MobileTransaction has tested Square’s EFTPOS terminals over time so you can trust our opinions about the service. We have also communicated with the company and experienced its features changing over the years.

Looking for the Square UK review?

Accepted cards

Then there’s Square Terminal that works independently, with the Point of Sale app installed and usable from its touchscreen. It takes contactless, chip and swipe cards and prints receipts.

The terminals accept most cards including eftpos debit cards, popular mobile wallets and and the Buy Now Pay Later solution Afterpay.

Square’s POS apps work as self-sufficient POS systems with functions to run any type of business from just your mobile device. There’s a POS app for general use, hospitality, retail and services.

Square has added many diverse business and payment features over the years to help small businesses sell in person and online. Listening to its users, they also launched Instant Transfers for immediate access to funds in your chosen bank account.

Our opinion: still the most comprehensive for the price

If the best value-for-money is key to your choice of card reader, we think Square is the leading option in Australia. It has the best-functioning payment tools and broadest point of sale and ecommerce features aimed at the budget-conscious merchant.

“During my years of testing Square, Ive always been struck at how many useful features it keeps packing into its platform. Diverse extras like contract templates, donation links and Buy Now Pay Later acceptance are very rare to see included free.”

– Emily Sorensen, Senior Editor, MobileTransaction

The pay-as-you-go structure with no contractual commitment makes it a good place to start for a low cost. As your business grows, you can expand on tools through partner apps and additional Square features.

In our experiences, the EFTPOS machines and POS registers are all good quality. While the hardware might not suit everyone, the regularly updated software makes payment processes run really smoothly. It’s a very user-friendly system, but customer service is more limited than other EFTPOS providers’.

Advantages

Disadvantages

| Criteria | Verdict |

|---|---|

| Product Payments: Good Hardware: Good / Excellent Software: Good / Excellent |

Good / Excellent |

| Cost and fees | Good |

| Value-added services | Good / Excellent |

| Contract | Excellent |

| Sign-up and transparency | Excellent |

| Customer service | Passable / Good |

| FINAL RATING | [4.3/5] |

Charges are simple and transparent

With Square, the only charges are the upfront price for a card reader and a pay-as-you-go transaction rate.

The cheapest EFTPOS machine, Square Reader, costs $65 incl. GST. Buying Square Terminal costs $329 incl. GST and Square Register $1,099 incl. GST. Regardless of the device, the card rate is fixed at 1.6% for any card.

It doesn’t matter whether the transaction was paid via contactless, chip and PIN or swipe, or which card brand was used – the transaction fee is the same. If the surcharging setting is on, the customer pays this fee instead.

No monthly (or other) fees are charged for the core payment features.

| Square fees | |

|---|---|

| Chip, tap, swipe transactions | 1.6% (any card) |

| Keyed, online, invoice transactions | 2.2% |

| Afterpay transactions | 6% + 30¢ + GST |

| Monthly fee | None |

| Payouts | 1-2 working days: Free Instant: 1.5% per transfer |

| Refunds | Original transaction fee is retained |

| Chargebacks | Free |

| Square fees | |

|---|---|

| Chip, tap, swipe transactions | 1.6% |

| Keyed, online, invoice transactions | 2.2% |

| Afterpay transactions | 6% + 30¢ + GST |

| Monthly fee | None |

| Payouts | 1-2 working days: Free Instant: 1.5% per transfer |

| Refunds | Original transaction fee is retained |

| Chargebacks | Free |

Payments online or where the customer is not present are charged a higher rate, i.e. every keyed, virtual terminal, payment link, ecommerce and invoice payment costs 2.2% of the transaction total. A higher fee is required for Afterpay: 6% + 30 cents (excluding GST) per transaction.

With Square, there’s no minimum contract period, and merchants don’t have to sell every month or meet a minimum sales volume.

Nothing is charged for PCI-DSS compliance or chargebacks, the latter being dealt with by a dedicated support team for payment disputes. Processing a refund to a customer will result in Square keeping the original transaction fee.

Payments are automatically deposited into your bank account within 1-2 business days. You can also choose to use a manual deposit schedule if that’s simpler for bookkeeping.

“We know from many businesses how important fast cashflows are, but Square is still the only EFTPOS provider who offers instant bank account transfers – for a fee, though.”

– Emily Sorensen, Senior Editor, MobileTransaction

If you need funds sooner, an Instant Transfer option lets you transfer money instantly to your compatible bank account for an additional fee of 1.5%, even during weekends or nights.

What about hardware costs? The Square Reader package includes a micro USB cable for charging. A wall charger for it has to be bought separately if needed, and Square sells an optional charging dock for $59.

Square Stand, which accepts chip and tap cards, for iPad is only $149, whereas the all-inclusive Register (that also has a tablet display) is $1,099.

Helpfully, Square offers interest-free instalment options if you can’t afford the upfront cost of their hardware.

The general-featured Point of Sale app is free, but specialised POS systems for restaurants, retail and booking services are available for a paid subscription, if not using the free plans.

Add-ons include additional employee permissions ($35 monthly per location), additional invoicing features ($30 monthly), Square Marketing ($20-$50 monthly) and Square Loyalty ($49-$149 monthly per location).

Any integrated tools from other providers, e.g. for ecommerce and bookkeeping, are paid for separately through those other platforms.

Eligible small businesses can apply for a Square business loan too for one fixed fee (cost depends on the loan) – but only after accumulating a consistent sales flow.

Best card reader offer

Get started for just $65 incl. GST. No monthly fees or commitment.

MobileTransaction is an independent payments industry resource trusted by over a million small businesses yearly.

Discounts do not influence our editorial content or recommendations. Ratings are based on full retail price. (Full policy)

Square Reader – how it works

The most popular of Square’s EFTPOS terminals is Square Reader, but how does it work?

It needs a compatible Android smartphone, tablet, iPhone or iPad with one of Square’s POS apps downloaded and Bluetooth switched on. This is where you begin each card reader sale.

In the app, you enter an amount or pick products or services from your items library. Tap “charge” and the customer can add a tip (if switched on) on your mobile device screen, then insert or tap their card on the reader. A receipt can be emailed, texted or printed (if a Bluetooth printer is connected) after each transaction.

“We found contactless cards and mobile wallets really straightforward – customers just “tap and go” on Square Reader. Chip cards with PIN codes need two devices: the reader for card insertion and mobile screen for PIN entry.”

– Emily Sorensen, Senior Editor, MobileTransaction

Customers enter their PIN on the touchscreen of the phone or tablet. In technical terms, this is called ‘PIN on COTS’ (PIN on commercial off-the-shelf devices), sometimes referred to as ‘PIN on glass’. That’s because Square Reader has no PIN pad or display.

Photo: MobileTransaction

PIN entry happens in the Square app, as seen here on iPad.

If the tablet is on a stand of a certain height, PIN entry can be more difficult to hide compared with entering it on a countertop card machine. If there’s a way for customers to shield their PIN for privacy, it would help them feel more comfortable about it.

PIN on COTS has been officially accepted by the PCI Security Standards Council, and we do not see cause for concern for merchants or payers. Still, some customers might not feel comfortable giving their PIN this way. If that worries you, you may want to consider alternative card readers.

No card reader? Tap to Pay on a smartphone instead

Square was one of the first in Australia to introduce a reliable tap-on-phone solution. It allows merchants with an NFC-enabled Android phone or iPhone to create a transaction in the Point of Sale app and accept contactless card or mobile wallet taps directly on their smartphone instead of on a separate card reader.

Of course this does not help chip card customers who still need an EFTPOS terminal, but Tap to Pay is an excellent backup for contactless payments.

POS app features

The free Square Reader app, ‘Point of Sale’, is a big draw, in our opinion. Out of all POS apps in Australia we’ve looked at, it comes with the most free features for managing sales and business operations from any compatible iPhone, iPad, or Android phone or tablet with a live internet connection.

Just to give an idea, the app lets you manually enter card details, send invoices and accept cash. There are custom discounts, tipping and split tenders so customers can pay some of the transaction total with a card and the rest with cash. It also allows you to sell email or physical gift cards to be redeemed in store.

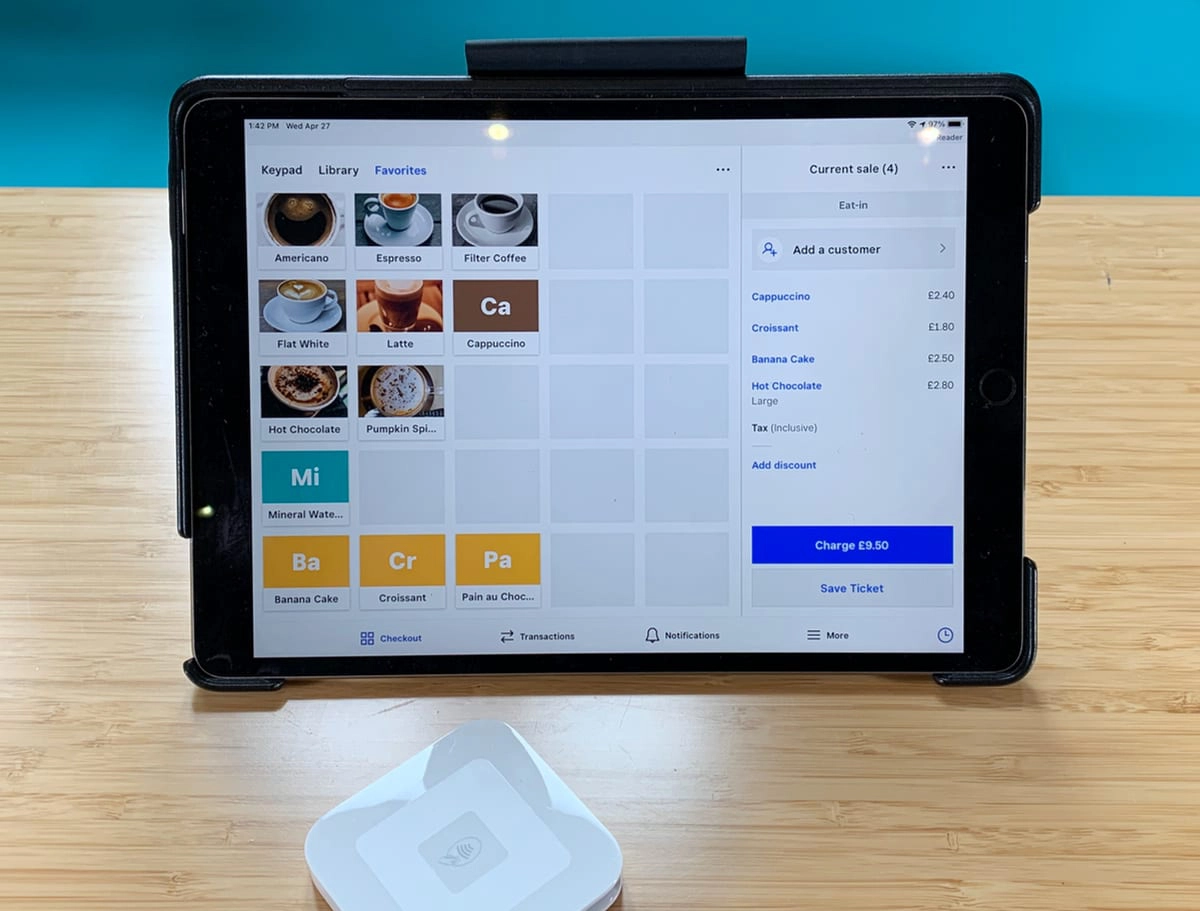

The customisable product inventory is great for tablets with its visual layout of products. Each product can have a picture, description, types (e.g. red, black, pack of 2, pack of 5), different prices for each type and inventory levels.

Photo: MobileTransaction

Add products, apply discounts and distinguish between product types.

To get the most out of Square’s tools, we suggest adding your products to the library before using the app. This enables you to track product popularity and differentiate between items when processing a refund. It also makes check-out easier. You can tap to add products to the bill, rather than manually entering each item or transaction total, which are both possible.

Businesses with teams of staff can add employees as individual users with limited permissions in the app. Individual employee accounts also enable a time sheet for each worker.

Restaurants can upgrade to Square for Restaurants, retailers to Square for Retail and service professionals to Square Appointments – iPad apps with features tailored to the industries. It is also possible to integrate the card reader with an entirely different POS platform like posBoss or Pronto Xi POS.

Square Reader vs Terminal

If a POS app on a mobile device is not for you, the EFTPOS machine Square Terminal is a pretty piece of equipment that works independently.

This is a touchscreen terminal with integrated checkout software (basically the Point of Sale app) navigated directly on the screen. The software keeps itself updated whenever Square fixes bugs and adds more features, so it’s always secure and synced with the latest version.

It accepts chip and PIN, contactless and swipe. PIN codes are entered on a touchscreen keypad, similar to a traditional credit card machine.

Given the large touchscreen and inbuilt software, Square Terminal is much bigger than Reader (like a conventional EFTPOS terminal). It has a built-in receipt printer so you don’t need to connect to a different one. It’s a pleasure to use – it isn’t too heavy or large for our hands, but needs ongoing cleaning if it’s in a dirty environment.

Square Reader works with 4G and WiFi through a connected mobile phone or tablet. Terminal, however, only works with a secured WiFi connection or Ethernet cable (the latter only in conjunction with Hub for Square Terminal, available at an extra cost). This makes Reader more suitable for on-the-go payments and Terminal best for a fixed area with a secure WiFi setup.

Regardless of the device, however, offline mode can kick in if there’s an internet outage.

Other hardware and accessories

A big advantage, we think, is that Square allows for different hardware setups to suit different kinds of businesses.

For example, Square Reader connects with compatible receipt printers, kitchen printers (for restaurants), cash drawers and barcode scanners. There’s also a fancy-looking charging dock for Square Reader for a countertop setup.

Then you have the point of sale (POS) registers with contactless and chip card acceptance built in so no separate EFTPOS terminal is needed.

Photo: MobileTransaction

Square Stand (requires an iPad) and Register, both with a card reader built in or attached.

To start, Square Stand is a white register where you can fit in a 10.2″ and 10.5″ iPad for the POS software. All Square-branded equipment has an Apple-inspired aesthetic – sleek and minimal – so perhaps it’s not too surprising it doesn’t work with Android.

For convenience, the Square Stand screen can swivel to face the customer for PIN entry. It also has a card slot for chip cards and NFC (near-field communication) for contactless payments.

You could also get Square Register, a stylish and unique tablet touchscreen register with a smaller EFTPOS terminal attached. This does not have a cash drawer or receipt printer, but they can be linked to it.

Many receipt printers work with the system, but some only work with certain Square devices.

Online payment tools

For some businesses we interact with, the best thing about Square are the free tools for online and remote payments.

For a start, all users can create a free online store (upgrade options available) or even just an ordering page for click-and-collect or QR code ordering. All you pay is the transaction fee per successful online payment.

Different types of payment links can be generated if you just want to send a link to customers, display a QR code in store or on a table, or even to embed on an existing website.

Invoices and estimates can also be sent to clients. In fact, all merchants have access to a free Square Invoices app, which no other EFTPOS company in Australia can offer. All the invoicing features used to be free, but there’s now a paid subscription for the most advanced functions, like multi-package estimates and project milestones.

Transactions over the telephone are possible through the complimentary Square Virtual Terminal or keyed entry in the Point of Sale app. From any desktop browser, you can log in to the Square account and go to the Virtual Terminal section where you input a customer’s card and transaction details.

Reports and accounting: extensive options

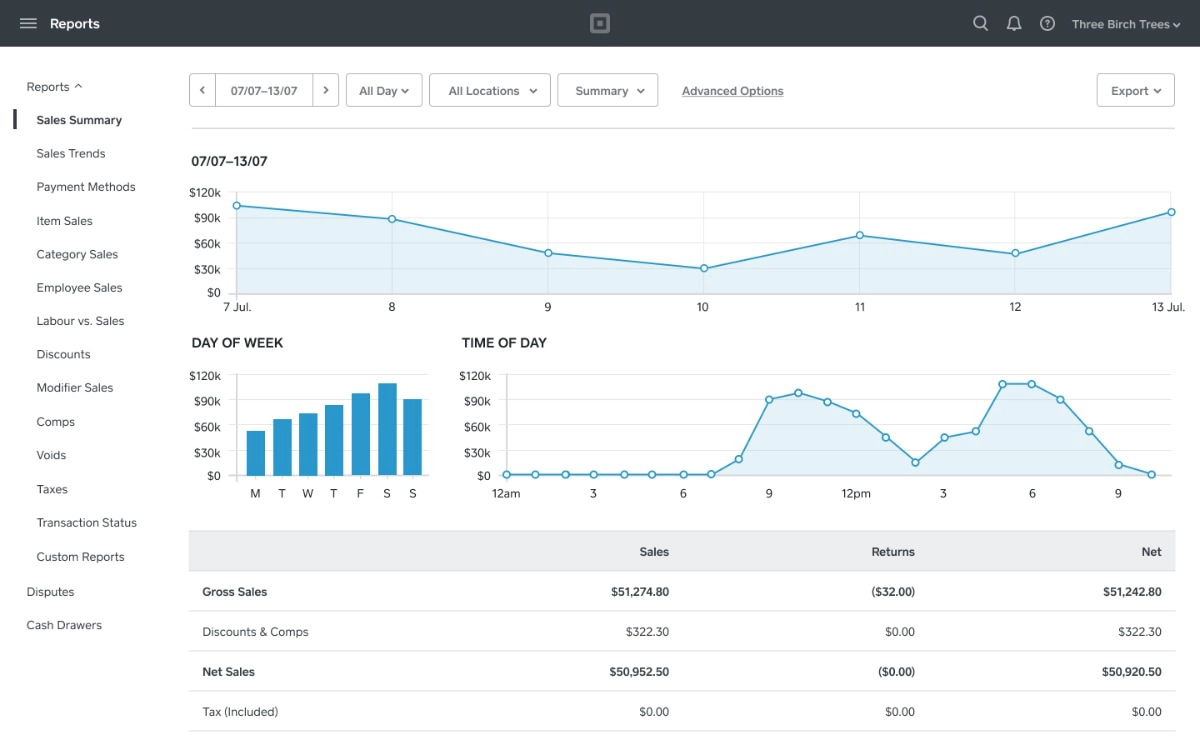

With all sales in the cloud, you can log in to the Square account in any internet browser and export sales to Excel for local storage or accounting purposes. The account also syncs with sales activities in real time so you can always check in remotely on how business is doing.

The app shows transactions, amount of money in the cash drawer (if cash management is switched on) and general sales reports (these can be emailed directly from the app). We noticed, however, that cashing-up reports require one of Square’s more specialised POS subscriptions.

Image: Square

Analytics in the Square backend are quite detailed, particularly as they come free.

Square analytics are fairly extensive. Square Dashboard shows a colourful overview of key sales information, and more analytics can be accessed in the Reports section. You can, among other things, analyse employee sales, taxes, product categories and any product modifiers that have been applied to sales.

For more complex accounting features, integrate data with Xero, Zoho Books or QuickBooks.

Who is it best for?

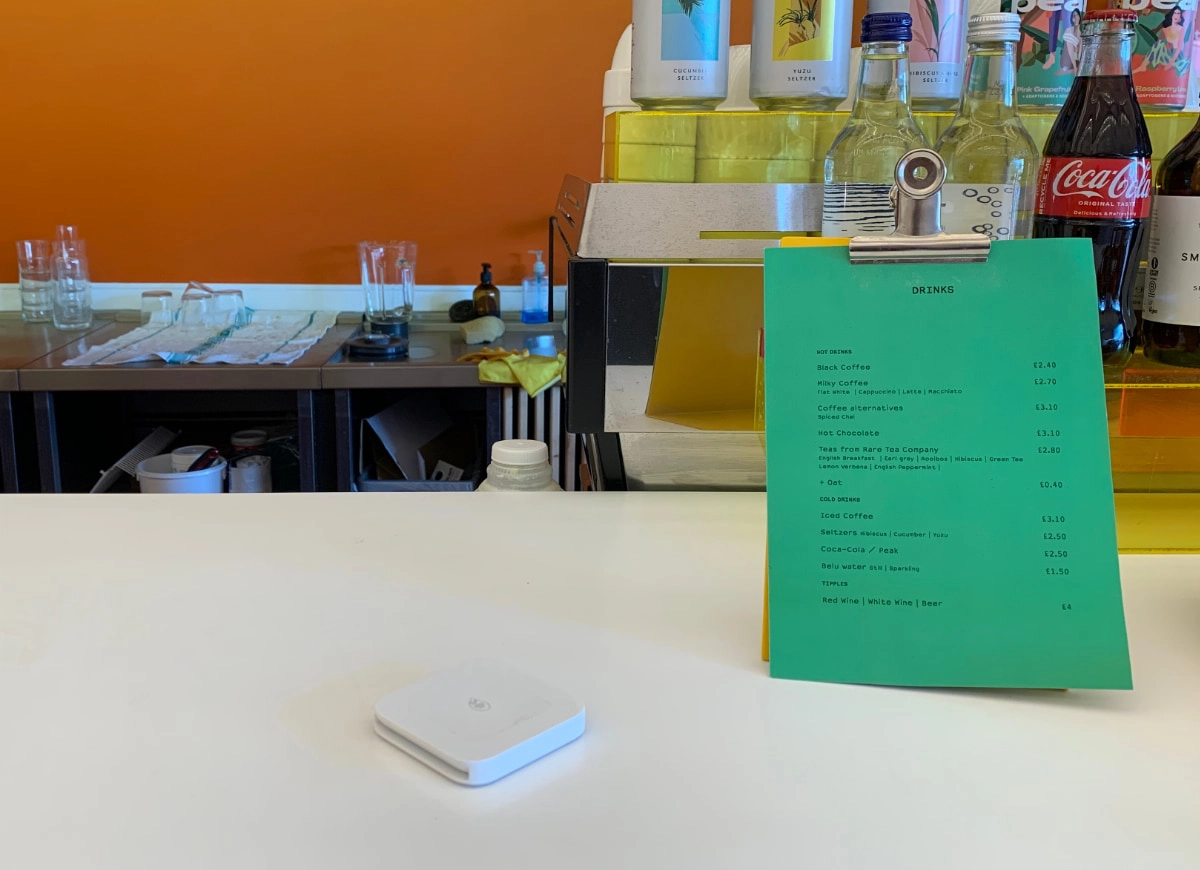

Square is aimed at a broad range of small businesses like coffee shops, independent retail shops, hairdressers, gyms, skilled professionals and many more. The features cover not only in-person payments but also self-service (e.g. QR code ordering) and online transactions.

Having tested the POS app, it is best suited to retail and hospitality – food-and-drink in particular – due to its comprehensive product library, checkout functions, tipping, analytics and staff management features. There’s even multi-location support for those selling in more than one location.

And let’s not forget the pocket-sized card reader for on-the-go payments. This comes in more than handy at market stalls, home visits and conferences.

A big advantage of Square are the many add-on options and integrations with partner platforms covering a wide range of business tools. This means you are not stuck with the free features. Growing businesses can use Square in conjunction with apps providing advanced software for e.g. inventory, scheduling, marketing and much more.

Photo: MobileTransaction

Square has been particularly popular with food-and-drink establishments.

As with other payment companies, Square has a list of prohibited businesses. Some of these industries are pharmaceuticals, adult entertainment, certain marketing or financial services, and illegal or otherwise questionable services.

Alternatives to Square

Launched more than a decade ago in the US, Square has had time to develop its offering and get to know what small businesses want. The platform therefore easily beats all other payment platforms with its breadth of easy, affordable, commitment-free and truly useful payment and business tools in Australia.

That said, newcomer Zeller is already a strong competitor with its standalone, mobile EFTPOS machine linked with a free business debit card. It settles funds nightly in its online account, allowing users to spend it the next day. Zeller’s EFTPOS transactions cost only 1.4% compared with Square’s 1.6%.

An even newer market entry, SumUp, sells an app-based card reader that’s cheaper than Square Reader. It costs $49 incl. GST and has a PIN pad and fixed 1.6% rate for chip and tap payments.

Tyro has also launched its own app-dependent card reader that looks like and costs ($59 incl. GST) about the same as Square Reader. It has no contractual lock-in and a fixed rate of 1.4% per transaction like Zeller – clearly an attempt to compete with Square.

CommBank has its own Square Reader-lookalike called Smart Mini for $59 that works with a very basic app.

Photo: MobileTransaction

Square Reader with a chip card inserted.

PayPal used to also offer an inexpensive card reader, but it has been discontinued.

If competitive rates are more important than a lack of monthly fees, we recommend PayNuts. Their transaction rates depend on your business turnover and cards accepted, but rates then go as low as 0.8% or nothing if surcharging is activated. Smartpay is another noteworthy alternative for surcharging on a “zero-cost” plan.

Customer support and reviews

Square is available to phone and email between 9pm and 5pm Monday-Friday (Melbourne time). There is no weekend or evening support, except for on the paid restaurant POS subscription or if you use Square Terminal. In those two cases, you get 24/7 support.

There’s an online Help Centre answering most questions in detail. A Seller Community for peer support and advice, and the Twitter and Facebook channels are used when responding to messages.

Square has received a significant amount of complaints the US. This is not the case in Australia, where reviews are generally positive. The few complaints that are made usually relate to account verification issues and poor customer support.

Getting started

Before purchasing a terminal, you need to sign up for a Square account and register your bank account. It typically takes up to a week to have a bank account verified, but you can still accept payments before the verification is finalised.

After signing up, you can order an EFTPOS terminal on the Square website. It is also possible to buy the card machines from other websites like Officeworks, JB Hi-Fi, Apple and Harvey Norman, all of which have different delivery and collection options.

When the account is set up and connected with your bank account, download the Square Point of Sale app on your mobile phone or tablet and log into the app. Connect the card reader with your mobile device via Bluetooth and you’re ready for tap-and-go and chip cards.