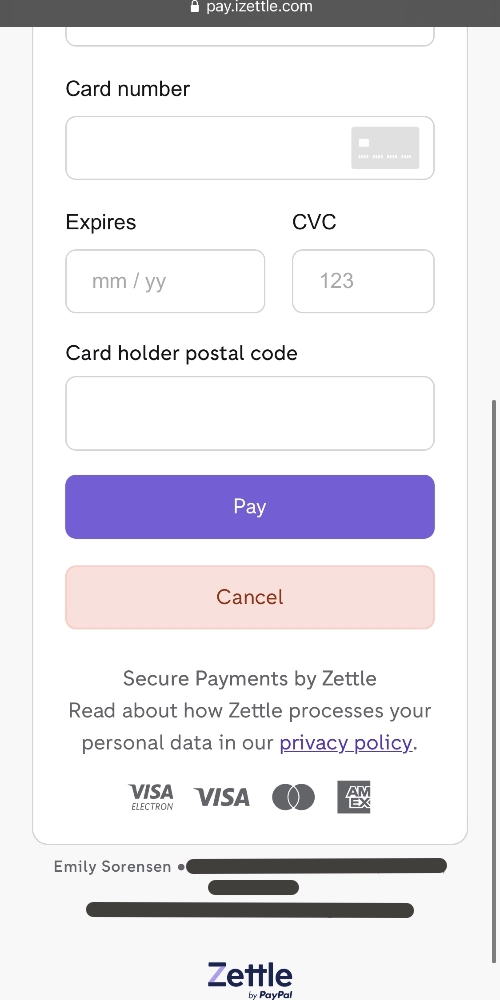

The customer will receive the link and can pay the transaction total any time with a Mastercard, Visa or American Express card. Once it is paid, the link will be deactivated. No card details will be stored. The customer is able to view an electronic receipt via a link they receive.

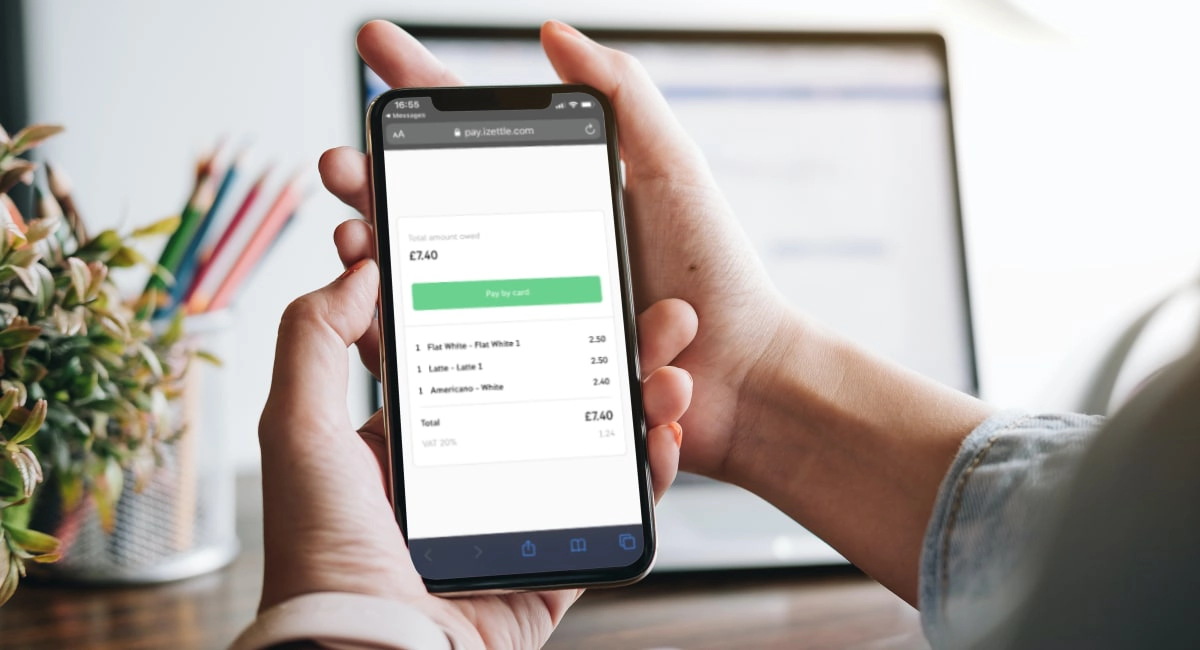

iZettle payment links by text.

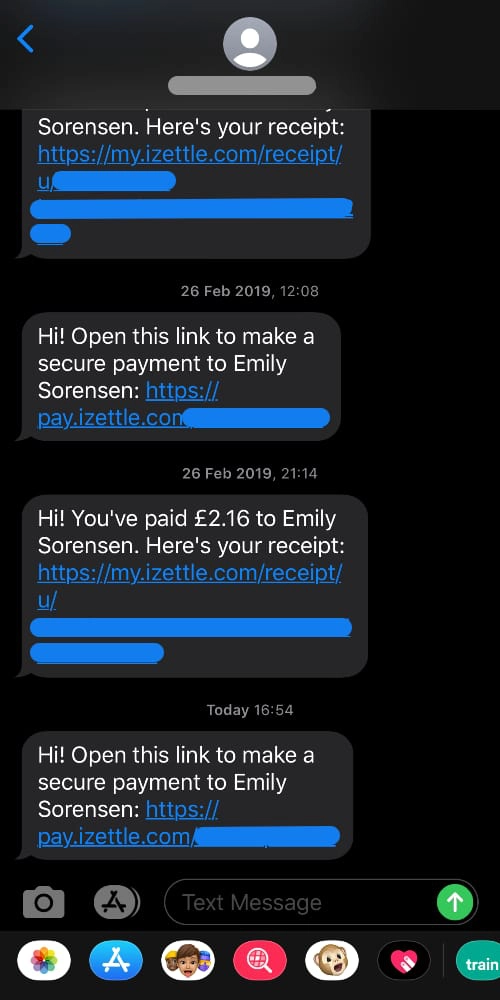

Payment links open up a browser page with the bill.

Checkout page where card details are entered.

Your business name and address are included on the payment link page, as are the items added from the product library if that’s how you created the bill. You can’t personalise the checkout page, but additional information can be added to customer receipts.

Zettle by PayPal QR code.

- After selecting PayPal in payment methods, a QR unique code is displayed on your screen.

- The customer opens their PayPal app and scans your QR code with their phone camera.

- The customer’s PayPal app shows the transaction and asks them to approve it.

- After approval, a payment confirmation appears on your screen.

These transactions are processed through PayPal, so the transaction fee is different (normally 1.75%) from payment link fees (2.5%).

Zettle by PayPal QR codes require scanning from the POS app, are unique to each transaction and cannot be printed, so they are mainly suitable for touch-free transactions in person. Moreover, they require the customer to pay through PayPal, which only suits some people.

What are Zettle Payment Links best for?

The quick startup and no lock-in make Zettle Payment Links great for getting up and running with card not present transactions in no time. iZettle has traditionally aimed to make payments easy for entrepreneurs, small businesses and low-volume merchants alike, which is certainly achieved with the free app and simple fee.

Cost-wise, Zettle’s fixed transaction rate for payment links is best for businesses making less than £2,000 monthly, as you may be able to get better rates for cardholder not present transactions with other providers.

That being said, if you just need to accept payment links temporarily or during some seasons, the lack of requirements to process a certain amount each month makes this a good deal that avoids the ongoing costs seen elsewhere.

The Go app works for both retail and food-and-drink, and using payment links is a natural extension to these sectors. But really, most merchants could use Payment Link as its generic functions can be adapted to so many payment request situations. For example, you can secure bookings, take deposits, close sales online and sell from a shop on the phone.

Professionals who are more used to detailed invoices with a due date and client information should look at Zettle’s invoicing.

Need email invoices? Here are the top invoice apps:

6 invoicing apps for UK businesses

POS features that work with payment links

Although Payment Links deserved this review on its own, we should not neglect the additional features that complement this payment method through the Zettle Go app:

Product library: If you’re selling physical products, we cannot underestimate the ability to create a product library with images, categories, variants, stock levels, SKU and more. In the app, you just tap the products to add to the bill, and the payment link’s checkout page will then display the itemised bill.

Discounts and VAT: Include VAT for products, and add % or £ discounts to either individual products or transaction totals.

Receipts: Customers can view an electronic receipt for paid transactions. This can be customised with a website URL, email address, phone number and additional written note. Your business name and address are automatically displayed.

If you need to send bills for businesses or detailed goods, you may want to try Zettle Invoices for the same transaction fee. To send an email invoice, pick this as the payment method at checkout and enter the customer details as required. This allows you to set a due date, as opposed to payment links that, casually, have limited payer information.

Reporting

All payment through Zettle are stored in the cloud, enabling you to view transactions and sales reports in real time from any internet browser or the Zettle app (depending on the information required). Sales reports can be exported to CSV and Excel files, or you can integrate Zettle with Xero or QuickBooks for advanced accounting features.

Overview of links in iZettle app.

As for Payment Links, you only get a collated overview of these in the app. To view the payment links that are paid and unpaid, you go to the Payment Links section via the side menu in the app. This is also where you refund Payment Link transactions (you cannot do this from the account in a browser).

Your backend Zettle account in a web browser can analyse sales trends, top-selling items (if using the product library) and revenue growth, identify repeat customers as well as keep track of inventory.

Customer support

All Zettle customers can contact the support team by email or phone every working day between 9am and 5pm.

Normally, the email responses can take a few days for a reply to non-urgent matters, so we recommend phoning the team if there’s a pressing matter.

Overall, the customer service is good for a low-cost payment service like Zettle, and the company has long received good reviews from businesses across the UK.

Alternatives: Best pay-by-links for small businesses in the UK

Our verdict

Out of all pay-by-link solutions in the UK, Zettle Payment Link is among the best for convenience and value on a low budget.

As shops, restaurants, bakeries and others are adapting to deliveries during the Covid-19 pandemic, Zettle’s Payment Link can be an invaluable stop gap to keep your business going in the short-term or longer run.

If you are planning to use cardholder not present links for payments in the long term, it would be worth checking alternatives with ongoing fees to suit a consistent sales volume above £2,000 per month.