Mobile payments refer to any payment made using a mobile device. Due to our ever-increasing smartphone dependence, various ways have been developed to allow consumers to pay conveniently through a phone.

To put this in perspective, statistics show that a third of UK consumers are now using their NFC-enabled phones for contactless payments in stores. Apple Pay, with their ‘limitless’ transactions, has even caused a 11% increase in the average mobile transaction total in the last half of 2017, as more and more people feel secure using their smartphones for point-of-sale transactions.

But there are more types of mobile payments than contactless phone payments, both for remote or face-to-face payments. Let’s look at the different ways you can pay with a mobile phone.

Overview

Point-of-sale solutions

NFC payments

Sound wave payments

MST payments

In-store & remote

Remote payments

Internet payments

Payment links

SMS payments

Direct carrier billing

Mobile banking

Point-of-sale solutions

Near-field communication (NFC) payments

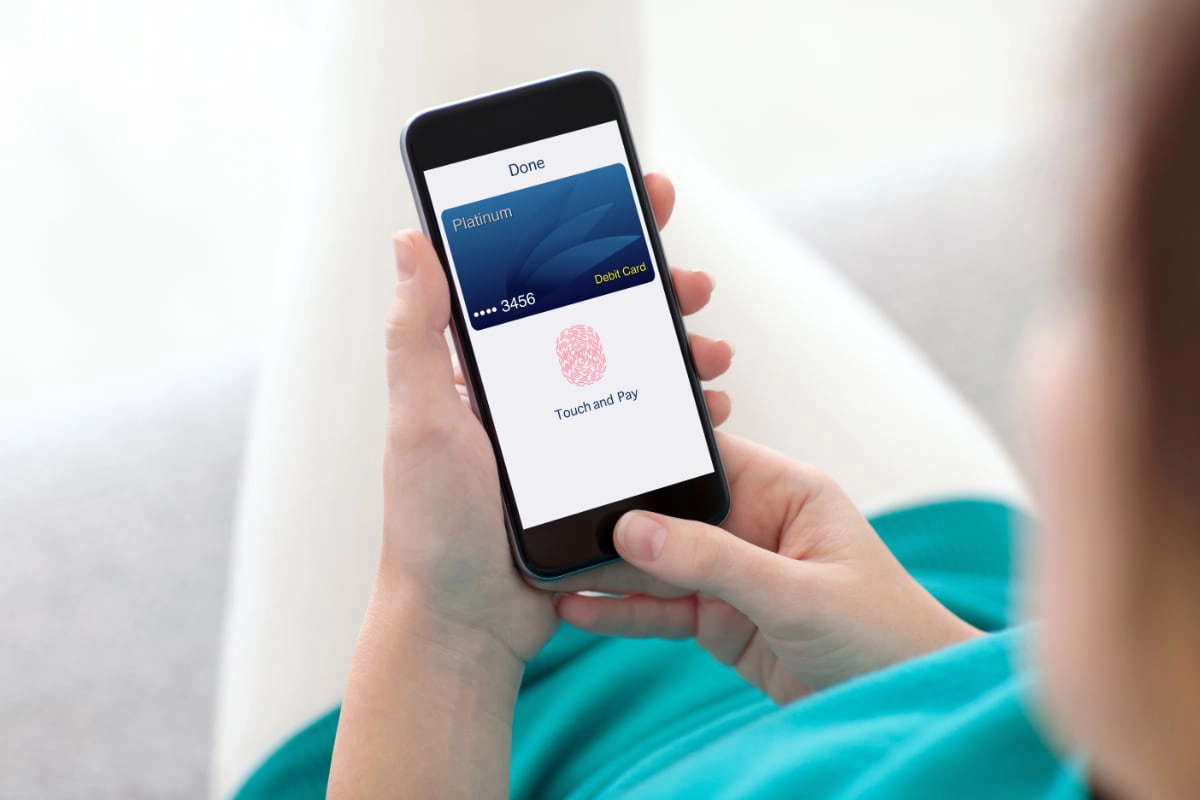

Use of near-field communication (NFC) payments is growing rapidly in the UK. Digital wallets using NFC for contactless card machines include Apple Pay, Samsung Pay and Google Pay. But how does it work?

NFC phones communicate with with NFC-enabled card machines using close-proximity radio frequency identification. The mobile phones don’t have to touch the point of sale to transfer information, i.e. money, but they have to be within a few inches of the terminal.

In London, busses and tube stations accept phone payments through NFC where you would normally tap the travel card. Similarly in China, NFC is accepted as a means of payment on all public transport, and in Japan, it is also being used to provide identity card information. In Nice, visitors and residents can use NFC to purchase almost anything.

NFC involves a direct, almost instantaneous transfer of encrypted data to point-of-sale devices, as opposed to chip and PIN technology that takes longer to process. Many mobile phone operators are looking at ways to further develop this technology.

iPhone uses fingerprint recognition to finalise each Apple Pay payment, contributing to the already-secure NFC technology.

Sound waves-based payments

Sound wave-based (or sound signal-based) mobile payments represent a newer, cutting-edge solution that works for most mobile phones. Transactions are processed – without the need for internet – through unique sound waves containing encrypted data about the payment. Sound waves are sent from a terminal to the mobile phone to convey payment details, where after the customer’s phone converts that data into analog signals that finalise the transaction.

Instead of using inbuilt technology like NFC, your mobile wallet, banking app or card terminal just needs a simple software installation. There’s no need for any extra hardware. This makes it an affordable solution especially in areas and countries where people can’t afford the latest smartphones, but rely on more basic technology to process payments.

Magnetic secure transmission (MST) payments

A third way to pay with a mobile phone at a card terminal is through magnetic secure transmission (MST). Samsung Pay uses both MST and NFC payments for contactless mobile phone payments.

MST is when a phone emits a magnetic signal imitating the magnetic strip on the payer’s credit card, which the card terminal picks up and processes as if a physical card was swiped through the machine. Some card machines may require a software update to accept MST, but most new terminals accept it already.

Magnetic secure transmission is as secure as NFC, in part because they both use a secure tokenisation system, and it is safer than using a physically present card.

Both in-store and remote payments

Mobile wallets

A mobile wallet (also called digital wallet) stores payment information on a mobile device, usually in an app. Mobile wallets can utilise different technologies in the payment process, most frequently NFC, but other modalities like QR codes have been used by some services.

Apple Pay is an example that cuts across several categories, allowing contactless payments on card terminals (using fingerprint authentication via the phone), in-app purchases and payments on the internet.

Google Pay and Samsung Pay are two other big mobile wallet contenders.

Digital wallets are very secure to use. They commonly work through complex encryption and tokenisation, a method using time-limited token numbers generated to process the specific transaction using your already-encrypted card “stored” in your mobile wallet.

Apart from credit and debit cards, it’s also possible to attach loyalty cards, boarding passes, tickets and other important documents in mobile wallets.

Quick response (QR) code payments

QR (abbreviation of “quick response”) codes have many uses and are often found in advertising, on product labels and what seem to be the most random places. Not everyone knows they can be used to pay for things too. It works through certain banking apps where your cards are already associated, and other apps by stores and providers where your card details can be connected.

To use an American example of in-store payments through a QR code, Walmart customers can use the Walmart Pay app, where their payment method is connected, and simply pay in store by scanning a QR code at checkout through the app.

In all cases, you have to aim the camera carefully to match the indicators on your phone screen before the app can scan the code. Some people report feeling this is a hassle, especially since you have first open the relevant app before you can start scanning.

QR codes take a few steps to open up an app on your phone, then a basic amount of precision to scan, which for some people can feel like a barrier.

Some e-commerce businesses use QR codes at their website checkout as an alternative to manually entering card details. For card-not-present transactions, this is more secure because your phone, that your card details are securely connected to, confirms you are the owner of the card – and because you’re not typing your unencrypted card details on a device screen.

More information: What are QR code payments and how does it work?

Remote payments

Internet payments

Many people simply pay on the internet in their phone browser (e.g. Safari, Chrome) or within apps, provided there’s WiFi or a 3G/4G network signal. There are several ways to pay this way. For instance, you can manually enter card details on a website to pay for an order (just like on a computer), automatically charge a bank card attached to a mobile app, use PayPal or follow a link to a digital invoice emailed to you.

Since smartphones could access the full internet, it has been common for people to simply enter their card details on a website checkout page to finalise a payment.

Pre-2010, this was commonly referred to as wireless application protocol (WAP) payments. WAP used to be the most common facility on smartphones connecting to the internet. So instead of a web browser with access to the entire internet, people paid through a more limited-capacity WAP browser or app – together classed as WAP payments.

But times have changed the payment landscape rapidly, and now, phones commonly use a newer mark-up language with full access to the internet.

Payment links

Overlapping with internet payments, we have payment links. Also named ‘pay by link’, it is most commonly referring to a button/link sent in an email, text message, messaging app or over social media. When the receiver clicks the link, a checkout page opens up in an internet browser where the recipient can enter their card details to process a transaction for a specified merchant.

The transaction total can be set in advance by the merchant sending the link, or in some cases entered manually by the recipient for e.g. charity donations. The merchant may itemise the bill so products are included on the customer’s digital receipt that follows, or you may only see a transaction amount with merchant details on the checkout page.

SMS payments

SMS payments – also called premium SMS – simply means paying for products or services via a text message. Once you’ve submitted a text message with the relevant information to the right payee phone number, the payment amount is added to your mobile phone bill. So in effect, you’re paying through your phone network provider, perhaps through direct debit or pay-as-you-go – the way you usually pay for your phone use.

Just a few years ago, SMS payments were one of the most popular methods of using mobile phones to pay for goods or services (even for person-to-person payments) or donate to charity, and for good reason due to its simplicity – all the user needs is a phone with text capability and prepaid SIM card or phone contract. With the increase in more advanced smartphones, however, other modes of mobile payments have seen faster growth.

Learn more: What are SMS payments?

Direct carrier billing

Direct carrier billing (DCB) – also called direct operator billing – is a way to pay through your mobile carrier instead of using bank or card details. A way to do this is to enter your phone number on a payment page or in an app, where after you go through a few authentication steps to confirm you’re the owner of that number (for instance, by confirming a text message). The payment will then be deducted from your phone bill or prepaid SIM card as with SMS payments.

Digital services like Google Play and the App Store offer the option to pay by DCB. It is also used for TV voting, charity donations and subscriptions for digital content.

Mobile banking

In certain countries such as Sweden and the UK, mobile banking has proven popular for transferring money between private individuals or paying bills.

Mobile banking is an increasingly popular way to keep track of personal finances, transfer money, pay bills and anything else your bank allows through their app.

Mobile banking is simply an app provided by the user’s bank, through which you can conduct financial transactions directly from your bank account. This is usually used for peer-to-peer transfers and payments to other people, but bills can also be paid this way.

Each bank has their own sign-up procedures for their app to verify you are the owner of the bank account. But once signed up, it is usually easy to log in on your phone and view your account balance and transaction history, make bank transfers, and anything else that your bank allows. Every bank has their own limits for what you can do through the app.

Not unlike mobile banking: What’s a neobank compared to other banks?