With the convenience of smartphones and availability of invoice apps, many entrepreneurs have shifted their invoicing from computer or laptop browsers to mobile devices.

App-based invoicing has a lot of similarities with desktop invoicing. The benefits of both are undeniable: customisable templates, saved data about suppliers, customers and products, less input errors, automated calculations, paper elimination, easier tracking, and better reporting and analysis.

Can these benefits be as great using only a mobile phone – and even exceed desktop performance? The growth in app-based invoicing indicates that it is.

UK-based accounting software provider FreeAgent disclosed a whopping 70% increase in the level of mobile invoicing year on year to Mobile Transaction, exceeding the overall growth in online invoicing.

We take a deep dive into the real benefits driving the growth.

The obvious: mobility

The benefits of mobile invoicing are undeniable. Business owners and their staff can generate invoices, send them to clients and check settlement directly from their smartphone. The flexibility to stay productive on the move accelerates turnaround times and enhances overall efficiency.

But looking beyond mobility, there are other benefits.

ET, Mobile Transaction

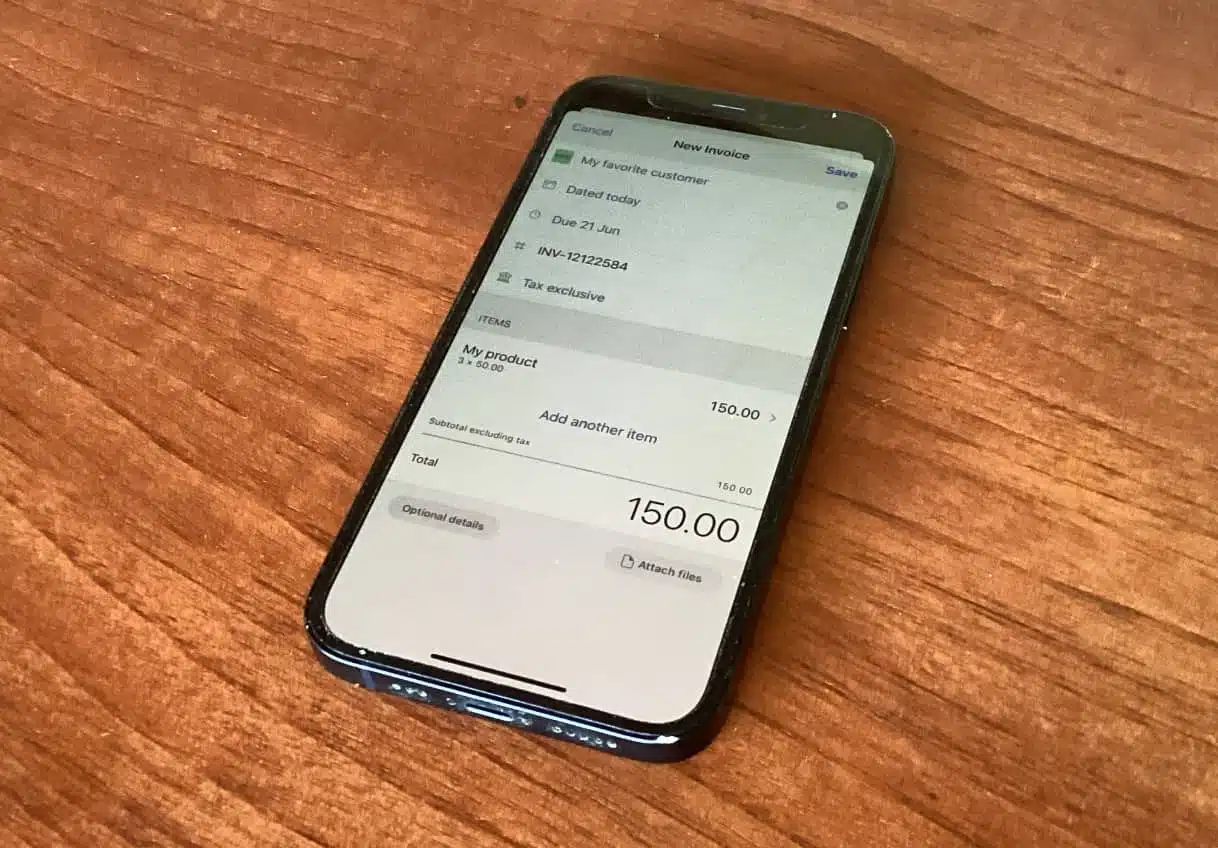

Our tests of invoice generation in the Xero accounting app resulted in time saved compared with the desktop app.

Simplified interface, faster turnaround

Invoicing apps have many of the same advantages as web-based invoicing when it comes to user-friendliness. What differs is the simplified interface that allows users to easily create, send and manage invoices.

Interfaces developed for iPhone or Android often have a smoother, more intuitive user experience compared with online software accessed through a browser.

Mobile apps load faster than websites, which could make a task consisting of several steps faster on an app. If your template is set up, and the invoice elements are simple, the task is most likely completed quicker in an app.

The combination of improved speed and a more intuitive task flow results in a few-seconds-to-minutes saved per generated invoice, which adds up over time.

We tested invoice generation in the accounting system Xero, comparing the browser version on a laptop with the Xero app on an iPhone.

Testing a few different templates, the overall time saved per invoice using the app was was around 12 seconds. Not much, but a factor here is that the testers had more experience with browser-based invoicing. The testers also felt that the app had fewer distractions: no long row of tempting browser tabs – just the the app screen to deal with.

Minimises manual entry

A simplified interface and smaller screen might also prevent business owners from adding pointless information to an invoice. Maybe those additional lines of words describing the invoiced goods or services are just not necessary.

Having tested both options ourselves, we found that an app leads to less clutter on an invoice. Pre-added inventory items or a quick one-liner to describe the invoiced items were enough.

Think of how messages became shorter when moving from letters to email, and shorter again when texting and chat messages became the norm. Format, interface and technology matter for length. Less manual entry – even if done habitually – means time saved.

Money received sooner

App invoicing can also reduce the time it takes to get paid.

Tradespeople and service providers working at customers’ premises or outdoors have found that sending invoices from their phone just after completing a job shortened settlement time. Probably at a psychological level, the physical proximity and efficiency of bundling related activities together compel the client to pay.

CEO of accounting software FreeAgent, Roan Lavery, confirms that merchants receive funds earlier by sending an invoice swiftly:

“The sooner an invoice is with a client, the sooner they’re likely to pay.

So it’s becoming common practice now for some small businesses – and in particular contractors and those in the building trades – to send their invoices straight from a mobile app as soon as a job is completed.”

FreeAgent CEO Roan Lavery.

Sole trader clients confirm this pattern. After leaving a session with her personal trainer at a park close to her workplace, Hannah says she receives the invoice from her coach within minutes:

“I usually pay it right away from my phone, as there is a link to settle by card and I just pay with Apple Pay with face ID.

It just feels good to tick the box for that as well: training done, payment done. I think I prefer to just get the invoice right away rather than days later.”

Security paramount

With plenty of benefits, the disadvantages are more difficult to spot. A possible downside – if not managed well – is security.

Mobile devices are portable and prone to loss, theft and unauthorised access. It is crucial to implement security measures such as device encryption, strong passwords or biometric authentication to protect sensitive information.

This is not unique to invoicing. If your phone and apps are compromised, you probably have a range of security issues to worry about. You should therefore make sure it’s possible to lock your phone if it gets lost or stolen.

Is a big screen sometimes better?

With the average smartphone screen size more than tripling in a decade, users have a sharper, higher-resolution touchscreen device to work with. In other words, the screen is now easier to read, so even the most minute details can be clear.

Still, more complex invoicing tasks are best done from a computer, with its bigger screen displaying all details together. For example, invoices containing multiple variables and sources might take longer to decipher on a phone, while spreadsheets or reports are easy to analyse on a wider-screen computer.

Some administrative tasks might also be more straightforward on a computer, such as importing or adding to your list of customer contacts. Most invoicing systems can import Google Contacts, though, and those might as well be done on a smartphone.