- Pros: Daily payouts with Westpac bank account. 24/7 technical support. Many POS integrations.

- Cons: Not cheap for fluctuating sales. Payouts slower with non-Westpac bank account. Poor service.

- Choose if: Your turnover is stable and you prefer the service of a trusted bank with a modern EFTPOS offering.

Overview

In brief

Our opinion

In detail

EFTPOS machines

Pricing and contract

Payouts

POS integrations

Reporting

Support and reviews

Our opinion: better than before, but cost can still prohibit

Existing Westpac account holders should definitely have a look at the EFTPOS offering, since they benefit from same-day funding. The bank’s customer service doesn’t sound great, but the card machines are used by many merchants across Australia – a sign Westpac that works at scale. But is it easy to use for a small business?

The fees have been simplified compared with a few years ago – you mainly just pay a monthly rental fee and fixed transaction rate for the most popular cards. But these fees are very similar to NAB’s and CommBank’s EFTPOS pricing, so we don’t think Westpac stands out in that regard. And other potential charges still lurk in the background for certain Westpac users, like chargeback fees if they have too many of them.

| Westpac criteria | Rating | Conclusion |

|---|---|---|

| Product | 4.1 | Good |

| Costs and fees | 3.7 | Passable/Good |

| Transparency and sign-up | 3.7 | Passable/Good |

| Value-added services | 3.8 | Good |

| Service and reviews | 2.7 | Bad/Passable |

| Contract | 3.9 | Good |

| OVERALL SCORE | 3.7 | Passable/Good |

Smaller merchants should carefully consider if the monthly fee is worth it. We generally think Zeller and Square have better pricing for small businesses with sporadic or smaller sales volumes, despite their slightly higher pay-as-you-go rates. That’s because there’s no monthly cost, and less time wasted on the bureaucratic hoops that Westpac as a traditional bank still has.

“Westpac has got rid of complicated pricing, but we’re still wary of the bank’s reputation for a bad service. The EFTPOS contracts might now be commitment-free, but a contract still binds you to certain conditions.”

– Emily Sorensen, Senior Editor, MobileTransaction

The EFTPOS Now terminal certainly appeals to modern merchants with its large touchscreen and adaptable software. But the basic plan just gives you a basic payment app for amount-based transactions, so you need the Presto add-on for a more complex checkout setup.

Best for: Medium-sized, stable businesses with a business bank account that they’re happy with at Westpac.

| EFTPOS Now | EFTPOS Connect | EFTPOS Flex |

|---|---|---|

| Standalone card terminal; possible POS integration with Presto | Terminal integrated with POS system | Fixed terminal linked with POS at countertop or self-service checkout |

Verifone T650p |

Ingenico Move 5000 |

Verifone P630 |

| Accepted cards (included as standard): Optional accepted cards: |

||

The most flexible terminal is EFTPOS Now, a mobile and portable Verifone T650p model with a large colour touchscreen. It’s the only one of the models that works independently – the others have to connect with a POS system.

“Verifone T650t is Westpac’s attempt at appealing to younger businesses. It looks great and sits well in the hand, but it does still have a monthly fee unlike Zeller’s equivalent terminal.”

– Emily Sorensen, Senior Editor, MobileTransaction

The T650p has a built-in receipt printer and good graphics with audio prompts for visually impaired people so, for example, the virtual PIN pad is clear to use on the screen. The terminal can split bills, surcharge, accept pre-authorisations (useful for hotels) and tips, and set up multiple user logins.

It works with 4G for mobile merchants or WiFi for fixed premises, though WiFi can be used on the go with 4G as a fallback connection.

Photo: Verifone

Verifone T650p can be used on its own or connected with a POS system.

Alternatively, you can link EFTPOS Now with over 130 compatible POS systems for retail or hospitality on the Presto plan. Without this integration, you can only really use the terminal for transactions where you enter a single amount, as opposed to adding products to a list of items that make up a transaction total.

If you’re going to use a card terminal for a fixed checkout, EFTPOS Connect – an Ingenico Move 5000 terminal – is probably better suited. It looks more traditional with its push-buttons, but connects with over 600 POS-related systems to suit almost any kind of checkout.

The EFTPOS Flex card machine, another push-button Verifone terminal, is only really for larger businesses that need it for self-service checkouts or as additional card PIN pads for a checkout.

As one of the few payment providers to enable this in Australia, Westpac’s card machines work offline if the internet connection fails.

Westpac used to offer other Verifone card machines such as the card reader and app called Westpac Genie, but this is no longer available. If you’re looking for such an app-based, more affordable solution, we recommend checking our EFTPOS machine comparison which points to the best options.

In the past couple of years, Westpac also added EFTPOS Air as an optional way to accept contactless payments directly on your smartphone. It costs nothing per month, but charges a fixed transaction rate (1.4%) a bit higher than the EFTPOS machine rates (1.2%).

Westpac EFTPOS fees and contract

Westpac has simplified their pricing considerably in the past few years, which we welcome cautiously. This is still a bank known for its bureaucracy, after all.

The main costs now are a monthly rental fee and fixed transaction rate. Westpac used to have setup fees and contract termination fees, but says that they don’t any more. There is no contract lock-in either, unless you agree to one with custom fees.

You should still ask Westpac for a full summary of costs, since the bank has not been transparent about all aspects of fees in the past.

The following fees apply for small businesses:

| Westpac costs* | |

|---|---|

| Monthly terminal rental | EFTPOS Now: $24.75/mo EFTPOS Now w/Presto: $35.00/mo EFTPOS Connect: $27.50/mo EFTPOS Flex: $24.00/mo |

| Contract lock-in | None |

| Setup fee | None |

| Transaction fees | eftpos, Mastercard, Visa, UnionPay: 1.2% Amex, Diners Club, JCB: Custom fees |

| Chargebacks | Free for occasional ones, or $33+ each if more frequent |

| Fee for damaging or not returning a terminal | Up to $550 per terminal |

*Pricing includes GST.

Regardless of the card machine model, the transaction fee for the most popular cards – Visa, Mastercard, eftpos and UnionPay – is fixed at 1.2%. This is quite attractive for a simplified rate, compared with Square’s 1.6% or Zeller’s 1.4% for all cards.

Transaction fees for JCB, Diners Club and American Express are not openly disclosed, but negotiated with those card schemes. You have to set up a separate agreement directly with American Express to accept that.

The EFTPOS machines are never owned by you, so after ending a contract, you’ll need to return it to Westpac’s terminal supplier. A lost or damaged EFTPOS terminal will cost up to $550 (incl. GST) to replace or fix.

What about chargebacks, when a customer disputes a card transaction? If you only have “occasional transaction disputes”, there may be no fee for them. Otherwise, a $33 chargeback fee and “excessive chargeback fee” may apply if you have an unusual amount of chargebacks during a period of time. There could also be authorisation charges for transactions requesting validation over the phone. Of course, this only applies to some transactions (maybe very few).

Businesses with a history of consistent card transactions can go for a custom price plan, where transaction fees are much more tailored around the card type. This arrangement also means there are more types of fees and a minimum monthly sales volume, but it usually works out cheaper for merchants with a high transaction volume due to the very low rates for popular cards.

If you go for EFTPOS Now, there is apparently no contractual lock-in, but beware that there used to be a $104.50 (incl. GST) cancellation fee to end the contract. Do ask about this – and other miscellaneous costs – before committing to avoid any nasty surprises.

Payouts and bank account

You do not have to use a Westpac bank account to receive payouts for EFTPOS transactions. With a non-Westpac bank account, funds will be paid into your bank account within 48-72 hours of each settlement (processing time excludes Fridays, weekends, NSW public holidays and bank holidays).

A strong point of Westpac is its “instant settlement” seven days a week, 365 days a year. Contrary to what you might think of “instant”, though, EFTPOS transactions are not actually processed straight away to your business bank account. Only one payout batch a day can be settled in your bank account. This means transactions after this payout are settled the day after.

You also need a Westpac business transaction account to receive these same-day payouts through the bank. And the instant settlement function is only available for Mastercard, Visa and eftpos transactions.

POS integrations

A great advantage of Westpac is its many card machine integrations with pretty much any point of sale (POS) system. A POS system is the register software – paid for separately – that runs on your checkout computer or tablet screen.

EFTPOS Now with Presto integrates with over 130 POS software systems including BLUETILL, Hike, POSWAY, Shift8 and others for small to medieum businesses.

If you want to connect with a POS system that’s not compatible with Presto, EFTPOS Connect uses the software Linkly to integrate with over 600 POS systems in Australia. Retailers in Australia will be familiar with Linkly, since many EFTPOS providers use it for integrations, so Westpac isn’t unique here.

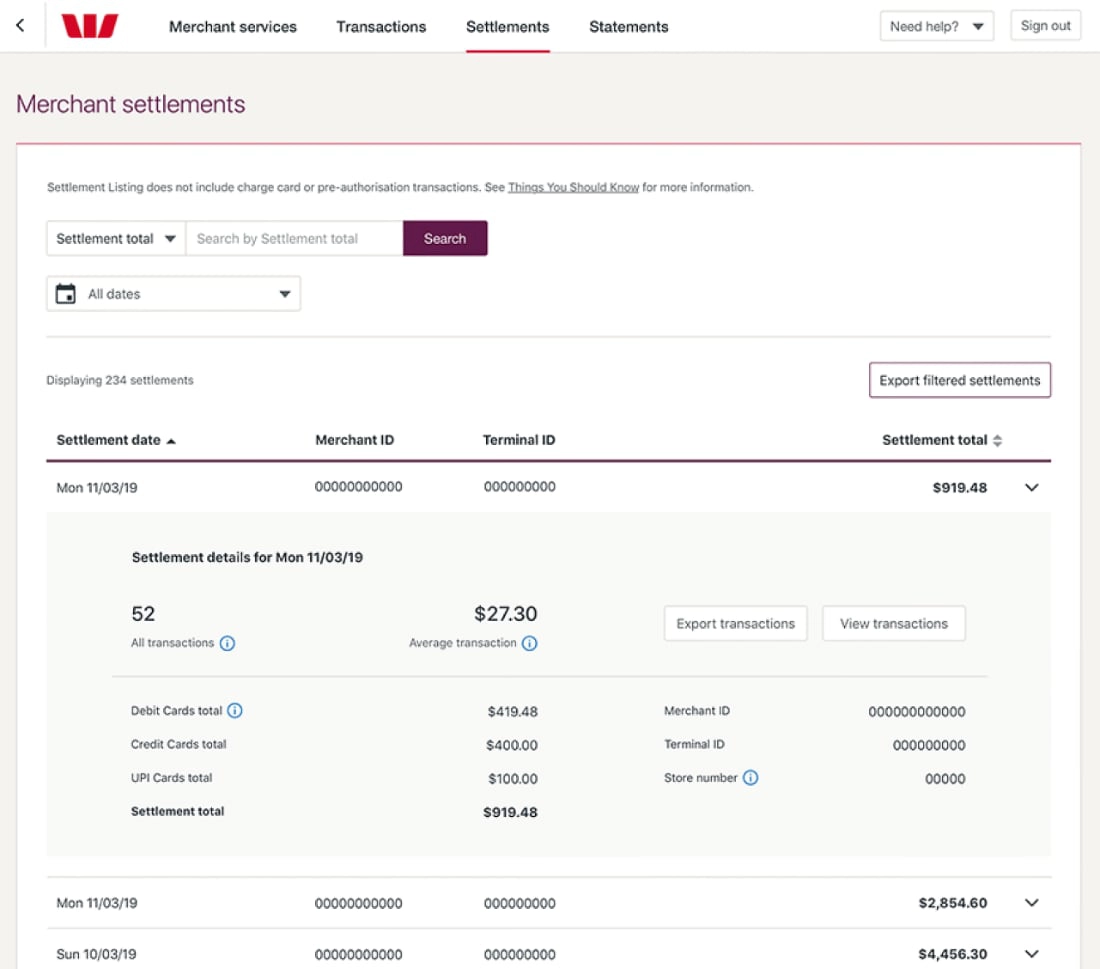

Image: Westpac

The dashboard gives access to transactions, settlements, terminal fleet and sales reports.

If the card machine is integrated with POS software, the POS system typically has various reporting functions and sales analytics where transactions of any payment methods are shown. In contrast, Westpac’s web portal is only for managing payment terminals, chargebacks and the payout schedule.

Customer support and reviews

24/7 customer support is included with all of Westpac’s EFTPOS solutions. This means that any time there’s a technical – or any other – problem, you can phone a help desk. You also have the flexibility of upgrading the card machine any time or discuss adjusting the fee plan if you experience growth in your business during your contractual term.

Generally, Westpac is a trusted service in Australia with about 100,000 merchants using it for card processing. When looking at general customer reviews, though, Westpac gets a lot of complaints from users having problems with basic account services. However, reviews from EFTPOS merchants are far in between, so it’s a little difficult to judge just how good that service is in comparison with private and business banking users.

Perhaps the best option for prospective merchants is to use a non-Westpac bank account for EFTPOS settlements to avoid the bank account issues reported by others.