What is it?

Barclaycard wants to empower on-the-go tradespeople and small businesses to accept payments anywhere, so they created the card reader service Barclaycard Anywhere.

It allows you to accept credit and debit cards through an app on your Android device, iPhone or iPad, as long as you have the Anywhere card reader for chip and PIN, contactless and swipe cards connected to the app.

The card reader and app do not connect with receipt printers, cash drawers, barcode scanners or any other hardware. Instead, the product aims to be a compact, mobile solution for impromptu card payments.

Accepted cards

Unlike market-leading card readers, Barclaycard Anywhere does not accept American Express, nor does it accept Diners Club, Discover or UnionPay cards. If you frequently service tourists and businesspeople with foreign cards, this is a limitation.

Barclays said in 2015 that they aimed to add new cards, but has hardly developed the service since.

Lowest fixed rate compared with competitors

The Barclaycard Anywhere card reader costs £29 +VAT (one-off purchase) with a 1.6% per-transaction charge.

The card reader has a similar price to those by Square, Zettle and SumUp, but Barclaycard peculiarly calls it a “one-off rental price”, implying you are renting the terminal and don’t own it completely. This is vague and unusual for an inexpensive card reader that’s purchased outright elsewhere.

The transaction fee applies to mobile wallets and all Visa, Mastercard, Maestro and JCB cards, whether they are debit, credit, commercial or business cards.

| Barclaycard Anywhere cost | |

|---|---|

| Card reader | £29 + VAT |

| App | Free |

| Transaction fees | 1.6% (any card) |

| Refunds | 75p each |

| Contract | Cancellable any time |

| Barclaycard Anywhere cost |

|

|---|---|

| Card reader | £29 + VAT |

| App | Free |

| Transaction fees | 1.6% (any card) |

| Refunds | 75p each |

| Contract | Cancellable any time |

This is one of the lowest default fees available for mobile card readers in the UK, which is a major selling point for Barclaycard Anywhere.

As with other card readers, you should also factor in the cost of data usage by your phone or tablet.

Barclaycard does, however, add a 75p fee per refund processed, whereas most other card readers only retain the original transaction charge, if anything is charged.

The plan is pay-as-you-go with no contractual obligations, no monthly fees and no lock-in, so it is overall an economical solution for seasonal traders or other small businesses.

Barclaycard Business (provider of Anywhere) generally has a 2-3 working day settlement time with a Barclays account or longer if the account is based at another bank, but Anywhere may have a 2-day payout time in any bank account.

Card reader

The card reader has not been upgraded for quite a few years, so it’s not the most cutting-edge card reader on the market, but it certainly works. It’s the same as that previously (but no longer) used by PayPal Here, Zettle and Worldpay.

It accepts NFC (contactless), chip and magnetic stripe cards and has a physical, push-button keypad for easy PIN entry. The transaction speed is comparable to an in-store card machine (assuming there is mobile connectivity of 3G or above).

When a payment has finished processing, the card reader communicates this with a green light but no beep. People are so used to an auditory clue to signify an OK transaction that it’s not clear to everyone when a transaction has gone through on the Anywhere reader.

Photo: Emily Sorensen, Mobile Transaction

The card reader at a market stall.

Transactions occur over your mobile device’s 4G or WiFi connection, so you need a compatible iPhone, iPad or Android device with the Anywhere app for it to work.

We’ve seen user reviews complaining that the card reader’s Bluetooth disconnects easily from the app, so the merchant has to wait for a whole, long minute to reconnect before they can take another payment. This is not ideal in a busy environment.

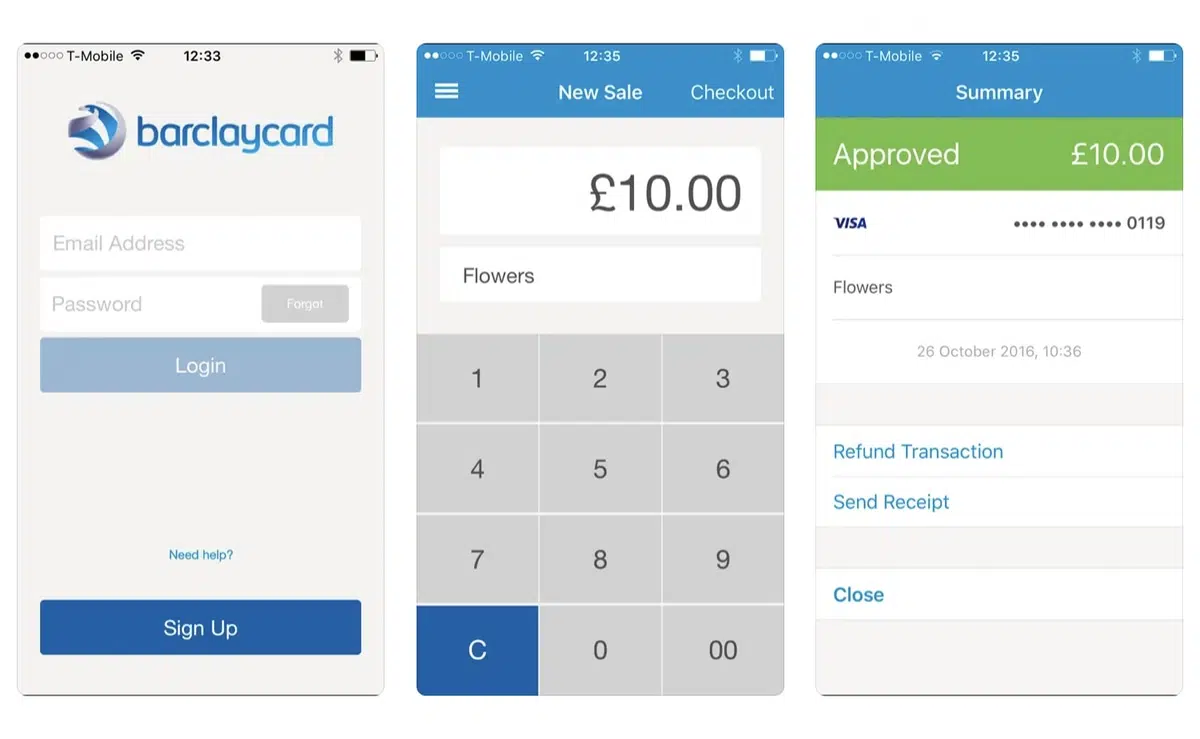

The app

A major reservation with Barclaycard Anywhere is that the app has actually got worse. It hasn’t been updated since the mid-2018 – 4 years ago – which is very bad and risky for businesses in need of a reliable payment service.

In 2015, the app could help you manage your business – including support for sales functions, stock monitoring, customer data and payment history.

However, the current app version is mainly just able to receive simple payments. There are no other point of sale (POS) functions and no product library. You have to add the name of the product/service and the amount to create a sale, and only an electronic receipt can be sent, not printed. Refunds can also be made.

But the last update did add a repeat payments function meant for charity contributions, which is not a given in this type of product. And there’s a web portal where you can export sales to Excel for accounting purposes and add multiple users.

From what we’ve seen in the past, the lack of investment in app development is unsurprising for a bank that does not specialise in mobile applications.

The app only has basic functions related to processing transactions.

A common complaint is that the app signs you out when it’s not used frequently and requires you to enter a password to log in. It doesn’t use facial recognition or touch ID, so it’s always a bit of a nuisance to log in before you can accept a new transaction (and the sometimes unreliable Bluetooth has to connect too).

The app supports Android devices with Bluetooth and Android 5.0 or higher. This includes Samsung Galaxy S3-S7, Samsung Note, Note II-5 and Google Nexus 4-9, among others. Compatible tablets that have been tested by Barclays include Huawei MediaPads, Samsung Galaxy Tab E, S2 and 4, and others.

Compatible Apple devices include iPhone 4 and onward, iPad 2 and above, and iPod Touch 5 and above (with iOS 10.0 or higher).

Who is it aimed at?

Barclaycard Anywhere’s target users are sole traders who only take occasional payments rather than high volumes, and expect an annual turnover of less than £1 million.

This includes tradespeople of all kinds, small or mobile premises, seasonal traders, pop-ups, hairdressers, plumbers or merchants selling at events like concerts or trade fairs. The repeat payments function is ideal for charities and perhaps street musicians.

Barclaycard highlights the service is ideal for making customers feel safe about making a card payment away from a shop environment. This makes sense considering Barclays is a trusted bank and their logo is on the card reader.

But all things considered, we would only recommend the card reader for businesses already banking with Barclays and insist on sticking with them for all business dealings. The stripped-down app is only really suitable for businesses who just need a portable card machine for very straightforward transactions.

Customer service and reviews

Customer service is provided by Barclaycard’s existing telephone support, so you don’t get a special team dealing with the Anywhere card reader or app. This is not great, and certainly shows how few are actually using the service.

What about reviews? The app has an average 2.1 stars in the App Store. Most ratings are 1 star, with customer feedback highlighting how basic or buggy it is. It is also apparent the app has not been adapted to newer iPhone models, and the developer has not provided the required details about how they handle data privacy.

In Google Play, customer feedback used to highlight bugs and the app crashing on Android devices. But the reviews and ratings have disappeared there, presumably because of the limited user base recently.

Getting started

To get started, you complete Barclaycard Anywhere’s online application which should take about 15 minutes. Approval depends on “financial circumstance and borrowing history”, which might make the approval rate a bit lower than elsewhere.

Certain documents may be required depending on your type of business. Your address history for the last 3 years or last 3 addresses is required from the business owner, partners and shareholders

After that, you order the card reader to be sent by post. Then you can download the free app on your mobile device and pair it with your mobile device via Bluetooth – and you are ready to accept cards.

Our verdict

Apart from a slightly lower transaction fee, Barclaycard Anywhere’s service does not offer any decisive advantages over its competition. It represents a somewhat convenient service, but comes with a basic app with bugs in many cases. This can get problematic for merchants who depend on a reliable terminal service to keep afloat as a business.

| Barclaycard Anywhere criteria | Rating | Conclusion |

|---|---|---|

| Product | 1.6 | Very bad/Bad |

| Costs and fees | 3.5 | Passable/Good |

| Transparency and sign-up | 3.4 | Passable/Good |

| Value-added services | 2 | Bad |

| Service and reviews | 2.5 | Bad/Passable |

| Contract | 4 | Good |

| OVERALL SCORE | 2.7 | Bad/Passable |

| Barclaycard Anywhere criteria |

Rating | Conclusion |

|---|---|---|

| Product | 1.6 | Very bad/Bad |

| Costs and fees | 3.5 | Passable/Good |

| Transparency and sign-up | 3.4 | Passable/Good |

| Value-added services | 2 | Bad |

| Service and reviews | 2.5 | Bad/Passable |

| Contract | 4 | Good |

| OVERALL SCORE | 2.7 | Bad/Passable |

It appears that Barclays has decided to rely on its strong banking brand to capture more conservative businesses as well as existing customers who may prefer to stick with something they already know. Barclays would probably claim that its banking experience means Barclaycard Anywhere offers a higher overall level of security, but the lack of software and hardware updates puts this into question.

Overall, Barclaycard Anywhere could have been much better. We believe the majority of small businesses would be better served by solutions such as Zettle, SumUp or Square for their much better features, frequent app updates and broader payment methods.