- Pros: Good card machine selection. 24/7 support. Merchant portal. Online payment options. Next-day payout option.

- Cons: Contract lock-in. Fees can be high for small businesses. Not transparent about pricing. Customer support issues.

- Choose if: You want a full card payment package directly from a card processor and consistently have a high sales volume.

Overview

In summary

What is Elavon?

Our opinion

In detail

Card machines

Pricing and contract

Online payments

Support and reviews

What is Elavon?

Elavon is a decades-old, global merchant service provider and acquirer serving UK merchants. It operates as Elavon for its in-person payment solutions and Opayo for its online payment platform.

The company offers the following products and services catering to any size business in most sectors:

- Card machines

- Online payment gateway (Opayo)

- Payments over the phone (Opayo)

- Merchant account for card processing

Elavon’s card machines are rented or purchased together with an Elavon merchant account, which includes acceptance of Visa, Mastercard and other cards depending on your contract.

Looking for popular card machines?

Compare best card terminals for small businesses

Our opinion: better for stable, high-volume businesses

At a first glance, Elavon looks like a decent merchant service provider of high-quality card machines for most business types. But a closer look reveals many costs that not all small businesses can afford. Add to that the lack of transparency around early terminations of contracts, and it may be too much hassle.

“For a small business, Elavon is not the easiest to deal with compared with businesses transacting for over £1-£2 million annually. This is a traditional credit card processor with a bureaucratic service that mainly benefits big companies.”

– Emily Sorensen, Senior Editor, MobileTransaction

Elavon’s card machine selection has hardly changed over the last several years. While other merchant service providers have mostly upgraded their card machines to Android card terminals like PAX A920, Elavon has stuck by a slightly outdated Poynt terminal and very outdated mobile card reader we don’t recommend. The traditional Ingenico card machines with push-buttons are okay and definitely work well.

| Elavon criteria | Rating | Conclusion |

|---|---|---|

| Product | 4 | Good |

| Costs and fees | 3.7 | Passable/Good |

| Transparency and sign-up | 3.2 | Passable |

| Value-added services | 3.8 | Good |

| Service and reviews | 3.4 | Passable/Good |

| Contract | 3.5 | Passable/Good |

| OVERALL SCORE | 3.6 | Passable/Good |

Overall, it’s unlikely you’ll lack any features relating to payments, whether online or in person. With extras like integrated POS software, a good range of online payment methods and an online portal to track transactions, you’ll probably get it all through Elavon.

Features aside, Elavon is a better choice for high-volume merchants looking for a long-term card payment solution than a new startup with uncertain prospects. Lower transaction fees for small businesses are available through Worldpay, Takepayments and other card machine solutions.

Elavon card machines

Elavon has a good selection of card machines, each with special strengths. They all accept contactless and chip and PIN cards from all the major card brands.

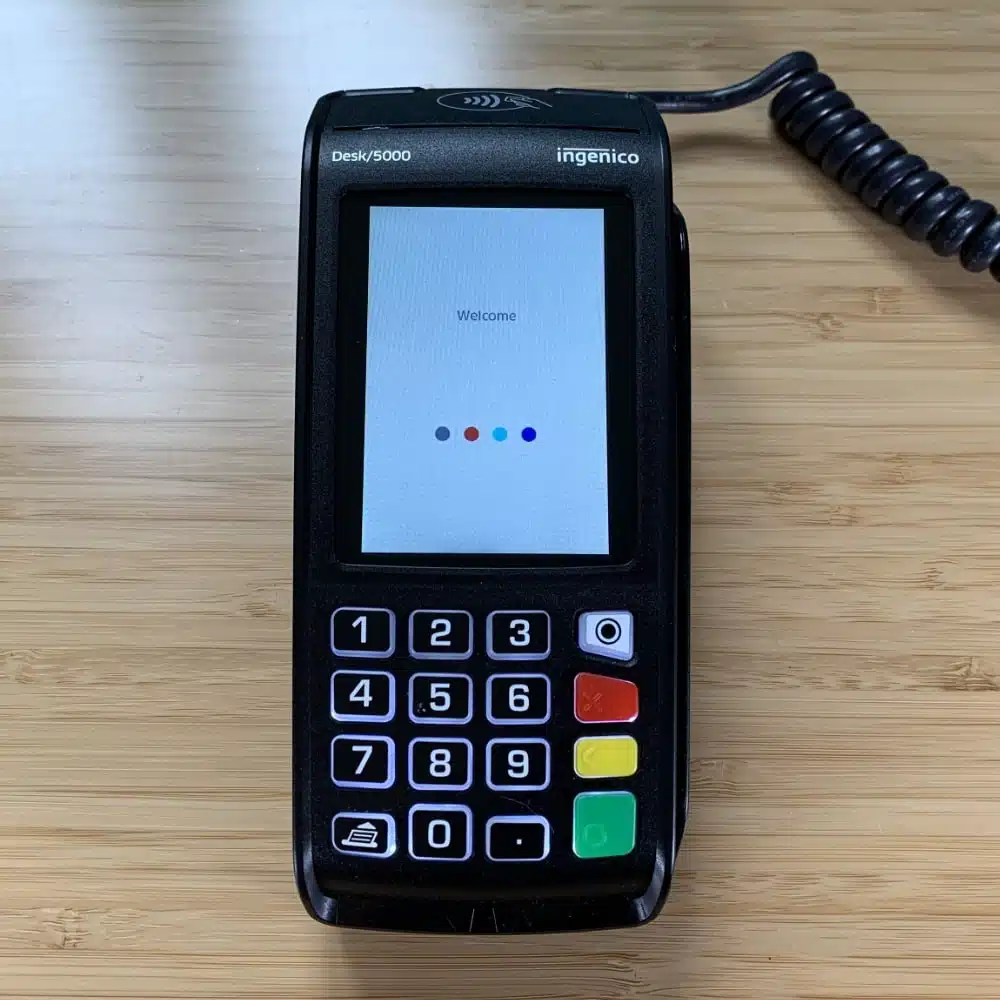

Two of them are Ingenico models (Move 5000 and Desk 5000) with a traditional look and touchscreen above a physical PIN pad. They use a Telium Tetra operating system with options for pre-authorisation of transactions (great for car hires and hotels), Dynamic Currency Conversion and displaying your company logo on the screen.

We’ve personally tested and tried the Ingenico Desk and Move 5000 terminals over time. Although not as “high-tech” as a smart POS terminal with a touchscreen, they are familiar for all people and very ergonomic with a physical, lit-up keypad and light weight. The countertop model (Desk 5000) is a little more restrictive with its cable, but this makes it more securely attached at a till point.

Tetra Desk 5000 (Ingenico)

Tetra Desk 5000 is an Ingenico model. Photo: MobileTransaction

Tetra Move 5000 (Ingenico)

Tetra Move/5000 in charging cradle. Photo: Elavon

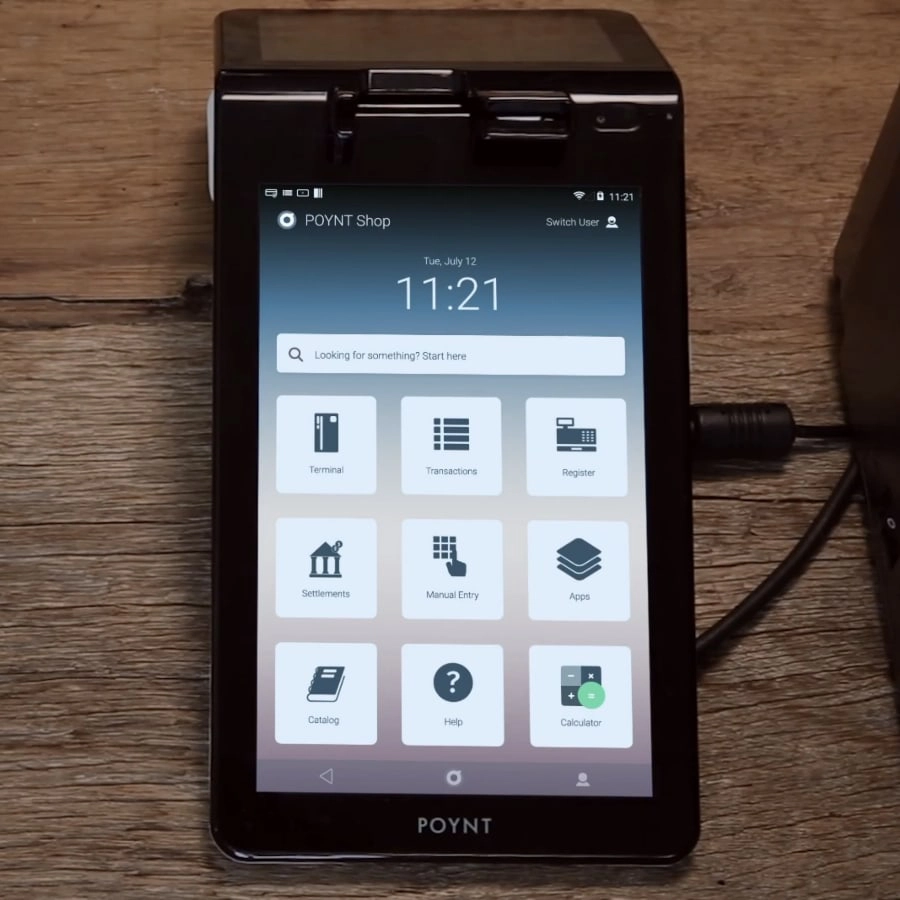

The Poynt model doesn’t have a physical PIN pad, instead showing all functions and keys on a medium-sized touchscreen. It also allows payments in a foreign currency, gift card acceptance and much more through its app selection on the screen.

Elavon is one of the few merchant service providers offering Poynt terminals. Most others opt for PAX terminals, which is generally more popular among users.

Poynt P61

Poynt P61 is a portable POS terminal. Photo: Elavon

The Elavon Mobile card reader (previously called MobileMerchant) is very lightweight and small, but then it only works in conjunction with a payment app on an iPhone or Android device. It doesn’t have a printer, in contrast with all the other card machines above, nor does it connect with an external receipt printer. Elavon Mobile is therefore better suited for casual payments on the go.

Elavon Mobile

The Elavon Mobile card reader needs an app.

It’s possible to use any of these card machines independently of an EPOS system, but the Ingenico terminals can integrate with POS systems through the Smartlink connector software.

The Poynt terminal and Mobile card reader use Talech POS software, which can be upgraded with a large tablet register and more point of sale features for retail or hospitality. The Talech app for the card reader is not great or reliable, but the full-fledged Talech EPOS for tablet registers is much better.

Pricing and contract lock-in

Elavon’s pricing is not very detailed on its website, barring some main costs like rental.

Every merchant goes through an enquiry stage where an Elavon sales rep asks about your sales turnover, type of business and the sort of setup needed. A quote will then be provided with transaction charges, monthly and other costs.

“Bigger businesses accepting more than £2 million annually can negotiate good rates. Since Elavon is an acquirer and card processor, there are no middlemen to add extra fees. But we hear that smaller businesses have a hard time dealing with Elavon.”

– Emily Sorensen, Senior Editor, MobileTransaction

The Tetra and Poynt terminals can be rented for a monthly fee of £15-£40 per terminal with a contract of up to 18 months. Elavon processes the debit and credit cards through your own dedicated merchant account with its own monthly fee from £10.

Some websites claim there is no early termination fee despite the guise of a lock-in, but some users complain of a charge of several hundreds of pounds when they try to cancel. Even if you were promised a lack of termination charges, it could still take months to cancel your contract so you end up paying more than expected.

| Elavon pricing | |

|---|---|

| Contract | Up to 18 months |

| Setup fee | From £25 |

| Merchant account | From £10/mo |

| Card machine rental | Tetra Desk 5000: £15 + VAT/mo Tetra Move 5000: £18 + VAT/mo Poynt P61: £40 + VAT/mo |

| Chip and tap transaction fees | 0.99%-3.75% + fixed fee (custom) |

| Monthly minimum processing fee | From £15/mo |

| Paper statements | From £3 each |

| Early termination fee | £0 to several £100s |

| Chargebacks | From £25 each |

| PCI-DSS compliance | Monthly and annual fees may apply |

| Elavon pricing |

|

|---|---|

| Contract | Up to 18 months |

| Setup fee | From £25 |

| Merchant account | From £10/mo |

| Card machine rental | Tetra Desk 5000: £15 + VAT/mo Tetra Move 5000: £18 + VAT/mo Poynt P61: £40 + VAT/mo |

| Chip and tap transaction fees | 0.99%-3.75% + fixed fee (custom) |

| Monthly minimum processing fee | From £15/mo |

| Paper statements | From £3 each |

| Early termination fee | £0 to several £100s |

| Chargebacks | From £25 each |

| PCI-DSS compliance | Monthly and annual fees may apply |

Transaction fees depend on your estimated business turnover, type of business and card type. Most Elavon card machines advertise fees from 0.99%-1% for chip and PIN or contactless payments, but the reality is more likely between 2%-3.75%, according to some reports. A fixed transaction fee in the region of 10p-20p is also applied to transactions.

Additional costs apply to American Express acceptance, should you choose this option. Online and keyed transactions cost more than in-person payments, plus a monthly gateway fee for the lowest fees.

You can expect many extra fees in your account, which may not all be communicated at sign-up. There will be annual and/or monthly charges for PCI-DSS compliance, SIM card charges for 4G connectivity and a minimum monthly service charge if an agreed minimum in card processing fees was not reached that month.

Monthly paper statements with an account summary cost at least £3 each, but you can view these details for free in an online portal to avoid this. Chargebacks incur an admin fee of at least £25, and there may also be charges for things like card authorisations, terminal installations and refunds.

Free payouts with the Mobile card reader can take a couple of working days, but any of the monthly rental plans include settlement the next working day. For an additional cost, it’s possible to clear transactions in your account the same day.

Don’t want a long-term contract? The Elavon Mobile reader costs £19 + VAT upfront without monthly fees following. Transaction fees are also fixed from 1.75%. Given Mobile’s lack of commitment and miscellaneous costs, it is the least intimidating card payment service from Elavon.

Image: Elavon

Elavon’s card machines can be integrated with a full POS system.

Online payments

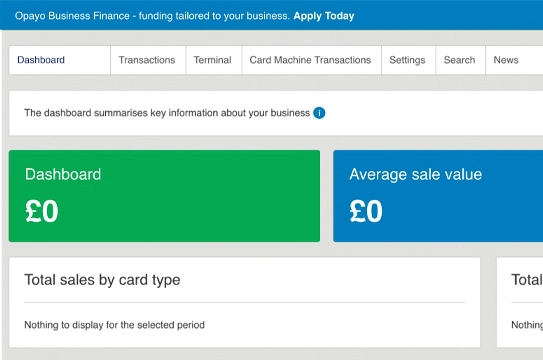

Apart from card machines, Elavon offers options for online payments under the name of Opayo (previously Sage Pay). This includes:

- Online payment gateway – for your ecommerce site

- Virtual terminal – for telephone payments

- Pay-by-link – for email invoices and other remote payments

- Recurring payments – for subscriptions and billing

There are two plans for these: “Fixed” for £25 monthly, no setup fee and transaction fees from 0.99% (first 350 transactions are free), or “Pay as you go” without a monthly fee, but with a £99 joining fee and transaction fees from 1.99% + 12p.

Image: Elavon

Opayo’s merchant portal shows card machine payments too.

Opayo also allows you to accept digital wallets, local payment methods and bank transfers online. You can customise the online checkout page, which can be integrated on select ecommerce platforms like WooCommerce and BigCommerce.

The online portal, where these features are managed, incorporates your card machine transactions too, allowing you to track these from any browser.

Reviews and customer support

A good thing about Elavon is its 24/7 customer support available to all its merchants. You can contact Elavon by telephone and email, though emails can take some days to get a reply for. You get a dedicated account manager, but this does not guarantee prompt responses.

“We’ve heard from small businesses that Elavon is not easy to deal with pre- and even post-sales. This seems to be a merchant service that prefers big businesses and deprioritises the small ones.”

– Emily Sorensen, Senior Editor, MobileTransaction

Elavon reviews from users are a mixed bag. We’ve seen similar complaints from users including:

- Slow service and poor service

- Unexpected fees and billing issues

- Equipment not turning up

- Unknowingly getting locked into a contract with a cancellation fee

Given that Elavon is one of the largest payment processors in Europe (with over 1 million businesses signed up), it is normal to receive a fair share of complaints. What we don’t like to see, however, is the reports on lack of customer support. You can sometimes wait a long time to get help for urgent, technological issues.