- Pros: Relatively simple costs. Monthly contract for switchers. With merchant account. Can beat your current fees and buy you out of old contract.

- Cons: Costs not transparent. Limited integrations. Support not always helpful. Most of the terminals look outdated.

- Choose if: You’re stuck in a card machine contract and can get lower fees than you currently have by switching to Handepay’s monthly contract deal.

Overview

In brief

How it works

Our opinion

In detail

Card machines

Contract

Pricing

Online payments

Service and reviews

How it works

Handepay is an independent sales organisation (ISO) offering card machine packages at average, but fairly simple, prices. Merchants can also get a virtual terminal for telephone payments, payment links and an online payment gateway.

The company provides card terminals through the hardware leasing company Merchant Rentals, which shares the same owners and address as Handepay (they are basically the same company). The card processing contract, i.e. merchant account, is provided by EVO Payments (in most cases) or Worldpay.

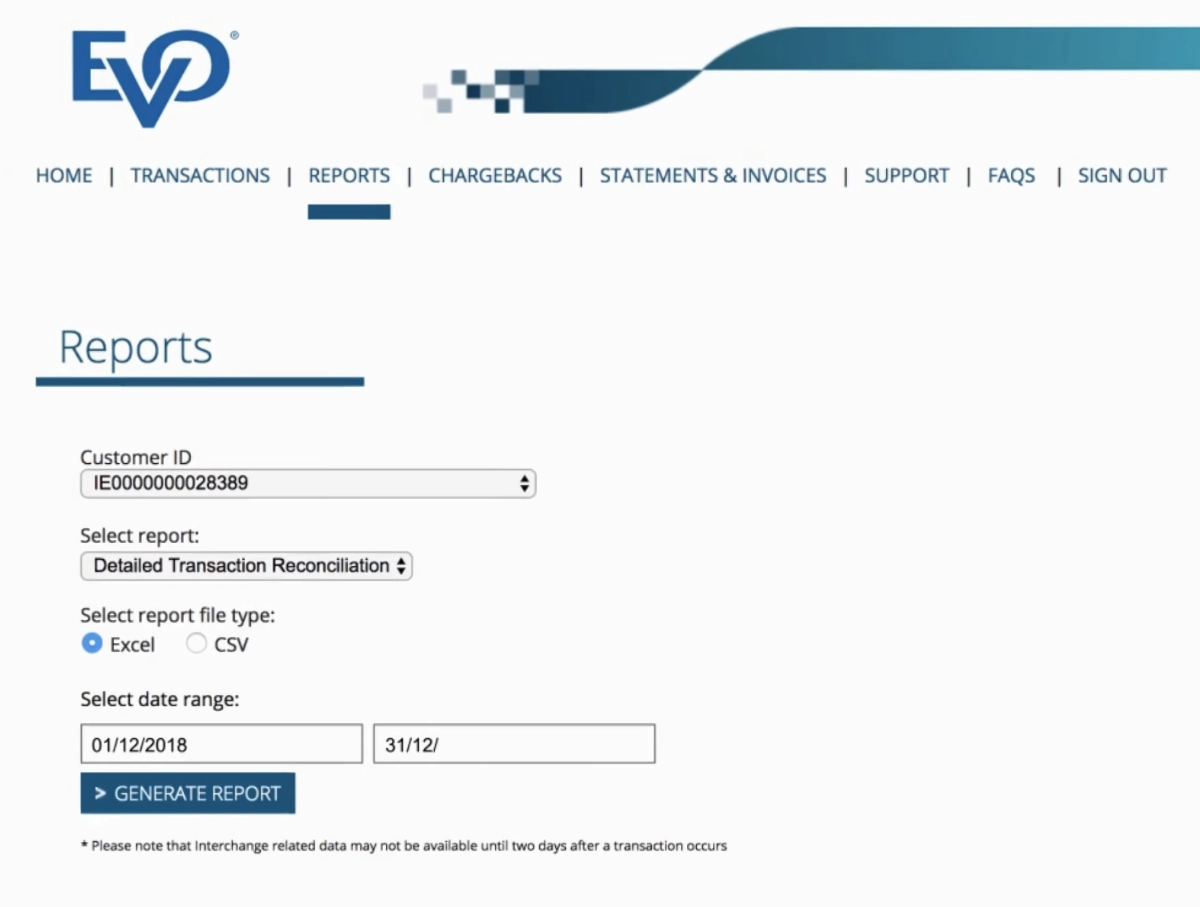

Those with an EVO merchant account get access to an online web portal (‘Business Resource Centre’) to monitor sales, reports, chargebacks and more in real time from a computer.

Image: Handepay

View transactions and reports in EVO’s Business Resource Centre.

Although Handepay sometimes uses face-to-face sales reps, the most common way to get started is to submit your information on the Handepay website to receive a callback with a quote tailored for your business. If the application goes well, you could be up and running with card payments within three working days.

Our opinion: potentially reasonable, not the best product

Handepay makes a lot of promises, mainly that their pricing is simple and there are no hidden fees. We can’t fault them on that as long as the proof is hidden (they do a good job of that), but it does generally seem that Handepay is a satisfactory choice in most cases.

The main downsides are the lack of popular POS integrations and not the greatest choice of card machines. The card terminals satisfy most small businesses, but they’re certainly not as cutting-edge as more popular brands in the UK. It is odd that Handepay does not integrate with leading POS systems, but they have at least now its own POS app for the Android terminal only.

| Handepay criteria | Rating | Conclusion |

|---|---|---|

| Product | 3.8 | Good |

| Costs and fees | 3.8 | Good |

| Transparency and sign-up | 3.6 | Passable/Good |

| Value-added services | 3.8 | Good |

| Service and reviews | 4 | Good |

| Contract | 3.8 | Good |

| OVERALL SCORE | 3.8 | Good |

The price challenge prize of £1,000 is great for merchants looking for a better deal, and it may just be the thing that cuts your costs in the long term. However, anything requiring commitment is worth being cautious about.

“Handepay keeps fees under wraps, but we like the switching deal and presumed simplicity of fees on a monthly basis. Don’t feel pressured into a contract before you understand the small print, though, as Handepay has had complaints about hidden terms.”

– Emily Sorensen, Senior Editor, MobileTransaction

Strong, stable businesses may not mind the annual plan, but new, fluctuating companies should make sure the lock-in is not longer than they feel comfortable with.

Card machines

Handepay has a few different card machine models by Taiwanese company Castles Technology (previously Spire Payments): two for portable or mobile use and another for a stationary setup at a till point.

Two of them look outdated with their push-buttons and somewhat chunky design: They’re not as cutting-edge as popular models by PAX, Verifone and Ingenico. They will do the job efficiently, but probably won’t stay in style for years to come.

Mobile and portable card machine

The mobile and portable terminal model.

One of these push-button terminals, Vega 3000 V3M2 (above image), is both a mobile and portable terminal, depending on the connectivity setup.

The mobile version comes with a built-in SIM card that connects with the local GPRS network wherever you are in the UK. This makes it suitable for anyone accepting cards on the go, outside, around premises or flexibly in different locations.

The portable version, on the other hand, uses your local WiFi network installed on your fixed premises. The terminal works within a radius of 50 metres from your central WiFi station. This is enough for most retailers, restaurants, bars and other services who need to take cards away from a counter.

Countertop card machine

The Handepay countertop terminal.

The countertop model (above image) has to be plugged into your power socket and phone line/broadband connection at all times in order to function. For this reason, it is only suitable for a stationary point of sale.

Mobile and portable card machine

The Castles Saturn smart POS terminal.

The latest model, the Saturn Android Smart Terminal, is the most adaptable (and cutting-edge) of the models. It’s pretty versatile with its potential to add new features to its Android software.

“I personally wouldn’t go for Handepay’s push-button models, as these are bound to be phased out in favour of the new Android terminal. Most new shops in the UK now go for touchscreen terminals like this one.”

– Emily Sorensen, Senior Editor, MobileTransaction

For a monthly fee, the touchscreen terminal can use a point of sale (POS) app called Register by Smart Volution. It can be a simple version or have more complicated features depending on the cost and hardware setup.

None of the card machines – including the countertop model – integrate with other POS systems. Instead, you have to manually enter each transaction amount on the terminal before the customer can tap or enter their card, rather than have your POS software sync with the card machine.

The lack of POS integration could be an issue if you want the fastest possible checkout experience with a particular EPOS system. Accounting software cannot be integrated either, so you’re reliant on the reporting options in your online merchant portal.

All the card machines have a built-in receipt printer and colour display.

The card machines accept a wide range range of cards including Visa and Mastercard, but some premium card schemes like American Express may require additional costs. The terminals are equipped to accept chip and PIN, swipe and contactless payments including Apple Pay, Google Pay and Samsung Pay.

Alternatives: See how our top picks for card machines compare

Contractual commitment

Handepay used to require contracts between 12 to 36 months – some merchants have even signed up for four years. They all auto-renewed for another 12 months at the end, unless cancelling three months in advance.

Thankfully, Handepay contracts are now either 12 months or monthly. That’s because UK laws changed in 2023 to ban contracts exceeding 18 months, and any such card machine commitment has to move to a monthly rolling contract at the end.

At Handepay, the annual contract is for businesses with no history of card payments, whereas the monthly plan is for merchants switching from their current card machine solution to EVO through Handepay.

According to many customers, Handepay has in the past not been open about its auto-renewal, so you have to make sure it is explained how and when exactly you should cancel a contract in advance, if it isn’t written in the contract.

Should you wish to cancel a contract early, you have to pay the remaining costs of it, which could be hundreds of pounds depending on the package.

Handepay fees

Although Handepay states they have “simple pricing with no hidden fees”, you’ll struggle to find specific costs on their website. Instead, merchants are encouraged to contact Handepay for a quote tailored for your business.

Common to all (or most) quotes, Handepay does not charge:

- A minimum required per month in card processing fees (monthly minimum service charge)

- Registration and setup costs

- PCI-DSS compliance fees

- Chargeback fees

According to the website, the only cost is the monthly rental of your chosen card terminal plus the transaction fees specific to your business.

| Handepay pricing | |

|---|---|

| Contract length | 1-12 months |

| Setup fee | None |

| Monthly terminal rental cost | Depends on card machine model |

| Monthly minimum charge | None |

| Next-working day payouts | £4/month |

| Transaction rates | Depends on card type, business and turnover |

| PCI-DSS compliance | Free |

| Early termination fee | Equivalent to cost of remaining contract |

Transaction fees are usually based on your type of business, turnover and type of card accepted. A domestic consumer Visa card, for example, will have the lowest rate, whereas a premium Amex card always incurs a higher rate. Whereas some payment providers add a fixed authorisation fee to the transaction rate, Handepay claims they do not.

Unfortunately, the pricing is not listed on the website, and it will vary how much people pay per month for a Handepay package. The only way to know the costs is to hear it from the sales team. This is generally not a great sign that the provider is genuinely transparent about all costs, so you should check for hidden charges and terms upfront before committing.

Handepay likes to advertise its “Price Challenge” to merchants stuck in another card machine contract. The promise is this: if Handepay cannot save you money compared to your old card processing fees, they will give you £1,000.

To enter the challenge, you need to submit a current card machine statement detailing all your fees. Handepay will then either beat those fees or pay you £1k – and they might be able to buy you out of the old card machine contract. This is great if you’re stuck in a bad deal elsewhere and think Handepay may be the right way forward.

Online payment tools

Like most merchant service providers, Handepay can add a range of online payment methods to your package. This includes:

Virtual terminal: Manually enter card payments on your card machine or in a web browser on behalf of a customer who is not present.

Pay by link: Send a unique payment link via email, text or social media. The customer can then complete the payment themselves on a web page.

Online payment gateway: Integrate an online checkout on your ecommerce platform of choice to accept payments through an online store.

Recurring payments: Sell subscriptions online with the optional recurring payment feature, requiring a one-off £50 fee to set up.

The payment gateway can the installed on a website built with EKM, Magento, OpenCart, PrestaShop, WooCommerce, Zen Cart and a selection of lesser-known shopping carts.

These remote and online payment methods have different costs to your in-person payments. In any case, subscribing to a payment gateway or virtual terminal (plans from £9.99 + VAT monthly) includes the pay-by-link feature and access to an online web portal where you can monitor all these transactions. For £19.99 + VAT monthly, 400 online transactions are included per month. Above this threshold, you pay 10p per transaction, which may be in addition to a base transaction rate.

Image: Handepay

Most Handepay customers are happy with the service.

Customer service and reviews

Handepay does not directly offer customer support. Instead, you can call EVO or Worldpay about your merchant account or the card machine provider (Merchant Rentals) about the equipment. Customer support is available 24/7, so even out-of-hours businesses can get help promptly.

Card machine issues are first dealt with remotely through troubleshooting, followed by a terminal replacement if it can’t be fixed.

We’ve seen a mix of negative and positive Handepay reviews regarding the service. Many of them have complained about the auto-renewal of the contract, lack of helpful support, contract issues and deceptive sales tactics where the merchant, for instance, didn’t realise the contract was longer than agreed.

Strong, stable businesses may not mind the fixed package over a few years, but new, fluctuating companies should make sure the lock-in is not longer than they feel comfortable with.

Most reviews on Trustpilot are very positive about the service, but the review patterns indicate they may not all be genuine.

We highly recommend reading through all contract terms before signing up with Handepay in case the sales rep has not been open about the small print. You should also be fairly certain your businesses will keep selling for the duration of the contract, as otherwise it can cost you dearly to terminate the contract early.