Contents

In summary

What is it?

Our opinion

In detail

Pricing

Payouts

Features

Compared with alternatives

Customer service

MobileTransaction personally tested GoCardless’s features so we could assess the service properly. Screenshots and opinions are our own.

What is it?

GoCardless is a UK-based company facilitating account-to-account (A2A) transactions in various online and remote payment contexts.

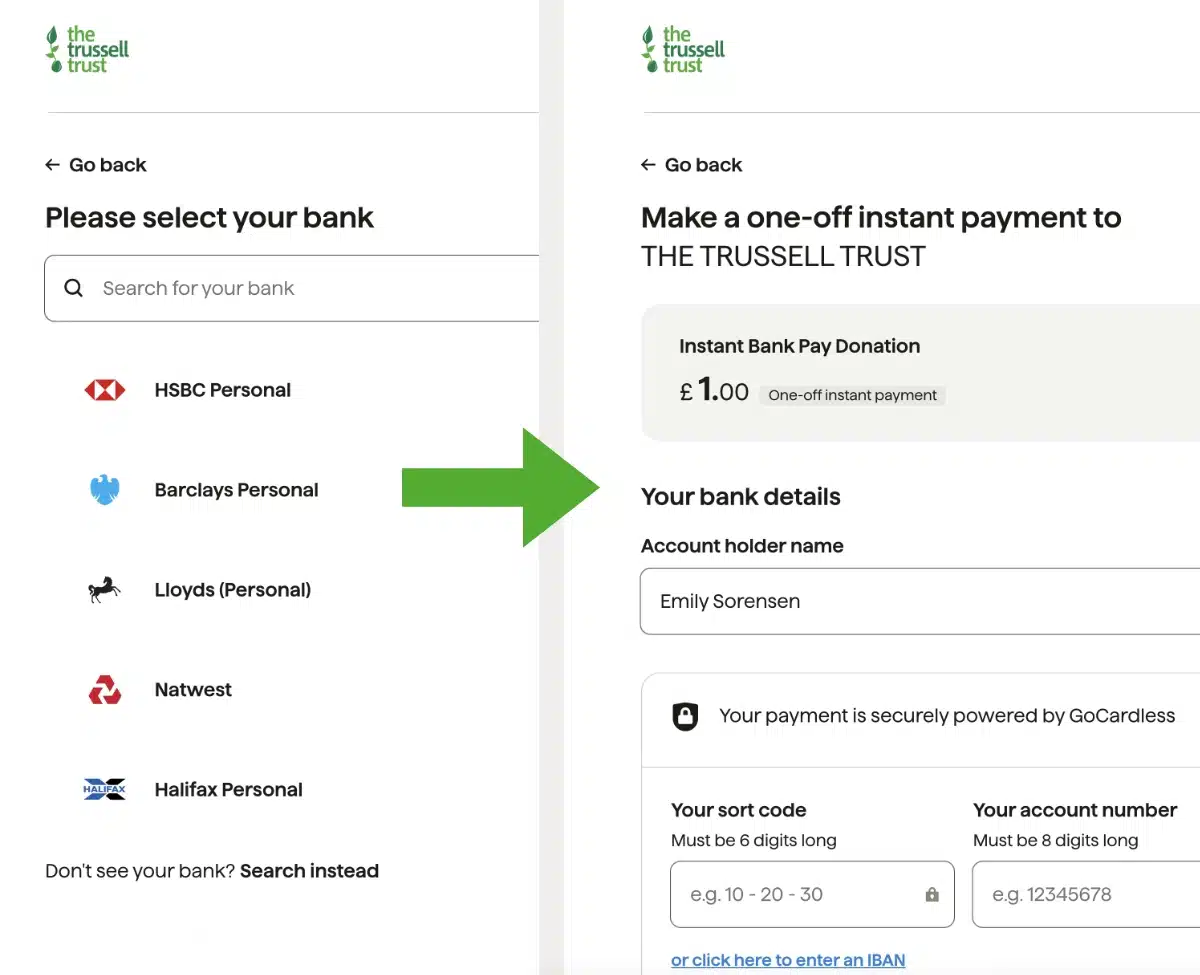

Account-to-account payments are user-friendly, direct bank transfers without intermediaries like a credit or debit card (hence the name GoCardless). Payers simply choose their bank in the online checkout and validate their account details with their banking app.

Image: MobileTransaction

GoCardless processes bank transfers instead of card payments.

The company’s edge over traditional bank transfers is its easy web interface, fewer failed transactions and automated payment processes (e.g. email notifications) that make life easier for both merchants and payers.

Its main products include:

- One-off bank-to-bank payments completed straight away

- Subscription payments via Direct Debit

These can integrate with your existing commerce software or be managed separately in the GoCardless web portal. Businesses can also generate APIs (application programming interfaces) to build a custom solution with their online store or app.

Our experience and opinion of GoCardless

GoCardless is a scalable system that makes it more accessible for merchants to accept bank-to-bank payments, but it does have some downsides too.

Based on our experiences, we think even small businesses can get started easily by signing up on the website and creating subscriptions and payment links from the uncomplicated web interface.

“I tested sending money from my bank account to another account, and it went through in a few seconds. The interface was really straightforward with clear instructions during the few steps needed.”

– Emily Sorensen, Senior Editor, MobileTransaction

It works well for most users on a laptop, but we think a GoCardless app for merchants would make it more convenient to manage payments and customers on the go. Customers, on the other hand, generally experience an easy payment flow on any device with good, automated email communications to follow.

| GoCardless criteria | Rating | Conclusion |

|---|---|---|

| Product | 4.2 | Good |

| Costs and fees | 4.2 | Good |

| Transparency and sign-up | 4.3 | Good/Excellent |

| Value-added services | 3.8 | Good |

| Service and reviews | 3.8 | Good |

| Contract | 4.7 | Good/Excellent |

| OVERALL SCORE | 4.1 | Good |

The customer service is generally okay, but if you prefer to pick up the phone to ask for help, I don’t think this is the most convenient solution since email support is encouraged. Especially since many are new to accepting bank payments, it would be good with a helpline.

Fees are best for VAT-registered businesses that can reclaim VAT, since this is added to processing rates. But the domestic rate is still lower than the card transaction costs for those who are not VAT-registered. With the availability of Instant Bank Pay, even settlement is handled the same day for the same low fee.

“Despite the added VAT, the rates are still attractive for online payments – but it certainly makes it more expensive for those who can’t claim back VAT.”

– Emily Sorensen, Senior Editor, MobileTransaction

Another thing to be aware of is that transaction fees are for all submitted payments, not just the ones that go through successfully. This is something GoCardless recently introduced in the last year. If many of your bank transfers don’t succeed, then, it means you pay a significant amount for failed payments, unless you subscribe to Advanced or Pro where the Success+ module prevents failed payments.

Getting your business name on customers’ bank statements also comes at an extra £50 monthly cost, which I’m sure many merchants won’t like. It’s quite an important feature to help customers trust a business and identify payments.

But the main question is whether your customers are happy to pay by bank transfer or would prefer a card payment. In today’s world, many still prefer debit and credit cards, and not everyone has a bank account and app for it. Still, GoCardless is cancellable any time, so it’s easy to trial.

Pricing

GoCardless has refreshingly simple and transparent fees, with several plans to suit different sizes of business.

There’s no monthly fee on any of the plans – the main cost is a transaction fee that’s higher on the more advanced subscriptions.

On the free Standard plan, the transaction fee is 1% (UK and Eurozone transfers) or 2% (international transfers) + 20p, plus VAT. This is charged on a pay-as-you-go basis from your payouts.

International transfers are powered by Wise that uses the real exchange rate. There is no extra fee for currency conversion.

Note that VAT is added to all the fees in the UK. So for the Standard UK rate, the full transaction rate is actually 1.2% + 24p for domestic transfers and 2.4% + 24p for international transfers including VAT.

You have a choice between 3 plans with the following features:

- Standard: Core features, multiple currencies.

- Advanced: Reduction of failed payments, verify account details at checkout, tailored customer experience.

- Pro: Identification of risky payers, chargeback monitoring.

Larger businesses can get on a custom plan with tailored fees, which requires a quote.

| GoCardless fees | |

|---|---|

| Monthly fee* | None |

| Transaction fees* | Standard: UK & Eurozone payments: 1% + £/€0.20 (fee max. £/€4) International payments: 2% + £0.20 Advanced: UK & Eurozone payments: 1.25% + £/€0.20 (fee max. £/€5) International payments: 2.25% + £0.20 Pro: UK & Eurozone payments: 1.4% + £/€0.20 (fee max. £/€5.60) International payments: 2.4% + £0.20 Extra 0.3% applies to transfers above £2k/€2k |

| Refund fee | £0.50 each |

| Chargeback fee | First 15 chargebacks/month free, then £5 each |

| Contract | Cancellable any time |

*Excluding VAT.

UK businesses pay no chargeback fee for the first 15 chargebacks (disputed transactions) per month, but then it costs £5 for each one after. This is still cheaper than most card payment providers who usually incur a charge of over £10 per disputed transaction.

Few other GoCardless costs apply, unless you subscribe to an add-on module (business name of customer’s bank statements: £50 monthly; custom checkout experience: £150 monthly) or are using a partner product with their own fees.

You can cancel the Standard, Advanced and Pro plans any time, but the custom plan comes with a contract explained to you at sign-up.

How long does it take to receive funds?

Settlement time – i.e. payout times – depend on the method of payment.

For Instant Bank Pay, transactions take less than a working day to settle in your business account. This is excellent compared with card transactions which typically take 1-3 working days to transfer to the merchant’s bank account.

Direct Debits (subscriptions) take 5-6 working days to settle – quite a bit slower than Instant Bank Pay. The initial Direct Debit transaction can take 1-2 weeks to settle, but you can choose to accept Instant Bank Pay for the first payment to avoid that.

Features

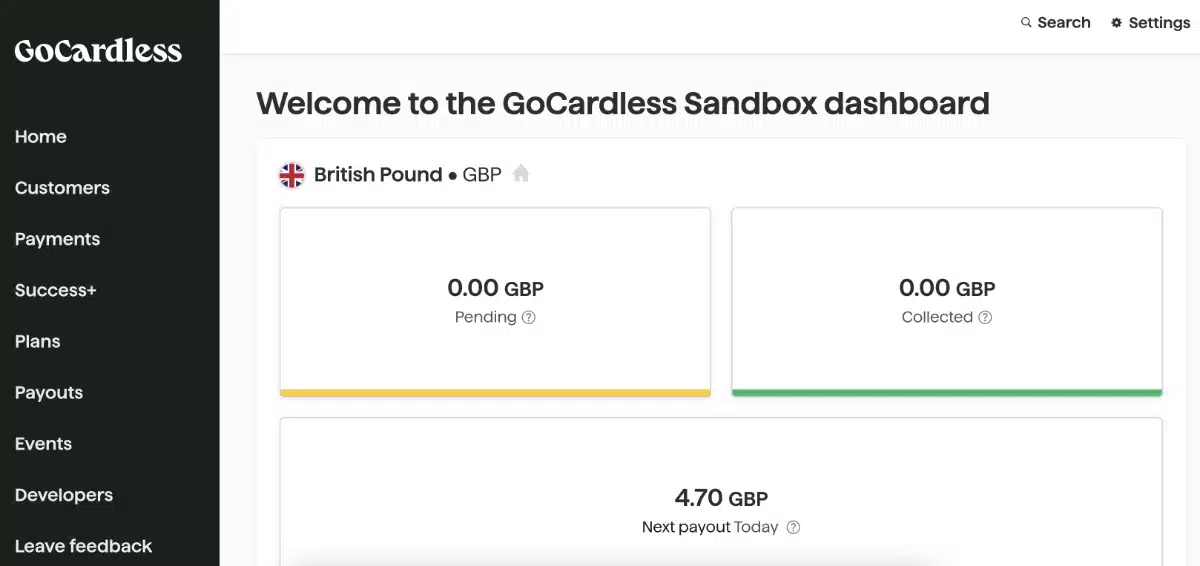

What can you do with GoCardless? We set up a sandbox (test) account to find out.

To create a user account, we just filled in some basic business information and contact details, then clicked to open our new dashboard in an internet browser.

The amount of features available depends on the plan you’re subscribed to. Everyone has access to these core features:

- Collect and manage subscriptions

- Instant Bank Pay (one-off payments)

- Ability to accept international payments

- Invite customers to create a Direct Debit online

- Integration with accounting and billing software

Image: MobileTransaction

Our merchant dashboard was simple, with a good overview of key figures.

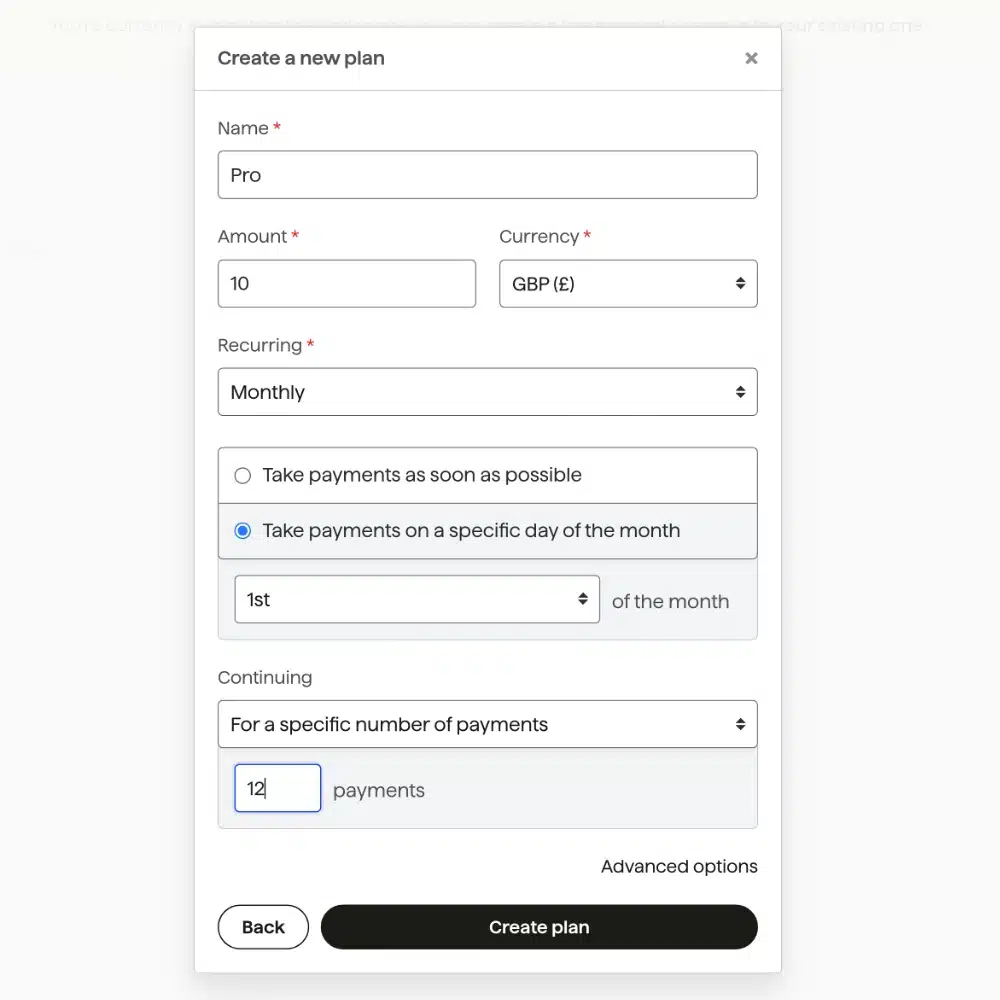

Subscriptions (‘Plans’) can be customised in the online merchant interface and shared with customers who need to pay on a recurring basis. This is done through Direct Debit in the UK, so the payer essentially gives consent to this through a streamlined interface.

“To me, it was quite straightforward to create a recurring payment. I named the plan, amount, frequency and date of payments, whether it continues until cancelled or after a set amount of payments, and a redirect link for when the customer has finished subscribing.”

– Emily Sorensen, Senior Editor, MobileTransaction

Apart from emailing customers a link to the subscription we wanted them to subscribe to, we could generate a link for a website that goes to the subscription checkout.

Image: MobileTransaction

Subscriptions are tailored in this pop-up.

When testing, it was not straightforward to edit all the details of an existing plan (except for name and redirect link), but you can cancel and create a new plan with the correct details.

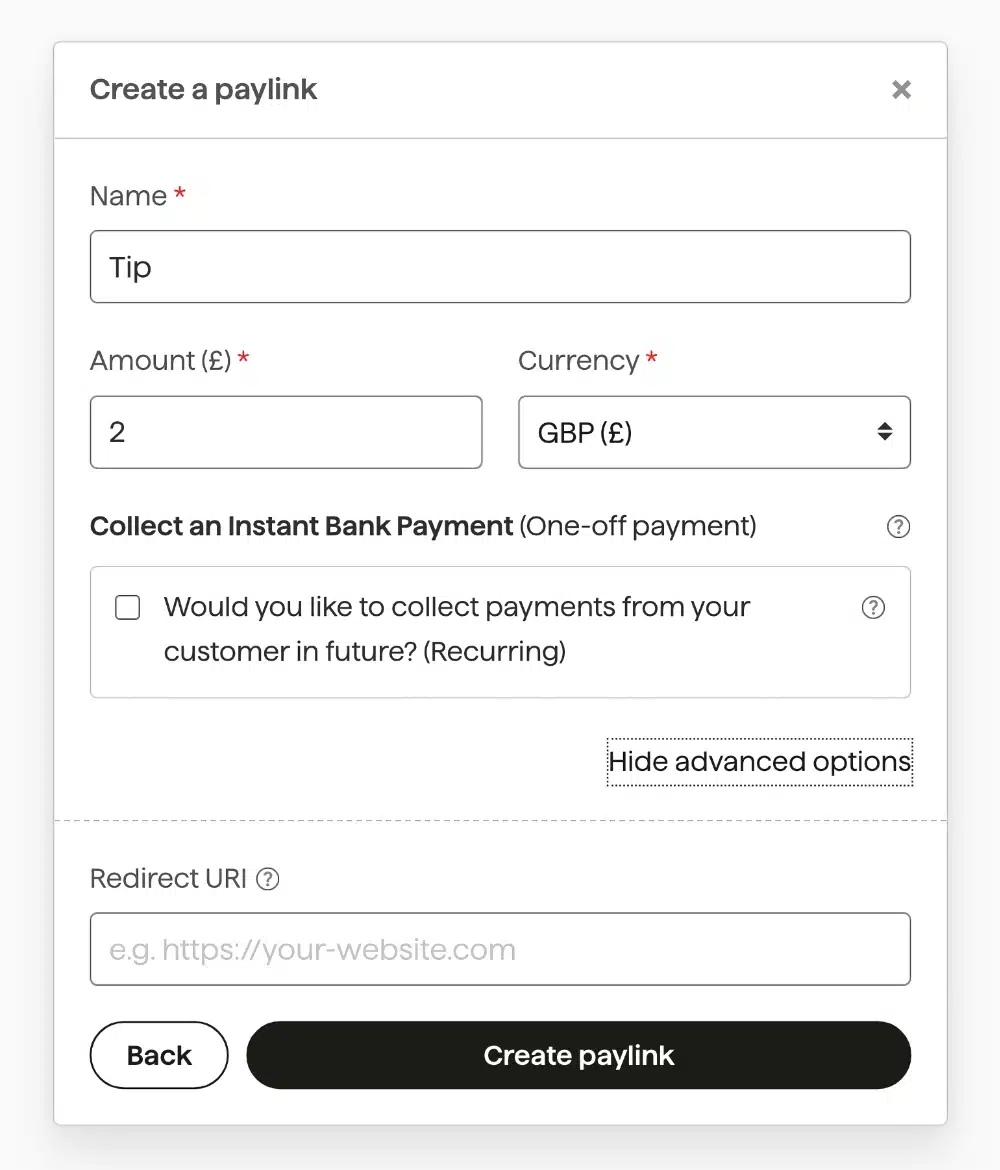

One-off payments (‘Instant Bank Pay’) are easily created in the form of a ‘paylink’. These are payment links for specified, one-off transactions via bank transfer, completed on a web page.

As with subscriptions, these payment links are easily created through the dashboard and added to a website, email, invoice, social media or anywhere else online, in-app or in messages.

Instant Bank Pay transactions can be used for the first payment of a subscription, which normally takes longer to clear. Both the customer and merchant get an instant confirmation that it’s gone through, and the funds take up to a day to settle in your bank account.

An overview of payouts (accepted payments moved to your bank account) is accessed in the dashboard. We found that useful for tracking which payments have been approved, processed and cleared.

Image: MobileTransaction

The merchant dashboard is simple and gives a good overview of key figures.

Customers can be managed and exported from the dashboard. If someone new completes a payment, they are added to this list. On Advanced and Pro plans, you can add customer details manually if talking to them on the phone or face-to-face – otherwise, only customers who signed up online are added.

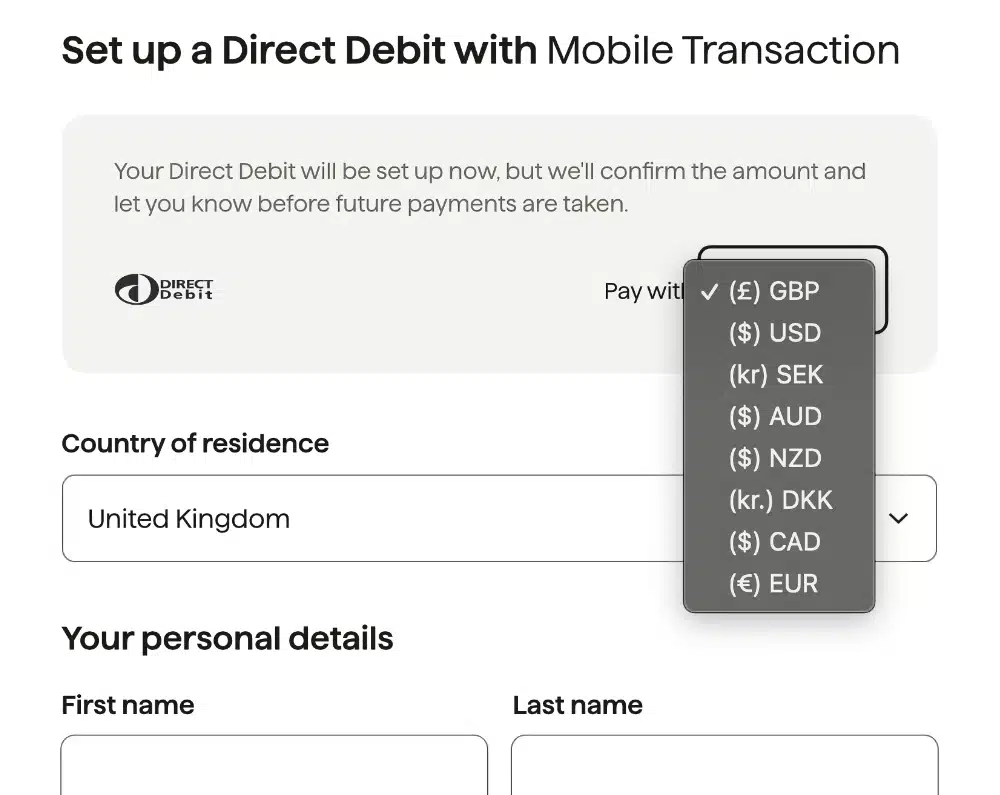

International payments are accepted in the currencies of GBP, EUR, USD, AUD, NZD, CAD, DKK and SEK. You can specify the currency for both subscriptions and one-off payments and accept bank payments from the Eurozone, US, Australia, New Zealand, Denmark, Sweden and Canada.

Image: MobileTransaction

Payers can select their currency and country in the online checkout.

Foreign transactions use the customer’s local bank debit schemes, instead of the UK’s Bacs Direct Debit scheme.

Avoiding payment failures (‘Success+’) is another feature that GoCardless is proud to implement (on Advanced and Pro, not Standard). It’s a system that uses intelligent mechanisms to maximise the chance of successful payments by initiating transfers during times when failure rates are reduced.

The Protect+ fraud protection system for subscriptions is also part of the Pro plan so you don’t have to worry about payment security.

Customisation options of the customer sign-up page are limited to adding your business details, logo and colour schemes on all plans.

On Advanced, you can also tailor email notifications so they align with your branding colours, but costs apply to this. On Pro, you can fully customise the payment pages and email notifications. Regardless of the plan, you have to pay extra for putting your business name on customer bank statements.

“Probably the biggest downside of all plans is the inability to specify a payment reference for customer bank account statements. This means payers will see GoCardless’ name instead of yours and might question what the payment was for. But with a £50/month add-on, your business name can appear on bank statements.”

– Emily Sorensen, Senior Editor, MobileTransaction

Users can integrate GoCardless’ payment flow on their website with APIs (Application Programming Interfaces) or simply connect it with 350+ compatible ecommerce, billing, invoicing, accounting or other platforms your business is already using. This way, you don’t have to log into GoCardless’ interface to manage transactions, but can stick to where you’re usually doing your admin.

Considering accepting cards instead? View card payment methods

One thing we noticed is lacking is a mobile GoCardless app. This would allow merchants to manage account features on their phone instead of having to log in via an internet browser. Of course, you can log into the online portal in your smartphone browser, but this is not as responsive or easy to do as on a large computer screen.

GoCardless compared with alternatives

So far, the UK hasn’t got a huge selection of specialised account-to-account payment platforms. GoCardless is the biggest one, but smaller platforms are emerging.

Larger businesses can opt for Swedish company Brite that specialises in instant bank-to-bank payments across borders. The downside of Brite is its preference for bigger online businesses and hidden fees, leaving out individual merchants, small teams and in-person payment options.

Several major business accounts now also incorporate bank pay into its payment acceptance solutions, for example Monzo.

Customer service and reviews

Customer support can be reached by email 24/7 and telephone on weekdays between 9-6pm (GMT/BST).

It’s clear from user complaints that the company prefers emailing, so you may not get a satisfactory response on the phone unless you’re a Custom subscriber paying for priority support. Custom users also get a dedicated “solutions engineer” to help with setup and issues.

GoCardless reviews are mostly positive, so it is overall a respectable platform with a high satisfaction rate.

That said, GoCardless is not free from negative reviews. Users have reported difficulties viewing pages on mobile screens (responsiveness issues) and being told to contact support in writing rather than by telephone.

Signing up for an account online is fast and easy, so you can get started with payments straight away if all goes smoothly.