- Pros: Free plan available. Integrated payments. Online booking page. Many payment methods. Bookings through Google and social media.

- Cons: Scheduling software and online booking page could have more features. Only works with Square Payments.

- Best for: Individual and teams of professionals in need of an easy booking system with convenient payment tools.

Overview

In brief

What is it?

Our opinion

In detail

Pricing

POS features

Online bookings

Payments and hardware

Reports

Support and reviews

MobileTransaction has personally tested Square Appointments for an honest review of the product. Opinions are the editor’s own.

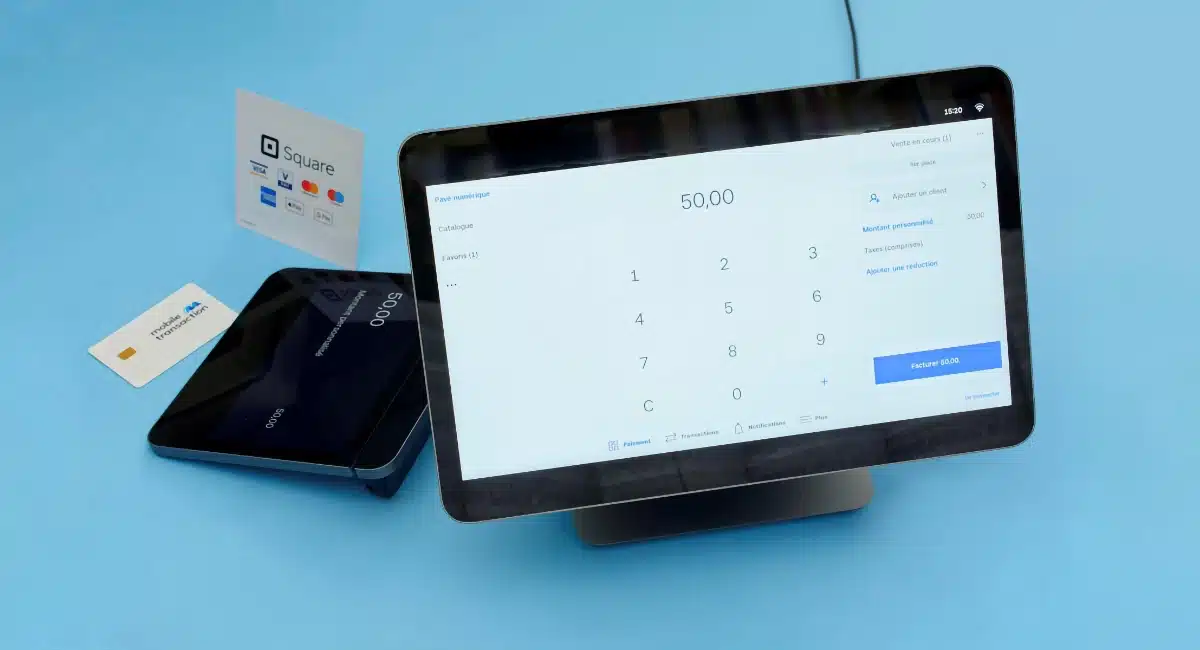

It’s easy and free to sign up and download the Square Appointments app on iPhone, iPad or an Android device.

Clients pay for their bookings online or in person through a Square card machine, with payouts settling in your bank account in 1-2 business days (or instantly for a fee).

The Appointments software has many useful features like no-show protection, team management, easy online bookings, customer library and in-store payment options from the app’s booking calendar.

As with all Square features, the Appointments system links with a wide range of free tools like a virtual terminal for telephone payments, sales analytics, payment links and contract templates.

You can also integrate the software with many external tools for marketing, ecommerce and much more.

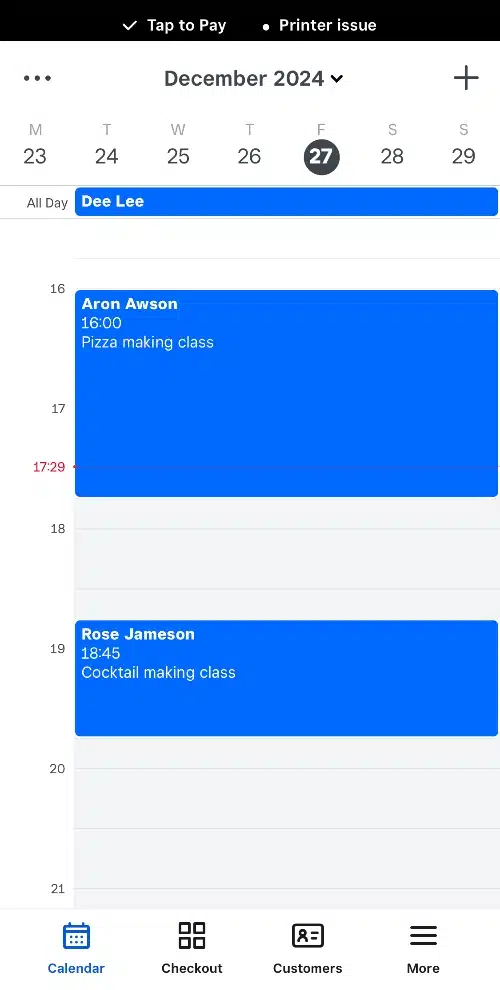

Image: MobileTransaction

Square bookings on iPhone.

Our opinion: exceptional value for solo professionals

Square Appointments is incredibly versatile, with a low barrier of entry for those on a budget. It doesn’t matter if you’re taking bookings online or in person, because it has so many different selling tools.

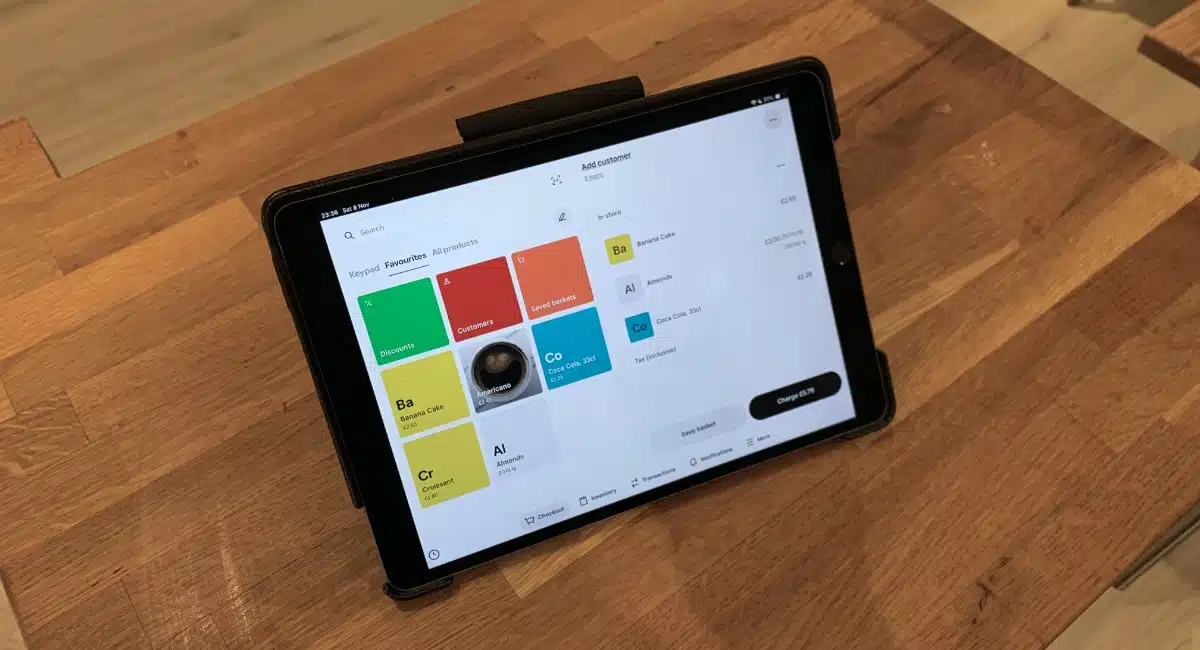

The Appointments app can be used for selling physical items and services alike, but it’s different from Square’s free Point of Sale app for its focus on the booking system mixed with more general features.

“Some of the features I like most about Square Appointments are the direct bookings via the Google Business Profile, Afterpay integration and no-show fees. I’d choose the system if I was juggling bookings as a solo practitioner.”

– Emily Sorensen, Senior Editor, MobileTransaction

It therefore suits many different professionals like barbers, hairdressers, beauty salons, consultants, cleaners, wellness specialists, teachers and trainers.

But while Square has excellent interconnected payment flows, it lacks truly advanced customisations for large firms. Sure, you can integrate with other software, but the booking flow is limited to Square’s (efficient, mind you) design.

We wholeheartedly recommend Square Appointments for individual practitioners and small teams of professionals, but it’s worth giving it a test run first if you’re a more complicated business with unique requirements.

Pricing

Square Appointments has three subscription tiers with more features on the paid plans: Free, Plus ($40/month) and Premium ($90/month).

No contractual commitment is required for any of the plans, and there’s a free 30-day trial.

| Square Appointments cost* | |

|---|---|

| Software subscription | Free: A$0/mo Plus: A$40/mo Premium: A$90/mo |

| Chip, contactless transaction fee | 1.6% (any card) |

| Online and keyed transaction fee | 2.2% |

| Payouts | 1-2 business days: Free Instant: 1.5% per transfer |

| Refunds | Transaction fee is retained |

| Chargebacks | Free |

*Pricing includes GST.

Other than that, there’s only a transaction fee per successful payment: 1.6% for chip and contactless card payments.

Online transactions through your booking site incur a 2.2% charge. If you take telephone bookings through the virtual terminal, invoice payments, keyed transactions through the app or a cancellation charge with a card on file, the fee is also 2.2%.

Square Appointments accepts all major cards in Australia, such as Visa, Mastercard, American Express, JCB and eftpos.

Standard payouts reaching your bank account the following business day are free, whereas instant transfers cost 1.5%. Chargebacks are free, but refunds cost the transaction fee originally charged.

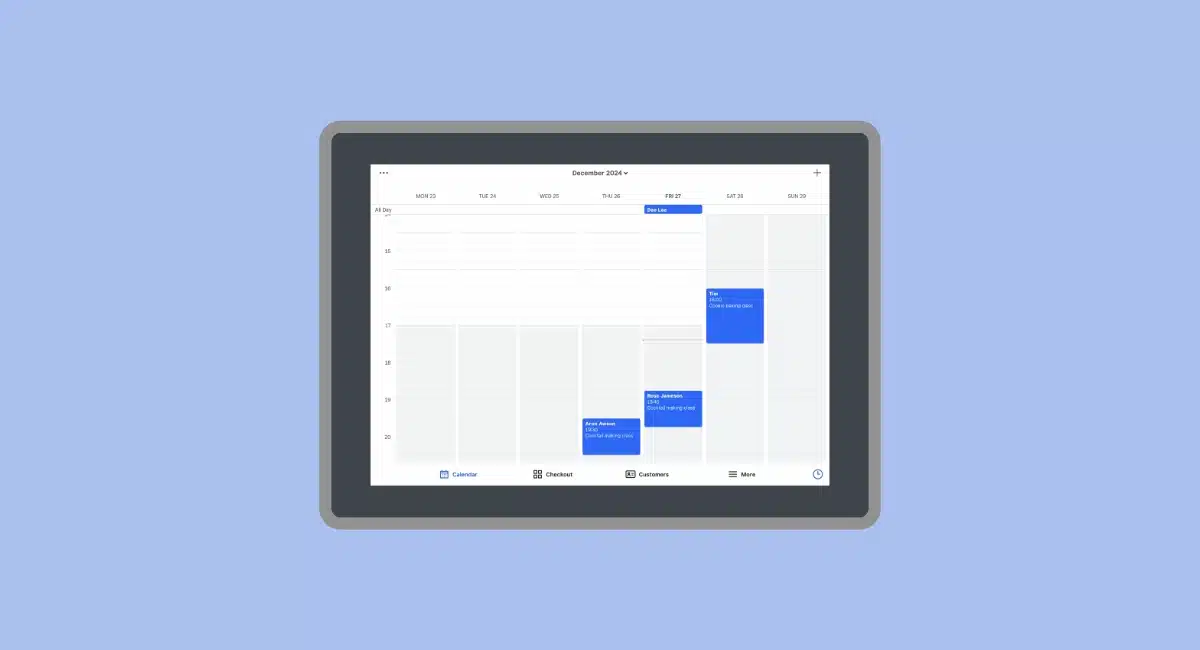

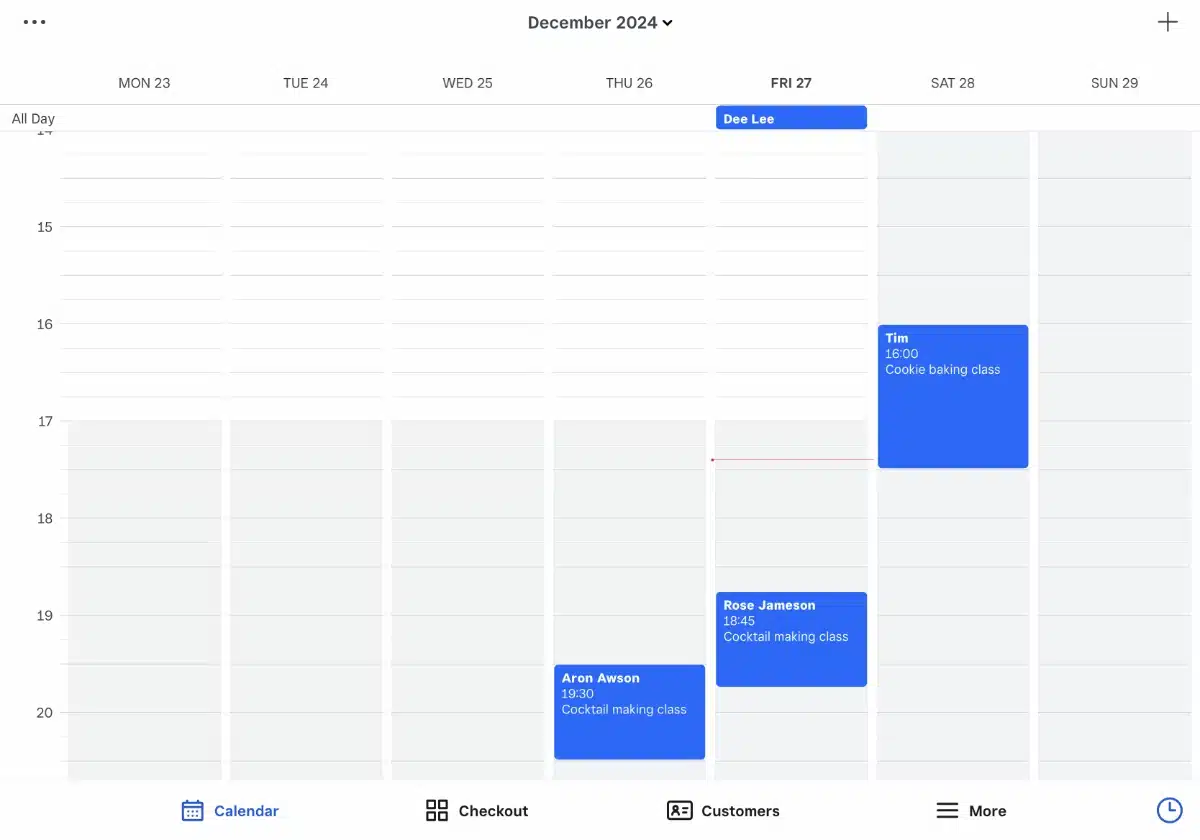

Image: MobileTransaction

A Square Appointments calendar in the iPad app.

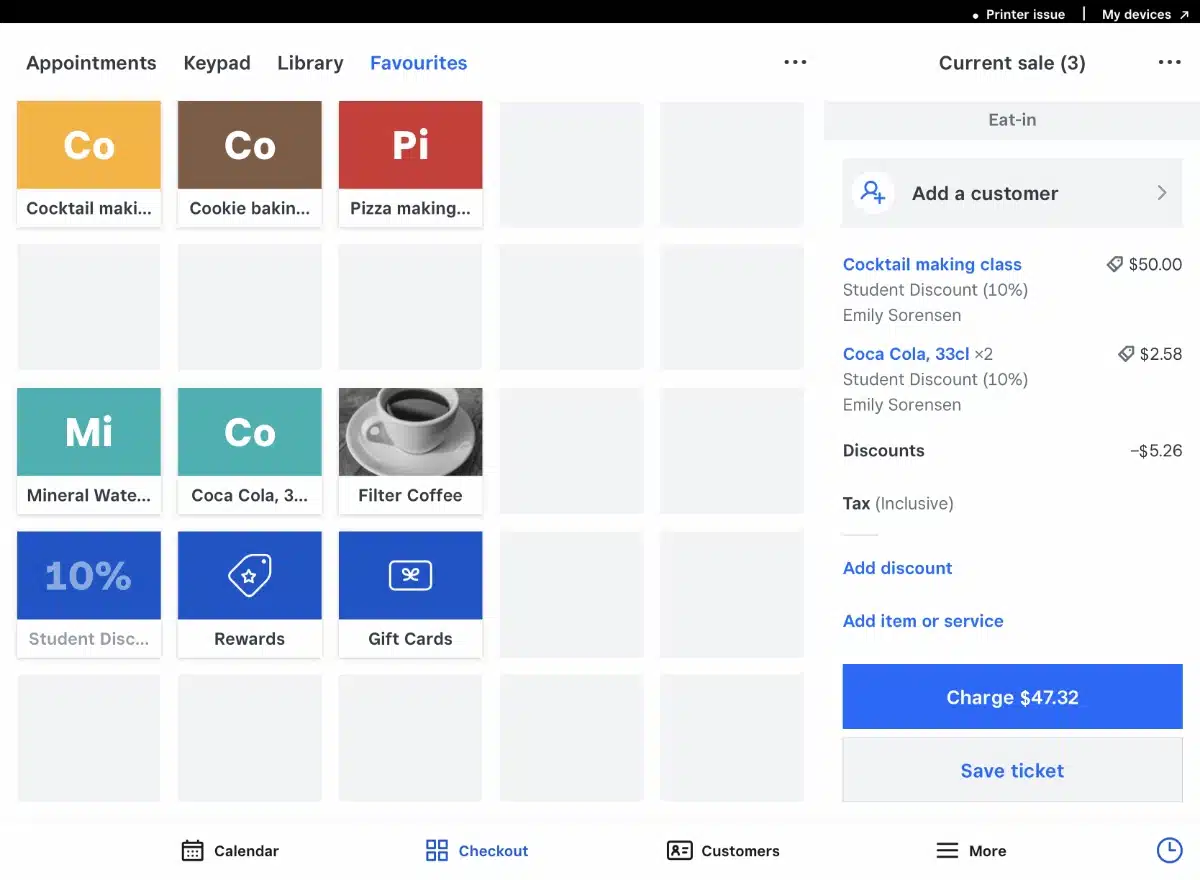

To create a booking, you:

- Pick a time slot in the calendar

- Add the customer who is booking

- Add the service that is being booked

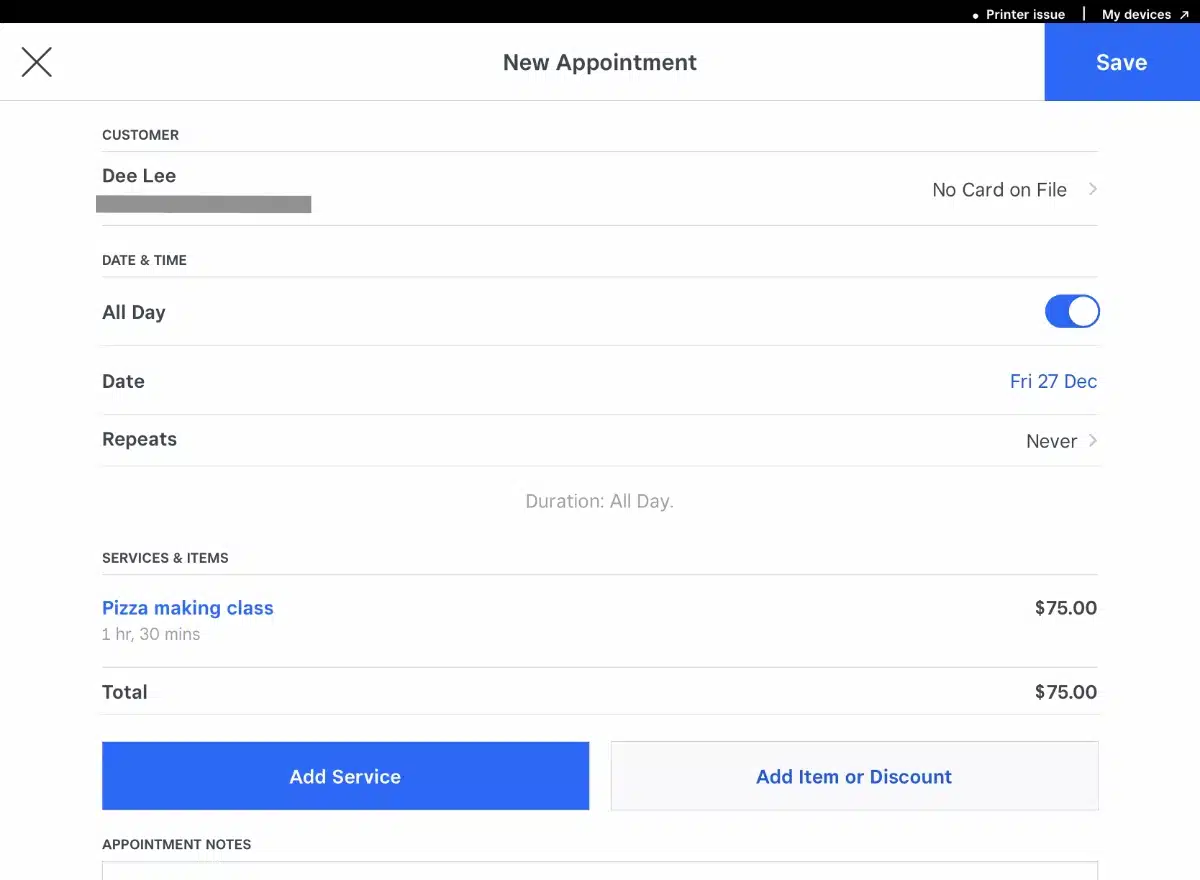

You can select a whole-day booking or timed slot and add physical products (e.g. if you’re selling a shampoo for your hairdresser client), set a discount or write a custom note about the booking.

“I love how easily physical products can be added to booking bills in Square Appointments. It allows merchants to mix and match services with add-on products without using a separate POS system.”

– Emily Sorensen, Senior Editor, MobileTransaction

After confirming this information, you can add an SMS or email notification for the client – and then the booking is added to the calendar.

Image: MobileTransaction

Booking details in the Square Appointments app.

You could then tap the confirmed booking in the calendar to edit it or process the payment from the till.

The customer can reschedule the booking through a link in the confirmation message or add the appointment to their Google, Apple, Outlook or Yahoo calendar. There is also a share button if they’re really excited about your service.

It’s also possible for customers to cancel the appointment, subject to your terms and cancellation policy of course.

Speaking of terms, Square Contracts is a complimentary feature that lets you create contracts, terms and conditions included with your client appointment emails through Square. It has preexisting templates for a service agreement, confirmation of delivery, credit card authorisation, sale of goods and completion of services, but you can create any kind of contract.

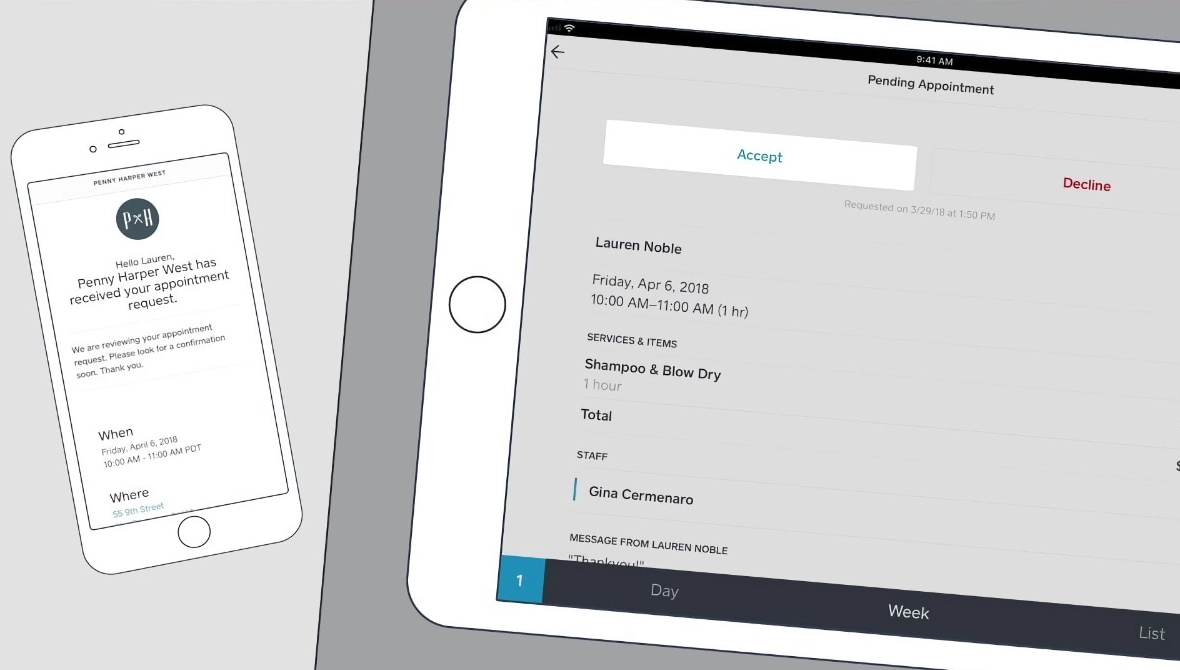

Other booking options can be set up, like automatically accepting bookings, or the business owner can manually accept each client booking for more control.

Image: Square

Square booking requests give you control over which bookings to accept.

You could also add a tipping option at checkout, customised email notifications and booking rules.

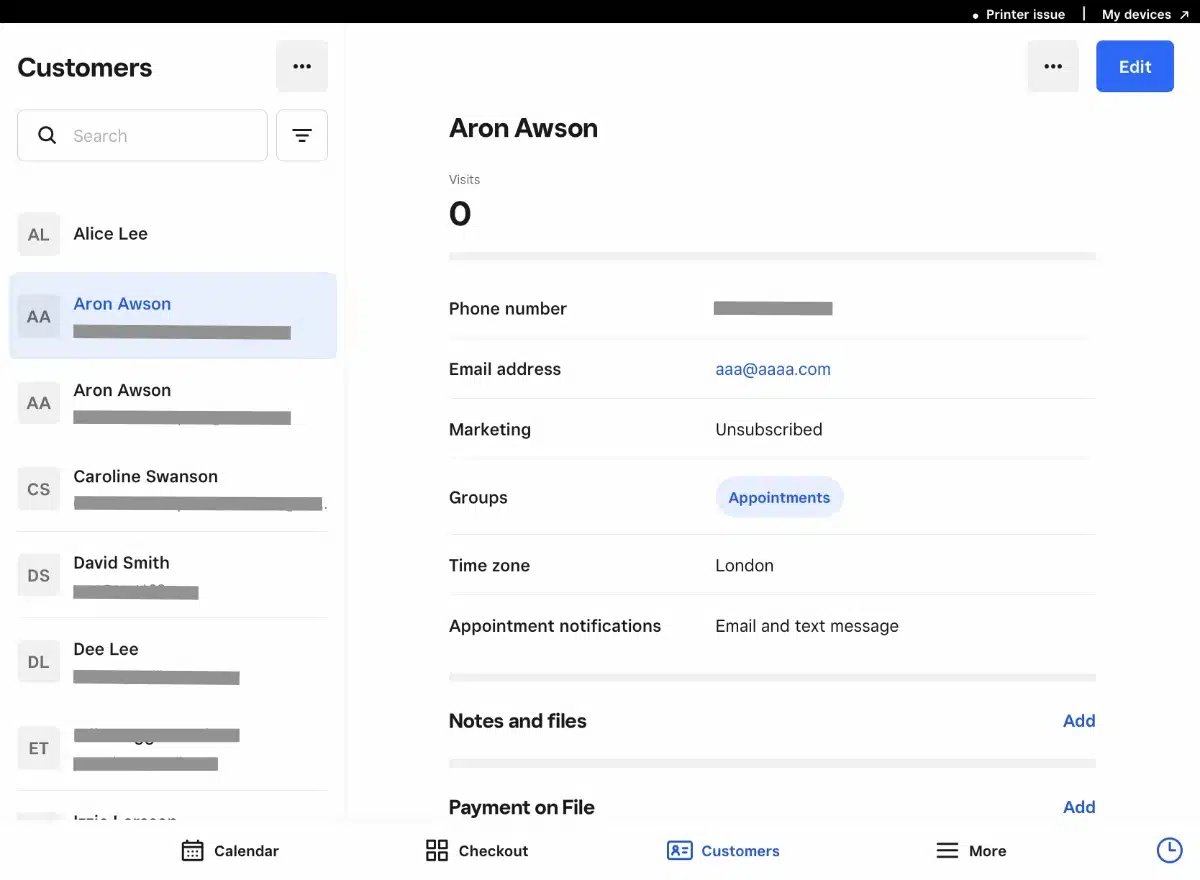

The customer directory saves you time if you have regular clients. The app automatically adds people on bookings to the library along with any contact details. You can also easily assign notes to a customer, like their preferences and birthdays.

By adding card details to the customer’s profile (card on file), you can charge the person’s card when necessary. This means that if you have a no-show or last-minute cancellation, you can still charge their card if the customer has agreed to this policy at the time of booking.

However, the cardholder can at any time retract their card information remotely, which has been a problem for some merchants. Imagine getting a customer booking, then retracting their card details and failing to turn up when this booking could’ve gone to a paying customer.

Image: MobileTransaction

Square’s customer directory makes it easy to save client and card details.

There is also an items library for adding all your services and products. When making an appointment, a service is selected for a time slot. Each service can have a duration, processing time and extra time added to keep the calendar availability accurate.

For example, hairdressers can easily add styling products to appointment transactions.

Image: MobileTransaction

You can add products to appointments when you check out a customer in the app.

You can allocate resources to a service, for example rooms or chairs. When a service is booked where a certain resource is required, the resource will then be booked automatically. Similarly, specific staff members can be added to a service.

To keep the booking calendar free of conflicts, you can book in personal events that apply to your business only. For example, lunch and time off can be booked so customers can’t opt for services during those times when a team member is unavailable.

The Premium plan has advanced staff permissions for customising employee roles and deciding what features they can access in the app. Premium also has time tracking, shifts and complex staff analytics.

On the same plan, staff commissions lets you add tiered or flat-rate commissions applying when certain services or products are sold. If a customer books several appointments with different staff members, the tip will automatically be split between those colleagues.

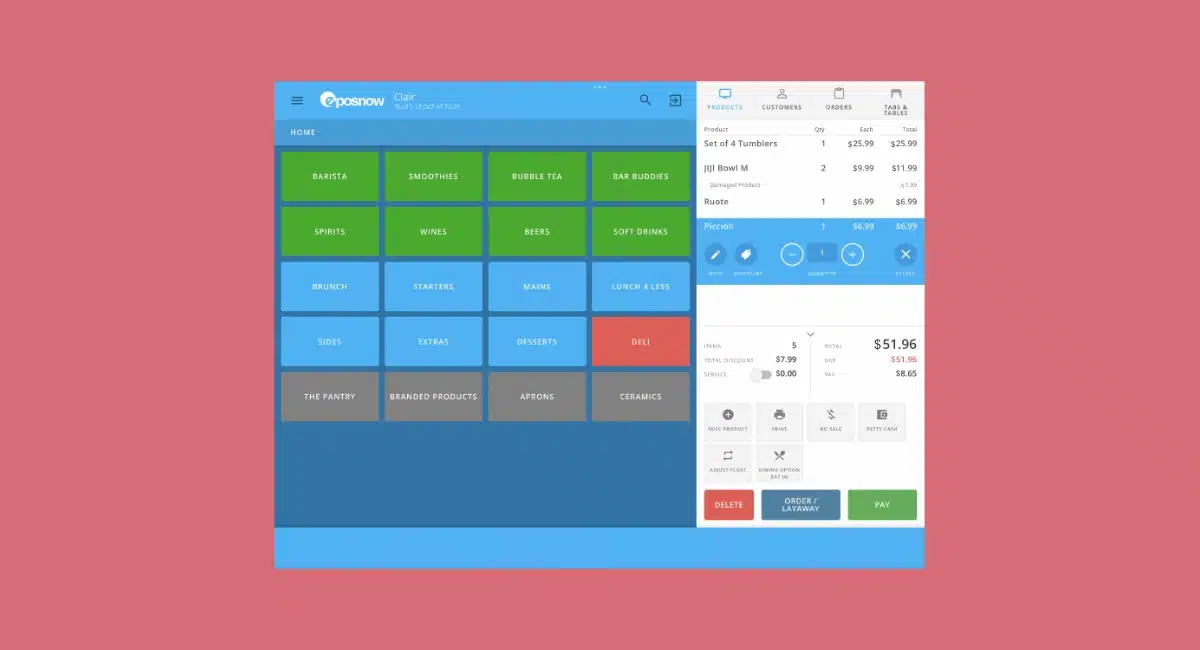

Online bookings

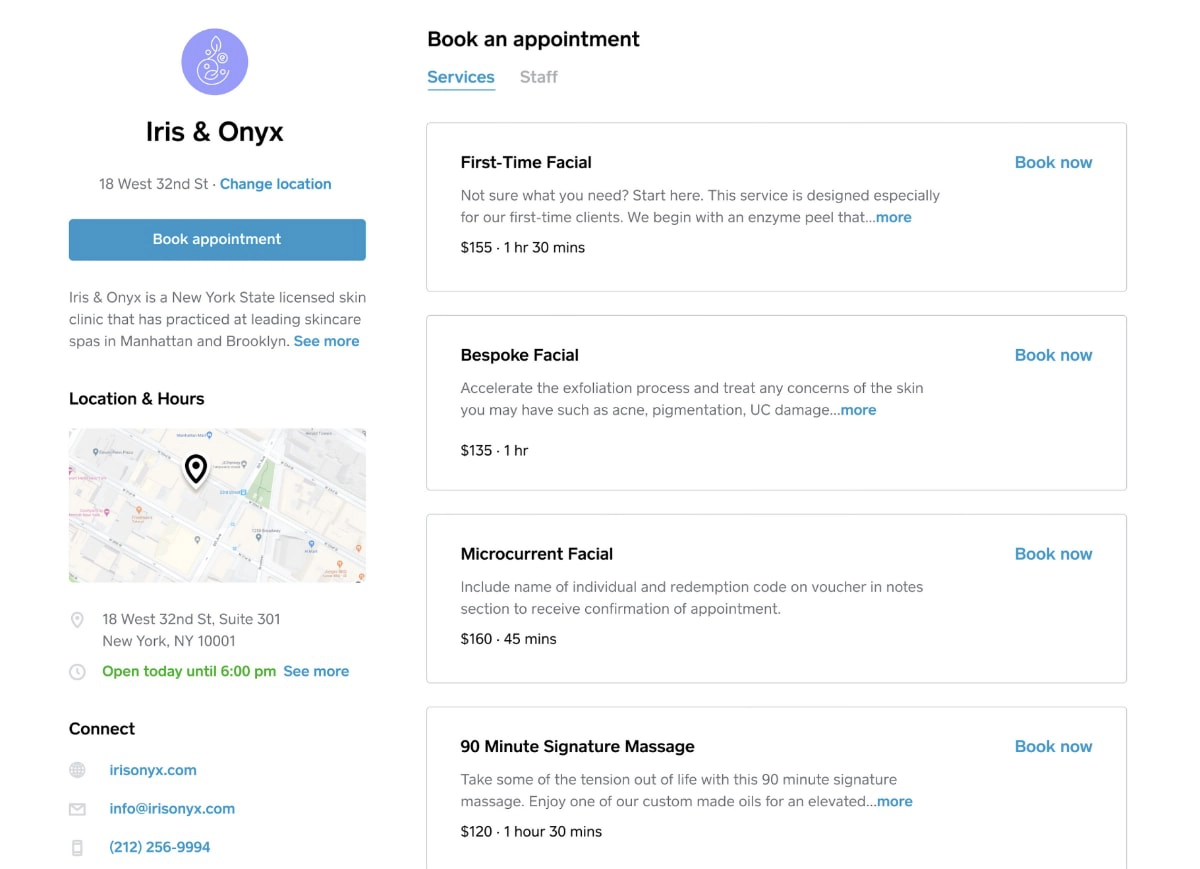

On both the free and paid Appointments plans, you get a free online booking website so clients can book remotely. It’s a complete website with a booking page connected to Square Appointments and the payment system.

The website runs on Square Online, a website builder with basic editing options to make it easy for anyone to create a modern site for ecommerce. There are no templates to pick from (unless you upgrade the ecommerce plan) – instead, you are carried through different steps to pick e.g. a colour scheme, pages and images.

Image: Square

Online booking page built with Square Appointments.

The website can be integrated with Instagram so followers there can book through a “Book” button. You can also connect the calendar with a business profile in Google search results for a more direct way for people to book.

If you already have a website, it’s possible to integrate the booking flow into it as long as your website platform is compatible (WordPress, Wix or Squarespace would work).

External vouchers, cheques and other payment forms can also be registered. A cash drawer can be linked to track cash sales.

The Appointments app works on iPad, iPhone, Android tablets and smartphones, but you don’t need any of these if you purchase Square Register or Terminal. Those touchscreen terminals can use the Appointments software and accept card payments.

To ensure clients pay for their booking, Square Appointments provides these options:

- Hold card for no-show protection – The customer is required to enter card details, allowing you to charge a cancellation fee within 14 days of the booking. After this, the card details are deleted.

- Require prepayment – The customer is required to pay upfront for the service.

Square has a default cancellation policy in the system, but you can create your own policy when editing these payment settings. It’s up to you how much you charge for no-shows, but only up to $500 is allowed. Alternatively, you can choose not to require a saved card or prepayment.

Reports and analytics

No matter how you’re taking bookings and payments through Square, transactions are recorded in real time in the cloud. This data can be analysed, emailed for print-offs or integrated with external accounting software such as Xero and Zoho Books.

The Appointments app has a section for reports, transactions and payouts so these can be monitored on the go. Receipts can be reissued and transactions refunded from the app.

In the browser-based Square Dashboard, more complex sales analytics allow you to look at sales trends, division of payment methods, staff performance and much more.

Customer support and reviews

All Square users can contact support by email or telephone on business days between 9 AM – 5 PM (AEST).

The lack of 24/7 service does not bother most merchants since it’s a user-friendly product. It does mean general queries can take a day or so to yield a response via email, though. Urgent issues are best dealt with over the phone during opening hours.

User reviews are generally positive because of Square’s ease of use, smooth payouts and excellent range of free tools.

Square Appointments in particular has had a lot of praise for its great value-for-money for professionals like personal trainers, hairdressers, massage therapists and yoga teachers.

But we think the online booking website is a bit inflexible to edit. And it can be an issue that you can’t prevent clients from removing their card details from the system, so you may not be able to charge for a no-show or late cancellation even when it’s a policy to do so.