What’s the best, or cheapest, card payment device for small businesses in Ireland?

We’ve looked at low-cost card readers with a reasonable (or no) contract and pricier models with variable fees.

The choice comes down to how you plan to use the device short- and long-term, payout and banking preference, POS requirements and what fees are best.

You don’t want to tie yourself into a long-term contract if sales aren’t guaranteed for that time, but that’s no issue with the commitment-free options.

Compare the best card payment machines for a small business in Ireland:

| Card machine | Pricing | Editor’s view |

|---|---|---|

Square Square |

|

“Square is the most versatile payment platform for small businesses in Ireland, improving its products all the time” |

SumUp SumUp |

|

“I love how simple and affordable SumUp is – yet it includes lots of extras like a business account” |

Dojo Dojo |

|

“Dojo has proven a hit with its simple card machine package that’s easy to deal with, service- and product-wise” |

Revolut Reader Revolut Reader |

|

“Revolut card machines are a great match for Irish merchants who are happy to use the business account too” |

Worldpay Worldpay |

|

“A new player in Ireland, Worldpay is already making a mark with its high-end card machines and custom contracts” |

myPOS myPOS |

|

“myPOS’s card machines and account work across borders, but fees and sign-up are a bit complicated” |

Yavin Yavin |

|

“Yavin holds great promise with its simple terminal package, but the Ireland service needs more attention” |

Clover by AIB Clover by AIB |

|

“AIBMS has some good Clover terminals that many are attracted to, but it’s a bureaucratic service” |

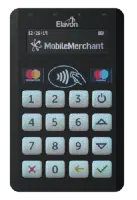

Elavon Mobile Elavon Mobile |

|

“Elavon is the other leading alternative to AIB, but its card reader is very outdated” |

*Excluding VAT.

SumUp and Square lead with their low-cost card machines and superb value for money.

Revolut appeals to merchants who like the business account, while myPOS’s standalone credit card machines attract with their complimentary features. Elavon’s card reader comes last as it’s much more limited.

Clover’s popular touchscreen terminals come with an AIBMS contract, but Dojo and Yavin are cheaper and with less commitment. Also with a contract, Worldpay is the closest alternative to Clover with its tailored, high-end terminals.

We’ve excluded independent sales organisations like Paymentsense, because they’re better for consistently high turnovers. And Zettle by PayPal is not in the list because it’s not available in Ireland.

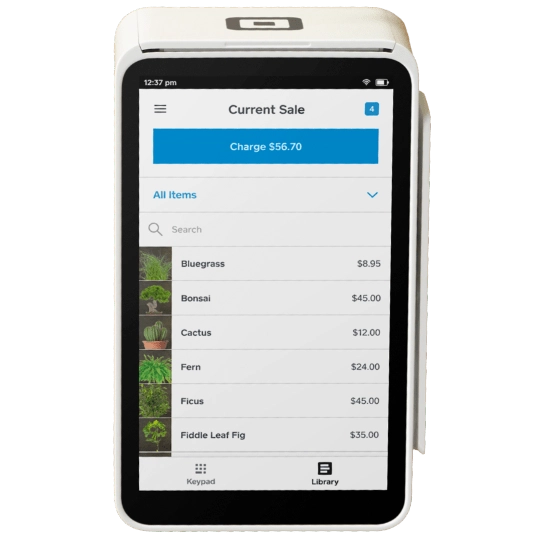

American company Square launched in Ireland just a few years ago. It’s a pay-as-you-go payment platform without contract lock-in or monthly fees for its card machines.

We’ve tested both the card reader and more complete touchscreen terminal, and they are both pleasing to the eye, easy to use, reliable and fast. For €19 + VAT, you can purchase Square Reader that works with a free, feature-rich Point of Sale app on your iPhone, iPad or Android device. It doesn’t have a physical keypad, instead prompting payers to enter their PIN in the app on your mobile device.

Square pricing:

The more expensive Square Terminal works on its own with a direct connection to WiFi and prints receipts. It can’t connect with 4G, so is better suited for fixed premises with a stable internet connection. The touchscreen terminal has many free POS features that are regularly updated.

“Square’s software is constantly updated and improved, and their credit card terminals are good quality despite the low price. I also love the huge selection of online tools that help you deal with payments in any situation.”

– Emily Sorensen, Senior Editor, Mobile Transaction

One of the clear advantages is Square’s wide selection of remote payment tools for all users. This includes payment links, email invoices, QR code payments, ecommerce, recurring payments, eGift cards and keyed payments. None of these have monthly fees, unless you upgrade to a monthly online store plan.

Photo: Mobile Transaction

Square Terminal next to Square Reader.

You can also upgrade from the free Point of Sale app to the paid Square for Restaurants, Retail or Appointments POS systems with more specialised features.

Transaction fees are fixed at 1.75% + VAT for chip and contactless cards, or higher for remote and online payments. Payouts take one working day to reach your bank account.

Pros

Cons

In Ireland, SumUp is one of the easiest and cheapest ways to get started with payments.

There’s no contractual commitment, monthly fee or long sign-up. You just create a SumUp account online, order the card payment device and wait 3-5 working days to receive it.

SumUp pricing:

| Solo Lite | Solo | Solo & Printer | |

|---|---|---|---|

|

|

|

|

| Card machine | Card reader linked with mobile app | Standalone, touchscreen (WiFi, 4G) | Standalone, with receipt printer (WiFi, 4G) |

| Price (purchase) | €34 + VAT | €79 + VAT | €139 + VAT |

| Website | |||

| Transaction fees | Pay-as-you-go: 1.69% €19/mo: 0.99%-1.99% |

||

| Contract | No lock-in, no monthly fee | ||

| Payouts | Next day in SumUp Business Account, 2-3 working days in bank account | ||

There are three card readers: SumUp Solo Lite that works with an app (on iPhone, iPad or an Android device), SumUp Solo with a touchscreen and countertop base or Solo with a receipt printer. The last two are pricier, but come with a SIM card to work independently without a phone or tablet.

“I always recommend SumUp as one of the easiest, cheapest card machine options with a business account thrown in for fast transfers. You can also do ecommerce, invoicing etc. from SumUp App – a very accessible way to manage business.”

– Emily Sorensen, Senior Editor, Mobile Transaction

SumUp merchants also get free access to payment links for remote payments, QR codes, email invoices and electronic gift cards. If you want a super-simple online store to share on social media, the free Online Store lets you create one in minutes.

Photo: Mobile Transaction

SumUp Solo and Solo & Printer terminals.

The only thing you’re paying is a transaction fee: 1.69% for all card payments on pay-as-you-go. With a €19 monthly subscription, the rate is just 0.99% for domestic consumer cards.

The free SumUp Card and Business Account provide an IBAN and next-day settlement (weekends inclusive). Otherwise, you wait 2-3 working days to receive transactions in a bank account.

For the monthly fee, you can subscribe to a more advanced point of sale (POS) system.

Pros

Cons

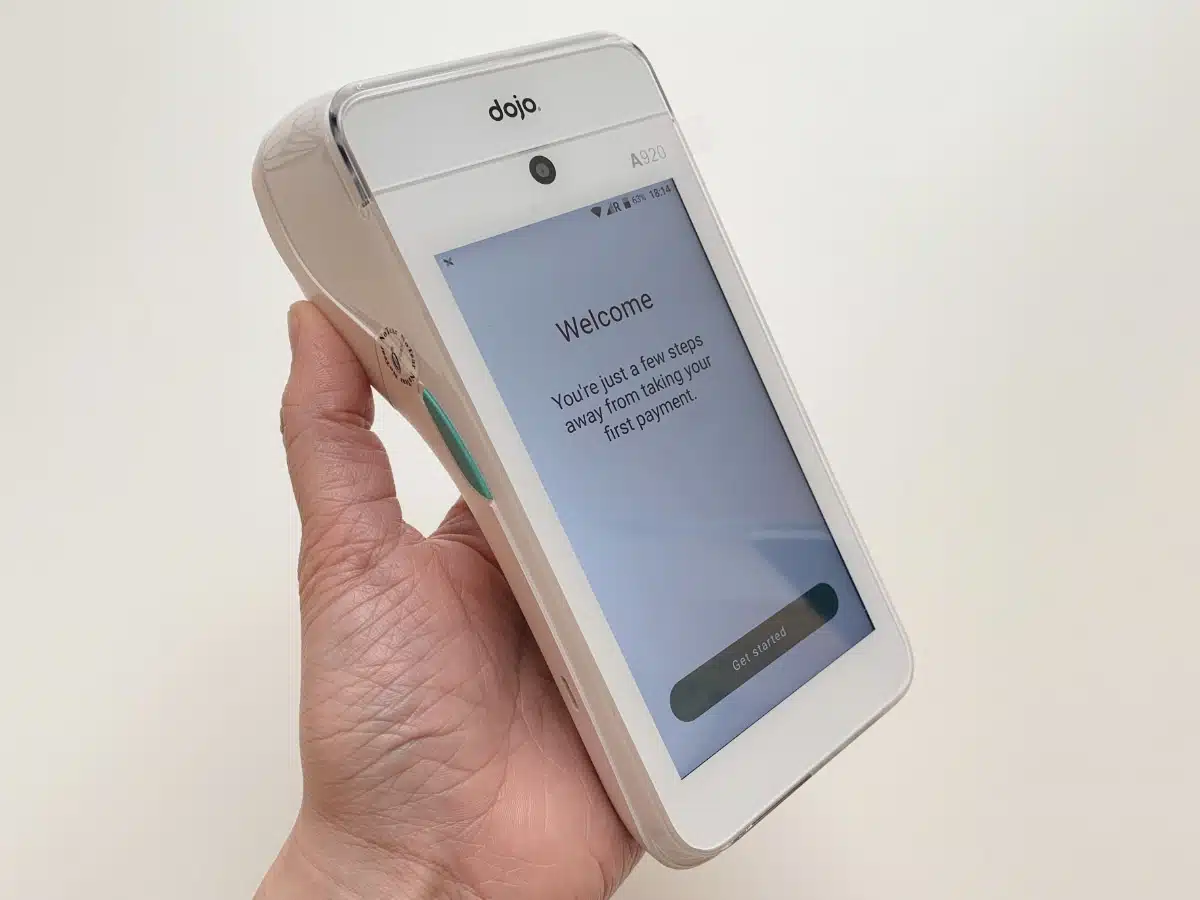

Dojo recently arrived in Ireland after much success in the UK, where the product has had some time to mature. The success is down to a smooth onboarding, good quality card terminal and short contracts. It also has next-day payouts, including weekends, depending on your bank account.

Dojo pricing:

| Dojo | ||

|---|---|---|

|

||

| Card machine | PAX A920 (WiFi, 4G) | |

| Monthly fee (rental) | Card turnover below €150k/yr: €20 + VAT Card turnover over €150k/yr: Custom |

|

| Transaction fees | 1.4%-1.99% + €0.05 | |

| Contract | Card turnover below €150k/yr: 6 months Card turnover over €150k/yr: Monthly €24.95 monthly min. payment charge applies |

|

| Payouts | Next day in bank account | |

Dojo’s only card machine (Dojo Go) is a popular PAX A920 model, which has been used across Europe for some years now. It has a touchscreen display and a simple payment app designed by Dojo.

“I’ve tested the Dojo terminal app and used it in shops many times, and it really works very smoothly. But if I were a retail shop, for instance, it wouldn’t be enough on its own because it lacks substantial POS features.”

– Emily Sorensen, Senior Editor, Mobile Transaction

To accept a card, merchants just have to enter the transaction amount and proceed to processing a chip and PIN or contactless payment through the display. There’s no way to itemise a sale in the app. If more complex point of sale features are required, it does integrate with POS systems in Ireland.

Photo: Mobile Transaction

Dojo just offers a PAX A920 card machine in Ireland, but it’s a good model.

For some, the biggest draw of is the short terminal rental contract. Those with an annual card turnover above €150,000 (€12,500 per month) get a monthly contract that can be cancelled any time, and transaction fees are customised around your business.

But merchants with a lower turnover have to start with a 6-month contract which rolls into monthly afterwards. Fees on that plan are 1.4% + 5¢ for consumer Visa, Maestro or Mastercard and 1.99% + 5¢ for business cards. If transaction fees do not amount to €24.95 for a month, you will still be charged €24.95 – this is known as a monthly minimum service charge. So you can’t, like SumUp and Square, just not use the card machine and avoid transaction fees.

Given all the charges, Dojo’s fees are only better than SumUp’s above ~€7,000 per month, depending on the average transaction size.

Although, businesses stuck in a card machine contract elsewhere can get up to €3,000 exit fees reimbursed by Dojo, which is quite good.

Pros

Cons

Revolut sells two card machines in Ireland: Reader and Terminal.

The cheapest, Revolut Reader, is a chip and contactless card reader that works with the Revolut app on your phone. It has a simple touchscreen display and the Revolut logo edged onto both sides so customers will trust the device for payments.

Don’t want to use the app to accept cards? Companies could choose Revolut Terminal, a standalone mobile terminal with a big touchscreen. It’s one of the few card machines in Ireland that accepts 19 currencies without conversion fees, since funds go into a matching currency account.

Sole traders will need to register for a Revolut Pro account (like a personal account with features for business) and companies for a Business account. Unfortunately, freelancers can’t buy Terminal, only Reader, but companies can order either.

Revolut pricing:

| Revolut Reader | Revolut Terminal | |

|---|---|---|

|

|

|

| Card machine | Card reader linked with mobile app | Independent touchscreen terminal |

| Price (purchase) | €49 + VAT | €189 + VAT |

| Offer | ||

| Transaction fees | Pro account: 1.5% (any card) Business account: EEA consumer cards: 0.8% + €0.02 All other cards: 2.6% + €0.02 |

|

| Contract | Revolut Business plan (from €0/mo), no lock-in | |

| Payouts | Next day (incl. weekends) in online Pro or Business account | |

You’ll have to navigate to the Merchant section in the Revolut app and request a payment via the card reader. It’s quick enough to do with practice, but not intuitive the first time around.

The Revolut app (used with the card reader) has a very basic product library to itemise the digital receipts and an overview of transactions. It doesn’t register cash transactions or connect with a receipt printer.

The only dedicated point of sale (POS) system that works with the card machines is Revolut POS, which is geared towards cafés.

Photo: Mobile Transaction

Revolut Reader is small and lightweight with a basic touchscreen.

A main advantage of Revolut is perhaps the low transaction fee for domestic cards: 0.8% + €0.02 for consumer Visa and Mastercard cards from the EEA. This, unfortunately, does not include Northern Ireland, which is charged the higher rate of 2.6% + €0.02 along with all other cards (non-consumer and non-EEA).

“Revolut’s domestic rate is unbeatable in Ireland, but based on my mixed experience of the card reader and slightly awkward payment flow, I’d only recommend Revolut Reader to those who regularly use the business account. I prefer Revolut Terminal – its payment flow is much more natural.“

– Emily Sorensen, Senior Editor, Mobile Transaction

All payouts reach the Revolut account within 24 hours, even on weekends, so they’re available to spend with the Revolut debit card. Cross-border merchants benefit from Revolut’s multi-currency accounts, which save money on exchange fees.

Pros

Cons

The global card processors, Worldpay, offers a range of the latest high-quality card machines to all sizes of business.

Because the company doesn’t yet have an Irish website, you’ll need to complete a contact form that will get you in touch with a sales rep who can give you an offer based on needs and your type of business.

Pricing for Worldpay:

| Worldpay – portable/ mobile terminal |

Worldpay – stationary terminal |

|

|---|---|---|

|

|

|

| Card machine | Ingenico Axium DX8000 (WiFi, 4G) | Ingenico Desk/5000 (LAN/Ethernet) |

| Price (rental) | Custom price | |

| Transaction fees | Tailored quote | |

| Contract | 18 months Monthly min. charge depends on plan Early termination fee applies |

|

| Payouts | 1-3 working days to bank account | |

| Offer | ||

Currently popular card machines on offer include Ingenico Desk 5000 for countertops and the portable and mobile Axium DX8000 terminal.

“Of all the traditional card terminal providers, we’ve had the best impression of Worldpay. Their contracts are competitive, and the card machines we’ve tested are designed for accessibility and hard wear.”

– Emily Sorensen, Senior Editor, Mobile Transaction

The lightweight, push-button Desk 5000 model has to be plugged into your Ethernet broadband, but then you can rely on a fast transaction process. The Axium DX8000 connects to the local mobile network with its built-in SIM card for on-the-go payments, or WiFi if on fixed premises and carrying it around for e.g. table service.

Photo: Mobile Transaction

Worldpay offers several card machines, including the pictured Desk/5000 and Axium DX8000.

We can especially recommend the Axium DX8000 for its large, colourful touchscreen display with optional apps to suit your shop functions. It has a built-in camera for barcode and QR code scanning, receipt printer and accessibility settings to make up for its lack of tactile keypad.

Worldpay is known for its reliable payment processing and tailored packages, so you can expect them to meet any retail needs including POS integration. Funds reach your bank account directly, typically within a few working days.

Pros

Cons

The payment company myPOS sells a few mobile card terminals with a built-in SIM card designed to work across Europe. This makes myPOS a great choice for cross-border merchants, for example if selling both in Ireland and Northern Ireland.

Pricing for myPOS:

| myPOS Go 2 | myPOS Pro | |

|---|---|---|

|

|

|

| Card machine | Standalone card reader (4G) | Standalone, touchscreen (WiFi, 4G) |

| Price (purchase) | €39 + VAT | €249 + VAT |

| Website | ||

| Transaction fees | Domestic, EEA, UK cards: 1.69% + €0.05 Amex: 2.49% + €0.05 Other cards: 2.89% + €0.05 |

|

| Contract | No standard monthly fee (other misc. fees apply), no lock-in | |

| Payouts | Instantly in myPOS e-account, manual bank account transfers cost extra | |

The card machines range in price from €39 + VAT for myPOS Go 2 (basic, standalone card reader) to €249 + VAT for myPOS Pro with a receipt printer. The touchscreen terminal Pro has apps for serving customers face-to-face and also remotely.

“Our tests of the myPOS card machines have revealed many detailed features that some competitors lack. But onboarding is tedious, and the inactivity fees extortionate after 10 months of no use.”

– Emily Sorensen, Senior Editor, Mobile Transaction

myPOS seemingly has no monthly fees, but after 10 months of no use, inactivity fees amount to €45 until the next time you accept a card. Still, you can just cancel the account as there is no lock-in. We would’ve liked to see more transparency around that.

The sign-up process takes a few days to complete since various proof is required. Most card transactions (Visa, V Pay, Mastercard and Maestro cards from the EEA and UK) cost 1.69% + €0.05. American Express costs €2.49 + €0.05 whereas all other cards incur 2.89% + €0.05 per transaction.

Photo: Mobile Transaction

myPOS Go 2 and Pro credit card machines.

Transactions through myPOS don’t go to your bank account. Every merchant gets an online e-money account where payouts go. You can then choose to transfer it to your Irish bank account for a fee, transfer it internationally or spend it with the complimentary myPOS Visa card.

myPOS also has a virtual terminal for telephone payments, payment links, invoicing and other online tools. There are, however, several different fees related to payment transfers, chargebacks, shipping etc. so it’s not necessarily the cheapest option.

Pros

Cons

The French fintech company Yavin now offers two WiFi/4G mobile card machines in Ireland. One is a small Yavin Reader (Nexgo N6 model) that looks and feels similar to a smartphone, but accepts chip cards, contactless and online payments.

The slightly pricier and bigger Yavin Terminal (Nexgo N86) also has a large touchscreen and the same payment features, plus a built-in receipt printer.

They both have a long battery life, SIM card and connect with compatible POS systems. Their offline mode allows you to accept cards without a connection, completed later when online again.

If there are any issues using the product, Yavin has a helpline to support. We know that their team is generally dynamic and focused on serving small businesses well.

Pricing for Yavin:

| Yavin Reader | Yavin Terminal | |

|---|---|---|

|

|

|

| Card machine | Standalone, touchscreen (WiFi, 4G) | Standalone, touchscreen, with receipt printer (WiFi, 4G) |

| Price (purchase) | €179 incl. VAT (50% off with promo code) | €199 incl. VAT (50% off with promo code) |

| Offer | ||

| Transaction fees | Custom rates + €0.02 | Custom rates + €0.02 |

| Monthly fee | €29 incl. VAT/mo | €29 incl. VAT/mo |

| Contract | Cancellable any time, no lock-in | |

The terminals are purchased upfront for €179 (Reader) or €199 (Terminal), but you get 50% off if stating Yavin’s promo code during sign-up. Apart from that, there’s a €29 (VAT not applicable) monthly fee, but the commitment-free contract can be paused, resumed or cancelled any time.

“Yavin started out as a promising service, but we have yet to see a similar level of service in Ireland as they have in France. Fees are also not transparent, but packages are potentially good for your business.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Transactions incur custom rates that vary between the types of cards accepted. Small businesses can expect low rates for domestic Visa and Mastercard transactions, but the monthly fee means you should make a few thousand euros every month at least to make it worthwhile.

Local cards typically incur a fee of around 0.7% while other European cards tend to cost 0.85%, plus a €0.02 fixed gateway fee that’s added to all transactions.

Yavin’s card machines are high-quality Nexgo touchscreen models.

The card machines are sent from France, and shipping takes about a week. They come connected with your IBAN and ready to accept payments upon arrival. Funds take just one working day as standard to clear in your bank account.

Pros

Cons

Clover is known for their white, standalone payment terminals with large touchscreens.

Their smallest terminal is Clover Flex. It prints receipts and has enough POS features to work as a portable checkout with card payments built in. Clover Mini is more like a tablet register, best stationed on a counter (although it can be carried around).

AIBMS pricing for Clover:

| Clover Flex | Clover Mini | |

|---|---|---|

|

|

|

| Card machine | Standalone, touchscreen, with receipt printer (WiFi, 4G) | Standalone, touchscreen, with receipt printer (WiFi, 4G) |

| Price (buy or lease)* | €630 upfront or €44/mo + €0-€200 setup fee |

€495 upfront or €32.50/mo + €0-€200 setup fee |

| Transaction fees | Custom, e.g. 0.18%-1.49% + 2¢ with AIBMS | |

| Monthly fees | Various for software, merchant account, PCI compliance, etc. | |

| Contract | 3-4 years’ lock-in | |

*Your quoted costs may differ from ours, as they are subject to change.

The amount of POS features depends on the software plan, which has a monthly fee. The simplest subscription only works with WiFi, so a truly mobile terminal reliant on 4G requires a higher monthly cost. Additional features are downloaded from the Clover App Market, but these have separate costs.

“AIB’s Clover terminals may look good, but they come with complicated terms and long contracts. I also don’t like the fact you have to add separate apps that cost extra if using it as a full-fledged POS system.”

– Emily Sorensen, Senior Editor, Mobile Transaction

The main provider of Clover terminals in Ireland is AIB Merchant Services. Here, you can expect to commit to 3- or 4-year contracts with a merchant account, payment processing, terminal lease and software subscription.

Clover Flex with Station Solo.

Suffice to say, the Clover solution is better suited for merchants with a stable turnover, as you’re locked into a contract with at least €70+ paid monthly just for the lease, merchant account and basic software. On top of that, you pay transaction fees and miscellaneous costs for setup, chargebacks and PCI compliance.

Businesses with a large turnover can, however, benefit from lower transaction fees negotiated with AIBMS. Moreover, the software customisations are attractive for those who like to pick and choose checkout features.

Pros

Cons

The pay-as-you-go card reader Elavon Mobile (previously Elavon MobileMerchant) works with the free talech Mobile app. This app setup has mixed reviews so we can’t wholeheartedly recommend it.

Elavon pricing:

| Elavon Mobile | ||

|---|---|---|

|

||

| Card machine | Card reader linked with mobile app | |

| Price (purchase) | €19 + VAT | |

| Transaction fees | Visa, Mastercard: 1.75% American Express: 1.9% Diners, JCB, UnionPay: 2.5% |

|

| Contract | No lock-in, no monthly fee | |

| Payouts | Next working day in bank account | |

The first Mobile card reader costs €19 (one-off price). The “standard fee” for card payments is 1.75%, which covers Visa and Mastercard transactions. Other card brands have different rates: 1.9% for Amex and 2.5% for JCB, Diners Club and UnionPay.

Photo: Elavon

The Elavon Mobile reader is very basic – and so is the connected mobile app.

The card reader used to rely on the Elavon MobileMerchant app, a very outdated app that couldn’t do many things. Now, it works with the slightly better talech Mobile app that has a product library, but still no integration with a receipt printer.

“Mobile is a very basic card reader that looks like a calculator. I’d be more interested in Elavon’s higher-end card machines on a contract, but those are not cheap.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Taking payments over the phone? Elavon merchants get a complimentary virtual terminal for over-the-phone payments. Additionally, Elavon Mobile doesn’t have lock-in or monthly fees.

Pros

Cons

Summary: which to choose?

Out of the credit card machines in Ireland, SumUp and Square have the best deal all-round. Their software is regularly updated, card readers are cheap, there’s no lock-in or monthly fees, and plenty of remote payment tools are included.

What’s more, their transaction fees are competitive for small businesses, especially given the business tools you get access to. Once sales exceed €8,500 per month, lower fees can be negotiated.

Revolut is a rising option, offering a card reader and high-performance terminal with low domestic rates and next-day payouts.

Another ambitious terminal we recommend is Dojo’s. It has some of the industry’s shortest rental contracts and decent fees above a €7,000-€12,5000 monthly turnover.

Yavin, Worldpay and Clover have good multi-functional terminals with expandable POS features and negotiable fees.

Elavon’s accompanying app is a bit restrictive, but you might prefer Elavon if you’re considering their other services in the future.

Whereas myPOS has a good range of card terminals to buy, it is better suited for cross-border merchants preferring an online account over a high street bank based in Ireland.

Summary of best card machines:

| Card machine | Best for |

|---|---|

Visit website |

|

Visit website |

|

Visit website |

|

Visit website |

|

Visit website |

|

Visit website |

|

Visit website |

|

Visit website |

|

Visit website |

|

We would say the least adaptable options are Elevon Mobile and Revolut. They are better for simple transactions where you just enter an amount or as a backup for impromptu payments on the go.

All other options can be expanded with complex features as your business grows, either in store or online.

Alternatively, you could set up Tap to Pay on a smartphone, which doesn’t require a card reader to accept contactless payments.