Zempler Bank (formerly Cashplus) is a UK-based bank account for companies and sole traders. In 2005, it was the first service to launch a prepaid card in the UK, and it was the first non-bank to launch a current account.

In February 2021, it became a full-fledged bank (Cashplus Bank). This was followed by a total rebrand in July 2024 to it current name: Zempler Bank.

The business account is managed through the Zempler Bank mobile app or web dashboard on a computer.

A Zempler account is particularly attractive to those with a poor credit history because there’s no credit check performed, and account features allow you to build a good credit history.

Unlike most other challenger banks, Zempler offers a business overdraft and business credit card to eligible users.

Getting started

Signing up is simple: fill in a short online application form which will be followed by an automatic business identification check.

After the verification, you immediately get a sort code and account number. However, you cannot use the account for payments before your Business Mastercard (prepaid debit) arrives by post (usually within 3-5 working days) and is activated.

Who can open a Zempler Bank Business account?

Zempler Bank’s Business accounts are open for most businesses and self-employed individuals based in the UK. Companies should have at least one director resident in the UK.

To qualify, you have to be over 18 years old and registered as one of the following:

- Limited company

- Sole trader

- Partnership

- Limited Liability Partnership

- Charity

- Public sector organisation

It does not matter whether you have a poor, little or no credit history as there are no credit checks. This means you can have e.g. county court judgements, previous defaults and bad credit and still be accepted.

| Zempler Bank account |

Fees |

|---|---|

| Monthly subscription | Business Go: Free Business Extra: £9/mo Business Pro: £19/mo |

| Annual fee | None |

| Card issue | Business Go: £9.95 for first card Business Extra: First card free Business Pro: 5 cards free £5.95 per additional one |

| Card payments | Business Go: Free in UK, 2.99% abroad Other plans: Free (both in UK and abroad) |

| Sending money (UK transfers, payments and Direct Debits) | Business Go: 3/mo free Business Extra: 20/mo free Business Pro: 500/mo free 35p each after free allowance |

| Receiving money domestically | Free |

| Incoming international payments | Up to £22 |

| Cash withdrawals | Business Go: £2 each in UK, £3 each abroad Other plans: Free |

| Cash deposits at Post Office | £4 min. fee (or 0.55% of deposit) |

| Rejected Direct Debits | £15 each, max. £90 per month |

| Overdraft | Variable interest rates |

Although Zempler has a free business account plan (Business Go), it comes with significant costs for certain functions.

For a start, receiving a debit card costs £9.95 upfront on Business Go, whereas the other plans don’t charge for it. Additional cards – i.e. up to 20 expense cards – cost £5.95 each beyond the free card allowance on any plan.

The first 3-500 (depending on the plan) bank transfers, standing orders and electronic payments (e.g. Faster Payments) a month are free. It’s then 35p per UK payment. Needless to say, very active accounts might want to subscribe to a paid plan that allows more than 3 free payments.

“Although Zempler Bank got rid of the old annual fee of £69 and now offers a free account, there are still fees for common functions like UK transfers. So a paid subscription might actually be cheaper.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Card payments in GBP are free, but paying in any other currency on the free plan has a 2.99% transaction fee. If you’re receiving a bank transfer from abroad, it costs a flat fee of up to £22 per transfer.

On the free plan, cash withdrawals cost £2 from a British ATM and £3 from ATMs abroad. This is not cheap if you often need cash, but it’s also not uncommon for free business accounts to charge for withdrawals.

When you deposit cash into the account at a Post Office on any plan, 0.55% of the deposit amount is charged or a minimum of £4 – whichever is highest. So retailers and market stall holders, for example, would pay quite a lot over a month if they deposit frequently.

Other fees may apply, like issuing a prepaid Euro card. Direct Debit failures are quite pricey at £15 each.

Account, security and international payments

Zempler Bank is a bank. The old Cashplus brand was an e-money current account until early 2021.

Like other UK banks, up to £85,000 of your money deposited in a Zempler business account is protected by Financial Services Compensation Scheme (FSCS), though it allows an account balance of at least £500,000. It is also regulated by the Financial Conduct Authority (FCA) and authorised by the Prudential Regulation Authority (PRA).

The account comes with a sort code and bank account number. In contrast with other banks, however, Zempler receives international payments in a central bank account shared by all Zempler Bank users.

It’s not yet possible to send money abroad directly from the business bank account.

There’s one IBAN number and BIC/SWIFT code for the central account receiving euros, and another for receiving GBP and other currencies. Both have their own account number belonging to Natwest who provides Zempler’s banking service for international payments. Once Natwest receives the incoming payment, Zempler will initiate the transfer to your bank account. A bit complicated, but that’s the current arrangement.

A flat fee of £15 applies to all incoming euro transfers from abroad, or £22 for other currencies.

Image: Zempler Bank

The Euro account is useful for borderless merchants.

The Business Account is in GBP currency, but you can add a Euro and USD account for free. This way, you can pay, send and receive money in those currencies without currency conversion fees. If you do transfer money from these accounts to your GBP Business Account, the 2.99% foreign transaction fee would apply on the free plan.

Zempler Bank can issue a main prepaid debit Mastercard for the account holder, and up to 20 prepaid expense cards. I’ve seen some users complain they can’t use this card at petrol stations, which is common for prepaid cards.

“I would’ve thought Zempler Bank had upgraded their cards to full-fledged Debit Mastercards (as opposed to Prepaid), but I see certain users still have payment issues because they have a prepaid card.”

– Emily Sorensen, Senior Editor, Mobile Transaction

What we love about the cards is the cashback on paid plans: 0.5% on Business Extra or 1% on Business Pro. You can earn up to £1000 cashback per month on eligible card payments – not bad.

It’s not possible to issue or pay in cheques with Zempler, but you can deposit cash at any UK Post Office.

Overdraft, credit card and credit builder

Unlike many online bank accounts in the UK, the Zempler Bank Business account also comes with credit and borrowing options.

With a Business Extra account, users can improve their credit score with the Creditbuilder tool. It works like this: the account holder commits to paying the £9 Business Extra fee on time for 12 months. Zempler then reports the on-time payments to credit agencies, who may boost your credit score after some months (though this is no guarantee).

Eligible business accounts will also receive an email offer of an overdraft of up to £2,000. The interest rate you pay for using the overdraft depends on your business, and there’s an annual fee too for the service.

Alternatively, the Zempler Business Credit Card is available to limited companies registered at Companies House and sole traders. This has a credit limit of up to £5,000, no annual fees and up to 56 days’ interest-free credit (then it’s a variable interest rate from 19.9% p.a.).

That said, the credit card is currently not offered to new applicants. Zempler states they “will reopen applications as soon as we can”, but I’ve seen this note for several years, so have lost faith that they will truly do it soon.

Zempler used to offer a business cash advance, but that’s no longer available.

App features

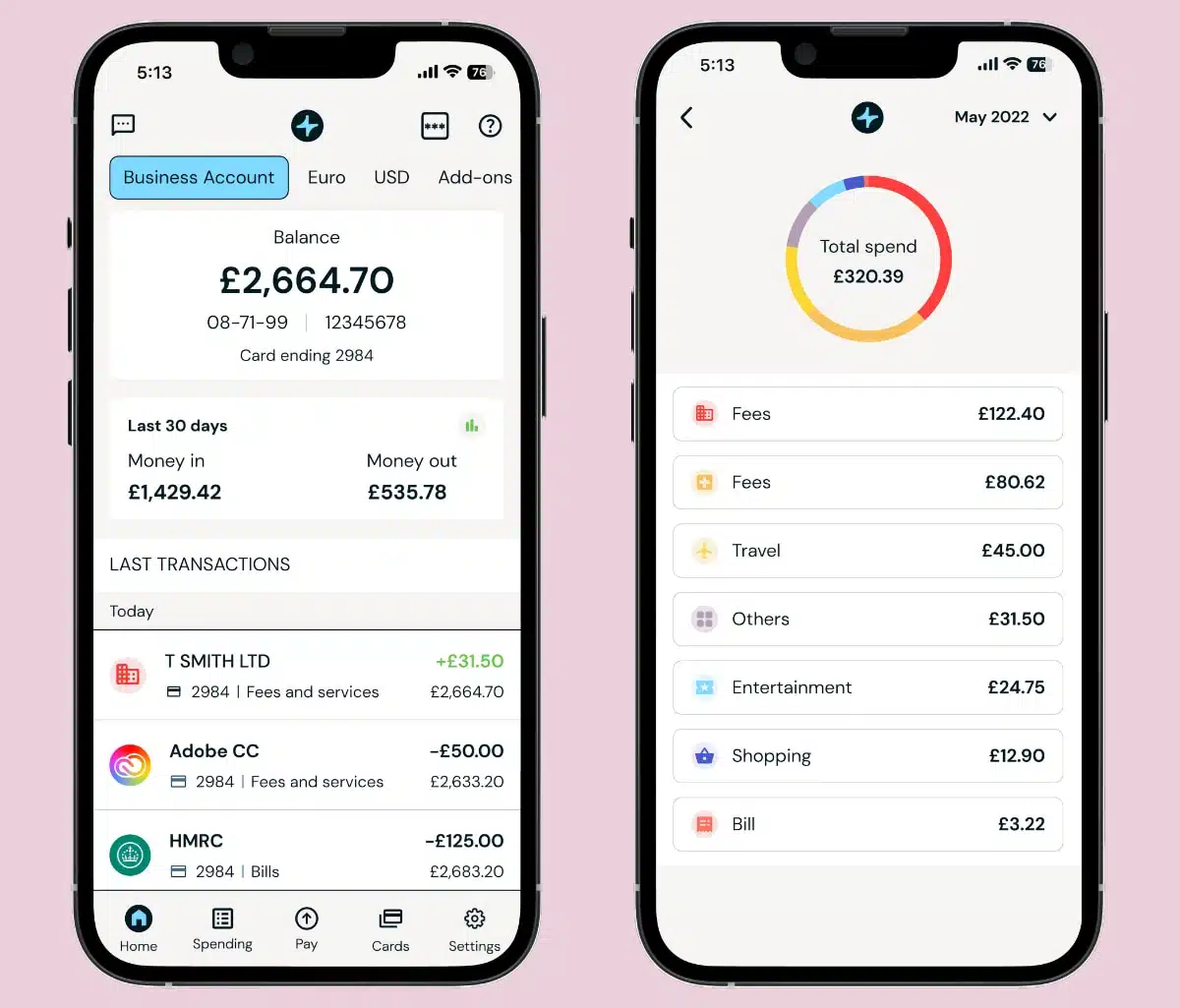

The business account is managed entirely through a mobile app (‘Zempler Bank’ app) or browser online banking account. The main banking features are:

Payments: Pay bills, transfer money, manage Direct Debits or standing orders. If you have multiple Zempler accounts (Business, EUR, USD), you can manage them all from the app and move money between them. Before a Direct Debit is taken, reminders ensure you have enough money ready.

Card management: Restrict transactions, block cards, view PINs and order up to 20 additional debit cards for your employees.

Zempler Bank’s app has some useful features for managing expenses and cards.

Transactions: Categorise expenses according to type (e.g. Travel, Fees and Services) for an easy overview of outgoing costs. The Spending Insights feature lets you track and tag payments via Google Maps and record detailed information about in-person card payments.

Record keeping: Take pictures of expense receipts and attach them to transactions. Download statements that are up to 18 months old to PDF, CSV and OFX files. Integrate with external accounting software.

Pots: Put money aside from the main account balance to savings pots dedicated to anything you’re saving for. Sole traders and entrepreneurs will find this useful for putting aside tax money for the next HMRC bill.

These are all fairly standard for online business accounts. In fact, I think it could be a much more interesting app

“I’ve noticed the functions in the Zempler Bank app are not that different from the old Cashplus app. It seems the bank has spent more money on the rebrand than actually adding to their product.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Some features are also lacking, such as generating a statement for a specific period and changing personal details. And the fact you can’t add a card to the Apple Pay or Google Pay wallet is the big disadvantage in this day and age.

Service and Zempler Bank reviews

Zempler Bank customer support is contactable by phone phone on weekdays between 8am and 8pm and Saturdays between 8am and 4pm. There’s no general support on Sundays or outside these working hours, except for the 24/7 phone number for lost and stolen cards.

You can find answers to common queries on Zempler’s FAQ pages and use the app/account any time.

What are the customer reviews like? Not great, actually. Common complaints about Zempler Bank include:

I hoped to see more improvements after the Zempler rebrand, but app users are still complaining about similar things as above.

In particular, customer service is still unhelpful or inaccessible, and even though sign-up is quick, Zempler may still ask for various documents to prove your business after you’ve been accepted. Some users also report too many security questions involved when sending a payment.

Yet, there’s a decent amount of positive reviews, but compared with competing challenger banks, Zempler seems to have more issues.

Our verdict: unique for credit, but slow to develop features

Zempler Bank stands out with its credit options (if you qualify for them), disregard of previous bad credit and the fact it was one of the first to offer prepaid online business accounts in the UK. The credit builder tool is particularly useful for solopreneurs who need a better credit rating.

But for a company that’s taken pride in being the first of many things, it’s surprising they haven’t put more resources into advancing the app much further. Most of the account features, such as categorised expenses and card controls, are quite standard for business accounts today.

And some features are sorely missing, like mobile wallet compatibility and sending international payments.

Fees for bank transfers, cash withdrawals and international payments could also make a bad deal for some, but less for those primarily using the account for card payments in the UK.

For a company that’s taken pride in being the first of many things, it’s surprising they haven’t put more resources into customer service and advancing the app.

If you need a business bank account, and you’ve got a poor credit history to turn around, then Zempler Bank could be perfect. You might not get access to an overdraft or credit card straight away, but consistent sales volumes can grant you that access over time.

If you’re looking for the best features in an app-based business account, we recommend looking at newer banking platforms that have managed to get a better rap than Zempler in just a few years.