What is Elavon MobileMerchant?

Elavon has been around for over 30 years and is one of the biggest acquirers and payment processors in the US, UK and Europe. The company offers a broad range of payment products for any size business, among others an app-based mobile card reader called MobileMerchant.

The card reader connects via Bluetooth with your WiFi/3G/4G-enabled smartphone or tablet running the MobileMerchant app.

Accepted cards

The service accepts Visa, Mastercard, JCB, Discover and Diners Club cards, as well as Apple Pay, Google Pay and Samsung Pay. There’s a possibility of accepting American Express too, which may come with an additional contract.

You can also accept card-not-present payments through a virtual terminal (accessed in an internet browser) that comes with the package. In addition, the web portal shows sales data, receipts, user rights and account settings.

Fees and costs

MobileMerchant used to be more transparent about pricing, but have removed most of them from the website. You now have to contact them for the latest fees.

At the time of writing, there’s a one-off setup cost of £29 for the card reader and registration, after which you only pay transaction fees for the sales processed and payouts settled (30p each). Please note that pricing can change, so do ask the sales representative for details.

| Elavon cost | |

|---|---|

| Card reader | £29 + VAT |

| MobileMerchant app | Free |

| Transaction fees | From 1.75% (depends on card) |

| Settlement | £0.30 per same-day payout |

| Contract | Cancellable any time |

Transaction fees start from 1.75%, which would be for Visa and Mastercard transactions, possibly domestic consumer cards only. This fee would increase to 2.75% for some cards like JCB and Discover, whereas Amex typically has a different rate.

We have been quoted 3.75% rate for virtual terminal transactions, but this may be different at the time you contact them.

There are no monthly fees or no long-term contract. Higher-volume businesses may negotiate cheaper transaction rates, but Elavon will likely try to get those businesses to go for a traditional chip and PIN machine instead.

Card reader

Resembling a simple calculator, the Elavon MobileMerchant card reader measures 69 x 110 x 17 mm and weighs just 123 g – small and lightweight. It looks really basic, but meets security standards like any other reputable card reader.

It has a slot at the bottom for the insertion of chip cards, whereas contactless cards and mobile wallets (processed via NFC) are held over the display for a quick payment.

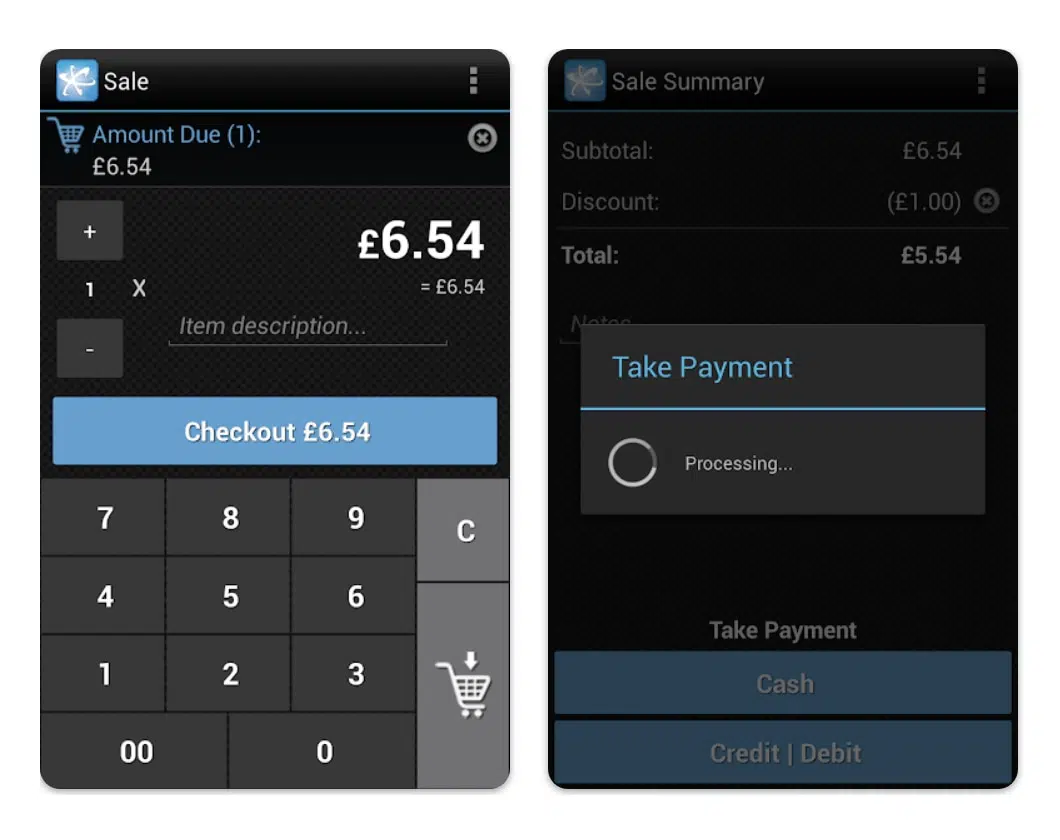

So how does a transaction work? You enter a GBP amount in the app plus any discount or product description. After picking debit/credit card as the payment method, the app communicates wirelessly with the card reader over Bluetooth.

The information is sent to the card reader that accepts the chip card or contactless tap. The customer can enter their PIN directly on the card machine’s PIN pad if needed, then the transaction completes over the internet.

The app

The MobileMerchant app works on iPhone and iPad running iOS 9.0 or later, or Android smartphones and tablets running Android 7.0 or up. It used to be compatible with Blackberry, but it’s unclear whether the latest version is.

What about features? The app has tipping functions, which not all free POS apps offer.

You can also add VAT and discounts to payments, create several user accounts for staff, process refunds and send text or email receipts after transactions. If you’re planning on printing receipts, however, MobileMerchant does not support this.

The MobileMerchant app looks a bit outdated, but has the basic features for card payments.

The app can also accept cash transactions, so there’s a way to track those on the go. It does not, however, connect with a cash drawer, so you’ll need a way to organise coins and notes if accepting this.

The app is not frequently updated. Last time the iOS app was updated was 1 year ago (July 2021). That is not a good indication of how serious Elavon takes the functioning of the app, as it typically requires regular updates (e.g. monthly) to fix new bugs or adapt to smartphone updates.

For security reasons, Elavon’s app doesn’t work on rooted or jail broken devices. Rooting is when the user can access system files on the device, enabling the operating system to be controlled or changed. Jail breaking is the removal of limitations imposed by the phone carrier, i.e. you may not be able to use a phone that has been unlocked (where it was previously locked to one mobile network).

How does it compare to other solutions?

Like other key players in the UK, MobileMerchant eliminates the need for a contract, monthly fees and minimum sales volume requirements, but falls short when it comes to fee rates and quality of the product.

The £29 price tag makes the Elavon card reader comparable or slightly more expensive than similar options. Elavon’s transaction fees are the most expensive among the main competitors in the UK. To compare:

- Zettle charges 1.75% for all card reader payments

- Square charges 1.75% for all card reader payments

- SumUp charges 1.69% for all card reader payments

What’s more, the apps by Zettle, SumUp and Square are much more frequently updated, so that the software actually works consistently. Most user reviews about MobileMerchant complain about the app not working or being buggy, rendering the card reader useless for payments. This rarely happens with the above competitors.

Customer service: 24/7 phone support

Elavon tries to compensate for its high prices by offering a round-the-clock call centre. Statistics published by Elavon indicate that the first-call resolution rate is 89%, which is quite good, although the few reviews available indicate poor service.

When we phoned MobileMerchant, they happily provided details of their prices without being salesy, but emailing did not give us any response even after a month. You may therefore be limited to calling rather than writing for support.

Getting started

To get started with Elavon MobileMerchant, you need to complete an online registration form requiring proofs of ID, address and business banking. The form takes 15 minutes to complete in most cases, though uploading documents can delay it.

The online registration is only possible if you’re ordering one card reader. For more than one, you need to call customer support to sign up that way. We generally recommend speaking to them before registering, as you won’t get the full picture of fees otherwise.

Our verdict

MobileMerchant falls far short of the alternatives available on the UK. Other mobile card readers (e.g. Zettle Reader, SumUp Air) have more feature-rich and reliable payment apps so you rarely lose a sale because of a technical issue. MobileMerchant’s outdated app offers little reassurance that you can trust it.

Elavon’s app has just basic features to accept card transactions – nothing more. In other words, we don’t see much reason to choose MobileMerchant over the cheaper options on the market that generally provide more cutting-edge solutions and lower fees.

| Elavon MobileMerchant criteria | Rating | Conclusion |

|---|---|---|

| Product | 2 | Bad |

| Costs and fees | 3.5 | Passable/Good |

| Transparency and sign-up | 3.7 | Passable/Good |

| Value-added services | 3.6 | Passable/Good |

| Service and reviews | 3.5 | Passable/Good |

| Contract | 4 | Good |

| OVERALL SCORE | 3.2 | Passable |

| Elavon MobileMerchant criteria |

Rating | Conclusion |

|---|---|---|

| Product | 2 | Bad |

| Costs and fees | 3.5 | Passable/Good |

| Transparency and sign-up | 3.7 | Passable/Good |

| Value-added services | 3.6 | Passable/Good |

| Service and reviews | 3.5 | Passable/Good |

| Contract | 4 | Good |

| OVERALL SCORE | 3.2 | Passable |

If you need remote payments and 24/7 customer support, it may be worth considering this package since you get a virtual terminal included without a monthly fee. But Elavon’s rate is higher than the virtual terminal fees of Square and SumUp.

In conclusion, this is not an advanced solution for anyone who wants more than a simple card reader for on-the-go payments. There’s no integration with point of sale hardware (such as a receipt printer) and no prospect of new features being added.

That said, it might be a good service for existing Elavon merchants who need an extra way to accept cards on the go.