Card and cash transactions are still popular in stores and online, but another option is emerging: account-to-account payments.

Unlike the familiar bank transfers initiated manually in your bank account, this new type of payment allows you to transfer money to a merchant in a few, quick steps without logging into your bank account. Let’s dig into how it works.

What is it?

Most of us associate money transfers with logging into a banking app or online banking page, adding a new payee by entering the recipient’s bank account details, and transferring the amount through the bank.

Account-to-account (A2A) payments allow you to pay by bank transfer in a more streamlined way. Typically, the payer would select this payment method at the checkout in an internet browser or app, then verify the transaction with a quick authentication check via their banking app.

This lets you bypass the card schemes (e.g. Visa, Mastercard) completely, as you are effectively making a direct bank transfer. Customers therefore do not need a debit or credit card to pay, but they do need a bank account set up for online banking or a banking app.

How does it work?

Account-to-account payments are not for peer-to-peer bank transfers between private individuals. It is for businesses and organisations to use bank transfers as an alternative to card payments.

To set up A2A payments, a business goes to a payment company (e.g. GoCardless, Atoa, Brite) that offers it, signs up and activates the chosen payment method via a simple integration or custom API (Application Programming Interface) with the help of a developer.

The specific uses for A2A payments include:

- One-off transactions from consumer to business (via online payment page)

- Fast payouts from business to consumer

- Subscriptions

- Invoice payments

- International bank transfers

The exact process of A2A payments depends on the sales channel and type of transaction. In any case, the transaction is completed not by logging into a bank account, but through an automated, user-friendly security check via the payer’s banking app.

For example, you can initiate A2A transactions for one-off payments in an online store or shopping app. This may require the user to enter their bank account number and sort code before authenticating the transaction via their banking app – if the banking app doesn’t allow you to just select the bank account without entering these details manually.

Instead of customers navigating to a website or app, they could also be sent a link to the payment page or click a URL on a digital invoice allowing them to pay the invoice total online.

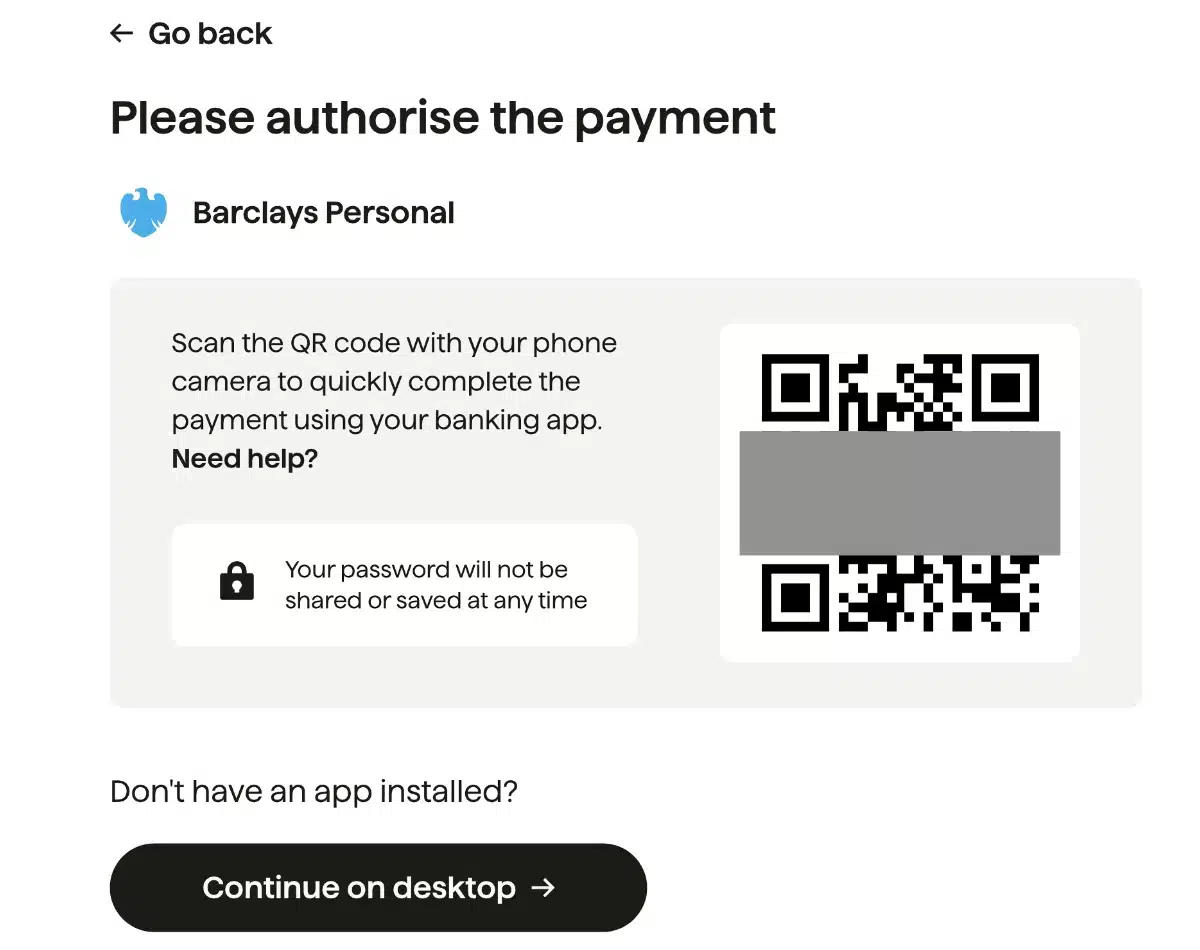

Example of a A2A payment confirmation page used by GoCardless.

The customer could also just scan a QR code with their smartphone camera, then verify the transaction via their banking app. This offers great potential for point of sale (POS) transactions for customers with no credit or debit card, although it is still rare to see A2A payments offered in brick-and-mortar stores.

A2A payment providers could also facilitate recurring payments, like subscriptions, through a compatible system like Direct Debits that occur automatically. Such ongoing payments do not need to be approved by the payer every time after the initial setup has been authenticated.

Another use is for businesses to easily initiate payouts to their customers internationally, or receive hassle-free bank transfers across international borders.

Speed of transfer

Bank-to-bank payments are generally faster than card transactions. You see this with traditional bank transfers that are instant or completed within 2 hours. The same usually applies to A2A payments, even across country borders.

With card payments, merchants typically receive payouts the next working day or later, although instant payments may be offered for a higher transaction fee. For this reason, A2A payment providers might advertise their service as “instant payments” for a low cost as the main advantage.

Open banking and PSD2

With the mergence of open banking came opportunities for fintech companies to integrate external bank accounts with their products.

Open banking is essentially the ability for consumers to permit their bank to share account and transaction details with the financial products they use. This allows fintechs to develop payment products, such as account-to-account payments, that comply with strict security, software and regulative standards.

The concept of open banking has been around in some form for decades, but in 2017, the European Parliament devised a new Payment Services Directive (PSD2) that was the main catalyst for account-to-account payments.

In essence, PSD2 is a legislation requiring participating banks to connect with third-party software that needs to access account holder data. This only happens if the account holder has consented to it via their online banking or bank app as well as the financial product (third party) providing the service requiring their account details.

Since PSD2 was launched, many banks across the world have opted into the open banking system. Participating banks have to comply with strict rules from the FCA (Financial Conduct Authority in the UK) or equivalent governing body in its country, so users’ money is protected like with card transactions.