No longer do you have to choose a high street bank for a business bank account. Recent years have introduced many new online business banking solutions aimed at younger, tech-savvy people – but really, anyone with a phone or laptop can apply for an online business account in minutes.

Limited companies and other business entities in the UK can choose between full-fledged bank accounts and e-money accounts, managed online and/or through a mobile app. E-money accounts tend to have more limitations and a prepaid card instead of a regular debit card.

Common to business accounts online are the fast sign-up, ease of use, smart budgeting tools and (usually) no contract term. Your choice of company account will depend on other things, as we shall see below.

Best business account comparison:

| Business account | Cost | Best for | Link |

|---|---|---|---|

| Starling Bank Bank account |

£0-£7/mo | Excellent app and support, loans and overdrafts | |

| Airwallex E-money account |

Free | Broadest multi-currency account features for global teams | |

| Revolut E-money account |

£0-£100/mo | Widest banking and payment features for EU dealings | |

| Monzo Bank account |

£0-£5/mo | Budgeting tools for UK-centric businesses | |

| Zempler Bank Bank account |

£0-£9/mo | Business credit options | |

| Tide E-money/bank account |

£0-£49.99*/mo | Premium support options and legal helpline | |

| Monese E-money account |

£9.95*/mo | Multilingual support |

*Excluding VAT.

Compare business accounts

Choosing the right business account for your company fully depends on your needs, so you have to ask yourself: what am I looking for?

Companies in a financially precarious position might be looking for lending options, in which case Starling and Zempler Bank are possible safety nets. Starling is the only account with its own business loans (in addition to overdrafts) for limited companies. The only business credit card is available to select (not all) Zempler users. Zempler also has business overdrafts and a credit builder tool that could increase your credit score.

| Business account | Overdraft | Loans | Credit card | Interest on savings |

|---|---|---|---|---|

| Starling Bank | Yes | Yes | No | No |

| Airwallex | No | No | No | No |

| Revolut | No | No | No | Yes |

| Monzo | No | No | No | Yes |

| Zempler Bank | Yes | No | Yes | No |

| Tide | No | No | No | Yes |

| Monese | No | No | No | No |

Those with a consistent plus balance can earn interest with the savings accounts from Revolut, Monzo and Tide.

If your business is very international – and we mean global, not just European – Airwallex is beyond doubt the winner for favourable transfer rates and the sheer number of currency accounts and local payment methods integrated.

Revolut is second best for that, but has better rates for European payments than global. And while Revolut has a good number of currency accounts, it has a more generalised appeal for companies who want many tools for payments, employees and budget management.

If all your customers are based in the UK, any of the other business accounts will do.

| Business account | Multi-currency | Currency accounts | Exchange rate |

|---|---|---|---|

| Starling Bank | No | GBP only | Variable |

| Airwallex | Yes | 60+ | 0.5% |

| Revolut | Yes | 33 | 0.6%-1% |

| Monzo | No | GBP only | 1% or Wise fees |

| Zempler Bank | No | GBP only | £15 or 0%-2.99% |

| Tide | No | GBP only | Variable |

| Monese | No | GBP only | 0%-3% |

Merchants who want to accept payments through their business account have the widest choice with Revolut and Tide. Monzo comes in second only because it doesn’t have its own card reader, while Zempler, Starling and Monese only scratch the surface with their invoicing. Airwallex sends payment links and offers integrations with ecommerce software (which, by the way, Revolut also does).

| Business account | Invoicing | Payment links | Tap to Pay | Card reader |

|---|---|---|---|---|

| Starling Bank | Yes | No | No | No |

| Airwallex | No | Yes | No | No |

| Revolut | Yes | Yes | Yes | Yes |

| Monzo | Yes | Yes | Yes | No |

| Zempler Bank | Yes | No | No | No |

| Tide | Yes | Yes | Yes | Yes |

| Monese | Yes | No | No | No |

Apart from these angles, you could also need things like:

- Accounting integration

- An acceptable level of service (rarer than you’d think)

- Budgeting tools

- Multi-user access

So look out for those things when researching business accounts.

Sole traders should check out these business accounts instead.

Starling Bank is a full-fledged bank with one of the best online business bank accounts we have tested. As one of only few on this list, it offers loans and overdrafts to businesses, but not a credit card. It has a Business Debit Mastercard and an excellent app for money management that we favour over competitors.

The business account is free, with options to add on a Business Toolkit module (£7/month) with browser-based features like payment scheduling and connecting with HMRC to submit VAT returns via Making Tax Digital.

Starling Business account can be managed through an app or on your laptop.

To qualify, you need to live in the UK and have a limited company or partnership registered at Companies House. Only the business owner and Persons of Significant Control can access the Starling account, so it wouldn’t be suitable for other employees to manage your banking.

The business account stores only GBP currency, but has an IBAN for international payments. You can send money to 34 countries and 17 currencies, and receive cross-border transactions, but no multi-currency accounts are available any more (EUR and USD accounts used to be options).

Retailers can rest assured it’s possible to deposit cash (up to £5k per day) and cheques into the account. The Starling app has extensive card controls, “spaces” for saving money for goals, and responsive 24/customer support through the app, email or by telephone.

Choose Starling Bank if: Domestic businesses prioritising a high-quality app, great service and who might need lending options.

Airwallex is MobileTransaction’s choice of business account – we’ve used it for years and are super-happy with it. As a multi-currency account with sub-bank accounts in different countries, it really suits teams spread across different countries in the whole world, not just Europe.

We’re especially impressed with the low transfer rates, local bank accounts in many countries (to avoid currency conversion) and big selection of local payment methods accepted if accepting online payments. Signing up with Airwallex is also a breeze with its onboarding call and responsive communications.

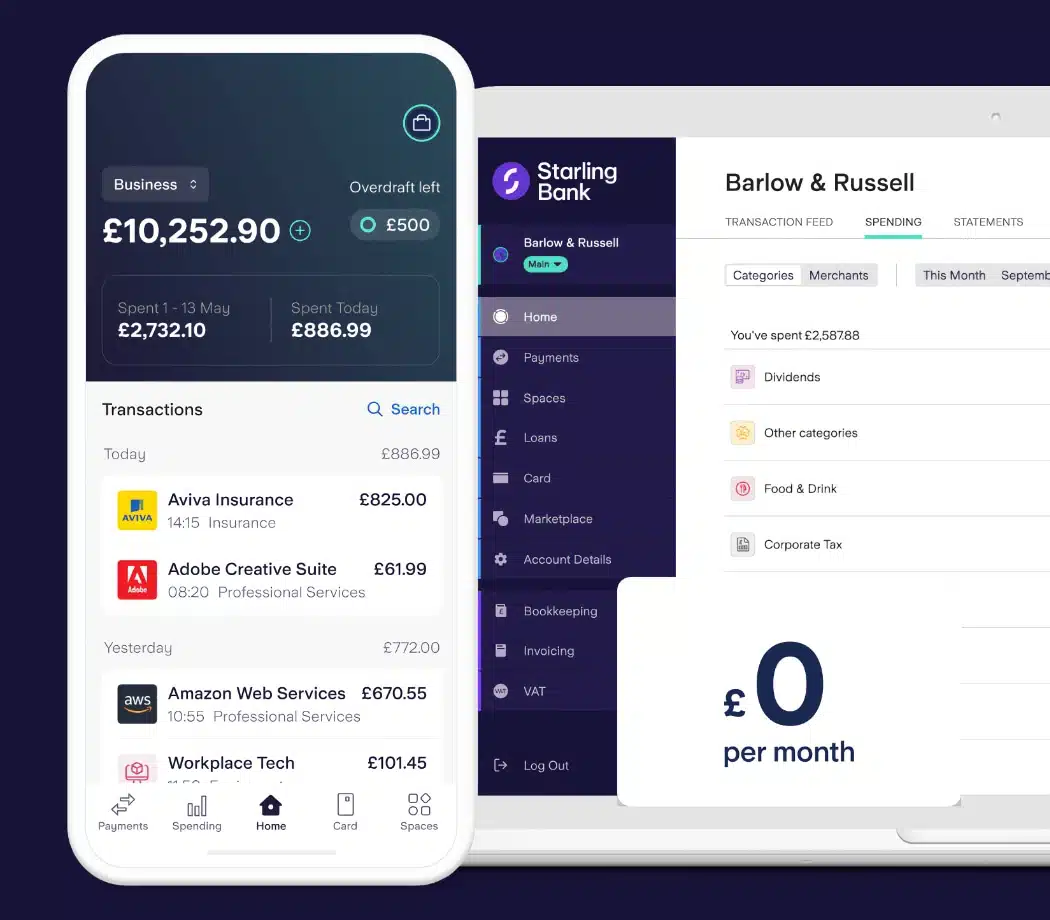

Airwallex is great for setting up accounts in different countries and currencies.

Our own experience of international transfers has consistently been impressive. Our team receives payments immediately in each their country for free, and it’s even possible to set up Direct Debits from the local accounts in GBP, USD, AUD and CAD currency to manage bills globally. You can send transfers to over 60 currencies and accept payments in 150+ countries.

There is no monthly or annual fee for an Airwallex account, just fees for certain transfers, currency exchanges and payment acceptance. For example, currency conversions (transferring money from one currency account to a different currency) in the most common currencies cost only 0.5% above the interbank exchange rate. That’s less than Revolut’s 0.6%-1% rates outside of their monthly allowance.

Airwallex also sends payment links and integrates with ecommerce websites with a decent range of local payment methods accepted online, on top of the conventional Visa and Mastercard options.

Choose Airwallex if: Your company regularly pays and receives money in many different countries and want the lowest rates.

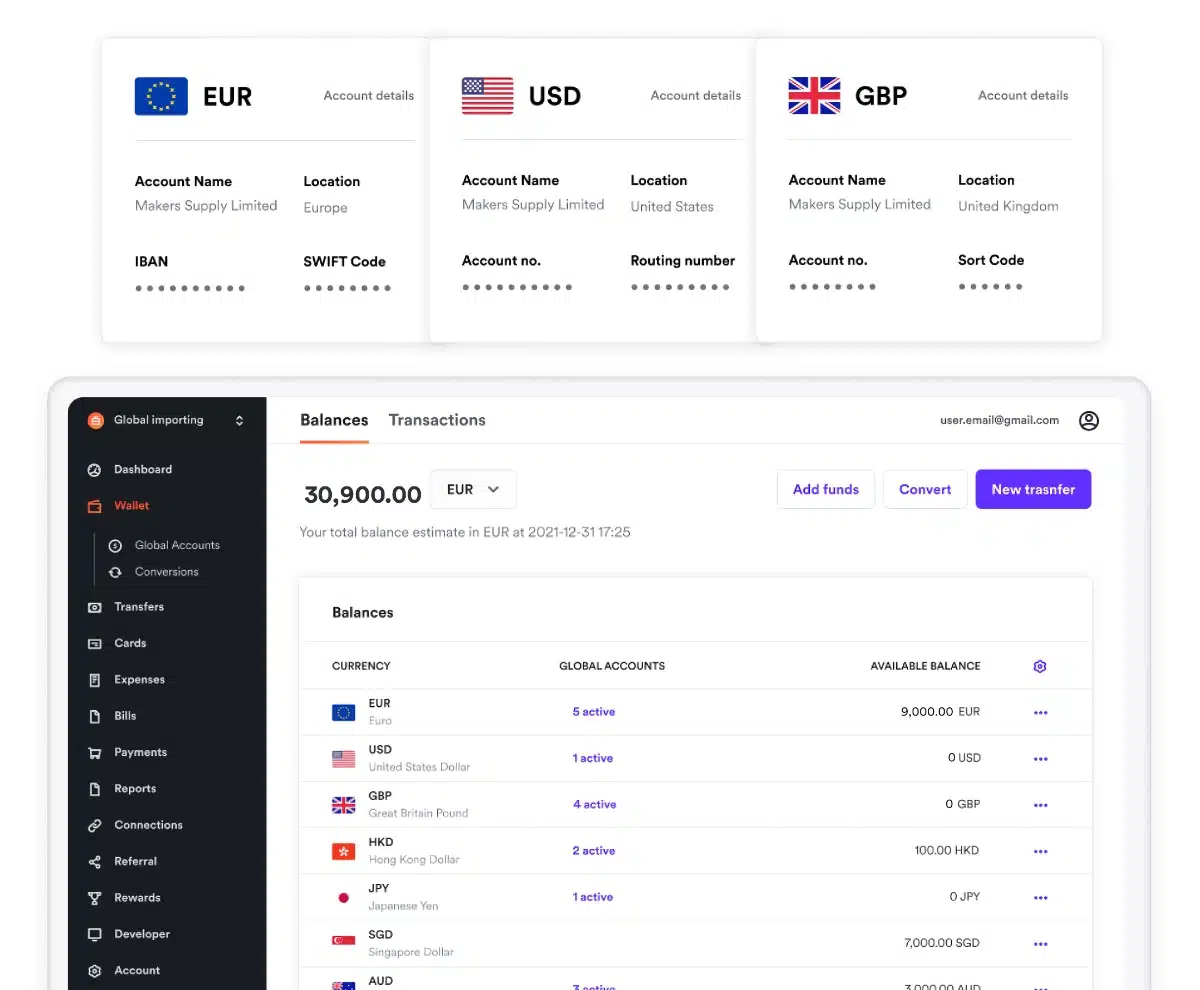

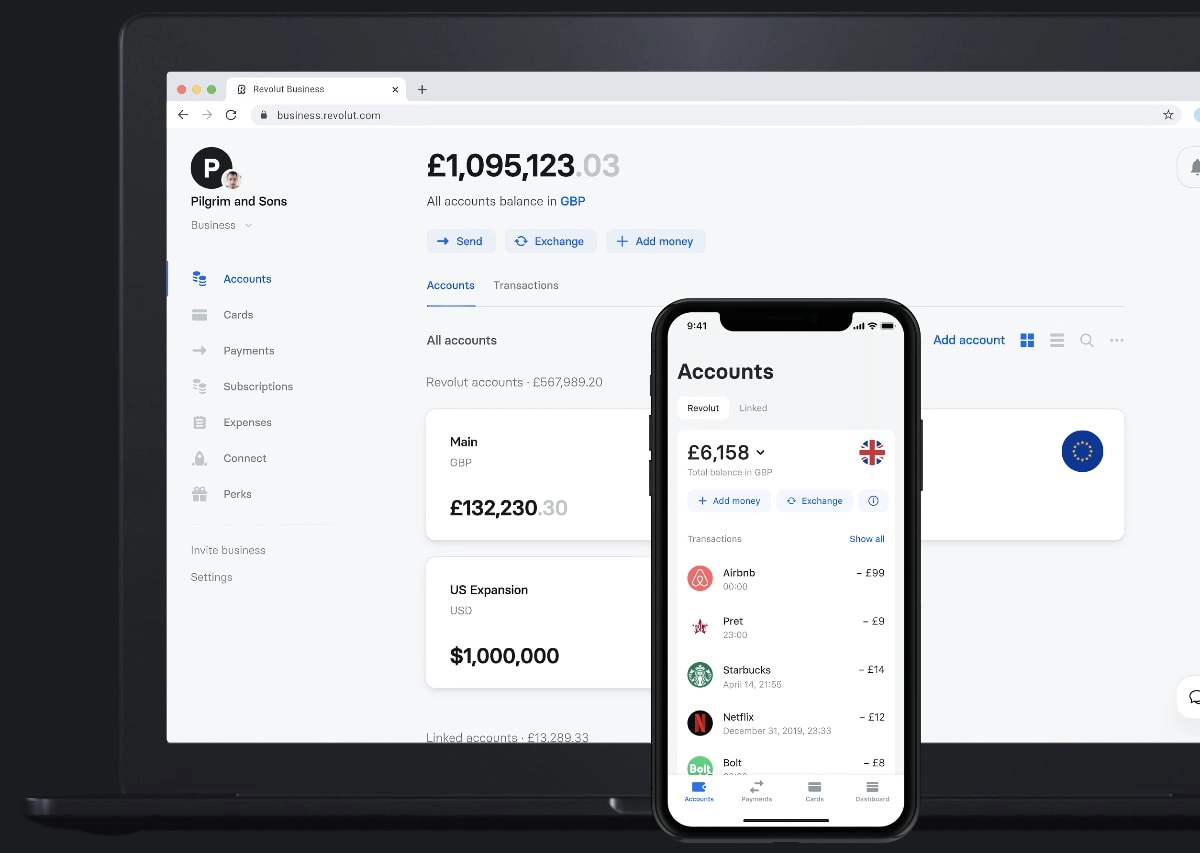

Revolut has recently been accepted as a UK bank, but is currently in a transitional phase (“authorised with restrictions”) before it can fully operate as a bank. Nonetheless, signing up with Revolut gives you a business account with an extensive range of tools for limited companies, partnerships and unlimited companies with international customers.

The biggest draw is perhaps its ability to send and receive 33 different currencies from sub-accounts added to the main account. This eliminates foreign exchange rates if you normally have a lot of cross-border payments. The main GBP business account comes with an IBAN and SWIFT code.

Teams can order up to 3 plastic Mastercard debit cards and 200 virtual cards for staff members, helping to monitor expenses, track usage and control cards remotely.

Image: Revolut

Revolut Business has many multi-currency accounts with multi-user access.

Companies can choose a free or paid monthly subscriptions with tiered features. The free plan has more pay-as-you-go charges, such as fees for international payments and £0.20 per UK payment beyond the monthly allowance of 5 free ones. It also lacks some features included in all paid plans, like APIs for integrations with other software, cashflow analytics and bulk payments.

The Grow (£19+/month), Scale (£79+/month) and Enterprise (custom pricing) plans provide free metal debit cards, more fee-free currency exchanges, interest on savings and advanced team controls like expense approval and custom permissions. They suit companies with different budgets managed by different teams, who perhaps need to integrate payments with other software.

Revolut’s currency accounts are mostly European with not as many local payment options as Airwallex. Still, the range of payment features is impressive, such as in-person payment acceptance like contactless taps on your phone, a card reader and payment links. It’s an all-round great choice for ever-changing startups – though the customer support is not as highly rated as Starling’s or Airwallex’s.

There are no credit, overdraft or loan options with Revolut yet, but this may change when it launches fully as a bank.

Choose Revolut Business if: You have a lot of European clients and need to manage company budgets efficiently.

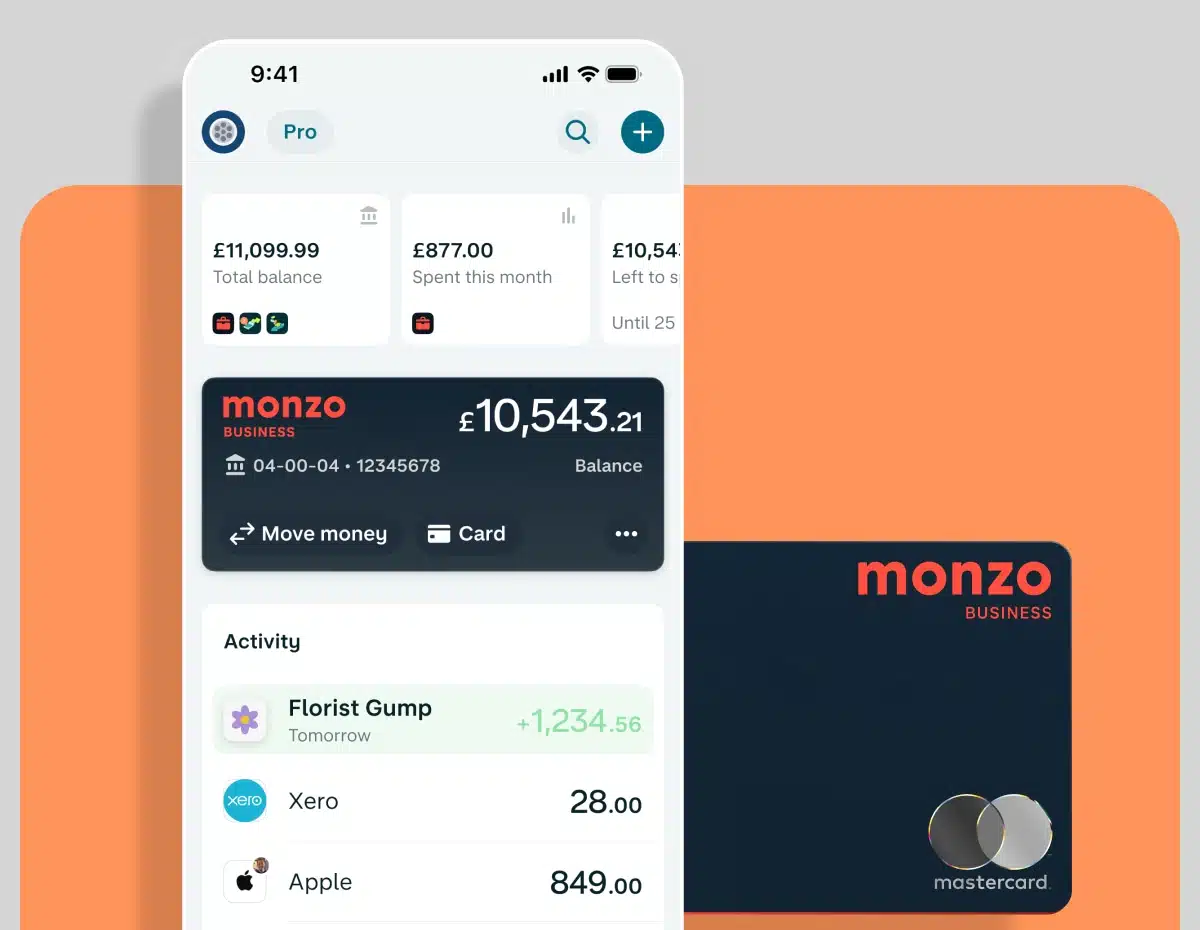

Monzo is a big online bank in the UK, but its banking features aren’t as comprehensive for businesses as they are for personal accounts. Still, banks that have business accounts with no monthly fees, easy sign-up and a Debit Mastercard are worth including when compared with expensive alternatives.

Monzo only accepts limited companies – not partnerships, unlimited companies or charities. The account is generally good for domestic businesses with a team of staff, if you opt for the paid plan.

Monzo doesn’t offer as many advantages for companies as for private individuals or even sole traders.

There are two tiers of Monzo Business:

Lite: Free bank account managed in the Monzo app or web browser. Save money into ‘pots’ to separate it from main account balance. Digital receipts. Add spending limits for different categories. Free UK payments and cash withdrawals.

Pro: For £5 monthly, you can add two more users with their own Monzo debit card, send invoices, integrate accounting (Xero, QuickBooks, FreeAgent, or export transactions) and automatically set aside a percentage in a Tax Pot.

In other words, the Pro plan is better for companies as it lets you connect with professional accounting software, manage VAT and tax deductions and let colleagues access the bank account.

Basic business banking features like cash deposits (deposit limit is low: max. £1,000 over 6 months), bank transfers, Direct Debits and standing orders can be managed in Monzo accounts. The account has an IBAN for receiving international SWIFT transfers for a 1% fee, but Wise is used to send money abroad.

Monzo does not offer loans or overdrafts for companies (only for sole traders), but the savings pots accrue 1.6% AER interest (variable). 24/7 customer support via chat, email and telephone is also available to all users.

Choose Monzo Business if: You have a personal Monzo account and want to stick with the same bank for your business.

If you’re looking for business accounts for bad credit, Zempler (previously Cashplus) would rank highly because they don’t do any credit checks at sign-up. This means you’re almost guaranteed to be accepted as long as your business is a UK-registered limited company, partnership or public sector organisation.

Zempler Bank’s business bank accounts are managed through a mobile app or web portal. Users get a prepaid Mastercard, and a Business Credit Card is available for eligible users who receive an offer for it. There is also an overdraft of up to £2,000.

Image: Zempler Bank

Zempler (when it was Cashplus) was the first UK non-bank to offer current accounts.

Zempler offers two account plans: Business Go for free or Business Extra for £9 per month. Although free, Business Go charges £9.95 upfront for the debit card and several basic things like £2 per UK cash withdrawal and 2.99% for payments in foreign currencies (GBP payments are free). Business Extra removes most of these charges.

To improve your business’ credit rating, Business Extra has an optional Creditbuilder feature where you commit to paying its subscription on time for one year. Doing this can increase your credit score (or harms it if you miss a payment).

The business account is in GBP currency, but free Euro and USD cash cards can be added for travel use. You can receive international payments in your GBP account via a central, shared Zempler account for a fixed fee of £15, but you can’t send money abroad.

The Zempler Bank app has some handy features like Direct Debit reminders before money is taken from your account, spending analytics, transactions categories and attaching pictures of expense receipts to transactions. You can order up to 20 extra prepaid business cards for staff members.

Customer support is only available on weekdays and Saturdays during the day. The service has received quite a few complaints about account issues and the app that’s been mired in technical issues. Still, we think it’s a good option for those who need better credit options.

Choose Zempler if: You’re looking to improve your company’s bad credit history through a new business account.

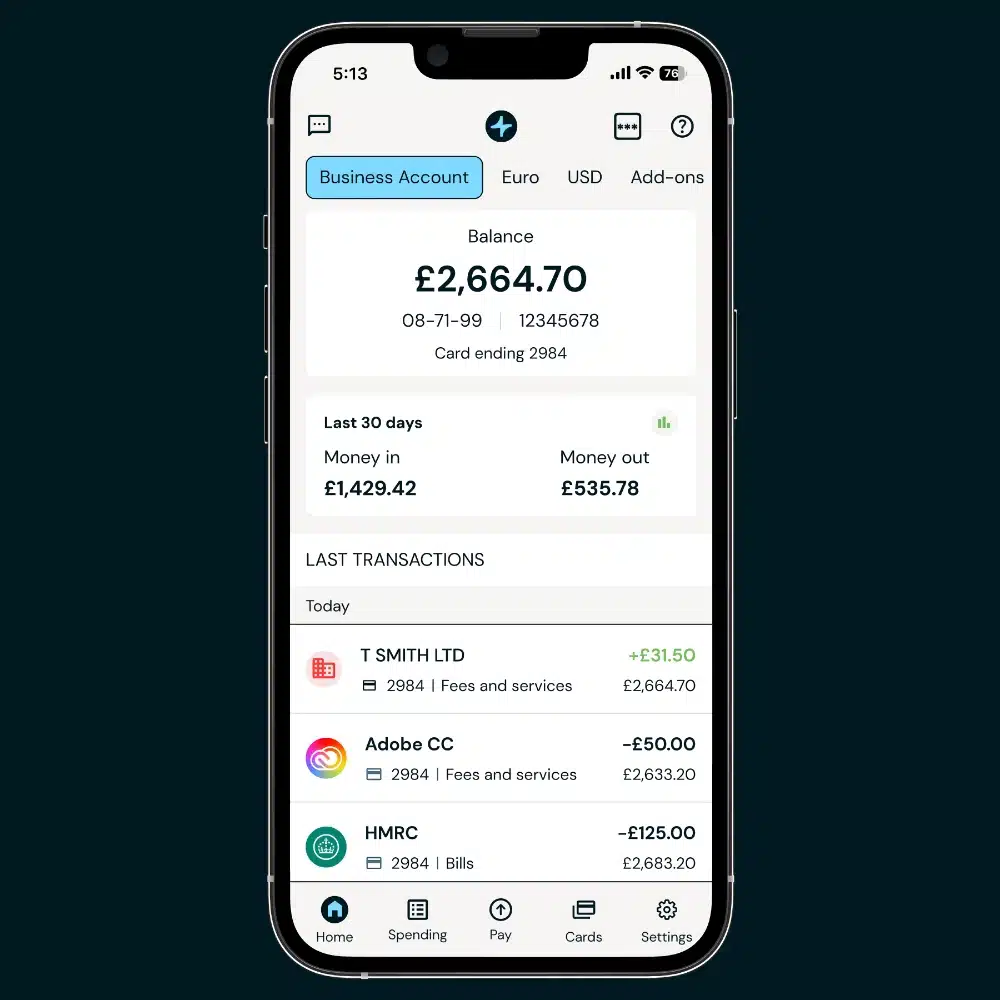

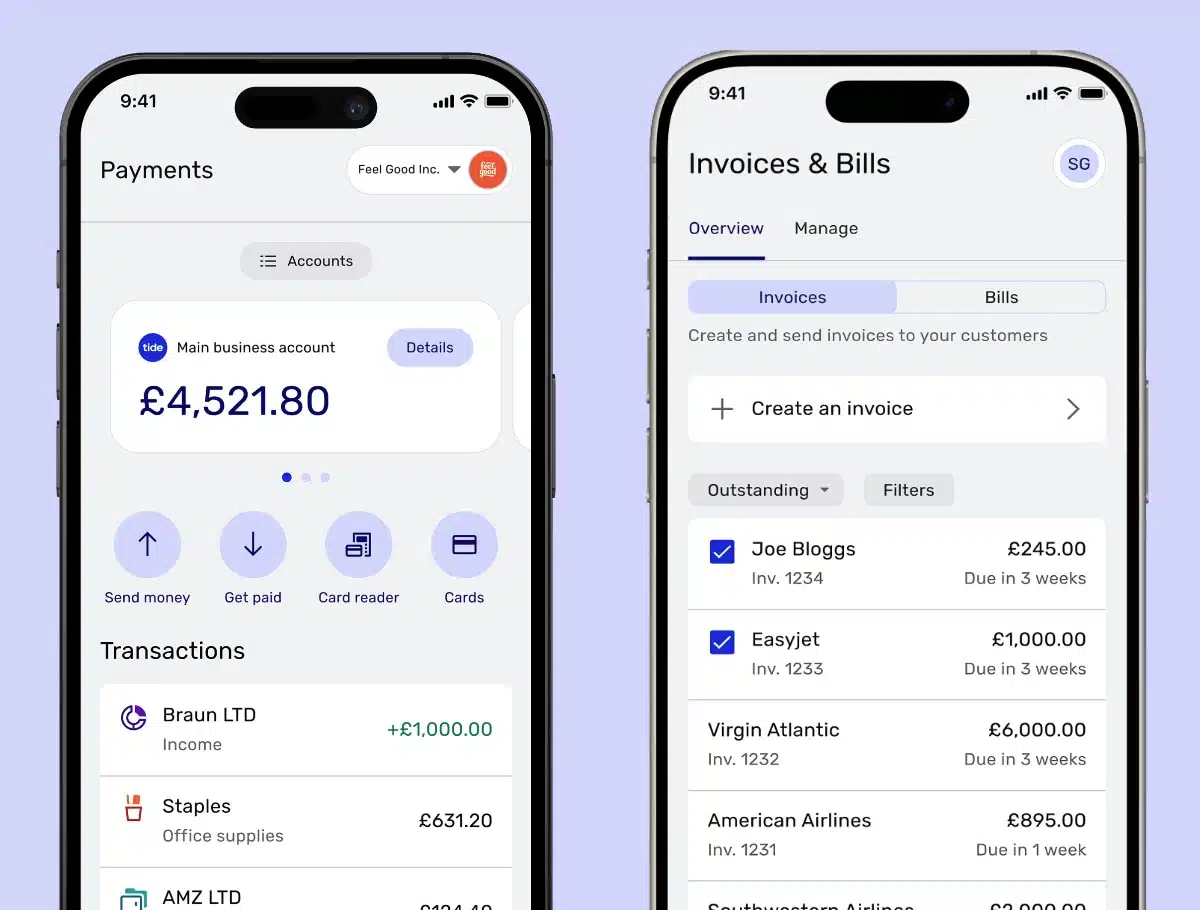

Tide is another UK-based business account that previously only provided e-money accounts, but an FSCS-protected business bank account provided by ClearBank is now also available when signing up. To be eligible, you have to be a UK-registered limited company. Partnerships, charities and other entities are not accepted.

All Tide accounts come with a business debit Mastercard, read access for your team and accountant, up to five business accounts for your company (to separate budgets), accounting integrations, invoicing and scheduled payments. A business savings account and in-app accounting features can be added.

Tide has some useful account features, but paid plans aren’t cheap.

The free plan charges 20p per UK payment, and the 24/7 messaging support in the app is not that good. Upgrading the business account to one of the three paid tiers (£9.99-£49.99 + VAT/month) adds free UK payments, free expense cards, priority and phone support and a 24/7 legal helpline. The highest tier has a dedicated team of account managers and 0.5% cashback on eligible card transactions.

The Tide app has an above-average range of features like invoicing, receipt uploads and an IBAN for receiving international payments, but you can’t send international payments from the GBP account. We therefore don’t recommend Tide for companies with clients abroad.

You can order dozens of expense cards for team members and integrate accounting software even on the Free plan, but the biggest distinguisher is perhaps the legal and tax support helpline on paid plans. This is for any business queries typically reserved for expensive solicitors or accountants, but for a monthly fee, Tide has you covered on that.

Choose Tide if: You want a dedicated account manager and ongoing tax/legal support.

Monese Business is an e-money account for companies based in the UK and registered with Companies House. It used to be the case that EEA residents could open an account, but this is no longer possible.

Although customer support is only available during daytime hours on weekdays, you can message or speak with staff in any of 14 different languages, whereas other business accounts only offer English-speaking support.

The Monese account is managed primarily in the app.

The Monese Business account is not free – you have to pay £9.95 monthly for a subscription (there are no tiered plans with more features).

This includes a Business Prepaid Mastercard, unlimited free UK payments, 6 free cash withdrawals per month, 0.5%+ fee on outgoing international transfers, and a 0.5% fee on card transactions in another currency. Cash deposits cost £1 in a Post Office or 2.5% at a PayPoint.

You can send and receive international payments from the Monese app, where you’ll find an IBAN or SWIFT code.

It is possible to receive money into your GBP-only Monese account from over 30 countries (foreign currency will be converted into GBP). You can also send international payments to these same countries around the world.

The online business account is managed through the app, which lets you send invoices, create automated savings pots, set card controls and colour-code transactions according to categories. Monese does not offer business loans or overdrafts to businesses.

Choose Monese if: Your business is UK-registered but you need the flexibility to send money internationally.

Looking for spend accounts? See our review of Soldo expense cards