There is no such thing as a perfect business bank account. But somewhere, there is a business account just right for your freelance situation.

Choosing a bank account as a self-employed individual is a precarious business. Fortunately, UK-based sole traders now have a wide array of online accounts with easy sign-ups and low costs to suit any budget.

We’ve tested quite a few business accounts for sole traders and know the ins and outs of each. Not all are full-fledged bank accounts – most are actually e-money accounts with a connected debit card that (usually) work just as well.

There are, however, limitations with any solution, which really depend on your particular needs and priorities. Let us pinpoint the strengths and weaknesses of the best business accounts for UK sole traders.

Have a registered company? See our business account comparison for companies.

| Account | Cost | Best for | Link |

|---|---|---|---|

| Tide e-money/bank account |

£0-£9.99*/mo | All-round money management and payment tools, good support options | |

| Monzo Business bank account |

£0-£5/mo | Sole trader loans and overdrafts, budgeting tools | |

| ANNA Money e-money account |

£0-£49.90*/mo | 24/7 messaging support and assistance by real people | |

| Starling Bank bank account |

£0-£7/mo | Low cost, customer service and enjoyable banking app | |

| Revolut e-money account |

£0-£19/mo | Multi-currency accounts and cross-border payments |

*Excluding VAT.

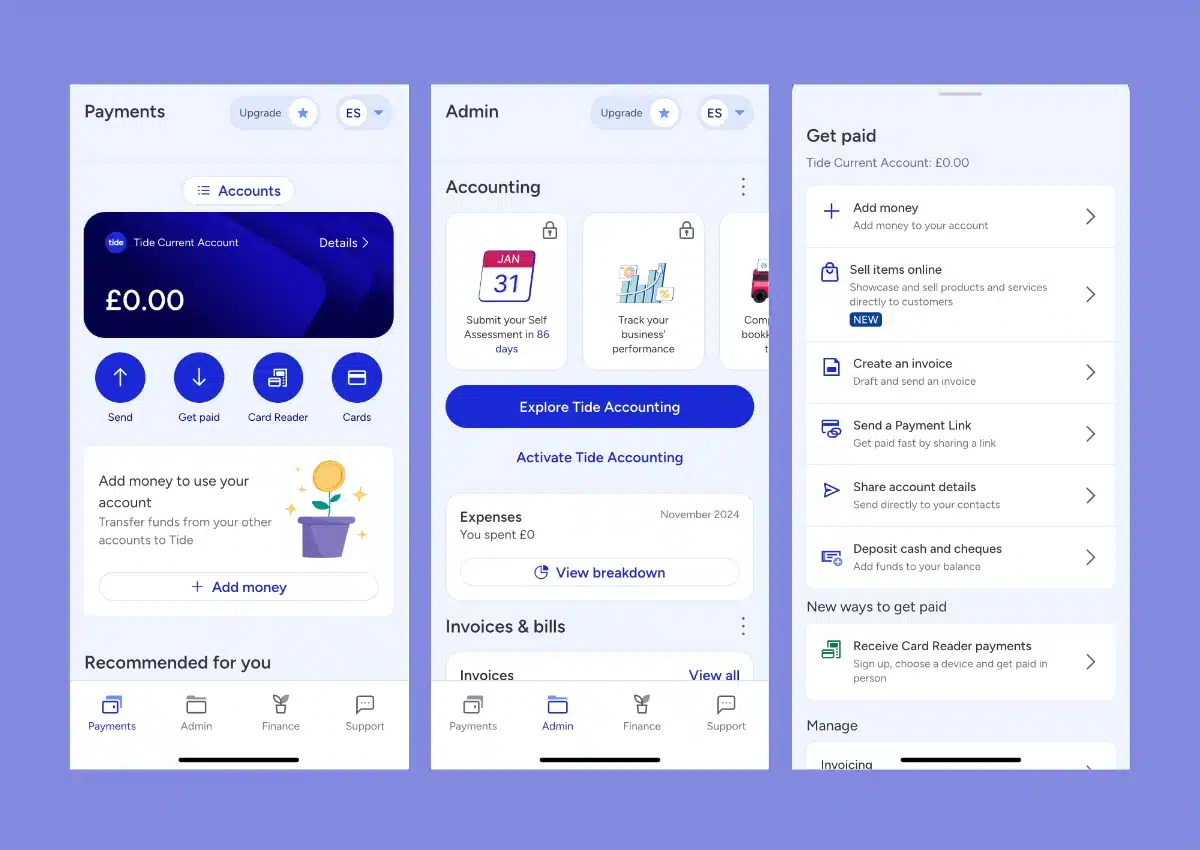

Tide Business is a current account for sole traders and companies. It comes with a Mastercard and can be managed through the Tide app or web browser.

We used to rate the account lower, but Tide has really upped their game with useful bookkeeping prompts, a better app layout and new ways to get paid. Signing up is also easy to do through the app.

Image: MobileTransaction

Tide has added many new features in the last few years that sole traders would like.

The two Tide Business plans best suited for sole traders are:

- Free (free): Domestic payments 20p each, basic support

- Plus (£9.99 + VAT/mo): 20 free domestic payments, 1 free expense card, phone-, trademark- and priority 24/7 support, legal helpline

All plans offer receipt storage, integration with Xero and QuickBooks, and the ability to hold several business accounts for things like expenses and taxes. There’s also payment scheduling, read-only access for accountants and transaction categorisation to simplify bookkeeping.

We’re particularly impressed by Tide’s many new ways account holders can accept payments for services and products. Not only can the Tide app turn your iPhone into a contactless card reader, it also lets you share links to pay for specific products and connect with a card reader.

For an extra fee, advanced invoicing and accounting features are added to the app.

The account now comes with an IBAN, so you can receive payments in GBP from abroad. Sole traders can send and receive euros for a 0.5% currency exchange fee. You can also deposit cash at any PayPoint or Post Office.

Many users have reported inadequate customer support, but there’s a gap in quality of service between Free and Plus. On Free, you have basic (read: slow) in-app support round the clock, while Plus provides “priority” support and a 24/7 legal helpline that’s helpful for some sole traders.

Choose Tide if: You want a versatile account with general tools for managing money and accepting payments.

Learn more in our review of Tide

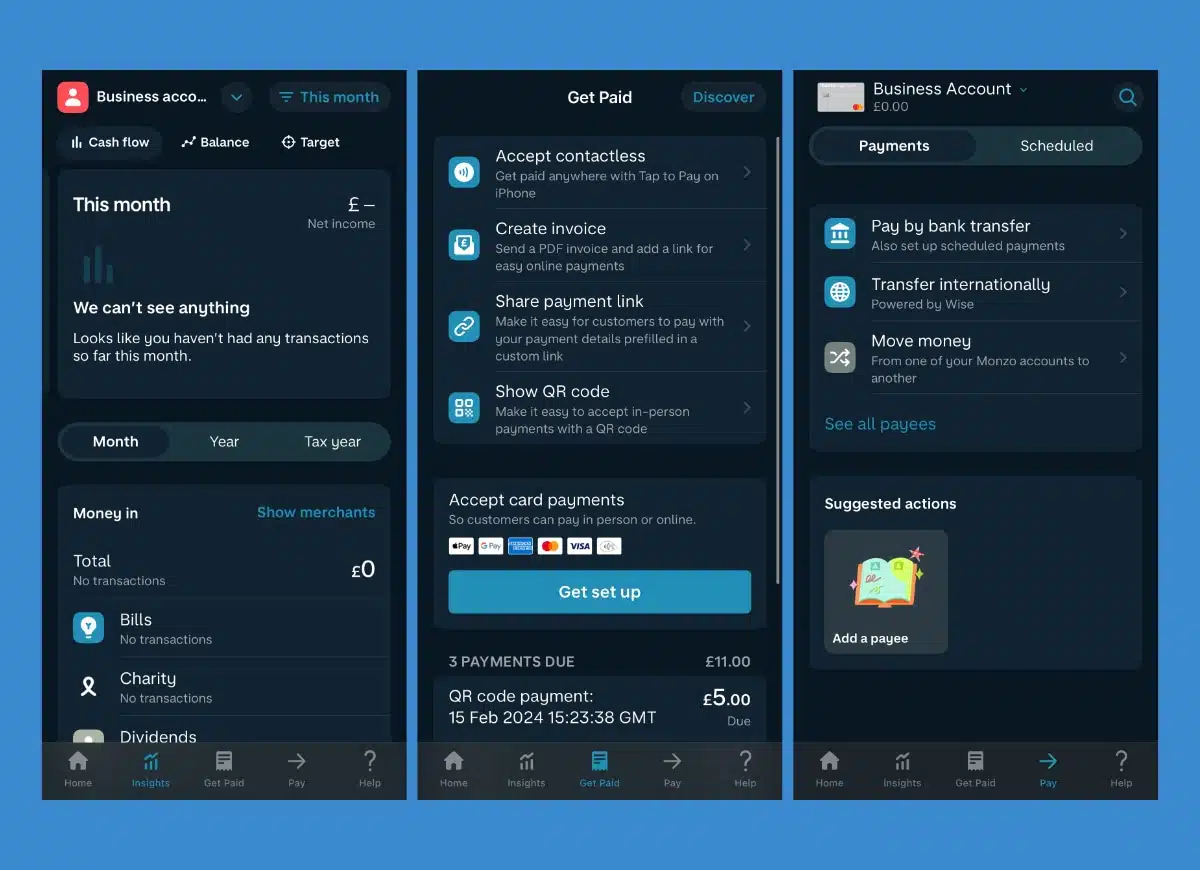

A couple of years ago, I was very underwhelmed by the Monzo Business bank account, when it didn’t seem to prioritise the business account as much as the personal account. Now, Monzo Business has enough to please most sole traders who want to get a bank account that’s not on the high street.

Image: MobileTransaction

We recommend Monzo Pro for its invoicing and automated Tax Pots.

There are two Monzo Business plans ideal for sole traders (the third plan, Team, is better for companies):

- Lite (free): Savings pots with interest, budgeting features, Tap to Pay on iPhone/Android, payment links

- Pro (£5/mo): Above + virtual cards, custom spending categories, automated Tax Pots, accounting integration, invoicing

The Pro plan is mainly for companies, but freelancers can also benefit from its invoicing and Tax Pots, which automatically set aside the right amount for taxes to pay HMRC later. The ‘pots’ help you separate money for different purposes, so you don’t spend what’s reserved for something else.

Monzo Business also lets you set spending limits within categories such as travel and bills, and name the categories if paying for Pro. I think these tools are quite useful for day-to-day monitoring.

The bank account has an IBAN to receive payments from abroad and integrates with Wise for outbound international payments, so it’s not limited for cross-border freelancing.

The complimentary Debit Mastercard can be used globally with no mark-up on the exchange rate if paying in a different currency. You can deposit cash into the account from any PayPoint in the UK, but deposits are limited to a maximum of £1,000 during 6 months, which isn’t much at all.

Amazingly, Monzo recently introduced sole trader loans and overdrafts, which none of the other business accounts on this list can offer.

We should add that Monzo Business scores highly among users for its 24/7 customer service, compared with all other banks.

Choose Monzo Business if: You want a real bank account with loan options and good budgeting tools.

Learn more in our Monzo Business review

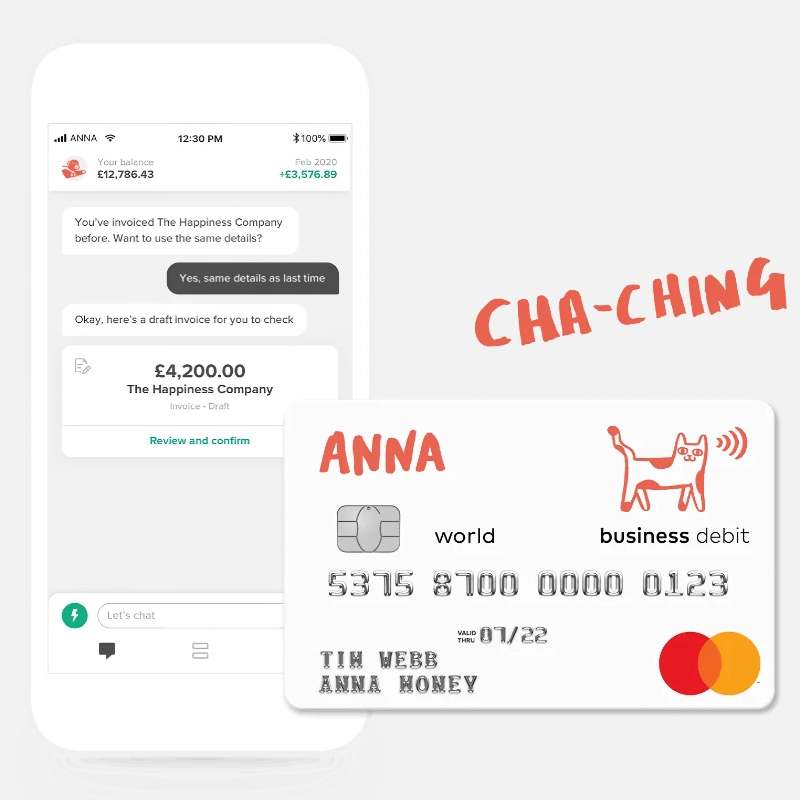

If you like the thought of getting someone else to do your admin, ANNA Money has nailed that with their round-the-clock messaging support in the app.

We fired the chatbot questions or tasks, and if the automated chatbot didn’t know the answer, a real customer service agent took over the chat to help within minutes.

The ANNA account comes with a Debit Mastercard.

Signing up with ANNA gives you a choice between 3 subscriptions:

- Pay As You Go (free): 1 debit card, fees for payments, transfers and cash withdrawals/deposits, £1 per saving pot, 1% fee for payment links

- Business (£14.90 + VAT/mo): Up to 5 cards, limited free payments, deposits and withdrawals, 2 free saving pots, £200 free payment link transactions

- Big Business (£49.90 + VAT/mo): Low currency conversion, unlimited free UK transfers, withdrawals, deposits and payment links

You get a Debit Mastercard from ANNA, which is better than the prepaid cards usually offered by e-money accounts.

To be frank, ANNA has improved its account a lot since we last tested it. You can now deposit cash into it, send payment links, send/receive international payments and access the account online, not just in the app. A Taxes add-on (£24 + VAT/month) also replaces the need for separate accounting software.

Past an invoice due date, the app can send polite invoice reminders to clients who haven’t paid yet. Pictures of expense receipts are stored, and you can even send physical receipts for ANNA to sort out. Sole trader taxes are monitored through the app as well.

But I mostly like how it manages admin tasks. For instance, you can just ask the chatbot to create and send an invoice to a client, and it will ask about the information to fill in. This personal touch gives it a rare sense of warmth not seen in other business accounts.

Choose ANNA Money if: Your clients are primarily based in the UK and all you need are invoicing and bookkeeping features in a friendly app.

Learn more in our ANNA Money review

Starling is a British bank managed through a banking app. It was one of the original online banks in the UK with a Sole Trader account for self-employed people.

The business account comes with a Debit Mastercard and IBAN for international transfers. You can deposit cash into the account at any Post Office and cheques directly through the app by snapping a photo of it.

Image: Starling Bank

Starling has good banking features with 24/7 access to customer support.

The bank no longer offers overdrafts or loans for self-employed people, only companies – a step back from a few years ago.

The Starling Bank app has a lot of useful features such as:

For £7 per month including VAT, freelancers can subscribe to Business Toolkit available exclusively in the online web account. This will automate your bookkeeping, give an up-to-date estimate of taxes due (cash basis accounting only) and organise expenses, invoices, bills and payments.

If you prefer, it’s possible to integrate with external software for accounting such as FreeAgent, QuickBooks and Xero.

Starling’s friendly customer support is available through the app 24/7.

Choose Starling Bank if: You prefer an online bank that feels most like a ‘real’ bank with a good quality banking app.

Learn more in our Starling account review for sole traders

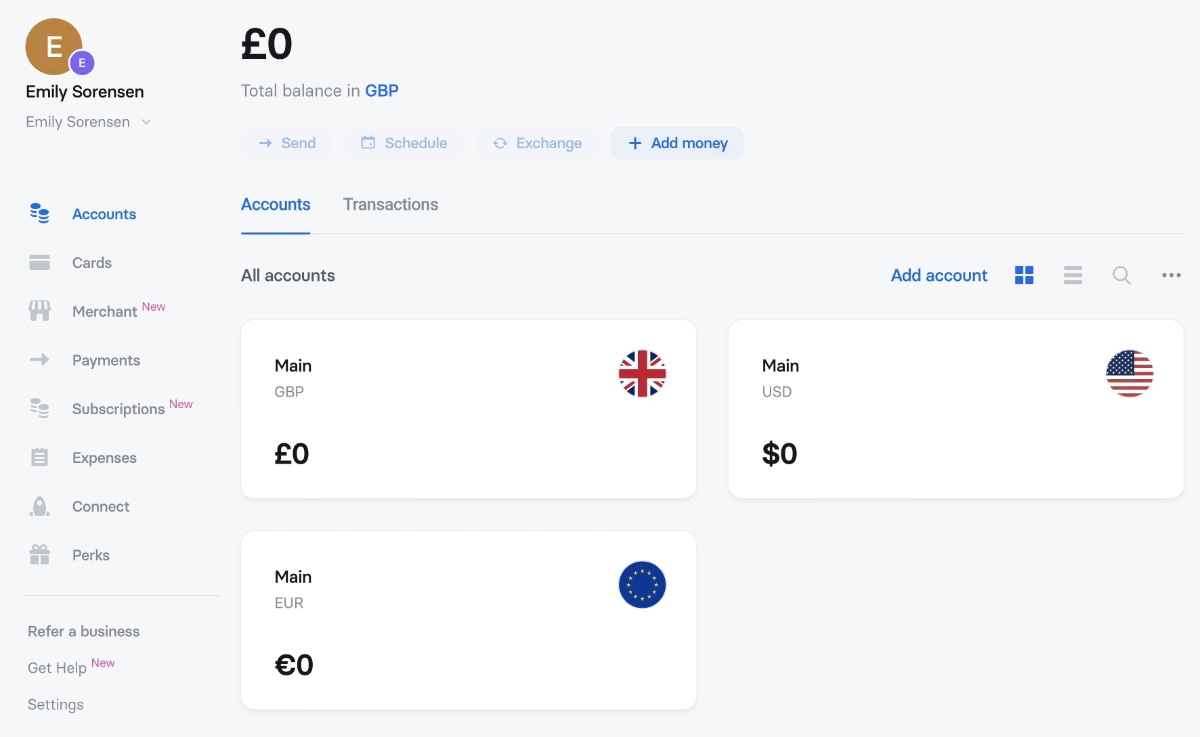

If you’re dealing with a lot of clients from abroad, then signing up for Revolut Business should be considered. It finally has a banking licence in the UK, but is only in the transitional phase to being a full bank.

Not only do you get a local GBP and EUR account – you also get an IBAN and currency accounts for US dollars and many more currencies. This means you can keep payments in different currencies separate to avoid exchange rates.

Image: MobileTransaction

Even the free Revolut Business account allows you to hold multiple currencies in one account.

The two Revolut Business accounts most suitable for freelancers are:

Basic (free): 5 free local payments, £5 per SWIFT transfer, unlimited team access, no markup fee on currency conversions up to £1k/month

Grow (£19/month): 1 metal card, 100 free local payments, 5 free international payments, no markup fee on currency conversions up to £10k/month, card controls, custom team user permissions, bulk payments, savings account with interest

What’s more, eligible users can accept card payments via contactless taps on iPhone, a card reader and payment links and invoices.

You can integrate the Business account with the accounting software QuickBooks or Xero. Travellers can use the Mastercard for transactions in 150 different currencies without fees.

Revolut isn’t great for cash users, though. You can’t deposit cash into the business account, so the only way to top up the balance is by credit card or bank transfer. Cash withdrawals also cost 2% of the amount every time, regardless of the plan.

Personally, I think Revolut is better geared towards companies that need to share account access with employees. Many of the features are used by companies dealing with many payments across the world.

Choose Revolut Business if: You travel for work and receive or send international transfers regularly.

Learn more in our Revolut Business review

Summary

| Account | Pros | Cons |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alternative without credit check: Cashplus Business Account – any good?