Tyro and Square are competing payment platforms with similar offerings.

One is an Australian stalwart with a strong focus on familiar EFTPOS technologies, while the other is an international payments giant that’s expanded their online payment solutions over the past few years.

Tyro offers tailor-made POS solutions, its own business banking and now updated EFTPOS terminals. Square offers unique card terminals and a register, as well as an online shop builder and many industry-specific apps and services.

Let’s compare the main differences between these two popular payment services.

|

|

|

|---|---|---|

| Credit card machines* | EFTPOS machines: $29*/mo rental or $59* purchase |

Reader for app: $65* to buy Standalone terminal: $329* to buy |

| Website | ||

| POS apps | Integrates with external POS systems | Point of Sale: Free Retail: $0-$109/mo Restaurants: $0-$129/mo Appointments: $0-$79/mo |

| Online payments | Ecommerce integrations available | Broad range of online payment methods |

| Loans | ||

| Deposits | Same day to Tyro Bank Account, 1-2 business days to other bank account | Instant or 1-2 days to bank account |

*Including GST.

Card machines more comparable than previously

Historically, Tyro and Square have taken vastly different approaches to EFTPOS machines.

Square has only ever sold its own, reliable and uniquely designed EFTPOS terminals. In contrast, up until recently, Tyro still offered rentals of legacy machines they called Countertop and Mobile. After some serious EFTPOS outages, they’ve finally upgraded to very modern models.

Square is much more design-oriented with at least as good uptime – if not better – than Tyro’s EFTPOS machines.

![]() Emily Sorensen, Senior Editor at MobileTransaction

Emily Sorensen, Senior Editor at MobileTransaction

Tyro Pro is the company’s most versatile EFTPOS terminal that’s suitable for nearly any environment. With its WiFi, Ethernet and mobile connectivity (SIM included), it works at the checkout with your chosen POS system, wirelessly on fixed premises or on the go wherever you do business.

Photo: MobileTransaction

Tyro Pro is a new, versatile model: Ingenico Axium DX8000. We tested the one pictured.

Tyro Pro is actually an Ingenico Axium DX8000 terminal, which we’ve tested.

We found it to be a good quality, high-performance card machine with a high-definition touchscreen that works well both outside and inside. Card payments are processed promptly on it, and the PIN entry interface is easy to navigate and big enough for large fingers – but the terminal is also relatively large.

Photo: Tyro

Tyro Go is small, but needs an app.

The only other model, Tyro Go, is a square-shaped card reader that connects with a phone to take payments through a basic Tyro app. Clearly inspired by Square Reader (more on that below), it’s a cheaper and very portable way to accept contactless and chip card payments.

How does Square compare? Well, Square Reader was the first of its kind globally, a minimal card reader with a tiny footprint. It doesn’t have a screen and must be used with a phone or tablet app.

Square also sells Terminal – a standalone unit with a touchscreen and built-in POS software.

It only works with WiFi or an internet cable, not mobile networks on the go, but it is wireless and essentially works as a self-sufficient checkout.

Compared with Tyro Pro, we prefer Square Terminal for its frequently-updated software that makes it very reliable (when connected to the internet) and constantly-evolving for a better checkout experience.

Photo: MobileTransaction

Square Reader has stood the test of time.

Photo: MobileTransaction

Square Terminal works independently.

Then you have Square Register, a large touchscreen register that only uses Square POS software (general and specialised). It has a touchscreen card terminal that attaches to its front or detaches if you want to place it closer to the customer.

Square Stand similarly has built-in chip and contactless card readers, but requires an iPad for the POS software.

Photo: MobileTransaction

Square Stand (left) holds an iPad whereas Register (right) is a POS tablet linked with a card reader.

Square accepts a variety of cards (Visa, Mastercard, eftpos, American Express, JCB), electronic gift cards, Afterpay, Apple Pay and Google Pay. Tyro accepts most of these payment options too, as well as UnionPay and Diners Club – but no Buy Now, Pay Later options like Afterpay.

It’s worth noting that to accept some of the major international credit cards with Tyro, you will require external contracts with those card providers.

Alternatives: Australia’s best EFTPOS machines for a small business

Tap to Pay on iPhone or Android an option?

With no EFTPOS machine in sight, it’s sometimes easier to accept contactless payments on your iPhone or Android phone.

This is a relatively new technology that both Square and Tyro offer, provided you have a compatible, NFC-enabled smart device. Customers can then just hover their contactless card or phone over your phone to process a payment in person.

Tyro recently launched Tap to Pay on iPhone and Android from an app called Tyro BYO. This is free to download after signing up with Tyro, only costing a fixed 1.4% per contactless card or mobile wallet transaction.

Although Square’s Tap to Pay app (the free Point of Sale app) is more versatile, it does have the higher transaction rate of 1.6%.

Fees: Tyro gradually getting simpler like Square

There used to be quite a big difference in how these two businesses operate.

Square has consistently had no lock-in contracts or monthly fees for its customers. Tyro, on the other hand, still charges rental fees for its main terminal, but now offers fewer additional fees and one card reader to purchase.

Tyro and Square pricing:

|

|

|

|---|---|---|

| Latest deals | ||

| Contract lock-in | None | None |

| Terminals | Tyro Pro (rental only): $29*/mo Tyro Go (purchase only): $59* |

Square Reader: $65* Square Terminal $329* Square Register: $1,099* Purchase only, no monthly fee |

| Setup fee | None | None |

| Swipe, chip, tap rate | 1.4% Custom rates with over $20k card sales/mo |

1.6% |

| Keyed, online rate | Base rate + 0.15%* | 2.2% |

| Non-Australian cards | +0.4% added fee | No added fee |

| Currency conversion | +0.4% added fee | No added fee |

| Settlement | Free | Next day: Free Instant: 1.5% fee |

| Refunds | Free | Transaction fee is retained |

| Chargebacks | Free | Free |

*Including GST.

Tyro’s monthly fee for Pro EFTPOS is balanced out by a lower transaction fee (1.4%) than Square’s (1.6%).

If the monthly EFTPOS turnover exceeds $20k, merchants can get lower, custom rates from Tyro that depend on the type of card accepted. Square has a similar deal, where businesses accepting more than $250k annually can negotiate lower fees.

Square’s fixed EFTPOS rate is 1.6% for any type of card through Square Reader ($65 incl. GST), Square Terminal ($329 incl. GST) and Square Register ($1,099 with GST).

Tyro also charges less than Square where details need to be keyed in: a base transaction fee in line with the EFTPOS rates plus an additional 0.15% per transaction. That being said, Tyro adds a 0.4% fee for transactions with a foreign card plus a further 0.4% if currency conversion was applied.

In the long run, these small percentages could play a big role in determining which will save you more money.

What about surcharging? Square has finally introduced this recently, with an option to automatically switch it on at weekends to recoup higher staff wages then. Tyro’s “No Cost EFTPOS” plan comes with surcharging, but only for Pro terminals transacting over $10k monthly.

Free bank account vs instant transfers

Tyro offers its own, free bank account where EFTPOS funds from the same day are deposited every evening, 7 days a week. Funds that stay in the account gather interest that rises according to how long it stays in the account – not bad, considering Square has no such account.

But Square has a different attraction: instant transfers to your choice of bank account for an additional fee of 1.5%. Otherwise, the free settlement takes 1-2 days to process to your bank account following EFTPOS transactions through Square. This includes weekends too.

If you need your cash settled quickly, Square is superior with its instant settlement option (for a fee). But Tyro’s same-day transfers in their dedicated bank account may appeal to those who can’t pay extra for faster payouts.

![]() Emily Sorensen, Senior Editor at Mobile Transaction

Emily Sorensen, Senior Editor at Mobile Transaction

POS systems very adaptable

If you’re looking for industry-specific integrations, both Tyro and Square excel.

As the more established brand in Australia’s EFTPOS industry, Tyro integrates with over 330 point of sale (POS) and practice management system (PMS) systems.

From hospitality and retail to mobile taxi terminals, Tyro has a lot of choice when it comes to point of sale integrations – with the Pro terminal. The Go card reader only connects with the Tyro Go App on an iOS or Android device.

Tyro also offers an integrations hub allowing restaurants to use their favourite apps to manage food ordering, bookings and menu management.

Coming from a different angle, Square doesn’t require external software to access competent, industry-specific POS systems.

Its user-friendly free app, Square Point of Sale, has an all-round selection of general POS features on an iPad, iPhone or Android device. There are also industry-specific POS systems (free and paid) that help businesses zero in on the exact solution needed, including:

By combining Square’s card terminals and register with a Square account, merchants can keep track of all payments, items, inventory, analytics and ecommerce stats.

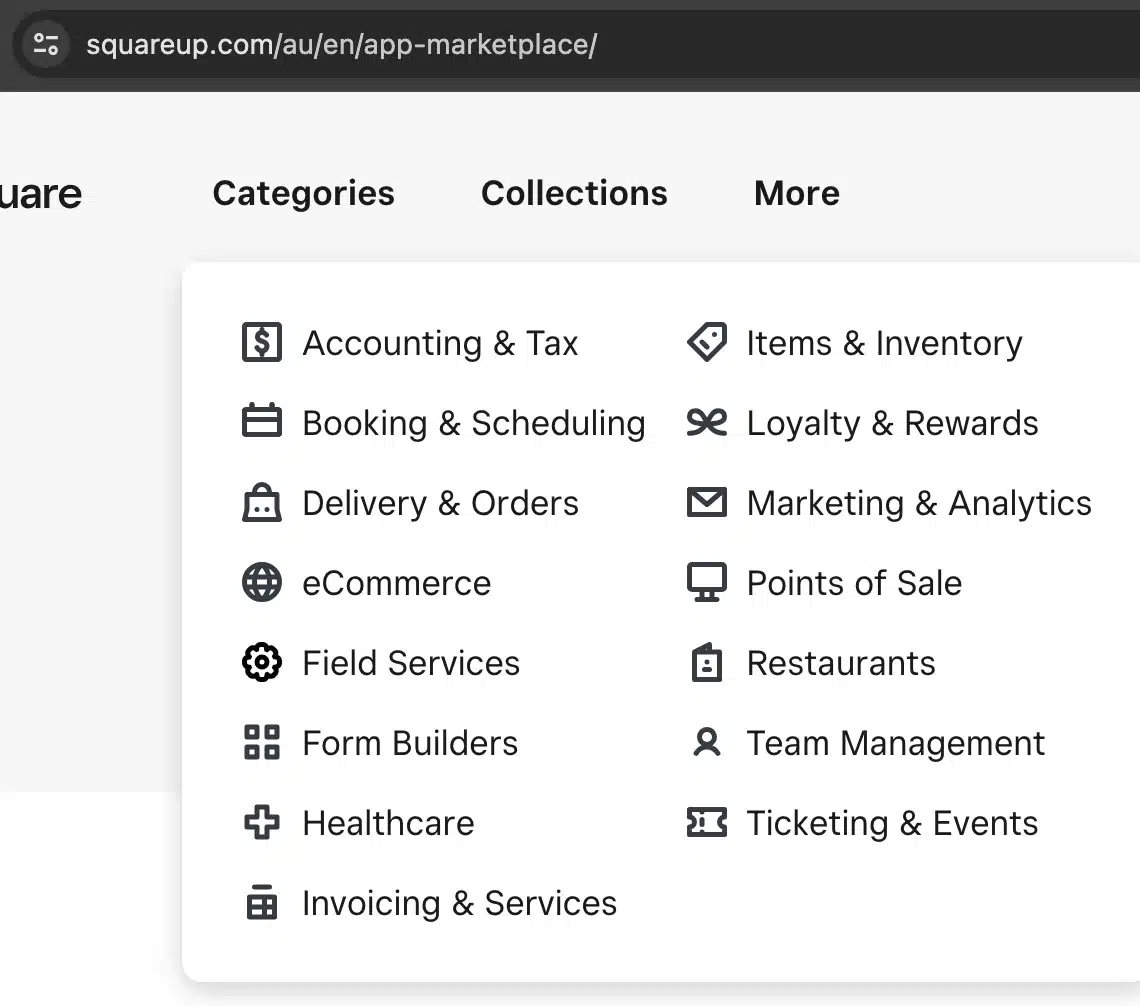

Image: MobileTransaction

Square integrates with a wide choice of external apps, divided into different categories (pictured).

If Square’s own software doesn’t suffice, you can still integrate with a wide selection of external POS systems, ecommerce platforms and many more business tools.

No shortage of ways to sell online

Both Tyro and Square allow customers to make transactions online, but as far as well-rounded ecommerce solutions go, Square leaves Tyro in the dust.

The dedicated website builder Square Online acts as the hub for your online business. This is something Tyro does not have – instead, it has an online payment gateway that’s basically a checkout integrated in your existing online store.

Only Square has a pay-by-link solution, allowing you to define a product or service with a fixed price and generate a payment link for it. You can embed this as a button on a website, print a QR code and send the URL for a remote payment. Even donation links can be created for customers to donate any amount.

| Remote payment method |  |

|

|---|---|---|

| Email invoices | ||

| Telephone payments | ||

| Recurring payments | ||

| Payment gateway | ||

| Online store builder | ||

| Payment links (to send) | ||

| Buy buttons (for website) |

| Remote payment |

||

|---|---|---|

| Email invoices | ||

| Telephone payments | ||

| Recurring payments | ||

| Payment gateway | ||

| Online store builder | ||

| Payment links (to send) | ||

| Buy buttons (for website) |

Square has the edge again when it comes to a smooth experience, because all the different payment methods are integrated so you can monitor payments in the Dashboard (back-end Square account in a browser).

In a similar vein, Tyro has an eCommerce Portal, but this is separate from the Tyro Portal for EFTPOS reporting.

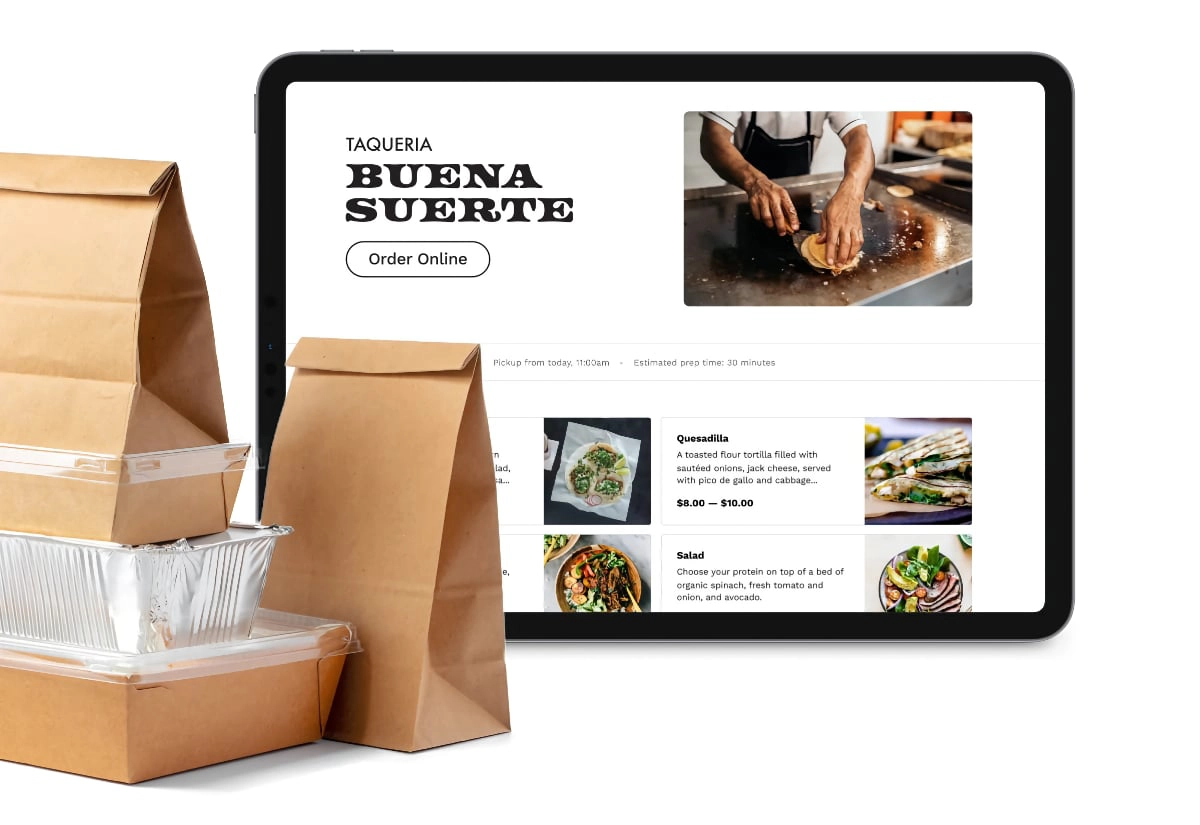

Photo: Square

With Square, you can build an online store or menu page with a QR code for takeaway ordering.

To send an email invoice, Tyro users have to make a trip to the eCommerce Portal to access their eInvoices in PDF form. Here, merchants can easily set up recurring payments with saved billing information from customers.

Square allows you to log into either Square Dashboard, the Point of Sale app or Invoices app to send one-off or recurring email invoices – quite a few options.

If you need to accept payments via phone, Tyro and Square can manage that too. Square’s virtual terminal comes as standard with your account, while Tyro accepts mail orders and telephone orders (MOTO) through their portal if you choose it.

Mixed reviews and service

Tyro has a 24/7 Australia-based support team. Their primary form of contact is via the website’s contact form, and they suggest that this be used for non-urgent matters. For those situations where things are a little more pressing, you can call them.

Tyro customers hoping to resolve problems on the resources page will find the knowledge a little vague and unhelpful. This is reflected in the company’s mixed Trustpilot reviews.

There, many users have complained of not hearing back from form submissions for over a week, if at all. Couple this with extremely long wait times on the phone, and it seems as though Tyro has some issues in the support department. Sometimes, their mobile apps also cause issues when updates are enforced.

Photo: Tyro

With Tyro’s older EFTPOS terminals, many users reported technical problems with little support.

Square’s support staff can be contacted via phone or email during the regular business hours of 9 AM – 5 PM, Monday to Friday. Unfortunately, there is no weekend or evening support, meaning you’re all on your own if something goes awry during the busy weekend rush.

Like Tyro, Square has an online Help Centre with frequently asked questions. And as a large international company, customers have access to a global network of people using the same technology, so finding the right answers is a little simpler than with Tyro.

On Trustpilot, Square mostly has positive ratings with some complaints about frozen accounts, poor support and a few usability issues with the interface. Our own experience of the software has always been easy, but we see how finding certain functions can get lost in the overwhelm of features in the backend Dashboard.

Our verdict on Tyro or Square: lots to like

Tyro is certainly a viable choice for brick and mortar stores who much prefer an Australian company to an American fintech brand. With its latest EFTPOS terminals and banking features, it acts as a solid step in the right direction towards more modern payment options.

It’s a portable and robust system that makes light work of tedious tasks such as reconciliation and reporting, meaning you won’t be spending as much time keeping track of settlements. And its POS integration is beyond extensive.

Unfortunately, with no real POS apps or website builders to speak of, there are definitely much better choices if you are running an online business.

Square offers incredible value for money when it comes to its hardware, apps and online checkout services. With no lock-in contracts or ongoing fees, it’s a no-brainer for any budget-conscious retailer looking to add a dynamic touch to their POS processes.

With simple invoicing and payment link options, Square has really left its mark in the online payments landscape and has now stepped it up even further with its ever-growing line-up of card terminals and registers.

If for any reason any of that goes wrong, the support offered by Square in Australia is generally satisfactory, certainly with the extensive help section. Support might not be offered during non-business hours, but when they help, they actually help.

With simple invoicing and payment link options, Square has really left its mark in the online payments landscape and has now stepped it up even further with its ever-growing line-up of card terminals and registers.

At the end of the day, if your business is looking for an all-inclusive POS system that is following advancing technological trends fast, and all with no contracts or lots of free extras, then it’s hard to beat Square.

If you need your cash settled quickly, Square is also superior with its instant settlement option (for a fee). However, Tyro’s same-day transfers in their dedicated bank account may appeal to those who can’t pay extra for faster payouts.