Two of Australia’s more interesting EFTPOS solutions are Square, an American company, and Smartpay that only serves Australia and New Zealand.

They both cater to small businesses, but not in the same way. Smartpay focuses on EFTPOS machines with surcharging. Square offers a range of EFTPOS terminals and surcharging too, but the big draw is a broader range of business tools on the same platform, saving sellers time.

We look at their EFTPOS machines, pricing and critical aspects of their offering to understand which is better for particular merchants.

|

|

|

|---|---|---|

| Upfront cost | $90 + GST setup fee – waived if staying 1 year (rental) | $65 – $329 incl. GST (purchase) |

| Transaction fee | Variable or free (with surcharging) | 1.6% or free (with surcharging) |

| Monthly cost | $0-$34.95 + GST | None |

| Payment methods | Terminals, over the phone | Terminals, payment links, over the phone, invoices, on website |

| Hardware | PAX A920Pro | Wide range of custom hardware, including point of sale registers |

| Commitment | None (but setup fee applies if leaving within 1 year) | None |

| Payouts | 1 business day | 1-2 business days or instant for an extra fee |

| Accepted payments |

|

|

|

|---|---|---|

| Upfront cost | $90 + GST setup fee – waived if staying 1 year (rental) | $65 – $329 incl. GST (purchase) |

| Transaction fee | Variable or free (with surcharging) | 1.6% or free (with surcharging) |

| Monthly cost | $0-$34.95 + GST | None |

| Commitment | None (but setup fee applies if leaving within 1 year) | None |

| Payouts | 1 business day | 1-2 business days |

| Accepted payments |

EFTPOS terminals

When it comes to the choice of EFTPOS terminals, Square wins with its attractive selection of user-friendly card machines: Square Reader and Square Terminal. To compare, Smartpay only has one card terminal: a PAX A920Pro model.

Let’s start with Smartpay’s wireless, portable terminal, the PAX A920Pro. This machine is an update of the old PAX D210 terminal that Smartpay has used for a decade.

Photo: MobileTransaction

Smartpay’s one and only EFTPOS machine is a PAX A920Pro model.

The Smartpay EFTPOS machine can be used for a fixed point of sale, portably around premises or on the go. It connects with broadband, WiFi or 4G with its included SIM card. The battery life is 8 hours from a full charge, although frequent usage would shorten this.

Smartpay’s terminal has a large touchscreen, which some users prefer to handle over push-buttons. It can process tips, surcharges, cash-outs and refunds, and potentially much more with additional apps installed. But Smartpay only has a simple card payment acceptance app installed, so the terminal’s built-in scanning function, for instance, cannot be used with Smartpay.

“Smartpay’s premium card machine, PAX A920Pro, is a great piece of equipment we’ve tested and used extensively, so it gets our full approval. But it’s a shame it doesn’t have point-of-sale features utilising its full potential.”

– Emily Sorensen, Senior Editor, MobileTransaction

In contrast, Square makes full use of its EFTPOS terminals’ features which we’ll move on to now.

First, we have (literally) square-shaped Square Reader with no buttons. It uses Bluetooth to connect with an app on the merchant’s smartphone or tablet to process card payments. This dual-device setup means the card reader is quite affordable and small, comfortably fitting in your pocket.

Photo: MobileTransaction

Square Reader is pocket-sized.

Photo: MobileTransaction

Square Terminal suits a counter.

Square Terminal, on the other hand, is a bigger EFTPOS machine that works independently with WiFi only (not 3G). This means you can’t use it out-and-about with just a mobile connection like you can with the small card reader or Smartpay’s terminal.

“In our tests over the years, we’ve always been impressed by how many point of sale features Square’s card machines and software contain, despite being so easy to use at the same time.”

– Emily Sorensen, Senior Editor, MobileTransaction

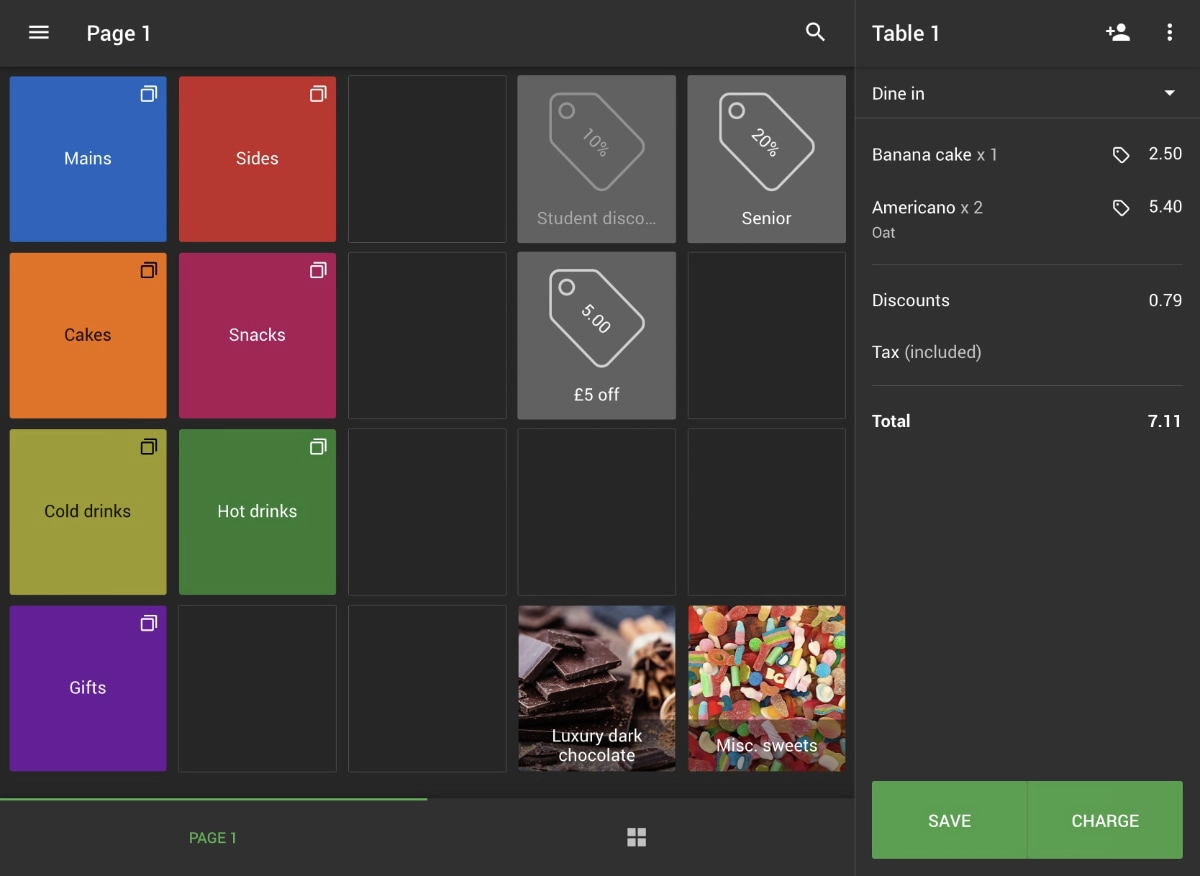

It features a large touchscreen with the same point of sale (POS) software installed as the free app that merchants can download on their phone for Square Reader. This POS software, although simple, has many more features than the Smartpay terminal, such as a product library and eat in/eat out settings.

Like Smartpay, Square’s card machines can be set up to automatically charge customers a surcharge covering the transaction rate. This is a recent addition that directly competes with Smartpay’s similarly “fee-free” terminal.

You also buy into a Square system that can be upgraded to the stylish POS systems Square Register (with a card reader and touchscreen) or Square Stand (requiring an iPad).

Pricing: both can surcharge, but fees different

The biggest difference between the companies is still the pricing, but Square’s ability to surcharge now means Smartpay isn’t unique in that regard.

To start with the most straightforward parts, Square has no monthly fees, contract or setup fee. You simply purchase a card machine and pay only a transaction fee when a payment takes place. If you process a refund, Square retains this transaction fee.

All new Square merchants can set up surcharging, where cardholders automatically pay the transaction fee that would’ve applied to the total transaction amount. This means the merchant receives their full price of the goods, taxes and tips while the customer pays the transaction fee that would’ve otherwise been deducted from the merchant’s card takings. In other words, it is “fee-free” selling for the business.

There’s also a monthly subscription for a number of optional add-ons such as the advanced plans for the retail, restaurant and booking POS systems, customer loyalty and extended invoicing features. No other costs are required.

| Cost |  |

|

|---|---|---|

| Terminal purchase price | n/a | Square Reader: $65 incl. GST Square Terminal: $329 incl. GST |

| Monthly fee | $0-$34.95 + GST/mo (rental) | None (terminals are bought) |

| Contract | Cancellable any time | None |

| Setup fee | $90 + GST (only payable if leaving within a year) | None |

| EFTPOS transaction fees | Custom, can be passed on as a surcharge | 1.6% (any card), can be passed on as a surcharge |

| Payouts | Fee may apply | Free |

| Refunds | Fee may apply | Transaction fee is retained |

| Chargebacks | Fee may apply | Free |

Square has no minimum monthly sales requirement, as opposed to Smartpay’s more complicated pricing hinging on your sales volume. Let’s have a look at the structure of Smartpay fees:

| Smartpay plans | Zero Cost EFTPOS | Simple Flat Rate |

|---|---|---|

| Card turnover requirement | Above $10k/mo upon registration | Any turnover |

| Monthly fee | If sales above $10k*/mo: Free If sales below $10k*/mo: $34.95 + GST/mo |

Fee may apply |

| Transaction fees | Variable fees that can be passed on to customers as a surcharge | Fixed rate for Visa, Mastercard and debit cards, fixed-cent fee for eftpos |

*Card transactions per terminal. Does not include American Express, debit card or MOTO (Mail Order and Telephone Order) transactions.

Smartpay offers two distinct plans: Zero Cost EFTPOS and Simple Flat Rate plans. The latter plan is comparable to that of Square – one rate for all cards. Only Visa, Mastercard and eftpos are accepted by Smartpay by default, while Square also accepts American Express and JCB. If you want to accept Amex with a separate contract via Smartpay, expect to pay above 3%.

The Zero Cost EFTPOS plan means the transaction fee is passed on to customers as a surcharge, but only merchants with a card turnover exceeding $10,000 monthly per terminal can get on the Zero Cost plan. And it’s only when you’re selling above this threshold that you avoid a monthly cost of $34.95 + GST.

“Square doesn’t require a monthly sales volume for its “fee-free” surcharging option, unlike Smartpay that requires you to sell $10k monthly and may charge a monthly rental fee too if sales dip below that.”

– Emily Sorensen, Senior Editor, MobileTransaction

For businesses exceeding $250k yearly in card sales, Square fees can be negotiated. Otherwise, you pay the fixed fee of 1.6% per EFTPOS transaction for any card type. Smartpay’s fees are subject to negotiation and based on your turnover and industry, regardless of your business size.

The ability to offer Afterpay, a popular Buy Now, Pay Later option, through Square (for a 6% + 30¢ + GST fee) is attractive for some businesses.

Fee-wise, we think Smartpay lacks a clear advantage since Square added surcharging – previously, Smartpay’s main advantage. Now, Square is more attractive with its lack of monthly fees for any business, transparent costs and value for money. The only downside is the upfront cost of purchasing an EFTPOS machine from Square. With Smartpay, you can avoid this since the machines are leased. You may also get lower rates from Smartpay, but that’s not always the case.

Access to funds: next-day or instant

Standard payouts are almost the same for Smartpay and Square, but Square has a small advantage.

Smartpay deposits funds in your chosen bank account the following business day, if your bank accepts real-time deposits. That means you will be able to access funds the day after each transaction, whereas Friday, Saturday and Sunday transactions all arrive on Monday.

Square transfers funds to your bank account the same evening that you took the payment(s), so normally funds should arrive in your bank account the next morning. If your bank accepts real-time payments every day, you will also receive funds during the weekend.

While next-day availability of funds is fast enough for many businesses, an additional option with Square has proven highly popular: with Instant Transfers, you can receive up to $5,000 of funds the same day within hours for an additional fee of 1.5% per transaction.

For many businesses we have talked to with time-critical purchasing needs, this is one of the attributes they value most about Square.

Online reports and accounting

Smartpay has some catching up to do with its online reporting interface. The terminals provide an overview of transactions for specific times such as on a date or specific shift, and transaction reports are sent via email. Until recently, Smartpay did not offer an online dashboard, but this feature is now being rolled out to some customers. We’d expect this to be available to all customers eventually.

In contrast, Square boasts an impressive online dashboard with a useful overview of transactions, along with sales reports identifying sales patterns in an easy-to-understand format. Reports are customisable, allowing you to analyse team performance, products, payment methods and much more.

Square allows you to integrate with accounting software Xero and QuickBooks. At the point of writing, Smartpay does not offer any accounting integrations. This can be bypassed if you connect the Smartpay terminal with a point of sale system, which can then be integrated with accounting software.

Big point of sale (POS) differences

If you need a checkout system, this is where Square and Smartpay really differ.

Square takes the lead with its own point of sale software free of charge, along with three specialised systems for retail, restaurants and service appointments. Smartpay also offers a free POS app for phones, but this is not as developed as Square’s.

First of all, you can use Square Reader with the free POS app called ‘Square Point of Sale’ on your phone or tablet. This app has been around for over a decade in other countries and is typically favoured by independent retailers and small food-and-drink businesses who find it more straightforward than complex hospitality tills. New features are continuously added on top of tools like real-time inventory management and sales analytics. We love its ease of use and simple design.

The industry-specific POS systems Square for Restaurants, Square for Retail and Square Appointments (popular with health, fitness and beauty providers) are offered as free or paid plans. These take more time to get used to compared with the generic Point of Sale app, but they are more powerful POS systems rich in features and suitable for a more sophisticated setup.

Square Terminal essentially uses the Point of Sale app on its touchscreen. Then there’s Square Register, a unique touchscreen checkout with a choice of Square’s own software built in. All of the EFTPOS terminals are compatible with various POS accessories, from cash drawers to receipt printers.

Image: MobileTransaction

Loyverse, one of the POS apps compatible with Smartpay, did well in our test, but can get pricey with add-ons.

Square integrates with external point of sale software too, for instance possBoss for hospitality, but also specialised systems like 360Winery and GRUBBRR for self-checkout kiosks.

Customers who don’t need an industry-specific system might be able to manage with Smartpay’s own free app ‘Till2Go’. It has some basic transaction reports and a product library, but pales in comparison with Square’s free software.

If you require more advanced POS solutions, Smartpay integrates with e.g. Abacus, Casio and Loyverse, but some big names are missing, such as Lightspeed (formerly Kounta or Vend) and Epos Now.

Online and remote payments

The contrast between payment options available through Smartpay and Square is stark. While Square offers just about any remote payment method you can think of, Smartpay is limited.

Smartpay’s only remote payment option is keyed entry on its EFTPOS terminals. This allows you to accept card transactions from customers you’re talking to over the phone.

Square, on the other hand, offers many remote and online payment options, including:

- Online payments via a website (built in Square or other ecommerce builder)

- Payment links

- QR codes (opening a link to a web payment)

- Email invoices

- Electronic gift cards

- Virtual terminal (for over-the-phone transactions)

- Keyed transactions through the POS app

If you want to offer customers several payment methods from one single platform, Square is therefore the most attractive alternative.

Business loans

Another eye-catching feature unique to Square is the option to apply for small-business loans between $100-$250,000. Square gives tailored offers based on your sales volume, account history and frequency of payments.

The loan doesn’t accrue interest, which is great, but it comes with a fixed fee agreed in advance. This charge and the loan are paid back automatically through a percentage of your sales transactions through Square. The higher your sales, the quicker your loan is repaid.

Note that this cash advance is only available to customers with a consistent sales history through Square, so new merchants do not immediately qualify.

Support and reviews

Customer support is a vital part of any service, especially for business owners who often need urgent help.

If 24/7 customer support is vital for your business, Square is not the best bet. The company has designed its products so it’s easy to work out issues on your own. In addition, Square has plenty of guides online, where it’s expected you look first before contacting support. Getting in touch with a real person is possible through a live chat, phone call and email on business days between 9am and 5pm Australian Eastern Time (AET).

Smartpay offers more: a 24/7 support line with technical experts on hand to help, should the terminal be faulty, 365 days a year. The online support guides are not as elaborate as Square’s, though.

While Smartpay’s support is more robust in theory, it’s clear from customer reviews it does not always meet users’ (higher) expectations. The onboarding process is rated highly, but the continued service and troubleshooting support are often criticised for being slow. While customers seem happy to ditch the big banks for Smartpay, top ratings are not yet achieved for a speedy service. From businesses we have talked to, unclear fees and surprise charges not communicated at onboarding are recurring issues.

Square’s users rave on about its user-friendliness and wide range of tools available for all types of businesses. Some of Square’s apps also come with reports of software glitches, though, such as issues pairing the card reader with the POS app. Overall, these issues are few compared with the total number of users.

Verdict: more advantages with Square

For a business with card transactions of less than $10k monthly, the choice is pretty simple: Square. You get free access to a big range of payment methods and business tools through a unified platform that’s easy to use, ultimately saving time and money.

Surcharging is also available through Square – without a monthly minimum sales volume required. With Smartpay, you must transact for at least $10k monthly per EFTPOS machine to apply for surcharging (“Zero Cost” plan), and then keep transacting above that threshold to avoid the monthly cost of lease.

For businesses exceeding $150k in card sales per year, the choice depends on what you value the most.

While Smartpay arguably has a better quality, more versatile EFTPOS machine, the terminal’s innate abilities are not fully exploited with more than basic payment features. In contrast, Square offers many more tools and point of sale features through all their terminals.

If you can’t afford Square’s upfront purchase cost of an EFTPOS machine (though financing options are available), you might want to opt for Smartpay’s terminal lease. But for businesses with an uneven cash flow, the instant transfer feature of Square is highly popular in Australia.

Whereas Square is generally better value for money, merchants might be able to get lower transaction rates with Smartpay. The only way to know this is by contacting Smartpay for a quote that’s tailored to your business.

>> If surcharging is vital for your business, it’s also worth checking out PayNuts and Zeller.