Contents

In brief

How it works

Verdict

In detail

Pricing

Terminal and POS features

Account and card

Remote payments

Service and reviews

Getting started

How Zeller works

Launched in May 2021, Zeller is an ambitious new company with a mature EFTPOS product that already ranks highly in the Australian market.

Zeller’s product is simple: for a one-off price, you get a cutting-edge EFTPOS terminal that can be used anywhere with WiFi or mobile connectivity. It comes in a box with a Mastercard linked to an online transactions account where payouts arrive by the business next day.

“We were impressed that right from the start, Zeller got the main thing right: they made it quick and easy to get up and running with an EFTPOS machine and spend funds without a bank account.”

– Emily Sorensen, Senior Editor, MobileTransaction

Alternatively, you can settle payments at a similar speed (the next business day) in your bank account at any Australian bank.

Accepted cards

To sign up, a company or sole trader just completes an online registration form that Zeller checks and verifies. Previously, the product was also available at Officeworks across the country, but the terminals are now purchased online where you are guaranteed the best offer.

Zeller Terminal accepts any chip and contactless payment through eftpos, Visa, Mastercard, American Express, JCB and popular mobile wallets.

We’ve witnessed the service steadily expanding features to include e.g. contactless card acceptance on a smartphone, invoicing and a savings account – with more to come soon.

Zeller alternatives? See the best EFTPOS machines for small businesses

Our opinion: a top Australian player, with a few limitations

We see Zeller as a worthy EFTPOS solution that already appeals to many small businesses and sole traders in Australia, despite being a new market entry.

The uncomplicated, but high-quality, EFTPOS machine is particularly useful for retailers, food and drink, professional services and beauty salons, even with teams of staff and multiple locations. We’re relieved to see it integrating with POS systems at last (it didn’t to begin with) and adapt to growing businesses too.

You get everything for taking card payments in one box (literally): a terminal and debit card. This combo gets to the heart of the matter for new businesses that need a consistently fast cash flow and dedicated company account to keep finances in order.

| Zeller criteria | Rating | Conclusion |

|---|---|---|

| Product | 4.6 | Good/Excellent |

| Costs and fees | 4.4 | Good/Excellent |

| Transparency and sign-up | 4.3 | Good/Excellent |

| Value-added services | 4 | Good |

| Service and reviews | 4 | Good |

| Contract | 5 | Excellent |

| OVERALL SCORE | 4.4 | Good/Excellent |

The lack of lock-in and monthly fees contrast with many Australian banks with EFTPOS machines on a long-term contract with fixed costs and steep exit fees. Zeller’s low rate for all types of cards is especially a good deal compared with alternative fixed-rate providers such as Square.

The upfront cost of $99 for Zeller Terminal is no longer a barrier for most businesses. Even the newly launched Zeller Terminal 2 ($199) with its attractive POS software is considerably cheaper than its direct competitor Square Terminal ($329).

A possible hindrance is the lack of integrations with ecommerce software. Although ideal as a portable all-in-one EFTPOS terminal for those who don’t need more than basic POS features, it also works with external, specialised POS systems (though not all POS systems).

New business tools and integrations are currently being developed, so it might not be long until Zeller is even more versatile.

Zeller pricing: very fair for no commitment

Zeller charges $99 for Zeller Terminal 1 and $199 for Terminal 2 including GST, which includes a 12-month product warranty. It is hard to beat these low prices for a so-called smart terminal with plenty of software included, plus a receipt printer in Terminal 1’s case.

If you change your mind about the purchase, it can be returned for a full refund through free shipping within a limited period of time.

There is no monthly fee, no contractual commitment or other ongoing charges, as you own the EFTPOS machine outright.

The main cost is a fixed rate of 1.4% (incl. GST) for all chip and tap transactions, no matter the type of card, including American Express. This EFTPOS rate is lower than any other pay-as-you-go solution in Australia. Businesses with an annual card turnover of more than $250k can negotiate lower rates.

| Zeller fees | |

|---|---|

| Zeller Terminal | Zeller Terminal 1: $99 Zeller Terminal 2: $199 GST and shipping included |

| Contract lock-in | None |

| Chip, tap and swipe fee | 1.4% incl. GST per transaction |

| Keyed transactions on a terminal | 1.7% incl. GST (all cards) |

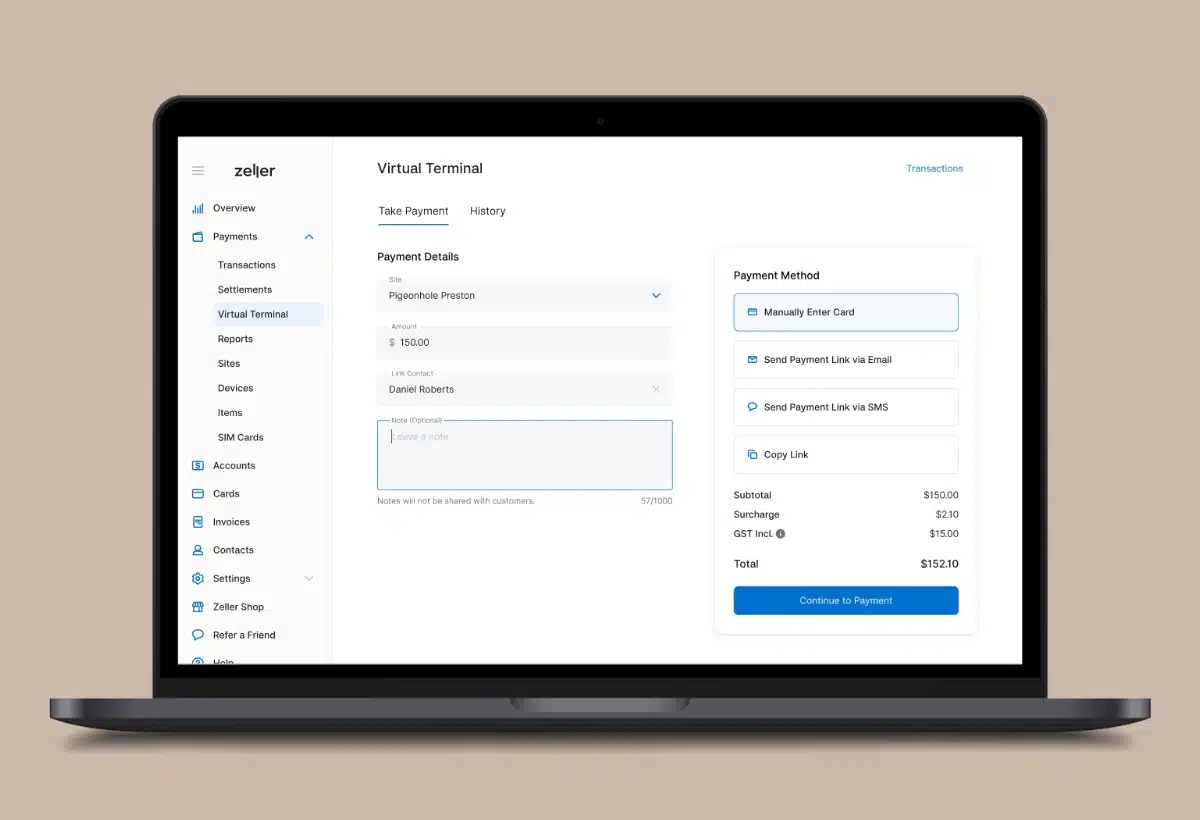

| Virtual Terminal/Pay by Link transactions | 1.75% + $0.25 incl. GST (all cards) |

| Invoice transactions | Domestic cards: 1.7% + $0.25 incl. GST Foreign cards: 2.9% + $0.25 incl. GST |

| Payouts | Free |

| Refunds | Free |

| Chargebacks | Free |

| Mastercard + Transaction Account | Free |

| Mastercard transactions | Domestic: Free Foreign: Fee applies |

| Zeller SIM Card | $15 price (incl. first month’s data) $15/mo for unlimited data |

If the merchant keys in transactions on the terminals, for example for over-the-phone payments, it costs 1.7% regardless of the type of card processed. This is cheaper than Square’s fixed keyed rate of 2.2%.

But if you were to use the browser-based Virtual Terminal (both for telephone payments and sending payment links), the fee is higher: 1.75% + $0.25 per transaction with any card. I should note that charging the same for Virtual Terminal and Pay by Link transactions is unusual – normally, the cost of any merchant-keyed card transaction is higher than when customers complete it online themselves.

Online payments via email invoices cost 1.7% + $0.25 for domestic cards or 2.9% + $0.25 for international cards.

Using the terminal with WiFi doesn’t cost extra, but for mobile 4G connectivity, you must buy a SIM card. Zeller sells its own SIM card for $15 upfront, whereafter you pay $15 monthly from the following month onwards for unlimited data on the Optus network.

“Mobile data does come at a hidden monthly cost, but you can choose any standard SIM card – it doesn’t have to be Zeller’s. A typical transaction only uses 1kB-2kB data to process, so that should give you an indication of how much SIM data you need.”

– Emily Sorensen, Senior Editor, MobileTransaction

If preferred, the terminal can at any time be set to a “fee-free” mode that passes on the transaction fee to customers, either in full or partially. It is essentially a surcharge enabling you to avoid ongoing fees completely – if your customers are willing to pay the fee.

A complimentary Mastercard linked with a free Zeller Transaction account is included in every package. These do not have a monthly fee or transaction charges – only a foreign transaction fee for international purchases with the card.

There’s no cost to closing the Zeller account, which can be done any time. Refunds and chargebacks are free to process, and so are payouts to either the Zeller account or your bank account.

Terminal and POS features

Zeller has a selection of two EFTPOS machines: Zeller Terminal (or Zeller Terminal 1 to highlight it was their first) and now also Zeller Terminal 2.

What are the similarities? As standalone, Android-based EFTPOS terminals, they act as portable checkouts with payment software built in. Apart from processing cards, refunds, tips, split payments, keyed transactions and surcharges, they let you monitor transactions right on the screen.

They don’t just suit independent merchants, because employees can have their own logins and permissions so the same machine can be shared between a manager, staff and anyone in between.

What’s more, Zeller gradually adds new functions to all of its terminal software. For example, all merchants can customise the screensaver to display a logo, QR code or other message. Receipts can also be branded with a logo and messages.

What about the differences between Zeller Terminal 1 and 2?

| Zeller Terminal 1 | Zeller Terminal 2 | |

|---|---|---|

|

|

|

| Price | $99 incl. GST | $199 incl. GST |

| Device colour | Black, white | Black, graphite, white |

| Connectivity | WiFi, 4G (with SIM), Ethernet (via dock) | WiFi, 4G (with SIM), Ethernet (via adaptor) |

| Software | Simple payment acceptance app | POS system app with product library |

| Card types accepted | Chip, contactless, swipe | Chip, contactless |

| Built-in receipt printer | Yes | No |

| Battery life | 1,000 transactions | 1,300 transactions |

| Touchscreen size | 5.5″ | 6.5″ |

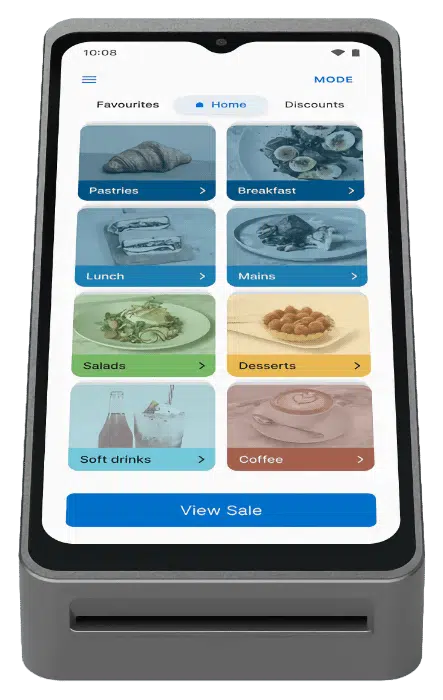

The biggest difference is the software. Terminal 1 essentially just accepts cards for non-itemised, single amounts. Terminal 2, on the other hand, has a fairly simple point of sale (POS) system – like Square Terminal – called Zeller POS Lite. It has a product library with categories, modifiers, discounts and a customisable layout on the display, all editable on the terminal, in the Zeller App or online dashboard.

Zeller Terminal 2, here pictured at a merchant’s business in Melbourne, is uniquely L-shaped.

But I wouldn’t say Terminal 1 is much more basic. Like Terminal 2, it allows merchants to add a surcharge and tip, and restaurants can split bills. And it’s the only model accepting swipe cards. With its built-in camera, Zeller Terminal 1 will eventually be able to scan QR codes for payments.

Perhaps the biggest advantage of Terminal 1 is its built-in printer for paper receipts apart from email and SMS receipts. Terminal 2 doesn’t have a printer, but can display a QR code on the screen for customers to scan for a digital receipt without giving away their email address or mobile number.

Zeller Terminal 1 only comes in black and white.

Although both have touchscreens, Terminal 2’s is 6.5″ which is 18% bigger than any other EFTPOS machine in Australia. Terminal 2 also has a 30% longer battery life than Terminal 1 and faster processor than other Australian card machines.

Both connect with WiFi and 4G through an optional SIM card, for backup if the WiFi fails or just general use on the road. Connecting via Ethernet cable is an option for stationary setups, but requires the dock (extra cost) with Terminal 1 and adaptor with Terminal 2.

You can integrate the terminal with point of sale (POS) systems like Abacus, Erply, Lightspeed Retail, Impos, H&L and OrderMate. Zeller advertises “over 600 different POS platforms”, but it’s not completely true since some of them are for other types of software like payment methods (Zip, Afterpay) or enterprise resource planning (Jim2).

“Zeller hasn’t been as quick as Square to add new payment features, but subtle developments over the last few years – like adding a brand logo to the screen – have made the EFTPOS product very attractive.”

– Emily Sorensen, Senior Editor, MobileTransaction

An integrated POS system allows you to push transactions from your chosen POS software to the terminal for a smooth sales flow. It also gives you more complete sales reports – for both cash as well as EFTPOS transactions.

A card machine fleet can be monitored and controlled remotely from the Zeller account through a web browser, so the solution suits multi-location businesses as well as single-location merchants.

Through the Zeller App, merchants can – in place of the card terminal – accept contactless card or mobile wallets payments directly on their NFC-enabled iPhone or Android device. Referred to as Tap to Pay, we love the convenience of this and have seen it increasingly adopted in real life.

Zeller’s different cards and accounts

Unlike other EFTPOS terminals in Australia, Zeller comes with a free Transaction Account online. This is not the same as a full-fledged bank account, but it acts in place of one.

The account settles EFTPOS transactions every midnight, and you can spend this the morning after with the Zeller Mastercard, as with any other business card. But it’s not possible to receive payments from other people or companies in the account apart from the Zeller Terminal funds.

EFTPOS funds can also settle directly in a bank account, typically the following business day.

The associated Zeller Debit Mastercard can be added to your Google Pay or Apple Pay wallets, but cannot withdraw cash at ATMs. It can be used in online and physical stores, and you can pay invoices and transfer money to other people, like employee bank accounts, from the dashboard.

The new Zeller Corporate Cards do, on the other hand, help companies manage staff expenses better. Business owners can issue several virtual or physical expense cards to help monitor staff spending within their allocated budgets.

That’s not even all – Zeller even launched a free savings account, encouraging you to store business funds there to earn interest over time.

These are all accessed through the browser-based Zeller Dashboard. Here, you can monitor expenses, categorise transactions, oversee sales, manage account settings as well as terminal fleets.

We like the dashboard’s contact directory where you can store, manage and categorise customers or vendors. It lets you monitor purchasing trends, and vendors or suppliers match with your card transactions when reordering stock.

The whole system also connects with Xero accounting software for advanced bookkeeping.

Online and over-the-phone payments

When Zeller launched, the company hardly offered any ways to accept payments remotely or online – this has changed now.

For a start, the browser dashboard has a Virtual Terminal page where you can manually enter and process card transactions while talking to the cardholder over the phone. This is a very straightforward way to take orders or deposits, provided you’re sitting in front of a computer.

It’s also possible to send email invoices free from the dashboard, so that clients can pay online. This is actually quite a good deal, since invoicing apps elsewhere generally charge for the privilege. The design and contents of Zeller’s email invoices are easy to read and sufficient for most merchants.

The virtual terminal, as seen in Zeller Dashboard.

Service and Zeller reviews: generally promising

Despite the low-cost nature of the Zeller offering, you still get Australia-based customer support every day of the week (Monday to Sunday) between 9 am and 1 am Australian Eastern Time (AET). You can call the team on a helpline, message them on social media or try to find an answer in a help section on the website.

If there’s a fault with the EFTPOS terminal, you can get express terminal replacement the same day if based in a city. Otherwise, it might take a bit longer to receive a replacement terminal, but Zeller makes an effort to be fast at resolving technical issues.

“Our own experience with the company has been very positive so far. It is our strong impression that Zeller really is trying to remove the usual barriers that merchants in Australia face when setting up a payment system.”

– Emily Sorensen, Senior Editor, MobileTransaction

Zeller reviews from real users show a general enthusiasm for the product’s ease of use, low fees and helpful support.

Photo: Zeller

Zeller Terminal works with POS systems (like pictured) or alone.

Getting started is easy

Zeller accepts most Australian sole traders, companies, trusts, partnerships and incorporated associations. This even includes certain individuals, schools and other entities that may not have an ABN number, and certain business types others deem as high-risk such as vape shops. Some of these (not all) business entities require specific proof in order to be accepted as a Zeller merchant.

On top of this, you’ll need to attach two types of proof of identity in the form of a passport, Medicare card or driver’s licence. If you only have one proof of ID, Zeller can verify you anyway through additional questions.

To get started, you first need to complete a short online registration form with basic contact information – no phone call is required. This creates the account, but you won’t be able to use it until the next step is completed: adding your business information and accompanying proof (if relevant).

The whole application takes about five minutes to complete, after which Zeller works on verifying it.

If your business is one of the simple ones to confirm, you may be verified immediately so you can use the account straight away. More complicated businesses may take a few hours, sometimes more than a day, to process. It’s best to complete the sign-up before purchasing the terminal to be sure you can use it.