It costs money to process payments from a customer’s credit or debit card to a merchant’s bank account. The true cost is determined by all the different parties involved in handling the transaction, and calculating it requires a detailed breakdown of these components.

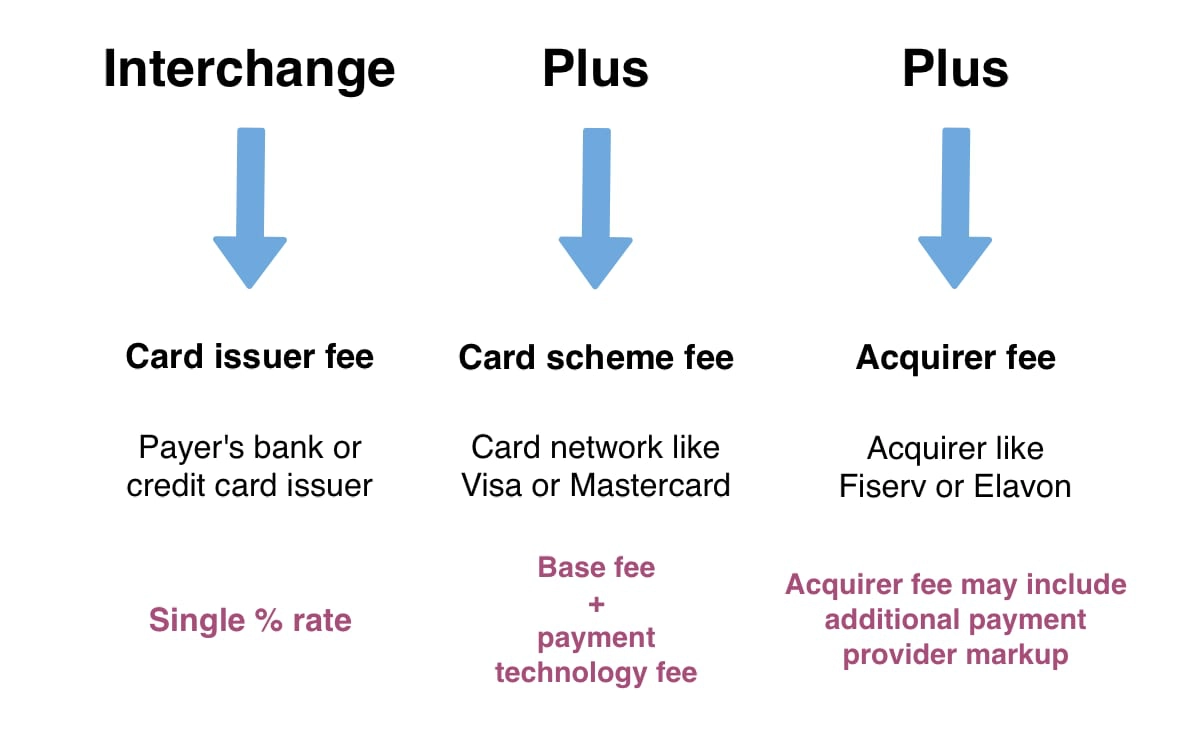

The pricing structure called Interchange Plus Plus (interchange++) is the most detailed breakdown of the true costs. Basically, interchange++ is a pricing model consisting of the fees charged by the relevant card issuer, card scheme and acquiring bank processing a transaction.

To explain it properly, you first have to know who’s involved in processing cards. Every time a card is being processed, the following parties work together to complete the payment:

The fees that each of these parties charge for their role in the transaction make the true cost of transactions. Bringing these together to a formula is exactly what Interchange Plus Plus is. The fees in the interchange++ pricing structure include:

In some cases, the card issuer and card scheme are the same, e.g. American Express issues cards directly to customers and is also a card scheme. This can make the fee look a bit different from payments where the card scheme and issuer are different.

Moreover, some acquirers provide card machines and card acceptance contracts directly to merchants. But in many cases, independent sales organisations (ISOs) represent acquirers so the merchant never has to deal with them directly. In the latter case, the ISO will likely add a markup on the acquirer fee to earn something as well.

The payment provider that offers the card machine or card acceptance contract will call this pricing model Interchange Plus Plus – or (incorrectly) Interchange Plus to simplify the name.

Image: Mobile Transaction

What determines the interchange++ fees?

First of all, card processing is a complicated process where card issuer, card scheme and acquirer work together to move a payer’s money to a merchant’s bank account. Different types of technology, security mechanisms and banking networks have different expenses to keep this up, so the cost varies accordingly.

Here are the things that determine the interchange++ fees.

Interchange rate

The interchange (IC) is typically a percentage rate determined, among other things, by:

- Country of card issue

- Country of transaction (where merchant is located)

- Type of card (e.g. corporate, consumer)

- Type of transaction (card present or card not present)

- Card technology (e.g. chip and PIN, contactless)

- Card security processes

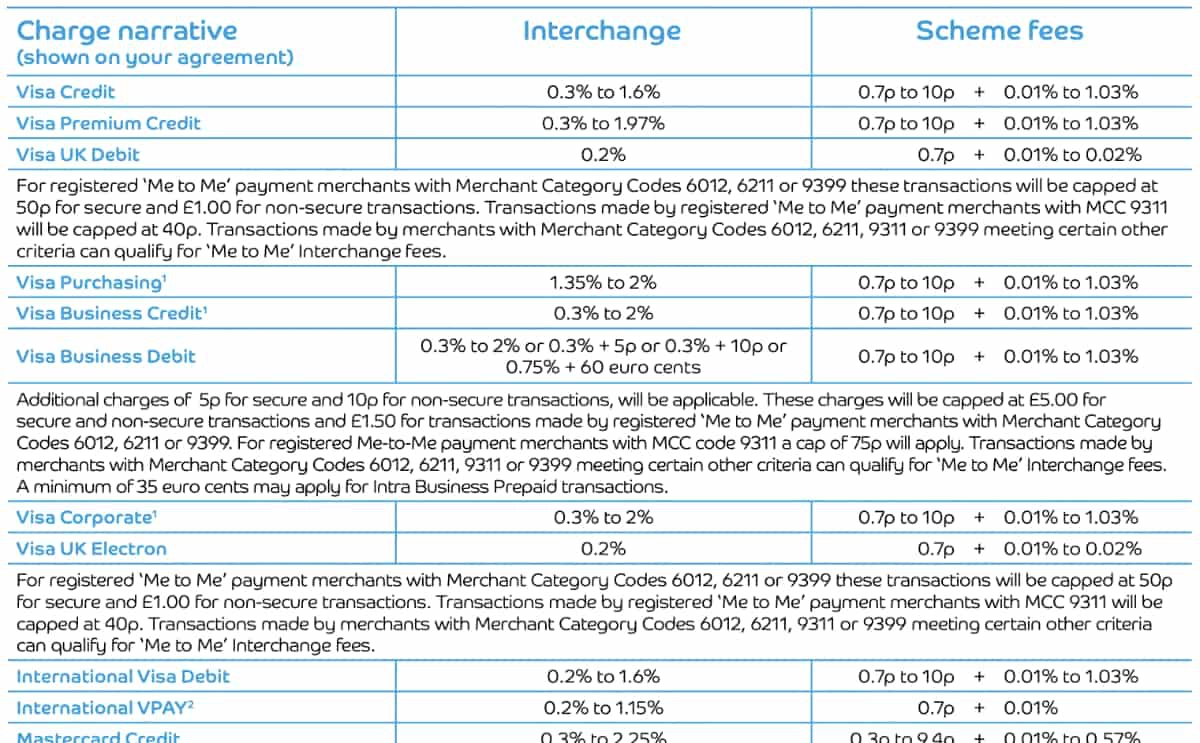

The wide range of factors involved means there are hundreds of different interchange fees. It is required by regulators that card schemes and/or acquirers publish these rates, so you should be able to find them online.

Scheme fees

Scheme fees consist of a base fee and payment technology fee. Sometimes, there are three scheme fees. They are charged by card networks such as Mastercard, Visa and UnionPay. These fees are determined by:

- Type of card (e.g. corporate, consumer)

- Type of transaction (card present or card not present)

- Authorisation fees

- Transaction volume/size

- Cross-border transaction costs

- Licensing fees

- Scheme fees for reports

- Anti-money laundering processes and fraud prevention

- Marketing and innovation funds

As you see, scheme fees can be complex too and are determined by similar things to what affect interchange rates. Apart from the above, the scheme fees fund the systems maintenance, customer services and much more.

Acquirer fee (+ merchant service provider margin)

Sometimes called a ‘Merchant Service Charge’ or ‘Processing Fee’, the acquirer fee is the markup determined by the acquirer for providing the card processing service. If a business deals with a merchant service provider (ISO or card machine provider), the acquirer fee may be merged with a markup added by the merchant service provider for their own profits’ sake.

This fee is the flexible part of the interchange++ equation and therefore varies a lot. It can be negotiated based on the merchant’s risk category (Merchant Category Code, or MCC for short), sales volume and country of residence. For example, high-risk business categories such as travel agents and gambling shops will get a higher merchant service charge/acquirer fee to make up for the additional risk of transaction failures experienced in those industries. Lower-risk categories such as retailers and cafés can get the lowest fees.

The fee also covers security measures, customer-facing services, banking networks and much more – and it’s a source of profit for acquirers (the higher the profit margin, the more expensive it is for the merchant).

Transparent, but complex, pricing model

Interchange plus plus pricing is definitely transparent as you can look up exact interchange rates and scheme fees, and also see in your provider contract how high their own/the acquirer’s margin is on top. An example of interchange plus plus fees are:

UK-issued Visa Debit card accepted in UK, card present:

0.2% (interchange) + 0.7p + 0.01% (scheme fees) + £0.60 (acquirer fee) + £0.30 (merchant service charge)

Typically, UK-issued consumer debit cards have the lowest interchange rates (e.g. 0.2%) while corporate, premium and foreign cards have the highest interchange rates (e.g. 0.3%-2.25%). Card scheme fees often consist of a flat fee (e.g. 3p-10p) and a percentage rate (e.g. 0.01%-1%). A merchant service charge or acquirer fee can be a fixed fee like 60p per transaction but really varies a lot between payment providers.

However, the price structure is more complicated – we’ve only scratched the surface.

Interchange rates and scheme fees can go up and down over time. For example, the European Union (EU) has successfully capped the Visa and Mastercard interchange rates at 0.2% for debit cards and 0.3% for credit cards within the European Economic Area (EEA). But Visa has, for example, introduced a 3D Secure fee of 0.02 EUR for each authentication request from 1 September 2019.

It is the acquirer’s responsibility to keep up with these changes and update their pricing according. While interchange rates are charged directly to the acquirer during transactions, card scheme fees are periodically invoiced to the acquirer after transactions (making it super-important for acquirers to keep up with changes).

Some of Barclaycard’s listed interchange rates and scheme fees (October 2020).

Then there is the relationship between acquirer and merchant-facing payment provider. Some acquirers, such as Barclaycard Business, are both acquiring bank and merchant service provider. This means Barclaycard offers card machines and card processing contracts directly to merchants who contact them for this, but Barclaycard also partners with independent sales organisations (ISO) who do all the selling for them.

You might think that getting an ISO (and additional party) to offer acquiring contracts on behalf of the acquirer will add more fees – or raise the “acquiring fee” – on an interchange++ pricing plan. But actually, acquirers can save money by avoiding the customer service and sales efforts required to deal with merchants directly, and therefore may reduce their fee. ISOs also have the ability to negotiate lower acquiring fees, allowing the ISO to add their own margin on top without inflating costs offered to the merchant.

Not everyone can get interchange++ pricing, though. A lot of merchant service providers only offer it to high-volume businesses or those experienced enough to negotiate complex card payment contracts.

Many small or new businesses get overwhelmed at the idea of a pricing structure with lots of different costs applied to each transaction, since it makes the total monthly costs less predictable.

Interchange++ pricing may also be a bad idea for those who regularly accept premium credit cards, cross-border payments and remote transactions, as the overall cost will be the highest for these types of transactions.

Blended pricing ‘blends’ the interchange, scheme and/or acquirer fees into one or several charges that are easier to understand than interchange plus plus

Instead, many prefer a blended pricing structure that hides the true cost described in the interchange++ model, but gives much more predicable fees to cover most transactions. Blended pricing applies to almost any price structure that’s not interchange plus plus: it ‘blends’ the interchange, scheme and/or acquirer fees into one or several charges that are easier to understand than interchange plus plus’s model of treating each transaction differently.

For example, one of the simplest blended rates available is SumUp’s 1.69% per transaction. SumUp sells card readers with no monthly fees – you just pay one predictable rate for all transactions. This covers interchange, scheme fees, acquirer fee, chargebacks (that are usually charged for individually with interchange++) customer service and other ongoing services.

A more complicated blended structure is the ‘Pay as You Go’ plan by Worldpay, which charges a fixed percentage (like 1.75%) for consumer Visa and Mastercard transactions, higher rate (2%+) for all other cards, and a “Transaction Authorisation” fee. Other providers may have a tiered pricing structure where transaction fees go down when transaction volume goes up.

With blended pricing, the acquirer or merchant service provider takes the hit if you accept a transaction that would be expensive on an interchange++ plan, but cheaper with a blended rate. Conversely, the merchant will likely pay more for domestic Visa Debit card payments with a blended rate than they would with interchange++.