Coming from Europe, SumUp has entered Australia with its inexpensive card reader to compete with Square. But is SumUp a good alternative to Square?

We at MobileTransaction have tested both payment companies for years. Typically, our tests find Square superior for its excellent-value payment tools to complement its EFTPOS machines, while SumUp’s EFTPOS and payment products are easier, cheaper but also more limited.

Let’s have a look at the main facts and products of Square and SumUp, followed by our verdict of which payment platform is best for small businesses in Australia.

|

|

|

|---|---|---|

| Products | Card processing, EFTPOS machines, payment links | Card processing, EFTPOS machines, POS, payment tools |

| Contract | No lock-in, pay-as-you-go | No lock-in, pay-as-you-go |

| Card rate | Chip, tap: 1.6% Online: 2.1% |

Chip, tap: 1.6%–1.6% Online: 2.2% |

| Card machines | $49 incl. GST | $52–$329 incl. GST |

| POS systems | SumUp App (free) | Square Point of Sale (free) Square for Restaurants Square for Retail Square Appointments |

| Remote payments | Payment links | Payment links, online store, virtual terminal, invoicing |

| Payouts | 2-3 business days | 1-2 business days Immediate with Instant Transfers |

| Accepted cards | ||

| Contactless wallets |

EFTPOS machines are very different

SumUp only sells one card reader: SumUp Air that connects with a payment app. Square sells an app-based card reader, Square Reader, and standalone EFTPOS machine, Square Terminal.

Let’s start with the card readers. Though both have a long battery life and connect with a free app for iPhone, iPad and Android devices over Bluetooth, the card readers look very different and the apps are not equally useful for everyone.

Square Reader is literally a small, square-shaped, plastic box with a chip card slot and contactless surface for tap-and-go. If a PIN code is required, a virtual PIN pad shows on the connected smartphone or tablet. SumUp Air is bigger, with a glass-surface display and PIN pad, so if a PIN code is requested, customers can enter it on the card reader.

Photo: MobileTransaction

Square Reader has no PIN pad, but is small.

Photo: MobileTransaction

SumUp Air’s glass PIN pad is easy to clean.

We like Square Reader for its tiny size and light weight, which can equally be problematic since it’s so inconspicuous it can get lost. If at a checkout, we recommend getting the card reader stand that Square sells to keep it stationary and safe.

SumUp Air looks very unique in Australia and not everyone will like its PIN pad which is hard, smooth glass, not the sort of push-buttons that people hard of seeing would prefer. It is very stylish, though, and the glass is quick and easy to wipe clean.

“We love Square Reader for its tiny size and excellent app, whereas SumUp Air avoids the awkwardness of PIN entry on a separate mobile device. It’s really down to personal preference which is better.”

– Emily Sorensen, Senior Editor, MobileTransaction

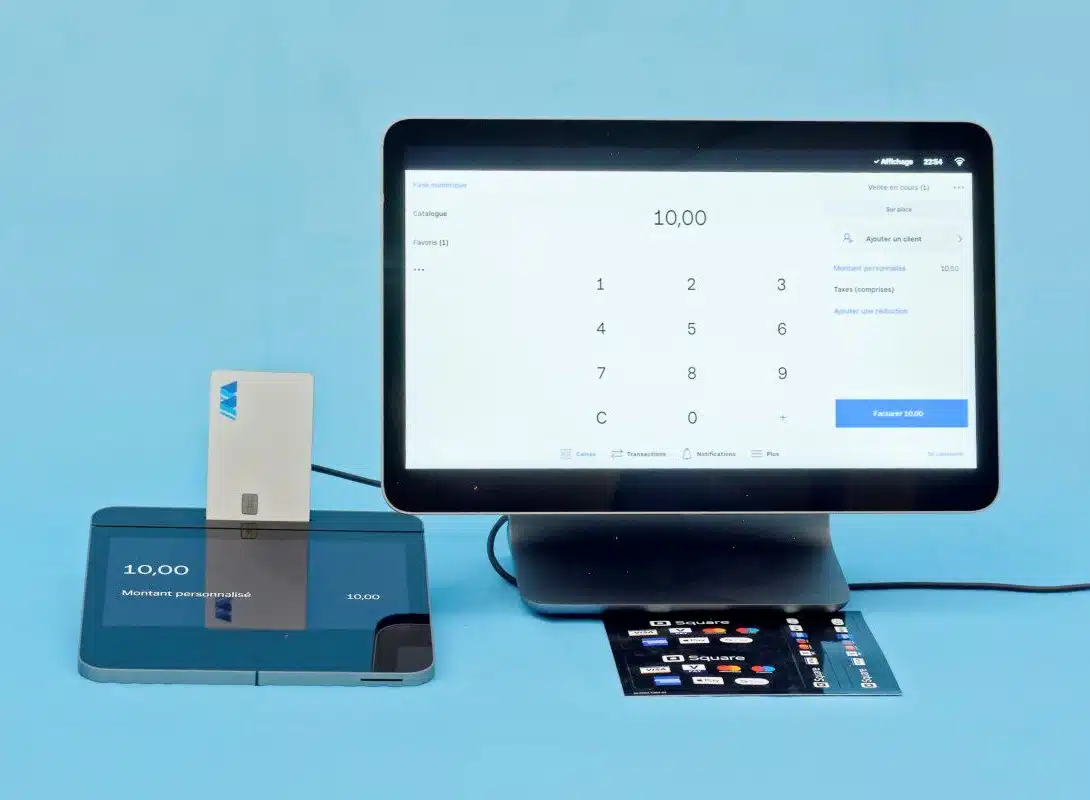

These card readers are ideal for mobile merchants, since they use a smartphone’s or tablet’s SIM connectivity (or WiFi) to process transactions. What if you need something more substantial for fixed premises? That’s where Square is ahead with its standalone EFTPOS machine, Square Terminal.

Photo: MobileTransaction

Square Terminal depends on WiFi, not mobile connectivity.

Square Terminal only works with WiFi or Ethernet (if using a connector cable), not 3G, 4G or other mobile connection since it has no SIM card. Still, it is wireless, portable and prints receipts, so ideal for table service and points of sale setups alike.

Its large touchscreen comes with Square Point of Sale software preinstalled so no other register screen is needed (though it does connect with Square POS on an external screen). The default software is the same as the free app used with Square Reader.

Tap-on-phone with Square

Those without a card reader can use Square Tap to Pay on iPhone or Android, where customers tap their card or mobile wallet directly on your smartphone to process a transaction – no EFTPOS terminal needed. This is something SumUp hasn’t introduced in Australia.

Fees: simple pricing without contract

The fees of SumUp and Square are very similar. Both have pay-as-you-go pricing where you buy an EFTPOS terminal upfront and only pay transaction fees when payments are processed. The main difference is in the cost of terminals and associated rate for chip and tap card payments:

SumUp Air: $49 incl. GST – 1.6% transaction fee

Square Reader: $52 incl. GST – 1.6% transaction fee

Square Terminal: $329 incl. GST – 1.6% transaction fee

As you can see, a higher fixed transaction rate applies through Square Reader than SumUp Air, so the latter is cheaper both to purchase and use for card payments. Only if you buy Square Terminal is the fixed chip and tap rate the some for both providers, but Terminal is considerably more expensive than the mobile card readers.

The above transaction rates are fixed regardless of the card brand (eftpos, Visa, Amex, etc.), type (debit, credit, commercial, consumer, etc.) or country of issue (Australian or international).

| Costs |  |

|

|---|---|---|

| Card reader with app | Air: $49 incl. GST | Reader: $52 incl. GST |

| Standalone terminal | None | Terminal: $329 incl. GST |

| Website | ||

| Chip, tap payments | 1.6% | 1.6%–1.6% |

| Afterpay transactions | n/a | 6% + 30¢ + GST |

| Pay-by-link transactions | 2.1% | 2.2% |

| Invoice and keyed transactions | n/a | 2.2% |

| Instant transfers | n/a | 1.5% added to transactions |

| Chargebacks | Fee applies | Free |

| Refunds | Free before payout, transaction fee retained after | Original transaction fee is retained |

Square charges 2.2% for online and keyed payments, whereas SumUp charges slightly less (2.1%) for payment links. This makes sense, since Square’s online payment features are much more elaborate so you’re paying more for the quality of it.

The Buy Now Pay Later option Afterpay is accepted by Square at the point of sale and online, for 6% + 30¢ (excl. GST) per transaction. This looks expensive, but that’s because it’s a type of credit. SumUp doesn’t offer any Buy Now Pay Later options.

None of them have contract lock-in or monthly fees, so it’s risk-free to sign up and test the services. You don’t even need to cancel the account, as it will just stay dormant until next time you need it.

Square has no fees for chargebacks, whereas SumUp does when a customer disputes a transaction through their bank.

If you refund a SumUp transaction within 2-3 days (before the payout is settled), there’s no charge – otherwise, it costs the original transaction fee. Square always retains the transaction fee for refunds processed.

Square has tons more than just EFTPOS solutions, some with a subscription like the online store ($0-$99/month on annual plan), invoicing ($0-$30/month) and email marketing ($20-$50/month). SumUp doesn’t offer additional features with fees.

Square has the fastest settlement

Neither platform charges for standard payouts to your bank account, which take:

- 2-3 business days through SumUp

- 1-2 business days through Square

Not only does Square have the edge with its slightly faster credit card processing, it also offers Instant Transfers to your bank account (optional setting for eligible users). This incurs a 1.5% transfer fee on top of the transaction fee.

When Instant Transfers is switched on, you receive card payments within minutes. Square is the only Australian payment company to offer this, so that’s a huge edge over EFTPOS competitors including SumUp.

POS: limited with SumUp, room for growth with Square

Apart from EFTPOS terminals, the companies offer a few point of sale (POS) registers.

The simplest is SumUp Point of Sale Lite, a branded white stand with a tablet built in that connects with Air for card payments. It can only use the ultra-simple SumUp App as its POS software, which is not sufficient for a restaurant or complex retailer.

Square Stand looks similar and even has a contactless function and chip card slot, but it requires an iPad to be placed inside. This enables you to use it with different POS systems for any industry.

Photo: SumUp

SumUp Point of Sale Lite register looks modern, but its POS software is very basic.

For a more premium product, there is also the tablet register Square Register (no iPad needed) with a fancy-looking touchscreen card reader attached. This is, in our opinion, the easiest all-in-one tablet register in Australia so far, but it does cost more and is hardwired to work with Square’s software.

Photo: MobileTransaction

Square Register has its own EFTPOS machine – a smart and adaptable, flat touchscreen terminal.

So how does the software compare?

For a start, both have sales reports in an online ‘Dashboard’, but Square’s are very customisable while SumUp’s are more basic.

SumUp only offers one POS system, SumUp App (free), which has enough features to run a simple checkout in a shop, café or other small operation. Square’s comparable Point of Sale app (free) also caters to general needs, but with noticeably more features.

Both have an inventory library with product variants, discounting and GST rates. There are options for tipping, cash acceptance and refunds, and transactions and payout statuses can be accessed in the apps. Staff members can have their own logins with restricted access to certain features.

On top of that, Square has more features like stock counts, employee and customer management, split tenders and marking transactions for eat-in or takeaway. You can view sales reports in the Square POS app and sell or accept gift cards. These functions are lacking in SumUp App.

Square also has upgrade options: Square for Restaurants ($0-$129/month), Retail ($0-$109/month) and Appointments ($0-$90/month). These are different POS apps designed for food-and-drink, retail shops and professionals using a booking system.

The Square platform can even be extended with dozens of third-party apps for advanced functions like inventory management, online ordering, ecommerce, accounting and marketing. SumUp doesn’t yet connect with other software in Australia, so is much more limited.

Many versus few online payment methods

The two payment companies differ hugely on their online and remote payment options. In essence, SumUp only has payment links for remote transactions, whereas Square accepts payments remotely in just about any way possible.

SumUp’s payment links can be sent via email, SMS, social media or copied and pasted into any message online. The recipient gets a link for an online checkout page where their card details are entered to complete the requested transaction.

Square offers the same pay-by-link features and more, such as QR codes and open-amount links for e.g. donations. Not only that, Square includes these features free:

- Virtual terminal for keyed, over-the-phone transactions

- Email invoicing with payment tracking

- Ecommerce store builder with an online checkout

- Recurring payments for subscriptions

Our own experience of Square’s features is consistently positive. They are easy to use from an internet browser or app, yet flexible with its optional functions and rarely with bugs because the software is frequently updated.

Square more extensive, SumUp a bit cheaper

Out of the two, Square is much more established in Australia, so it’s unsurprising that its payment products are broader.

SumUp, on the other hand, boasts the lowest transaction rate for an app-based card reader, and the cheapest card reader all-round. You’d have to buy Square Terminal to match SumUp’s rate. Even online transactions are lower with SumUp: 2.1% versus Square’s 2.2%.

But I would say you really get what you pay for. The slightly higher cost of Square’s products gives you more complimentary features and upgrade options than SumUp would ever have. What’s more, Square’s instant transfers are very attractive for cash-strapped merchants reliant on quick funds to get by.

For sure, SumUp will grow and introduce more payment features down the line like it has in Europe. It’s certainly a company we stand behind and consistently have a good experience with. Until then, Square is best for its quality and range of online and EFTPOS payment solutions in Australia.