Overview

In brief

What is it?

Our opinion

In detail

Card machines

Fees and pricing

POS integrations

Remote payments

Service and reviews

Getting started

What is Smartpay?

Smartpay is an EFTPOS provider that offers a card machine with acquiring (card processing) plans to suit individual merchants.

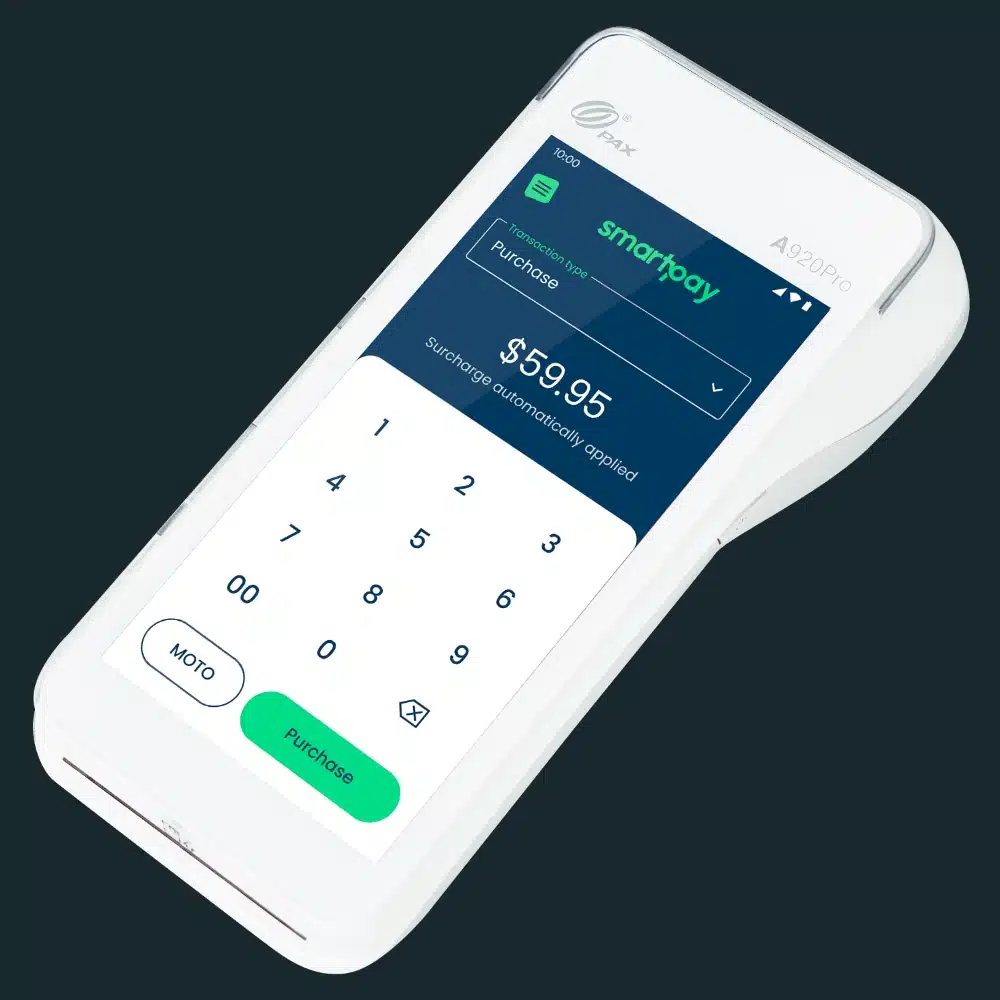

Photo: MobileTransaction

Smartpay’s latest EFTPOS terminal (PAX A920Pro) is a genuinely good device.

The company serves over 35,000 small and medium-sized (SME) business users in Australia and New Zealand, making it one of the largest independent merchant service providers in these countries.

The biggest draw is the SmartCharge function letting merchants pass on the full transaction cost to customers as a surcharge. This plan is available for those accepting over AU$10,000 in card payments monthly, whereas merchants making less can opt for a fixed-rate plan.

Smartpay’s one and only terminal model accepts Visa, Mastercard, eftpos and the contactless wallets Apple Pay, Google Pay, Samsung Pay. Amex can be added with a separate contract.

Accepted cards

Customers can take cash out through the card terminals when using their debit cards, if your shop allows it. You also have the option to add keyed payments for over-the-phone transactions.

Merchants receive payouts in their bank account (at any bank) the next business day, which is faster than most alternatives.

Our opinion: a package deal fit for some, not all

All things considered, do we think Smartpay is a good deal for a small business? Not for a good chunk of merchants.

For a start, the Zero Cost plan is only offered to merchants with an average monthly turnover of AU$10,000 per terminal – and only through Visa, Mastercard and eftpos.

But if you consistently accept over $10k monthly in card payments, and your customers are generally happy to pay a surcharge, then Smartpay could be very cheap. Some customers do not like the extra fee, though, and may avoid businesses adding a surcharge.

Those accepting fewer transactions could opt for the Simple Flat Rate plan, but Smartpay is not necessarily the best option for a fixed rate compared with Square and Zeller.

| Smartpay criteria | Rating | Conclusion |

|---|---|---|

| Product | 4.2 | Good |

| Costs and fees | 3.7 | Passable/Good |

| Transparency and sign-up | 3 | Passable |

| Value-added services | 2.7 | Bad/Passable |

| Service and reviews | 4 | Good |

| Contract | 3.8 | Good |

| OVERALL SCORE | 3.6 | Passable/Good |

| Smartpay criteria |

Rating | Conclusion |

|---|---|---|

| Product | 4.2 | Good |

| Costs and fees | 3.7 | Passable/Good |

| Transparency and sign-up | 3 | Passable |

| Value-added services | 2.7 | Bad/Passable |

| Service and reviews | 4 | Good |

| Contract | 3.8 | Good |

| OVERALL SCORE | 3.6 | Passable/Good |

Although generally transparent about packages, we were concerned that information about monthly fees was hidden and that a $90 + GST charge is applied if you leave before 12 months. So even though a commitment-free service with zero acquiring costs is advertised, this only applies in some cases.

On the other hand, Smartpay could be worth switching to from the big, traditional banks that lock you into their service and add more fees on top of transactions and card machine rental.

“Smartpay’s new EFTPOS terminal is one of the highest-performing terminals I’ve tested, but Smartpay is not so much about the terminal as it is a package deal for those who rely on surcharging.”

– Emily Sorensen, Senior Editor, MobileTransaction

What about the EFTPOS machines? It would have been better if Smartpay had more than one model of EFTPOS machine, but we find their PAX A920Pro very versatile. It has a long battery life, smooth payment flow and is future-proof with its large touchscreen and little built-in features.

But we were disappointed by the lack of online portal with sales reports and a transactions overview – instead, you receive monthly statements.

We haven’t seen enough user reviews to confidently say it’s a reliable service with a better offering than competitors. But given its recent year-on-year growth, it seems enough SMEs are finding value in it.

EFTPOS machine

Smartpay only offers one EFTPOS machine model: the portable and mobile PAX A920Pro terminal. This is a recent upgrade from their old PAX D210 machine that they had for years.

The new EFTPOS machine is a mobile Android terminal, which we’ve tested, with a large colour touchscreen and high-speed thermal receipt printer built in. It’s a very popular model in Europe, gradually making its way to Australia too.

“I like the crisp look of the simple payment app that Smartpay built for the new Android terminal. But it’s probably more exciting with a POS integration that can make use of PAX A920Pro’s extra functions like barcode scanning.”

– Emily Sorensen, Senior Editor, MobileTransaction

Its battery life is 8 hours from a full charge, but this may vary depending on the frequency of transactions and display settings (for instance, ours lasted longer with a lower screen brightness).

It has 4G, WiFi and broadband connectivity options and comes with a SIM card for mobile data, so it suits pretty much any professional setup.

Although wireless on the go or around premises, you can keep it on a counter as a stationary card machine. Its base keeps it stable, while allowing you to pick it up and go to customer tables. If the base is wired to broadband, the terminal’s Bluetooth keeps it connected to the base while using it wirelessly.

The Smartpay EFTPOS machine is a PAX A920Pro.

The card machine accepts contactless (NFC), chip and swipe card payments, with options to refund transactions. It also has free add-ons like tipping and cash-out options to offer alongside cash acceptance.

It can automatically apply surcharges for customers so you don’t have to calculate it, but note it’s a requirement to make it clear to customers when surcharging is applied.

You can use the terminal independently or integrate it with point of sale (POS) systems.

As for reports, you only get a monthly statement of EFTPOS transactions, which also counts as your tax report. The past month’s sales are emailed to you in the first week of the following month. It is also possible to view and print transactions and reports on the terminal.

Pricing

Smartpay offers two EFTPOS plans: Zero Cost EFTPOS and Simple Flat Rate. No contractual commitment is required, so you can cancel any time.

According to Smartpay, a $90 + GST “setup fee” is waived upon registration, but this is payable if you leave the EFTPOS plan within 12 months. So in reality, this is more like an early termination charge that was never intended as a setup fee.

The Zero Cost EFTPOS plan has no fixed monthly fee as long as you’re accepting at least $10,000 AUD monthly from Visa, Mastercard and eftpos cards per terminal. Otherwise, you pay an EFTPOS rental fee of $34.95 + GST monthly. Amex, keyed payments (MOTO) and debit card transactions do not count towards this minimum.

In fact, it is only merchants with an average card turnover of above $10k monthly who can apply for the Zero Cost plan in the first place.

Apart from that, transaction fees are automatically passed on to each customer paying with an eftpos, debit, Visa and Mastercard card via a surcharge. Smartpay automatically calculates this and adds a commission, which is how the company earns money with this plan.

If a customer doesn’t want to pay this, the merchant can choose to bypass it on the terminal. This will deduct the charge from the transaction settled in your bank account.

| Smartpay fee | |

|---|---|

| Setup fee | $90 + GST – waived at registration, but payable if leaving contract within 1 year |

| Contract | Cancellable any time |

| Monthly fixed cost | Zero Cost: $34.95 + GST if applicable sales less than $10k/mo, free if above Simple Flat Rate: Monthly fee may apply |

| Transaction fees | Zero Cost: Variable surcharge to cardholders – merchant can opt to pay this if preferred Simple Flat Rate: Custom fixed % for Visa, Mastercard and debit cards, custom fixed-cent fee for eftpos |

| Receipt paper rolls | Free, but you pay for shipping and handling |

| Terminal replacement | Free if technical issues cannot be resolved over the phone |

| Smartpay fee | |

|---|---|

| Setup fee | $90 + GST – waived at registration, but payable if leaving contract within 1 year |

| Contract | Cancellable any time |

| Monthly fixed cost | Zero Cost: $34.95 + GST if applicable sales less than $10k/mo, free if above Simple Flat Rate: Monthly fee may apply |

| Transaction fees | Zero Cost: Variable surcharge to cardholders – merchant can opt to pay this if preferred Simple Flat Rate: Custom fixed % for Visa, Mastercard and debit cards, custom fixed-cent fee for eftpos |

| Receipt paper rolls | Free, but you pay for shipping and handling |

| Terminal replacement | Free if technical issues cannot be resolved over the phone |

Then there’s the Simple Flat Rate plan. Upon signing up, Smartpay looks at your type of business and card turnover and determines a fixed percentage rate that applies to all Visa, Mastercard and debit card transactions. A fixed cent fee is also applied to eftpos transactions.

Smartpay does not mention anything about a fixed monthly fee on Simple Fixed Rate, which often means there is a monthly fee. You should inquire about this when registering, as it could be a hidden cost.

American Express acceptance requires a separate contract through Amex directly, who will then charge you their own rates. Smartpay can add a merchant-controlled surcharge to these transactions on the Zero Cost plan, if requested.

There’s no cost for new receipt rolls, only for shipping and “handling” of them. Similarly, if the EFTPOS machine breaks down and it cannot be sorted with the technical department, a free replacement is delivered.

Chargebacks may incur a fee, which Smartpay can elaborate on during registration.

POS integrations

The EFTPOS machine integrates with a choice of 20+ POS software solutions including posBoss, MobiPOS and Abacus. This enables you to produce comprehensive sales reports (which are limited in Smartpay) and connect payments with products sold, staff accounts and customer loyalty functions.

If you only need a simple POS system, Smartpay offers its own free Till2Go app for iPhone, iPad and Android smartphone or tablets. It has a simple product library, transaction reports and digital receipts.

Due to limited features (it lacks e.g. discounting) and very few users, we cannot really recommend Till2Go without improvements, but it may fill the gap for small coffee shops, market stalls and other entrepreneurs who need slightly more than just card transactions.

Remote payments

Mail order and telephone order (MOTO) payments are available, but this is subject to an additional application.

When activated, you can key in transactions directly on the EFTPOS machine, so no computer is needed as would be the case for some virtual terminals.

Based on user reviews, Smartpay’s MOTO transactions have hidden transaction limits that can get in the way of accepting high-value payments. You can apply for higher limits, but it may not be granted.

Since Smartpay does not specialise in online payments, you’ll need to look elsewhere for an ecommerce solution.

Customer support and reviews

We definitely like that Smartpay has 24/7 customer support every day of the year – that’s more than the competitors Zeller and Square can offer. It means if your terminal breaks down, or you need to sort out a payment issue, Smartpay should be available any time to help over the phone.

Regarding customer reviews, there aren’t that many of them. Most of them are positive about the service and Zero Cost plan, but there are also merchants who have been blindsided about fees, and others experiencing issues with the MOTO service and withheld transactions.

Overall, we’re not so confident about the quality of service received by real users, but at least the promise of round-the-clock support is there.

Getting started

To sign up for Smartpay, you need to complete an online registration form on their website. The company will then call you back for an individual quote based on your needs and average card turnover.

It may take some days for the application to be approved, after which a further 5–7 business days pass for the EFTPOS terminal to arrive by post. The whole onboarding process may therefore take up to two weeks before you can accept the first transaction – quite slow.