You could say Shopify is the go-to online store platform for retailers, while Square is the jack-of-all-trades platform for small businesses with an emphasis on payments. It’s not so simple, though.

Shopify always focused on ecommerce, but has developed its own point of sale (POS) system. In contrast, Square started with the world’s first mobile credit card reader with an app, then added more payment tools including ecommerce.

Both giants in their own right, which platform should you choose? Depending on what you need the most, the answer could be easy, but you should know the key differences to make an informed decision.

|

|

|

|---|---|---|

| Primary product | Payment tools, card readers, POS systems | Online store platform |

| Card machines | App-based, standalone | App-based |

| POS systems | General, Retail, Hospitality, Services | Retail |

| Online store builder | ||

| Payment systems | Square Payments (built in) | Shopify Payments (built in), external payment gateways |

| Remote payments | Online checkout, e-invoices, virtual terminal, payment links, QR codes, recurring payments | Online checkout, e-invoices, virtual terminal |

| Payouts | 1-2 business days | Up to 5 business days with Shopify Payments |

|

|

|

|---|---|---|

| Primary product | Payment tools, card readers, POS systems | Online store platform |

| Card machines | App-based, standalone | App-based |

| POS systems | General, Retail, Hospitality, Services | Retail |

| Online store builder | ||

| Payment systems | Square Payments (built in) | Shopify Payments (built in), external payment gateways |

| Remote payments | Online checkout, e-invoices, virtual terminal, payment links, QR codes, recurring payments | Online checkout, e-invoices, virtual terminal |

| Payouts | 1-2 business days | Up to 5 business days (Shopify Payments) |

Subscription costs

Some similarities exist between Shopify and Square pricing, but Shopify’s USD-priced subscriptions are decidedly more expensive.

Shopify is primarily an online store platform, so you must subscribe to a paid ecommerce plan. Longer subscriptions are cheaper when calculated on a per-month basis, but they’re all paid for upfront which can be large sums of money paid annually, every other year or every three years.

The cheapest subscription is Shopify Lite (US$9/month on a monthly plan), but this only includes Buy Buttons, invoicing and access to the free Shopify POS app. Online store plans start at US$29/month on a monthly plan (Basic Shopify) with a general set of online store features. The medium plan, just called Shopify, is US$79 per month whereas Advanced Shopify is $299 per month (monthly plans). GST is added on top of all these prices.

The Shopify POS app can be used on all these plans for free – but only the Shopify POS Lite features. The full range of Shopify POS features costs US$89 per month per location in addition to the ecommerce subscription.

|

|

|

|---|---|---|

| Lock-in | None | None |

| EFTPOS machines | Reader: A$65 Terminal: A$329 Register: A$1,099 |

WisePad 3: A$69* |

| Ecommerce plans | A$0-$95/mo | US$9-$299*/mo |

| POS software | A$0-$129/mo | US$0-$89*/mo + ecommerce plan |

| Online & keyed transactions | 2.2% | Shopify Payments: 1.4%-2.9% + A$0.30 External gateway: 0.5%-2% Shopify fee + card processor fees |

| Card reader payments | Reader: 1.6% Terminal, Register: 1.6% |

1.5%-1.7% |

| Payouts | Free | Free (Shopify Payments) |

| Refunds | Free | Shopify keeps original transaction fees |

| Chargebacks | Free | A$25 |

| Currency conversion | n/a | 2% |

| Trial |

*Excluding GST.

|

|

|

|---|---|---|

| Lock-in | None | None |

| EFTPOS machines | Reader: A$65 Terminal: A$329 Register: A$1,099 |

WisePad 3: A$69* |

| Ecommerce plans | A$0-$95/mo | US$9-$299*/mo |

| POS software | A$0-$129/mo | US$0-$89*/mo + ecommerce plan |

| Online & keyed transactions | 2.2% | Shopify Payments: 1.4%-2.9% + A$0.30 External gateway: 0.5%-2% Shopify fee + card processor fees |

| Card reader payments | Reader: 1.6% Terminal, Register: 1.6% |

1.5%-1.7% |

| Payouts | Free | Free (Shopify Payments) |

| Refunds | Free | Shopify keeps original transaction fees |

| Chargebacks | Free | A$25 |

| Currency conversion | n/a | 2% |

| Trial |

*Excluding GST.

With Square, there is no requirement to subscribe to ecommerce to use a POS system, or vice versa. In fact, most Square software is available as a free service, with options to upgrade to a paid plan for more features.

Square has a selection of products with different costs, though, but we’ll keep it simple by focusing on the ecommerce and point of sale systems.

Square Online is the online store builder. Apart from the free plan with basic online store features, there’s a Professional subscription for $20 AUD monthly, Performance for $35 AUD monthly and Premium for $95 AUD per month (all including GST). On an annual plan, you pay for a year upfront which works out a bit cheaper per month.

Square has a selection of POS apps for the different industries: Square for Retail (free or $109 AUD incl. GST monthly plan), Square for Restaurants (free or $129 AUD incl. GST monthly plan) or Square Appointments (free for one user, paid plans for more).

Square has other features that may incur a monthly cost (if they’re not free). For example, advanced employee permissions for the point of sale have a monthly fee of $35 AUD/month per location, though basic permissions are free of charge. Shopify offers many additional apps at a cost, but most of them are developed by other companies with their own fees.

Commitment and cancelling a subscription

Neither of the platforms require a contract lock-in for any of their packages, but you cannot get a refund for subscription payments.

This is mostly an issue with an annual ecommerce plan (and the 2- or 3-year plans of Shopify) because it’s a large, non-refundable sum of money you’re paying in advance of using the online store. So even though you can cancel it any time, you can’t decide to get your money back if you change your mind later.

To cancel a Shopify subscription, you have to contact support in advance of the auto-renewal of your subscription(s). The support team will then do this for you, after which your online store will be inaccessible.

In contrast, Square allows you to cancel any subscription any time in your account without having to contact support. All the many free features and saved changes will still be accessible in the Square account thereafter.

Transaction costs: Square simple, Shopify complex

Then we have transaction fees that in some ways are similar, but high-volume merchants will see some clear differences.

Online transactions through a Square website, payment link, QR code, email invoice or virtual terminal cost a fixed 2.2% per transaction. Only on Square Online Premium does the transaction fee reduce to 1.9% through your online store.

Shopify has tiered rates: 1.75% + 30¢ AUD on Basic Shopify, 1.6% + 30¢ AUD on Shopify or 1.4% + 30¢ AUD on Advanced Shopify for Australian cards, or 2.7-2.9% + 30¢ AUD for American Express and other international cards. This applies to email invoices and virtual terminal payments as well.

Only Shopify allows you to use another online payment gateway, but for an additional fee: 2% on Basic Shopify, 1% on Shopify or 0.5% on Advanced Shopify. This is added to your external card processing fees per transaction. It’s like a penalty fee for using a different processor, but Shopify calls it a “transaction fee”.

Shopify also adds a 2% currency conversion rate on all transactions paid with a foreign-currency card, which could make a big difference to cross-border retailers. Square has no such fee.

Card reader payments are a fixed 1.6% through Square Reader, or 1.6% through Square Terminal or Square Register. Shopify charges 1.5%-1.7% for this depending on your subscription tier.

Given the fact that 20% or so online purchases end up being refunded, Shopify’s refund cost could make a big difference to your margins, particularly when transaction values are high.

Overall, the discounted rates on the higher Shopify plans do not make a big difference for businesses transacting only a few thousand dollars a month.

But the rates between Square and Shopify make a clear difference when it comes to refunds: Square charges nothing, while Shopify charges the original transaction fees (both the percentage and fixed fee) for every refund processed.

Given the fact that 20% or so online purchases end up being refunded, this could make a big difference to your margins, particularly when transaction values are high.

On top of this, Shopify charges $25 AUD per chargeback, refunded if you successfully resolve the customer dispute. Square does not have a chargeback fee.

With Shopify Payments, you have to wait up to a week to receive funds from online sales into your bank account. With Square, transactions are typically settled in your bank account the next business day.

Online store builder: basic versus mature

If you only looked at the differences between the website builders, Shopify would win hands down.

It is simply the most advanced online store builder with lots of functions to grow any retailer with either Shopify’s own features or the 6800+ apps you can add. While user-friendly enough for a lay person to handle, it also allows developers and web designers to implement their own code.

With Square Online, you also get an online store builder, but only a few templates (one for retailers, another for food and drink) with basic customisation options so you can create a site with no prior experience. Integrations for accounting, inventory and more are available, but they don’t expand the functions of the website builder itself.

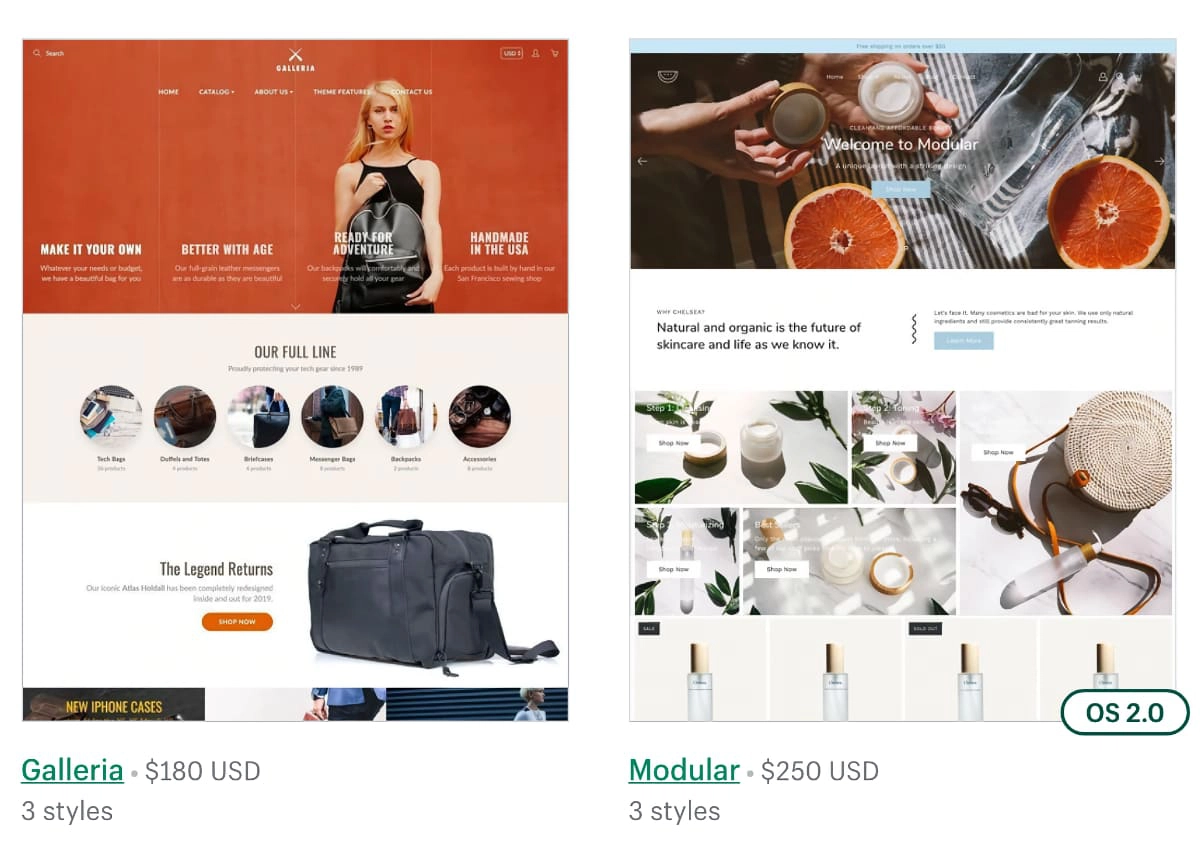

Image: Mobile Transaction

Example of paid Shopify templates.

All of Shopify’s website plans require a subscription, but then you get enough features to start a professional web store even on Basic Shopify. A Shopify website is equipped to handle many products linked to different stock locations (if needed).

Although some themes are free, the best cost up to $350 + GST. The premium themes you pay for generally have more customisation options in the website builder, whereas free designs are less flexible. In other words, Shopify doesn’t give you the same design settings across all themes.

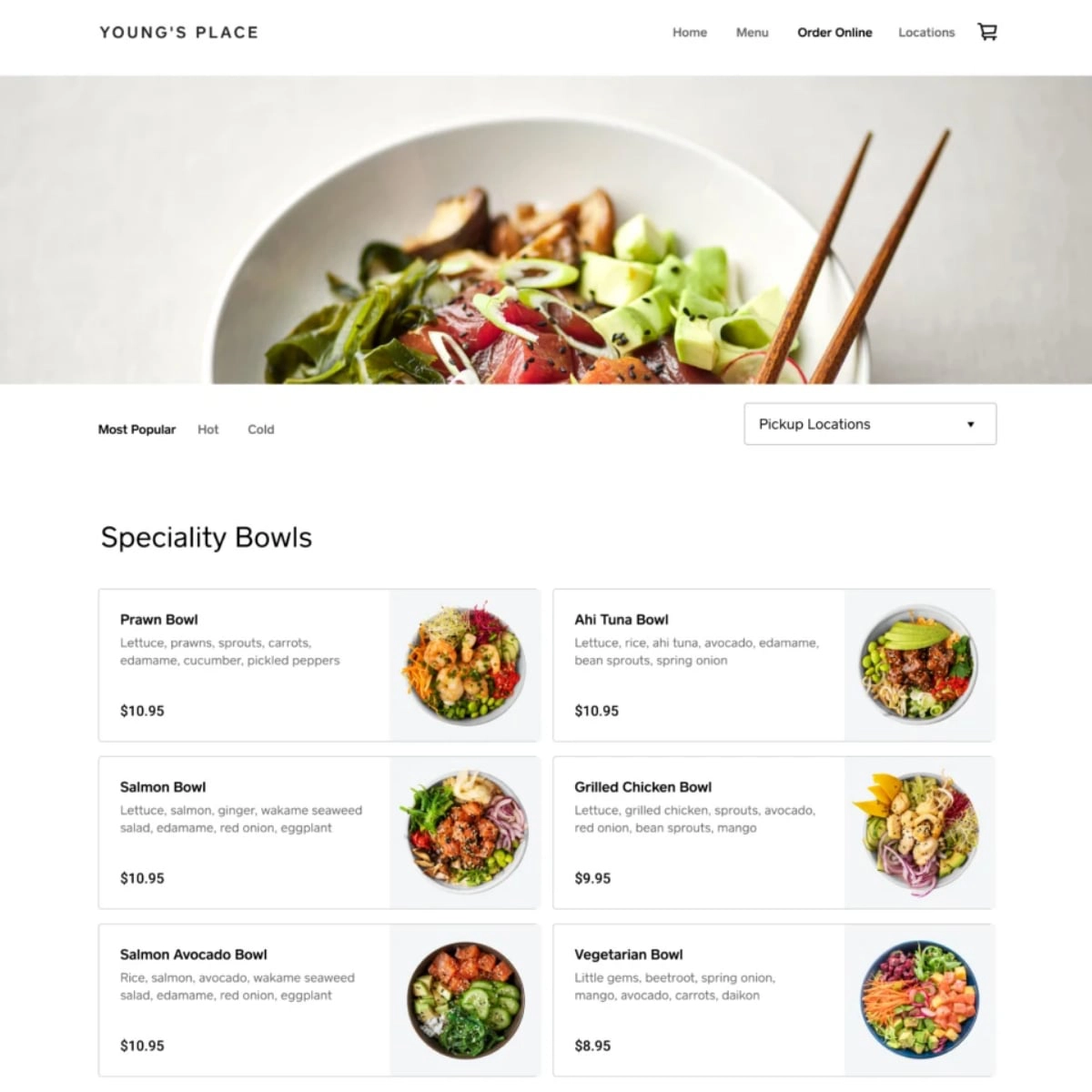

Image: Square

Square offers a free, simple web page for online ordering.

You can build a free online store with Square if you can live with the Square branding in the footer and the free URL. Suffice to say, a subscription is better for serious stores using Square, particularly as many features are missing on the free and cheaper plans.

But Square Online is perfect for a single online ordering page (free of charge) for delivery, collection and shipped orders.

In-person payments at a point of sale

Those who only do business face to face should go for Square with its industry-tailored POS systems. There’s no value in using Shopify POS unless you’re actively using the mandatory ecommerce subscription that has to be paid for.

Shopify POS is designed to benefit online retailers who need a POS system that cleverly works together with the online store for a unified sales experience between online and in-store purchases.

This synergy is very valuable in today’s retail environment, for example when customers purchase something online and want to exchange it in person or they need to collect it in store. To fully benefit from this, the monthly cost of Shopify POS Pro is necessary.

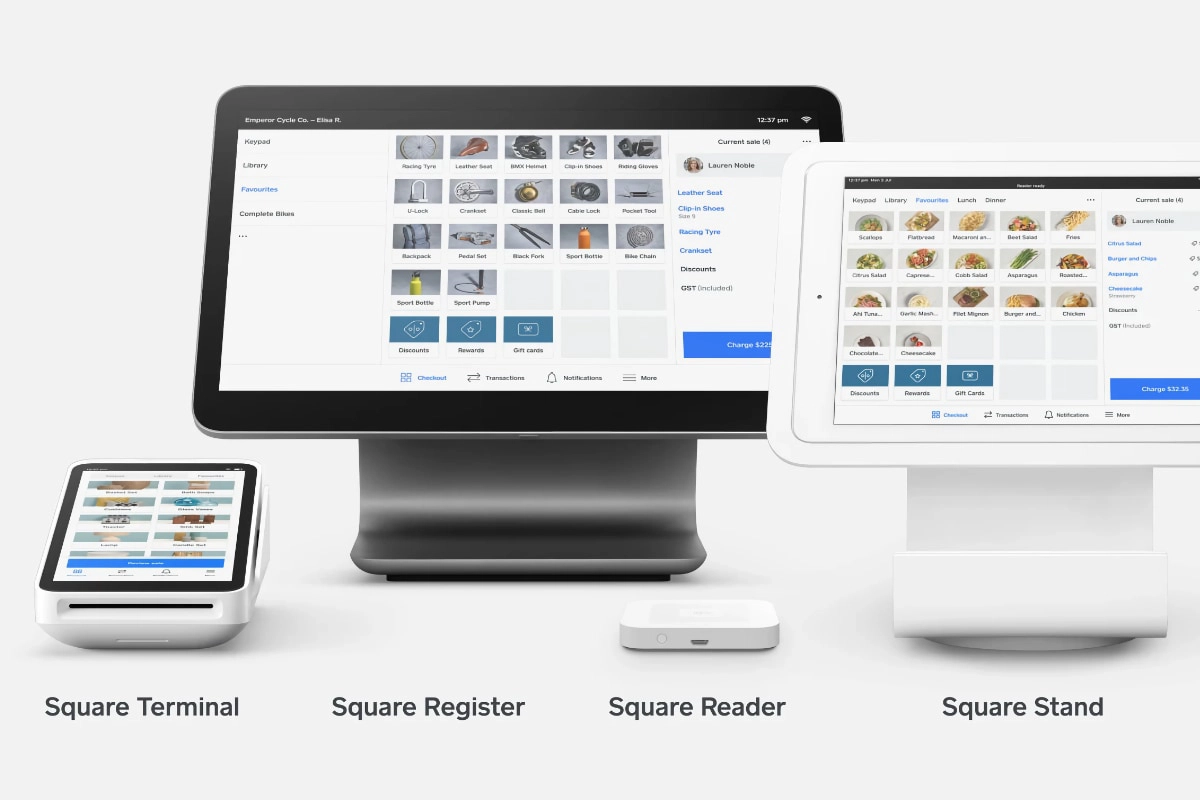

Photo: Shopify

The Shopify POS app makes an online retailer more flexible in store.

Square, on the other hand, lets you use its general (Square Point of Sale), hospitality (Square for Restaurants), retail (Square for Retail) and service (Square Appointments) POS software independently from other sales channels if preferred.

They all have free versions and there are paid subscriptions for all but the general POS system. This allows you to choose a system designed for your sector, with options to mix and match with any other Square tools in your account.

What about hardware? While Shopify POS, Square Point of Sale and Square Appointments work on Android, iPhone and iPad, the restaurant and retail apps are made for iPad or Square Register.

Photo: Square

Square has different POS apps, equipment and hardware for various setups.

Both Shopify and Square sell their own card readers that connect to its apps, but Square also offers Square Terminal and Square Register with POS software built in.

Cash drawers, receipt printers and barcode scanners can connect with either provider, but Shopify is not built for hospitality and therefore won’t work with a kitchen printer. In other words, there’s more choice with Square.

Payment system and remote payments

Square and Shopify come with their own credit card processing system built in, but only Shopify allows you to use an alternative payment system.

All of Square’s POS and online features use Square Payments. For this reason, you should not choose Square if you want another payment processor in your online store or brick-and-mortar shop. You can add PayPal as a payment method on the Performance plan only, but not Laybuy, Alipay or others.

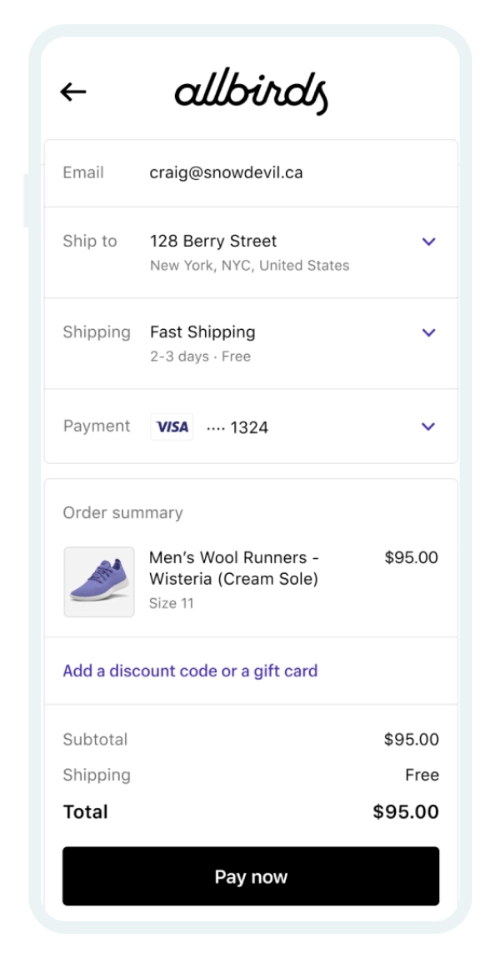

Image: Shopify

Example of a Shopify checkout.

Shopify Payments is Shopify’s default payment system, but you can use another online payment gateway with an added fee per transaction accepted, for example Afterpay, Braintree or Stripe. This gives you more flexibility to use a better processor, but the cost prohibits merchants on a budget to choose something with lower rates.

Apart from its online checkout, Shopify has a basic virtual terminal labeled a “Draft Order”. As the name suggests, it’s best for creating orders on behalf of the customer. In contrast, Square Virtual Terminal is a very versatile solution designed for Mail Order/Telephone Order (MOTO) payments.

Email invoices can be sent through Shopify, but again, Square Invoices comes with more features including a dedicated app.

Payment links and QR codes for touch-free ordering can only be generated and sent via Square – just pay a transaction fee.

Does Square work with Shopify?

Does Square integrate with Shopify (or vice versa)? Yes and no.

Several inventory syncing platforms can connect your Shopify inventory with Square inventory, like Square Sync (Shopify App Store) and Finale Inventory (Square App Marketplace). This means you can use Shopify for your online store and Square as your in-store solution and keep stock synced.

What about using Square as your online store and Shopify as your POS system? As stated earlier, Shopify POS is only worth it when connected to a Shopify online store.

That said, you could use Shopify for both POS and ecommerce and Square only for its free tools like payment links and invoicing, but then your transactions won’t be processed by the same payment system.

Square integrates with several big ecommerce platforms such as Wix and WooCommerce, so you could also choose to bypass Shopify completely.

Image: Square

Square excels with its cross-platform selling and easy-to-use software for merchants.

Customer service and reviews

Shopify offers 24/7 phone, email and chat support for all its subscribers.

This is much more than Square’s regular support hours between 9am and 5pm (Melbourne Time) on business days only. Paid subscribers to Square for Restaurants, however, do get round-the-clock phone support – essential for bars and restaurants operating nights and weekends.

What about reviews? They’re a mixed bag. Like most payment platforms, both get a fair amount of complaints from users about poor customer support and frozen payments (relatively common issue for payment services).

Reaching a real team member from Square is a challenge, as you’re encouraged to find answers through the online help section or submit a message. Shopify is not much better, even on the higher plans.

Some users complain they pay more in Shopify fees and chargebacks than what they earn through the online store. Square’s lower price point means this isn’t an issue, but the downside is that Square’s POS or ecommerce software is too simple for some users.

Alternatives: Compare the best ecommerce platforms in Australia

Verdict: Shopify for online retail, Square for all-round value

There’s lots to love about Square’s all-round features that work for most small businesses, whereas retailers would thrive with Shopify’s optimised features built to convert more customers online.

Shopify is built for retail – you see this with its features catering to large product inventories, not services. Only Square has specific solutions for food and drink, beauty or other professional services.

Square does provide an easy entry point into ecommerce, but you’ll struggle with its online store limitations beyond a few hundred items in your inventory. Developers and designers will also struggle to customise a Square site, but its templates are modern and crisp. The amount of customisations available with Shopify, on the other hand, far surpasses Square’s.

Brick-and-mortar shops usually prefer Square for its easy, efficient POS systems, EFTPOS readers and simple pricing, but Shopify does allow integrations with major POS systems other than its own pricey version.

Best for: Any small business that wants the widest range of tools on the same payments platform

Sign up free with Square

Best for: Any size retailer that needs an expandable, but user-friendly, online store

Try Shopify’s 14-day free trial