When it comes to payment gateways, Stripe is undoubtedly one of the more advanced options on the market. It’s a go-to choice for coders and businesses with relatively complex websites using tailored subscription systems, for example.

Whether it’s the 3.5% + $0.30 fee for international payments (plus an added 2% for currency conversions) or you’d just like something less complicated, we understand why you might consider alternative payment platforms.

Ultimately, business owners have different payment needs, budgets and levels of technical skill. You might want a solution that’s easy to use, convenient or with faster payouts. In any case, let’s explore the best Stripe alternatives for Australian merchants.

What is an online payment gateway?

Payment gateways are essentially an online checkout that accepts credit and debit cards online. When customers pay through the checkout interface, the card information is encrypted, verified and processed. Upon approval, the payment gateway lets the customer know, and funds go to the merchant’s account.

1. Square: perfect fit for small businesses

Square boasts an exceptionally easy-to-follow design that can be used by even the most technophobic business owner. If that’s not enough, the platform integrates with other popular ecommerce software, like GoDaddy or WooCommerce.

“I’ve always had a soft spot for Square’s many online payment features that just keep getting better despite being free. The software is regularly updated to quash bugs, and the online checkout flow is easy to follow from the customer’s side.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Unlike a few other options on this list, there’s no need to worry about complicated pricing structures either. Square keeps everything simple with a flat rate for all of their online card transactions (2.2%), meaning international or low-value payments are still cost-effective. This essentially makes it the one-size-fits-all of payment processing.

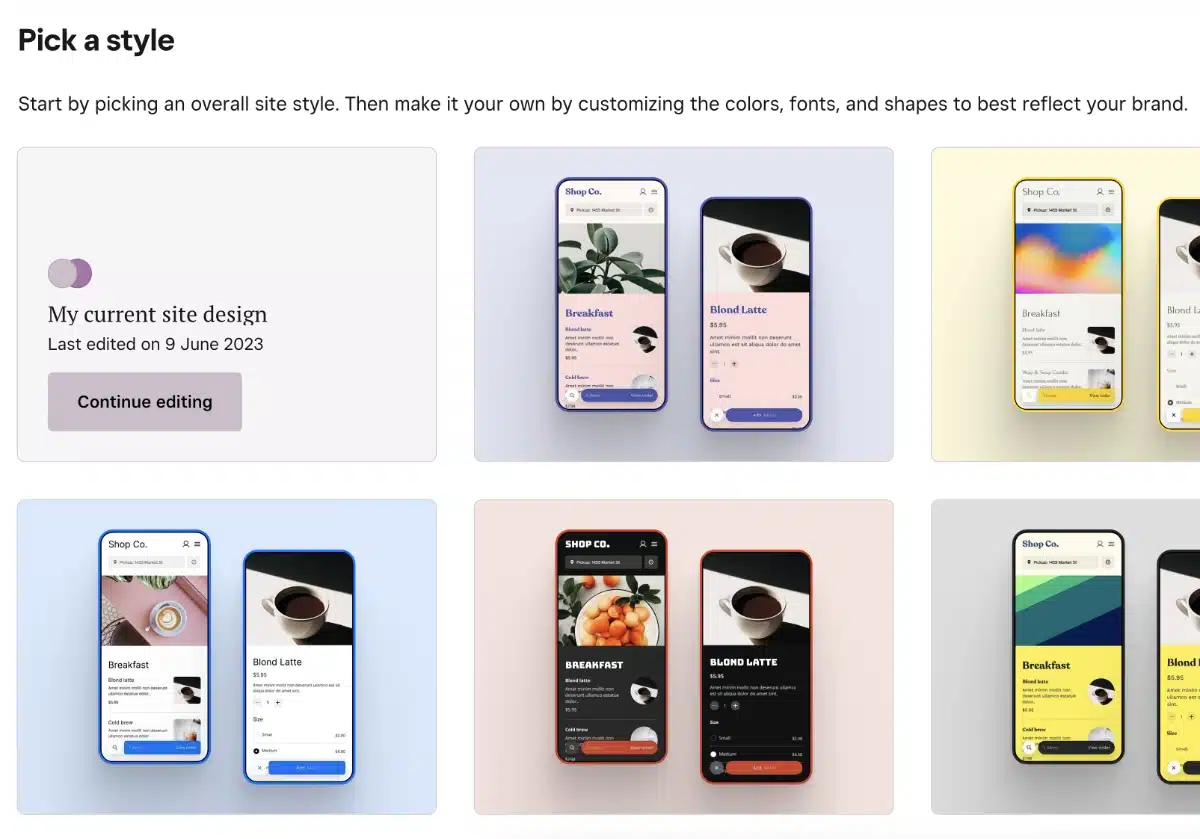

Square makes it easy to build a mobile-friendly online store with payments built in.

What about invoicing? Like Stripe, Square lets you create and send professional invoices to all of your customers to receive credit card payments online with minimal effort. There’s an app dedicated for that, with an optional subscription for more complex invoice management.

And let’s not forget about payment links. Whether you’re taking donations, sending one-off or permanent links or embedding buttons to buy products on a website, Square covers most of that. It makes it easy to sell through social media or ask clients to pay online.

Still unconvinced? Square throws in a free online store builder to get you started – though most likely, you’ll need an upgrade to a paid plan to get the most out of it.

2. Adyen: powering global payment websites

If you’re looking to process payments on a large scale, Adyen certainly appeals to some of the larger businesses and enterprise customers.

“It’s been clear from our communications with Adyen that they’re only really good for larger businesses with a high, consistent turnover. The payment gateway is one of the best globally, but not for a small business.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Rather than generic subscription plans, Adyen tailors ongoing fees and transaction rates around your annual turnover, type of business and range payment methods accepted.

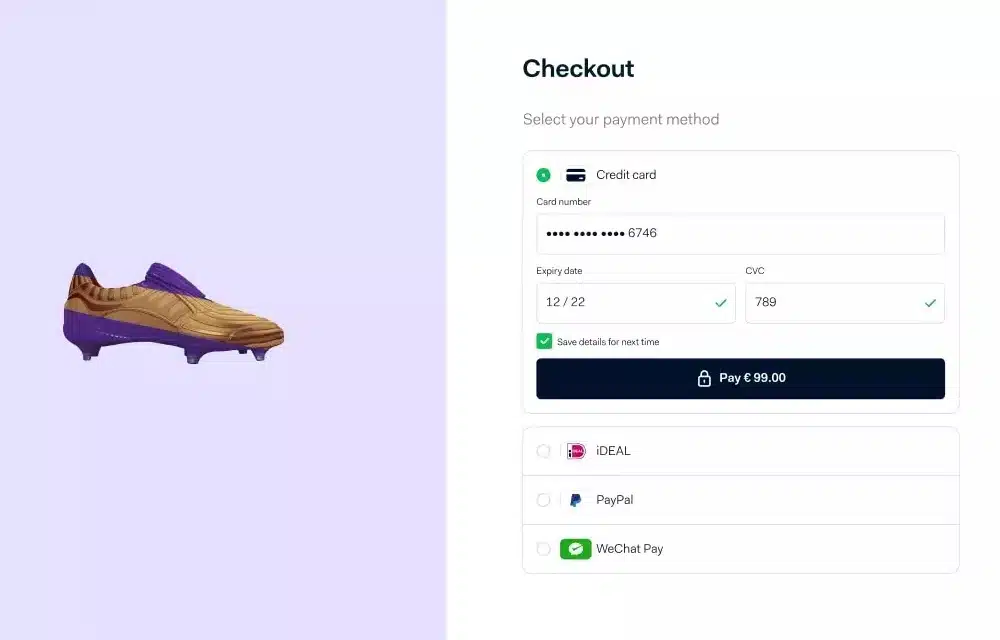

You can customise Adyen’s online checkout, if you can get an account as a large business.

Still, Adyen’s offering is only available for any businesses raking in around AUD 2 million in card payments annually, so you’re best sticking to one of the other Stripe alternatives if you’re yet to hit that revenue milestone.

3. Airwallex: simplifying cross-border payments

Originally known for its multi-currency accounts, Airwallex evolved into a payment gateway that excels in international payments.

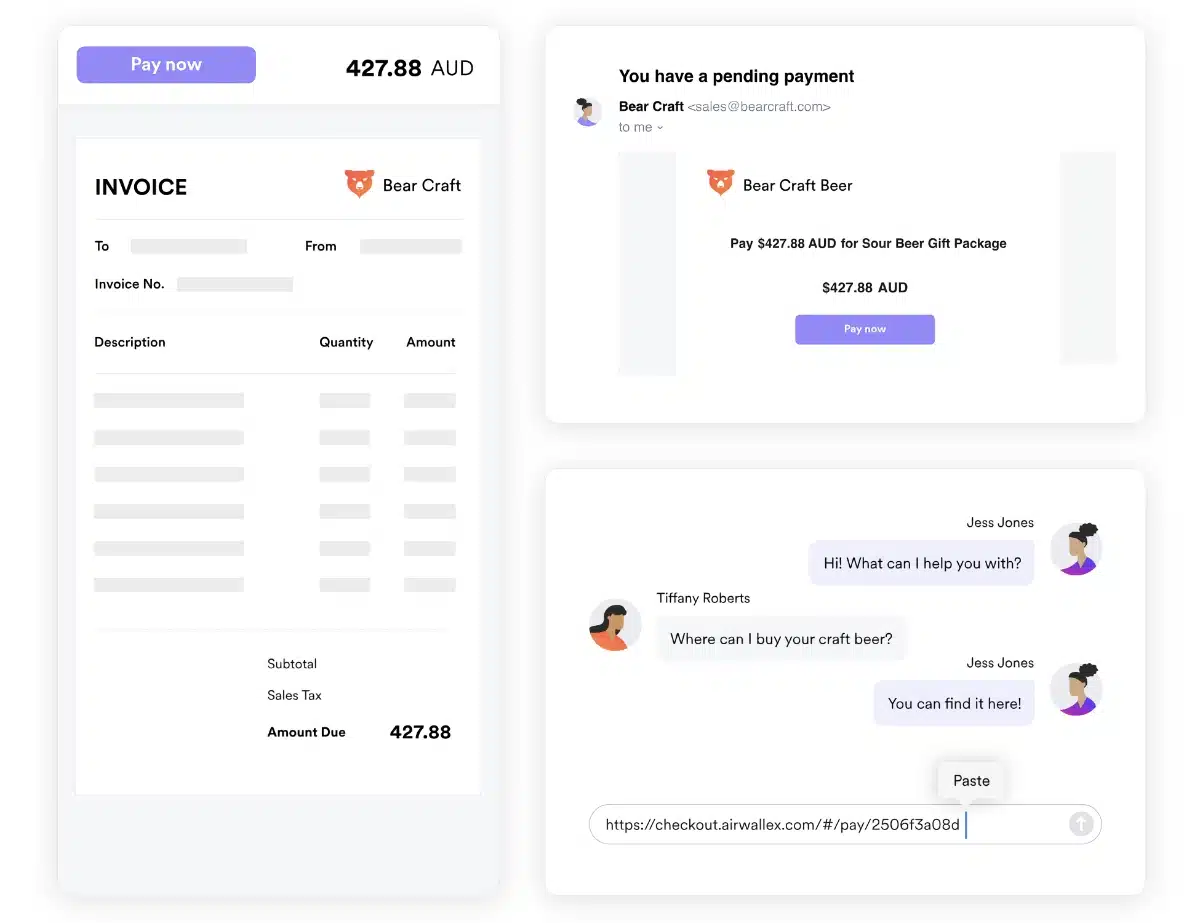

Like Stripe, it has a very advanced, secure online payment gateway developers can shape into its own payment flow on a website. It also has payment links that can be added to email invoices or shared online.

“We use Airwallex at Mobile Transaction as our main account because it’s superb for multi-currency banking. With colleagues spread across countries, it’s worked out to be the fastest and cheapest solution for payments.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Apart from some of the best exchange rates in payment processing, Airwallex’s competitive fees and exceptional user interface make it a wise choice for anyone looking for a customer-first experience.

Airwallex offers payment links and ecommerce integrations.

Airwallex’s 1.65% + $0.30 fee for domestic payments slightly trumps Stripe’s 1.7% + $0.30, making it just as viable for non-international vendors too.

What’s more, its hourly sync with plugins like Xero can be a lifesaver for anyone looking to compile their accounting and other business tools in one place.

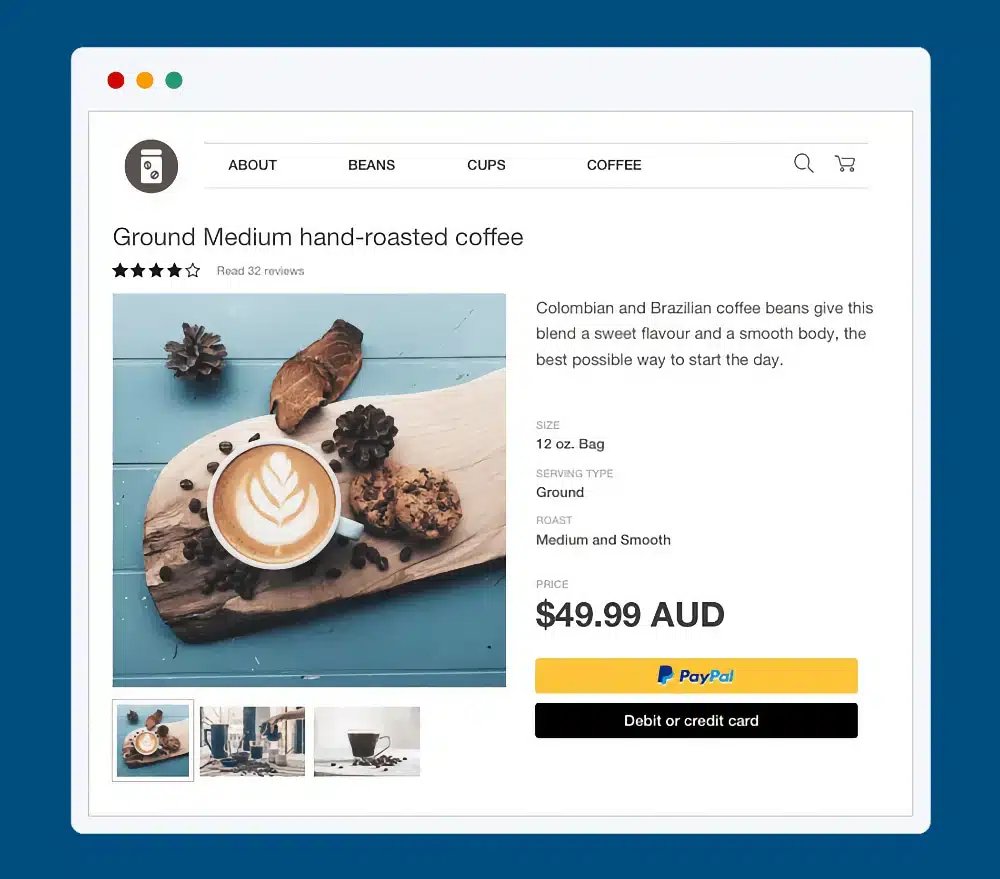

4. PayPal: the trusted name in online payments

No one can deny PayPal’s convenience and familiarity, being a fairly household name since the early 2000s. With a smooth setup and all the basic features you need to receive payments, it’s clear to see why businesses are lured by the simplicity – just remember to transfer funds from your business account to your bank account.

“You almost can’t avoid paying or charging with PayPal as a freelancer at some point, because clients trust it and know how to use it. But it’s really bad for fees in most cases.”

– Emily Sorensen, Senior Editor, Mobile Transaction

PayPal offers a choice of ways to integrate its payment flow on your website.

You know what you’re getting with the PayPal commerce platform, but unfortunately, that means exorbitant fees and a distinct lack of customer service. We’ve never been able to get adequate help through the contact options, and that’s a trend among users.

Most annoyingly, goods and services transaction fees are usually around 4%, so this can quickly eat into earnings if you’re not selling at least mostly in bulk.

Still, you can manage your payments quite well with recurring billing, so it remains an option worth thinking about.

5. Eway: reliable and secure payment processing

Since 1998, Eway has managed to carve out a niche for itself in the Australian market, primarily due to their consistency in transaction fee rates.

Like PayPal, Eway’s claim to fame lies in its ever-presence in the online payments industry, so Australian businesses don’t need to feel like they’re taking a gamble with a less established platform.

The services mainly include a online payment gateway to integrate in your online store, and a virtual terminal for over-the-phone payments.

While Eway might boast about competitive rates and fraud protection, the annual fees dampen the enthusiasm slightly, making it less accessible for small business owners on a long-term basis.

6. PayNuts: customisable solutions for diverse businesses

PayNuts recognises some of the unique challenges each business faces, so their personalised rates based on your specific needs are easily their strong suit.

While exceptional services, many of the options on this list lack a dedicated support team, so PayNuts can be a massive help for any novices to payment gateways that could benefit from a strong relationship with their provider.

Final thoughts

Ultimately, don’t be afraid to venture beyond the Stripe bubble for any payment gateways your business needs!

Although payment processors like Stripe have dominated the online payment scene in Australia, it’s still worth considering alternatives that might be able to provide more flexible solutions for managing payments.