Need to take payments over the phone or mail order? Not sure which virtual terminal to choose?

Quite a few payment solutions in Australia offer virtual terminals – or MOTO (Mail Order Telephone Order) payments – but only a handful suits small businesses.

What is a virtual terminal?

A virtual terminal is a browser-, app- or EFTPOS screen where merchants complete a card transaction via keyed entry on behalf of the cardholder. The customer usually shares their card details over telephone or mail order.

Accepting payments when a card is not present comes at a greater risk than your regular chip or contactless transaction.

This means higher transaction fees compared with in-store EFTPOS sales, plus PCI-DSS compliance documentation, a global security standard for card payments.

With all of the fees, features and data security conditions, which virtual terminal should you go with?

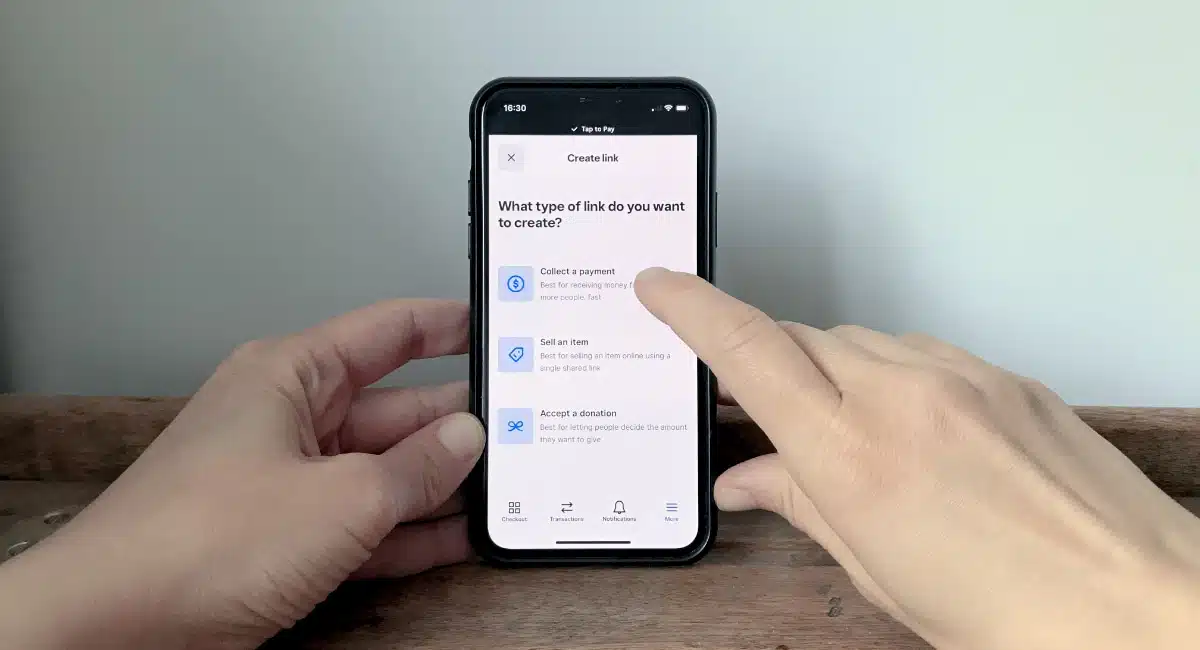

We should note that many sellers opt for payment links instead, where the cardholder receives a link to a web page to complete the transaction themselves. These has lower fees than MOTO transactions. View the best payment link solutions here.

Compare the best virtual terminals in Australia:

| Virtual terminal | Highlights | Fees |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Best for: Small, new or seasonal businesses needing an easy, not-binding option for remote payments.

Not for: Hotels that need to take deposits (no preauthorisations).

Advantages

If you’re looking for no commitment, a quick registration and no monthly fees, Square is your best solution.

There’s just a fixed transaction fee per Virtual Terminal payment via Visa, Mastercard, American Express or JCB.

“I love the simple, yet very adaptable, Virtual Terminal in Square’s account. I can add items to orders, tax rates, payment method (card is not the only option) and more, and recurring payments can be managed separately.”

– Emily Sorensen, Senior Editor, Mobile Transaction

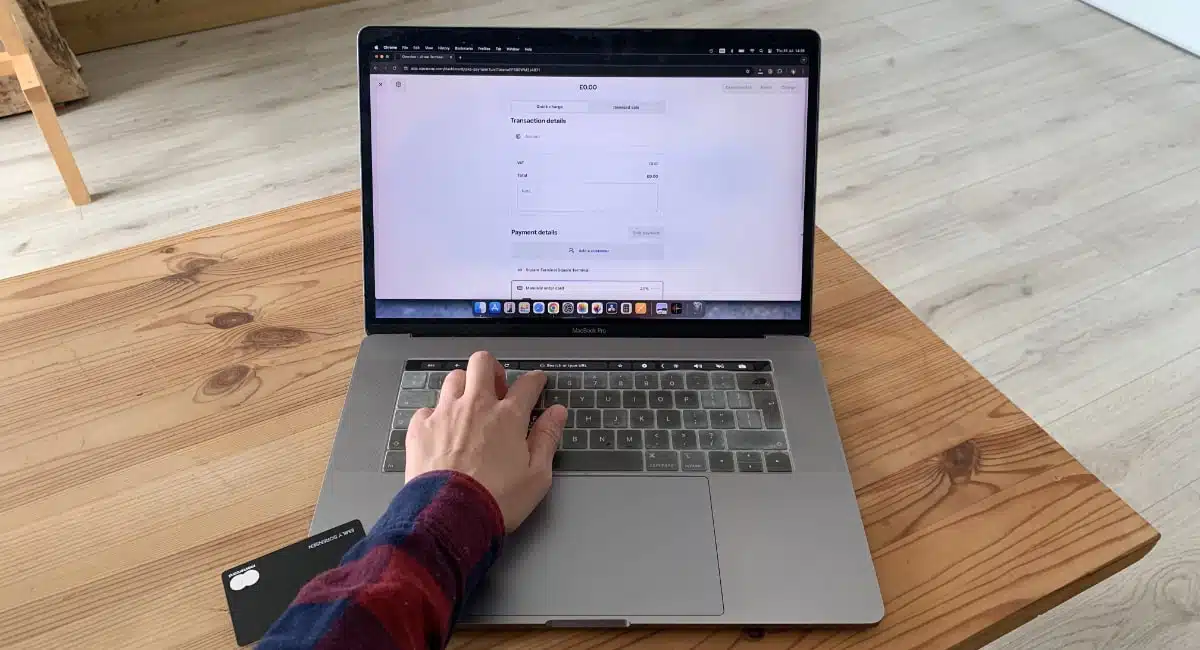

Image: Mobile Transaction

A snapshot of some of Square Virtual Terminal’s payment options.

You can go many months without using the terminal, without being charged, and it will still be available as a complimentary feature in your Square account.

The virtual payment terminal is straightforward – enter the card details, amount, customer info and a short note for sales reports, or itemise the bill with products or services, GST, discounts and variants.

It’s also possible to record the transaction in cash, gift card or other tenders, or split it into different payment methods.

Square pricing

Monthly cost: Free

Transaction fee: 2.2% (any card)

PCI-DSS compliance: No fee

In another section of the account, you can set up a new regularly occurring card (not bank) transaction, if the customer has approved saving their card details in the system.

There’s no requirement to submit PCI documentation with Square, but they do expect you to follow general safety checks in line with regulations.

Last but not least, an instant transfer option is available for an extra 1.5% fee. This allows you to receive funds straight after each transaction. The standard, free payouts reach your bank account the next day, weekends included.

Square really has lowered the threshold for getting started with payments, whether it’s for the point of sale, via invoicing, ecommerce or in this case a virtual terminal. With a Square account, you can take payments in any of these ways for a fixed percentage.

Best for: Newly started professional services that need a business account with fast access to funds.

Not for: Businesses that need advanced settings like preauthorisations or recurring payments.

Advantages

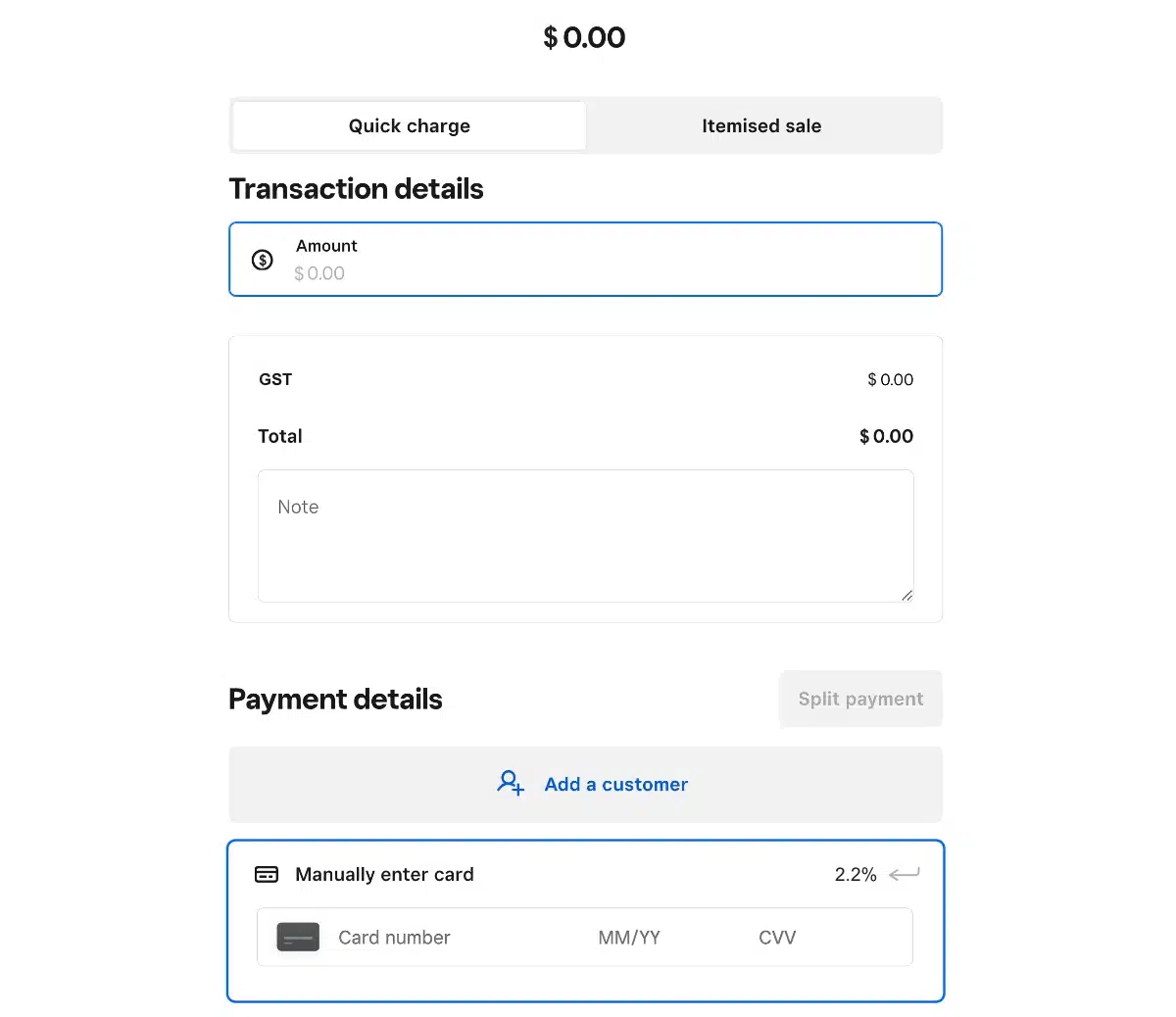

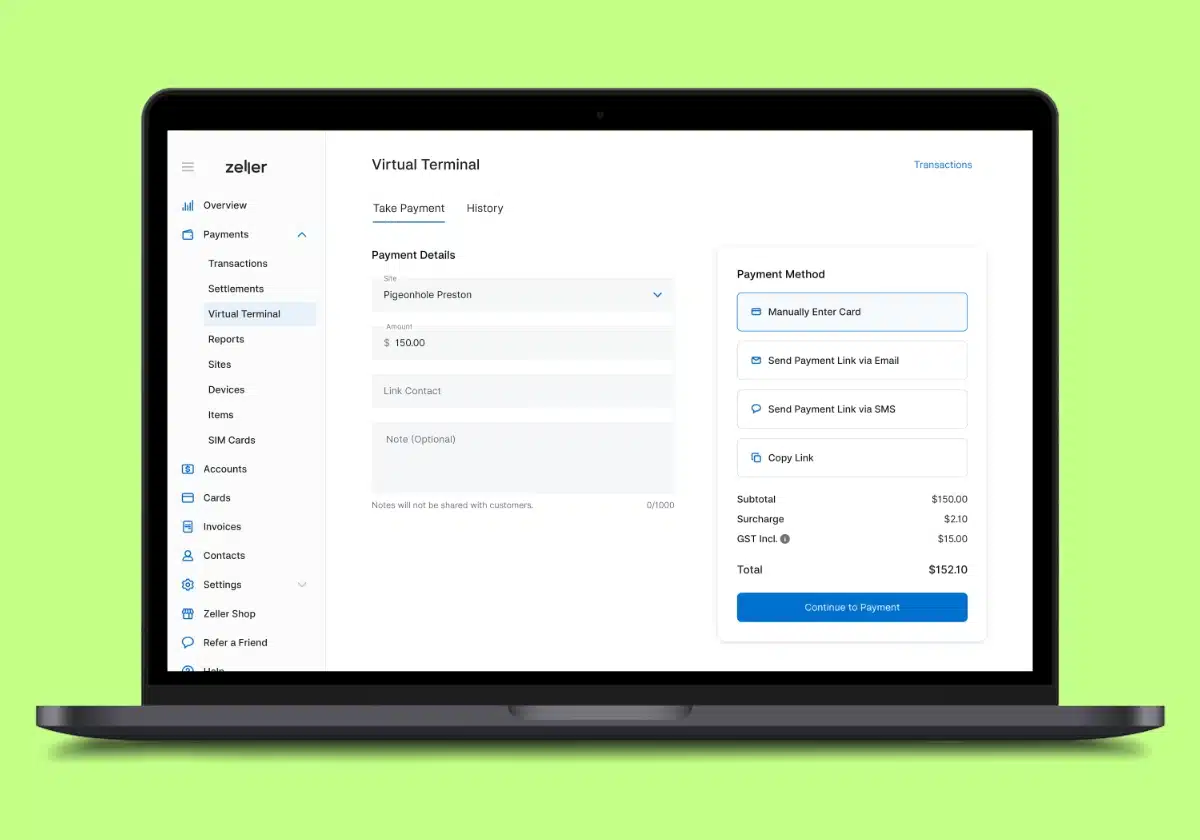

Zeller Virtual Terminal is another MOTO solution without monthly fees that we highly recommend. Like Square, it is easy to use through a computer browser from a dashboard (pictured below).

Zeller Virtual Terminal is similar to Square’s, but with fewer functions.

The virtual terminal allows you to enter a business location (where the merchant is creating the payment), amount, contact and note about the transaction. You can’t yet itemise the bill with individual amounts.

Zeller’s solution isn’t just for MOTO payments – merchants can use the virtual terminal page to send payment links via SMS, email or copy-and-paste.

There’s no extra cost for PCI-DSS compliance, just a transaction fee. When using the virtual terminal in a browser for telephone payments or sending a payment link, the transaction fee is 1.75% + $0.25 for both domestic and international cards.

Zeller pricing

Monthly cost: Free

Virtual Terminal transactions (in browser): 1.75% + $0.25

Keyed transactions on Zeller Terminal: 1.7%

PCI-DSS compliance: No fee

To save money, you can also key in telephone payments on Zeller Terminal for 1.7% (without the added fixed fee) for both domestic and international cards.

Although these rates are lower than Square’s, Zeller adds a fixed fee of $0.25 to the browser-based transactions, making transaction amounts below (about) $60 more expensive. But MOTO transactions on Zeller Terminal cost less than Square’s virtual terminal.

Zeller accepts Visa, Mastercard, American Express and JCB via the virtual terminal, covering the most popular cards.

Users also get an online business account where payouts arrive the next day, unless they prefer bank account transfers the next business day.

Best for: Online businesses using PayPal services regularly and with primarily Australia-based customers.

Not for: Anyone on a budget, as you pay $25 monthly with high transaction fees added on top.

Advantages

PayPal is a popular choice for small businesses, partly because it is so well-known.

The virtual terminal itself is effective and highly secure, but PayPal makes it your responsibility to set up PCI compliance, which can be costly if you require assistance.

“I’m sure some merchants have good reasons for using PayPal Virtual Terminal with its choice of currencies and settings, but I personally wouldn’t pay $25 monthly for it when that doesn’t even include transaction fees or PCI-DSS compliance.”

– Emily Sorensen, Senior Editor, Mobile Transaction

PayPal Virtual Terminal accepts Visa, Mastercard and Maestro, and transactions settle in your PayPal account within minutes.

PayPal’s virtual terminal is simple to use, but costs are a little complicated.

To cut to the chase, the costs of their virtual terminal are some of the highest for small businesses. Firstly, there’s a $25 monthly fee (GST included) for having the virtual terminal in the first place.

Domestic virtual terminal payments cost 3.6% + $0.30 of the transaction amount, while international transactions incur 4.6% + $0.30.

Add too that a currency conversion fee of 3% on top of the base exchange rate, if the payer’s card is in a foreign currency.

PayPal pricing

Monthly fee: $25 (incl. GST)

Domestic transactions: 3.6% + $0.30

International transactions: 4.6% + $0.30

Currency conversion fee: 3%

PCI-DSS compliance: Costs apply

Additional fees may apply to certain transactions, like for “card account verification” or “uncaptured” payments. Tired of reading about PayPal fees? Maybe this virtual terminal isn’t for you.

The platform does, however, offer a broad range of online payment features such as recurring payments and a PayPal checkout for your website. If you’d like to have all this in one place, you may prefer PayPal.

To sign up, you submit an online form followed by a phone call. PayPal’s customer service is unfortunately bad in general, and it’s only available during working hours.

Best for: Those already committed to the in-store Tyro ecosystem.

Not for: Sole traders and small teams wanting the most mobile-friendly, easiest solution.

Advantages

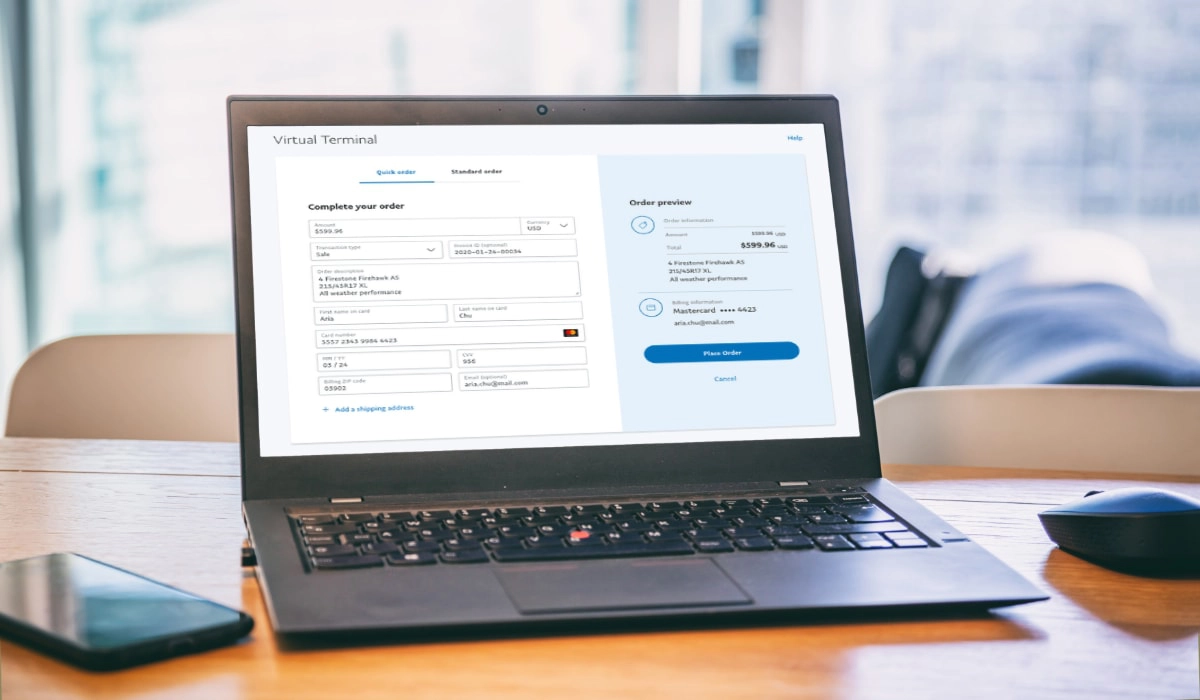

Tyro is a chameleon of sorts in the payment industry. The company offers card terminals, its own banking app and loans. It also has a virtual terminal with no commitment required.

Image: Tyro

Tyro eCommerce dashboard allows you to accept keyed payments.

It’s accessed via Tyro’s eCommerce browser dashboard and EFTPOS terminals. Tyro’s 24/7 customer support can help you add the virtual terminal to your EFTPOS machine.

MOTO transactions cost more than EFTPOS transactions, but Tyro will only give out the fees after a chat to hear your requirements.

Tyro does require relevant PCI paperwork and determines your PCI-DSS level while onboarding. Certain criteria have to be met to qualify for accepting virtual terminal payments.

Tyro pricing

Monthly cost: May apply

Transaction fee: Custom quote

PCI-DSS compliance: Costs may apply

Merchants with high transactions will need to prove their compliance regularly, while category 4 (low transactions) businesses only need to comply with the standard. PCI-DSS compliance support will cost extra.

If you’re already involved with the Tyro ecosystem, then this Virtual Terminal would be a no-brainer. Tyro allows users to input any phone or mail orders straight into pre-existing terminals.

And while it is a company that has a strong focus on in-store retail, customers who can only phone in for a payment can do so.

Best for: Businesses with a high turnover looking for the security of a big bank.

Not for: Tradies or very small businesses looking for transparent providers with an easy sign-up.

Advantages

PayWay Virtual Terminal is Westpac Bank’s own secure solution for collecting and managing customer payments online.

All major credit cards are accepted, including Mastercard, Visa, UnionPay, American Express, Diners Club and JCB, some of which require separate agreements.

PayWay Virtual Terminal allows merchants to accept payments over the phone with an instant credit card approval/decline response for credit cards.

Its web portal supports multiple payment types, such as one-off and repeat payments for regularly invoiced customers.

PayWay pricing

Monthly cost: Custom quote

Transaction fee: Based on revenue

PCI-DSS compliance: Costs may apply

Settlement reports and reconciliation can be accessed remotely from the PayWay Portal. The reports are quite basic, but contain transaction amounts, customer reference numbers and the staff members accepting the payment.

Frankly, if you want to handle inventory and stock, other more comprehensive virtual terminals are better.

Westpac offers customised quotes, based on turnover, for businesses looking to start up with virtual terminals.

We should note: Westpac requires a comprehensive PCI-DSS compliance check for its merchants.

Depending on the transaction amount, and if customer details are kept on site, most merchants are only required to comply via a self-assessed questionnaire (SAQ). For virtual terminal users, this is around 80 questions long.

Higher-transaction businesses may need to pay for an external assessment via an Approved Scanning Vendor (ASV) or Qualified Security Assessor (QSA).

Needless to say, using a virtual terminal through one of Australia’s biggest banks does come with a stringent set of compliance rules.

Best for: Travel companies looking to cut down on fees and don’t need all the bells and whistles.

Not for: Companies and sole traders that don’t work in the travel industry.

Advantages

Mint Payments is an Australian payment solution for both brick-and-mortar retailers and online businesses.

Their tailored setups offer custom pricing, fast settlements and a rewards program to help compete with large international payment companies.

Using the Mint Merchant Portal, merchants can receive payments through their web browser without a card being present.

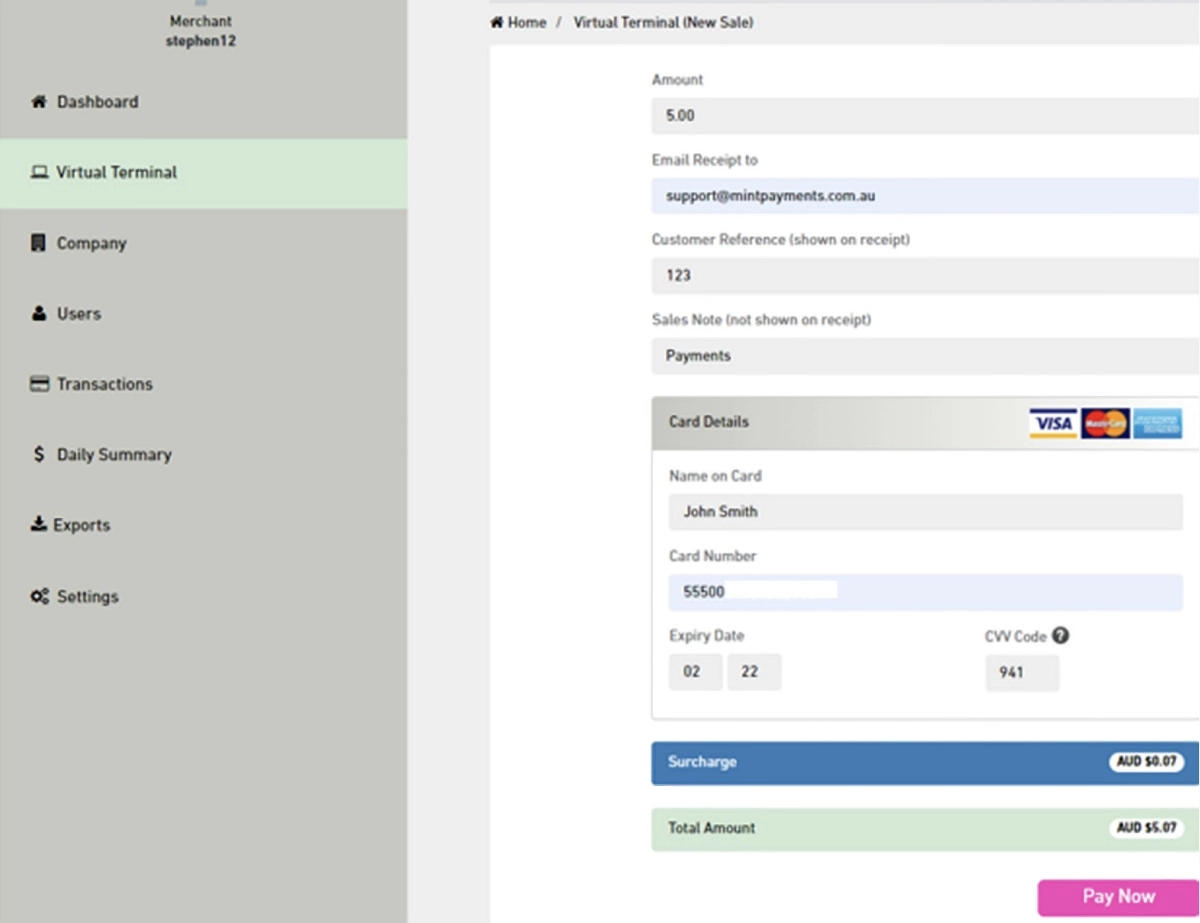

Image: Mint Payments

Mint Virtual Terminal is quite basic, but does the job smoothly.

Compared with other virtual terminals, the Mint virtual terminal appears quite minimal and rather basic in its features. Depending on the type of retailer using it, this could be a positive or negative thing.

The virtual terminal page lets you enter card details, customer information, a reference number, sales note and surcharge.

If you want to maintain a tight ship when tracking inventory, Mint may not be what you’re looking for.

Merchants must comply with PCI-DSS and get timely certification for its systems and processes.

Retailers may be audited for data security by Payment Networks or Mint. Mint also requires merchants to ensure their service providers meet compliance standards.

Mint pricing

Monthly fee: None

Transaction fees: 1.6%+ for Visa and Mastercard

Custom fees with $90k+ monthly turnover

PCI-DSS compliance: Costs may apply

Mint serves a lot of travel agents, so it could be ideal if your business is in this field. With competitive transaction fees and no monthly fees, it’s a simple, yet limited, platform that handles the basics well.

Best for: Online retailers with a Shopify store that only occasionally requires MOTO payments.

Not for: Non-retailers or businesses with a minimal online presence.

Advantages

Shopify is an easy-to-use, all-in-one ecommerce store builder. It’s popular worldwide for its impressive collection of tools that let anyone fully manage their online business, including selling through a virtual terminal.

But this isn’t a virtual terminal in a clear-cut way. Instead, Shopify allows users to create a draft order and take a remote payment through that.

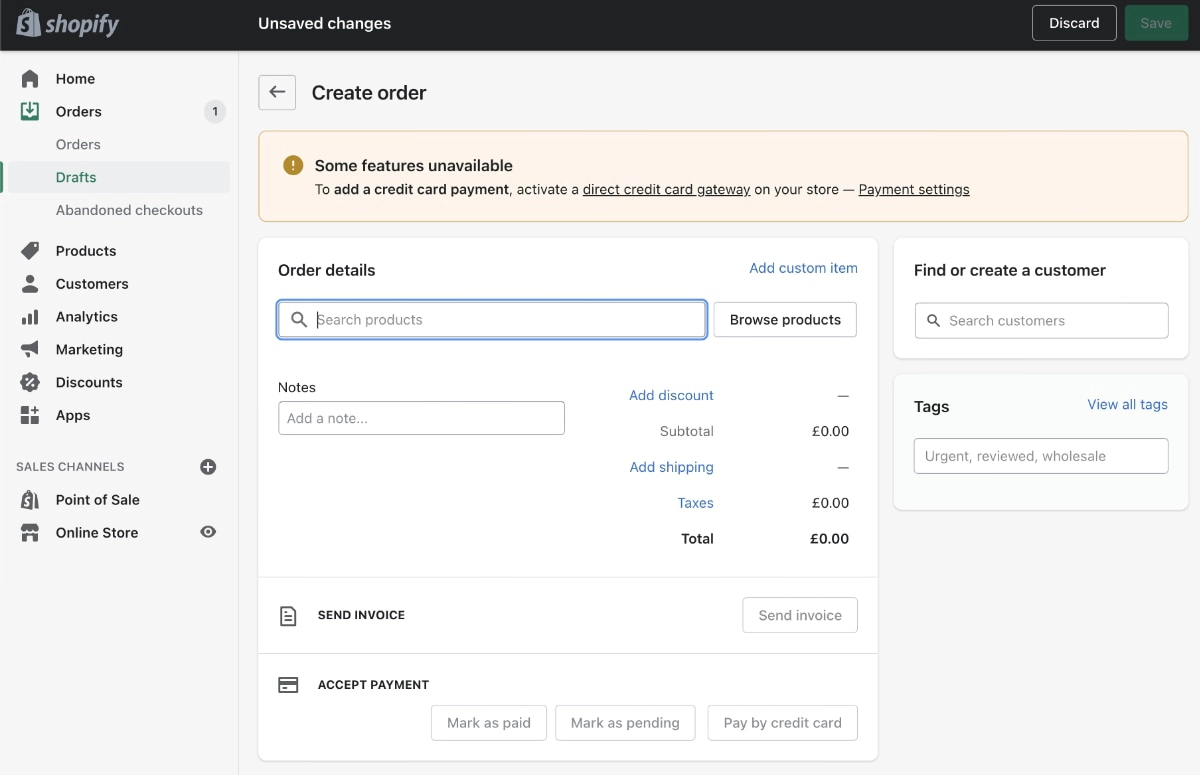

Image: Mobile Transaction

There’s nothing called “Shopify Virtual Terminal” officially – instead, it is called “Draft Order”.

Basically, merchants can create orders for their customers, which are similar to orders that customers create for themselves. Once a payment is accepted, the draft order is finalised and converted into an official order.

Draft orders can be created in-store, online or elsewhere from a computer. They’re great for handling purchases where billing info is provided over the phone, just like other virtual terminals.

During testing, we could apply discounts, shipping, customer information and reference numbers, or duplicate existing orders. When marked as paid or pending, the draft couldn’t be edited.

Shopify pricing

Monthly fee: $42 – $575 depending on ecommerce plan

Shopify Payments rates: 1.4%-2.9% (plan-based) + $0.30 per transaction

Other payment system: Rates depend on processor + 0.6%-2% Shopify fee for using external gateway

PCI-DSS compliance: Included in cost

Shopify’s inventory management and reporting systems are great features. They’re well-integrated into the draft order process, so retailers can easily create transactions with customer billing information.

Transaction fees depend on whether you use Shopify Payments or another payment gateway (there’s a choice). You must also subscribe to an online store plan, so using the virtual terminal without monthly fees isn’t possible.

Retailers using Shopify Payments automatically get Level 1 PCI compliance. This means Shopify’s PCI certification covers your store, cart, hosting and virtual terminal at no extra cost, with ongoing on-site assessments for risk management.

The major credit cards are accepted, including Visa, Mastercard and American Express.

Summary

| Virtual terminal | Best for | Website |

|---|---|---|

|

Small, new or seasonal businesses needing an easy, non-binding option for remote payments. | |

|

Merchants needing a simple but useful virtual terminal with free next-day transfers. | |

|

Online businesses using PayPal services regularly and with primarily Australia-based customers. | |

|

Those already committed to the in-store Tyro ecosystem. | |

|

Business without a website looking for the security of a big bank. | |

|

Those who want to cut down on fees and don’t need all the bells and whistles. | |

|

Those with a Shopify online store who want to take the occasional MOTO payment. |

| Virtual terminal |

Best for |

|---|---|

| Square |

Small, new or seasonal businesses needing an easy, non-binding option for remote payments. |

| Zeller |

Merchants needing a simple but useful virtual terminal with free next-day transfers. |

| PayPal |

Online businesses using PayPal services regularly and with primarily Australia-based customers. |

| Tyro |

Those already committed to the in-store Tyro ecosystem. |

| Westpac |

Business without a website looking for the security of a big bank. |

| Mint |

Those who want to cut down on fees and don’t need all the bells and whistles. |

| Shopify |

Those with a Shopify online store who want to take the occasional MOTO payment. |