Invoicing software has come a long way in Ireland. Not only do tradespeople, businesses and sole traders send digital invoices online (as opposed to snail mail) – many prefer to do it from a mobile app, which is what we will be looking at.

To complicate matters, invoice apps in Ireland are not always advertised as such. Apart from a few dedicated invoicing companies, you could be looking at apps from:

- Accounting systems

- Payment providers

- Digital business accounts

What’s more, some are only worth the price for high-turnover companies while others are free or worth the cost for cash-strapped sole traders.

We’ve tested and researched the most viable of these solutions, looking at the things that matter for small businesses. This includes payment options, features that get you paid faster, and easier billing management on the go.

Compare the best invoice software in Ireland for a small business:

| Invoice app | Costs | Best for | To site |

|---|---|---|---|

|

€0 or €20*/mo 2.5% + VAT /transaction |

Free invoice app with many extras | |

|

From €0/mo 1%-2.8% + €0.20 /transaction |

Easy for business account holders | |

|

€0-€8*/mo 0.99%-1.69% /transaction |

Low fixed rate, with business account | |

|

€4.17-€32.99*/mo 1.9%-3.9% + €0.25 /transaction |

Dedicated, modern invoicing app | |

|

€15-€31*/mo 1.5%-3.25% + €0.25 /transaction |

Sole traders and startups with accounting needs | |

|

Free feature From 3.4% + €0.35 /transaction |

Sole traders looking for convenience | |

|

US$29-$69*/mo 1.5%-3.25% + €0.25 /transaction |

Those relying on Xero for accounting |

*Excluding VAT.

| Invoice app |

Costs | Best for | To site |

|---|---|---|---|

|

€0 or €20*/mo 2.5% + VAT /transaction |

Free invoice app with many extras | |

|

From €0/mo 1%-2.8% + €0.20 /transaction |

Easy for business account holders | |

|

€0-€8*/mo 0.99%-1.69% /transaction |

Low fixed rate, with business account | |

|

€4.17-€32.99*/mo 1.9%-3.9% + €0.25 /transaction |

Dedicated, modern invoicing app | |

|

€15-€31*/mo 1.5%-3.25% + €0.25 /transaction |

Sole traders and startups with accounting needs | |

|

Free feature From 3.4% + €0.35 /transaction |

Sole traders looking for convenience | |

|

US$29-$69*/mo 1.5%-3.25% + €0.25 /transaction |

Those relying on Xero for accounting |

*Excluding VAT.

Features we strongly recommend in invoice apps

The main purpose of invoices is to get paid for services or products by a specific date.

Having used invoices for years, the two things in apps we’ve benefitted from most are:

- Integrated payment options – A link to paying by card online, easy bank transfer or PayPal on the invoice makes it much more likely that the customer settles the bill straight away.

- Payment reminders – Often, it doesn’t take much to prompt a faster payment. Reminders to pay can be automated, taking the burden out of emailing clients to remind them of upcoming or overdue payments.

If you only provide bank account details and expect clients to manually transfer the money, they may postpone paying.

Additionally, we think it’s important to use an invoicing app that’s properly supported in this country. Some global invoicing solutions work in Ireland, but don’t have a phone number or understanding of local tax rules.

Apart from those things, the features we recommend most are the ones you will use. Different trades and companies have their own internal processes, so see what works for you and how the app suits your bookkeeping system and budget.

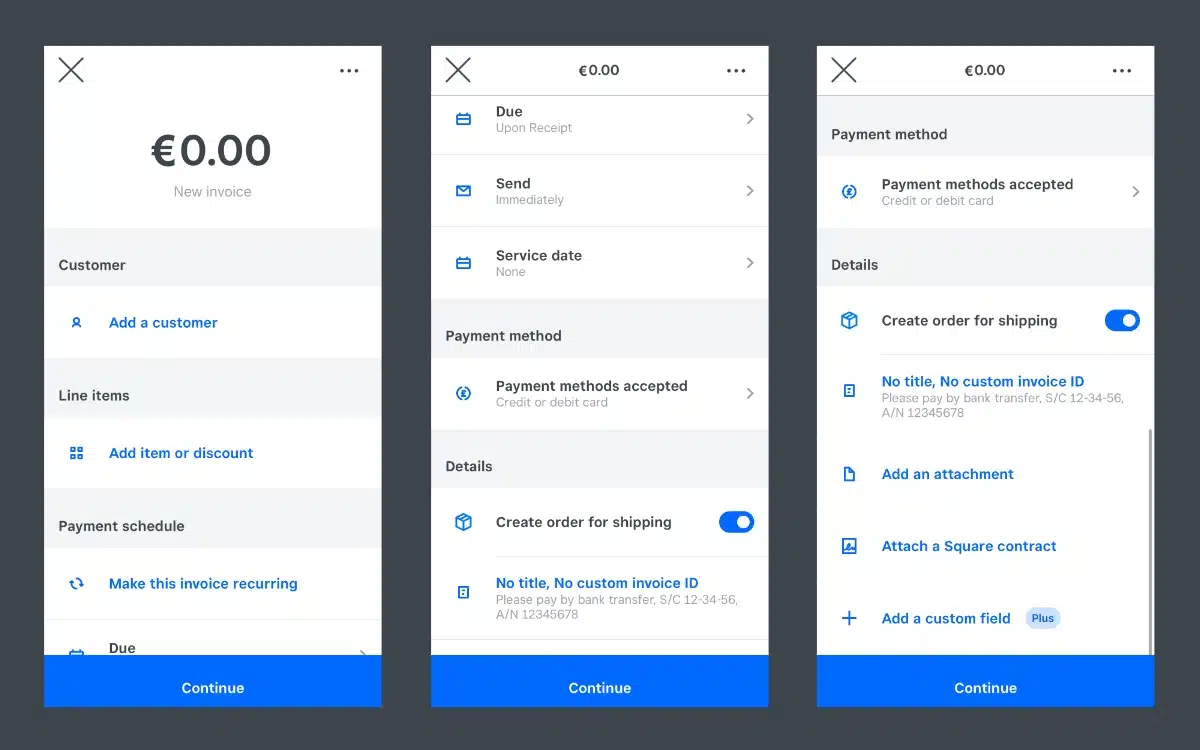

Square – best free app in Ireland for all business types

Out of all the apps we’ve tested, Square Invoices is the best free invoice app in Ireland. It’s very easy to sign up and use, and you can accept card payments directly through the invoice for 2.5% + VAT per transaction.

“Square offers one of the easiest, fastest ways to get started with invoicing that we’ve tried. The main downsides are the transaction fee (bit high for Irish cards) and monthly fee for certain features other apps might include for less.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Many of the app features are free, including unlimited invoices. You only pay when the client pays online through the link in the email invoice. The paid Plus subscription has additional features, like custom layouts and organising project files into folders.

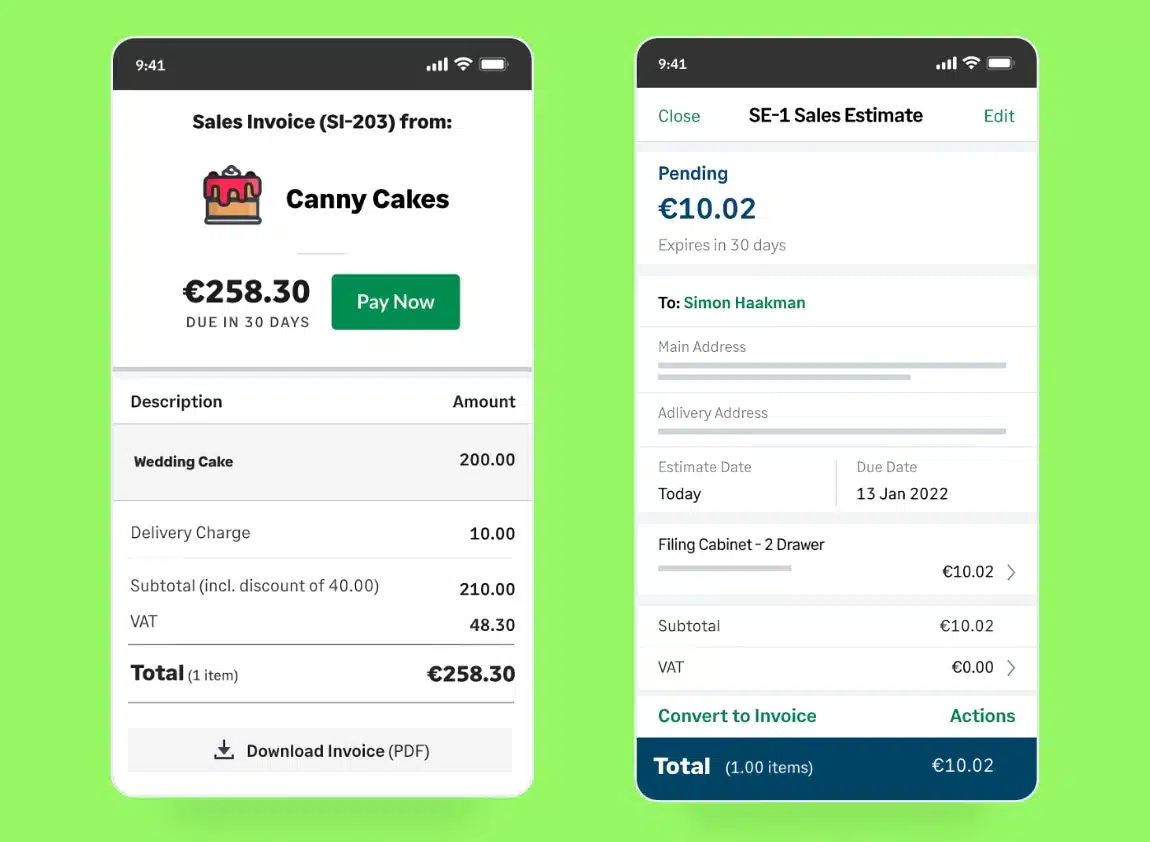

Image: Mobile Transaction

Square invoices can be tailored in many ways from the app.

Payments are deposited in your bank account within 1-2 business days. After registering via the simple online form, Square performs identification checks to verify your business and bank account.

It can take a few business days for your bank account to link up, but invoices can be sent straight away.

On the paid plan, the app allows you to send estimates converting into invoices when the client accepts the quote. You can also set up recurring invoices, invoice tracking and deposit requests. If the client does not pay directly through the invoice, you can mark it as paid with cash, gift card, bank transfer or another method.

Pricing

Monthly cost: €0 (Free plan), or €20 + VAT (Plus plan)

2.5% + VAT per card transaction

Existing users of Square Reader can already send invoices through the Square Point of Sale app for the same fee. You can even accept invoice payments directly through the invoice app with the card reader for the lower fee of 1.75% + VAT.

Integrated payments: Square (Visa, Mastercard, American Express)

Best for: Most accessible invoicing software for tradespeople who want flexible app features.

Revolut – just enough advantages to make it great

Revolut is quite popular in Ireland, so for many, it’s actually the easiest way to send invoices. You just need a free Pro (for freelancers) or paid Business (for companies) current account and the respective app for it.

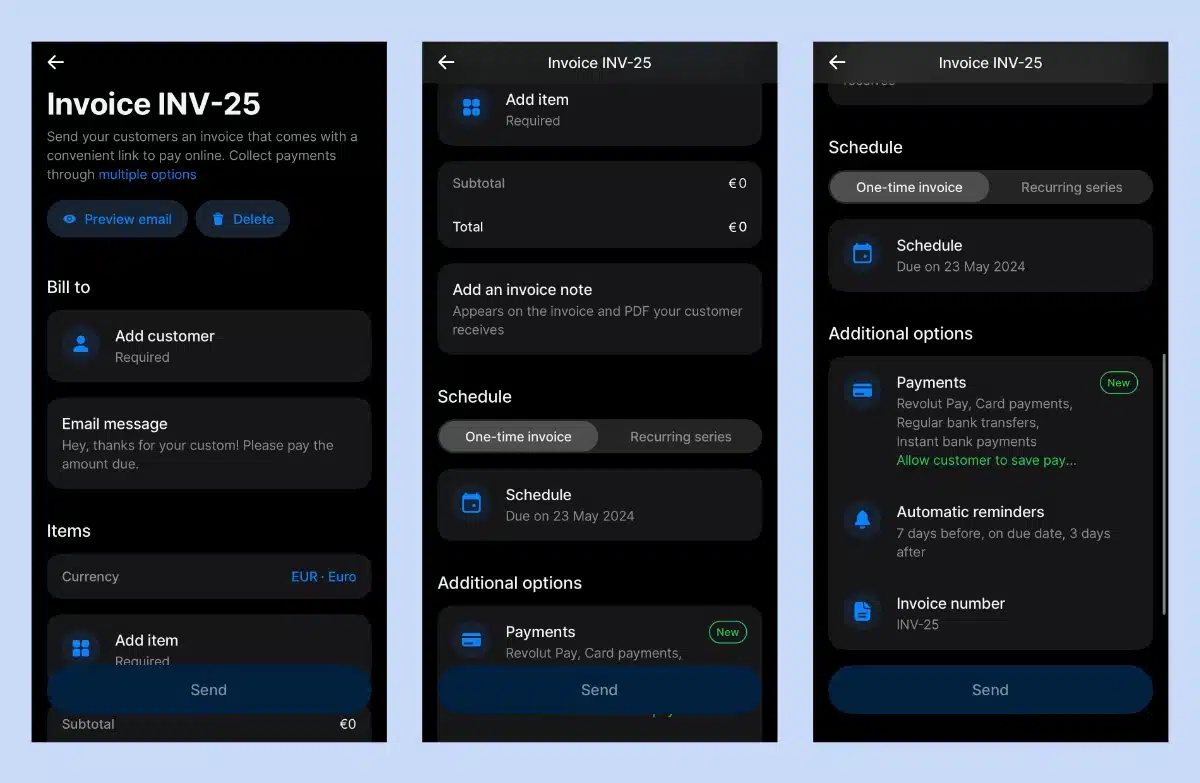

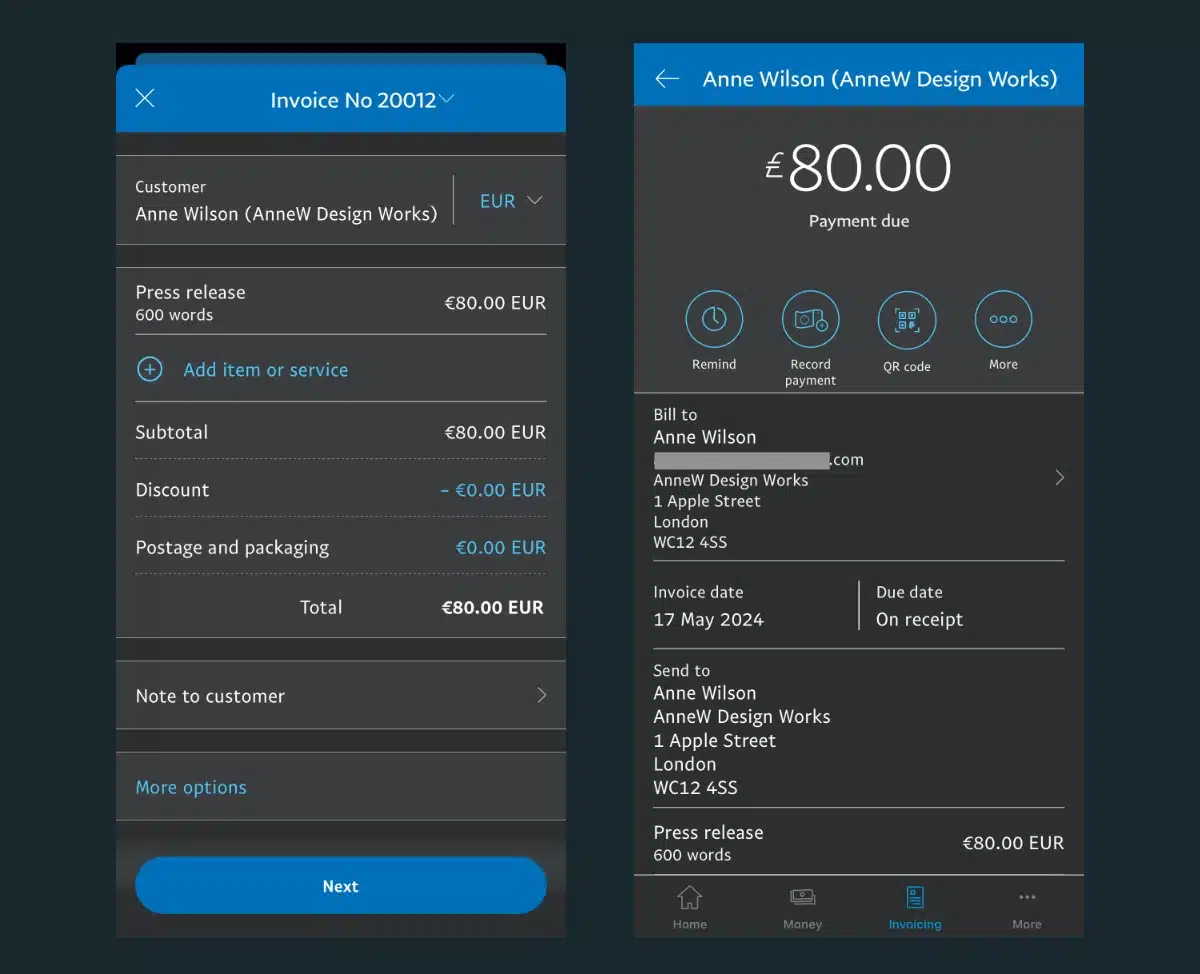

Image: Mobile Transaction

Revolut lets you create invoices from the business account app (pictured).

Email invoices are generated and managed in the personal or Business Revolut app on a mobile device. The app also sends payment links or accepts Tap to Pay on iPhone, if the client is there in person to pay via contactless.

The app makes it easy to create an invoice, allowing you to add a customer, email message, currency, items, costs and a note. Invoices can recur on a schedule or be sent as a one-off, with or without automatic payment reminders.

We really liked how we had full control over which payment methods the customer can use.

This includes card payments (Visa, Mastercard, Apple Pay, Google Pay), Revolut Pay (from other Revolut accounts) and streamlined bank transfers where the payer doesn’t manually enter account details. Instead, the payer picks their bank from a drop-down list and verifies the transaction via their banking app.

Pricing

Monthly cost: €0 for Pro; from €10 for Business account

EEA consumer cards, bank transfers, Revolut Pay: 1% + €0.20 per transaction

All commercial and non-EEA (incl. UK) cards: 2.8% + €0.20 per transaction

Transaction fees are low for Irish and EEA consumer cards and bank transfers, while all other cards (including British) cost more. The free Pro account plan makes Revolut great value for sole traders, particularly if you need a multi-currency account to save money on cross-border transfers.

“It was very easy for me to create invoices in the Revolut Business app. The fact you can choose different currencies is great for those offering services across borders.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Just beware that all of the payment features are only available with a Merchant Account requiring a separate application. Once approved, you receive payouts the next day in the Revolut account.

Integrated payments: Visa, Mastercard, Apple Pay, Google Pay, Revolut Pay, bank transfer

Best for: Revolut Business account users whose clients like a choice between card and bank payments.

SumUp – better than average for a free solution

SumUp is best known for their cheap card readers and payment features for small businesses, which we’ve tested extensively. Merchants can in fact receive payments remotely in various ways, like through digital invoices.

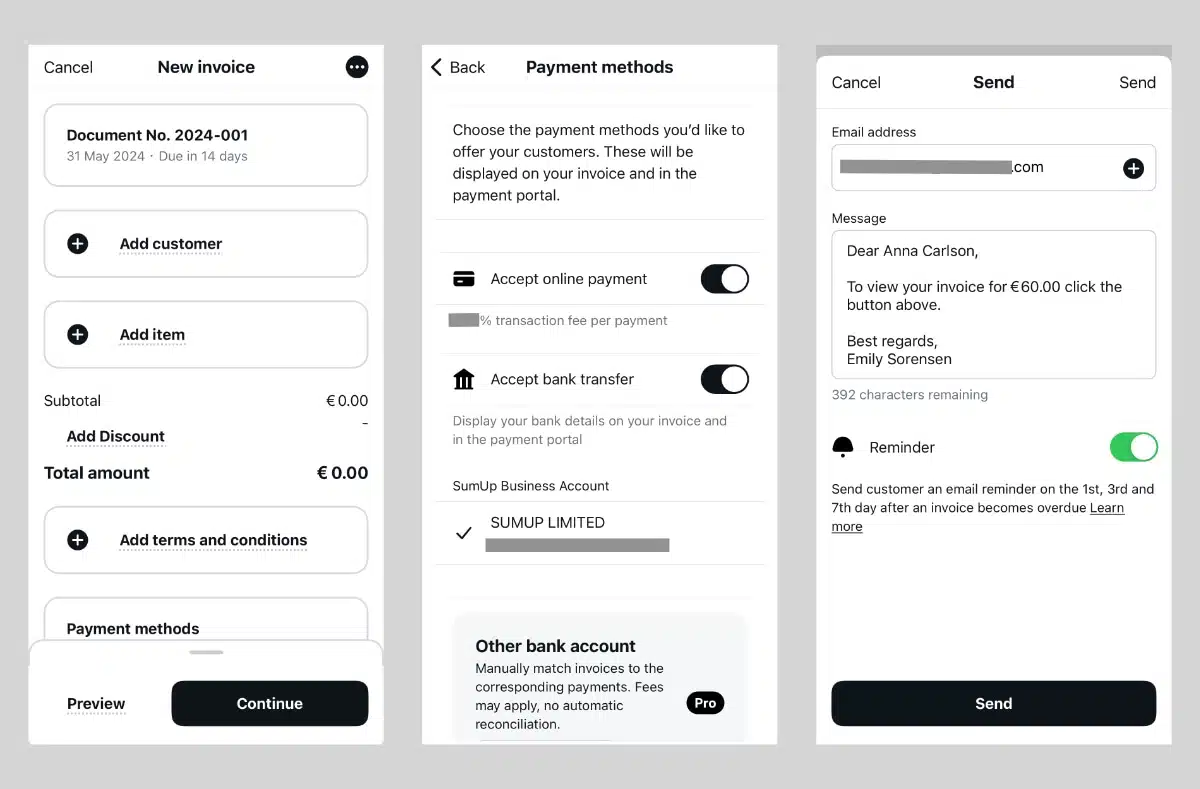

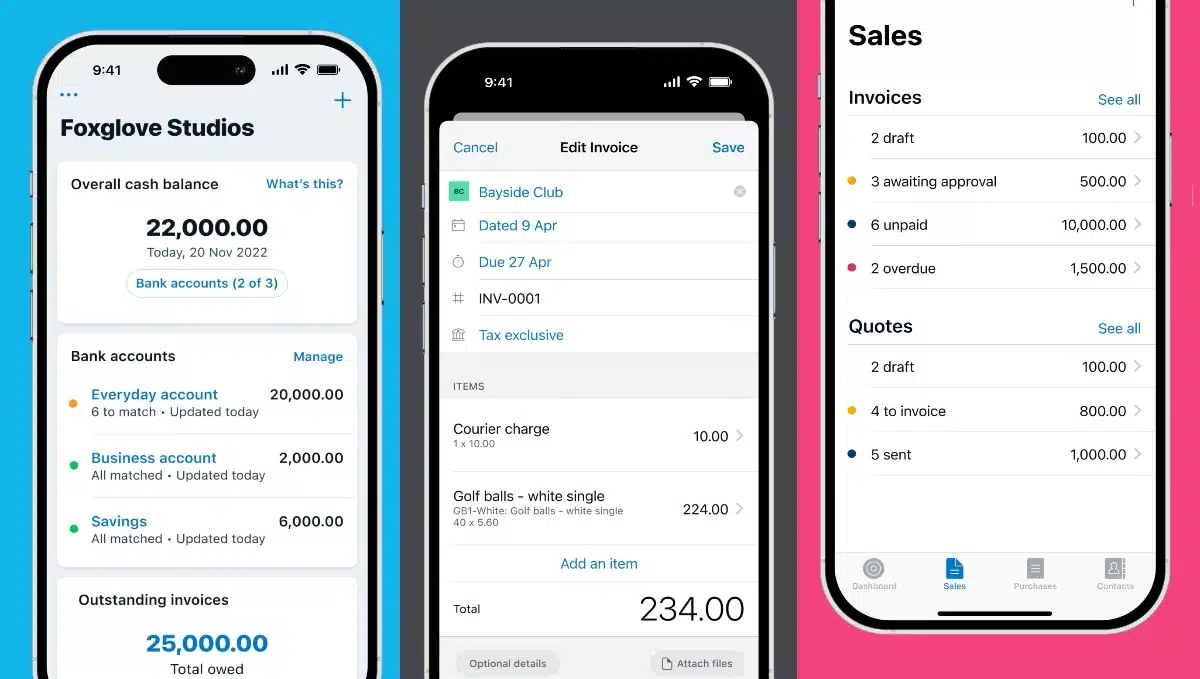

Image: Mobile Transaction

Invoice creation screens in the general-purpose SumUp App.

SumUp has no contract terms, and there’s no monthly fee for standard-template invoicing, just a pay-as-you-go rate of 1.69% per card transaction.

Upgrading to the Pro plan gives you invoice customisations, bank transfers to any bank account, and 14 invoice languages. Crucially, the transaction rate drops to 0.99% for all cards on Pro.

It’s easy to get started: just sign up on the website, connect your bank account and start invoicing clients from the SumUp App or browser dashboard.

SumUp App is actually a simple point of sale (POS) app. It has a product library, transactions overview and checkout interface for accepting cards, cash, QR code payments, keyed transactions and payment links.

In another section of the app, you can create, manage and monitor invoices and quotations with your own terms and conditions attached.

Pricing

Monthly fee: €0 (Free plan) or €8 + VAT/month (Pro plan)

Transaction fee: 1.69% (Free plan), 0.99% (Pro plan)

There’s no limit on how many email invoices you can send, and saved products and customers can be added. If you log into the SumUp account on a computer, you can create credit notes and delivery notes as well, neither of which are available in the app.

“As a popular payment solution in Ireland, I recommend SumUp for invoicing. I find the app very simple, and the invoices look professional with the perk of a very low card rate on the Pro plan.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Payouts take 1-3 working days to reach your bank account. With the free SumUp Business Account and Card (online account and prepaid debit card), you get to receive transactions the next day, including weekends.

Integrated payments: SumUp (Visa, V Pay, Mastercard, Maestro, American Express, Discover), bank transfers

Best for: Selection of free payment methods, not just invoices, from the same app.

Invoice2go – dedicated invoice software

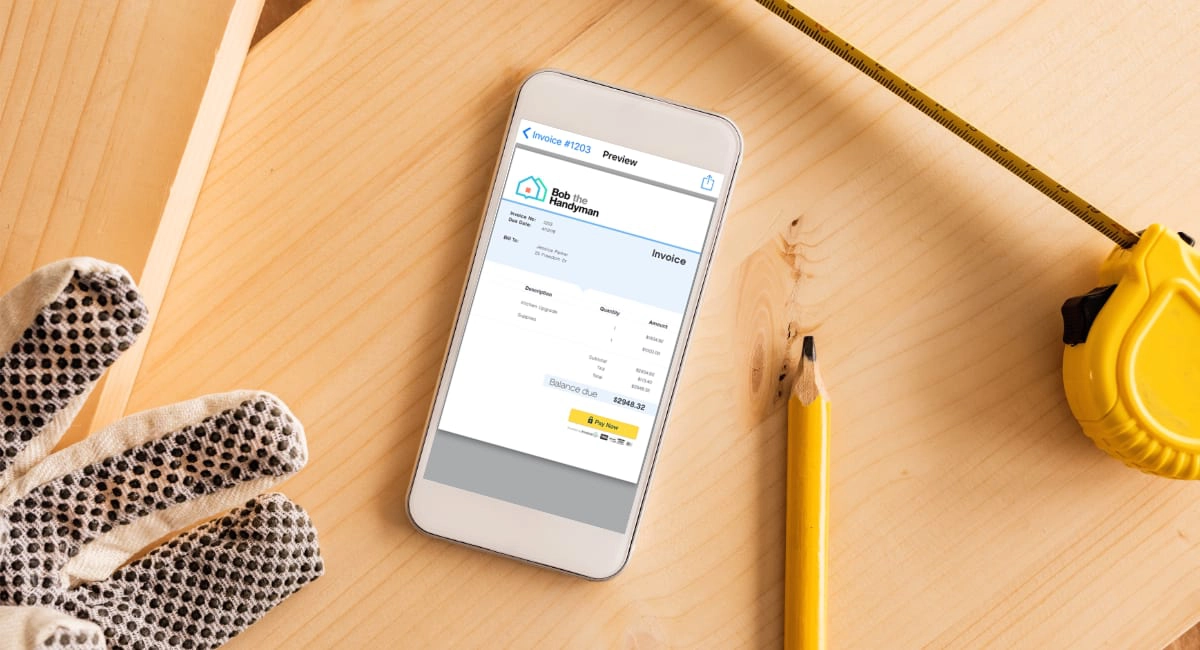

Invoice2go is a global invoicing system with an app that Irish merchants can use on iPhone, iPad and Android devices. The software looks sleek and includes invoice templates, invoice tracking, multi-currency support, customisation, recurrent billing and estimate-to-invoice conversion.

The invoice templates in Invoice2go have several customisation options.

Invoice2go has three plans that can be paid upfront monthly or annually (which would be cheapest per month). The cheapest, Starter, includes 30 invoices for the whole year on an annual plan (€4.17 + VAT/month) or 2 invoices per month on the monthly plan (€4.99 + VAT/month).

“The complicated limits on how many invoices you can send on each plan make Invoice2go less attractive to me. This is a solution that could be simpler and with fewer app issues.”

– Emily Sorensen, Senior Editor, Mobile Transaction

The annual Professional plan (€5.83 + VAT/month) includes 100 invoices annually. The same plan paid monthly (€6.99 + VAT/month) allows for 5 invoices per month. If you noticed, annual subscriptions come with more invoices when calculated per month.

Premium (€32.99 + VAT monthly or €329.99 + VAT annually) has unlimited invoices.

All subscriptions let you have unlimited clients, team members and projects, and send unlimited estimates. The system integrates with Stripe for card processing, taking around 7 calendar days to reach your bank account – quite slow, to be honest!

Higher plans get lower transaction fees through Stripe. You can expect additional fees for cross-border payments and currency exchanges both through Stripe and PayPal.

Pricing

Monthly fee: €4.17-€27.50/month for annual plan, €4.99-€32.99/month for monthly plan (excl. VAT)

Card payments (Stripe): 1.9%-2.4% + €0.25 for domestic cards and Amex, 3.4%-3.9% + €0.25 for foreign cards

PayPal transactions: From 3.4% + €0.35 (standard rate)

On the plus side, Invoice2go specialises in invoicing instead of general accounting tools – the opposite of QuickBooks and Xero.

But many users have said the app is cumbersome, that features and saved data can disappear, and that the price is too high for an increasingly problematic user experience.

Integrated payments: PayPal, Stripe (Visa, Mastercard, American Express)

Best for: Those who don’t mind paying more for a reputable, dedicated invoice app.

Sage – worthy for sole traders who need accounting too

Sage is a popular accounting system for freelancers, sole traders and small businesses from different trades. It has a handy Sage Accounting app where you create, send and monitor invoices, quotes and expenses alongside your bookkeeping.

The Sage app doesn’t just cover accounting – it has invoice, quotation and estimate tools.

Considering how old the company is (founded in 1981), we think the invoice app is surprisingly modern. Even so, you do still have to pay a monthly fee covering accounting as well as invoicing features.

The lowest monthly cost is €15 + VAT for the Accounting Start subscription for one user only. Subscribers can send and track sales invoices, create VAT returns and link bank transactions with accounting records.

The next step up is the Accounting subscription for €31 + VAT monthly for unlimited users. It sends and manages quotes, estimates and purchase invoices, can pull data from uploaded paper invoices and receipts, and handles multiple currencies. Of course it also has more accounting features.

Pricing

Monthly fee: €15 + VAT (Accounting Start plan, single user), €31 + VAT (Accounting plan, unlimited users)

Stripe card payments: 1.5%-1.9% + €0.25 for EEA cards, 2.5% + €0.25 for UK cards, 3.25% + €0.25 for international cards, 2% currency conversion

You can connect the digital invoices with Stripe to accept cards online. It would then be Stripe charging transaction fees, not Sage.

“Sage doesn’t overwhelm with too many features, like Xero might do for individual entrepreneurs. But you have to pay for the higher subscription to benefit from all the invoicing features.”

– Emily Sorensen, Senior Editor, Mobile Transaction

The Sage Accounting app looks attractive and easy to use, but isn’t updated as often as other solutions in this article. We’re therefore a little cautious about rating Sage higher, since a good mobile experience is dependent on regular updates to quash bugs and optimise the user flow.

We should also highlight that the monthly cost makes this better for tradespeople who are definitely going to use Sage for accounting too. You can get cheaper, equally good invoicing tools for less elsewhere if that’s all you need.

Integrated payments: Stripe (Visa, Mastercard, Apple Pay, Google Pay)

Best for: Tradespeople, sole traders and startups who want an all-in-one system for invoicing and accounting.

PayPal – convenient and effective, but high fees

Love it or hate it, PayPal Business is a globally popular payment account with many online tools that have been honed over decades.

Its PayPal Business app for iPhone and Android includes reliable invoicing features for drafting, sending and managing invoicing on the go.

Image: Mobile Transaction

PayPal invoices are easily customised, sent and managed in the PayPal Business app.

To use the app and online account for payment acceptance, you sign up online for a PayPal Business account. If you already have a personal account, this can be converted into a Business account, which adds online payment tools to the browser dashboard.

Having personally used PayPal Business to send invoices, we can confirm it’s easy to customise and manage them. Clients will be eased with the familiar brand of PayPal, and the merchant can keep funds in their online business account along with other PayPal transactions received online.

Quotations can be sent and turned into invoices when accepted, and payment reminders are easily sent from the app if the client hasn’t paid.

Pricing

Monthly cost: None

Transaction fees: 3.4% + €0.35, plus 0.5%-2% for non-Irish cards, plus 3% for currency conversion

Many merchants use PayPal for online payments because of its brand recognition/trust, Seller Protection, reliable app and – importantly – lack of monthly fee.

These are good aspects, but the transaction fee is high (3.4% + €0.35) and eye-watering if a client pays with a foreign card for an extra 0.5% 0r 2% fee depending on the country of issue.

“Many of my clients have preferred PayPal invoices because they’re convenient, but I don’t like the high transaction fees, especially with international clients and currency exchanges.”

– Emily Sorensen, Senior Editor, Mobile Transaction

All users can choose to charge clients in many currencies, making it suitable for cross-border business – if you can afford the additional 3% cost of currency conversion. Other fees may be added depending on the type of transaction.

And beware: if you ever need customer support, it can be very difficult to get any helpful response from PayPal.

Integrated payments: Visa, Mastercard, American Express, PayPal

Best for: Merchants already using PayPal for ecommerce.

Xero – trusted by bigger businesses

Better known for its advanced bookkeeping software, the invoicing tools in the Xero Accounting app are approachable for all business types, including sole traders and small companies.

The app works on iPhone and Android devices, but it’s expensive because the plans include accounting. You can’t just pay for invoicing for a lower price.

The Xero Accounting app doubles as an invoicing app.

The cheapest plan, Starter (USD $29/month), lets you send quotes and up to 20 invoices per month from the app, and enter 5 bills monthly. The higher plans, Standard (USD $46/month) and Premium (USD $69/month) provide unlimited invoices, quotes and bills.

Regardless of the plan, you get accounting reports, Hubdoc receipt capture and reconciliation of bank transactions. The Standard plan reconciles transactions in bulk, while Premium also works in multiple currencies.

You can add a button to invoices for accepting card payments via Stripe and bank account-to-account payments via GoCardless.

Pricing

Monthly fee: USD $29-$69 + VAT

Stripe card payments: 1.5%-1.9% + €0.25 for EEA cards, 2.5% + €0.25 for UK cards, 3.25% + €0.25 for international cards, 2% currency conversion

GoCardless direct debits: 1%-1.4% + €0.20 (domestic), 2%-2.4% + €0.20 (international)

Rather than paying transaction fees to Xero, each accepted card payment or direct debit transfer incurs a cost via Stripe or GoCardless. It’s possible to add a payment button on invoices that’s handled by another card processor – Xero is flexible like that.

“Xero caters to a lot of businesses, so it might be the best choice for small businesses with accountants who prefer it. We like the versatility, but it’s not worth the price if you’re just looking for invoicing.”

– Emily Sorensen, Senior Editor, Mobile Transaction

The system has a steep learning curve that some only find worth the time if they use it for a larger company. But the interface has improved over the years, and it’s generally a solid system for keeping the books in order.

Integrated payments: Stripe (Visa, Mastercard, Apple Pay, Google Pay), GoCardless bank transfers

Best for: Xero users who’d like their invoices integrated with bookkeeping.

Alternative invoicing apps

More invoicing solutions are available in Ireland, but many have flaws like only being accessible in a browser.

Here’s a rundown of the most interesting alternatives:

- Bullet – Irish accounting app with invoices, but expensive if only using invoicing

- QuickBooks – no payment integrations in Ireland, but the app has invoicing tools

- Kefron – powerful invoice automation with AI, but best for big-volume invoicing

- Tradify – Irish job management and invoicing app for tradespeople, but expensive

- FreshBooks – has a dedicated invoicing app, but no Irish support line

- Billdu – British but global, still needs to prove itself in Ireland

- Zoho – free invoice generator app, but no dedicated support for Ireland

- Wave – low-cost and Canadian, but not focused on Irish customers

- Stripe – invoices more developed in web portal, mobile app more limited